Simple Ways To Boost Your Retirement Income

Saving money sounds simple, but there are many ways to go about it. While nothing beats early saving, you can catch up with the right approach if you fell behind. Here are some tactics that can help you boost your retirement income:

- Set goals, such as when you want to retire and how much youll need.

- Start saving as soon as possible to take advantage of interest.

- Make contributions to your 401 if you are eligible.

How Much Are The Student Loan Repayments

Each plan has a threshold for your weekly or monthly income. You repay:

- 9% of the amount you earn over the threshold for plans 1, 2 and 4

- 6% of the amount you earn over the threshold for the Postgraduate Loan.

So, a Plan 1 graduate earning £60,000 per year , will pay 9% student loan repayments on everything they earn over £20,195 per year, which is £39,805.

9% of £39,805 is £3,582.45.

This means that monthly they will pay back £298.53

The Difference Between Gross And Net Income

You may have heard of the term net income before, so you may be interested in learning how it differs from gross income. Net income is whats left of the total amount of your gross pay once taxes and other required payments have been deducted. Gross income is your earnings without any deductions, whereas net income is the amount you actually keep.

Some deductions you may have to pay include:

- Child support payments

- Expenses relating to your job, from travel costs to uniforms

- Health savings account contributions

- Voluntary benefits, for example, disability, critical injury, sickness, and accident

- Life insurance premiums

- Health insurance premiums

Deductions that reduce your taxable income are known as pre-tax deductions. Other deductions, for example, voluntary benefits and contributions, will not lower taxable income and are known as post-tax deductions.

Net income is often called disposable income or take-home pay, as its what remains for you to spend. Net income is what you can count on for your monthly budget. Debt payments, bills, living expenses, and other obligations all come out of your net income.

Do not ever use your gross income to calculate this, as you will end up being left short every month. This is because the money you have every month will always be reduced by your taxes and deductions, which is why your net income matters when it comes to everyday expenses.

Recommended Reading: How To Get Credit Score Up After Bankruptcy

How To Get The Numbers Right

The gross income formula for an individual is the total amount of income from all sources. This includes salaries, rents, dividends, and any other type of income. To get to the bottom of it, follow these steps:

Now, to calculate gross income for a business, do the following three steps:

The Importance Of Gross Monthly Income

Now that you know how to calculate your gross income, you may be wondering why it matters in the first place. Keeping track of this value is crucial because it affects any line of credit application, for example.

The amount a lender offers you will depend, in part, on the amount of your gross monthly income. Keeping records of your income is essential to demonstrate that you have money coming in every month that you can use to make loan repayments.

Don’t Miss: How Long Does It Take To Recover From Bankruptcy

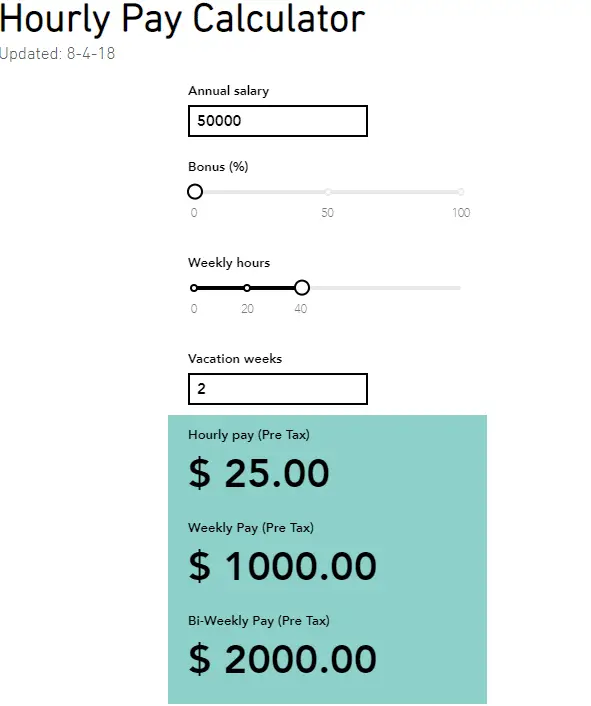

Example: Hourly Pay And Child Support

Enzo is a single father who makes $40 per hour as a professional editor. He devotes eight hours a day and three days a week to the job. Enzo works from home to spend more time with his son. To help with expenses, his ex-wife sends him $400 per month. Additionally, Enzo self-published a fantasy book trilogy, earning around $500 per month. What is his gross monthly income?

