Will Bankruptcy Affect My Credit

There is no clear answer to this question. Unfortunately, if you are behind on your bills, your credit may already be bad. Bankruptcy will probably not make things any worse.

The fact that you have filed a bankruptcy can appear on your credit record for ten years. But because bankruptcy wipes out your old debts, you are likely to be in a better position to pay your current bills and you may be able to get new credit.

Postconfirmation Modification Of The Plan

At any time after confirmation and before “substantial consummation” of a plan, the proponent of a plan may modify the plan if the modified plan would meet certain Bankruptcy Code requirements. 11 U.S.C. § 1127, 1193. This should be distinguished from preconfirmation modification of the plan. A modified postconfirmation plan does not automatically become the plan. A modified postconfirmation plan in a chapter 11 case becomes the plan only “if circumstances warrant such modification” and the court, after notice and hearing, confirms the plan as modified. If the debtor is an individual, the plan may be modified postconfirmation upon the request of the debtor, the trustee, the U.S. trustee, or the holder of an allowed unsecured claim to make adjustments to payments due under the plan. 11 U.S.C. § 1127.

Chapter 7 Vs Chapter 11 Bankruptcy In 2021

Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card. Explore our free tool

In a Nutshell

Chapter 11 bankruptcy can be quite similar to Chapter 7 bankruptcy. But it’s also really different. Learn how each type of bankruptcy can provide you with debt relief.

For many people, filing for bankruptcy relief is a difficult decision. Once the decision is made, however, itâs time to decide what type of bankruptcy to file. If you’re not eligible to file for Chapter 13 bankruptcy, it helps to understand the difference between Chapter 7 vs. Chapter 11 bankruptcy before making a decision.

The United States bankruptcy laws have the goal of giving the unfortunate but honest debtor a fresh start. One way that can be accomplished is by having a bankruptcy trustee liquidate the debtor’s assets for the benefit of creditors as part of a Chapter 7 bankruptcy proceeding.

How Do I Contact The Bankruptcy Court

The Bankruptcy Court Clerks Office is located in Burlington, Vermont. The address is: Federal Building, 11 Elmwood Avenue, Room 240. The public counter in Burlington is open Mondays through Fridays from 8:30 a.m. to 5 p.m. You may call the Clerks Office at 802-657-6400. You may leave a message on the Clerks Office answering machine after business hours. In your message, be sure to include your name, contact number and the best time to call you back. The court also has its own website at www.vtb.uscourts.gov. It contains plenty of helpful information and links.

Remember: The court and the Clerks Office cannot provide you with legal advice!

Adapted from the Vermont Bankruptcy Court website. Revised March 22, 2019.

Myth #10: Personal Bankruptcy Will Ruin Your Family

Lots of things lead to family problems, but bankruptcy may actually offer a solution to some of your problems. You may be on the brink of divorce because of your financial crisis. Our Firm sees this a lot. In some cases, you can put a stop to the family problem by filing for bankruptcy and getting a fresh, financial start.

Although filing for bankruptcy can be a very difficult decision in your life, the absence of all this stress may give your relationship a fighting chance.

Need more information about bankruptcy? Please at 281-888-5581. The road to financial freedom starts here.

Get Answers. Get Help.

Global Financial Crisis Of 2008

As the Financial Times noted during the fall of 2008, “the 2005 changes made clear that certain derivatives and financial transactions were exempt from provisions in the bankruptcy code that freeze a failed company’s assets until a court decides how to apportion them among creditors.” This radically altered the historic process of paying off creditors and did so just a few years prior to trillions of dollars in assets going into liquidation as a consequence of bankruptcies following from the global financial crisis of 2008.

Some observers have argued that this contributed to the financial crisis of 2008 by removing the incentive that creditors would normally have to keep a borrower out of bankruptcy. Institutions who provided short-term funding to financial firms such as Bear Stearns and Lehman through repo lending could abruptly withdraw that funding even if it risked pushing the firms into bankruptcy, because they did not have to worry about tying up their claims in bankruptcy court, due to the new safe harbor provisions of BAPCPA.

On October 4, 2009, FDIC Chair Sheila Bair proposed imposing a haircut on secured lenders in the event of a bank default, in order to prevent this kind of short-term funding run on a troubled bank. “This would ensure that market participants always have some skin in the game, and it would be very strong medicine indeed,” Bair said.

