Types Of Bankruptcy That Can Be Filed In The United States

Liquidation vs. Reorganization

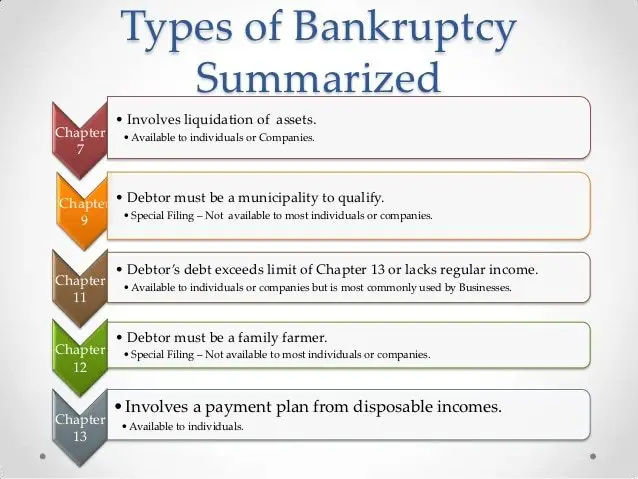

Currently, there are six chapters of bankruptcy in the United States: Chapter 7, Chapter 9, Chapter 11, Chapter 12, Chapter 13, and Chapter 15. Chapter 7 and Chapter 13 are the most common bankruptcy filings.

It is worth noting that there is a current proposal entitled Consumer Bankruptcy Reform Act of 2020 that would replace Chapter 7 and Chapter 13 with Chapter 10 and have two options. Those options include a no-payment discharge and a debt-specific repayment plan. The options would be dependent upon an individuals ability to pay based on variables such as annual income, assets and would take into consideration minimum payment obligations. Well cover the newly proposed CBRA in more depth in the near future.

Of the current chapters of bankruptcy that can be filed, only one, Chapter 7, provides liquidation of debt. This is the most common bankruptcy filed in the United States.

The other remaining 5 chapters of bankruptcy are geared towards reorganizing debt in a manner that allows the filer to repay either all or part of her or his debt.

Business Bankruptcy: Chapter 7 Vs Chapter 11

Businesses can file either Chapter 7 or Chapter 11 bankruptcy. Businesses who file Chapter 7 bankruptcy are in the process of shutting down. All of the business assets – from real estate to personal property – are sold and unsecured creditors are paid in order of priority. Businesses donât get to claim exemptions – everything goes.

A bankruptcy proceeding under Chapter 11, on the other hand, can be used to restructure the business and its financial obligations. The bankruptcy protections granted by the automatic stay give the business an opportunity to propose a payment plan. As of February 20, 2020, small businesses are able to file a less complicated version of Chapter 11 called Subchapter V.

What Are All Of The Different Chapters Of The Bankruptcy Code

Bankruptcy Law as a whole is a combination of the Bankruptcy Code, the Federal Rules of Bankruptcy Procedure, the Federal Rules of Civil Procedure, State Law, Federal Law, and Case Law developed in the courts. The explanations below are just a brief overview, but every chapter of the Bankruptcy Code is extremely complex. It is advisable that no matter how simple your situation may seem, the bankruptcy code is full of traps and you should hire a competent attorney that will make sure that you receive the best possible outcome.

Recommended Reading: Epiq Corporate Restructuring Llc

Choosing The Right Type Of Bankruptcy

Your income and assets will determine the bankruptcy chapter you file. For instance, too much income might preclude you from filing a simple Chapter 7 case. Or, if you have property you’d lose in Chapter 7 that you’d like to keep, you can protect it in Chapter 13.

In Chapter 7 bankruptcy, the bankruptcy trustee has the power to sell your nonexempt property to pay back your creditors. As a result, Chapter 7 might be costly if you own a lot of assets. By contrast, Chapter 13 bankruptcy allows you to keep all of your property in exchange for paying back a portion or all of your debts through your repayment plan.

Further, if certain conditions are satisfied, Chapter 13 bankruptcy offers debtors additional benefits that aren’t available in Chapter 7 such as the ability to:

- save a home subject to foreclosure–or a car from repossession–by catching up on missed payments

- reduce the principal balance of your car loan or investment property mortgage with a cramdown, or

- eliminate your second mortgage or another unsecured junior lien through lien stripping.

