How Long Does Chapter 13 Stay On Your Credit Report

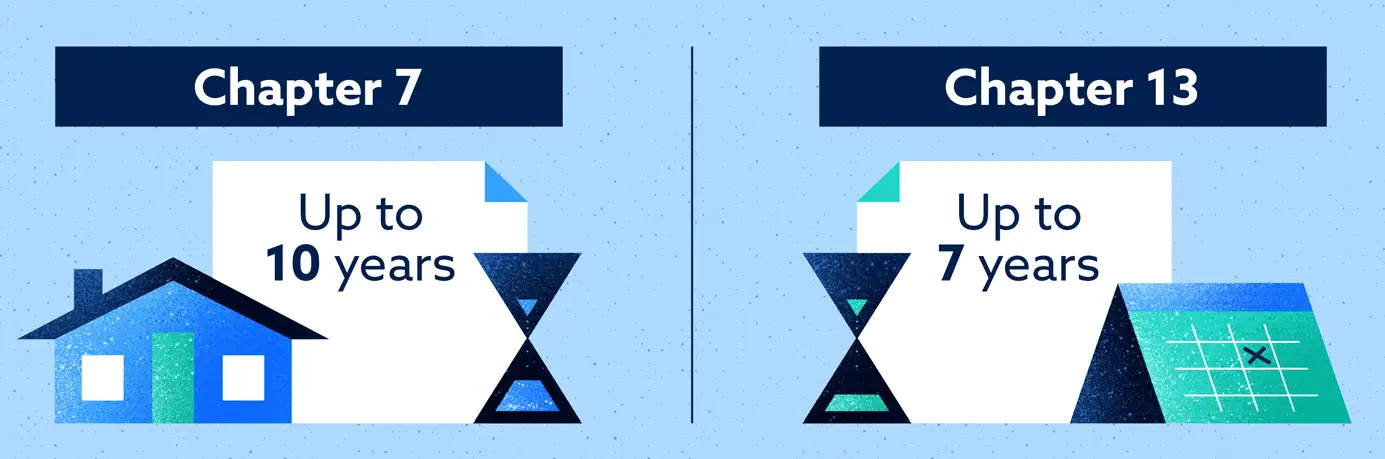

How long is a bankruptcy on your credit report? As weve said before, Chapter 13 bankruptcy goes easier on the filer, and credit reporting outcomes are no different. Unlike the ten years associated with a Chapter 7 bankruptcy filing, a Chapter 13 bankruptcy filing is removed from your credit report seven years after filing. This is lighter treatment due to partial repayment of the debts included in the Chapter 13 bankruptcy.

Also, the individual debts are usually paid off in some portion through a court-created and court-ordered repayment plan that stretches from three to five years. Therefore, individual debts may begin to come off your credit report during those three to five years.

Can I Improve My Credit Score After Bankruptcy

Even though bankruptcy remains on your credit report for up to ten years, you can start rebuilding your credit right away. Credit scoring companies look at several factors when computing your scores:

- your payment history

- your outstanding debt

- the length of your credit history, and

- how much new credit you’ve applied for.

You can start to improve your credit after bankruptcy by making all of your payments on time. Keep your debt load low, especially as compared to your available credit. And when you are ready, get a credit card, make small charges, and pay the bill off in full every month.

Myths About Credit Score After Bankruptcy

Everyone wants to know when considering bankruptcy: How long does bankruptcy affect my credit? What will my credit score be after bankruptcy? Will I ever be able to apply for a credit card again without being credit-shamed? There are a few myths about credit scoring and credit post-bankruptcy filing that we like to debunk to give our clients some peace of mind.

One is that you cant get a loan or credit card after filing for bankruptcy. This simply is not true. While Visa and Mastercard may not be sending you offers with frequent flier miles for a while, many clients successfully apply for secured cards to help them restore their credit faster. These cards require collateral, are available for people with damaged credit, and help build credit like any other card.

