The Energy Bills Support Scheme

The Energy Bills Support Scheme is one part of a package of support to households with rising energy bills, initially announced by the government on 3 February 2022.

On 26 May 2022, the UK government announced a new £15 billion package of targeted government support to help with the rising cost of living, whereby domestic energy customers in Great Britain will receive a £400 discount on their bills in autumn 2022.

The Office for National Statistics will carry out a classification review of this new scheme when all the information becomes available. We will also consider other aspects of the recent announcements and reflect them in the public sector finances in due course.

Cbos 2020 And 2021 Extended Baseline Projections Of Revenues

Percentage of Gross Domestic Product

In CBOs current extended baseline projections, federal revenues measured as a percentage of GDP are higher in the next few years than they were in last years projections and similar to last years projections thereafter.

Data source: Congressional Budget Office. See www.cbo.gov/publication/56977#data.

The extended baseline projections, which generally reflect current law, follow CBOs 10-year baseline budget projections and then extend most of the concepts underlying those projections for the rest of the long-term projection period.

GDP = gross domestic product.

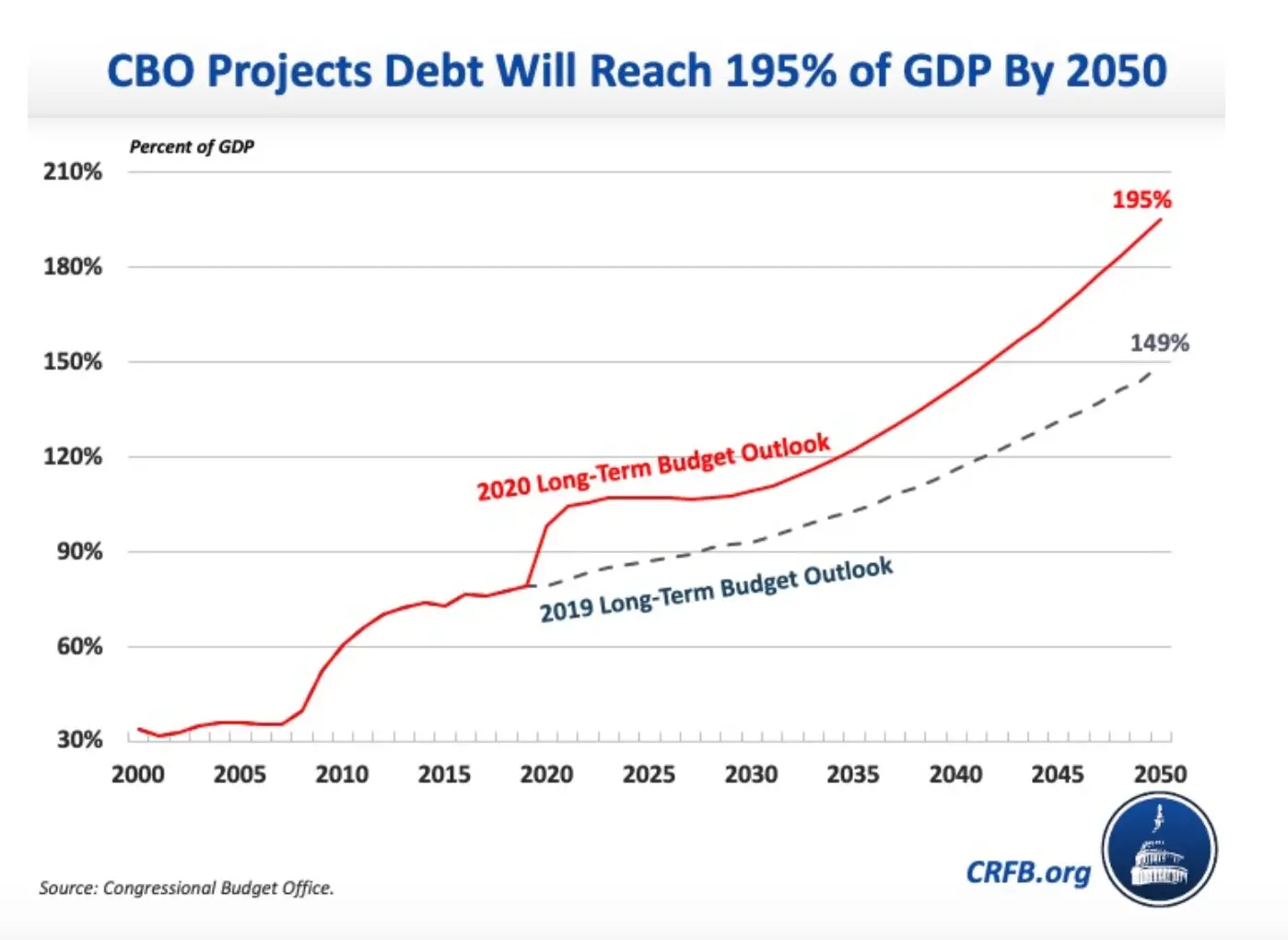

How To Look At The National Debt By Year

It’s best to look at a country’s national debt in context. During a recession, expansionary fiscal policy, such as spending and tax cuts, is often used to spur the economy back to health. If it boosts growth enough, it can reduce the debt. A growing economy produces more tax revenues to pay back the debt.