1. Determine annual income

The editing business earns Enzo $40 per hour and works 24 hours per week. To find his gross monthly editing income, he multiplies his pay by the hours worked.

40 x 24 = 960

Enzo makes $960 per week.

2. Multiply by the weeks in a year

To find out how much he makes in a year, he multiplies by 52.

960 x 52 = 49,920

Enzo makes $49,920 a year from his editing job.

3. Divide by the months in a year

To find his gross monthly income from editing, Enzo divides his yearly income by 12.

49,920 / 12 = 4,160

Enzo makes $4,160 per month.

4. Add together additional income

Enzo calculates his additional income from child support and book sales.

400 + 500 = 900

Enzo makes $900 in additional income each month.

5. Add additional income to monthly hourly income

To determine his gross monthly income, Enzo adds his additional income to his monthly salary income.

Gross monthly income = 900 + 4,160

Gross monthly income = 5,060

Enzo makes a combined gross monthly income of $5,060.

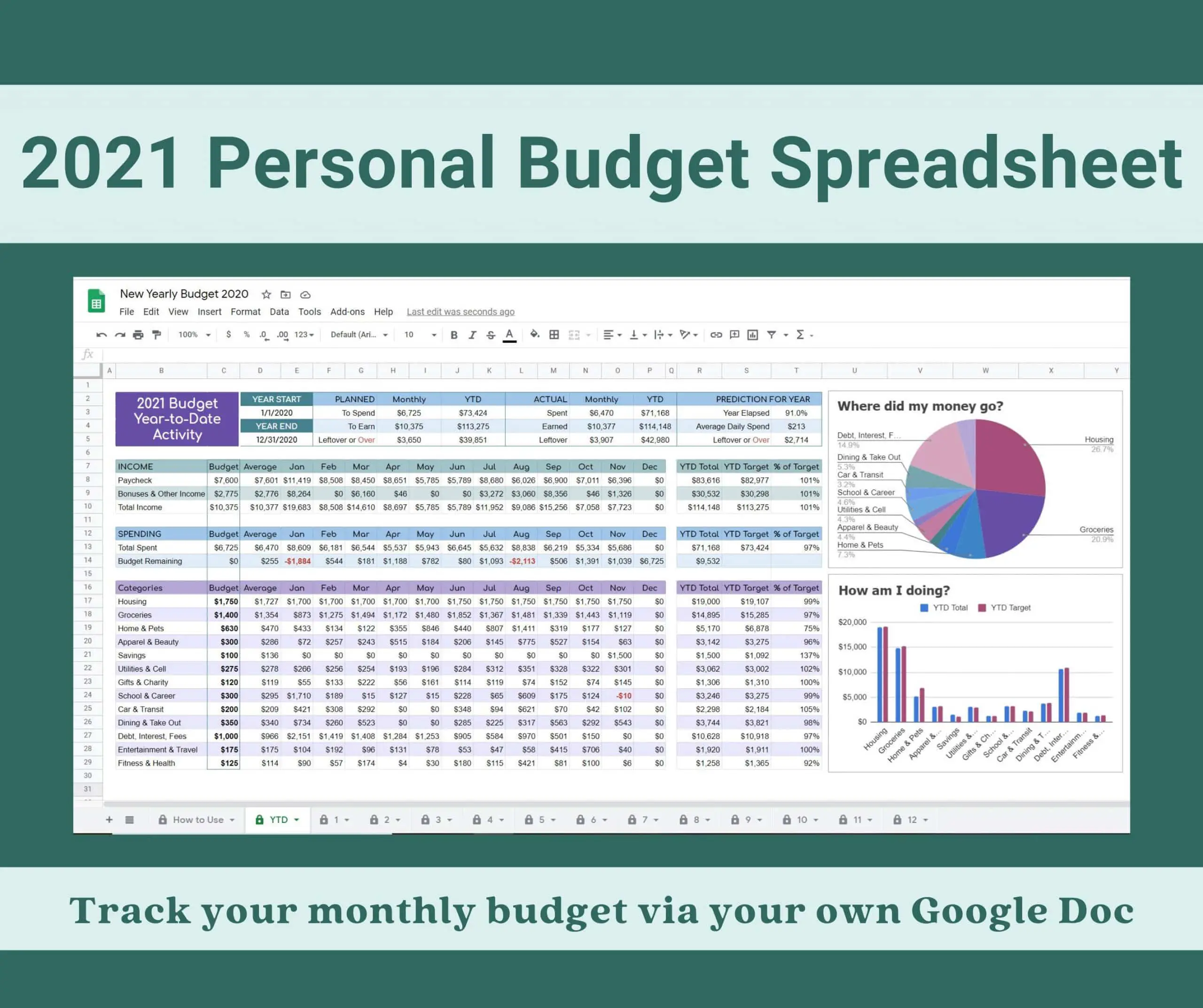

How To Calculate Monthly Income From Biweekly Paycheck

*This post may have affiliate links, which means I may receive commissions if you choose to purchase through links I provide . Please read my disclaimer for additional details. Thank you for supporting the work I put into this site!

Almost every budgeting method out there requires that you write down your income and expenses to get started. How do you calculate your monthly income if you are on a biweekly paycheck schedule though? Some months you will have 2 paychecks and some months you will have 3.

There are several options available for those that have biweekly paychecks. There is no one right answer. It really all depends on your financial situation and your financial goals how you want to accomodate for your biweekly paychecks.

Read Also: What Does It Mean When A Bankruptcy Case Is Dismissed

What Is The Difference Between Gross And Net Income

The difference between gross monthly income and net monthly income is that gross monthly income is the amount earned prior to any tax deductions, and net monthly income takes out tax withholdings and other deductions. In other words, your net pay is the amount deposited in the bank by your employer.

The Importance Of Knowing Your Gross Monthly Income

If you’re applying for a home or car loan, or if you’re trying to develop a budget, it’s important to know how much is coming in the door every month. Most lenders will need to know how much you earn to determine if you’ll be a reliable borrower.

Knowing your gross monthly income can also help with deciding on an amount to save for retirement. If you’re trying to determine how much to dedicate to your retirement account every month, knowing where you stand from a gross income perspective will help inform that decision.