Here are a few scenarios that explore which bankruptcy strategy would be best:

Its All About You We Want To Help You Make The Right Legal Decisions

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesnt influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

The Bankruptcy Code is divided into different chapters of which three are most common Chapter 7, Chapter 11 and Chapter 13. Both Chapter 7 and Chapter 11 are available to businesses and individuals, whereas Chapter 13 is reserved exclusively for individuals. Individuals can file under any of the three chapters either as individuals or together with their spouse as a couple. All three chapters afford debtors an automatic stay, which prevents creditors from taking any action to enforce their claims without first seeking relief from the bankruptcy court. The following is a brief description of the relief afforded by each of the chapters, for more information please click on the links within the article or consult with a bankruptcy;attorney.

Don’t Miss: How To File Bankruptcy In Wisconsin

Chapter 1: Adjustment Of Debts For Individuals With Regular Income

Chapter 13 bankruptcy is a reorganization bankruptcy typically reserved for individuals. It can be used for sole proprietorships since sole proprietorships are indistinguishable from their owners. Chapter 13 is used for small businesses when a reorganization is the goal instead of liquidation. You file a repayment plan with the bankruptcy court detailing how you are going to repay your debts. Chapter 13 and Chapter 7 bankruptcies are very different for businesses.

Chapter 13 allows the proprietorship to stay in business and repay its debts and Chapter 7 does not.

The amount you must repay depends on how much you earn, how much you owe, and how much property you own. If your personal assets are involved with your business assets, as they are if you own a sole proprietorship, you can avoid problems such as losing your house if you file Chapter 13 instead of Chapter 7.;

The Different Chapters Of Bankruptcy Explained

Most people in the United States are familiar with the term bankruptcy.

Bankruptcy, handled in the federal courts, can help a person get rid of any debt they have or make a plan to repay it.

However, can you tell the differences between each of the different chapters of bankruptcy? There are six chapters of bankruptcy in the United States, Chapter 7, Chapter 9, Chapter 11, Chapter 12, Chapter 13 and Chapter 15, with Chapter 7 and Chapter 13 bankruptcy being the most common forms filed.

Below is an overview of the details of each of the different chapters of bankruptcy.

Chapter 7

Chapter 7 bankruptcy, sometimes referred to as liquidation bankruptcy, is the most common type of bankruptcy in the U.S., and the most basic form of bankruptcy. Chapter 7 provides liquidation of an individuals property and then distributes it to creditors. Individuals are allowed to keep exempt property.

The courts may provide businesses that file chapter 7 with a trustee that operates the business for a period of time. In general, the trustee will take charge of asset liquidations and proceeds.

Chapter 9

Chapter 9 bankruptcy is a bankruptcy for municipalities cities, towns, counties and school districts, for example. Municipalities that file chapter 9 earn protection from creditors while they develop a plan for adjusting their debts. In 2013, the city of Detroit filed chapter 9, becoming the biggest city in the history of the U.S. to file for bankruptcy.

Chapter 11

Chapter 12

Chapter 13

Recommended Reading: How Many Bankruptcies Has Donald Trump

Types Of Bankruptcy Filings

Chapter 7: Liquidation

Chapter 7 is designed for individuals and businesses experiencing financial difficulty that do not have the ability to pay their existing debts. Under Chapter 7 a trustee takes possession of all of your property. You may claim certain property as exempt under governing law. A bankruptcy trustee then liquidates all non-exempt property and uses the proceeds to pay your creditors according to a distribution scheme required by the Bankruptcy Code.

The main purpose of filing a Chapter 7 case is to obtain a discharge of your existing debts. A bankruptcy discharge is a court order releasing you from liability for many types of debts. If, however, you are found to have committed certain kinds of improper conduct described in the Bankruptcy Code, your discharge may be denied by the court and the purpose for which you filed the bankruptcy petition will be defeated.

Even if you receive a discharge, there are some debts which are not discharged under the law. These include certain types of taxes, student loans, alimony and child support payments, debts fraudulently incurred, debts for willful and malicious injury to a person or property, and debts arising from a drunk driving charge. Generally speaking, a bankruptcy discharge does not remove liens from your property.

