Americas Best Personal Bankruptcy Self

Its easy for financial situations to get out of control. Sometimes it begins with the loss of a job, where income levels change dramatically. Or perhaps its the death of the primary wage earner in the family, where the rest of the family can no longer meet the obligations that were taken on previously. Or maybe its a significant change in the economy, or a consistent debt pattern that has finally spiraled out of control.

Whatever the reason for deep, ongoing financial issues, there often comes a time when enough is enough. Creditors call constantly, the debt load and related interest continues to increase, and there is no apparent way out of the situation. Thousands of people and families just like you experience this exact same type of financial difficulty each year. And while it is never an easy decision, sometimes the filing of a bankruptcy is the best decision.

If you decide to proceed with the filing of bankruptcy, then Standard Legals Bankruptcy legal forms software package is the most effective do-it-yourself solution available for either an individual filing or a joint filing with your spouse.

Arent Bankruptcy Forms Available For Free From The Court

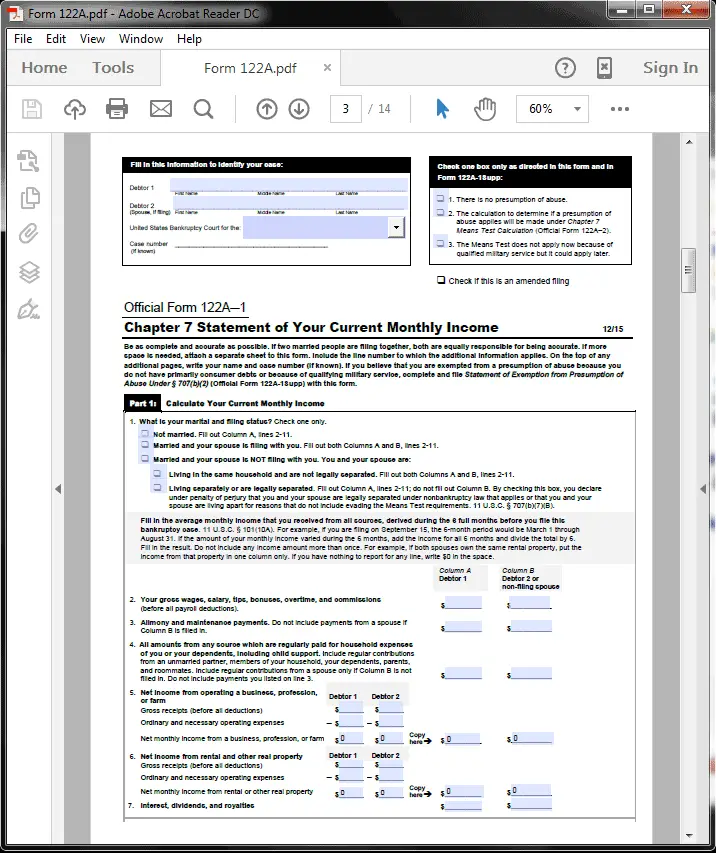

Basic PDFs of all U.S. Bankruptcy Court forms are available online for free. But the Bankruptcy Courts PDF forms have some significant limitations in how they work, as not all PDFs work in the same way.

The Bankruptcy forms from Standard Legal are fully-functioning calculation PDFs that are writable and savable.

The PDF forms provided by the Court are not.

The most critical function missing from the free Court forms is Save Filled the ability to fill-in any of the form fields then save the PDF so that the answers remain saved as entered within the form. The ability to Save Filled is critical for two reasons:

1) without Save Filled, the user is forced to finish then print a form all in one sitting, a difficult task for many of the Bankruptcy forms given the amount of information required and

2) without Save Filled, the user must start a form again from scratch if there is an error, change or addition later.

For those two reasons alone, the Save Filled forms available from Standard Legal are of great value.

But there are other important differences in how the free Court forms work vs. the forms from Standard Legal:

Standard Legals forms auto-complete any like fields. The forms the Court provides do not always auto-complete the like fields so if Name is an entry field three times on one form, you must fill in your name three times in three locations on the Courts version.

Paid Consumer Bankruptcy Software

There are various websites that sell consumer bankruptcy software. Generally, they all provide the forms you need to fill out your DIY bankruptcy. Some even let you electronically file them.

If you are looking for a do it yourself Chapter 7 bankruptcy software, there are a few things you want to keep in mind. Each consumer bankruptcy software costs a different amount and might provide different forms.

