What Are Todays Mortgage Rates

Todays mortgage rates are at historic lows.

Typically, home buyers applying after Chapter 7 bankruptcy will be charged higher interest rates. But shopping around in todays low-rate market could help you net a fair deal on your home loan.

If youre thinking about buying a home, check with a few mortgage lenders to verify your home loan eligibility and find out what rates you qualify for.

Popular Articles

Step by Step Guide

First Things First: The Bankruptcy Discharge

How long after bankruptcy can you buy a house? It varies. However, to even be considered for a mortgage loan request, the bankruptcy must first be discharged. A bankruptcy discharge is an order from a bankruptcy court that releases you from any liability on certain debts and prohibits creditors from attempting to collect on your discharged debts.

In simple terms, this means you dont have to pay the discharged debts, and your creditors cant try to make you pay. A discharge of your debts is just one step in the bankruptcy process. While it doesnt necessarily signal the end of your case, it is something lenders will want to see. The court often closes a bankruptcy case shortly after the discharge.;

Can I Buy A House 1 Year After Chapter 7 Discharge

In most cases, theres at least a two-year waiting period from your Chapter 7 discharge date until you can be approved for a home loan.

There are some limited circumstances in which you can obtain a loan after one year from the discharge, explains Andrea Puricelli, production resources engagement manager for Inlanta Mortgage.

But thats only if the bankruptcy was caused by extenuating circumstances beyond your control and youve since exhibited an ability to manage your financial affairs responsibly.

Such extenuating circumstances could apply if you were forced into bankruptcy due to a serious illness or major job loss or income reduction.

But in most cases, it takes more than a year to recover after declaring bankruptcy. So most home buyers will have to wait two years or more before applying anyway.

You May Like: How Many Times Can You File Bankruptcy In Florida

Is Buying A House After Bankruptcy Possible

A bankruptcy proceeding can reduce or even eliminate your debts, but it will damage your credit report and in the process, which can affect your ability to obtain credit in the future for things such as new credit cards, a car loan, and a home mortgage.

It is possible to buy a house after bankruptcy, but it will take some patience and financial planning. It is important to check your credit report regularly to make sure everything is there that should beand nothing is there that shouldnt be. You can start to rebuild your credit using secured credit cards and installment loans, making sure all payments are made on time and in full each month.

What Are Fha Loans

FHA loans are mortgages backed by the Federal Housing Authority, designed for people who may have trouble getting a conventional loan because of a poor credit history or income. FHA loans have easier credit requirements and lower down payments.

Since the U.S. government backs the loans, lending institutions are more willing to offer them to applicants with poor credit scores, although the lower your credit score, the harder it can be to find a lender.

A borrower with a FICO score of 580 can qualify for an FHA mortgage with a down payment of 3.5% and someone with a 10% down payment can qualify with a 500 score. The lower the score, the higher the interest rate and the harder it may be to find a lender. While applying with a credit score less than 600 is possible, less than 2% of FHA mortgage borrowers had a credit score that low early in 2021.

The waiting period to get an FHA loan after a bankruptcy without extenuating circumstances is:

