Average Monthly Debt Payments By Age And Generation

Across all types of debt, Gen X members make the highest average monthly payments: $586. On the other end of the spectrum, Gen Z members make the lowest average monthly debt payments: $190. This makes sense, given that Gen X members have the highest average total debt, while Gen Z members have the lowest.

| Generation |

|---|

|

533.4 |

Choose A Repayment Method And Set A Goal

Whichever method you choose, the first step is going to be to take stock of everything you owe, how much you owe in total, and the interest rate. Then, you can start to prioritize what you owe.

Two popular strategies are the debt avalanche and the debt snowball. The debt snowball tackles the smallest debt first to build momentum, working through bigger debts next, while the debt avalanche focuses on paying down higher-interest debt first to decrease the amount you pay overall.

How To Deal With Too Much Mortgage Debt

Refinance to a lower interest rate. Though rates were at record low levels in 2020, the Fed was geared to start raising them in 2021 as the pandemic recovery got underway. If youre paying 5%-6%, the saving could be enough to make the mortgage payment manageable.

You could also refinance to a longer period and lower mortgage payments. Going from a 15-year to a 30-year mortgage will appreciably cut your monthly payments. The downside is youll end up paying a ton more in interest over the life of the loan.

Your best option might well be to sell the house and downsize into something that fits your budget. Consider renting versus owning since you can usually rent a house in the same neighborhood for less than youre paying on your mortgage.

You wont build any equity, but renting gives you much more flexibility if financial challenges arise.

Read Also: Pallets Merchandise For Sale

Generation Z: Current Age 11 To 23

People who fit into Generation Z were born between the years 1998 and 2010.

As to be expected, people who are under the age of 18 are not typically included in debt surveys and reports because, as minors, they cannot enter contracts for credit cards and loans. However, there is data for this generation, typically starting when they reach adulthood in the eyes of the law.

- Total credit card debt: Generation Z carries an average of $2,047 in total credit card debt per person, the lowest among five generations, according to Shift Processing.

- Retail credit card debt: On average, their retail credit card debt is $1,124, according to Experian.

- Mortgage debt: Gen Z holds an average mortgage debt of $172,561, according to Experian.

- Total non-mortgage loan debt: They owe an average non-mortgage debt of $10,942, according to Experian.

- Student loan debt: The federal student loan average balance per borrower for people who are 24 and younger is $14,807.69, according to the Federal Student Aid report.

- Auto loan debt: Generation Z borrowers who carry a car loan balance owe an average of $14.620, according to LendingTree.

Gen Zs average credit card debt by exact age is:

No debt information has been reported for people who are under the age of 20.

Generation Alpha: Current Age 0 To 10

And now we come to the future: people born between the years 2011 and 2025, or Generation Alpha. Of course, babies and children have no debt of their own, though their parents and grandparents and perhaps even their great grandparents most likely do.

Will this generation have the same needs and desires to borrow money? At this stage, nobody knows.

Recommended Reading: How Long Does Bankruptcy Stay On File Uk

Average American Debt Payments In : 869% Of Income

The St. Louis Federal Reserve tracks the nation’s household debt payments as a percentage of household income. The most recent number, from the second quarter of 2020, is 8.69%.

That means the average American spends less than 9% of their monthly income on debt payments. That’s a big drop from 9.69% in Q2 2019. This drop could be related to debt relief programs and other allowances made for coronavirus-related income loss — though it could also indicate that consumers have paid off their high-interest debts.

You Use Balance Transfers

Many creditors offer new credit cards with balance transfers available at low interest rates for an introductory period. Its important to remember, though, that after the introductory period the interest rates typically skyrocket to 18% or more. Additionally, credit card companies are charging fees for transferring balances. If you keep switching credit card balances, you may have a problem managing your finances.

Don’t Miss: What Happens When You Declare Bankruptcy Uk

How Many People Have Student Loans

The White House notes that there are more than 45 million student loan borrowers in the U.S. That may account for both those who just left school and those who have been out of school for a long time. The reports also indicate that, of those who have student loans, about 16% of them are in default. That includes about a third of all senior citizens who still have student loan debt that they have not repaid.

