Keeping Your Car With A Chapter 13 Bankruptcy

A Chapter 13 bankruptcy is a debt consolidation program designed to help protect your property and re-establish payments with your creditors if you have fallen behind. The program offers many unique benefits that can actually help you keep your vehicle, improve your payment terms and re-establish your credit.

The Chapter 13 plan prioritizes payments to secured creditors, such as your car loan. Payments to general unsecured debts are deferred until a later time. Most often, general unsecured debts are significantly reduced or eliminated under the program . The program is designed to create a balanced budget based on your income and expenses. This means you can file bankruptcy and keep your car!

If you have gotten behind on your vehicle payments, the Chapter 13 plan can bring your account current through the debt consolidation process. The Chapter 13 bankruptcy will protect your car from a repossession. If your vehicle has been repossessed, a Chapter 13 will help you to get your car back provided it has not been sold at auction.

Improving Your Payment TermsIn short, the Chapter 13 program is a way of refinancing your vehicle as well as consolidating other debts. There are several ways that the Chapter 13 plan can improve your payment terms on your vehicle loan.

Read Also: What Does Dave Ramsey Say About Bankruptcy

How Does Chapter 7 Bankruptcy Work

Chapter 7 bankruptcy provides financial relief to qualified individuals struggling with debt. Once filed, the automatic stay stops most creditors from contacting you. While in place, those creditors cannot call you, send you bills or letters, or take other action to collect the debt. If you have a car loan when you file for bankruptcy, the creditor cannot repossess the car.

On average, you can expect the Chapter 7 process to take three to four months.

How To Use A Reaffirmation Agreement To Keep A Car In Chapter 7 Bankruptcy

The bankruptcy law provides an exception to the above rule:if you sign a reaffirmation agreement, the lender cannot consider you indefault and repossess the car just because you filed for bankruptcy. So what is a reaffirmation agreement?

A reaffirmation agreement is a document that states that youare agreeing to be responsible for a debt after bankruptcy. So, if you sign a reaffirmation agreement forthe car loan, the agreement gets approved, and you later stop payments on theloan, the lender can sue and recover from you any money still owed on theloan. Remember that normally the lenderwould not be able to do this, because Chapter 7 bankruptcy eliminates yourpersonal liability on the car loan.

The way to ensure that you can keep a car in Chapter 7bankruptcy, then, is to sign a reaffirmation agreement, and to comply with the otherrequirements of the loan contract, which usually include making timely paymentsand keeping the car insured. If you dothese three thingstimely sign a reaffirmation agreement, keep making yourpayments, and keep the car insuredyou can keep the car after Chapter 7bankruptcy.

There are exceptions to this general approach, such as when the lender makes significant concessions on the interest rate or the principal in the reaffirmation agreement, so it is best to get competent legal advice before deciding how best to deal with a reaffirmation agreement