Types Of Corporate Bankruptcy

The type of bankruptcy proceedingsChapter 7 or Chapter 11generally provides some clue as to whether the average investor will get back all, a portion, or none of their financial stake. But even that will vary on a case-by-case basis. There is also a pecking order of creditors and investors, which dictates who gets paid back first, second, and last . In this article, we’ll explain what happens when a public company files for protection under Chapter 7 or Chapter 11 and how that affects its investors.

How Do You File Chapter 7 Bankruptcy

You can probably complete the process within six months. You’ll have to follow several steps.

Find an attorney:Before diving into the various forms required to file Chapter 7, find a qualified bankruptcy attorney to help. Its hard to find money for a lawyer when you need debt relief, but this is not a DIY situation. Missing or improperly completed paperwork can lead to your case being thrown out or not having some debts dismissed.

File paperwork: Your attorney will help with filing your petition and other paperwork. But its on you to gather all relevant documentation of your assets, income and debts. An automatic stay goes into effect at this point, meaning that most creditors cannot sue you, garnish your wages or contact you for payment.

Trustee takes over: Once your petition is filed, a court-appointed bankruptcy trustee will begin managing the process.

Meeting of creditors: The trustee will arrange a meeting between you, your lawyer and your creditors. Youll have to answer questions from the trustee and creditors about your bankruptcy forms and finances.

Your eligibility is determined: After reviewing your paperwork, the trustee will confirm whether youre eligible for Chapter 7.

Secured debts: To resolve your secured debts, the property held as collateral may be ordered returned to the creditor. Or you may be able to redeem the collateral or reaffirm the debt .

Are All Of The Debtor’s Debts Discharged Or Only Some

Not all debts are discharged. The debts discharged vary under each chapter of the Bankruptcy Code. Section 523 of the Code specifically excepts various categories of debts from the discharge granted to individual debtors. Therefore, the debtor must still repay those debts after bankruptcy. Congress has determined that these types of debts are not dischargeable for public policy reasons .

There are 19 categories of debt excepted from discharge under chapters 7, 11, and 12. A more limited list of exceptions applies to cases under chapter 13.

Generally speaking, the exceptions to discharge apply automatically if the language prescribed by section 523 applies. The most common types of nondischargeable debts are certain types of tax claims, debts not set forth by the debtor on the lists and schedules the debtor must file with the court, debts for spousal or child support or alimony, debts for willful and malicious injuries to person or property, debts to governmental units for fines and penalties, debts for most government funded or guaranteed educational loans or benefit overpayments, debts for personal injury caused by the debtor’s operation of a motor vehicle while intoxicated, debts owed to certain tax-advantaged retirement plans, and debts for certain condominium or cooperative housing fees.

Whats Life After Bankruptcy Like How Long Is Chapter 7 Bankruptcy On Your Credit Report

Most people who file Chapter 7 bankruptcy feel a sense of relief that all of their credit card and medical debt, along with other dischargeable debt, is totally gone. Many people see their credit scores improve if they had credit scores in the sub-600 range.Â

The bankruptcy process often creates a new sense of confidence, where people feel more comfortable with their financial affairs than when they began. Part of the reason is the two required personal finance courses. Chapter 7 bankruptcy also forces you to reflect on your financial situation.Â

People who file Chapter 7 bankruptcy usually get more serious about budgeting, saving, and rebuilding their credit, using tools like credit builder loans and secured credit cards.Â

Chapter 7 bankruptcy stays on your credit report for 10 years, but many people who file see their credit improve and are able to get approved for a mortgage within a few years if they make good financial decisions post-bankruptcy.

Can I Keep All Of My Exempt Property

Maybe. If property is exempt you do not have to sell it in order to pay off your debts. However, the exemptions do not affect the right of a secured creditor to take property that is pledged as collateral to cover their loan if you are behind on payments. Secured creditors have a security interest in your property. Some creditors, even if they are not secured creditors, may take exempt property. Examples are the Internal Revenue Service and parties enforcing a domestic support obligation. There is more information about secured creditors below.

In a Chapter 13 case you may be able to keep all of your property. Read more in our section about the different Bankruptcy Chapters.

How Is Property Handled In A Chapter 7 Vs Chapter 11 Case

A Chapter 7 case is a liquidation bankruptcy. Debtors who have non-exempt equity in property may lose that property in a Chapter 7 vs. Chapter 11 case.

Most Chapter 7 cases filed by individuals are no-asset cases. No-asset cases mean the debtors keep all assets, but get rid of substantial debts.