Consider a few key figures:

- 45 million people have student loans in the U.S.

- About 16% of all student loan borrowers are in default

- About 1/3 of all senior citizens still carry student loan debt

- The typical Black borrower still owes 95% of their student loans 25 years after they graduate

- About 66% of people who have a Pell Grant come from a family that earned under $30,000 per year.

What To Do When You Have Too Much Student Loan Debt

Consolidate and refinance your loans to get a lower interest rate. The rates for federal loans typically range from 3.5% to 7%, but private loans can creep higher.

Federal interest rates are set by Congress and private student loans cant be refinanced through a federal loan. You can, however, refinance them through private lending institutions.

Federal loans do offer income-driven repayment plans that are worth exploring. In those, monthly payment plans are based on your income.

The best plan is to shop around for colleges and careers before you shop around for loans. Many times, you can get as much educational bang for your buck at smaller state schools or community colleges charging half what top-rated universities charge.

Don’t Miss: Is Burger King Filing For Bankruptcy

Student Loan Repayment Status

Federal student loans

If borrowers can’t make payments, they can postpone them through deferment or forbearance. Interest typically accrues during these periods, but borrowers with subsidized loans don’t owe the interest that accrues during deferment.

The number of borrowers in forbearance spiked in 2020 due to the automatic student loan payment pause that’s be in place since March 2020. The Office of Federal Student Aid has also temporarily suspended delinquency and default data.

-

Federal loan borrowers in school: 6 million

-

Federal borrowers in grace period: 1.2 million.

-

Federal loan borrowers in repayment: 400,000.

-

Federal loan borrowers in deferment: 3.1 million.

-

Federal loan borrowers with loans in forbearance: 24.9 million.

-

Federal loan borrowers in default: 7.5million

How Many Americans Are In Debt

Even though household net worth is on the rise in America so is debt.1 The total personal debt in the U.S. is at an all-time high of $14.96 trillion.2The average American debt is $58,604 and 77% of American households have at least some type of debt.3,4,5

Lets pause a second to define debt. Plain and simple, debt is owing any money to anybody for any reason. If you have debt, youve most likely agreed on terms of repayment, and those terms mean specific payments at specific time periods until the debt is paid offtypically with interest .

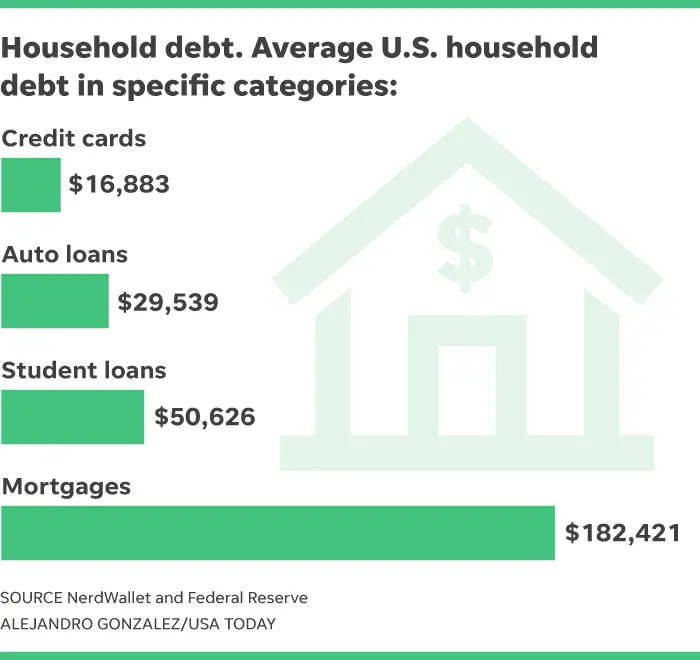

Some of the most common types of debt in America include credit cards, student loans, auto loans, home equity lines of credit , and mortgages. Though each impacts Americans of all ages, some age groups are more impacted than othersso well look at not only American totals and averages, but also at debt across various age groups.

