Federal Housing Authority Loan

An FHA loan is a federally-insured loan. It’s attractive to first-time, cash-strapped home buyers because it offers the ability to put down as little as 3.5% of the purchase price.

Additionally, the requirements are more liberal than conventional loans. You’ll likely qualify with a credit score of:

- 640 and 3.5% down

- 580 if you can afford a higher interest rate, or

- 500 and 10% down.

If you’d like better terms, consider taking steps to improve a credit score of less than 640.

Can A Bankruptcy Stop A Foreclosure In Georgia

Stopping A Foreclosure In Georgia Bankruptcy and Other Options. Many Bankruptcy cases in Georgia, and other states, are filed to stop a foreclosure of the family home. They are not filed only because of the foreclosure, but the realization that the family home is about to be lost is usually the final straw after a period of financial problems.

Tips For Buying A House After Bankruptcy

Try out some of these tips if you want to buy a house after bankruptcy.

- Rebuild your credit based on these five factors:

- Consistent, on-time payments. Youre judged on how often youve been late and how late the payments were made.

- Total debt vs. available credit. If youre close to the limit on your available credit, particularly from multiple sources at once, your score will likely decrease.

- This is affected by the average age of your credit sources. Having a long history is better, but only if its not full of late payments.

- Recently opened accounts. If youve just applied for many accounts, your score will likely be lowered by the hard inquiries.

- Range of credit. Having a variety of accountsmortgage, credit card, other loanscould increase your score.

- Pay off your existing debts.

- Wait until you can afford a larger down payment.

- Get a cosigner, whose income will be used to judge the affordability of a loan and lower the required down payment.

- Get a preapproval letter, which helps you when shopping around by giving lenders more information on your finances.

- Simply wait seven to 10 years until the bankruptcy is cleared from your report, making lenders far less nervous about your ability to make payments.

Now that youre aware of waiting times and credit repair factors, you need to know what score to aim for. Weve got a few things to say about that, too, so take a look at our guide on and set an appropriate target.

Also Check: How Long A Bankruptcy Stays On Credit Report

How Long After Bankruptcy Can I Get An Fha Home Loan

Some lenders make it possible to get an FHA Home Loan as soon as 1 day after discharge. In some instances you can receive an FHA loan during the Chapter 13 plan, or after 12 months of successful payments and approval from the trustee. There are a number of stipulations which you must adhere to best qualify for an FHA home loan. Some mortgage companies commonly see the duration of time to qualify for an FHA loan after bankruptcy as 3 years. As long as youre properly aligned with the qualifying factors, there are mortgage companies that will work to get you for a FHA home loan.

How Long After A Chapter 7 Bankruptcy Can I Buy A House

A Chapter 7 bankruptcy is a debt elimination program designed to help eliminate unsecured debts that you can no longer afford to pay. Rebuilding your credit after a Chapter 7 discharge requires managing credit wisely and establishing a positive payment history for all of your bills.

Typically, you will qualify for a new home purchase within 2 years of a Chapter 7 court discharge, depending on each bank’s lending standards. Other factors include how you have managed your credit since the discharge and your income at the time of the loan application.

You May Like: Epiq Bankruptcy

S To Buying A Home After Bankruptcy

If youre one of the millions of Americans who have , financial recovery can seem like a pipe dream. But dont give up. According to a study by the Consumer Financial Protection Bureau, peoples after filing for bankruptcy. While any credit improvement is good news, is it enough to offer a chance at homeownership? Heres what you need to know about buying a house after bankruptcy.

How Soon Can I Apply For A Mortgage Following A Bankruptcy

You will not be able to apply for a mortgage immediately after having your debts discharged through a bankruptcy. There is typically a waiting period before any lender will consider you. This is because lenders will base their decision on your financial behavior in the time period following your bankruptcy.

According to Steve Rhode, WRALs Get Out of Debt Guy, rebuilding your credit after bankruptcy is something that should begin on the day you get your discharge papers. If you do that, then within a year you’ll be qualified for good rates on a car and within two to three years you’ll be qualified for excellent rates on a new mortgage.

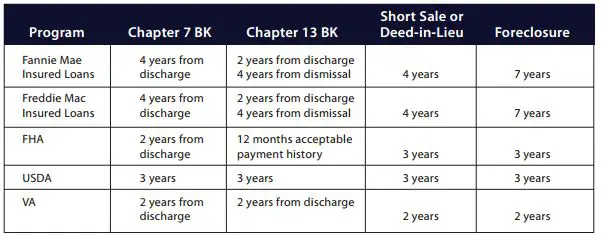

Typically, there are different waiting periods for different kinds of mortgage loans.

- For conventional mortgage loans: These have the longest waiting period. You will need to wait two years following a Chapter 13 bankruptcy, and four years following a Chapter 7 bankruptcy.

- For FHA and VA mortgage loans: You will need to wait one year after a Chapter 13 bankruptcy, and two years following a Chapter 7 bankruptcy.