Your net income is also of great importance. One way to think about net income is to see it as the “spendable” cash that actually flows through to your checking or savings account every month. Net income is also useful in developing a monthly budget since your regular after-tax expenses, both fixed and discretionary, will come from your net income.

Unfortunately, when you’re quoted a salary of $75,000, you don’t receive that amount in usable cash. A significant share of the money is dedicated to taxes and fixed deductions, so knowing your net income will help you develop a more stable budget and allow you to stay on top of your finances.

Also Check: Wholesale Pallets For Sale

Examples Of Gross Monthly Income Calculations

The formulas above can easily be applied to real-world situations. Businesses need to use their gross profit formula to understand when and where to make adjustments when necessary. It shows them where problem areas may be as well as how to address them. The following examples show each of the above three formulas.

How Do You Calculate Net Rent From Gross Rent

Net effective rent is calculated by multiplying gross rent by the length of the lease minus the discounted months you’re given by the property owner. Then, you divide the amount by the length of the lease. Finally, you subtract the calculated amount from the gross rent to get your net effective rent.

Don’t Miss: When To File Bankruptcy Chapter 13

How Much Income Do I Need For A 500k Mortgage

The Income Needed To Qualify for A $500k Mortgage A good rule of thumb is that the maximum cost of your house should be no more than 2.5 to 3 times your total annual income. This means that if you wanted to purchase a $500K home or qualify for a $500K mortgage, your minimum salary should fallbetween $165K and $200K

What Is Your Life Expectancy

Unfortunately, the question how long will I live? is up in the air for most us. While we will never really have a straight answer, averages can help us guess. According to estimates from the SSA, an average male can expect to live around 18.1 years once he hits age 65. In contrast, the SSA projects the average woman to live approximately 20.7 years more after age 65.

However, its important to remember that these numbers are guesses based on data. Reviewing your and your familys health history will give you a stronger idea. For example, think about any congenital conditions or predisposed diseases you may have once you get older. Or, look at your physical health until now. Both of these can have a significant impact on your longevity.

Overall, though, you dont want to leave your financial planning up to chance. Its better to choose a generous age and stick with it. That way, you have some cushion.