A business that files Chapter 7 vs. Chapter 11 closes its doors. The trustee sells the business assets to pay unsecured creditors in a Chapter 7 case. Secured creditors repossess or foreclose on the collateral, including real estate. Unsecured claims are paid in order of the priorities set by the U.S. Bankruptcy Code.Â

In a Chapter 11 case, the debtor chooses whether to keep or surrender property to the secured creditor holding the lien. A lien is a security interest that gives the creditor the ability to take property back if the debt is getting paid, either through a repossession or foreclosure. The property with the lien on it is called the collateral. If the property does not have a lien and it does not serve as collateral for a secured debt, the debtor is generally able to keep all property.

Can I Lose Property in a Chapter 7 vs. Chapter 11 Case?

Each bankruptcy case is different. However, most people who file a Chapter 7 case don’t lose any property because everything they own is protected by an exemption. As a result, debtors in Chapter 7 bankruptcy don’t pay back any unsecured creditors as part of their bankruptcy case.

What Debt Can And Cant Be Erased

Chapter 7 bankruptcy can erase the following common debts:

These debts are known as âdischargeableâ debts.Â

The moment someone files bankruptcy, a rule called the âautomatic stayâ goes into effect. This temporarily stops anyone from collecting any debts you owe them.Â

Chapter 7 bankruptcy cannot erase the following types of debts:

-

Child support and alimony

-

Recent tax debts and other debts you owe the government like fines

-

Student loans can usually not be erased

These debts are known as non-dischargeable debts.Â

Secured debts are debts that are backed by property, such as a mortgage backed by a house or a car loan backed by a car. If you want to keep your property that secures a debt, you cannot erase the debt in Chapter 7 bankruptcy. Before you file, you must also make sure youâre current on your debt payments. If youâre willing to give up the property, then Chapter 7 bankruptcy can erase secured debts.

