Shop Carefully For A Car Loan With A Fair Interest Rate

Even if your finances have hit the skids and you’ve landed in bankruptcy court, it doesn’t have to mean you need to put the brakes on buying a car.

“Lenders lend to people in bankruptcy all the time,” though interest rates could be sky high, says Edward Boltz, a bankruptcy attorney in Durham, North Carolina, and president of the National Association of Consumer Bankruptcy Attorneys.

Even if you’ve landed in bankruptcy court, it doesn’t have to mean you need to put the brakes on buying a car.

The key to buying a car after a bankruptcy, experts say, is to shop around for an auto loan, just as you would if you didn’t have that black mark on your credit report.

When you’re just emerging from bankruptcy, “you’re likely to agree with just about anything they’ll give you. But you shouldn’t just take the first offer you get,” warns Chris Kukla, senior vice president at the nonprofit Center for Responsible Lending.

A study by the center found that in 2009, consumers paid $25.8 billion in extra interest over the lives of their loans due to inflated interest rates, according to Kukla. Those who paid exorbitant interest rates were more likely to fall behind on their loans and eventually have their cars repossessed.

How Long Does It Take To Rebuild Your Credit After Chapter 7 Bankruptcy

A Chapter 7 bankruptcy stays on the borrowers credit report for 10 years. This means that after 10 years, all records of the bankruptcy must be removed from your credit report. That said, the impact the bankruptcy has on a credit score decreases as time passesdue in part to the immediate reduction in the consumers debt-to-income ratio, which is how much you owe in relation to the amount of available credit you have. Because of this, you may start to see improvements in as little as one to two years after discharge.

Newfoundland & Labrador Bankruptcy Exemptions

In Newfoundland and Labrador, property exempt from seizure in bankruptcy is set by the provincial government and applies to the equity in an asset. Equity is the difference between the value of the asset and what you owe on the asset.

Example: If you have a car worth $6,000 and you still owe $4,000 on the loan, the equity you have in the car is $2,000. In Newfoundland and Labrador, the exemption for a car is $2,000. In this case, you would be entitled to keep the car and your unsecured creditors cannot take this from you when you file for bankruptcy.

Don’t Miss: Epiq Corporate Restructuring Llc

When Should I Buy My Car

Although the right time to buy your car varies depending on your financial circumstances, the best time to buy a car is when you can score the best deal and interest rate. Waiting until your credit score improves to purchase a car could reduce the interest rate a lender offers you. But if you cant wait and need transportation now, search for the best deal.

Because of COVID-19, some car manufacturers were forced to close their factories for months and saw inventory and sales decline. According to J.D. Power, automobile sales were down 14.6 percent last year compared to 2019. As a result of this lower demand, some dealers ran incentive programs to encourage people to buy. Some even have discounts for first responders.

If youre in need of a vehicle, now might be the best time to look. But do your due diligence and dont purchase a vehicle you cant afford.

The Process For Buying A Car After Bankruptcy

Filing for bankruptcy and wiping out your credit score, as well as your debts, can be stressful. On top of that, attempting to make a major purchase like buying a car can seem daunting.

But heres some positive news. Getting a car loan after bankruptcy is possible in many cases. Youre not the only one to go through the bankruptcy process, and there are lenders ready to consider the financing needs of consumers in this situation.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

