How Does The Chapter 7 Process Differ From Others

There are several different types of bankruptcy, though the two most used by individuals are Chapter 7 and Chapter 13. About 70% of those who filed for bankruptcy in 2020 filed Chapter 7, with almost all remaining filing Chapter 13. A small fraction filed Chapter 11, which is a reorganization bankruptcy most commonly used by businesses.

Chapter 7 is a much faster process than Chapter 13. Once Chapter 7t is discharged, the court process is finished. The rest maintaining a budget and living within your means is up to you. With Chapter 13, the court, you, your trustee and your creditors agree to a repayment plan that takes 3-5 years. The plan is based on what the court determines your ability to pay is, and if you stick with it, the rest of your unsecured debt is discharged once its completed. If you dont, the bankruptcy is dismissed and youre back in the situation you were in before filing.

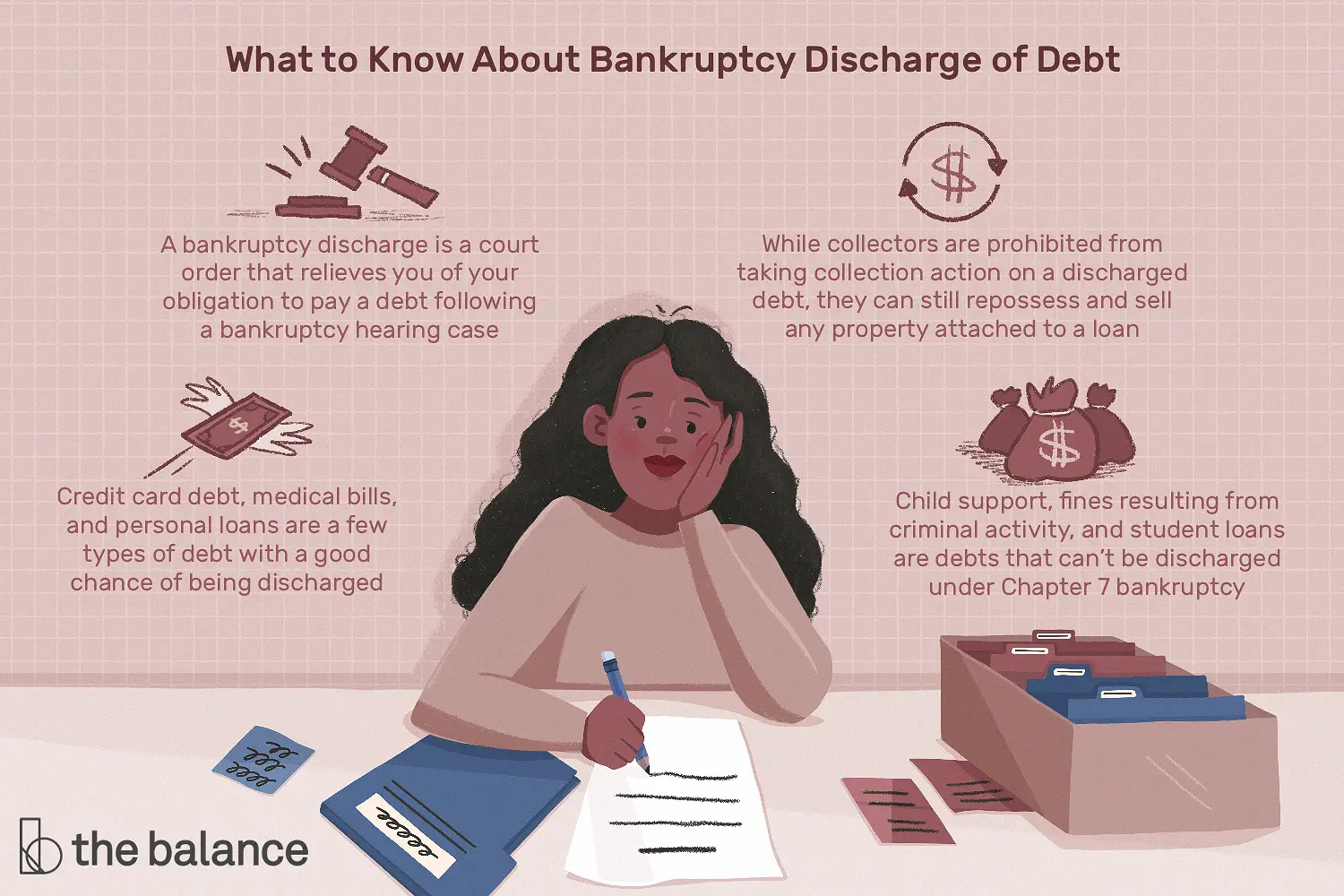

How A Bankruptcy Discharge Works

A copy of the discharge order will be mailed to all your creditors, as well as to the U.S. Bankruptcy Trustee, the trustee who is personally handling your bankruptcy case, and the trustees attorney. This order includes notice that creditors should take no further actions to collect on the debts or they’ll face punishment for contempt.