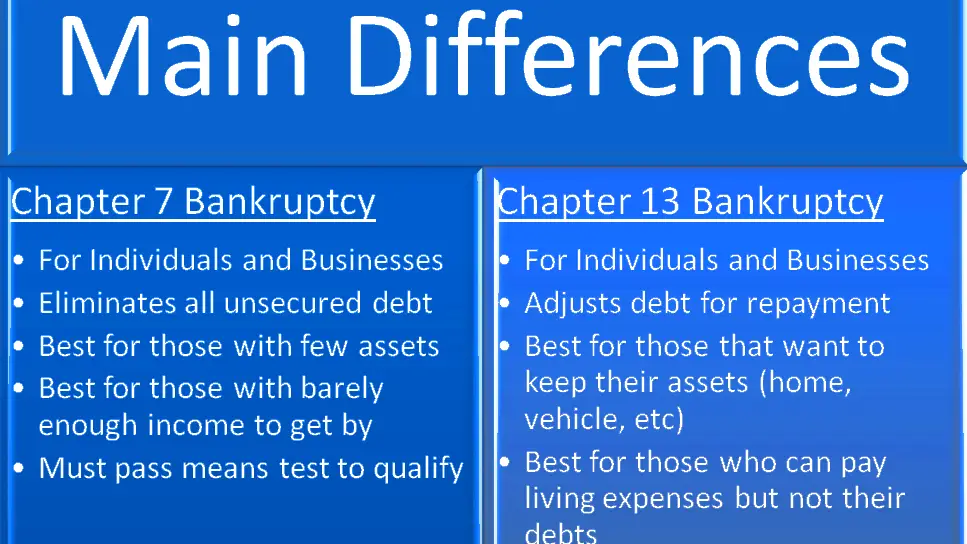

Chapter 7 Two years from the time of discharge.

Chapter 13 Two years if plan payments have been made on time and the trustee of the bankruptcy gives an OK.

Some banks have a three-year waiting period, which overrules the FHAs waiting period.

You May Like: How To Be A Bankruptcy Lawyer

How Can I Get A Mortgage With A Favorable Interest Rate

With a recent bankruptcy on your credit report, most lenders will see you as a risk and are likely to charge you higher interest rates. Naturally, nobody wants to pay more on interest than is necessary. You are likely wondering how to maximize your interest savings, while still being able to purchase a home in a timely manner. Some suggestions include:

When You Are Ready To Buy A House Talk To Us

Now that you know how to go about getting a house, we hope that you find success. Of course, once you have managed to secure financing for a home, you will need to look into protecting your investment with a suitable homeowners insurance policy.

Working with an independent agent in our network can help you save money by ensuring that you are getting the home coverage you need at a competitive rate. We wish you the best of luck in finding and purchasing your new home. Share your experiences with us in the comments.

Recommended Reading: What Happens When Chapter 13 Bankruptcy Is Dismissed

Tips To Earn A Mortgage Approval After Bankruptcy

If youre trying to get a mortgage after bankruptcy, the first thing youll need to do is get your credit score back on track. Theres no quick fix for rebuilding your credit after a bankruptcy, but your most recent actions have a more significant impact on your credit score than past negative events.

Keep these tips in mind to help your chances at mortgage approval.

Focus on improving your credit. Do what you can to improve your credit before applying for a mortgage after bankruptcy. Your credit score wouldve taken a hit, but you can improve it by paying your bills on time and keeping your credit utilization low. If you plan on getting a mortgage after a Chapter 13 bankruptcy, its crucial to follow your repayment plan as agreed.

Your credit score will play a significant role in your loan costs. Heres a quick look at how a difference in credit score can impact a $250,000 conventional loan with a 30-year term.

| $190,483 | $440,483 |

As the table illustrates, a 740 credit score can save you more than $68,000 over the life of a 30-year loan.

Apply for credit cautiously. While you may qualify for other forms of debt, such as credit cards or an auto loan, soon after bankruptcy, be cautious about taking on additional debt if you anticipate applying for a mortgage.

Sell Or Buy A Rancho Bernardo Home In Accordance With The Law

Once your bankruptcy gets discharged, youll feel like a tremendous weight was lifted off your shoulders. However, the process of getting your life back is still not over, and relaxing at the Black Mountain Park might have to wait a bit.

With the help of an experienced bankruptcy attorney in Rancho Bernardo, your real estate purchase or sale will be safe, efficient, and in accordance with the law. Contact the law offices of Chang & Diamond today and schedule your first consultation.

Don’t Miss: Will Bankruptcy Get Rid Of Irs Debt

Start Saving By Setting A Budget

A stable financial situation will be key to ending bankruptcy and getting approved for the mortgage refinance after bankruptcy. You will need to create a formal budget to be successful, and its not as complicated as you think:

- Find a budgeting platform that makes this easy for you;

- Enter your bills and categorize your expenses.