Also Check: Can You File Bankruptcy On Student Loans In Minnesota

Example: Salary Pay And Additional Income

Mani works as a programmer for a network of elite hotels. She makes $65,000 per year addressing support tickets and resolving application issues. Her department performed beyond expectations throughout the year, encouraging upper management to hand out handsome end-of-year bonuses of $5,000 each this month. Aside from her job, Mani published an online lecture discussing application development and management. An influencer reviewed it recently, gaining her $3,500 for the month in sales. What is her gross monthly income for the month?

1. Determine annual income

Mani makes $65,000 per year at her job.

2. Divide by the months in a year

Mani divides her salary by 12.

Monthly salary income = 65,000 / 12

Monthly salary income = 5,416.67

Mani makes $5,416.67 per month from salary. However, she also has additional income to account for.

3. Add together additional income

Mani calculates her additional income from the bonus and lecture sales.

Combined additional income = 5,000 + 3,500

Combined additional income = 8,500

Mani makes $8,500 in additional income.

4. Add additional income to monthly salary income

To determine her gross monthly income, Mani adds her additional income to her monthly salary income.

Gross monthly income = 8,500 + 5,416

Gross monthly income = 13,916

Mani made $13,916 in gross income this month.

Understanding Gross Monthly Income

Whenever you apply for any loan or a credit card, one of the first things a lender examines in your application is your gross monthly income. The gross monthly income, along with your credit score, helps the lender to determine whether you are eligible for the loan or credit card. Usually, a higher gross monthly incomemakes you eligible to get a higher loan or a credit card with a higher credit limit.

Thatâs why knowing what is gross monthly income and learning how to calculate it can be helpful. Once you know your gross monthly income, you will be able to plan your finances and make the correct investment decisions. This article will help you understand what gross monthly income means and how to use the gross monthly income calculatorto determine yours.

Here’s what this article will cover:

What is gross monthly income?

This can even include any income you earn from various investments or a business, or any other activity. For instance, you are renting out a room in your apartment. This is your rental income, and it is considered as part of your gross monthly income.

Deep diving into Gross Monthly Income Definition

Salary

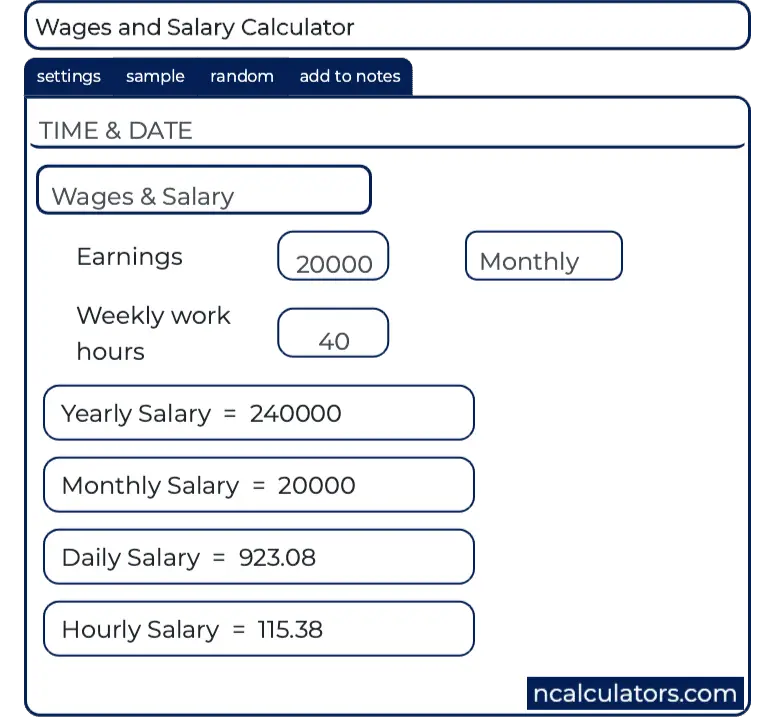

Hourly

Also Check: Can You File Bankruptcy For Free

Calculating Gross Monthly Income If You Receive An Annual Salary

If you’re paid an annual salary, the calculation is fairly easy. Again, gross income refers to the total amount you earn before taxes and other deductions, which is how an annual salary is typically expressed. Simply take the total amount of money you’re paid for the year and divide it by 12.

