Can You Declare Bankruptcy On Taxes

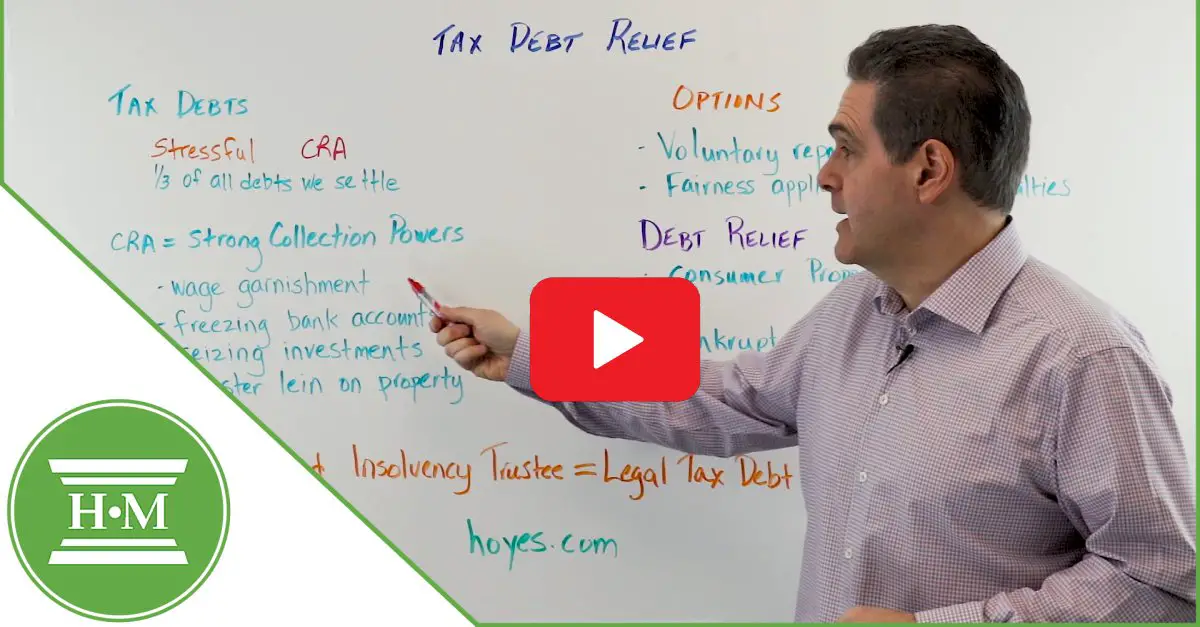

The body in charge of assessing and collecting taxes in Canada is the Canada Revenue Agency . Unlike the regular creditor, the CRA has the power to collect money owed. Here are a few things that they can do:

- Freeze your accounts.

- Send notices to your customers to pay money to them instead of your business.

- Register a CRA lien against your home if you own it.

Unlike a bank, they donât need any special permission from the courts. Also, they donât need your consent to do all of this. If you want to avoid all of this, then you should pay your tax debts. What if you canât?

Can you declare bankruptcy on taxes? The common misconception is that personal bankruptcy doesnât cover tax debts. However, tax debts are just as unsecured as credit card debts. As such, the CRA will eliminate tax debts when you complete your bankruptcy duties. To file bankruptcy on tax debts, you must satisfy the following conditions:

- You need to be insolvent.

- Every outstanding tax return must have been filed.

- You must have filed every HST return if you are self-employed.

- CRA may request extra information or a creditorsâ meeting.

- Complete your bankruptcy obligations.

- There may be complications if the tax debts exceed $200,000.

These are some of the most important conditions to satisfy if you are looking to clear tax debts in Canada through bankruptcy. It is also important to note that bankruptcy cannot eliminate all kinds of tax debts in Canada.

Debts Never Discharged In Bankruptcy

While the goal of both Chapter 7 and Chapter 13 bankruptcy is to put your debts behind you so that you can move on with your life, not all debts are eligible for discharge.

The U.S. Bankruptcy Code lists 19 different categories of debts that cannot be discharged in Chapter 7, Chapter 13, or Chapter 12 . While the specifics vary somewhat among the different chapters, the most common examples of non-dischargeable debts are:

- Alimony and child support.

- Certain unpaid taxes, such as tax liens. However, some federal, state, and local taxes may be eligible for discharge if they date back several years.

- Debts for willful and malicious injury to another person or property. âWillful and maliciousâ here means deliberate and without just cause. In Chapter 13 bankruptcy, this applies only to injury to people debts for property damage may be discharged.

