Estimated Home Loan Eligibility

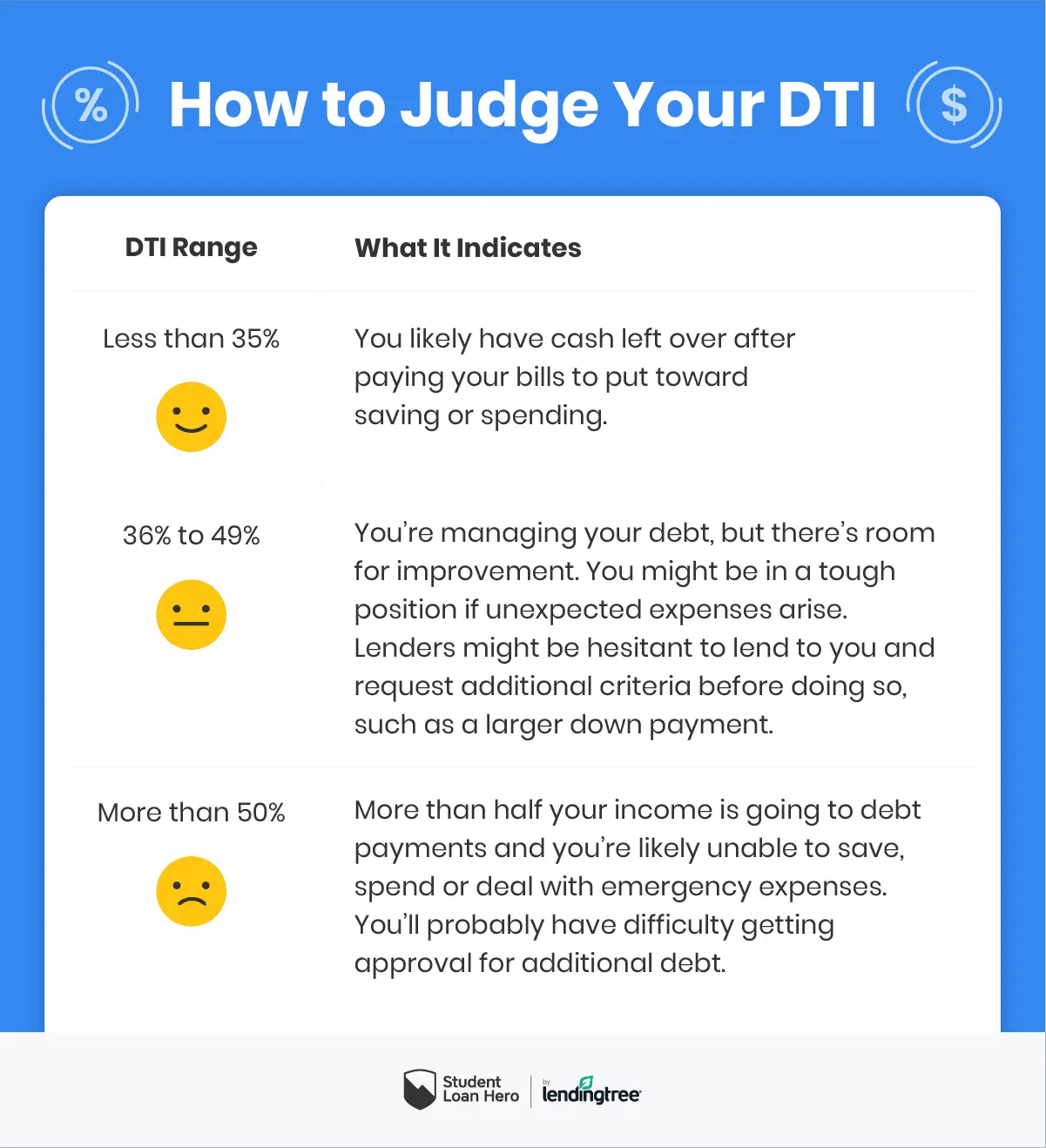

| Your DTI is very good. Having a DTI ratio of 36% or less is considered ideal, and anything under 20% is excellent. | Your DTI is good. Having a DTI ratio of 36% or less is considered ideal. | Your DTI is OK. It’s under the 50% limit, but having a DTI ratio of 36% or less is considered ideal. Paying down debt or increasing your income can help improve your DTI ratio. | Your DTI is over the limit. In most cases, 50% is the highest debt-to-income that lenders will allow. Paying down debt or increasing your income can improve your DTI ratio. |

|---|---|---|---|

| Remaining |

Your debt-to-income ratio measures your monthly debt obligations in comparison to your monthly gross income, or the amount of money you earn before taxes. Its calculated by dividing your minimum monthly debt payments by your monthly gross income, and its expressed as a percentage.