For example, if you’re paid an annual salary of $75,000 per year, the formula shows that your gross income per month is $6,250.

Many people are paid twice a month, so it’s also useful to know your biweekly gross income. To find this amount, simply divide your gross income per month by 2.

Continuing with the above example, you’d divide $6,250 by 2 to arrive at $3,125 as your biweekly gross income.

How Much Are My Monthly Income Tax Contributions

The best way to calculate your Income Tax contributions is to use an Income Tax calculator. However, it is perfectly possible to calculate your contributions yourself.

Your Income Tax contributions are determined by which Income Tax band you are in.

In the UK, everyone has a tax-free allowance of £12,570. However, if you earn over £100,000 per year, your tax-free allowance goes down by £1 for every £2 that your adjusted net income is above £100,000. This means your allowance is zero if your income is £125,140 or above.

In 2022, the UK Income Tax rates are currently the following:

| Band | |

| over £150,000 | 45% |

Income Tax is paid on earnings within the different thresholds. For example, if you earn £60,000 per year :

- You pay no tax on the first £12,570

- You pay 20% on earnings between £12,571 and £50,270

- 20% of £37,700 is £7,540

- You pay 40% on earnings between £50,271 and £60,000

- 40% of £9,729 is £3,891.60

- So, if you earn £60,000 per year, you pay a total of £11,431.60 in Income Tax.

If you then want to work out what that is a month, simply divide the number 12.

- £11,431 / 12 = £952.63

- So your monthly Income Tax contribution is £952.63 if you earn £60,000 per year.

Recommended Reading: California Bankruptcy Exemptions 2021

How Do You Calculate Debt To Income Ratio On Conventional Loans

Debt to income ratio is the total amount of minimum monthly payments a borrower has which includes all of the borrowers minimum monthly payments divided by monthly gross income. The following are included as monthly borrower debts:

Proposed monthly housing payment that consists of:

Any other minimum monthly credit payments reporting on credit bureaus. Taking the total of borrowers minimum monthly payments and dividing by the borrowers gross monthly income will yield the debt to income ratio. The percentage get is the debt to income ratio.

What Is Monthly Debt

Monthly debts are recurring monthly payments, such as credit card payments, loan payments , alimony or child support. Our DTI formula uses your minimum monthly debt amount meaning the lowest amount you are required to pay each month on recurring payments. Whencalculating your monthly debts, you can exclude:

- Monthly utilities like water, garbage, electricity or gas bills

- Car insurance expenses

- Health insurance costs

- Groceries, food or entertainment expenses

To calculate your total minimum monthly debts, add up each minimum payment. If you pay more than the minimum amount on your credit cards, this does not count against your DTI, since only the minimum amount youre required to pay is included in the total. For example, if you owe $5,000 on a high-interest credit card and your minimum monthly payment on that card is $100, then $100 is the minimum monthly debt amount used for your DTI.

Don’t Miss: What To Do After Filing Bankruptcy

Add Up Income And Expenses Columns

Now that youve documented all your expenses and income, its time to add up each column and face the music: If your income exceeds your expenses, you might want to whistle the Kingston Trios Put Your Money Away as you decide how best to deploy that excess cash. If, on the other hand, your expenses outstrip your income, its time for a more sobering tune like Destiny Childs Bills, Bills, Bills or Lou Reeds The Debt I Owe and some hard choices. Budgeted expenses should never exceed 90% of your take-home income.

But dont let that sad song get you too down. By adding up your income and expenses, and seeing where the difference lies, youve taken the most important step yet to creating a budget that will allow you one day to sing Happy Days Are Here Again.

How Do Lenders Determine Mortgage Loan Amounts

While each mortgage lender maintains its own criteria for affordability, your ability to purchase a home will always depend mainly on the following factors.

Many different factors go into the mortgage lenders decision on homebuyer affordability, but they boil down to income, debt, assets, and liabilities. A lender wants to know how much income an applicant makes, how many demands there are on that income, and the potential for both in the futurein short, anything that could jeopardize its ability to get paid back.

Income, down payment, and monthly expenses are generally base qualifiers for financing, while and score determine the rate of interest on the financing itself.

Don’t Miss: How Long Do Bankruptcy Restrictions Last