Don’t Miss: Can You Keep Car In Bankruptcy

Types Of Debt In America

Consumer debt reached $14.56 trillion after the fourth quarter of 2020, according to the New York Federal Reserve.

The debt for Q4 was up $414 billion from the previous year and up nearly $1.9 trillion over the previous record high of $12.68 trillion in the third quarter of 2008.

There has been consistent growth in four main areas of debt home, auto, student loans and credit cards. Non-housing debt has risen faster, increasing 51% since 2013 compared with a 24% increase in mortgage debt.

Home Total mortgage debt rose to $10.4-trillion, an increase of $1 trillion from the same juncture in 2017.

But the increase is a good thing overall. The rise of mortgage debt is an indication of recovery in the housing market. Household debt has been growing for five years, but mortgage balance growth has been on a slower incline since it stopped declining in 2013.

Auto Total auto debt in Q4 of 2020 is $1.37 trillion, a jump of $100 billion from the same time in 2018.

When the Federal Reserve lowered interest rates in 2008 to fight the recession giving consumers more incentive to pursue the typical three-to-five year loan for autos it kick-started a trend that has held true today. Auto loans continue to increase because of low-interest rates.

Student Loans They continue to escalate, growing to a record $1.56 trillion in Q4 of 2020, up $100 billion from the same juncture in 2018. The average student debt in 2020 was $38,792.

What Is The Average Student Debt For Millennials

14.8 million millennials have student loans, more than any other generation. Millennials charge an average of $ 38,877 per lender.

How much student loan debt does the average 30 year old have?

Similarly in 2016, 60.4% of students ages 24 to 29 accumulated an average of $ 11,030 in an academic loan. 62.3% of students 30 years of age or older have accumulated an average of $ 10,940 in loans. Adults between the ages of 30 and 45 owe almost half of all student loans.

What age group holds the most student debt?

Lenders aged 50 to 61 receive the average student loan debt in 2021, at $ 43,214.16 The group of 24-year-olds and teens followed the lowest, at $ 14,657.92 on average.

Recommended Reading: What Happens If You File Bankruptcy

Financial Situation Changes Over The Past Year By Household Income

| 32% | 26% |

Aside from an overall decrease in household income and an overall increase in expenses, some of the top reasons why some Americans finances have gotten worse are a specific, unexpected large expense and job loss .

Meanwhile, Americans whose household finances have gotten better over the past 12 months report opposite experiences. More than half of those with better finances say its because their household income increased overall, and 24% say its because their household expenses decreased.

How Much Student Loan Debt Does The Average 30 Year Old Have

Similarly in 2016, 60.4% of students ages 24 to 29 accumulated an average of $ 11,030 in an academic loan. 62.3% of students 30 years of age or older have accumulated an average of $ 10,940 in loans. Adults between the ages of 30 and 45 owe almost half of all student loans.

How much student loan debt does the average person have?

The average college debt among student creditors in the United States is $ 32,731, according to the Federal Reserve. This is an increase of almost 20 percent from 2015-2016. Most lenders have between $ 25,000 and $ 50,000 in student loans.

At what age do most pay off student loans?

The average student loan takes 20 years to pay off their student loans.

- Some undergraduate graduates take over 45 years to repay their student loans.

- 21% of lenders see a student loan amount increase in the first 5 years of their loan.

Read Also: How To Get Out Of Bankruptcy Chapter 13 Early

Average Credit Card Debt In 2020

| Figure | |

|---|---|

| Delinquency rate of all credit card loans from commercial banks, Q2 2020 | 2.42% |

According to the latest Household Debt and Credit survey results from the New York Fed, Americans owe $807 billion in credit card debt as of Q3 2020. That’s down from $881 billion in Q3 2019 and $817 billion in the second quarter of 2020.

This could be because Americans are spending a bit more conservatively with their than they were before the pandemic.

“Consumers tightened their belts in 2020, leading them to carry less revolving debt and focus on paying their credit card bills on time every month,” says Melinda Opperman, President of , a nonprofit HUD-approved housing and nationwide consumer credit counseling organization headquartered in Riverside, California.