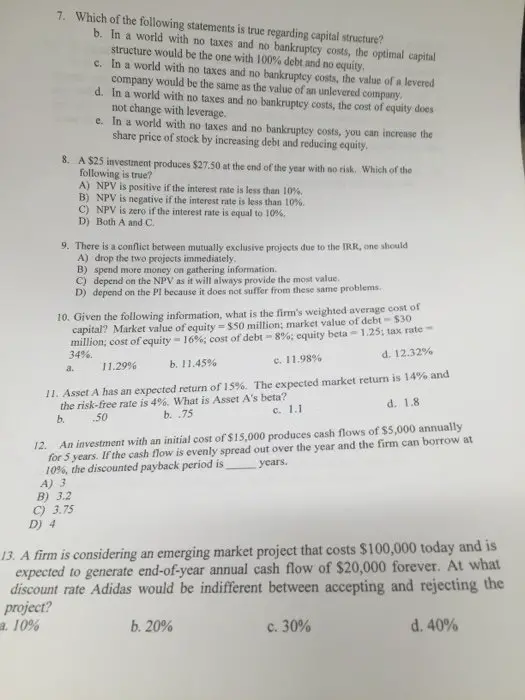

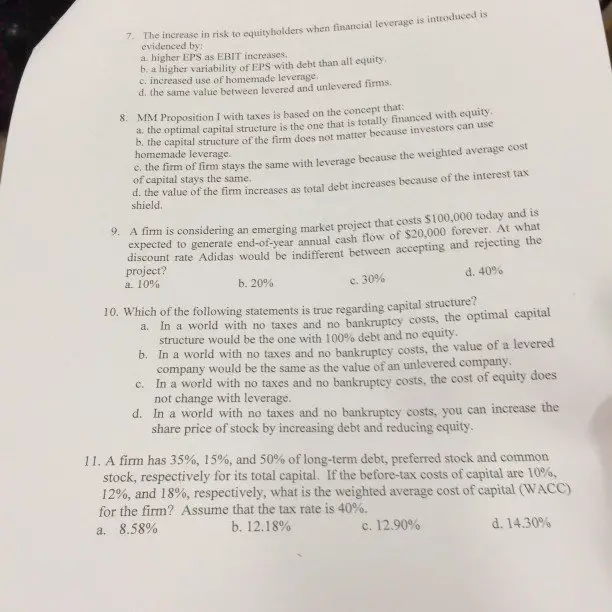

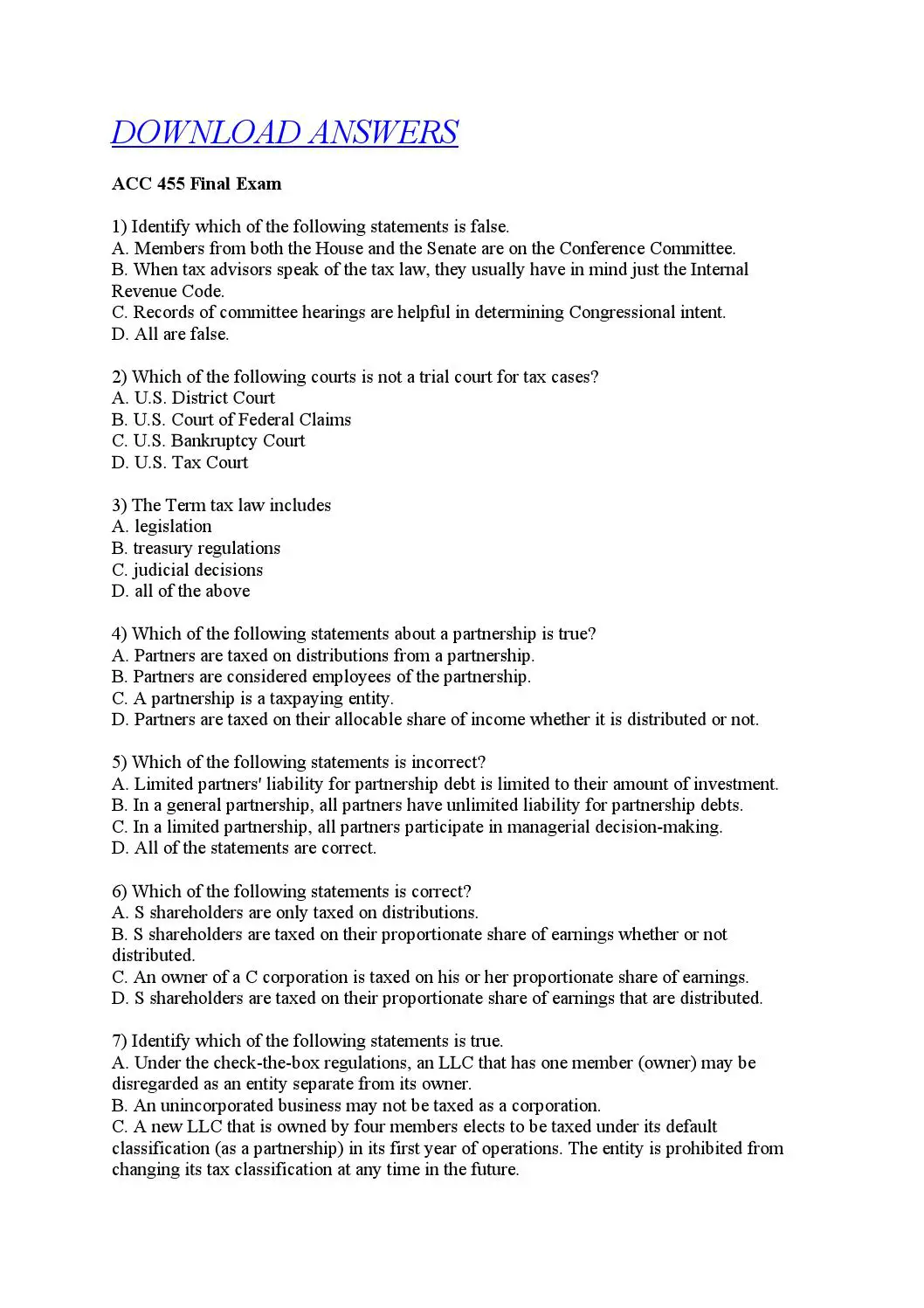

Which Of The Following Statements Regarding The

- School

- 94%31 out of 33 people found this document helpful

This preview shows page 27 – 30 out of 61 pages.

Students who viewed this also studied

British Columbia Institute of Technology

BLAW 3100

British Columbia Institute of Technology

BLAW 3100

British Columbia Institute of Technology

BLAW 3100

British Columbia Institute of Technology BLAW 3100

c8

British Columbia Institute of Technology BLAW 3100

Ch 10-13,15 Practice Q’s.pdf

British Columbia Institute of Technology BLAW 3100

c5

We have textbook solutions for you!

The document you are viewing contains questions related to this textbook.

Myth #6: You Can Only File For Bankruptcy One Time

Wrong. While the bankruptcy laws were tightened in 2005, you are still permitted to file for bankruptcy more than once, depending on when you filed and the type of bankruptcy.