Keep a copy of your order of discharge along with all your other bankruptcy paperwork. You can use a copy of these papers to correct credit report issues or to deal with creditors who try to collect from you after the bankruptcy discharge.

You can file a motion with the bankruptcy court to have your case reopened if any creditor tries to collect a discharged debt from you. The creditor can be fined if the court determines that it violated the discharge injunction. You can try simply sending a copy of your order of discharge to stop any collection activity, then talk to a bankruptcy attorney about taking legal action if that doesn’t work.

Once You Have Successfully Complied With The Order Confirming The Chapter 13 Case Your Trustee Will Then File His Or Her Report Of The Completed Plan

How long does it take to file bankruptcy chapter 13. Filing for debt relief under chapter 13 can take just a few days or a few weeks, depending on how quickly you complete the steps for filing chapter 13. A chapter 13 bankruptcy case is a debt reorganization. It could take a few hours or a few weeks to file chapter 13 bankruptcy.

At the meeting, the trustee will ask questions to verify the information you presented in your petition. And, if that happens, moneylenders usually have no basis for the objection. Your chapter 13 repayment plan dictates how long it takes to complete a chapter 13 bankruptcy.

Get free education, customer support, and community. Call a qualified athens bankruptcy lawyer today. But there are some instances when your chapter 13 case will fall outside this standard three to five year period.

From filing bankruptcy to discharge. Featured in forbes 4x and funded by institutions like harvard university so we’ll never ask you for a credit card. Chapter 13 and your credit report.

In this plan, you must provide fixed payments to your trustee. Creditors can attend and ask you questions, but they arent likely to show up. A completed chapter 13 bankruptcy stays on your credit report for 7 years after the filing date, or 10 years if the case was not completed to discharge.

Filed within 14 days of the bankruptcy petition. Once the final payment is made on a ch.

Don’t Miss: Can You Rent An Apartment If You File Bankruptcy

How To Remove Bankruptcy From Credit Score

If the bankruptcy on your report is inaccurate, untrue, misreported, or disproved, you can easily remove it from your credit report by a legal process. But if the bankruptcy is legitimate, it will remain on your record for 10 years if you filed for Chapter 7 bankruptcy or seven years if you filed for Chapter 13. After these periods, they will automatically be removed.

Most consumers are concerned about how to remove bankruptcy from their credit score. The Fair Credit Reporting Act claims that these timelines are the maximum time for a bankruptcy filing that can stay on your credit report. But they could be on your credit history for less time, depending on the type of bankruptcy filing.

When Is A Discharge Challenged

A bankrupt’s discharge may be opposed by creditors, the LIT or the BIA if the bankrupt has failed to meet his/her obligations or has committed an act of misconduct under the Bankruptcy and Insolvency Act of the BIA). The Court will then review the opposition and render a decision.

There are four types of discharge:

- Absolute dischargeThe bankrupt is released from the legal obligation to repay debts that existed on the day the bankruptcy was filed, with the exception of certain types of debt.

- Conditional dischargeThe bankrupt must meet certain conditions to obtain an absolute discharge. Generally, the bankrupt will be required to pay a certain amount of money over a specific period. However, the Court may also impose other conditions. Once all conditions have been met, an absolute discharge will be granted.

- Suspended dischargeAn absolute discharge that will take effect at a later date.

- Refused dischargeThe Court has the right to refuse a discharge.

Read Also: Mark Cuban Bankruptcy

How Long Does It Take To Get A Bankruptcy Discharge

In most bankruptcy cases, the main goal is to get a discharge. The discharge is a permanent court order that prevents your creditors from holding you personally liable for any discharged debts. That means no collection calls, no lawsuits, and no garnishments.

So how long does it take to get a discharge? The answer depends upon which type of bankruptcy you choose.

Difference Between Entering A Discharge And Closing A Bankruptcy Case With A Final Decree

When the court enters a discharge in your bankruptcy, it wipes out your personal liability for all debts that were included in the discharge. In Chapter 7 bankruptcy, you normally receive a discharge a few months after filing your case. If you filed for Chapter 13 bankruptcy, you typically have to complete your Chapter 13 repayment plan before the court will grant you a discharge.

Even if you receive a discharge, your bankruptcy remains open until the court enters a final decree or order closing your case. But the court will not close your bankruptcy if the trustee is continuing to administer your case .

Also Check: Renting An Apartment After Bankruptcy

Las Vegas Bankruptcy Timeline

Bankruptcy in Nevada, like most legal proceedings, follows specific timelines. Both Chapter 7 bankruptcy and Chapter 13 bankruptcy have their own specific timelines. Erik Severino, our Las Vegas Bankruptcy attorney assists you in filing bankruptcy and keeps you within the rules and bankruptcy timeline in the process of declaring bankruptcy in Henderson and Las Vegas.