You will need as much money as you can save for the down payment in the next 12 to 24 months.

Talk To Financial Experts To Get Everything Under Control

At Ortiz & Ortiz we have helped hundreds of clients over the last 30 years. With offices in Astoria, Brooklyn and Manhattan, we can guide you from filing for bankruptcy in New York to dealing with the consequences of bankruptcy.

If you want to know how to buy a home after bankruptcy, you are in the right place. Tell us about your case so we can help you.

You May Like: Do Married Couples Have To File Bankruptcy Together

Here’s What You Need To Know

Recently, more than one million Americans filed for personal bankruptcy. Of these filings, about 706,000 were Chapter 7 bankruptcies and about 330,000 were Chapter 13 bankruptcies. In many cases, personal bankruptcies are the result of unsurmountable medical bills or result following long periods of unemployment, a common problem in the recent economy.;

If you are among the millions of people who have filed for personal bankruptcy in the past few years, you may think that your dream of homeownership is an unattainable one. But, believe it or not, you can still buy a house as well as homeowners insurance.

How To Reestablish Credit After Bankruptcy

Once the bankruptcy process is over, reestablishing and maintaining; is key to your financial health. Lenders will be looking for zero delinquencies postbankruptcy.

While you work to build new credit, dont go overboard opening an extensive number of accounts, as this will work against you, advises Carey. Usually, opening just a couple of revolving credit lines and paying them in a timely manner over the course of 12 months helps to increase credit scores back to an acceptable level.

Read Also: Do You Lose Your House If You File Bankruptcy

Purchasing A Home After Chapter 7 Bankruptcy

A typical no-asset Chapter 7 bankruptcy case takes between four and six months to close. However, the Chapter 7 filing remains on your credit report for ten years. That does not mean that it will be ten years before you can qualify for a home loan. Depending on the type of loan and your specific financial circumstances, you could qualify for a loan to purchase a home as soon as a year after filing for bankruptcy relief.;

The type of home loan has a great deal to do with when you can buy a house after Chapter 7 bankruptcy. There are rules for some home loans that prevent the borrower from qualifying for the home loan for a specific period after bankruptcy.

For example, the waiting period for most FHA loans is two years after the date of the bankruptcy discharge. However, you could qualify for an FHA loan after one year if you can prove that the bankruptcy was caused by circumstances that were not within your control, such as a federal disaster or being laid off from work. Likewise, the waiting period for a VA loan is usually two years after a Chapter 7 bankruptcy discharge.;

Fannie Mae backed conventional loans have different waiting periods. Most loans backed by Fannie Mae require a four-year waiting period to buy a house after Chapter 7 bankruptcy. However, the waiting period could be reduced to two years in some cases.

Special Cases: Getting A Mortgage After Bankruptcy

Not everyone has a textbook case with an easy answer. Some applicants can achieve mortgage approval sooner than the prescribed waiting periods. They have what are called in the mortgage industry mitigating or extenuating circumstances. These are events beyond your control that caused your bankruptcy.

Others have issues that can lengthen the waiting time to get a mortgage after bankruptcy. Here are a few specifics.

Read Also: What Is Bankruptcy And Insolvency Act

Save Money Before Applying To Buy A House After A Bankruptcy

With a recent bankruptcy, you will want to show potential lenders that you have money saved up to put down on a house. You do not necessarily have to put down 20% that is another myth out there but the more you have, the easier time you will have getting a mortgage after a bankruptcy.

The Federal Housing Administration or FHA offers 3.5% down payment home loans for people who have at least a 620 FICO score. If your score is lower than that, you would likely need to put down up to 10%. One of the most popular programs we hear about is for an FHA loan after the bankruptcy was discharged 24 months. Learn how much of a home you can afford with a FHA loan today.

