Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month. Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, into the calculation. Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

What Are The Limitations Of The Debt

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

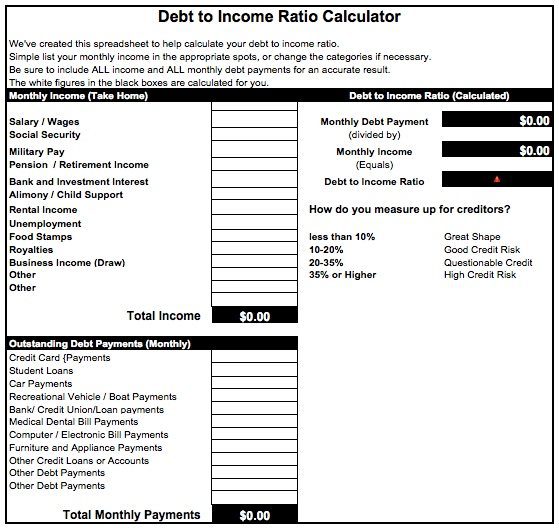

How Do I Calculate My Debt To Income Ratio

Calculating your DTI is simple and not very time consuming. To calculate your debt to income ratio, add up all of your monthly debt payment obligations including your mortgage, car loans, student loans, and minimum monthly payments on credit cards. Do not include expenses such as groceries, utility and gas. Then, calculate how much you earn each month. Finally, divide your monthly debt obligations by your gross monthly income to get your DTI.

For example if you and your spouse earn $6,916 per month, your mortgage payment is $1,350, your car loan is $365, your minimum credit card payment is $250, and your student loans are $300, then your recurring debt is $2,265. Divide the $2,265 by $6,916 and you will find your DTI is 32.75 percent.

- The FHA Loan is For:First time buyers, repeat home buyers, families and qualified permanent residents

- The FHA Program Can Be Used To:Buy HomeRefinance

- Low Closing Costs

- As low as 5% Down

- Low Closing Costs

You May Like: How Do I Find Foreclosed Homes

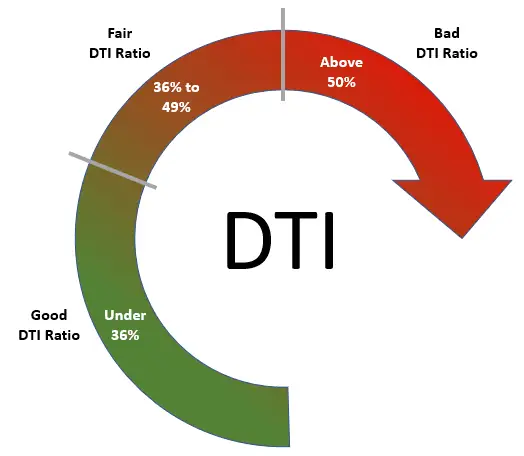

What Is Considered A Good Debt

There is no standard value for debt-to-income ratio. Every lender has its own risk tolerance and sets its own limit. However, within the home loan industry, good DTI normally falls between 30 percent and 50 percent, with 43 percent being the cap for many lending institutions.

A higher-than-preferred DTI doesnt automatically disqualify you from a home loan. Other factors, such as a high credit score and having a substantial amount of verifiable cash, may help you get a loan even with a less-than-ideal DTI.

Additionally, some loan providers, such as BNC Mortgage Lenders, take a one-on-one approach to lending, treating every customer as an individual and helping them find unique mortgage solutions even with high or nuanced DTI ratios.

How To Calculate Dti Your Debt

How to Calculate Your Debt-to-Income Ratio DTI RatioTotal Your Monthly Debt. Example: You dont need to include payments you make for car insurance,utilities,health insurance,groceries and other monthly expenses that dont involve financing.Total Your Monthly Income. Example. Doing the Simple Math. Example. Example.

Also Check: How Soon After Bankruptcy Can You Buy A House

Next Step: Understand The Total Cost Of Borrowing

When considering a new loan or restructuring your current debts, remember to consider your borrowing costs. Extending the term of your loan may lower your monthly payment, but you may pay more in interest over the life of the loan, increasing your total payments.

To qualify for a customer relationship discount, you must have a qualifying Wells Fargo consumer checking account and make automatic payments from a Wells Fargo deposit account. To learn which accounts qualify for the discount, please consult with a Wells Fargo banker or consult our FAQs. If automatic payments are canceled, for any reason at any time, after account opening, the interest rate and the corresponding monthly payment may increase. Only one relationship discount may be applied per application.

Before you apply, we encourage you to carefully consider whether consolidating your existing debt is the right choice for you. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come from a lower interest rate, a longer loan term, or a combination of both. By extending the loan term, you may pay more in interest over the life of the loan. By understanding how consolidating your debt benefits you, you will be in a better position to decide if it is the right option for you.

Wells Fargo Bank, N.A. Member FDIC.

What Is Front End Ratio Calculator

3.9/5Front End RatioCalculatorcalculate

Similarly, you may ask, how do you calculate the front end ratio?