Don’t Miss: How Does Bankruptcy Chapter 7 Work

Find Out How To Keep Your Car Under Chapter 7 Or Chapter 13 Bankruptcy

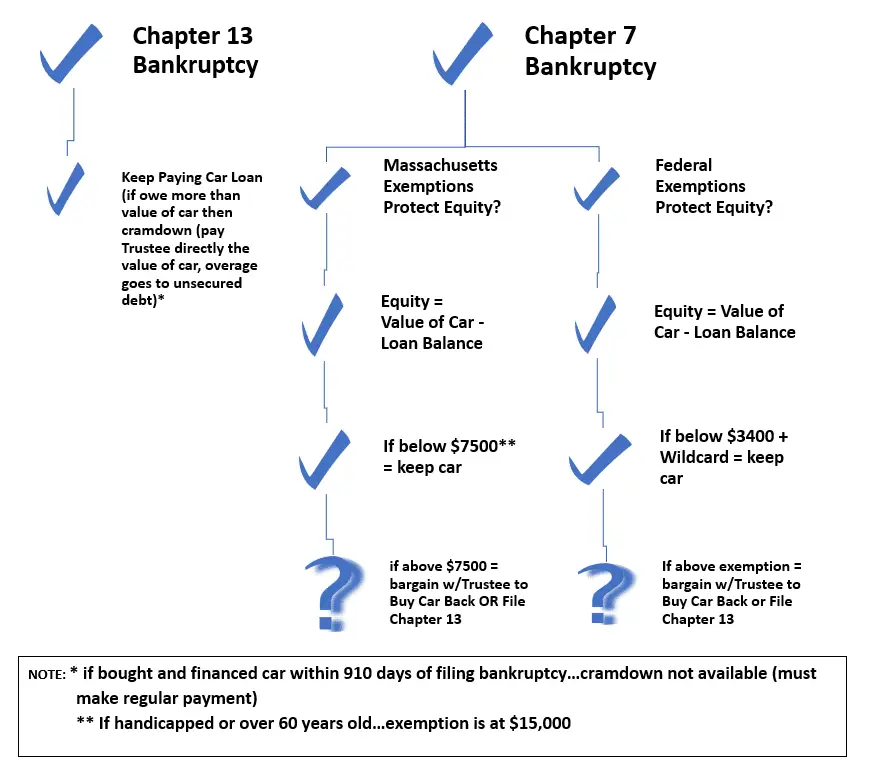

Filing for bankruptcy doesnât mean that youâll have to give up your car. But itâs not a given that youâll be able to keep it either. Being able to retain your vehicle in bankruptcy depends on the amount of equity, whether you can continue paying the loan , and the bankruptcy chapter that you choose to file.

Donât Miss: How To File Bankruptcy In Wisconsin

Keeping A Car Thats Not Paid Off

First, if youâre close to having it paid off, there is a good chance you have at least a little bit of equity in the car. In this context, equity is calculated by subtracting the current loan balance from the carâs value. As long as the equity is less than the exemption amount , your bankruptcy trustee canât touch your car.

About your car loan

Chapter 7 bankruptcy is not a way to get a free car. If youâre still making payments on a car loan, you havenât paid for your car yet and the only way to keep the car is to pay for it.

Redeem the car by paying only how much itâs actually worth

One way to do this is through a redemption, where you pay for the car’s current value in a single payment, no matter how much you owe. If that sounds like an option for you, here’s where you can learn more about how to redeem your car.

Is paying a lump sum to redeem your car not possible? You have other options!

If you’re like most, you probably don’t have access to that kind of money right after your bankruptcy filing. That is where reaffirmation agreements come in.

Reaffirmation Agreement Basics

A reaffirmation agreement allows a bankruptcy filer to keep their car by preventing the car loan from being discharged. They exist, in large part, to protect banks and credit unions after a Chapter 7 bankruptcy. Here are some details about the process of reaffirming a car loan.

If you were facing repossession, a reaffirmation may not be the way to go

Keep the car, keep the debt

Recommended Reading: What Is A Contingent Claim In Bankruptcy

Returning The Vehicle Bankruptcy To Get Out Of A Car Loan

Sometimes the best option is returning a vehicle with a car loan to the lender. Then you’ll be out from under the car loan entirely. Many bankruptcy filers will return a fianced car to the lender when they:

- paid too much for the vehicle

- can’t afford the monthly payment, or

- don’t want the vehicle or the car loan associated with it.

If you’re in this situation, you’ll check the box that states that you plan to “surrender the property” when you’re filling out the Statement of Intention for Individuals Filing Under Chapter 7form. You can also surrender a car with a car loan in Chapter 13 bankruptcy.

Contact Our Bankruptcy Lawyers In Nevada

Are you thinking about filing for bankruptcy? Are you worried about keeping your vehicle? Our Las Vegas bankruptcy attorneys can help. We can help you understand what you can do to keep your car, and we can help you take the right steps to save your vehicle from bankruptcy. Call us today to begin working on your case.

Recommended Reading: Can You File Bankruptcy Only On Credit Cards

Keep Your Car In Bankruptcy Chapter 13

You dont need to be current on your car loan to keep your car in chapter 13. In fact, chapter 13 is often used to stop repossession and give you time to catch up missed payments. Creditors cannot refuse to accept payment on the car loan if you file chapter 13. If you get behind on your car, and the creditor wont work with you, threatening repossession unless you come up with all the missed payments at once, chapter 13 can help.

In chapter 13, you can cram down some car loans. This is not possible in chapter 7. In a cram down, you pay the value of the car, not what is owed, over the term of the chapter 13 plan. The interest rate will change as well. in 2020, the current interest rate is 5.5% So, of you owe a lot more on your car than what it is worth, and at a higher interest rate, chapter 13 may be an option. To cram down a car, you must have purchased it more than 910 days before you file your bankruptcy .

