Credit Settlement Will Hurt Your Credit Score

When you settle a debt, the account status will be noted as settled in full rather than paid in full. When an account is closed with a settled in full notation, it stays on your credit report for seven years from the date of final discharge. That notation is a bad mark on your credit history, which is the number one factor used in calculating credit scores. So, each debt you settle will damage your credit score.

But if your accounts are already in collections, they already count negative remarks on your credit report. If you already have multiple collection accounts listed in your report, the damage has already been done to your score. Essentially, its the old adage that you cant fall off the floor. If your credit score is already bad, theres less risk to settling your debt.

On the other hand, if you have a good score or even a fair one then you should expect the settlement to drag your score down. You need to consider carefully what will happen once you get out of debt. Its definitely possible to rebuild your credit, but you want to limit the damage whenever possible as you eliminate your debt.

A Popular Social Media Item Wrongly Claims That Consumers Are Not Obligated To Pay Back Debt That Creditors Have Written Off And Sold To Debt Collectors

Advertisment:

One common form of urban folklore is the “legal talisman” text, typically a message informing readers that they can gain significant advantage simply by invoking some little known legal stratagem that will protect them from penalty or punishment they might otherwise experience. Social media users were exposed to another example of this form in 2017, one which advised them they were not legally obligated to pay any debts that creditors had sold off to third parties:

DON’T PAY THEM A DIME!

If your original creditor sold your debt to a collection agency, they also wrote off your debt on their taxes which wrote off your obligation to pay. You can dispute the transaction via dispute.transunion.com Your dispute reason is “contract was cancelled” and write “NO CONTRACT” in the dispute comments. I have cleared THOUSANDS off my own report and have been working to help my friends and family do the same! for FREE! Peace and love to all! Knowledge is power!

