Will Employer’s Discriminate Against Me If I File Bankruptcy

Bankruptcy laws, like any other legislated laws, evolve through various court interpretations over time. The precedence set in these evolving cases determine in many incidences how other similar court decisions might turn out. Discrimination in hiring over bankruptcy has recently evolved in a direction worthy of note.

The bankruptcy laws most used in determining discrimination in hiring practices is found under the bankruptcy codes nondiscrimination provision, 11 U.S.C. Section 525. There are two parts to the law that apply in determining discrimination:

- Section 525 reads in part, governmental unit may not deny employment to, terminate the employment of, or discriminate with respect to employment against, a person that is or has been a debtor under this title

- Section 525 reads in part, No private employer may terminate the employment of, or discriminate with respect to employment against, an individual who is or has been a debtor under this title.

In interpreting these two statutes, the federal Eleventh Circuit Court of Appeals ruled in Myers v. ToJays Management Corporation on May 17, 2011, that a private employer can refuse to hire a person based solely upon the fact that he or she filed for bankruptcy. This is the third federal appeals ruling of its kind, marking a clear trend for a precedence allowing such discrimination in hiring practices. All three rulings were handed down in 2010 and 2011.

Considering Bankruptcy?

Can A Bankruptcy Case Be Dismissed Without A Discharge

It also depends on whether or not the earlier case resulted in discharge. A bankruptcy discharge releases the debtor from personal liability of any debts included within a bankruptcy case. If the previous case was dismissed without a discharge, you could file again right away, subject to restrictions.

What Disqualifies A Person From Getting Bonded For An Insurance Job

Related

Insurance sales agents and brokers sell insurance products to consumers who possess varying degrees of sophistication. Several states require insurance professionals to be licensed and bonded to help protect individuals and businesses from being deceived and manipulated when seeking personal and property insurance. Getting bonded attests to your professionalism and shows you were vetted by a surety bonding company. You may be disqualified from obtaining a bond if you dont meet your states eligibility requirements. Poor credit scores, history of criminal activity and moral turpitude are among the reasons for being denied a surety bond.

Read Also: Declaring Bankruptcy In Oregon

Consider A Consumer Proposal

Many concerns regarding the impact of a bankruptcy on employment do not apply in the case of a consumer proposal. A consumer proposal is a repayment arrangement made with your creditors, to repay a portion of what you owe.

In fact, professional designation holders often file a consumer proposal as an alternative to bankruptcy. Since someone who has entered into a repayment arrangement through a consumer proposal is not bankrupt, they are generally excluded from professional guidelines. As such, a proposal can often solve some of the situations that arise in terms of your employment and looking for debt relief solutions. However, any professional should first check any regulations with their professional designation body or society.

Unlike in a bankruptcy, a consumer proposal filing can also allow you to hold director or executor roles.

Every situation is unique, which is why it is important to discuss your personal debt relief needs with a Licensed Insolvency Trustee. Your trustee will carefully review your financial situation and provide you with the best course of action without unduly affecting your employment.

How Filing For Bankruptcy Will Affect Your Job Applications

DISCLAIMER: We are pleased to communicate with you concerning legal matters. However, if you communicate with us through this website regarding a matter for which our firm DOES NOT ALREADY REPRESENT YOU, your communication may NOT be treated as privileged or confidential, and shall NOT be deemed to create an attorney/client relationship. Furthermore, you should NOT provide confidential information to anyone at our law firm in an e-mail inquiry or otherwise unless we have FIRST entered into a representation agreement. The information provided in this website is provided for informational purposes only, and should not be construed as legal advice on any subject. By continuing on to our web site you are deemed to have agreed to these terms and conditions.

© 2021 FBD Law. All Rights Reserved.

Read Also: How Much Does Credit Score Go Up After Chapter 7 Falls Off

Will You Lose Your Job Due To Bankruptcy

No employergovernment or privatecan fire you solely because you filed for bankruptcy. Nor can an employer use a bankruptcy filing as a reason to change other terms or conditions of your employment. For instance, your employer can’t:

- reduce your salary

- demote you, or

- take away responsibilities.

However, if the employer has other valid reasons for taking these actions, such as tardiness, dishonesty, or incompetence, the fact that you filed for bankruptcy won’t protect you.

But if you’re fired shortly after your employer learns of your bankruptcyand no other justifications existyou might have a case against the employer for illegal discrimination.

Bankruptcy And Applying For Jobs

If you are applying for a job with a private employer, you do not have a right to conceal a past bankruptcy from the employer. They may find out about the bankruptcy from your credit report, and businesses hiring for positions that involve handling money may think twice about hiring someone with a bankruptcy on their record. Unfortunately, you do not have much recourse in this situation. You can refuse to let a prospective employer conduct a credit check, but this also will be a red flag that may result in the loss of this opportunity. The best approach is probably to be honest about any concerns that the employer will find and explain the situation from your perspective. Your openness may convince the employer that you would be a trustworthy employee despite your past financial troubles.