- Debts for death or personal injury caused by the debtorâs operation of a motor vehicle while intoxicated from alcohol or impaired by other substances.

- Debts that you failed to list in your bankruptcy filing.

Other Types Of Bankruptcies

Chapter 7 and 13 are the most common types of bankruptcy, but there are others. For farmers and fishermen dealing with tax debt, Chapter 12 bankruptcy offers similar protections as Chapter 13, but with additional special conditions and leniencies. Many corporations and partnerships opt for Chapter 11, which is more of a reorganization plan.

Don’t Miss: How Many Times Has Trump Filed For Bankrupsy

Bankruptcy Discharge Wont Remove Liens

While the automatic stay can stop new lien petitions, existing liens arent removed when you file. If you have a federal tax lien placed on any property because of back taxes that you owe, the discharge of that debt during bankruptcy wont remove the lien. Even if the debt itself is discharged during your bankruptcy, the lien must be paid. Make sure to do this as quickly as possible, so you dont have issues if you try to sell the property.

You May Make Surplus Income Payments

When you file for bankruptcy, you must do the following:

- disclose to the LIT information about all of your assets and liabilities

- advise the LIT of any property that was sold or transferred in the past few years

- surrender all your credit cards to the LIT

- attend the first meeting of creditors

- attend two counselling sessions

- advise the LIT in writing of any address changes

- if required, attend an examination at the Office of the Superintendent of Bankruptcy and

- assist the LIT as needed in administering your estate.

You may be required to make additional payments to your LIT for distribution to your creditors.

In addition to paying the LIT’s fees, you may be required to make additional payments to your LIT for distribution to your creditors. These are called surplus income payments.

Each month during the bankruptcy process, you must submit a copy of your pay stubs and proof of other income to the LIT. The LIT then calculates your surplus income.

Surplus income is the part of your earnings that exceeds the amount of income a family needs to maintain a reasonable standard of living. This amount is set by the OSB annually. The larger your family, the more you are allowed to keep the more you earn, the more you are required to contribute.

In other words, if your household income exceeds the level set by the OSB, then you must make additional payments to your LIT during your bankruptcy.

Don’t Miss: Toygaroo

What Happens When You File For Bankruptcy

Filing for bankruptcy will have major repercussions on the rest of your finances. It will discharge you from unsecured debts, which includes credit cards, payday loans, amounts owing to utility companies, student loans under certain circumstances, and tax debt.

The downside is that you will have to sell any non-exempt assets you own to pay off your creditors, as well as 50% of any surplus income over a certain threshold.

Bankruptcy will provide CRA debt relief, but it will come at a cost. Some of the assets that could be liquidated if you declare bankruptcy include:

- Vacation and investment properties that are not your primary residence

- Secondary vehicles

- Non-RRSP investments, including TFSAs, as well as RRSP contributions made in the 12 months before filing

- Jewelry, artwork, collectibles, and other valuables.

In addition to surrendering assets, you will also have to make surplus income payments for 21 months until you are finally discharged from your debts. Surplus income payments are 50% of any net income earned above a certain threshold that depends on the size of your family. It should give you enough to live, but the payments can be considerable depending on your income.

If you owe money to the CRA, bankruptcy will eliminate those debts, but these are all factors to consider. Talk to an insolvency trustee about your options.

Eliminating Tax Debt: The Cra And Bankruptcy Court Decisions

Date 25.04.21

Bankruptcies and Consumer Proposals are designed to legally release Canadians from the burden of tax debt, while leaving their retirement savings intact. But when the Canada Revenue Agency gets involved, things may end up playing out in various unexpected ways, including a visit to Bankruptcy Court.

Like any other organization owed money, the CRA has the right to oppose a taxpayers discharge from Bankruptcy and petition the Bankruptcy Court to decide the outcome. Luckily, the CRA will not normally oppose a discharge. When they do oppose it is because the tax debt is large, or the taxpayer has failed to file back taxes. In extreme cases there could be an accusation of tax evasion or fraud, or the taxpayer has attempted to evade CRA collection efforts.

In these cases, the CRA is prone to oppose the discharge and a Court hearing gets scheduled. Even if the CRA itself does not request opposition to the Bankrupts discharge, the BIA legally requires a discharge hearing if tax debt is over $200,000 and 75% of the total debt owing.