- For USDA mortgage loans: You will need to wait one year after a Chapter 13 bankruptcy, and three years following a Chapter 7 discharge.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

Try To Get An Fha Mortgage

The FHA understands that the recent economic downfall has created hardships for many Americans, and is therefore rather forgiving of bankruptcies in your credit history. If you can qualify for an FHA loan, this may be your best method of securing affordable home financing in a timely manner.

Be aware that borrowers who obtain an FHA loan will be required to pay an additional fee for mortgage insurance for at least eleven years however, these loans do enable buyers with poor credit to get financing at a reasonable interest rate and with a small down-payment. According to Jeff Lazerson, head of Mortgage Grader, Inc, the FHA is the new and only subprime game in town.

How Many Years After Bankruptcy Can You Buy A House

If youve gone through a Chapter 7 bankruptcy, you need to wait at least 4 years after a court discharges or dismisses your bankruptcy to qualify for a conventional loan. Government-backed mortgage loans are a bit more lenient. You need to wait 3 years after your bankruptcys dismissal or discharge to get a USDA loan.

You May Like: How Many Times Have Donald Trump Filed For Bankruptcy

Create A Budget Together

Another step you can follow to buy a house after bankruptcy is taking control of your monthly budget. You can create a reasonable budget by paying all your bills on time. Figure out your overall monthly expenses, and check out the spaces you can adjust your budget. Besides, you can foresee upcoming annual costs, including taxes or car registration, and keep some money aside to settle these expenses.

How Long After A Chapter 7 Can I Buy A House

If youre reading this, theres a good chance youve filed for Chapter 7 bankruptcy. Its during Chapter 7 that the court wipes away ones debt, leaving them with less than ideal credit.

You will need to wait at least four years after your bankruptcy is dismissed or discharged before qualifying for a mortgage. Not sure you can wait for that long? Then look into requirements for government-backed programs such as FHA, VA, and USDA loans.* You may be able to obtain a mortgage with one of these loans in just a few years following the discharge or dismissal of your bankruptcy.

*NOTE: FHA, VA, Conventional, and USDA loan requirements are subject to change. Non-QM loans may be temporarily unavailable. As a result of COVID-19, mortgage investors are unable to support as many loans, meaning underwriting guidelines for government and conventional loans are becoming more strict.

Also Check: How Many Times Donald Trump Bankruptcy

Buying A Home After Bankruptcy: A Step

Its no secret that buying a house is part of the American dream. Homeownership allows you to build equity, enjoy predictable monthly payments, and benefit from tax deductions. Plus, thanks to various loan programs available, you can get pre-approved for a mortgage even if you dont have a great credit score.

But what if you have a bankruptcy on your record? Can you really buy a home soon after your credit took such a major hit? Though every borrowers situation is different, you can eventually purchase a home after bankruptcy.

Continue reading as we answer some questions related to this topic.

How To Prepare Yourself For A Post

Explore all of your financing options. Check with different financial institutions, including credit unions, to see what type of auto financing is available. Ask whether having a cosigner would help you get a better interest rate. Learn about subprime lenders.

Know what you can afford before you shop. Make sure your new car payment will not make meeting your other living expenses harder. You donât want to end up in a stressful financial situation all over again.

Do some window shopping. It can be hard to get excited about buying a used vehicle. To combat this and feel better about buying something other than a brand new car, do some research. Find out which cars hold their value the longest, have the features youâre looking for while fitting into your budget, and ⦠well⦠excite you the most.

Learn the numbers. By the time youâre at the car dealership, you should know not only what kind of car you want but more importantly, what kind of down payment and monthly payment you can afford.

Avoid âbuy here, pay hereâ offers. âBuy here, pay hereâ dealerships often charge extremely high interest rates, up to 29%, and many have a reputation for not treating their customers well.

Rebuild your credit for as long as possible. This will allow you to make the most of your fresh start and apply for a car when your credit is stronger. The longer you can wait, the better.

Read Also: Northcarolinadebtrelief Org Review

Analyze Your Debts And Credit Report

Analyze your current financial position to check out where you stand now. The next thing you can do is get a copy of your credit report. If you have a previous record of your finance before filing for bankruptcy, you can use it to analyze the complete picture of your past and current financial position. Make sure to check your financial status regularly so that you can keep an eye on mistakes and correct them accordingly. It will encourage you to make further progress ahead.

How To Apply For A Mortgage After Bankruptcy Steps To Follow

Also Check: What Is Epiq Bankruptcy Solutions Llc

Bankruptcy Foreclosure Short Sale And Your Credit Score

If you want to buy a home despite a bankruptcy or foreclosure on your record, you’ll need to clean up your finances. The single most important step is repairing your . Your credit score is your financial lifeblood, a tool that you wield to get a mortgage loan approval. You cannot get a mortgage without a credit score and credit history that proves to lenders that you can be counted on to repay the loan.