How Long After Bankruptcy Can I Buy A Car

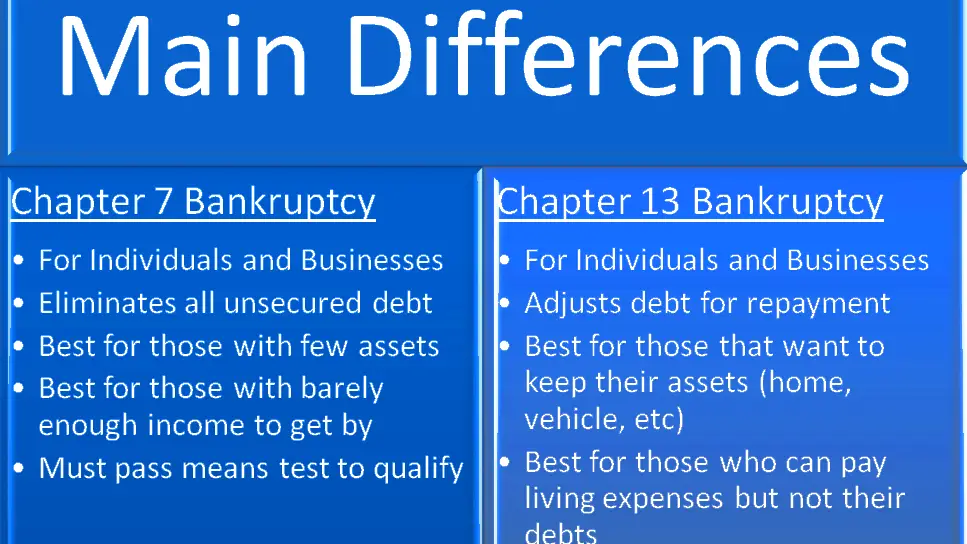

Most people filing for bankruptcy file for a type called Chapter 7, in which the debtors non-exempt assets are sold and the proceeds given to the creditors. Filing for Chapter 7 bankruptcy takes about 120 days, or four months, until the case is closed and the debts are erased. The bankruptcy can then stay on the debtors credit report for up to 10 years.

The other main type of personal bankruptcy is Chapter 13, designed to enable people with steady incomes to hold on to property that might otherwise be lost through the bankruptcy process. A plan is created for the debtor to pay all or part of their debts to creditors over three to five years. A Chapter 13 bankruptcy may stay on the debtors report for up to seven years.

You dont necessarily have to wait years to buy a car, but consider spending some time to rebuild your credit before applying for a car loan after bankruptcy. Debt.org, a debt-help organization, recommends applying for a secured credit card, and paying it off each month for 12 months, before moving onto an unsecured credit card and seeking a car loan. A positive credit history will help your credit score, which is a key factor in determining whether you will qualify for an auto loan, and what interest rate you might get, says the Consumer Financial Protection Bureau . The longer the history, the more information there is to potentially improve how you are seen as a credit risk, says the bureau.

Prince Edward Island Bankruptcy Exemptions

On Prince Edward Island, property exempt from seizure in bankruptcy is set by the provincial government and applies to the equity in an asset. Equity is the difference between the value of the asset and what you owe on the asset.

Example: If you have a car worth $6,000 and you still owe $3,000 on the loan, the equity you have in the car is $3,000. In P.E.I., the exemption for a car is $6,500. In this case, you are entitled to keep the car and the creditors included in your bankruptcy claim cannot take it from you.

Don’t Miss: How Many Bankruptcies Has Donald Trump

Applying For An Auto Loan After Bankruptcy In 2021

Can I get a car loan after Chapter 7? ? Chapter 7 Bankruptcy sticks on your credit report for 10 years. However, you can redeem your credit ratings by;

Nov 5, 2020 In some cases, you can apply for a mortgage after a bankruptcy after a waiting period of 1 or 2 years. In others, you may have to wait as long;

We know you have plenty of questions regarding how long after bankruptcy can you buy a car loan. Our understanding bankruptcy experts have been helping;

You Maintain Repayments On Your Vehicle

You may have agreed to use the vehicle as security for a loan. We call this a secured debt.

If you fall behind in loan repayments, the secured creditor is able to repossess and sell the vehicle. You need to contact your secured creditor to discuss what you intend to do.

If the creditor sells your vehicle and you still owe them money, this is called;a ‘shortfall’. You can list this in your bankruptcy. The creditor can no longer pursue you for this debt.

Don’t Miss: How To File For Bankruptcy In Wisconsin

Search For A Good Lender

Most finance companies will shy away from car leases following bankruptcy because of the risk. But that doesn’t mean there aren’t any lenders that will be willing to work with you. As you search for a lender, make sure you:

- Ask plenty of questions, such as:

- What are my leasing options?

- Are there any incentives or rebates I can qualify for?