Another myth is that bankruptcy will ruin your credit forever. In fact, some imagine a dramatic movie where a character realizes they are bankrupt and yells Im ruined to the heavens. But this is also a myth and not reality. Although bankruptcy will damage your credit in the short term, its impact will absolutely be gone from your credit report after no more than ten years. And there are opportunities to practice good financial habits along the way, such as paying bills on time and avoiding purchases you do not have the income to pay for, which will make your credit stronger than ever.

Read Also: Can I Get A Bankruptcy Removed Early

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine creditworthiness. That means what FICO, VantageScore or anyone else considers good may not all be the same.

Keep that in mind as you read what might be considered a good credit score range.

Whatâs a Good FICO Credit Score Range?

When it comes to âwhatâs good,â FICO says scores between 670 and 739 qualify. Scores in that range, it adds, are near or slightly above the U.S. average.

Whatâs a Good VantageScore Credit Score Range?

When it comes to VantageScore, scores between 661 and 780 might be considered good.

What Is Credit Reporting And How Does It Affect Me

In Canada there are two major credit reporting agencies Equifax and TransUnion. Most people commonly refer to these agencies as the credit bureaus. Credit reporting agencies do exactly that: they report credit history. They can also be referred to as an information service as they provide copies of your credit report to potential lenders. This allows the banks and other lenders to determine how much risk they are taking when they loan you money. Whenever anyone lends money they are taking a risk that it will not be repaid.

To get any significant credit, you need a good borrowing history.

Approximately once each month every major lender in Canada sends a report about their borrowers to the credit bureaus. Also, the federal Superintendent of Bankruptcy reports a list of everyone who filed a consumer proposal or bankruptcy to the credit bureaus, as well as a list of everyone who has been discharged. The credit bureaus collect this information, summarize it, and sell it to their members, the lenders.

When you apply for credit you normally sign an application that provides the lender consent to access your credit history. Generally this consent allows then access not only the first time you apply, but anytime afterwards as well, as long as your account is open. It is also this consent that allows the lender to provide the bureau information on your payments etc. once you have been approved.

Read Also: What Is Epiq Bankruptcy Solutions Llc

How Long Does Chapter 7 Stay On Your Credit Report

How long will bankruptcy stay on your credit report? If you file a Chapter 7 bankruptcy, youll probably have to wait the full ten years the maximum timeframe for record of the bankruptcy filing itself to disappear from your credit report.

Individual debts included in the bankruptcy, however, may disappear sooner. You can look for these in your credit reports from one of the three bureaus Experian, Equifax or Transunion all of whom are legally required to provide you a copy of your credit report upon request under the Fair Credit Reporting Act . These agencies can tell you what your credit score is after bankruptcy.

Looking closely at the data on the reports, your individual debts may be listed as included in bankruptcy or discharged with a zero balance. In a Chapter 7 bankruptcy, the debts should fall off the sooner of either seven years from the date delinquency on each account began, or seven years from the date you filed for bankruptcy.

How To Build Credit After Bankruptcy

While bankruptcy stays on your credit report for up to seven years, not all hope is lost. You can still start to rebuild your credit score right away, and that begins with staying on top of your finances like paying bills on time, regularly monitoring your credit scores, and seeking certified credit consultants for help to repair credit.

While bankruptcy is a last resort, Credit360 should be your first option! We may not remove debt from your credit report, but we can help your debt be more manageable. Our certified credit consultants team identifies any details on your credit report that damage your credit score and actively aims to remove the information by contacting associate bureaus on your behalf.

Even if you have already filed for bankruptcy, our credit repair consultants at will help you rebuild your credit back to good standing, putting you back on the right track to building the life you deserve!

Read Also: How Many Bankruptcies Has Donald Trump Filed

After Filing Bankruptcy In Canada How Long Will It Be On My Credit Report

How long will bankruptcy show on credit reports in Canada for the first time bankrupt after receiving a ?