To calculate the frontend ratio, add up your expected housing expenses and divide it by how much you earn each month before taxes . Multiply the result by 100 and that is your frontend DTI ratio.

Additionally, how do you calculate your debt to income ratio? To calculate your debt-to-income ratio:

Thereof, what is front end debt to income ratio?

The frontend debt-to-income ratio is a variation of the debt-to-income ratio that calculates how much of a persons gross income is going toward housing costs. In contrast, a back-end DTI calculates the percentage of gross income going toward other types of debt like credit cards or car loans.

What is a good back end ratio?

Many lenders have a rule of thumb that a borrowers backend ratio should not exceed 36%, though a borrower with good credit puts lenders a bit more at ease in special cases.

You May Like: Rocket Mortgage Qualifications

You May Like: How To Claim Bankruptcy In Washington State

What Should Your Debt

Creditors will also consider your DTI ratio when applying for a mortgage refinance. As with mortgage loans, a higher DTI will make it much harder to get approved for refinancing your home loan. Check our refinance calculator to determine if refinancing your mortgage is the right choice for you.

- For cash-out refinance, Chase recommends that consumers have a DTI of 40% or lower.

- Rocket Mortgage states that most lenders prefer consumers which have a DTI of 50% or lower when applying for mortgage refinance.

Is 31 A Good Debt

Expressed as a percentage, a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income. Lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage.

Is 35% a good DTI?

35% or less: Looking Good Relative to your income, your debt is at a manageable level. You most likely have money left over for saving or spending after youve paid your bills. Lenders generally view a lower DTI as favorable. 36% to 49%: Opportunity to improve.

You May Like: How To Stop A Garnishment Without Bankruptcy

High Debt Doesnt Always Mean A High Dti Ratio

Owing a large amount of money doesnt necessarily mean youll have a high DTI ratio it depends on what you earn and how much of your income goes toward debt repayment.

As an example, if you owe $1,000 in monthly debt payments and have a gross monthly income of $2,000, your DTI ratio will be high at 50%. However, if your gross monthly income is $10,000, your DTI ratio is only 10%.

In other words, your debt payments need to remain in proportion to your monthly income to remain affordable. But if your income is on the low side, its easier for your DTI ratio to creep up quickly.

Add Up Your Monthly Gross Income

Next, youll want to add up your monthly gross income. Consider all of your income. When you apply for a loan, your lender will likely require documentation of your income.

If you are a W-2 employee, documentation will likely come from your W-2 form and/or your last several pay stubs. If you are self-employed or have income from a side hustle, your lender will likely look at your business tax returns. If you have money coming in from a side hustle but dont have a business tax return or other documentation, your lender may not allow you to use that income as part of your DTI calculation.

If you have properties you rent out, you need to calculate that too. The mortgage payments on your rental properties are included as part of your monthly debts, but you may not be able to use all of the rental income as part of your income calculation. Many lenders will only allow you to count 75% of the monthly rent towards income. That leaves a buffer for maintenance and vacancies.

Don’t Miss: How To File Bankruptcy Chapter 7 Yourself In Texas

What Is The Difference Between Debt

Both calculations evaluate your risk as a borrower, but consider different factors of your financial profile.

The DTI ratio considers your income and all monthly debt obligations to see how much money goes into paying off your debt. Lending institutions use the DTI ratio to evaluate borrowers, but it doesn’t impact your credit score.

The credit utilization rate is a key evaluating factor of your credit score. This calculation measures your credit usage by comparing your maximum credit limit to your outstanding balance. Unlike the DTI ratio, the credit utilization rate only considers revolving credit credit cards, personal credit lines and HELOCs. It doesn’t factor in installment debt or your monthly income.

What Is A Debt

Debt-to-income ratio is the ratio of total debt payments divided by gross income expressed as a percentage, usually on either a monthly or annual basis. As a quick example, if someone’s monthly income is $1,000 and they spend $480 on debt each month, their DTI ratio is 48%. If they had no debt, their ratio is 0%. There are different types of DTI ratios, some of which are explained in detail below.

There is a separate ratio called the credit utilization ratio that is often discussed along with DTI that works slightly differently. The debt-to-credit ratio is the percentage of how much a borrower owes compared to their credit limit and has an impact on their credit score the higher the percentage, the lower the credit score.

Why is it Important?

DTI is an important indicator of a person’s or a family’s debt level. Lenders use this figure to assess the risk of lending to them. Credit card issuers, loan companies, and car dealers can all use DTI to assess their risk of doing business with different people. A person with a high ratio is seen by lenders as someone that might not be able to repay what they owe.

There are two main types of DTI:

Front-End Ratio

Back-End Ratio

Recommended Reading: When To Buy A Car After Bankruptcy

How Much Does Your Debt

Your DTI never directly affects your or . may know your income but they dont include it in their calculations. Your is still factored into your home loan application. However, borrowers with a high DTI ratio may have a high credit utilization ratio which accounts for 30 percent of your credit score. Lowering your credit utilization ratio will help boost your credit score and lower your DTI ratio because you are paying down more debt.