Prior to any hearing, the CRA is often willing to discuss and negotiate a settlement with the taxpayer and the Insolvency Trustee. The CRA could allow the taxpayer to be discharged from the Bankruptcy if a financial settlement is agreed to and paid to the Trustee and if the Bankrupt remains current with any post-bankruptcy tax obligations. The Bankruptcy Court must then approve these settlement arrangements before a discharge is issued.

Don’t Miss: Bankruptcy Lawyer Salary

Chapter 7 Vs Chapter 13

Chapter 7 and Chapter 13 are the two most common types of personal bankruptcy.

In a Chapter 7 bankruptcy, a trustee appointed by the bankruptcy court will liquidate many of your assets and use the proceeds to pay your creditors some portion of what you owe them. Certain assets are exempt from liquidation. Those typically include part of the equity in your home and automobile, clothing, any tools you need for your work, pensions, and Social Security benefits.

Your nonexempt assets that can be sold off by the trustee include property , a second car or truck, recreational vehicles, boats, collections or other valuable items, and bank and investment accounts.

In Chapter 7, your debts are typically discharged about four months after you file your bankruptcy petition, according to the Administrative Office of the U.S. Courts.

In a Chapter 13 bankruptcy, by contrast, you commit to repaying an agreed-upon portion of your debts over a period of three to five years. As long as you meet the terms of the agreement, you are allowed to keep your otherwise-nonexempt assets. At the end of the period, your remaining debts are discharged.

In general, people with fewer financial resources choose Chapter 7. In fact, to be eligible for Chapter 7, you must submit to a means test, proving that you would be unable to repay your debts. Otherwise, the court may determine that Chapter 13 is your only option.

Take Your First Step Towards A Debt Free Life

If you are overwhelmed by debt and live in the Toronto area, call us at 416-498-9200 to book a FREE, confidential appointment. We will review your financial situation in detail and discuss all of your options with you. Alternatively, you can fill out the form below and our team will reach out to you.

Read Also: What Is Epiq Bankruptcy Solutions Llc

Get A Debt Consolidation Loan To Repay Your Tax Debt

Another option for gaining tax debt relief is taking out a debt consolidation loan. A debt consolidation loan is a new loan that is taken out in order to consolidate separate debts. It often provides a lower interest rate and affordable monthly payments to make it easier for you to deal with your tax debt repayments. Taking out a new debt consolidation loan does come with its own associated risks, however. You may not be able to secure favourable interest rates, which in turn could mean trading in your original tax debt for another kind of debt. Another form of tax debt relief may be more appropriate for tackling the tax debt head on.

I Will Not Be Able To Get Future Credit/buy A House

As stated earlier, bankruptcy is intended to be rehabilitative in nature, not punitive. It would not be fair to punish someone forever for filing a bankruptcy, so the record of it stays on your credit report for six years following discharge for first-time bankrupts. After that, it is gone. Your ability to buy a house will always be governed by your financial circumstances: your income, your assets, your spending and obligations. Many former bankrupts have been taught budgeting by their Trustee as part of the process and are now, of course, debt-free. So on paper, as long as they have the downpayment, many look pretty attractive as a lending risk. Even while the bankruptcy is still on your report when you apply for a mortgage, most still get approved in our experience. CMHC will guarantee a mortgage within three years of your discharge from bankruptcy depending on your financial situation.

You May Like: Can You Be Fired For Filing Bankruptcy

How Bankruptcy Stops The Irs

When you file a bankruptcy case, an injunction called the automatic stay goes into effect to stop creditors, including the IRS, from starting or continuing collection activity, like sending you letters, garnishing your wages or your bank account, or filing liens against your property.

The stay continues during the bankruptcy case. It can be lifted only by the bankruptcy court after a request by the creditor .

Once the bankruptcy case is over, the IRS will be free to resume collection activity unless the tax debt has been wiped out or paid in full.

Keep in mind that the automatic stay will go into effect the first time that you file for bankruptcy. However, that’s not always the case for subsequent filings. You could lose the stay if you’ve had repeated bankruptcy filings.

Negotiate Payment Terms With The Cra

You may be able to negotiate a payment schedule. Contact your income tax collections officer, explain your circumstances, and offer a payment schedule you can manage. Offering a series of post-dated cheques can be an indication of good faith and may be an easy solution for smaller income tax debts. For example, if you owe $2,000, you may offer to pay $200 per month for the next 10 months by way of post-dated cheques.