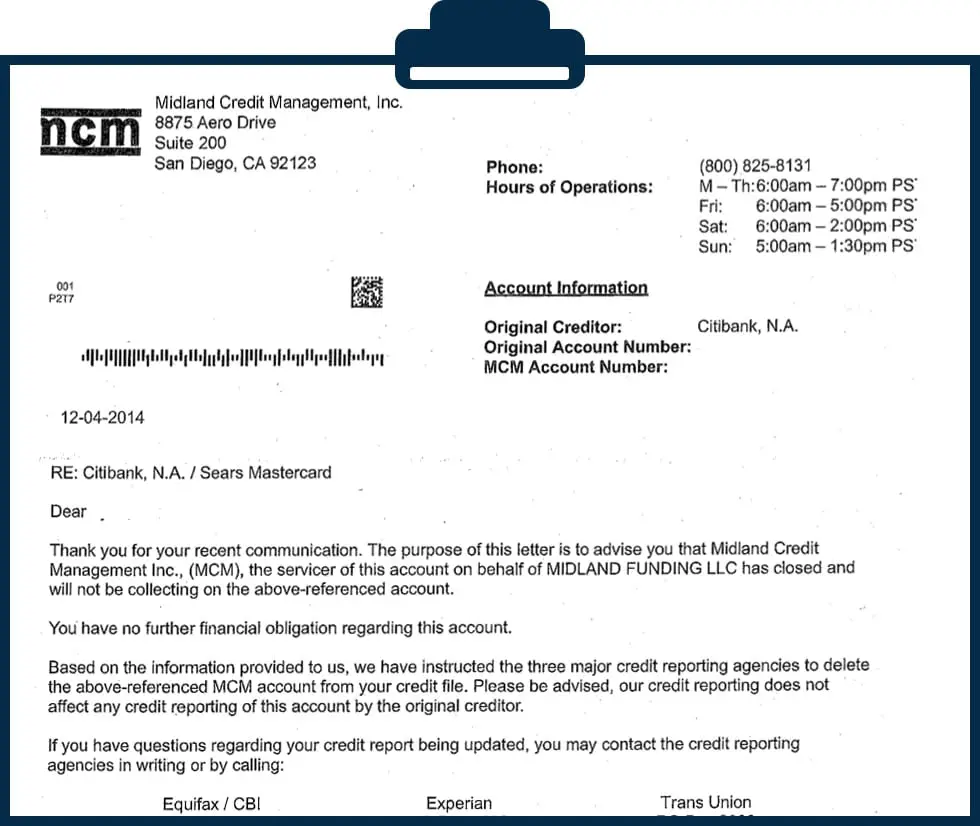

Likewise, it is not true that a creditor’s selling off a debt to a collection agency means negative information about that debt must be removed from a consumer’s credit report. Any legally incurred debt, regardless of who currently holds the right to collect it, may be validly reported to, and listed by, credit reporting agencies such as Equifax, Experian, and TransUnion.

Or, as one reddit contributor put it:

. “How to Dispute an Error on Your Credit Report.” 16 December 2011.

Advertisment:

What Is A Debt Buyer

In todayâs economy, many creditorsâincluding credit card companies, utilities, phone companies, banks, and lendersâregularly sell to debt buyers old debts that they have been unable to collect. The creditors package these old debts into portfolios, which they sell to debt buyers for pennies on the dollar. It is not uncommon for a debt buyer to pay less than five cents per dollar owed.

The debt buyer purchases from the creditor an electronic file, or âdatastream,â of information about the portfolio of debts. The debt buyer usually does not purchase copies of individual contracts or account statements to substantiate that the individuals whose names are included in the portfolio actually owe the money.

Once the portfolio of old debt is bought, the debt buyer either aggressively pursues an individual for payment of the supposed underlying debts, or re-sells the portfolio to another debt buyer. When collecting, debt buyers often cast a wide net to find people who owe money.

Recommended Reading: How To Get A Car While In Bankruptcy

What If Youre Contacted By More Than One Collection Agency For The Same Debt

If youre contacted by more than one collection agency for the same debt, it means that the original creditor has hired a secondary collection agency, or the first one has sold the debt to a second creditor. This indicates the original creditor and even the first collection agency have given up on you. This means that the second collection agency has paid even less for the debt than the first one. If the agency hasnt been able to reach you by phone but knows that you are receiving its letters, it may be willing to take even less.

The Benefits Of Contingency Fee Debt Collection

Pay Onlyfor Performance. The most significant advantage of using a contingency fee arrangement is that you don’t have to worry about paying the collection agency unless they successfully retrieve your money.

Maximum Results. You can rest assured that a contingency-based collection agency will give its utmost to your accounts. Because they don’t get paid unless you get paid, the agency will be highly motivated to do everything in its power to bring you the best possible result. This may also provide some peace of mindif a collection agency is willing to risk not collecting a fee for the work they put into things, you probably have a good chance of retrieving your debt.

No Up-front Fees. An additional advantage of using a collection agency charging on a contingency basis is that you don’t pay anything while your debt is still outstanding.

Recommended Reading: Can A Wife File Bankruptcy Without Husband

How Much Do Collection Agencies Charge

There are thousands of debt collection companies out there with different pricing options, so getting an idea about how much collection agencies charge can better prepare you for vetting collection services. Collection agencies charge their clients in a myriad of ways though, most collection agencies offer either contingency collections or flat fee programs for third-party collection services.

Contingency Collections

Most collection agencies offer contingency collection plans. This means you have to pay only when the agency recovers revenue on your behalf.

The contingency rate is a percentage of the dollars recovered. Most companies charge anywhere from 20% to 50% contingency on dollars recovered. Additionally, some agencies may also charge a retainer for services in contingency collections contracts.

However, some factors about your accounts could increase the contingency rate because they result in more difficult collection scenarios:

- If a year has passed since the date debt incurred or date of last payment/charge

- If the debt has a court judgment against it

- If the account had mail returned with no forwarding address

- If you previously placed the debt with an agency or attorney

- If the debt resulted from a bad check given to you by the consumer

Flat Fee

After the letter series under the flat fee plan, which is the first of two phases, theres an optional contingency-based phase with more intensive collection efforts that follow.