In Chapter 7, you can receive a discharge once every 8 years, and in Chapter 13, you can receive a discharge every 2 years.

If you get discharged through Chapter 7, you have to wait 6 years before obtaining a discharge through Chapter 13.

If you obtain a Chapter 13 discharge, you must wait 4 years before getting a discharge through Chapter 7.

If your prior case was dismissed, there is typically no waiting period to re-file . In these situations, it is crucial to contact a knowledgeable bankruptcy attorney, as there are certain motions that must be filed in order to extend the bankruptcy protection in your current case. Our Firm has the knowledge and experience to guide you through this process. We have assisted numerous clients with subsequent filings.

Can A Financially Troubled Business Continue To Pay Its Suppliers While Not Paying Payroll Taxes Or Sales Tax

With the penalties and interest imposed, it is never a good idea to fail to timely pay taxes. But in the case of payroll taxes withheld from employees or sales tax collected from customers, nonpayment can lead to personal civil or criminal liability.

When a business collects taxes from others, such as withholding income taxes or Social Security taxes from employees, but fails to remit those taxes to the federal government, the “responsible persons” of that business are subject to a penalty under Sec. 6672 of the Internal Revenue Code equal to the amount of tax not paid. Often referred to as the “100% penalty,” this may be imposed on officers, owners, employees, and others who willfully fail to remit the withheld taxes. State law may provide a similar penalty for state payroll taxes ).

A good candidate for imposition of the 100% penalty is a person, such as a CPA making payment decisions while managing a tight cash flow, who pays the client’s suppliers while knowing or acting in reckless disregard of the business’s failure to remit withheld payroll taxes to the IRS or a state tax authority. This is true even if the individual pays creditors at another’s direction. For example, in Greenberg, 46 F.3d 239 , a controller who paid creditors knowing his company owed payroll taxes was found liable for the Sec. 6672 penalty, despite the fact that he had been instructed to do so by the CEO and feared losing his job.

What Does It Cost To File For Bankruptcy

It currently costs $338 to file for bankruptcy under Chapter 7 and $313 to file for bankruptcy under Chapter 13 . The filing fee is paid to the Bankruptcy Court and must be paid in cash, bank draft, certified check or money order.

If you cant pay the filing fee all at once, the court may allow you to pay this filing fee in installments. You must file an application requesting permission to make installment payments. If you cannot pay the filing fee in installments, have a very low income and do not have a lot of valuable property, you may request that the court waive the filing fee. Although occasionally there are some exceptions, generally if you hire an attorney you will have to pay the attorney and the filing fee.

Capital Loss Carryover Worksheetlines 6 And 14

Partnerships and Corporations

Filing Requirements

A separate taxable estate isn’t created when a partnership or corporation files a bankruptcy petition and their tax return filing requirements don’t change. The debtor-in-possession, or court-appointed trustee, must file the entity’s income tax returns on Form 1065, Form 1120, or Form 1120-S.

In cases where a trustee isn’t appointed, the debtor-in-possession continues business operations and remains in possession of the business’ property during the bankruptcy proceeding. The debtor-in-possession, rather than the general partner of a partnership or corporate officer of a corporation, assumes the fiduciary responsibility to file the business’ tax returns.

Partnerships

The filing requirements for a partnership in a bankruptcy proceeding don’t change. However, the responsibility to file the required returns becomes that of the trustee, or debtor-in-possession.

A partnership’s debt that is canceled as a result of the bankruptcy proceeding isn’t included in the partnership’s income. However, It may or may not be included in the individual partners income. See Partnerships, later, under Debt Cancellation.

Corporations

Tax-Free Reorganizations

Internal Revenue Code section 355 generally provides that no gain or loss is recognized by a shareholder if a corporation distributes solely stock or securities of another corporation that the distributing corporation controls immediately before the distribution.

Receiverships

The Us Trustee Or Bankruptcy Administrator

The U.S. trustee plays a major role in monitoring the progress of a chapter 11 case and supervising its administration. The U.S. trustee is responsible for monitoring the debtor in possession’s operation of the business and the submission of operating reports and fees. Additionally, the U.S. trustee monitors applications for compensation and reimbursement by professionals, plans and disclosure statements filed with the court, and creditors’ committees. The U.S. trustee conducts a meeting of the creditors, often referred to as the “section 341 meeting,” in a chapter 11 case. 11 U.S.C. § 341. The U.S. trustee and creditors may question the debtor under oath at the section 341 meeting concerning the debtor’s acts, conduct, property, and the administration of the case.