There are two large credit reporting agencies in Canada: Equifax and Trans Union. Unfortunately neither of them is very forthcoming with regards to their credit reporting practices.

A few years ago you could go to their websites and read a complete description of their reporting procedures. Today, unfortunately, their websites are mostly sales vehicles, so that they can sell you their credit reporting services, and thats a key point to remember: Credit bureaus are profit making businesses: they exist to sell credit information to the lenders and to consumers . They are not impartial arbitrators they are there to earn a profit. Theres nothing wrong with earning a profit, but its important that you understand their perspective.

With that background, based on the most recently available information , Equifaxs policy is to retain the note about your first bankruptcy on their system for six years after the date of discharge.

So, for example, if you in January of year 1, and you were not discharged until October, year 2, the note about your bankruptcy would remain on your credit report for six more years, until the end of October, year 8. Its not the date that your bankruptcy started that matters its the date you were discharged.

In the past Trans Union maintained this information for seven years.

How Can You Rebuild Credit After Bankruptcy

Declaring bankruptcy is a major decision, and it can have a big impact on your credit profile. But, its effects wont last forever. To learn more about how you can improve your credit health, one step at a time, check out this blog on how to rebuild your credit history.

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located here.

What You Need to Know:

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

*Subscription price is $24.95 per month .

Recommended Reading: Has Mark Cuban Ever Filed For Bankruptcy

How Long Does Bankruptcy Stay On Credit Report In Canada

How long a bankruptcy will stay on your credit report in Canada depends on the number of bankruptcies youve already filed. If this is your first bankruptcy, it will remain on your credit for six years after filing.

If this is your second time filing for bankruptcy, it will stay on your credit report for 14 years. If you file for bankruptcy three times or more, it remains on your credit for life. The Canadian Government outlines these timelines.

How Long Do I Have To Wait To Purchase A Vehicle After Filing Bankruptcy

You will be surprised to know, that most consumers filing for bankruptcy receive many offers from car dealerships inviting them to come purchase a car right after filing for bankruptcy. These often come in the form of mailers sent right to your home. This is because car dealers know that you cannot file for bankruptcy again for 8 years if you previously filed chapter 7 bankruptcy and want to file again. This is a good risk for an auto dealer and lender that you will make your payments moving forward. With that said, it may take a while for you to get your credit scores up to get the best offers, so your interest rate may be on the higher end if you need a vehicle right after filing for bankruptcy.

In chapter 13 bankruptcy, car loans may be approved by your chapter 13 trustee if you need to purchase a vehicle while in a chapter 13 plan so long as your payments, interest rate and the amount your are borrowing are reasonable.

How Long Do I Have to Wait to Purchase a Home After Filing Bankruptcy?

If you live in Washington State and want to know what more information about how long a bankruptcy may stay on your credit report in Washington State, give Symmes Law Group a call at or contact us to get the counsel you need.

Read Also: How Many Bankruptcies Has Donald Trump Filed For

What Is The Duration Of A Chapter 13 Bankruptcy On Your Credit Report

A Chapter 13 bankruptcy may last up to seven years on your credit record. Unlike Chapter 7, Chapter 13 bankruptcy requires you to create a three- to five-year repayment plan for part or all of your obligations. Debts covered in the repayment plan are discharged after you finish it.

If you were overdue on any of your discharged obligations before filing for this kind of bankruptcy, they would be removed from your credit record seven years from the date of delinquency. All of your previous discharged debts will be removed from your credit record at the same time as your Chapter 13 bankruptcy.

How Long Does Bankruptcy Stay On Credit Reports

Bankruptcy will stay on your credit report for up to seven years. There are two main credit bureaus in Canada, Equifax and TransUnion, and they both calculate, collect, and generate credit scores and credit reports. Equifax removes bankruptcy from your credit report six years after declaration. Whereas TransUnion will remove bankruptcy from your credit report seven years after filing. However, if youve declared bankruptcy more than once, it will remain on your credit report for 14 years.