Remember that this is your DIY bankruptcy, so choose the software that is best for you.

One thing to consider when choosing your software is whether or not it allows you to electronically file your forms. Some DIY consumer bankruptcy software allows you to file online while others require you to print forms.

What is the best do it yourself Chapter 7 bankruptcy software for your needs?

You May Like: How Many Bankruptcies Has Donald Trump Filed

Ezbankrputcyformscom Bankruptcy Software Vs Free Government Forms

Don’t spend hours searching the internet interpreting bankruptcy questions written in legal terms and trying to find what information to enter on which forms. EZBankruptcyForms Bankruptcy Software allows you to enter your bankruptcy data in a way that will flow smoothly with the information you have gathered using our Bankruptcy Without a Lawyer tutorial. At $44, this is the least expensive version of EZBankruptcyForms Chapter 7 Bankruptcy Software, for filers with a “simple bankruptcy” of UNDER 30 ORIGINAL UNSECURED CREDITORS to declare on your bankruptcy and 14 OR LESS COLLECTION AGENCIES on your bankruptcy paperwork . includes the 18 necessary US Government bankruptcy forms , modified to auto-populate, auto-calculate and cross-reference throughout. Using our software, a novice should be able to complete his/her bankruptcy paperwork in under 8 hours , while it should take about 2 hours for someone with experience to complete the paperwork using EZBankruptcyForms. Our Bankruptcy Software is designed for the bankruptcy novice, and includes an instruction manual where you can find answers to your bankruptcy legal questions for free, on your own.Filing Chapter 7 Bankruptcy Without A Bankruptcy Attorney

The general rule on whether or not to use an attorney is this: The simpler the filing, the more likely you can do it on your own and save the bankruptcy attorney fees. There is risk. Mistakes may wind up costing you more than an attorney would. But, it can be done.

Forms are available online via the U.S. court web site. Various financial web sites provide tools to help you go through the process of filing. Self-help books are available at all the typical bookstores and web sites.

You may fairly ask: What is a simple bankruptcy. The answer: If you have no property other than your home and you can wipe out most of your debt, you have a simple bankruptcy. Be prepared to study the procedures and the laws in your local bankruptcy court. Knowledge is always power, so when filing bankruptcy its wise to inform yourself before filing on your own.

Read Also: Did Donald Trump File Bankruptcy

Types Of Bankruptcy Software

There are two types of bankruptcy software.

- Form-based: These offer basic forms, usually in PDF format, and perhaps some explanation or guidance beyond what youll find in the official forms themselves.

- Interactive: Instead of filling out forms, youll answer questions online, and the software will take your answers and insert the data into the appropriate form.

Decide If A Diy Bankruptcy Is Right For Youthink Long And Hard About If A Diy Bankruptcy Is Right For You

Consider alternatives to bankruptcy. It might be best for you to negotiate with your creditors or consult with a credit counseling agency or even do nothing. Remember, your situation is unique. Figure out what is best for you.

Consider if you want to get a bankruptcy lawyer to help you out in the process. Getting a lawyer has its advantages. Bankruptcy can be confusing, and a lawyer will be able to help guide you through the process of filing a Chapter 7 bankruptcy.

However, lawyers can be expensive. That might mean a DIY bankruptcy is right for you.

Recommended Reading: Has Mark Cuban Ever Filed For Bankruptcy

Completing The Bankruptcy Files

The design format of all Bankruptcy documents are determined solely by the U.S. Bankruptcy Court. Since all documents must follow the Courts format, Standard Legal provides all of its Bankruptcy forms as individual PDF files matching the Courts exact format.

Every Standard Legal Bankruptcy form is built so that all required information is supplied quickly by the user directly within each data collection field on each Bankruptcy form. The user moves from one data field to the next simply by hitting the TAB key on the keyboard. There is no need to search through a PDF file to locate an area where information must be provided. Simply click the computers cursor into the first data field on a form, then hit the TAB key to continue to the next field until all are completed.

Keeping the individual Bankruptcy forms separate in this process makes each file size manageable and allows a user to skip forms not required for a particular filing. In this setup, there is no duplication of data entry, either!

Do It Yourself Bankruptcy Software Is A Trap

By Cathy Moran

Good intentions and a good education are apparently not enough for Upsolve to get the means test right.