The CRA will often agree to let you pay over time, but keep in mind:

- You will pay the full amount owed

- The CRA will continue to charge interest until the debt is paid in full

- The CRA will typically not accept a payment plan more than one year long

If the CRA does not accept your offer, the Agency will likely take further action to collect the tax debt. The CRA has more powers of collection than commercial creditors, and can easily register a lien against your home or garnish your wages. Therefore, you should be prepared to try a different solution.

Recommended Reading: How Many Times Has Donald Trump Declared Bankruptcy

Bankruptcy May Not Always Clear A Tax Debt

Even if you go bankrupt, or your corporation, or someone close to you , you can still be held liable in the future for a Canada Revenue Agency tax debt you believed bankruptcy had erased. This is pursuant to the Federal Court of Appeal decision in Canada v. Heavyside, 1996 FCA 3932 . As outlined below, there are many circumstances where bankruptcy will not erase a tax debt and it is important, before you consider bankruptcy, to be aware of the risks of potential future liability and ways to protect yourself.

How We Resolve Tax Debt Problems

The team at Farber Tax Solutions has a history of proven success at negotiating with the Canada Revenue Agency. Our experienced team of ex-CRA, legal, and accounting professionals understand how to correctly review and analyze tax debt scenarios and create a comprehensive plan for resolving tax problems.

Our tax professionals work with you to examine your documentation, fully comprehend all aspects of your situation, and determine the best course of action. If necessary, we have a proven history of communicating and negotiating with the CRA, and can work to clarify your situation and potentially reduce interest charges and penalties on your debt.

Don’t Miss: What Is Epiq Bankruptcy Solutions Llc

Can I Get A Credit Card After I File For Bankruptcy

When you file for bankruptcy, you must hand over your credit cards to your LIT. An LIT will also explain credit rebuilding strategies and programs to you. You can apply for a credit card after youre discharged from bankruptcy, and will likely need to start with a secured credit card, where you would pay a deposit to guarantee your credit limit.

Opposition To Bankrupt’s Discharge By The Trustee And A Creditor Court/osb No: 11

Background

Information provided by the bankrupt at the time of filing for bankruptcy with regard to a $200,000 second mortgage, registered against his property less than a year before filing for bankruptcy, was not accurate. Also, the bankrupt did not disclose that he had not received any funds in consideration of granting this mortgage. In addition, the trustee indicated that the bankrupt had been uncooperative regarding dealing with his property. The creditor opposing the discharge provided information to the Court showing that the bankrupt put the creditor to unnecessary expense as the creditor was taking steps to obtain payment. The bankrupt did not appear at the discharge hearing.

The decision to oppose the bankrupt’s discharge was based on a number of factsFootnote 1 including:

- Bankrupt has put any creditors to unnecessary expense by a frivolous or vexatious defence.

Court decision

The Court found that the bankrupt was not only evasive and uncooperative but also disruptive and caused additional expense for creditors. The Court found that he had not rehabilitated himself and as a result of his conduct the Court refused his discharge.

Read Also: Bankruptcy Falls Off Credit Report

About Licensed Insolvency Trustees

Organize A Voluntary Repayment Plan With The Cra

If you think you can pay back your tax debt but require an extension in time, it is possible to contact the Canada Revenue Agency to organize a repayment plan. Provided you can pay back all of the tax debt you owe, you can work with the CRA to agree to make monthly payments until your tax debt is repaid in full. It is important to note, however, that in addition you will need to pay any penalties and interest associated with your tax debt. The CRA may give you up to a year to make your repayments.

Read Also: How To File Bankruptcy Yourself In Texas

How To Avoid Future Tax Debt Problems

To avoid debt problems in the future, it is important that you understand how you arrived at your current situation, in which you owe a great deal of money to Canada Revenue Agency.

Do you owe taxes because you cashed in the last of your RRSPs to pay your debts? This cant happen again soon, because any remaining RRSPs will be liquidated in your bankruptcy.

On the other hand, if you are self-employed, you can easily find yourself with a tax debt at the end of the year. It is important to prepare for such an eventuality and to make sure that you make payments throughout the year.

We recommend that at the beginning of each year, self-employed individuals estimate the amount of income taxes they will owe and then remit one twelfth of this amount to the tax authorities even if the tax authorities do not require such frequent payments. Then, at the end of the year, tax time will actually be enjoyable as you will have minimal or no accumulated income tax debt. You might even receive a refund!

Finally, make sure you have realistic expectations concerning your lifestyle and your expenses . When do we accumulate tax debt? When we dont feel we can afford to pay it. Proper budgeting and business management can eliminate the monthly deficit that often contributes to serious tax arrears.