Us Debt By Presidential Term

The national debt between the Ronald Reagan era and Bill Clintons administration slowly increased, but it nearly doubled during the presidential term of George W. Bush to more than $9 trillion.

Here, then, is a brief timeline of how American debt has grown since John Hancock signed the Declaration of Independence on July 4, 1776.

Negative Real Interest Rates

Since 2010, the U.S. Treasury has been obtaining negative real interest rates on government debt, meaning the inflation rate is greater than the interest rate paid on the debt. Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pensions, or bond, money market, and balanced mutual funds are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk. Economist Lawrence Summers states that at such low interest rates, government borrowing actually saves taxpayer money and improves creditworthiness.

In the late 1940s through the early 1970s, the U.S. and UK both reduced their debt burden by about 30% to 40% of GDP per decade by taking advantage of negative real interest rates, but there is no guarantee that government debt rates will continue to stay this low. Between 1946 and 1974, the U.S. debt-to-GDP ratio fell from 121% to 32% even though there were surpluses in only eight of those years which were much smaller than the deficits.

What Percentage Of Americans Are In Debt

Just how many Americans are in debt? According to financial experts, the percentage of Americans in debt is around 80%. 8 in 10 Americans have some form of consumer debt, and the average debt in America is $38,000 not including mortgage debt. Owing money just seems to be a way of life for Americans, as collectively we have $14 trillion in debt. That amount is climbing ever higher. Consumer debt can be broken up into 4 main categories: mortgage debt, auto loans, student loans, and credit card debt. Unpaid medical bills and expensive medical costs are quickly contributing to debt that Americans currently carry.

