National Debt And Budget Deficit

The federal government creates an annual budget that allocates funding towards services and programs for the country. This is made up of mandatory spending on government-funded programs, discretionary spending on areas such as defense and education, and interest on the debt. The budget deficit can be thought of as the annual difference between government spending and revenue. When the government spends more money on programs than it makes, the budget is in deficit.

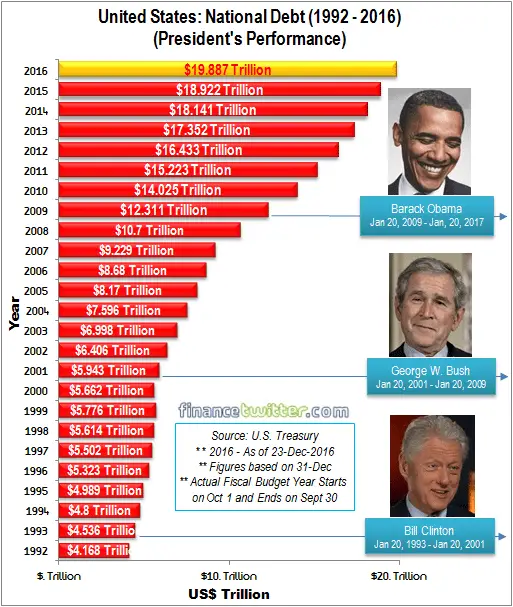

National Debt By President

The National Debt has always been an area of interest for the United States President George Washington appointed future President Alexander Hamilton to understand and solve the $80 million debtthat had accrued due to the Revolutionary War. Hamilton came up with the plan to pay off the debt through taxes and the creation of the national bank. Since then the United States has steadily increased its budget deficit, and the national debt has continued to rise.The first time that the national debt hit the $1 billion mark was in 1863 while the Civil War was occurring it hit the $2 billion was two years later when the civil war ended in 1865. As the country went to battle during World War I and World War II, the national debt hit the $10 billion mark and $100 billion marks respectively. By 1982 after the Vietnam War and the Cold War, the national debt hit the $1 trillion mark for the first time in history. By the 21st Century, the national debt got to $20 trillion after major events such as the War on Terror and the Great Recession. Today , the national debt stands at $30.2 trillion and public debt is roughly 100% of the country’s GDP.

Why Is The Debt So High

As of March 2022, the U.S.s national debt stands at $30.2 trillion.Factors that contribute to the U.S.s high national debt include continued federal budget deficits, the government borrowing from the Social Security Trust Fund, the steady Treasury lending from other countries, low interest rates that promote increased investment, and raised debt ceilings.

Other factors that contribute to the high national debt include the inefficient healthcare system and the changing demographics of the country. Though the U.S. spends more than other countries on healthcare, health outcomes are not much better. In addition, the Baby Boomer generation are now becoming elders and seeking benefits and increased healthcare services. The government will spend, sometimes inefficiently, more on programs and services for the longer living older generations.

You May Like: Are Student Loans Dischargeable In Bankruptcy

How Much Debt Does The Average American Have

Most Americans have borrowed money at some time during their lives, either by taking out a loan or by using a credit card. While debt often gets a bad reputation, it can also be a useful financial tool. Without the help of loans and credit cards, many people couldnt afford to pay for homes, cars, medical bills, or other major expenses.

So how much money does the average American owe?

In this article, we look at average debt by generation. We also cover some effective strategies for paying off your debt.

Heres what we cover:

- How much money does the average American owe?

- What is the average debt by generation?

- How can I start paying off my debt?

Key takeaways

- As of 2020, the average American has $92,727 of debt. This amount includes credit card balances, auto loans, mortgages, personal loans, and student loans.

- The average amount of debt varies by generation. Debt balances tend to increase until people reach middle age. When people get closer to retirement, their debt usually starts to decrease. However, many retired Americans still carry a substantial amount of debt.

- If you want to lower your debt, it helps to have a plan. One strategy is to reduce your debts interest rates. You may be able to get lower interest rates by refinancing your loans or consolidating your debt.