- What’s the best interest rate I’ll be able to get?

- What’s the minimum accepted credit score?

- Are there are any short-term leases available?

What Type Of Mortgage Can You Get After Bankruptcy

Its technically possible to get any type of mortgage loan after a bankruptcy. There are no rules in place that permanently exclude you from getting a certain type of loan because youve gone through a bankruptcy. As long as you meet the waiting period discussed above, youre free to apply. But you can qualify for some types of mortgage loans much easier than others.

An FHA loan could be a great option if you have a bankruptcy on your record. FHA waiting periods are shorter than other types of loans. If you have a Chapter 13 bankruptcy, theres no waiting period at all after a court dismisses or discharges you. FHA loans also have looser requirements compared to other types of government-backed loans.

One of the major benefits of getting an FHA loan after a bankruptcy is its lower credit requirements. Even after a court dismisses or discharges your bankruptcy, it will still negatively influence your credit score. A Chapter 7 bankruptcy will stay on your credit report for 10 years, while a Chapter 13 bankruptcy will stick around for 7.

During this time, your credit score will be much lower than before your bankruptcy. You can buy a home with an FHA loan with a credit score as low as 580 points. You may even qualify for a loan with a score as low as 500 points if you have a down payment of at least 10%. However, at Rocket Mortgage®, the minimum credit score is 580.

Read Also: How Soon After Filing Bankruptcy Can I Buy A House

How Long After Bankruptcy Can I Buy A Car Loan

So youve had to file for bankruptcy, but life continues, and you now need a car. How long do you have to wait? If you file Chapter 7 bankruptcy, you will have to wait until the process has finished and your credit is unfrozen. This will generally take about 6 months, and you will need that time to improve your credit score anyways.

Chapter 13 bankruptcy is a different story. This process is long, arduous, and involves a trustee. It can take up to five years for the Chapter 13 bankruptcy process to finish, and its reasonable that you will find yourself in need of a car during that time. If you need to buy a car during Chapter 13 proceedings, you will need to demonstrate sufficient need, financial recovery, and you must obtain permission from your trustee.

Can I Buy A Car After Bankruptcy Debtorg

How Long after Filing Bankruptcy Can You Buy a Car? While the effects of bankruptcy hang around for 7 to 10 years on your credit report,;

Oct 29, 2018 If you can wait the four to six months it typically takes to complete a Chapter 7 and receive the discharge papers, its best you do. Lenders;

People often wonder if bankruptcy will ruin their odds of getting a car loan. It may be more difficult, but New Roads Auto Loans can help.

Read Also: What Is A Bankruptcy Petition Preparer

I Had A Bankruptcy Discharged Six Months Ago Can I Buy A Home

Q: I have five years with solid employment , a bankruptcy discharged and I want to see if I would be able to buy a $70,000 house with 20 percent at closing?–Timmy, Lawrenceville, GA

A: The 5 years and $40k sound fine. Twenty percent down is $14K. You will be financing $56K. The next items are other liabilities like a vehicle loan, college/student loan, credit card debt etc. Your credit score is very important as well. I do not understand “bk discharged”, is this a short sale or foreclosure? If so, highly unlikely.Donna Schulze is a Realtor® with CENTURY 21 Seaside Village Properties in Osterville, MA.

A: I would encourage you not to guess. Contact a local mortgage broker that knows the area and put your application in along with all supporting documentations as requested. They should be able to then tell you exactly what you need to know, how much you can get approved for with a mortgage and also provide you with a “pre-approval” letter that you can use with your upcoming purchase. There are too many variables these days to guess and too many new rules and guidelines to follow. Good luck with your purchase.David Congdon is a Realtor® with Islands International Realty in Satellite Beach, FL.

A: I don’t know of any traditional lenders that would lend to you with a recent bankruptcy.

Good Luck!

What Happens To My Car During Bankruptcy

Filing for bankruptcy is a serious decision that can damage your credit for seven or 10 years, depending on the type of bankruptcy. But if you’re drowning in debt you can’t pay, it can serve as a last resort to help you hit “reset” on your finances.