In North Carolina and Alabama, bankruptcy administrators perform similar functions that U.S. trustees perform in the remaining forty-eight states. The bankruptcy administrator program is administered by the Administrative Office of the United States Courts, while the U.S. trustee program is administered by the Department of Justice. For purposes of this publication, references to U.S. trustees are also applicable to bankruptcy administrators.

May An Employer Terminate A Debtor’s Employment Solely Because The Person Was A Debtor Or Failed To Pay A Discharged Debt

The law provides express prohibitions against discriminatory treatment of debtors by both governmental units and private employers. A governmental unit or private employer may not discriminate against a person solely because the person was a debtor, was insolvent before or during the case, or has not paid a debt that was discharged in the case. The law prohibits the following forms of governmental discrimination: terminating an employee; discriminating with respect to hiring; or denying, revoking, suspending, or declining to renew a license, franchise, or similar privilege. A private employer may not discriminate with respect to employment if the discrimination is based solely upon the bankruptcy filing.

Do I Have To Attend A Court Hearing In A Chapter 7 Vs Chapter 11 Case

Debtors must attend a meeting of creditors in each bankruptcy case regardless of filing under Chapter 7 vs. Chapter 11. However, Chapter 7 cases usually don’t have any other court hearings, unless the individual debtor is reaffirming a car loan.

There are numerous court hearings a debtor attends in a Chapter 11 bankruptcy case.Â

Myth #2: Lenders Will Ignore You If You File For Bankruptcy

False. After Congress passed the new bankruptcy laws in 2005, much of the stigma associated with bankruptcy vanished. Many lenders understand the problems with our economy and the affect of this crisis on consumers. So many will offer credit to those affected by bankruptcy. While interest rates may be higher, you can still get credit, despite a bankruptcy filing.

Alternatives To Chapter 7 Bankruptcy

Alternatives to bankruptcy may be able to help you get the fresh start you need. The one that’s right for you will depend on your financial situation and the types of debts you owe. Let’s go over each option.

Debt Settlement:You can negotiate with your creditors. If you’ve fallen behind on payments or are about to, you can contact your creditor to discuss the issue. You may be able to work out an affordable payment plan or negotiate a debt settlement for less than the full amount owed. This is especially true with credit card debt. Typically, a settlement needs to be paid in a lump sum.

Repayment Plan: Entering into a debt management plan with an agency is another option. Unlike in debt settlement, a debt management plan involves paying back your debt over time on more doable terms than you have now. Typically only unsecured debts can be included in a debt management plan.

Debt Consolidation: Taking out a debt consolidation loan to pay off your debts is another debt relief option. You would then have only one monthly payment to make to the new creditor. These loans often offer lower interest rates than what you’re already paying.

Another option is selling your valuable property to pay back creditors. But be careful. The money you get for your property may not be enough to pay off or settle all of your debts. You may end up having to file for bankruptcy anyway.

When Does The Discharge Occur

The timing of the discharge varies, depending on the chapter under which the case is filed. In a chapter 7 case, for example, the court usually grants the discharge promptly on expiration of the time fixed for filing a complaint objecting to discharge and the time fixed for filing a motion to dismiss the case for substantial abuse . Typically, this occurs about four months after the date the debtor files the petition with the clerk of the bankruptcy court. In individual chapter 11 cases, and in cases under chapter 12 and 13 , the court generally grants the discharge as soon as practicable after the debtor completes all payments under the plan. Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing. The court may deny an individual debtor’s discharge in a chapter 7 or 13 case if the debtor fails to complete “an instructional course concerning financial management.” The Bankruptcy Code provides limited exceptions to the “financial management” requirement if the U.S. trustee or bankruptcy administrator determines there are inadequate educational programs available, or if the debtor is disabled or incapacitated or on active military duty in a combat zone.

Myth #9: Most People Do Not Qualify For Bankruptcy Because Of The Means Test

This is not true. When the new bankruptcy laws passed in 2005, many debtors became frantic. Creditors tried to convince the country that bankruptcy would only apply to a small percentage of poor and destitute people. This was a massive fabrication of the new laws. In reality, the 2005 legislation changed the method in which debtors qualify for bankruptcy under the Means Test, but it did not prevent people from filing.

In fact, bankruptcy filings have actually increased since the new laws were enacted, especially in light of the foreclosure crisis. Dont believe what you hear whether on television, in the paper, or from friends or family members. To learn the truth about the current bankruptcy laws under Chapter 7 and Chapter 13, give our Firm a call.