Can I Keep My Car If I File Chapter 7

Chapter 7 is often called liquidation bankruptcy. This means that you sell items to help pay creditors, and your remaining unsecured debts are typically discharged. In some cases, when a person has almost no assets, nearly all their debts are eliminated through bankruptcy. Chapter 7 typically takes only a few months to complete.

Regarding your car, you can usually keep your vehicle in Chapter 7 because you are protected by Indianas wildcat exemption. However, if the equity you own in your vehicle is more than the wildcat amount , the court may require you to sell the vehicle to pay creditors.

Chapter 7 has a bankruptcy means test. In 2005, the law was changed to include a means test to try to screen out people who may abuse the system. If your monthly income is greater than Indianas median, you must pass this test to determine if your filing is considered abusive. Chapter 7 is codified at 11 U.S.C. §§ 101, 109.

Recommended Reading: Unclaimed Pallets For Sale

You Maintain Repayments On Your Vehicle

You may have agreed to use the vehicle as security for a loan. We call this a secured debt.

If you fall behind in loan repayments, the secured creditor is able to repossess and sell the vehicle. You need to contact your secured creditor to discuss what you intend to do.

If the creditor sells your vehicle and you still owe them money, this is called a ‘shortfall’. You can list this in your bankruptcy. The creditor can no longer pursue you for this debt.

Bankruptcy Lawyers Serving Arlington Heights Libertyville And Chicago

One issue that concerns many people before they file for bankruptcy is whether the court will let them keep their car. The answer depends, first, on whether the person owes any money on the car. If they paid off their car loan, then they get to keep the car as long as its value does not exceed the state’s vehicle exemption. If the person still owes money on the car, then that may complicate the issue. People in that situation can choose to either walk away from the car or keep making payments on it.

Also Check: How To Get A Copy Of Your Bankruptcy Discharge

Can I Buy A Car After Bankruptcy

If you’re in the process of bankruptcy, you may be wondering if you’ll ever be able to get another car. The good news is, you can! Here’s what you need to know about buying a car after bankruptcy.

When you file for bankruptcy, your credit score takes a hit. This means that it will be harder to get approved for a loan. However, it is possible to get approved for an auto loan after bankruptcy.

There are a few things you can do to improve your chances of getting approved. First, make sure to shop around for lenders who specialize in loans for people with bad credit. Second, be prepared to make a larger down payment than usual.

If you follow these tips, you should be able to get approved for an auto loan after bankruptcy and get back on the road!

The Law Offices of Omar Zambrano has helped thousands of people and businesses in the past to get out of debt and start over.

Our goal is to help you find a fresh start so FAST!

Schedule your free consultation today! By Calling 626-338-5505 or visiting us at 12738 Ramona Blvd Baldwin Park CA 91706

Featured Posts

Contact Cravens & Noll Bankruptcy Law Group

The best way to be sure you are getting the best results from your bankruptcy case is to consult with lawyers who specialize in this area. With years of experience, the lawyers at Cravens & Noll are ready to protect your car and home amid your bankruptcy case.

Worried about if you will lose your home and car? Contact us now for a free initial bankruptcy consultation

Bankruptcy Attorney Info

Don’t Miss: Bankrupt Houses For Sale

How Much Do You Owe On Your Car

One of the main qualifiers that decide whether or not you can keep your car is the amount you owe on it. Typically, when courts are deciding what property can be sold to creditors, there is a specific process they follow.

The equity in your car is simply determined by the value of the car less the car loan. If the amount that you owe is not enough to cover the equity value of your car, then creditors have the potential to repossess and sell it. Simply put, the value of the car cannot exceed the amount you owe when you file.

If all of the equity value of your car is protected through the motor vehicle exemptions of Virginia, then you can keep your vehicle. This means that your cars market value is exempt to creditors.

Determine Your Car’s Value

In your bankruptcy paperwork, you’ll report your vehicle’s “fair market value,” or the amount you can sell it for, considering its current age and condition. Check websites such as Kelley Blue Book and the National Auto Dealers Association for values. Your bankruptcy trustee will likely want a printout from one of the sites to prove your vehicle’s value.