There are two main types of bankruptcy: Chapter 7, which liquidates some of your assets, and Chapter 13, which focuses on repaying debts. What happens to your car in bankruptcy depends both on the type of bankruptcy you file and how much equity you have in your vehicle.

Recommended Reading: What Is Epiq Bankruptcy Solutions Llc

Q: Summer 5 2014 Should I Buy Your Vehicle Whilst In Section 13 Bankruptcy Or Chapter 7 Bankruptcy Debts

Right now, section 13 personal bankruptcy try slightly different. This processing normally requires about 5 years to accomplish the court-ordered payment program. So, you may get into a scenario the spot where you need to get a motorcar. In this case, make sure you speak to your court-appointed trustee in order to get authorization. As long as you show that buying comes into play and within cause, they might grant their inquire.

Check Your Credit Report

Lenders look at your credit reporta detailed report of your credit historyto determine your creditworthiness. Although bankruptcy filings can remain on your credit report for up to 10 years, it doesnt mean you have to wait 10 years to get a mortgage.

You can speed up the process by making sure your credit report is accurate and up;to date. Its free to check: Every year, you are entitled to one free credit report from each of the big three Equifax, Experian, and TransUnion.

A good strategy is to stagger your requests, so you get a credit report every four months . That way you can monitor your credit report throughout the year. One of the best credit monitoring services could also be useful in this endeavor.

On your credit report, be sure to watch for debts that have already been repaid or discharged. By law a creditor cannot report any debt discharged in bankruptcy as being currently owed, late, outstanding, having a balance due, or converted as some new type of debt . If something like this appears on your credit report, contact the credit agency right away to dispute the mistake and have it corrected.

Other mistakes to look for:

- Information that is not yours due to similar names/addresses or mistaken Social Security numbers

- Incorrect account information due to identity theft

- Information from a former spouse

- Outdated information

- Wrong notations for closed accounts

- Accounts not included in your bankruptcy filing listed as part of it

Read Also: How To File Bankruptcy In Wisconsin

Can A Car Loan Help You Out Of Bankruptcy

While a car loan cannot cause the bankruptcy to be completed and discharged, having a car loan line of credit can help the payer’s credit score increase as long as it is being paid on time. Even if you agree to continue paying the car note and to make the payments on time, it is not guaranteed that the filer will be able to keep his or her property under a Chapter 7 bankruptcy. In order to make your car a non-exempt item of property when filing Chapter 7, you could reaffirm your debt to repay the loan or redeem the debt by paying the market value to the lender in a lump sum.

Another option, which cannot help finalize a bankruptcy, can help the filer build up good credit. This step toward finalizing the bankruptcy is to buy a low-cost car. Going this route will make it more feasible to get a lower interest rate and to manage a car note.

The Trouble With Buy Here Pay Here

But consumers don’t like hearing “no,” and feeling like they’re being judged, he says, so they may be inclined to take the first offer they receive. That’s thrown open the doors for “buy here, pay here” auto dealers, where shoppers arrange financing and make payments at the dealership. These dealers, in particular, can be “very aggressive in marketing to people with credit problems,” Kukla says. But that could be disastrous.

Katie Moore, a financial counselor with the nonprofit GreenPath Debt Solutions, says dealers who offer to sell cars with no credit check and no money down “are really preying on consumers who are uneducated about the process.”

They’re likely to offer sky-high interest rates and lengthy loan terms on older vehicles in order to keep the monthly payments low. But it’s not uncommon for the car to break down, while the buyer is still paying on the loan, Moore says.

Kukla says these kinds of dealerships tend to sell vehicles that have 100,000 miles or more on their odometers. The dealerships typically buy the cars at auction, put a bit of money into them and then sell them for two to three times more than their cost.

The dealers then require a down payment of 25-30 percent of the price. “It’s a huge down payment on a very unreliable car,” Kukla says.

Kukla says about one-quarter of those vehicles end up being repossessed, and then can be sold to the next buyer facing a credit crunch.

Read Also: Chapter 7 Falls Off Credit Score