The theory of supply-side economics says the growth from tax cuts is enough to replace the tax revenue lost if the tax rate is above 50% of income. When tax rates are lower, the cuts worsen the national debt without boosting growth enough to replace lost revenue.

Major events, like wars and pandemics, can increase the national debt.

During national threats, the U.S. increases military spending. For example, the U.S. debt grew after the September 11, 2001, attacks as the country increased military spending to launch the War on Terror. Between fiscal years 2001 and 2020, those efforts cost $6.4 trillion, including increases to the Department of Defense and the Veterans Administration.

The national debt by year should be compared to the size of the economy as measured by the gross domestic product. That gives you the debt-to-GDP ratio. That ratio is important because investors worry about default when the debt-to-GDP ratio is greater than 77%that’s the tipping point.

You can also use the debt-to-GDP ratio to compare the national debt to other countries. It gives you an idea of how likely the country is to pay back its debt.

Recommended Reading: Can You File Bankruptcy Just For Credit Cards

Federal Debt When Interest Rates Rise

Federal debt

getty

When interest rates rise, how much will the interest cost of the federal debt increase? The Federal Reserve is increasingly talking about tapering its efforts to keep long-term interest rates low, the latest being the minutes from their September 2021 meeting. After ending their purchases of long-term securities, they are likely to raise short-term interest rates. When they are in a hurry to shift the economy, they move short-term interest rates by three percentage points in a year. The timing of an interest rate increase is uncertain, but the likelihood of an increase in the next couple of years is nearly certain.

The federal government has about $22 trillion of debt held by the public. Last year interest on the debt came to $413 billion, with a low average interest expense of about 1.5%.

What would happen if interest rates rose by, say, three percentage points for both short-term and long-term interest rates? The short answer will sound like it is coming from a proponent of bigger spending: not too much. But the not too much answer comes in the context of trillion dollar deficits, with more on the way. It turns out that interest expense is not the big item that the United States needs to worry about.

National Debt Statistics By President

11. During Roosevelts time in office the national debt increased by 1,048%.

When President Franklin D. Roosevelt was in office, the national debt has increased the most compared to the year before. Though if we look at the national debt history, we can see that the national debt increases the most when the country is at war.

Franklin D. Roosevelt was in office from 1933 until 1945. He served as president during the Great Depression and World War II and was the one responsible for the New Deal. Roosevelt instituted a series of programs for financial relief and opened jobs for a lot of people.

In the post World War II years, however, the national debt gradually decreased. The GDP to debt ratio was highest in 1946. If we look at the ratio of GDP to debt by year, we can see that the percentage lowered steadily and reached 31% in 1974.

12. Woodrow Wilson increased the national debt by 727%.

Much like Franklin D. Roosevelt, Woodrow Wilson also had to deal with a world war while serving his presidential term. He was in office from 1913 until 1921. When he left office, the US had a national debt of almost $24 billion. Compared to the national debt today this doesnt seem like much. However, before Woodrow Wilson became president, the US national debt only amounted to $2.3 billion.

13. The national debt was increased by 186% while Ronald Reagan was in office.

14. George Walker Bush added approximately $5 trillion dollars to the national debt.

Recommended Reading: Does Filing For Bankruptcy Affect Getting A Job

Current Foreign Ownership Of Us Debt

Japan owned $1.32 trillion in U.S. Treasurys in July 2021, making it the largest foreign holder of the national debt. The second-largest holder is China, which owns $1.07 trillion of U.S. debt. Both Japan and China want to keep the value of the dollar higher than the value of their own currencies. This helps to keep their exports to the U.S. affordable, which helps their economies grow.

China replaced the U.K. as the second-largest foreign holder in 2006 when it increased its holdings to $699 billion.

The U.K. is the third-largest holder with $579.8 billion. Its holdings have increased in rank as Brexit continues to weaken its economy. Ireland is next, holding $324.3 billion. Luxembourg, Switzerland, Cayman Islands, Brazil, Taiwan, and France round out the top 10.