If you are applying for a government job at the federal, state, or local level, by contrast, you have protections against discrimination based on a previous bankruptcy. The employer cannot take the bankruptcy into account when deciding whether to hire you.

Recommended Reading: How To File Bankruptcy In Texas Without An Attorney

You May Like: Nortel Epiq

Be Careful What You Ask For In Bankruptcy

Bonding companies and debtors can learn an important lesson from the U.S. Bankruptcy Court for the Middle District of Louisianas recent opinion on how surety bond claims are treated once a bankruptcy plan is confirmed.

In the case, Falcon V, L.L.C. and its affiliated debtors filed for chapter 11 bankruptcy in May 2019. Falcon engaged in oil and gas exploration and development in Louisiana. Argonaut Insurance Company issued four performance bonds to fulfill Falcons oil and gas lease obligations. Argonaut gave Falcon $10,575,000 in bonding, of which $3.2 million was secured by cash. The key events during the bankruptcy were:

- The court approved Falcons request to continue the surety bond program. Falcon noted in its motion that the premiums were needed to preserve the estate.

- The court approved Falcons disclosure statement noting that it would continue all bonding currently in place.

- Falcon confirmed a chapter 11 plan that called for it to assume all contracts not yet completed, called executory contracts.

- Argonaut did not object to the disclosure statement nor confirmation of the plan.

- Argonaut filed a proof of claim that it was owed $10,575,000, $3,213,720.55 of it secured by cash and the other $7,361,279.45 unsecured.

- Argonaut’s proof of claim recited that the surety bond program was a financial accommodation but reserved its rights with respect to the programs description as executory contracts.

Can You Be Bonded After A Bankruptcy It Depends

Obviously nobody wants to file for bankruptcy, but sometimes people have no choice. A bankruptcy can affect your life in many ways and it is only natural for you to want to know more about them and be better prepared.

One way in which a bankruptcy can have an impact on you is by affecting your chances of getting bonded, i.e. obtaining a surety bond. Not all bonds, however, are the same. To what extent a bankruptcy will affect your ability to get bonded will depend on the type of bankruptcy, the type of the bond and several other factors. Whether you have recently filed for bankruptcy or have one on your history read on to find out how you can still get a surety bond.

Find out what your bond cost will be even after bankruptcy today!

Read Also: How To Declare Bankruptcy In Ca

Bankruptcy And Construction Contracts

Construction is a high risk business and anyone who has engaged in it for long has encountered the problem of one or more of the various parties engaged in a project either disappearing from the project or filing bankruptcy in the midst of the job.

If it is the Owner or Developer of the Project one faces the prospect of the various professions and trades instantly ceasing work and taking actions to protect their various secured and unsecured claims while the Bonding Company, if any, often assumes responsibility for the job. If it is a subcontractor or material supplier, the immediate result may not be so obvious but the long term disruption of the Project may be just as extreme.

Anyone involved in construction should have both a working knowledge of the law of Bankruptcy and should understand how bankruptcy can affect the project and rights to recovery. And the danger of bankruptcy becomes greater as more trades and other entities are involved on the Project. A client once commented to the writer, as he prepared to put out for bid, that he would have over thirty entities involved on the Project within two months and that if any of them went under the other twenty eight would pay the price of delay, confusion and finger pointing. As I told him, it was up to him, as the Developer, to minimize that effect and to do it by advance planning.

1. OUTLINE OF ARTICLE

First, this article describes the bankruptcy process from a general standpoint.

2. HOW BANKRUPTCY WORKS

What Is Required To Get A Bankruptcy Trustee Bond

The surety company underwriter will require the following:

- Completed and signed bond application form

- Financial statements

- Copy of the court order appointing the trustee and indicating the bond amount required

- Copy of the court-specific bond form

Once the underwriter has everything they need, they will review all the documents and issue a decision. If approved, they will issue the bond to the trustee immediately.

You May Like: If You File Bankruptcy Can You Rent An Apartment

Can I Lose My Job If I File Bankruptcy

It is illegal in Canada for an employer to fire someone simply because they filed bankruptcy.

Certain professions, however, have professional conduct standards that require someone to disclose if they are bankrupt. Often these are professions that involve management of money and trust accounts such as an insurance/investment broker, lawyer or accountant. In some cases, their professional designation may be affected. In others, the type of work they can do is limited until after the bankruptcy is discharged.

We explain later in this post how a consumer proposal can remedy the employment challenges faced by a bankruptcy filing.