Recommended Reading: How Does Bankruptcy Affect Tax Filing

Public Debt And Intragovernmental Holdings

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

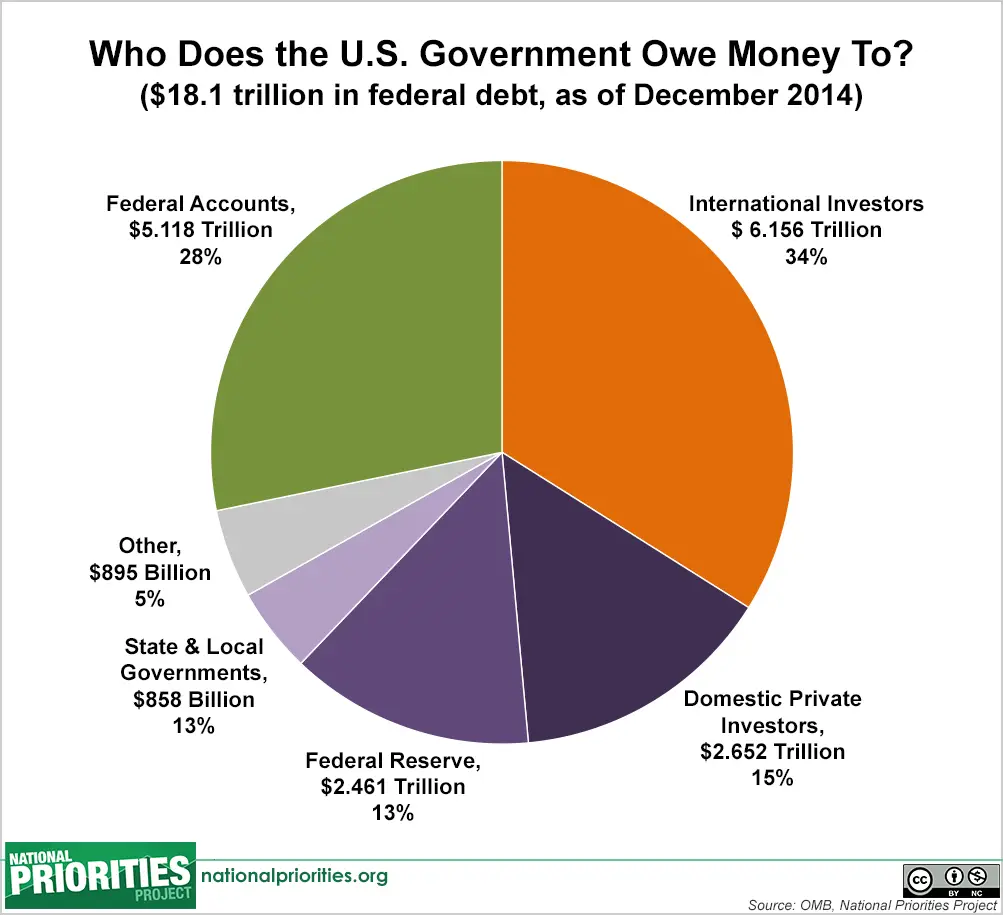

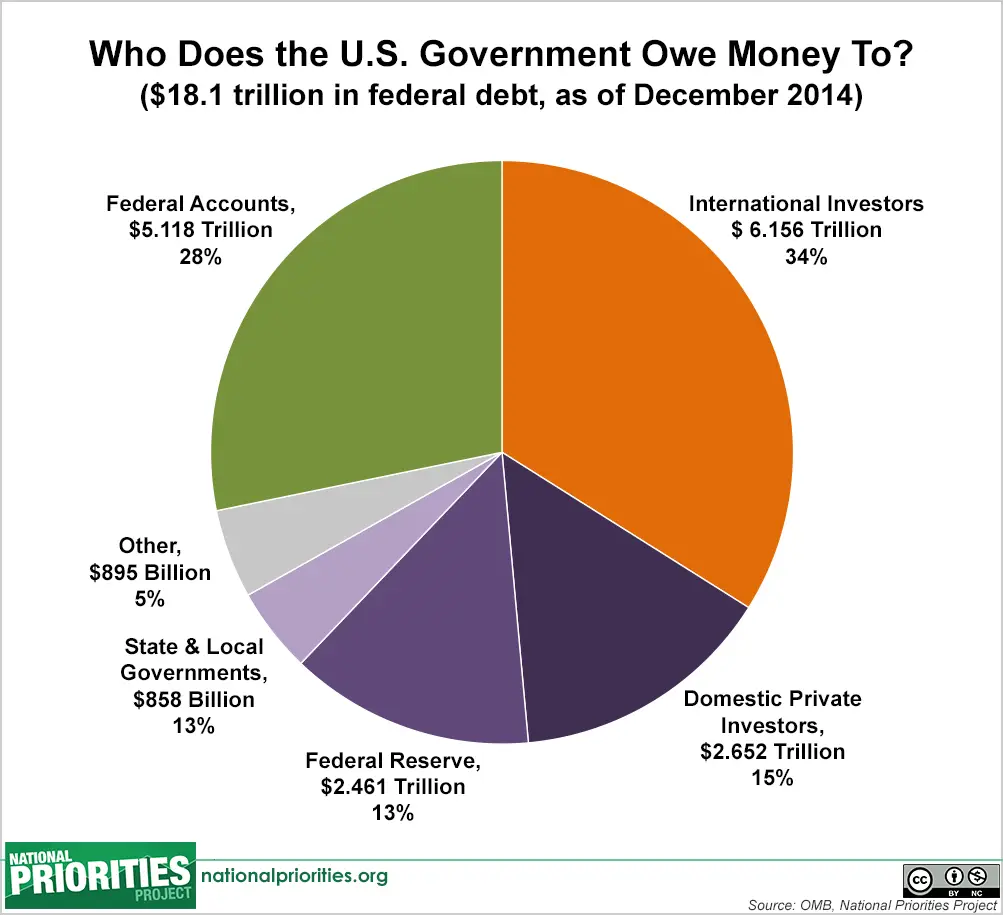

The Social Security Trust Fund owns a significant portion of U.S. national debt, but how does that work and what does it mean? Below, we’ll dive into who actually owns the U.S. national debt and how that impacts you.

Bad Information On Debt Relief

Cody Hounanian, executive director of the Los Angeles-based Student Debt Crisis Center, said the mobilization effort is needed because information gaps could harm borrowers if they don’t file the required online application. Some borrowers, he said, didn’t see an application immediately when the program was announced Aug. 24 and now are unsure what to expect.