There is a debt relief strategy involved with bankruptcy in Nevada. Thus, our bankruptcy lawyer offers a free initial consultation to discuss your particular debt relief strategy. Also, Erik and legal staff have put together a list of important time-lines and waiting periods relative to declaring bankruptcy. Furthermore, we have included important time periods, deadlines, approximate filing periods, basic time-lines, and general length of times for both chapter 13 bankruptcy and chapter 7 bankruptcy cases in Nevada.

How Long Does It Take to File bankruptcy in Las Vegas?

Most Las Vegas Chapter 7 bankruptcies are closed and discharged within 4 to 6 months. There are exceptions to that bankruptcy timeline. more complex bankruptcy cases may pend for longer periods of time. It is advisable that any debtor with complex bankruptcy issues consult with an experienced Nevada bankruptcy attorney. Call the Law Offices of Erik Severino for a free bankruptcy consultation and debt evaluation.

How Long Does It Take To File A Chapter 7 Bankruptcy Case

There are a few things youâll have to do before you can file bankruptcy. How long this takes depends entirely on how quickly you move through the steps. Some people take weeks or even months to get ready others get it done in the span of a week. Hereâs a breakdown of these pre-filing steps:

-

Gathering information: Youâll need to collect some documents, like your tax returns and paycheck stubs so you can submit them to the court and/or the trustee. But, youâll also need to have information about how much you spend on living expenses, what your assets are and how much theyâre worth.

-

Taking credit counseling: This course has to be completed in the 180 days before your bankruptcy petition is filed with the court. It usually takes only 1 hour.

-

Completing the bankruptcy forms: This is often the longest part of the process. Folks working with a law firm wait for the lawyerâs office to complete this step. Once done, they’ll meet with the bankruptcy lawyer to sign their forms. Folks filing on their own can take several hours to fill out the bankruptcy forms. Upsolve users typically take a total of about 3 hours to provide the information needed to generate their forms.

-

Filing the forms with the court: How long this takes depends on whether you go to the bankruptcy court in person or mail it in. Due to COVID-19, some courts have started accepting forms through electronic means, like sending an email or uploading the documents through a portal.

Recommended Reading: Purchasing A Car After Bankruptcy

How To Get Proof You’ve Been Discharged

Your discharge from bankruptcy will happen automatically, so you won’t necessarily get proof sent to you.

Email the Insolvency Service to get a free confirmation letter. You should only ask for this after the discharge date.

If you ask for a confirmation letter, you must include your:

- full name

- National Insurance number

- court reference number

If youre applying for a mortgage, youll need a Certificate of Discharge. If you originally applied for bankruptcy through a court then youll need to ask them for a certificate. This costs £70 and £10 for extra copies.

If you originally applied for bankruptcy online, email the Insolvency Service for a certificate. Theres no fee for a Certificate of Discharge if you applied online.

Phase : Filing Date 341 Meeting Of Creditors

The 341 meeting is scheduled about 30 days after the petition date. The meeting itself typically takes less than 10 minutes to complete.

While waiting for your 341 meeting, youâll likely hear from your trustee. Theyâll let you know what documents they need from you to prepare for your 341 meeting. As long as youâve kept the documents you used when preparing your bankruptcy forms, doing this shouldnât take very long.

Most filers also get the financial management course out of the way while they wait for their 341 meeting. Bankruptcy law requires every person filing bankruptcy to complete this education course. It tends to be a little longer than the first course, usually around 2 hours.

Don’t Miss: Can You Rent An Apartment After Filing Bankruptcy

Does The Debtor Have The Right To A Discharge Or Can Creditors Object To The Discharge

In chapter 7 cases, the debtor does not have an absolute right to a discharge. An objection to the debtor’s discharge may be filed by a creditor, by the trustee in the case, or by the U.S. trustee. Creditors receive a notice shortly after the case is filed that sets forth much important information, including the deadline for objecting to the discharge. To object to the debtor’s discharge, a creditor must file a complaint in the bankruptcy court before the deadline set out in the notice. Filing a complaint starts a lawsuit referred to in bankruptcy as an “adversary proceeding.”

The court may deny a chapter 7 discharge for any of the reasons described in section 727 of the Bankruptcy Code, including failure to provide requested tax documents failure to complete a course on personal financial management transfer or concealment of property with intent to hinder, delay, or defraud creditors destruction or concealment of books or records perjury and other fraudulent acts failure to account for the loss of assets violation of a court order or an earlier discharge in an earlier case commenced within certain time frames before the date the petition was filed. If the issue of the debtor’s right to a discharge goes to trial, the objecting party has the burden of proving all the facts essential to the objection.