Upsolve describes itself as a non-profit, created by Harvard Law School graduates, whose mission is to help low-income Americans in financial distress get a fresh start through Chapter 7 bankruptcy at no cost.

Admirable, so far.

Until you read this drivel about the means test.

When Congress changed the bankruptcy laws in 2005, income requirements were added to prevent bankruptcy abuse. You can file under Chapter 7, but if your income exceeds a certain amount in California, you are not eligible for a bankruptcy discharge.

Poppycock. A good bankruptcy lawyer could tell you so in a heartbeat.

And yet, someone with a heart beat wrote this promo for a piece of software.

Sadly, the public will be mislead to their detriment.

Also Check: Bankruptcy Petition Preparer Fee

Summary & Alternatives To Chapter 7

If you reach the last resort of filing bankruptcy, there are ways to avoid the fees and file for free.

Chapter 7 bankruptcy is designed to discharge debt and give you a faster fresh start. You may have to sell some nonexempt assets to pay as much of the debt as you can, but filers keep their homes in 90% of all consumer bankruptcy cases. Chapter 13 requires a payment plan to address the debt. Because debt is addressed over time, filers can keep their home and other important assets.

Only with Chapter 7 can you seek a waiver on filing fees.

Though you have the option to file Chapter 7 and to do it yourself, there are ways to address debt prior to filing bankruptcy. A nonprofit agency that offers could discuss debt management programs that could ease the debt burden. Examining those options before filing bankruptcy, could help you avoid the significant negative mark bankruptcy has on your credit score.

5 Minute Read

Reviews For Bankruptcy Ch 7 / 13 Legal Forms Software

N. Jackson, Charlotte NC February 24, 2018

I got a very high praise from the Chapter 13 Trustee in my 341 creditors meeting about the amazing job I did on my Chapter 13 petition. Thank you for your software!

D. Ashley, Snohomish WA September 13, 2017

With Standard Legals do-it-yourself Bankruptcy legal forms software for personal Chapter 7 and 13 filings, I was able to see the forest through the trees! The software has easy to follow instructions and customized court forms to enter in my personal data, which saved me days of modifying the court forms on my own. Standard Legal takes away anxiety and uncertainty and enables the user to move forward without paying for an attorney. I HIGHLY recommend using Standard Legals Bankruptcy forms software if you decide to file without an attorney.

Al Y., San Jose CA May 3, 2016

I want to express my thanks for the Bankruptcy software from Standard Legal. It is easy to follow and simple to understand. I am happy about the money I will be saving in not using an attorney. Thanks again!

Michael Gilliland, Liberty IN July 7, 2014

I am so grateful for your product. You help give your customers a sense of empowerment during a very stressful and frightening time. And the price just cannot be beat.

J. Cozzolino, AZ November 3, 2012

Great forms and a very well put together bankruptcy software package! Very impressed by the simplicity and ease of use. Well, well worth the money spent on it!

Don’t Miss: Can You Rent An Apartment After Filing For Bankruptcy

Chapter 7 Bankruptcy Software

Preparing and filing chapter 7 bankruptcy cases just got easier thanks to CINcompass. This cloud-based chapter 7 bankruptcy software provides features and tools to make preparing and filing bankruptcy cases easier and faster. From consultation to discharge, CINcompass is the affordable software solution of choice to maintain an efficient and profitable practice.

Take advantage of the free CINcompass 14-day trial to see for yourself how easy it is to prepare cases with this chapter 7 bankruptcy software today.

How To Pick A Do It Yourself Chapter 7 Bankruptcy Software

There are many different kinds of consumer bankruptcy software out there. If you are looking for a DIY bankruptcy, this article will help you choose which tools to use.

There are a lot of good reasons to use consumer bankruptcy software for your DIY bankruptcy.

For example, bankruptcy can be expensive, so using consumer bankruptcy software might be a cheaper option for you.

Another reason is that bankruptcy can be confusing. A do it yourself Chapter 7 bankruptcy software can help you have a DIY bankruptcy without getting lost in a pile of paperwork.

Many people are able to have a DIY bankruptcy without the need for an expensive lawyer. Luckily, there are many available do it yourself Chapter 7 bankruptcy software on the market that you can use in your own DIY bankruptcy.

But what is the best do it yourself Chapter 7 bankruptcy software?

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

What Is A Bpp

Bankruptcy Petition Preparers are non-lawyers paid by consumers to prepare bankruptcy documents, for filing in court.