Hounanian said older borrowers, in particular, could be at risk if they’re not willing or able to complete the online application when it becomes available.

You can sign up to receive updates at www.ed.gov/subscriptions. You’d provide an email address to the U.S. Department of Education and click on the top box “NEW!! Federal Student Loan Borrower Updates.”

Others will try to get the word out too. Farmington Hills-based GreenPath Financial Wellness is hosting a free webinar from 8 p.m. to 8:30 p.m. on Oct. 6 called “Student Loan Forgiveness what you need to know “

To register online to attend, see

Another issue: Some social media sites, Hounanian said, are spreading misinformation, particularly targeting Black and Brown borrowers, wrongly suggesting that they should avoid applying because the forgiveness program is simply a way for the government to collect more taxes.

There may be some reason for confusion, but experts say borrowers should still apply for debt relief.

Read Also: How Do You Say Bankruptcy In Spanish

Debt Can Create Bezzle

The third of the economic problems associated with rising debt is that it can encourage and accommodate a rise in fictitious wealth or bezzle. This is often the most damaging consequence of rising debt because this fictitious wealth creates distortions in economic behavior both as it is created and, much more importantly, as it is destroyed. When this fictitious wealth is eventually destroyed, the process can occur either quickly, in the form of a financial crisis, or slowly in the form of lost decades of stagnation and low growth.

There are two main ways in which the impact of fictitious wealth can affect economic activity, and although the link between rising debt and the creation of fictitious wealth isnt always causal, even when it isnt they are usually both symptoms of the same set of underlying monetary distortions.

Second, rising debt in certain economies can also be the result of formal or informal pressure on banks to lend into nonproductive investment that, because of soft budget constraints, isnt written down for many years. When that happens, expenditures that should be expensed are in fact capitalized, causing income-statement expenses to be understated and balance-sheet assets to be overstated, so that both net income and wealth are artificially boosted to higher levels than they otherwise would have been if only productive activity were recorded.

Amortizing Bezzle

The Effect of Nonproductive Investment on the Lending Banks

Duck Soup Economics

How Much Debt Does The Average American Have

Most Americans have borrowed money at some time during their lives, either by taking out a loan or by using a credit card. While debt often gets a bad reputation, it can also be a useful financial tool. Without the help of loans and credit cards, many people couldnt afford to pay for homes, cars, medical bills, or other major expenses.

So how much money does the average American owe?

In this article, we look at average debt by generation. We also cover some effective strategies for paying off your debt.

Heres what we cover:

- How much money does the average American owe?

- What is the average debt by generation?

- How can I start paying off my debt?

Key takeaways

- As of 2020, the average American has $92,727 of debt. This amount includes credit card balances, auto loans, mortgages, personal loans, and student loans.

- The average amount of debt varies by generation. Debt balances tend to increase until people reach middle age. When people get closer to retirement, their debt usually starts to decrease. However, many retired Americans still carry a substantial amount of debt.

- If you want to lower your debt, it helps to have a plan. One strategy is to reduce your debts interest rates. You may be able to get lower interest rates by refinancing your loans or consolidating your debt.

You May Like: What Happens To Your Home If You File Bankruptcy

Why The Federal Reserve Owns Treasurys

As the nation’s central bank, the Federal Reserve is in charge of the country’s credit. It doesn’t have a financial reason to own Treasury notes. So why does it?

The Federal Reserve actually tripled its holdings between 2007 and 2014. The Fed had to fight the 2008 financial crisis, so it ramped up open market operations by purchasing bank-owned mortgage-backed securities. The Fed began adding U.S. Treasurys in 2009. It owned $1.6 trillion, by 2011, maxing out at $2.5 trillion in 2014.

This quantitative easing stimulated the economy by keeping interest rates low and infusing liquidity into the capital markets. It gave businesses continued access to low-cost borrowing for operations and expansion.

The Fed purchased Treasurys from its member banks, using credit that it created out of thin air. It had the same effect as printing money. By keeping interest rates low, the Fed helped the government avoid the high interest rate penalty it would incur for excessive debt.

The Fed ended quantitative easing in October 2014. Interest rates on the benchmark 10-year Treasury note rose from a 200-year low of 1.43% in July 2012 to around 2.17% by the end of 2014 as a result.