How Much Money Does The Average American Owe

According to a 2020 Experian study, the average American carries $92,727 in consumer debt. Consumer debt includes a variety of personal credit accounts, such as credit cards, auto loans, mortgages, personal loans, and student loans.

Credit cards are the most common type of credit account in the United States. About 75 percent of Americans have at least one credit card, and the average American has four credit cards at once. The average credit card balance is $5,315.

Auto loans

About 60 percent of Americans have auto loans to help pay for their cars. The average auto loan balance is $19,703.

Mortgages

About 44 percent of Americans carry mortgages on their homes. The average mortgage balance is $208,185.

Personal loans

About 22 percent of Americans have personal loans. The average personal loan balance is $16,458.

Student loans

About 14 percent of Americans have student loans. The average student loan balance is $38,792.

Recommended Reading: How Long It Takes To File Bankruptcy

Average Credit Card Debt By Education

People with higher educational attainment tend to have more credit card debt.

The mean consumer with no high school diploma has $3,387 in credit card debt. The median high school nongraduate has $1,200.

People with more schooling are also more likely to carry credit card debt, up to a point. 32.4% of high school nongraduates carry credit card balances, against 51.7% of people whove completed some college. The percentage of Revolvers tails off for college grads, of whom 43.2% carry credit card balances. But college grads who do carry credit card debt have more, on average.

Beyond the headline that college grads and dropouts tend to have more credit card debt heres what we can say about the relationship between card balances and education:

How The Debt Compares To Gdp Plus Major Events That Impacted It

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

The U.S. national debt moved above $30 trillion on Jan. 31, 2022. It has grown over time due to recessions, defense spending, and other programs that added to the debt. The U.S. national debt is so high that it’s greater than the annual economic output of the entire country, which is measured as the gross domestic product .

Throughout the years, recessions have increased the debt because they have lowered tax revenue and Congress has had to spend more to stimulate the economy. Military spending has also been a big contributor, as has spending on benefits such as Medicare. In 2020 and 2021, spending to offset the effects of the COVID-19 pandemic also added to the debt.

When the debt gets so big that it hits the debt ceilingthe limit put in place by Congressinvestors may worry that the U.S. will default on the debt. In that case, the government will need to raise the debt ceiling or reduce the debt through higher taxes, spending cuts, and more.

You May Like: Bankruptcy Lawyers In Pa

The Great Federal Debt Debate

Some people worry about the countrys ability to repay its debts, or about passing on debts to the next generation. But generally, most economists agree that there is some level of debt that can be OK, and even beneficial.

Another way to see debt is as a useful tool that allows the government to respond to unforeseen crises , provide necessary services that private industry cant or wont provide, or make long-term investments for the good of the country, like in infrastructure or education. It may even save money in the long run, if we spend to prevent problems from getting more expensive. In this view, leaving some debt for future generations may well be worth it if it also means leaving a safer, stronger country and world. In the case of climate change, more spending on renewable energies now could prevent the worst-case scenarios, making the future safer and also saving money in the long run.

Deficits and debt are actually less controversial than you would think from listening to the rhetoric. Both major political parties in the U.S. tend to run deficits when they are in power. For this reason, its worth reading between the lines and asking some questions when anyone argues against a program or law on the grounds of the debt. Often, its not a question of whether or not to add to the debt. Its more a question of when politicians believe it is worth adding to the debt: from tax cuts to wars to COVID relief, all debt is not created equal.

How Much Credit Card Debt Is Too Much

It depends on your personal financial situation. The higher your income, the higher the monthly credit card payment you can afford. So if youre looking only through a cash flow lens, you only have too much credit card debt when you can no longer keep pace with the monthly minimum payments.

But you shouldnt only or even primarily evaluate credit card debts through a cash flow lens.

Its much more important to think about the total cost of your credit card debt and what that means for your finances over the long term. Credit card interest rates are really high, with even low-interest credit cards charging 15% APR or higher. At 15% APR, unpaid balances grow by 1.25% each and every month, far above the inflation rate.

Youre not going to outrun that by parking your money in a high-yield savings account or investing in the S& P 500. At least, not in the long run.