In general, if the debts you owe are personal in nature and not the result of fraudulent or irresponsible business activity, an insolvency filing shouldnt impact you professionally, but its still important to check.

Government Bonds And Bankruptcy

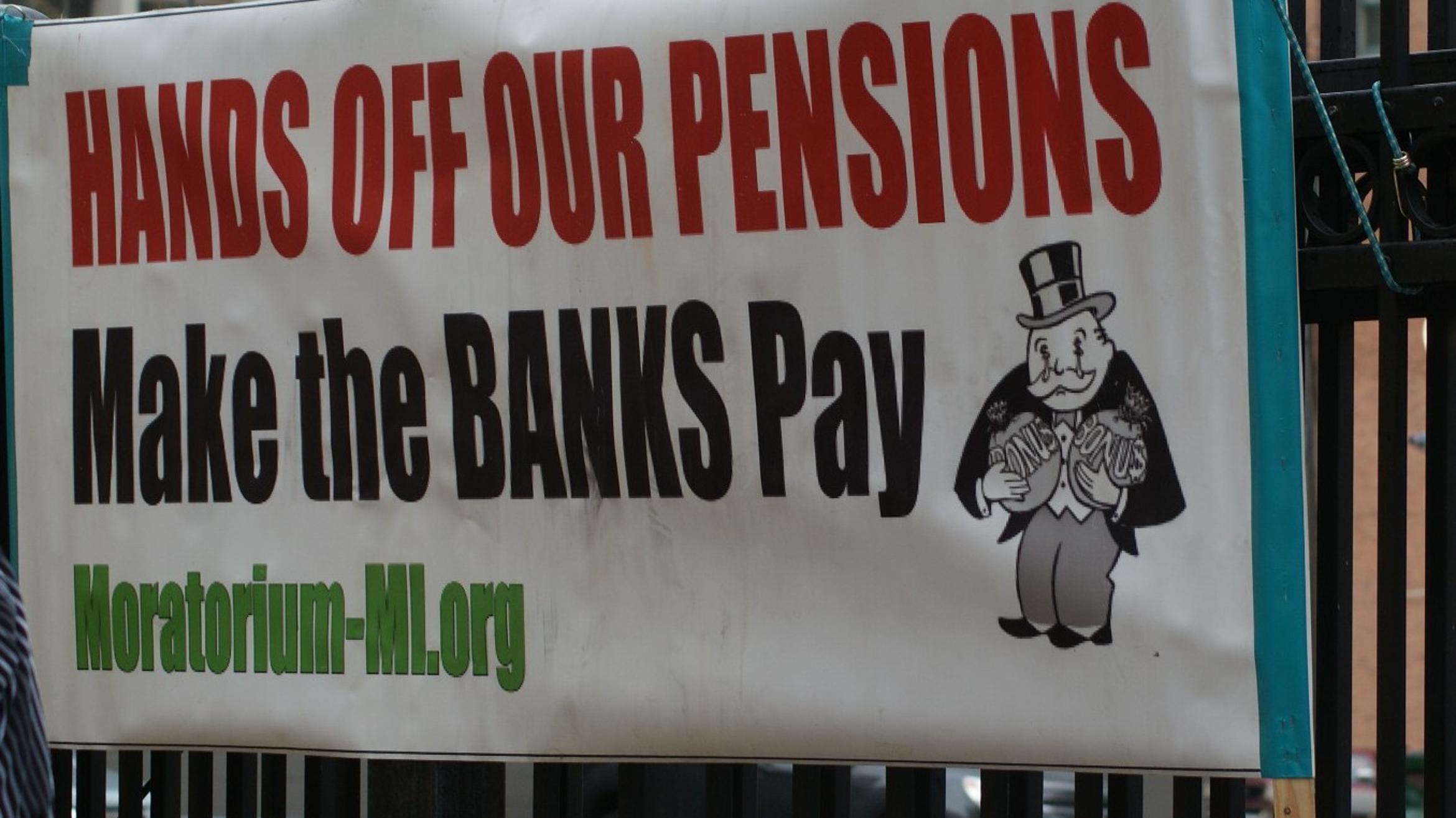

Holders of corporate bonds are not the only investors who face the prospect of their investment landing in bankruptcy. Some governments, many of which faced financial challenges due to underfunded pensions for retired employees, now also confront reduced tax revenues due to the impacts of shutdowns.

Highly indebted state governments such as Illinois and New Jersey cannot declare bankruptcy. However, local governments in all but Georgia and Iowa have at least some ability to reorganize their finances. While defaults on municipal bonds have historically been rare, certain municipalities may find themselves on the path into bankruptcy that overextended governments in Detroit and Stockton, California traveled following the global financial crisis.