The Federal Open Market Committee said the Fed would begin reducing its Treasury holdings in 2017. But it purchased Treasurys again just a few years later.

Solutions To Reduce The National Debt

76% of voters believe that the President and Congress should allocate more time and energy towards addressing the national debt. Americans care about the national debt, and some work has been done in order to address this issue. Solutions include raising revenue , cutting spending, and growing the countrys GDP.

Policy options such as the Simpson-Bowles plan and the Domenici-Rivlin Task Force have made efforts to create plans to reduce the national debt. Centers and institutes such as the American Enterprise Institute, Bipartisan Policy Center, Center for American Progress, and Economic Policy Institute all proposed things ranging from slow growth to reduction in benefits for high-income individuals.

Young people across America are getting educated about fiscal policy and making changes at their colleges and universities with Up to Us. Sign the pledge to let local representatives know that you are concerned about the nations fiscal future, or get involved by learning about how you can make a difference in your own community.

Recommended Reading: What Does Filing For Bankruptcy Do

First What Can We Expect In A Recession

Its always helpful to go back and review recession outcomes so that we can manage our expectations. While every recession varies in terms of length, severity and consequences, we tend to see more layoffs and an uptick in unemployment during economic downturns. Accessing the market for credit may also become harder and banks could be slower to lend, because theyre worried about default rates.

Read more: The Economy Is Scary. Heres What History Tells Us

As the Federal Reserve continues to raise rates to try to clamp down on inflation, well see an even greater increase in borrowing costs for mortgages, car loans and business loans, for example. So, even if you qualify for a loan or credit card, the interest rate will be higher than it was in the prior year, making it harder for households to borrow or pay off debt. Were already seeing this in the housing market, where the average rate on a 30-year fixed mortgage was recently approaching nearly 6%, the highest level since 2009.

During recessions, as rates go up and inflation cools, prices on goods and services fall and our personal savings rates could increase, but that all depends on the labor market and wages. We may also see an uptick in entrepreneurship, as we saw in 2009 with the Great Recession, as the newly unemployed often seek ways to turn a small business idea into reality.

Read Also: Can Filing Bankruptcy Clear Irs Debt

Debt Grows Into The Trillions During 1980s And 1990s

At the start of the 1980s, an increase in defense spending and substantial tax cuts continued to balloon the federal debt. The national debt at the end of the Ronald Reagan era was $2.7 trillion.

The era under President Bill Clinton was marked with tax increases, reductions in defense spending and an economic boom that reduced the growth of debt, but it still reached a staggering $5.6 trillion by 2000.

Recommended Reading: How Do You Get A Bankruptcy Off Your Credit Report

Concerns Over Chinese Holdings Of Us Debt

According to a 2013 Forbes article, many American and other economic analysts have expressed concerns on account of the People’s Republic of China’s “extensive” holdings of United States government debt as part of their reserves. The National Defense Authorization Act of FY2012 included a provision requiring the Secretary of Defense to conduct a “national security risk assessment of U.S. federal debt held by China.” The department issued its report in July 2012, stating that “attempting to use U.S. Treasury securities as a coercive tool would have limited effect and likely would do more harm to China than to the United States. An August 19, 2013 Congressional Research Service report said that the threat is not credible and the effect would be limited even if carried out. The report said that the threat would not offer “China deterrence options, whether in the diplomatic, military, or economic realms, and this would remain true both in peacetime and in scenarios of crisis or war.”

Recovery From The Civil War

The Civil War alone is estimated to have cost $5.2 billion when it ended and government debt skyrocketed from $65 million to $2.6 billion. Post-Civil War inflation along with economic disturbance from Europes financial struggles contributed to the vulnerable economic climate of the late 19th century.

The collapse of Jay Cooke & Co., a major bank invested in railroading, caused the Panic of 1873. Nearly a quarter of the countrys railroads went bankrupt, more than 18,000 businesses closed, unemployment hit 14 percent and the New York Stock Exchange began sinking.

This period of deflation and low growth continued for 65 months making it the longest depression, according to the National Bureau of Economic Research. During this time the government collected less money in taxes and the national debt grew.