Chapter 11: Reorganization

Chapter 11 is designed for the reorganization of a business. It is also available to individual debtors who exceed the thresholds for Chapter 13 bankruptcies.

What Is The Difference Between Chapter 7 And Chapter 13 Bankruptcy

If you do ultimately decide to file, one of the first big decisions you’ll make is whether to file Chapter 7 or Chapter 13 bankruptcy. These chapter names refer to sections of the U.S. Bankruptcy Code where it’s outlined how, exactly, your debt is taken care of in each process. The choice to file one or the other determines whether you’ll be put on a debt repayment plan or if your debts will be settled with the property you own. If you find yourself at a crossroads, start here to get a grasp on what’s ahead.

Read Also: What Is Epiq

Benefits And Drawbacks Of Chapter 12 Bankruptcies

- The debt ceiling is substantially higher than other bankruptcy options.

- The process is simpler and more affordable than Chapter 11 bankruptcy.

- You must repay all of your secured debts if you have any remaining disposable income.

- At least half of your households income must be derived from fishing or farming.

Different Chapters Of Bankruptcy

While the phrase “filing for bankruptcy” is often used as blanket term for individuals andbusinesses, the fact is that there are several different types of bankruptcy.Before determining that declaring bankruptcy is the best course of action, adebtor must consider which type of bankruptcy will benefit him most.

Don’t Miss: How To Become A Bankruptcy Petition Preparer

Plus Info On The 2019 Small Business Reorganization Act

Most new small businesses dont survive and are faced with the decision concerning whether they should file for some form of business bankruptcy. Between 2005 and 2017, only about one-fifth of new small businesses survived more than one year. About half of those businesses continued on for up to five years, while only about one-third made it to 10 years.

Bankruptcy is a process a business goes through in federal court. It is;designed to help your business eliminate or repay its debt under the guidance and protection of the bankruptcy court. Business bankruptcies are usually described as either liquidations or reorganizations depending on the type of bankruptcy you take.

There are three types of bankruptcy that a business may file for depending on its structure. Sole proprietorships are legal extensions of the owner. The owner is responsible for all assets and liabilities of the firm. It is most common for a sole proprietorship to take bankruptcy by filing for Chapter 13, which is a reorganization bankruptcy.

Corporations and partnerships are legal business entities separate from their owners. They can file for bankruptcy protection under Chapter 7 or Chapter 11, which is a reorganization bankruptcy for businesses. The different types of bankruptcies are called chapters due to where they are in the U.S. Bankruptcy Code.

What Are The Major Types Of Bankruptcy

Unlike in the USA which has chapter 7 bankruptcy and chapter 13 bankruptcy for individuals, there are only two main types of bankruptcy personal and business.

There can be two types of bankruptcy considered under the business type small business bankruptcy and corporate bankruptcy.

The equivalent of American chapter 13 bankruptcy in Canada is a consumer proposal, and is administered under the Bankruptcy & Insolvency Act but it is not a type of bankruptcy.

Need Help Reviewing Your Financial Situation?Contact a Licensed Trustee for a Free Debt Relief Evaluation

We have all of the information that you need to know about filing bankruptcy, whether it is personal bankruptcy or business bankruptcy.

Read Also: How To File For Bankruptcy In Wisconsin

Chapter 1: For Family Farmers And Fishermen

Similar in design and intent to Chapter 13, Chapter 12 provides family farmers and family fishermen who meet certain criteria to propose a repayment plan lasting from three to five years.

However, anticipating the seasonal nature of many small farming and fishing operations, Chapter 12 allows more flexibility in structuring periodic payments.

Chapter 12 helps multigenerational families involved in the business in which the parents have guaranteed debt.

Family farmers or fishermen considering Chapter 12 should be aware of several changes that came about in 2019 regarding the sale of assets. Its a good idea to review these changes with an attorney or an accountant trained in bankruptcy law.

Chapter 1: For Foreign Creditors

A fairly recent addition to the federal Bankruptcy Code, Chapter 15 was adopted to enhance cooperation in international insolvencies. Such filings are rare, but they are useful to parties representing debtors, creditors, and assets involving more than one country seeking efficient and reasonable bankruptcy processes.