As you plot your strategy, first assess the damage to your credit score. That depends on a number of factors, including your credit history before your trouble with homeownership. If you had a high score before the foreclosure, bankruptcy or other negative event, your credit score probably dropped further than those whose scores were always lower. According to FICO, creator of the FICO credit score, a foreclosure or similar event could derail your credit score by 100 points or more.

The damage to your credit score also depends on the type of home loan woes you suffered. According to FICO, a bankruptcy is on average more damaging to your credit score than a foreclosure, short sale or deed in lieu of foreclosure. A short sale or deed in lieu of foreclosure can be just as damaging to your score as a foreclosure credit reports don’t generally differentiate between these types of foreclosure alternatives.

Buying A House After Chapter 7 Bankruptcy

If you had a bankruptcy discharged a year ago or more, you might be starting to get your finances back in order. Maybe youre even thinking about buying a house.

The good news is that its possible to purchase a home following a Chapter 7 or Chapter 13 bankruptcy.

But theres a waiting period before you can take out a mortgage usually at least two years. And lenders will be looking closely at your credit score, credit reports, bankruptcy discharge details, and other factors to ensure you qualify.

Tread carefully after bankruptcy and take steps to improve your credit. With hard work and patience, youll eventually be able to get a home loan.

You May Like: How Many Times Has Donald Trump Declared Bankruptcy

How Soon Can I Qualify For A Mortgage After Bankruptcy

Filing bankruptcy doesnt mean youll never qualify for a mortgage. One reason to file a bankruptcy case is to eliminate burdensome debt so you can get a fresh start. Some lenders, such as credit card and even certain car loan creditors, will take a chance on you right after you emerge from bankruptcy.

Mortgage lenders and guarantors want to ensure they wont compromise resources by lending to someone whos not ready for the responsibility of home ownership. Therefore, they usually wont approve loans right after the borrower gets a bankruptcy discharge. There could be a waiting period of up to 5 years.

Youll pay a higher interest rate, and the terms may not be as favorable as you like, but some for most former bankruptcy debtors. Mortgages are a different story.

During that waiting period, you must keep your new developing credit record clean. If you run into trouble, you might have to restart the clock. Every lender or guarantor has its own set of guidelines. If you are able to obtain a mortgage right away and that mortgage is foreclosed a year after your bankruptcy case is discharged, youll have another waiting period before you can qualify.

The Purpose Of Filing Chapter 7 Bankruptcy

The purpose of filing bankruptcy is to get out of debt. Filing bankruptcy discharges most unsecured debts. In other words, you get rid of the debts that you cannot afford to pay.

Examples of unsecured debts that you can discharge in Chapter 7 include:

- Some old personal income taxes

- Medical debts

- Old rent, utility, and lease payments

- Some liens on household goods

Some debts are not dischargeable in bankruptcy, including alimony, child support, and most student loans and taxes. However, for the most part, many people get rid of most or all of their unsecured debts through Chapter 7.

Recommended Reading: How Many Times Trump Declared Bankruptcy

How Do You Get A Mortgage After Bankruptcy

So how do you go about buying a home if you dont have cash on hand and need to finance the purchase? Lets take a look at whats involved in getting a mortgage and how bankruptcy impacts that.

If your credit score is below 600, you may be a candidate for a bad credit home loan, commonly known as a subprime loan. These loans typically carry interest rates that are at least a couple of percentage points higher than standard also known as prime borrowers can get. Youre also likely to pay additional fees. In the end, getting a mortgage before your bankruptcy has fallen off your credit reports will likely cost you much more over the life of your loan than if you waited until your credit improved.

Buying A House After Chapter 7 Bankruptcy Faq

How soon can I buy a house after Chapter 7 discharge?

Most home buyers have to wait at least 2 years after Chapter 7 discharge before they can get approved for a home loan. It may be possible to qualify sooner if you were forced into bankruptcy for reasons beyond your control, but early approval is rare.

What is the average credit score after Chapter 7?

The average credit score after a Chapter 7 bankruptcy is commonly in the low 400s to mid 500s, according to attorney Jeremiah Heck. To qualify for a home loan, you typically need a credit score of 580-620 or higher.

Can you buy a house after Chapter 7 with a co-signer?

Yes, having a co-signer can improve your chances of getting a mortgage post-bankruptcy. But remember that this can be a risky move for the co-signer. So you want to be sure you can make the monthly payments on time if you choose this option, recommends Graham. Also, you will still likely need to wait two to four years after a bankruptcy to apply for a mortgage loan, even with a co-signer.

Can I get a VA loan 1 year after Chapter 7?

Usually not. The minimum waiting period to obtain a VA loan after Chapter 7 bankruptcy is two years.

Can I get an FHA loan after Chapter 7?

Yes, provided you rebuild your credit and wait two years after your bankruptcy is approved by the courts. Avoiding new debt after your bankruptcy is discharged can also help your chances of qualifying for an FHA mortgage.

What credit score do I need for an FHA loan?

You May Like: What Is Epiq Bankruptcy Solutions Llc