Read Also: How To Declare Bankruptcy Without A Lawyer

Income Security And Covid

Income security spending of $1.6 trillion was boosted by $569.5 billion in pandemic relief payments and $79 billion in child tax credit payments. It also included $397.9 billion for unemployment compensation, $168.1 billion on food and nutrition assistance, $89.8 billion in housing assistance, and $156.1 billion in federal employee retirement and disability costs.

How Much Did George W Bush Add To The National Debt

President Bush added $6.1 trillion to the nations debt, the second-largest amount in dollars. This took National Debt from $5.8 trillion in 2001 to $11.9 trillion in 2009 a 105% percent increase. Unlike Wilson and FDR, Bush presided over two simultaneous wars which were initiated in response to the 9/11 attacks.

Don’t Miss: Can You File Bankruptcy On Credit Cards Alone

Is China’s Strategy Working

China’s low-cost competitive strategy seems to be working. Its economy grew more than 10% for the three decades before the 2008 recession. In 2019, it grew at 6.1%, an even more sustainable rate.

China has become one of the largest economies in the world. And if you measure it by gross domestic product and consider purchasing power parity , China is seen as the worlds largest economy.

China also became the world’s biggest exporter in 2009. China needs this growth to raise its low standard of living. For these reasons, we’ll likely see China remain one of the world’s largest holders of U.S. national debt.

Are We Helpless When It Comes To The National Debt

In some ways, yes. But there are actions you can take to mitigate the effect of the national debt on your life.

- Pay your taxes: According to the IRS, the federal government loses $1 trillion each year due to unpaid taxes.

- Put pressure on your Congressional reps: Call or write to your Representatives and Senators in support of tax code reform, increased funding for the IRS to track down tax cheats and closing loopholes that give the countrys most profitable companies tax bills that are lower than most Americans.

- Follow your reps voting history: If youre curious how your Representatives and Senators have voted on fiscal policy issues, thats easy to check. You can use voting history to back up your concerns when writing or calling your reps.

- Learn about healthcare reform: While national healthcare remains a contentious topic, it could pay to learn how other countries control healthcare costs and how those policies could benefit you, your neighbors and the impact rising healthcare costs has on the national debt.

Rehling from Wells Fargo Investment Institute says that while the national debt has increased substantially over the past decade, the U.S. isnt unique in this regard. The rest of the developed world has seen similar trends.

While these budget trends are unsustainable over the long run, there is no indication that current debt levels are overly worrisome, he says.

Also Check: Pros And Cons Of Filing Bankruptcy In Texas

Dispelling A Myth About Modern Monetary Theory

Before going into the different consequences of debt, it is necessary to discuss briefly some of the confusion that has arisen in recent years from a naïve understanding of modern monetary theory . Many proponents of the theory have argued that MMT teaches that there are no spending constraints on a government that is monetarily sovereign and that such a government can spend an unlimited amount without worrying about the consequences until there is a surge in inflation.

This simply isnt true. What MMT really shows is that there are no direct spending constraints on a government that is monetarily sovereign. It can always create money or debt to fund its spending needs without first needing to obtain the funding. This doesnt mean, however, that there are no indirect constraints. In fact, there are always economic constraints. This is because an economy cannot consume and invest more than it produces and imports, and any ex ante imbalance between the two must be resolved by implicit or explicit transfers that reduce the purchasing power of some sector of the economy by enough to bring the two back into balance.

Drawback Of Measuring Debt By President

Neither of the techniques mentioned above is a very accurate way to measure each president’s impact on the national debt because the president doesn’t have much control over the national debt during their first year in office.

For example, President Donald Trump took office in January 2017. He submitted his first budget in May. It covered the 2018 fiscal year, which didn’t begin until October 1, 2017. Trump operated the first part of his term under President Barack Obama’s budget for fiscal year 2017, which ended on Sept. 30, 2017.

While the time lag may make it seem confusing, Congress intentionally sets it up this way. An advantage of the federal fiscal year is that it gives the new president time to put together their budget during their first months in office.

Don’t Miss: How Much Is Bankruptcy Chapter 7 In Ohio