Wars In Iraq And Afghanistan

Overseas wars and military operations launched after the Sept. 11, 2001, attacks in the U.S., in combination with increased domestic security spending, interest costs, and long-term veterans funding obligations, has added about $8 trillion to the national debt since 2001, by one estimate.

Meanwhile, annual U.S. military spending exceeds that of the next nine highest spenders combined.

Also Check: What Happens When You File For Bankruptcy

National Debt Interest Rate

Since the government has many debts with different lenders, there may be different terms with each loan, including varied interest rates. The higher an interest rate on debt, the more the borrower must pay. The lower the interest rate, the less the borrower owes on top of the loan balance.

When calculating its interest, the federal government adds the interest it owes collectively on all debt into one figure. As of 2020, the interest on national debt is $479 billion.

How The Debt Compares To Gdp Plus Major Events That Impacted It

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

The U.S. national debt moved above $30 trillion on Jan. 31, 2022. It has grown over time due to recessions, defense spending, and other programs that added to the debt. The U.S. national debt is so high that it’s greater than the annual economic output of the entire country, which is measured as the gross domestic product .

Throughout the years, recessions have increased the debt because they have lowered tax revenue and Congress has had to spend more to stimulate the economy. Military spending has also been a big contributor, as has spending on benefits such as Medicare. In 2020 and 2021, spending to offset the effects of the COVID-19 pandemic also added to the debt.

When the debt gets so big that it hits the debt ceilingthe limit put in place by Congressinvestors may worry that the U.S. will default on the debt. In that case, the government will need to raise the debt ceiling or reduce the debt through higher taxes, spending cuts, and more.

Also Check: When You File Bankruptcy Do You Lose Your Car

Public Sector Net Cash Requirement

The public sector net cash requirement represents the cash needed to be raised from the financial markets over a period of time to finance its activities.

The amount of cash required will be affected by changes in the timing of payments to and from the public sector rather than when these liabilities were incurred. However, it does not depend on forecast tax receipts in the same way as our accrued based measures of borrowing.

PSNCR may be similar to borrowing for the same period and close, but not identical, to the changes in the level of net debt between two points in time.

Federal And Provincial Debt

Summary

- In recent years, deficit spending and growing government debt have become a trend for many Canadian governments. Like households, governments are required to pay interest on their debt.

- In aggregate, the provinces and federal government are expected to spend $49.6 billion on interest payments in 2020/21.

- Residents in Newfoundland & Labrador face by far the highest combined federal-provincial interest payments per person . Quebec, Canadas second most populous province, is the next highest at $1,417 per person.

- The federal government alone will spend $20.2 billion on debt servicing charges in 2020/21, which is roughly equivalent to what the government expects to spend on Equalization and collect in Employment Insurance Premiums .

- Ontarians are projected to spend $20.3 billion on combined federal and provincial interest costs in 2020/21, which is more than the province will spend on infrastructure this year.

- Meanwhile, total expenditures on interest costs for Albertans is close to the expected spending on advanced education in the province. Combined federal-provincial interest costs for British Columbians are more than what the province expects to spend on its Medical Services Plan this year.

Read Also: How Long To Wait To File Bankruptcy Again

Why Does Interest Rise

Higher interest rates and growing debt are two of the main causes of the interest on the debt. But what causes them to rise?

Interest rates increase when the economy is doing well. Investors have the confidence to buy riskier assets, such as stocks. There’s less demand for bonds, so the interest rates must rise to attract buyers.

The debt is the accumulation of each year’s budget deficit. This happens each year when spending is greater than revenue. A larger debt also affects the deficit, thanks to the higher interest payment.

Each president and Congress since President Bill Clinton’s administration has planned to overspend. There are a few reasons for this strategy.

First, deficit spending stimulates the economy by putting money into the pockets of businesses and families. They purchase goods and hire workers, creating a robust economy. Government spending is a component of GDP for this reason.

Second, the U.S. can rely on countries such as China and Japan to lend it the money to buy their products. The U.S. owes China and Japan more than any other country as a result.

Finally, politicians get elected to create jobs and grow the economy. They tend to lose elections when unemployment and taxes increase. Congress has little incentive to reduce the deficit as a result.

How Much Is The Us In Debt

In terms of federal debt, the dollar amount isnt a good indicator of the national debt. The debt to GDP ratio is more important in national debt statistics. This ratio compares the debt to gross domestic product. If the percentage is higher it means that the country might default on the debt due to the inability to keep up with financial obligations. If the ratio is lower, it means that the country has enough revenue to pay out the debt along with the accrued interest. Though a high debt to GDP ratio is not always a bad thing it is sometimes due to rapid economic growth.