Recommended Reading: How Often Can You File For Bankruptcy In California

How Do Bankruptcy Exemptions Work

Most of the Chapter 7 bankruptcy exemptions have a limit. This means that anyone filing bankruptcy can protect certain types of property up to a certain amount. For example, say your car is worth $3,500, and the exemption for motor vehicles in your area is up to $6,000. In this case, you’d be allowed to keep your vehicle because its value is lower than the exemption amount.

What if your vehicle was worth $9,000? In this case, your trustee could sell the vehicle for $9,000. They would then give you the $6,000 that’s protected by an exemption and divide the remaining $3,000 amongst your creditors.

Your House In Chapter 13 Bankruptcy

When youre behind on your mortgage payments but want to keep your home, Chapter 13 bankruptcy might give you the time you need to catch up. Under this type of bankruptcy, the court approves a plan for you to repay the past-due mortgage amounts over three to five years, while continuing to make your current mortgage payments. As long you keep up with both of those payments, your lender cant foreclose on the house.

But how often do Chapter 13 filers succeed in completing their repayment plans? Many of the readers we surveyed were still making their plan payments. Of the others, however, nearly half had their case dismissed before they were able to complete the plan, which usually happens when a debtor cant keep up with the payments. It was likely that these readers didnt have enough income to cover their living expenses as well as the monthly plan payments. Bottom line: Despite good intentions, not all Chapter 13 bankruptcy filers are able to keep their houses.

Recommended Reading: How Long Does Bankruptcy Show Up On Credit Report

Recommended Reading: Can You File Bankruptcy A Second Time

What Happens To My Car Once I File For Bankruptcy

You may or may not be able to keep your car when you file for bankruptcy. The type of bankruptcy you choose to pursue, how much equity you have in your vehicle and whether you own the car outright or are financing or leasing it will determine what happens to your car in bankruptcy. Other factors like the value of your car and exemptions in your state will determine what happens to your car once you file for bankruptcy.

Keeping A Car In Chapter 7 Bankruptcy By Reaffirming The Car Loan

Many lenders will let you keep a car after bankruptcy as long as you’re current on the payment and continue to make the payment after the case ends. The lender will give you the title when you pay the amount due under the discharged contract.

This arrangement works well because if the car breaks down or is in an accident, the filer can stop making payments and give the vehicle back to the lender. However, without a contract in place, the payments aren’t reflected on the filer’s credit report, and the lender can repossess the car at any time.

Filers who don’t want to risk losing the vehicle can sign a new contract called a “reaffirmation agreement.” Although you might be able to convince the lender to agree to better terms, you should assume they’ll remain the same because the lender isn’t obligated to modify the loan. Therefore, while signing a reaffirmation agreement can help you keep a car in Chapter 7 bankruptcy, it isn’t a tool you should rely on if you’re behind on your payments.

Learn more about your car in Chapter 7 bankruptcy.

Recommended Reading: How Many Times Did Donald Trump File For Bankruptcy

Explore Your Bankruptcy Options

Get the financial relief you are entitled to by filing for bankruptcy protection. Our team represents individuals and small business owners in Chapter 7 and Chapter 13 bankruptcy cases. We can also provide help filing for Chapter 11 reorganization bankruptcy and Chapter 12 bankruptcy for family farmers and fishermen.

We can help you through the petition and filing process. We can help you retain your assets when you choose Chapter 7 bankruptcy. We can even help you restructure financial debt through other bankruptcy filings with complex financial structures or extremely large debt loads. Call Farmer & Morris Law, PLLC to speak to a member of our client intake team and learn what happens if you declare bankruptcy today.

Read Also: Can You Get A House After Filing Bankruptcy

Can You Keep Your Car After Filing Bankruptcy

There are several factors that go into whether you’ll be able to keep your vehicle through the bankruptcy process. Since your vehicle is considered an asset, and potentially a valuable one, it’s something creditors may pursue when looking to collect debt. Your vehicle may, however, be counted under an exemption that protects it from repossession. In general, the following is considered to determine if you’ll be able to keep your car:

- The type of bankruptcy you’re filing

- Whether you own, lease or are still financing the vehicle

- The value of the vehicle

- What exemptions apply where you live

Read on to learn more about what you can expect to happen to your vehicle when you file bankruptcy.

Also Check: How Do You File For Bankruptcy In Texas