Other Services

Additional Accommodations For Debt During Covid

If you’re dealing with significant debt during the Coronavirus/Covid-19 pandemic, you may have a few additional options available for relief.

First, if you’re able to anticipate that you’ll be unable to keep up with your debt before you actually start missing payments, reach out to your lenders and creditors and let them know about your situation. Many credit card companies and other lenders are offering additional accommodations for borrowers experiencing hardship during the pandemic. This might include allowing you to temporarily halt or lower your minimum payments or pause the interest gathering on your account.

In order to receive these accommodations, it’s vital that you reach out to your lender proactively, before you begin missing payments. Additional accommodations will not begin automatically.

Lenders are unable to offer accommodations for debt that’s already past due. So, if you’ve already missed one or more debt payments, or have a debt that’s in collections, be prepared to navigate the collection process as you would normally.

You can find more information on dealing with debt during the Covid-19 pandemic via the Consumer Finance Protection Bureau.

Recommended Reading: Bankruptcy Attorneys In Maryland

What Are My Options Before Being Sued And After Being Sued

Downsides Of Diy Debt Settlement

Regardless of whether you take on the task yourself or reach out to a debt settlement company, you may face a tax burden if you do reach a settlement. If at least $600 in debt is forgiven, youll likely pay income taxes on the forgiven amount.

Another downside to either DIY or professional debt settlement is that your credit score will take a dive, and the settlement will remain on your credit report for seven years.

And dont forget that, if you decide to DIY, youll be on your own. In other words, you wont have a debt settlement professional or anyone else to negotiate on your behalf.

Don’t Miss: How To Qualify For Home Loan After Bankruptcy

Ask The Debt Collection Agency To Validate Your Debt

As mentioned above, you have the right to get all the information pertaining to the debt. Within 5 days of contacting you, the debt collection agency has to verify details around the original debt like the name and address of the original creditor, amount, date incurred, etc. They should also have your correct contact information connected to the debt to make sure that its actually yours.

If you dont believe the debt is yours, you have up to 30 days to dispute it. While the collector is confirming the validity of the debt, they cant engage in any collection activities. If the debt cant be verified, the collection agency has to stop collection activities and remove it from your .

Need help coming up with the best letters to communicate with debt collectors? The Consumer Financial Protection Bureau has a number of debt collection letter templates you can use to send to the collection agency.

Does The Agency Know Your Industry

With so many collection agencies vying for companies business, they have to find ways to stand out. One way to do this is to focus on specific niches, such as healthcare, insurance, utilities, credit cards or mortgages. For business owners in very specific industries, the experience the collection agency has in the industry should be the deciding factor when comparing two similar collection agencies.

Make sure the collection agency you choose is well versed in state and federal rules governing your industry as well.

Recommended Reading: What Does Bankruptcy Mean For Boy Scouts

The Minimum Amount A Debt Collection Agency Will Sue You For

If you owe a debt and fail to repay it, you may be sent to a collection agency or even sued by a debt collector. The goal of these debt collection companies is to legally collect on the debt owed by someone who has failed to pay. Collection agencies may attempt to collect by contacting you, arrange payment plans to pay what you owe, or suing for debt recovery.

If you find yourself in this type of situation, don’t panic! This article will give you information about the debt collection process and how much a debt collector can sue for, and what to do.

Summit Account Resolution: Best Collection Agency For Small Businesses

Summit Account Resolutions transparent pricing, low minimum collection balance requirement and variety of service options make it our choice as the best collection agency for small businesses. Summit collects both commercial and consumer debt across the U.S., serving many different industries.

It has some of the lowest rates in the industry, charging as little as 7% for certain first-party collection programs to as much as 50% if its a consumer collection account. Rates are negotiable. There arent any upfront fees, nor additional charges for older accounts. The companys pricing is set on a contingency basis. If Summit AR doesnt collect any money, you dont have to pay. To recover debt, it employs several tactics, including skip tracing and litigation services.