So our take is, any credit card debt is too much. Dont charge more on your credit cards than you can afford to pay off in full each month. And if you absolutely must rack up credit card debt in an emergency, make a plan to pay it off as quickly as you can.

You May Like: Foreclosed Homes In Jacksonville Fl

Which President Created The Most Debt

In terms of percentages, President Franklin Delanor Roosevelt added the most debt with a 1,048% increase in national debt from his predecessor President Herbert Hoover. With $236 billion added to the national debt, President Roosevelt served as president during the time of the Great Depression which largely depleted the countrys revenue. To combat this, he set up the New Deal which included relief programs and government spending to address unemployment, severe droughts and agriculture disruptions, and bank failures. The largest part of the addition to the national debt was World War II – the war cost the country $209 billion from 1942 to 1945.

Is Credit Card Debt Always Bad

No, not always. If you dont have enough money in your checking account to cover an emergency expense, a credit card could be your only option.

Plus, many credit cards offer 0% APR promotions that waive interest for new cardholders, sometimes for 18 months or longer. Pay off eligible purchases during the promotional period and youll avoid interest entirely.

But dont get in the habit of carrying credit card debt at regular interest rates. Youll end up paying far more than your original charge and could find it difficult to get out of debt at all.

Also Check: Pallets Of Stuff For Sale

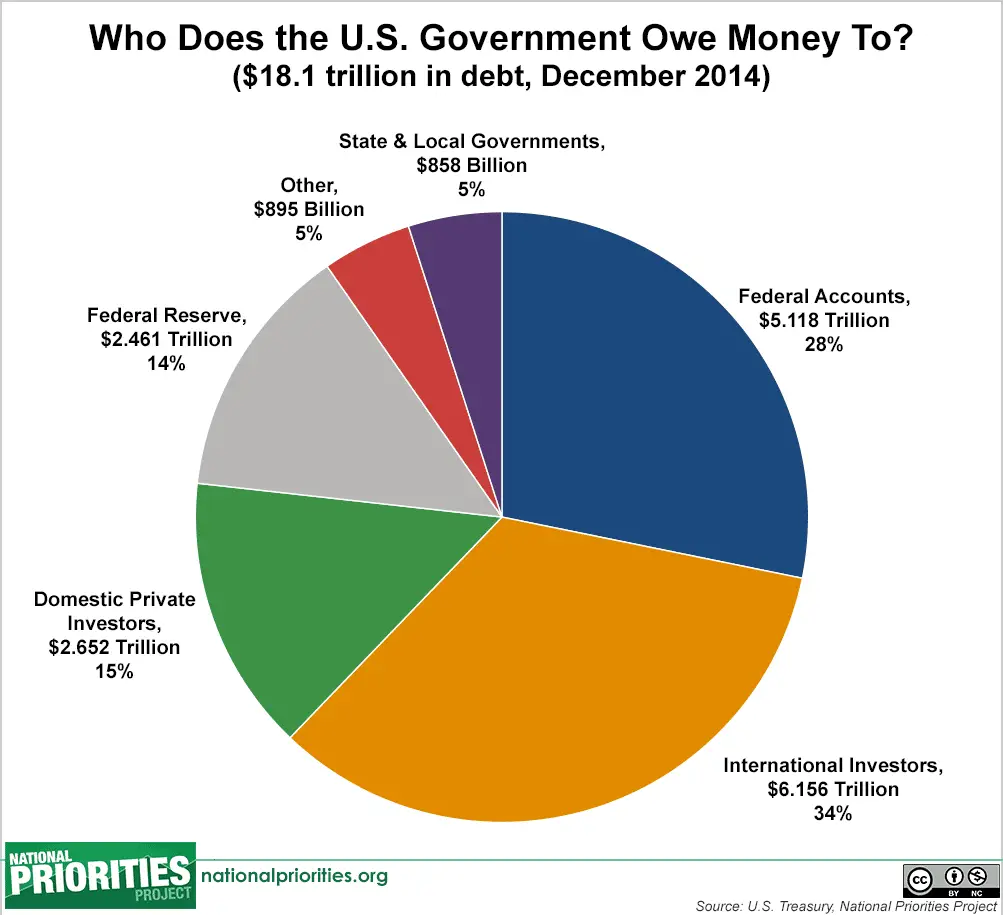

Us National Debt Now Tops $31 Trillion For The First Time Ever Here’s Who The Country Owes

The gross national debt in America has hit new heights, surpassing $31 trillion, according to a U.S. treasury report released this week.