Weigh Your Monthly Debt Payments Against Your Income To See If Youre Overextended

A debt-to-income ratio is a key factor that lenders use to determine if youll be approved for a loan. During the underwriting process after you apply for a loan, the underwriter will check your debt-to-income ratio to see if you can afford the loan payments. If your DTI is too high, you wont get approved for the loan.

For consumers, debt-to-income is an easy way to measure the overall health of your finances. You can check your DTI to see if you have too much debt for your income. If your debt ratio is too high, then you know to scale back and focus on debt repayment. If you need help, call to speak with a trained credit counsellor for a free debt and budget evaluation.

Also Check: How Does Filing Bankruptcy Affect You

When You Apply For A Loan Like A Mortgage Auto Loan Or Personal Loan Lenders Often Want To Know How Much Debt You Have Compared To How Much Money You Earn In Other Words They Want To Know Your Debt

Your debt-to-income ratio, or DTI, is a calculation of your monthly debt payments divided by your gross monthly income.

Lets take a look at how to calculate your debt-to-income ratio, learn why your DTI matters, understand what a good debt-to-income ratio looks like and how to lower your DTI ratio.

How To Calculate Dti Ratio

In the world of real estate investment strategy, debt to income ratio, or DTI, is a way to compare the amount of debt you have to your overall income.

It is a lenders way to estimate a potential borrowers ability to make the monthly payments due on its loan, taking into account the borrowers income and existing fixed monthly expenses, including debt service. It is generally expressed as a percentage.

Also Check: B Stock Customer Service

Why Do Lenders Check Credit Utilization Ratio And What Is It

Your credit utilization ratio measures how much credit you use compared to your credit limit. Together, your credit utilization ratio and DTI ratio both affect your mortgage loan.

You can use this calculation to determine your credit utilization ratio:

Current Balance ÷ Credit Limit = Credit Utilization Ratio x 100

For example, lets say that you have a $15,000 credit card limit and as of this month, you have used up $5,000 of that limit. In this example, you have a 33% credit utilization ratio.

A good rule of thumb you can consider applying to your own situation: Keep your credit utilization below 30%.

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

Don’t Miss: How Does A Bankruptcy Affect Credit Score

How Is The Front End Debt Ratio Calculated

Front-end debt ratio, sometimes called mortgage-to-income ratio in the context of home-buying, is computed by dividing total monthly housing costs by monthly gross income. The front-end ratio not only includes rental or mortgage payment, but also other costs associated with housing like insurance, property taxes, HOA/Co-Op Fee, etc.

Add Up Your Monthly Debts

The first step toward calculating your debt-to-income ratio is adding up all your monthly debt payments. Your list of monthly debts will include any debts listed on your credit report, including:

- Auto loan payments

- Child support and alimony payments

- Home equity line of credit payments

- Line of credit payments

- Student loan payments

- Timeshares payments

If you co-signed any loans for friends or relatives, they should also be accounted for on your list of debts.

For fixed-payment loans like rent, an auto loan or a personal loan, you will use your regular monthly payment. Use your minimum monthly payment for variable payments such as credit card payments or a home equity line of credit.

For your mortgage payment, you will calculate with the full PITI . This will be your regular monthly payment if you escrow your taxes and insurance. If you dont escrow, your lender will likely take your annual tax and insurance payments, divide them by 12 and include them as part of your mortgage payment for purposes of DTI calculation.

Total monthly debts: $2,400

Recommended Reading: Serenity Home Retention Department

Wells Fargo Credit Score Standards

760+, Excellent

You generally qualify for the best rates, depending on debt-to-income ratio and collateral value.

700-759, Good

You typically qualify for credit, depending on DTI and collateral value, but may not get the best rates.

621-699, Fair

You may have more difficulty obtaining credit, and will likely pay higher rates for it.

620 & below, Poor

You may have difficulty obtaining unsecured credit.

No credit score

You may not have built up enough credit to calculate a score, or your credit has been inactive for some time.

Does Dti Ratio Affect Your Credit Scores

Your DTI ratio may not directly impact your credit scores. But there are some indirect ways that your DTI or income can impact your credit scores.

For example, your credit utilization ratio may account for nearly 30% of your credit scores. And it looks at outstanding balances on your credit cards relative to your total available credit. Reducing your credit utilization ratio will also reduce your DTI ratio and could improve your credit scores.

But a loss of income could make it difficult to pay your bills on time. And late or missed payments could affect your credit scores. Thatâs because a loss of income can change your DTI ratio.

Recommended Reading: How To File Bankruptcy In Chicago For Free

How To Calculate Your Front End Debt

| Front End Ratio Example |

|---|

| Back End Ratio | 33% |

To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your DTI is $2,000 ÷ $6,000, or 33 percent.

This number doesn’t necessarily portray a detailed picture of your financial strengths and weaknesses, but it does give lenders the thumbnail sketch of your finances they need to make a decision.