Recommended Reading: When Is A Bankruptcy Removed From Your Credit Report

Projected Revenues Through 2051

In CBOs extended baseline projections, revenues measured as a share of GDP are generally higher than they have been, on average, in recent decades. Revenues have averaged 17.3 percent of GDP over the past 50 years, but they have fluctuated between 15 percent and 20 percent of GDP over that period because of changes in tax laws and interactions between those laws and economic conditions.

CBOs revenue projections are based on the assumption that the rules for all tax sources will change as scheduled under current law.30 CBO projects a continued decline in revenues as a percentage of GDP in 2021, reflecting the economic disruption caused by the pandemic and the federal governments response to it, including the enactment of legislation. After declining from 16.3 percent in 2020 to 16.0 percent in 2021, total revenues as a share of GDP are projected to reach 17.2 percent in 2025. Largely because of scheduled increases in taxes resulting from the expiration of certain provisions of the 2017 tax act that affect individual income taxes, revenues are projected to rise after 2025, reaching 17.9 percent of GDP by 2027. From 2028 to 2031, revenues grow more slowly than GDP. In the agencys extended baseline projections, revenues grow faster than GDP after 2031 and total 18.5 percent of GDP in 2051.

Who Owns The Us National Debt

8. 78% of the national debt is owned by the public.

Depending on who owns it, there are two types of national debt: intragovernmental and public. So, lets do a little national debt breakdown. The majority of the debt is owned by foreign countries, investors, banks, individuals, federal reserves, mutual funds, state and local governments. Thats 78% of the total and represents the public debt.

9. $6.1 trillion of the national debt is intragovernmental.

The intragovernmental debt amounts to 22%. It is owned by federal agencies that have more money than they can spend, so they buy US treasury bonds. The federal agencies and trust funds that own national debt are:

- The Social Security Trust Fund

- The Federal Disability Insurance Trust Fund

- The Office of Personnel Management Retirement

- The Military Retirement Fund

If we look at the US debt to the penny, then more than $22 trillion is owned by the public and over $6 trillion is intragovernmental.

10. Japan and China are the foreign countries that own the most US debt.

China used to be the foreign country that owned the highest amount of US federal debt. However, all that changed in June 2019, when Japan bought more than $20 billion US foreign debt. This now makes them the largest foreign debt holder.

Besides Japan and China, other major foreign holders of US treasury debt are the United Kingdom, Brazil, Ireland, Luxembourg, and others.

You May Like: Does Filing Bankruptcy Stop A Judgement

Cost Of Debt Is On The Rise

Here’s why: According to the Congressional Budget Office, the average interest rate paid on the national debt in FY 2021 was approximately 1.5%, historically a very low figure.

Most experts agree that interest rate increases are coming, and a consensus expectation is that there will be three or four rate hikes by the Federal Reserve in 2022. The central bank on Wednesday strongly hinted that the first rate hike will happen in March, and the market is now pricing in as many as five increases this year alone.

As interest rates rise, which they have in dramatic fashion in January, so will the interest rate paid on newly issued Treasury securities. While this is happening, our national debt is exploding.

In 2017, the national debt was $20 trillion. Just four years later, that amount is approaching $30 trillion. The recent stimulus programs brought on by the Covid crisis helped add a staggering $6 trillion to the total.

The math is easy.

Interest rates are still near an all-time low. According to the Monthly Treasury Statement, in 2001, interest paid on the national debt was an average of 5.4%, about 3½ times what it is now.

If we get back to that rate, which is far from inconceivable, interest on the debt would cost American taxpayers $1.4 trillion, based on our present level of national debt. That is twice the budget of the Defense Department.

The interest rate comet is now visible on the horizon.

Other Labor Market Outcomes

In addition to the rate of labor force participation and the size and growth of the labor force, CBOs long-term labor market outlook includes projections over the next 30 years of the unemployment rate, the average and total number of hours that people work, and various measures of workers earnings. The agency regularly updates those projections to incorporate revisions in historical data, reassessments of economic and demographic trends, and changes to the agencys analytic methods.

Unemployment. The unemployment rate is projected to decline gradually in the coming years as a result of continued economic growth and legislation the Congress passed in 2020. In CBOs projections, the overall unemployment rate falls from 6.7 percent at the end of 2020 to 5.3 percent by late 2021. It is projected to fall below its natural rate by 2024 and reach 3.9 percent by 2026. However, the unemployment rates for younger workers, workers without a bachelors degree, and Black or Hispanic workers are expected to improve more slowly than the overall unemployment rate.

After the first decade or so, the unemployment rate is expected to remain roughly one-quarter of one percentage point above its natural rate, a difference that is consistent with both the average historical relationship between the two measures and the projected gap of one-half of one percent between actual and potential GDP.8

Recommended Reading: How To Get A Copy Of Your Bankruptcy Discharge