If you find that hard to wrap your head around, it basically boils down to more than $93,000 of debt for every person in the country, according to the Peter G. Peterson Foundation.

And with the dramatic rise in interest rates over the past few months the Fed funds rate is currently between 3% and 3.35% the national debt will be growing at a rate that makes it even harder to ignore.

What Should I Do If Im In Debt

The average American debt is at $92,727 and if you have a balance, the worst thing you can do is ignore it. Interest may accrue on your account, and missed payments could lead to late fees and damage to your credit.

If youre looking to get out of debt, heres where to start:

- Make a list of what you owe. List all of your debts with balances, due dates, interest rates, minimum monthly payments and contact information.

- Go over your budget. Write down how much you earn each month and how much you spend on bills, such as rent, utilities, groceries and minimum debt payments.

- Find room for debt payments. Subtract your bills from your income to see whats left over. Put this amount toward your debt each month. You can also put windfalls, such as tax refunds, toward your principal balances.

- Prioritize the debts. Financial experts usually recommend using one of two methods: the snowball method or the avalanche method. With the snowball method, you pay off your smallest balance first, then move one by one to the largest. With the avalanche method, you can focus on paying off the balance with the highest interest rate first to save more money and work down from there.

- Make a goal. Based on your debt balance and your extra payments, how long will it take until youre debt-free? For example, if you want to pay off $5,500 in credit card debt and you can pay $500 each month, then the balance should be gone in 12 months, assuming a 16 percent APR.

Don’t Miss: How To Buy A New Car After Bankruptcy

Coronavirus And The National Debt

The U.S. government has taken efforts to offset the effects of worldwide health pandemic by borrowing money to invest in individuals, businesses, and state and local governments. Of these responses, the CARES Act has been the largest stimulus package in U.S. history. This stimulus package included $2.3 trillion towards relief for large corporations, small businesses, individuals, state and local governments, public health, and education. In order to pay for the relief fund, the government needed to expand its debt to do so, the government borrowed money from investors through the sales of U.S. government bonds.

Us Debt: How Big Is It And Who Owns It

US federal debt is still a record high. This week it passed a milestone: the fourth straight year the deficit has passed the $1tn mark. As of today, the national debt stands at $16,066,241,407,385.80 .

It’s an issue that’s sure to come up in the first presidential debate this Wednesday.

So, how does the US borrow money? Treasury bonds are how the US – and all governments for that matter – borrow hard cash: they issue government securities, which other countries and institutions buy. So, the US national debt is owned mostly in the US – but the $5.4tn foreign-owned debt is owned predominantly by Asian economies.

Under President Obama’s first term, that figure has gone up from $3tn, a rise of 74.1%. Under George W Bush, it went up too – by 85% over the whole two terms – and 64% in his second term alone.

Holders of US Treasury bonds, $bn

The US Treasury releases the figures on this every quarter – we have made them more useable. So, who has the most?

It reflects a US national debt which has grown starkly, from $7.8tn in 2005 to busting through the US debt ceiling of $14.294tn last year – according to these day by day figures.

The full data is below. What can you do with it?

Read Also: Do You Need An Attorney To File Bankruptcy

How To Get A Business Debt Consolidation Loan

The process of consolidating business debt varies slightly depending on the borrowers needs and the lenders requirements. However, here are a few general steps to follow if you want to get a business debt consolidation loan:

Read Also:

Countries With The Highest Default Risk In 2022

In May 2022, the South Asian nation of Sri Lanka defaulted on its debt for the first time. The countrys government was given a 30-day grace period to cover $78 million in unpaid interest, but ultimately failed to pay.

Not only does this impact Sri Lankas economic future, but it also raises an important question: which other countries are at risk of default?

To find out, weve used data from Bloomberg to rank the countries with the highest default risk.

Recommended Reading: How To File For Bankruptcy In California Without A Lawyer