If you can show that you have skin in the game, it is more likely that a lender will view your file favorably and give you a mortgage.

Another plus of FHA mortgages with low;credit scores is that if you are approved by a lender, the interest rate will often be lower than standard market rates. Buying a house with bad credit scores is always challenging so its very important that you get advice from financial companies that have access to mortgage programs, like the FHA.

Making Changes To Your Bankruptcy Forms

Your bankruptcy forms are signed under penalty of perjury. When you file, you’re declaring that the information in your bankruptcy forms is true and correct to the best of your knowledge. If you accidently leave something out or make a mistake, you’ll need to make changes to your forms.

This is done by filing an amendment with the court. You might need to file an amendment because you forgot to list an asset or a , you need to add information that was originally missed, you change your mind about signing a reaffirmation agreement, or the trustee requests that forms be amended.Â;

Don’t Miss: Which Of The Following Phrases Best Summarizes Chapter 7 Bankruptcy

Can I Buy A Car After Bankruptcy In 2021

4 minute read ⢠Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card. Explore our free tool

In a Nutshell

Yes, but it makes sense to wait as long as you can after receiving your discharge. You’ll need to be careful and make certain that youâre getting a good deal.

Written by Attorney Andrea Wimmer. Â;

Odds are, you need your car. You need it to get to work, to drive your kids around, to go grocery shopping. Scrolling through the confirms that being able to buy a car after bankruptcy is a worryÂ;for many.Â;

âCan I buy a car after Chapter 7 bankruptcyâ is really two questions:Â;

How long do you have to wait to buy a car after Chapter 7?

How long after bankruptcy can you get a car loan?

Dealing With Your Vehicle

One of the forms you will file with the bankruptcy court is called the Statement of Intention. In this form, you tell the court what you plan to do with property that is securing a debt you owe, like real estate or a vehicle.Â;

If you own your vehicle but are still paying on the loan, you have a few options on how to deal with it in Chapter 7 bankruptcy.Â;

Reaffirmation

You can reaffirm the debt, keep your vehicle, and continue making payments. This means the debt will not be discharged and you will continue making monthly payments during and after bankruptcy. If you miss future payments the lender will have the right to repossess the vehicle and possibly try to collect on any deficiency between the balance you owe and the amount they get when selling the vehicle.

If you select this option in your Statement of Intention, your car lender will send you a reaffirmation agreement for you to complete and return. In some bankruptcy cases a reaffirmation hearing will be scheduled.

Surrender

If you choose to surrender your vehicle, then it will be repossessed and the debt will be discharged in your bankruptcy. Filers with high car payments they can’t afford often choose to surrender their car to get out of the debt.Â;

Redemption

Read Also: Who Pays For Chapter 11 Bankruptcies

What Type Of Mortgage Can You Get After Bankruptcy

Its technically possible to get any type of mortgage loan after a bankruptcy. There are no rules in place that permanently exclude you from getting a certain type of loan because youve gone through a bankruptcy. As long as you meet the waiting period discussed above, youre free to apply. But you can qualify for some types of mortgage loans much easier than others.

An FHA loan could be a great option if you have a bankruptcy on your record. FHA waiting periods are shorter than other types of loans. If you have a Chapter 13 bankruptcy, theres no waiting period at all after a court dismisses or discharges you. FHA loans also have looser requirements compared to other types of government-backed loans.

One of the major benefits of getting an FHA loan after a bankruptcy is its lower credit requirements. Even after a court dismisses or discharges your bankruptcy, it will still negatively influence your credit score. A Chapter 7 bankruptcy will stay on your credit report for 10 years, while a Chapter 13 bankruptcy will stick around for 7.

During this time, your credit score will be much lower than before your bankruptcy. You can buy a home with an FHA loan with a credit score as low as 580 points. You may even qualify for a loan with a score as low as 500 points if you have a down payment of at least 10%. However, at Rocket Mortgage®, the minimum credit score is 580.