“But those encouraging numbers are ironically a sign of financial instability struggling families are cutting back wherever they can as we all brace for the fallout when foreclosure and eviction moratoriums end.”

So what does that mean for individual credit card holders?

According to Experian’s Oct. 20 report, Americans have an average of $5,897 in credit card debt spread over three cards. Americans also have 2.4 store credit cards, on average, with a total balance of $2,044.

Average Credit Card Debt In America: 2021

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.Terms apply to American Express benefits and offers. Visit americanexpress.com to learn more. Citi is an advertising partner.

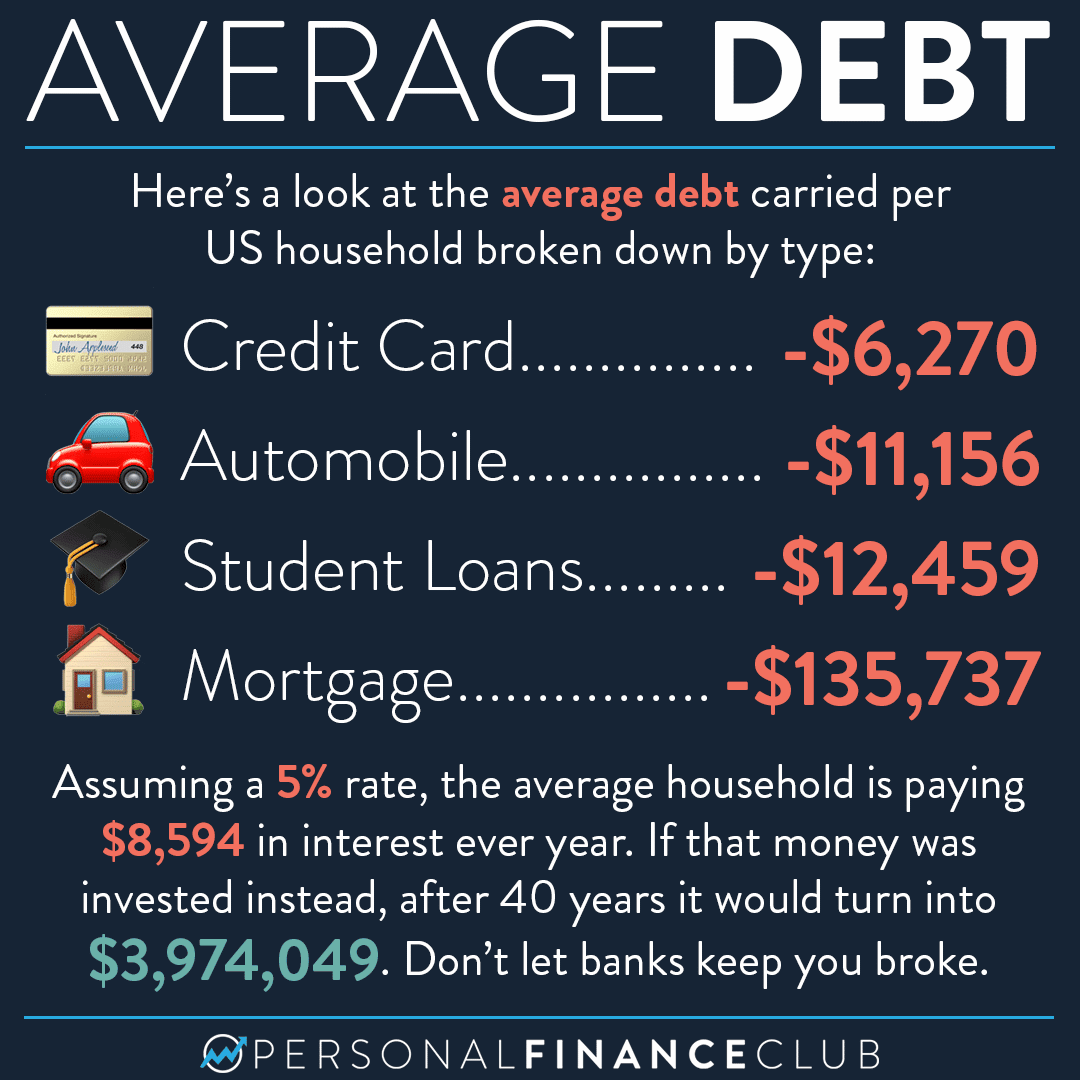

Our researchers found the median debt per American family to be $2,700, while the average debt stands at $6,270. The average balance for consumers is $5,315, although some of that debt may be held on joint cards and thus double-counted. Overall, Americans owe $807 billionacross almost 506 million card accounts. Below, you’ll find some of the most prominent trends that emerged.