A Chapter 15 filing typically is not central to a bankruptcy involving a foreign individual or entity. Instead, it is considered ancillary, the main event unfolding in the foreigners home nation.

Recommended Reading: How To File Bankruptcy In Wisconsin

Can You Back Out Of A Chapter 13

Chapter 13 comes with a right to dismiss. This means that at any point of your case you can get out of the case and out of the bankruptcy system altogether. So knowing that you have this right to dismiss can make Chapter 13 a more attractive choice when you are trying to decide what type of bankruptcy to file.

What Type Of Bankruptcy Is Right For You

If youre interested in filing for bankruptcy protection, we highly recommend that you speak with a well-qualified bankruptcy attorney. For many, the bankruptcy process is confusing, especially due to scarcely used terminology and various legal ramifications that fall outside of the routine day-to-day scope of our typical lives.

Income and assets will determine the bankruptcy chapter that you file. An individual with too much income would likely be unable to file Chapter 7. However, an individual that doesnt want to lose property that theyd otherwise lose by filing for Chapter 7, would likely consider filing Chapter 13.

There are numerous considerations to make when determining what chapter to utilize when filing for bankruptcy protection, and speaking with an attorney is a prudent and smart choice.

If you believe you are unable to afford an attorney, you can still represent yourself as a pro se debtor. This essentially means you dont need an attorney to file bankruptcy and can represent yourself. Whichever choice you make, we recommend that you take an active role in learning about the bankruptcy system and how it can help your situation specifically. Information you learn during the bankruptcy process can also be used to help you avoid debt-related problems in the future.

Recommended Reading: How To File Bankruptcy In Wisconsin

The Debtors File Documents Called Petition Schedules Statement Of Affairs Along With Some Other Documents With The Bankruptcy Court

These documents are reviewed by the Chapter 13 Trustee and other creditors. In addition to the documents the Debtors also file a Plan of Reorganization. This is called debt adjustment. The intention is that over the next 3 to 5 years the Debtors will pay all the disposable income to their creditors by way of the Bankruptcy Trustee. At the end of their Plan period their remaining debts will be discharged, unless they are non-dischargeable.

Employed Homeowners Facing Mortgage Delinquency Or Foreclosure Chapter 13

For homeowners who have fallen behind on mortgage payments, Chapter 13 offers a way to catch up or “cure” past due mortgage payments while simultaneously eliminating some portion of dischargeable debt. Filers can save the home from foreclosure and get rid of a lot of credit card debt, medical debt, and possibly even second and third mortgages or HELOCs. Chapter 7 bankruptcy does not provide a way for homeowners to make up mortgage arrears, so it’s not a good choice for delinquent homeowners who want to keep a home.

You May Like: Can I File Bankruptcy Without My Spouse Knowing

Advantages Of Chapter 7 Bankruptcy

Chapter 7 bankruptcy is an efficient way to get out of debt quickly, and most people would prefer to file this chapter, if possible. Here’s how it works:

- It’s relatively quick. A typical Chapter 7 bankruptcy case takes three to six months to complete.

- No payment plan. Unlike Chapter 13 bankruptcy, a filer doesn’t pay into a three- to five-year repayment plan.

- Many, but not all debts get wiped out. The person filing emerges debt-free except for particular types of debts, such as student loans, recent taxes, and unpaid child support.

- You can protect property. Although you can lose property in Chapter 7 bankruptcy, many filers can keep everything that they own. Bankruptcy lets you keep most necessities, and, if you don’t have much in the way of luxury goods, the chances are that you’ll be able to exempt all or most of your property.

- You can keep a house or car in some situations. You can also keep your house or car as long as you’re current on the payments, can continue making payments after the bankruptcy case, and can exempt the amount of equity you have in the property.

Eligibility To File A Chapter 7 Bankruptcy Case

In order to be eligible for a Chapter 7 case, you must receive credit counseling from an approved agency within 180 days prior to filing. When you file, you are required to provide the court with a certificate from the agency describing the services you received along with a copy of any debt repayment plan you and the agency may have developed. After you file, you will also have to complete an instructional course concerning personal financial management in order receive a discharge. Classes are run by independent agencies and require additional costs. A list of accredited credit counselors can be found at the United States Trustee’s website, .

Recommended Reading: Bankruptcy Falls Off Credit Report