Detroit’s 2013 bankruptcy after decades in which its tax base shrank is a cautionary tale for municipal bondholders. The bankruptcy court gave retired city employees priority for repayment and they recovered nearly 90% of the pension benefits promised them. Bondholders were given lower priority and recovered only about 80% of the value of their investment.

Losses like Detroit’s bondholders experienced are somewhat less likely today because states have adopted laws which protect bondholders. For example, California, which has accounted for almost 30% of all city and county bankruptcies since the global financial crisis, has a law that places liens on future property tax revenues to ensure bondholders will be repaid.

Recommended Reading: How Many Times Has Donald Trump Filed For Bankruptcy

Circumstances Where An Employer Will Receive Official Notice:

There are three main scenarios when your employer will receive notice that you have filed a bankruptcy case. This will happen if the bankruptcy filing is stopping a wage garnishment if you owe money to your employer and have to list them as a creditor or if you are filing a Chapter 13 case which requires a payroll deduction order for plan payments.

Stopping a wage garnishment

You might decide to file a bankruptcy specifically to stop a wage garnishment. A wage garnishment occurs after a creditor has filed a lawsuit against you to collect the money you owe. Most often creditors will receive a judgment against you because you did not respond to the lawsuit. If you do not respond within a certain time period, the judge will enter a default judgment against you. Once a judgment is entered, your creditor can serve it on your payroll department so that they can get money from your paycheck before you even see it. This can result in you not having enough money in your paycheck to keep up with expenses.

When you file a bankruptcy case an automatic stay goes into effect immediately, which freezes certain legal proceedings. Your wage garnishment will stop. Your payroll department has to receive notice of your case in order to do so. It can vary by employer whether others in the company are informed.

If you owe your employer money and have to list them as a creditor

Chapter 13 payroll deduction order

Also Check: Can You Buy A Car After Filing Bankruptcy

Who Must Request Issuance Of The Fidelity Bond

Either the employer or the job applicant can request issuance of the bond for job placement to occur, by filling in the Fidelity Bond Certification Form. This request is to be made to any local partner agency in any Job Center in Wisconsin. These offices are designated as State Job Centers, or Workforce Development Centers. The partner willrelay the request to the Job Service local bonding representative.

Also Check: Trump Personal Bankruptcies

Military Personnel And Security Clearances

If you want to join the military, you will typically have to disclose previous bankruptcies during the application process. Depending on the specific branch of the military you are applying to, a credit check can also be required. Because each branch of the military has its own rules about financial eligibility, talk to a military recruiter to learn more about whether filing for bankruptcy will affect your service eligibility.

If you are in the military, it’s not so much the bankruptcy that will have a negative impact on your security clearance, but your financial stability. Security clearance determinations are usually made on a case by case basis. Before filing your case, check with the necessary military personnel or department to discuss any issues that might jeopardize your security clearance or otherwise adversely affect your military career. For more information, read Special Rules for Military Members.

What Happens To A Chapter 13 Bankruptcy Case When It Is Discharged

Closing a Chapter 13 Bankruptcy Case After Discharge Chapter 13 benefits debtors and creditors because the repayment plan allows the filer to catch up on important debts, such as a late house or car payment. Instead of turning over assets to the trustee to sell, the filer makes regular payments to the Chapter 13 trustee for three to five years.

Don’t Miss: Do Married Couples Have To File Bankruptcy Together

What Happens To My Wages In Bankruptcy

You keep your wages in a bankruptcy. Your Trustee does not seize or control your income directly. However, you are required to submit a monthly income and expense report to your Trustee. This information is used to calculate if you earned enough to go over the government set income limit in a bankruptcy. If you do go over this limit, you will be required to make additional surplus income payments.

Can You Still Get A Job If You File For Bankruptcy

Many people who file for bankruptcy want to know whether they can get a fresh start perhaps by taking on a new job.

The good news is that filing doesnt usually affect your ability to take on new positions, either at your existing company or a new one.

In general, hiring managers do not require you to disclose your financial history.

However, they may conduct a credit check or insolvency search to find out more about you as a candidate.

Companies offering roles that involve a high degree of financial trust will often conduct background research on the criminal and financial history of applicants.

Most, though, wont bother.

Recommended Reading: Has Donald Trump Ever Filed For Bankruptcy

Can The Bond Be Issued At Any Time

For a new bond to be issued, the employer must make the applicant a job offer and set a date for the individual to start work. The job start date will be the effective date of the bond insurance, which will terminate six months later. After six months, continued coverage is available for purchase if the worker has exhibited job honesty underthe program’s bond. With sufficient justification a renewal bond may be issued. Contact the State Bonding ServiceCoordinator with questions about eligibility for a subsidized renewal bond.