Recommended Reading: What Is Epiq Bankruptcy Solutions Llc

Quickly Rebuilding Your Credit Score

As mentioned above, debtors who proactively rebuild their credit scores often rebound in months instead of years. Here are some ways you can help yourself recover from bankruptcy more quickly:

- Build a Payment Reserve: Make thirteen payments a year on auto loans and other secured debts. You will probably not miss the extra $100 or so per month, and the reserve builds goodwill with the creditor.

- Get a Credit Card: Advising former bankruptcy debtors to borrow money might seem strange. But responsible credit use is usually the quickest way to rehabilitate a credit score. Use the card each month, and pay off the balance each month.

- Remember What You Have Learned: Chapter 13 debtors must remit a monthly debt consolidation payment to the bankruptcy court. This payment usually requires financial discipline. So, do not go nuts once this obligation ends. Continued sacrifice brightens your familys financial future.

If your family follows these tips, after a few years pass, you might not remember that you filed bankruptcy at all.

An Athens bankruptcy lawyer can give you more information in this area. An attorney does more than file paperwork. Only a lawyer can give you solid advice before, during, and after your bankruptcy.

How Long Does A Bankruptcy Stay On Your Credit Report

When consumers have more debt than savings and are faced with mounting bills and saddled with other ones such as student loans, filing for bankruptcy might be the only option. However, if you are considering filing for bankruptcy it’s important to consider the long-term consequences.

One of these consequences is the impact bankruptcy can have on your credit. Depending on how you file, the bankruptcy could remain on your credit report for seven or as long as 10 years. People who have exhausted all their options and can not get another job or increase their income are faced with few choices.

Filing for bankruptcy often remains the only viable choice for some individuals. People who are considering filing for bankruptcy should first consult with a non-profit credit counseling agency or attorney to see if it is the right choice for them.

The law states that consumers must also seek pre-filing bankruptcy counseling. The counseling helps people learn about several options other than bankruptcy, such as settling with creditors, entering into a debt management plan or simply not paying the debt.

You May Like: How To Buy A New Car After Bankruptcy

Negative Information On Your Credit Report Is Treated Differently

According to Experian, one of the three credit bureaus, specific accounts that are delinquent when included in a bankruptcy will be deleted seven years from the date you were initially late with your payment.

This falls in line with the way all negative information, including late payments, are dealt with when it comes to your credit reports. Generally speaking, negative marks like late payments and accounts in collections will stay on your credit reports for seven years before falling off automatically.

Is Your Credit Rating Really Worth Stressing About

Are you current on all your debt payments? Yes? No? Maybe?

If youâre behind on any debt payments, your credit score could probably be better. So, rather than worrying about possibly making your already bad credit worse, think about how a bankruptcy discharge could help you build credit.

So, what happens to my credit score if I file bankruptcy?

Like all negative information reported to the credit credit bureaus, filing any type of bankruptcy will have a negative impact on your credit score. Since a bankruptcy filing is public record, they will find out, even if theyâre not directly notified by the bankruptcy court.

But, unlike other things that have a negative effect on your FICO score, a bankruptcy filing is often the first step to building a good credit score.

Read Also: Epiq Bankruptcy Solutions Llc Ditech

Must You Wait Until Bankruptcy Is Off Your Record To Fix Your Credit

Not at all.

There are several things you can do to fix your credit while the bankruptcy is still on your record.

It will be difficult for you to find credit or get decent interests rates while the bankruptcy is still on your report. But that doesnt mean you cant repair your credit.

Think of it this way.

People who declare bankruptcy already had a poor credit score. So bankruptcy doesnt necessarily hurt your score. In fact, many people say theyve seen their credit score get better after they declared bankruptcy.

So bankruptcy doesnt have to be a death sentence.