What Happens On The Day The Case Is Filed

The day you submit your bankruptcy forms to the court, sometimes called the filing date or the petition date, sets a few things in motion. For one, the automatic stay is triggered. This stops creditors from trying to collect a debt from you and even stops a garnishment. First, the clerkâs office assigns a case number, a judge, and a bankruptcy trustee to the case. Then it schedules the 341 meeting of creditors. The date of the 341 meeting determines a number of important deadlines for the bankruptcy case.

Read Also: Is Taco Bell Filing For Bankruptcy

Your Responsibilities Don’t End When You Receive A Discharge

Just because you received a discharge doesn’t mean that you have no more responsibilities in your bankruptcy. If you have a complex bankruptcy with ongoing lawsuits or appeals, your case might remain open for a long time after the court grants your discharge.

In addition, if you have nonexempt property that the trustee has not abandoned, it will remain property of the bankruptcy estate. The court will not close your case until the trustee files a report stating that he or she has administered all property of the estate.

Until the court closes your case, you have a duty to cooperate with the trustee. This means that you may still be required to:

- turn over nonexempt assets to the trustee

- provide additional information or documentation

- testify in a pending lawsuit, or

- appear at a deposition or 2004 examination.

Do You Have Surplus Income

If your monthly income is $200 or more in excess of the current surplus income limit set by the government, it is possible that your bankruptcy will be extended for longer than nine months, and you will be required to pay a portion of this income into your bankruptcy.

It is not wrong to make surplus income, but it is only fair that a portion of it be paid to your creditors. Having surplus income also lengthens the period you are bankrupt usually to twenty-one months for first-time bankruptcies.

For more information, see our page on surplus income.

Recommended Reading: Bankruptcy Petition Preparer Guidelines

Chapter : The Fast Track

In a Chapter 7 case, youll probably receive your discharge within 4 months of filing your bankruptcy petition. But this doesnt mean you have to wait for the creditors and debt collectors to get off your back. During the time period between filing and discharge, the automatic stay provision of the Bankruptcy Code gives you immediate debt relief by preventing your creditors from starting or continuing collection efforts while your case is pending.

How Long Does A Chapter 13 Bankruptcy Take

A Chapter 13 bankruptcy involves a repayment plan, so it takes quite a bit longer to complete. Typical Chapter 13 bankruptcy cases last 3 to 5 years. As part of the repayment plan, secured debts, like car loans are paid off. Depending on the type of debt you have, this type of bankruptcy may provide more debt relief than a Chapter 7 filing. Itâs always best to speak to a bankruptcy attorney about a Chapter 13 filing, as there are many moving parts in the Chapter 13 bankruptcy process.

Also Check: How To File For Bankruptcy In Iowa

Speak With A Professional

The U.S. Bankruptcy Court strongly suggests that those filing get an attorney. Court officials, including judges, are barred by law from offering advice to people whove filed for bankruptcy. The court does have information and documents available for those doing it themselves, legally called pro se.

How Long Does Bankruptcy Take

Filing for bankruptcy does not immediately eliminate your debts when you sign the initial paperwork. Instead, filing just means that you are entering the bankruptcy process. During bankruptcy, your creditors cannot demand payment from you directly, but you will still pay them indirectly through your bankruptcy trustee. Your debts are cancelled only at the discharge of your bankruptcy, which happens some months after you file for bankruptcy and then only if you meet all the bankruptcy duties laid out in your bankruptcy agreement.

The length of time you are in bankruptcy is determined by several factors such as whether you have filed bankruptcy before, your faithfulness in following your bankruptcy duties, and many others. Most of the time, you will be out of debt faster with bankruptcy than with a low-interest debt consolidation loan or a consumer credit counselling program. However, other debt solutions such as debt settlement or a consumer proposal may get you out of debt sooner than a bankruptcy, and certainly with less damage to your credit history.

Recommended Reading: Trump Declares Bankruptcy

When Does The Discharge Occur

The timing of the discharge varies, depending on the chapter under which the case is filed. In a chapter 7 case, for example, the court usually grants the discharge promptly on expiration of the time fixed for filing a complaint objecting to discharge and the time fixed for filing a motion to dismiss the case for substantial abuse . Typically, this occurs about four months after the date the debtor files the petition with the clerk of the bankruptcy court. In individual chapter 11 cases, and in cases under chapter 12 and 13 , the court generally grants the discharge as soon as practicable after the debtor completes all payments under the plan. Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing. The court may deny an individual debtor’s discharge in a chapter 7 or 13 case if the debtor fails to complete “an instructional course concerning financial management.” The Bankruptcy Code provides limited exceptions to the “financial management” requirement if the U.S. trustee or bankruptcy administrator determines there are inadequate educational programs available, or if the debtor is disabled or incapacitated or on active military duty in a combat zone.