Don’t Miss: When Does Bankruptcy Come Off Credit Report

Average Revolving Credit Card Balance In : $6271

A revolving credit card balance is one that persists between payments — in other words, it’s what people pay interest on. It’s one of the most important figures when looking at credit card debt.

The latest figures reported on revolving credit card balances come from the 2019 SCF, which took place before COVID-19 threw our finances into a tailspin. But at the end of last year, the average revolving balance for cardholders who had a revolving balance was $6,271.

As we know, outliers can skew means, so we also report medians where we can. The median amount of revolving credit card balances in 2019 was $2,700. So some cardholders out there are revolving a lot more than $6,200.

Here’s how the mean and median revolving credit card debt have changed over time:

The Majority Of States Saw Debt Increase By As Much As 59%

Debt decreased in certain states but increased in others by as much as 5.9%. Among the states that saw a rise, only two showed growth that was in line with the national average . The rest had growth of at least 0.6%, with several seeing growth of more than 1%.

On the opposite end of the scale, consumers in 15 states and Washington, D.C. saw their average debt balances decrease. The majority of states with declining balances reported a reduction of 1% or more.

Recommended Reading: How Long Does Bankruptcy Take To Come Off Credit Report

A Sign You Owe Too Much On Your Home

The house youre thinking of buying costs more than 2.5 times your annual income. For instance, if you make $60,000 a year, avoid any house that cost more than $150,000.

Whatever the sale price, your monthly payment should not exceed 28% of your gross monthly income.

A 20% down payment is highly recommended, since it could save you thousands of dollars in private mortgage insurance . A 15-year mortgage is also preferable to a 30-year, since youll save tens of thousands of dollars in interest.

It wont hurt to visit a mortgage calculator, punch in some numbers and see exactly how much house you can afford.

Average Student Loan Debt By Age And Generation

![American Debt Statistics [ Updated April 2020] Shift Processing American Debt Statistics [ Updated April 2020] Shift Processing](https://www.bankruptcytalk.net/wp-content/uploads/american-debt-statistics-updated-april-2020-shift-processing.jpeg)

The average student loan debt carried across generations is $33,658. Baby boomer members carry the most student loan debt, with an average of $43,678. Gen Z members carry the least student loan debt, with an average of $15,574. Four out of the five generations of Americans carry an average student loan debt of more than $30,000.

| Generation | |

|---|---|

|

$146 |

255.8 |

Though members of the Silent Generation have lower average student loan debt that Gen X and baby boomer members, their average next payments are significantly higher, suggesting they may be trying to pay down their loans more quickly. For more insights into student loan debt, check out our full report on student loan debt in America.

Also Check: Where To Buy Pallets Of Merchandise

How Does Your Debt Compare

Debt enjoyed a banner year in 2021. Americans racked up $601 billion to run the total U.S. household debt to record-shattering $14.15 trillion.

For a little perspective, you would need a stack of $1,000 bills 364 feet high to have $1 billion. To reach $1 trillion, that stack would have to be 63 miles high. So, Americas debt is approximately an 882-mile-high stack of $1,000 bills.

Welcome to Debt Mountain.

Houses account for most of that. Americans held $10.31 trillion in mortgage debt in 2021. That worked out to an average debt of $208,185 for households that carried a mortgage.

But again, that is secured debt. Just qualifying for a mortgage requires at least a minimal level of financial stability.

The other big unsecured debt was student loans, which were $1.58 trillion in 2021, with the average borrower owing $37,584.

Other forms of unsecured debt like personal loans, medical bills and utility bills make up the rest of that 882-mile-high mountain.