Anyone can be a BPP, provided they comply with the rules governing BPP practice contained in the bankruptcy code.

Customers who use a BPP are representing themselves in the bankruptcy court. This means they are responsible for making the choices required of them in their case. They must also provide the BPP with complete and accurate information to be entered in the documents.

Because BPPs are not lawyers, their customers must obtain necessary legal information and advice from an independent source such as a self-help law book or a lawyer.

Think of it this way, A BPP’s customers are their own lawyers and the BPP is thewww.bankruptcylawproject.com.

-

Can’t Find What Your’re Looking For?

- Google Search the Web

Check Out Free Diy Chapter 7 Bankruptcy Resources

There are many free resources online with information about how bankruptcy works. If you are feeling lost or just want to get more informed check out free DIY Chapter 7 bankruptcy resources online.

For instance, Upsolveâs learning center posts a wide variety of informative bankruptcy content. Whether you are looking to find out what those legal terms you keep coming across mean or how to stop wage garnishment, Upsolve has an article for you. Upsolve is continually updating its content to provide you with up to date answers about your bankruptcy related questions.

If you make use of free online resources you can make sure you DIY Chapter 7 bankruptcy goes smoothly.

Read Also: What Is A Bankruptcy Petition Preparer

Legal Assistance For Low Income Debtors

Legal advice for those in low-income situations comes in many forms. Keep in mind there are many ways to address the cost of bankruptcy. A tax refund could be applied to attorney fees. One could stop paying unsecured debts and use that money for an attorney and ask the debt be addressed in bankruptcy. Property that isnt exempt from bankruptcy could be sold think jewelry, the antique furniture or painting passed down by your uncle, a car that isnt necessary.

In addition, legal help is available to those in need, though the availability varies by location. Some bankruptcy courts have free clinics to help people file on their own. Legal aid groups and pro bono attorneys will work for free. Call the local Legal Aid Society in your area, the state bar or check the web site for the local bankruptcy court to find information.

Chapter 1 Should You File For Chapter 7 Bankruptcy

Your first objective is to figure out whether you canand shouldfile for Chapter 7 bankruptcy. This chapter will give you an overview of the bankruptcy process and help you decide whether Chapter 7 bankruptcy is right for you. In the chapters that follow, we explain how to complete the required bankruptcy paperwork, what happens to your debts and property when you file for bankruptcy, how to get help with your bankruptcy, how to pick up the financial pieces once your bankruptcy is final, and more.

You May Like: Epiq Bankruptcy Solutions Llc Scam

How To Find A Good Bankruptcy Attorney

When seeking legal representation in bankruptcy, you’ll want to look for an experienced bankruptcy lawyer, not a general practitioner. Not only does bankruptcy require understanding how many principles interrelate, making a mistake can be costly. Most lawyers won’t accept a bankruptcy matter unless they practice bankruptcy law regularly.

Here are some suggestions for finding the best bankruptcy lawyer for your job.

Personal Referrals

Knowing someone who had a good experience with a bankruptcy lawyer is often your best source. Call that lawyer first. Your lawyer might know a good bankruptcy lawyer, as well. Or, if a family member or a friend used a lawyer in a nonbankruptcy matter, ask that lawyer if they would recommend a bankruptcy attorney.

Group Legal Plans

If you’re a member of a plan that provides free or low-cost legal assistance and the plan covers bankruptcies, make that your first stop in looking for a lawyer.

Lawyer-Referral Panels

Most county bar associations will give you the names of bankruptcy attorneys who practice in your area. Keep in mind that bar associations don’t screen the lawyers. It’s up to you to check out the credentials and experience of the person to whom the bar association refers you.

Online Directories

Legal Aid

Legal Clinics

Many law schools sponsor legal clinics and provide free legal advice to consumers. Some legal clinics have the same income requirements as Legal Aid others offer free services to low- and moderate-income people.

Why Use An Attorney

If all of the hypothetical scenarios above are not enough to convince you, perhaps knowing that bankruptcy is a specialty practice will convince you. Bankruptcy attorneys specialize in filing successful bankruptcies and winning a full discharge for their clients. They are able to work with you and offer their best legal advice and obtain the best possible results unlike bankruptcy preparers. While you go on with your life, a bankruptcy attorney works to free you as much as possible from your debts and allow you that fresh start you need.

Also Check: Can You Get A Personal Loan After Bankruptcy