Summit AR serves both consumer and commercial customers, and has experience collecting debt from a range of debtors. It employs ethical and empathetic tactics, and strives to treat debtors with dignity and respect. Summit ARs debt recovery rate is 34.8%, but according to the company, there are some cases in which that rate is 80%.

When you become a client of Summit AR, you get access to an account manager. You also get to use an online portal, enabling you to add new accounts and monitor existing ones whether its 12:00 p.m. or 12:00 a.m.

Don’t Miss: How To Apply For Credit Card Debt Forgiveness

How To Negotiate Credit Card Debt Settlement Yourself

If your debts are already in collections and youre receiving settlement offers, then you may not need a professional debt settlement company to handle the negotiation for you. Instead, you may be able to save yourself some money and handle the debt negotiation yourself.

To do this, you will want to send formal letters to each of the collectors or creditors that hold your debts. Here is the step-by-step process for do-it-yourself credit card debt settlement:

The Truth: Should You Never Pay A Debt Collection Agency

George Simons | July 21, 2022

Summary: When a collector contacts you, respond with a debt validation letter. You may not want to pay a collector if you will never have any income or assets, if you don’t owe the debt, if you want to settle for less, if the statute of limitations has expired, or if the collector doesn’t own the debt.

You’ve heard that you should never pay a debt collection agency, and now you want the truth. What happens if you never pay collections? Should you pay the debt collector or the original creditor?

Debt collection agencies can employ a variety of shifty tactics. They may start with harassing phone calls and escalate from there. But depending on your situation, you may never need to pay a debt collector. Not sure where to begin? SoloSuit can help.

Also Check: How Long Does Chapter 7 Bankruptcy Stay On Your Credit

Should I Hire A Collection Agency If I Have Small

While most collection agencies will collect debts over $50, whether you should hire one depends on how many customers owe you money. If its one or two past-due accounts and its an occasional occurrence, collecting the debt on your own may be more effective. But if you have a lot of customers who havent paid their bill in more than 60 or 90 days, it may be worth calling for help. A good debt collection agency is effective at recovering money owed to you and will do it in an empathetic way.

What To Expect In 2021

A lot has changed for collection agencies since January. Heading into 2020, the industry was focused on new rules and regulations regarding debt collections, increased competition, and declining commission rates. But then the COVID-19 pandemic occurred, and everything changed.

Like other industries, collection agencies across the country were required to shut down in-person operations, shifting to remote workforces or halting operations altogether.

At the same time, states aiming to protect struggling consumers during the pandemic, limited the work collection agencies can do. Massachusetts, for example, banned debt collectors from making collection calls, filing new collection lawsuits, garnishing wages or earnings, or repossessing property and vehicles. In Illinois, debt collectors must work with consumers to create payment plans that meet clients financial situations or delay collection for 60 days.

The federal government is also taking steps to limit what debt collection agencies can do during these unprecedented times. A bill has been introduced in the U.S. Senate that, if passed, would only allow debt collectors to communicate with consumers in writing during a major disaster, such as the current coronavirus pandemic. The limitations on collection agencies would last for 120 days from when the president declares a major disaster.

You May Like: What Does It Mean When A Bankruptcy Is Discharged

Pros And Cons Of Collection Agencies

There are several reasons why businesses turn to a collection agency for help. Many business owners are strapped for time. They barely have a moment to bill customers, let alone chase down late ones. A collection agency takes that off your hands. Sure, theres a fee, but its better than getting nothing if you dont collect it on your own.

You also get legal protection when you work with a collection agency. The last thing you want is to face legal action because of the way you attempted to collect debt. A reputable collection agency knows the rules and regulations. You have less chance of being sued if you hire an accredited and highly rated collection agency.

The collections success rate tends to be higher when you work with a collection agency than if you try to collect the debt yourself.

The biggest downside of working with a collection agency is that there is a fee for doing so. You dont get all of the money you are owed, because the collection agency takes a percentage for their efforts. However, it is often better to get some of what you are owed, rather than none at all.

Key takeaway: The benefits of hiring a collection agency are that you dont have to chase down clients, nor do you have to worry about being sued if youre collection tactics are too aggressive.