When you go through the mortgage application process, lenders review your DTI ratio to assess whether you can handle monthly mortgage payments in addition to your current monthly obligations. If you dont meet a lenders minimum DTI ratio requirements, you might not be approved for a mortgage loan. A debt-income ratio calculator can help you crunch the numbers.

Buyer Bewareof How Much You Can Afford

Because debt-to-income ratios are calculated using gross income, which is the pre-tax amount, its a good idea to be conservative when you feel comfortable taking on. You may qualify for a $300,000 mortgage, but that amount may mean living paycheck-to-paycheck rather than being able to save some of your income each month. Also remember, if youre in a higher income bracket, the percentage of your net income that goes to taxes may be higher.

While your debt-to-income ratio is calculated using your gross income, consider basing your own calculations on your net income for a more realistic view of your finances and what amount youd be comfortable spending on a home.

How Much Do Debt Ratios Affect A Credit Score

Your income does not have an impact on your credit score. Therefore, your DTI does not affect your credit score.

However, 30% of your credit score is based on your credit utilization rate or the amount of available on your current line of credit. Generally, your utilization rate should be 30% or lower to avoid having a negative effect on your credit score. That means that in order to have a good credit score, you must have a small amount of debt and actively pay it off.

Also Check: How To Get My Bankruptcy Discharge Papers

What Is Your Debt

Your debt-to-income ratio, which is typically expressed as a percentage, shows how much of your total monthly income goes toward your monthly debt payments. This debt may include your mortgage, , car loans, student loans, and personal loans.

When a lender is reviewing your loan or credit application, itll consider your DTI ratio as an indicator of how likely you are to repay a loan. A high DTI ratio could indicate a greater risk because youre already using a lot of your income to pay other debt.

A lender may assume this means you might not be able to comfortably afford to take on a new debt payment. The lower your DTI ratio, the more attractive you are to a lender and the more likely you are to get approved.

To calculate your DTI ratio, follow these steps:

For example, lets say your monthly income before taxes is $6,000 and these are your debt payments every month:

- Mortgage: $1,100

- Student loans: $1,500

Heres another example:

- Car payment: $400

Open A Debt Consolidation Loan Or Balance Transfer Credit Card

Debt consolidation may help you get a better interest rate and pay down your balances sooner, ultimately helping you bring down your debt-to-income ratio.

Two common strategies of consolidating debt is with a personal loan or a balance transfer credit card:

| Debt consolidation vs. balance transfer |

| Debt consolidation loan |

Read Also: How To Apply For Bankruptcy In Michigan

Can I Get A Debt Consolidation Loan With A High Dti

While it may be rare, some lenders give out debt consolidation loans to high DTI borrowers. If you do qualify, you might have to pay a high-interest rate, but a co-signer can help mitigate that risk.

At the end of the day, a high debt-to-income ratio isnt permanent. It can be a pain to combat, but with the right amount of discipline, you can effectively lower your DTI.

Our mortgage experts will work with you to help lower your DTI while finding a mortgage you can afford.

How To Lower Your Debt

Don’t Miss: Does Chapter 7 Bankruptcy Stop Garnishment

Get A Loan With A High Debt

Most of us walk through our lives carrying debt. The average American today has more than 25k racked up in outstanding payments. It seems that having debt has become the norm, and its not a fun situation to live in. So, how can we combat this?

The good news is that debt is not a dead-end situation. An aspiring homeowner with a high debt-to-income ratio can still lower their ratio and get a loan.

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

Also Check: Can You File Bankruptcy While On Social Security

How To Calculate Debt

When you apply for a loan or consult a financial expert, you might hear the term debt-to-income ratio, or DTI ratio for short. But what does debt-to-income ratio mean? And why does it matter?

Hereâs some helpful information about DTI ratios, including how to calculate your own ratio and steps you can take to improve it.

Key Takeaways

- A debt-to-income ratio is a snapshot of your income in comparison to your monthly bills and other debts.

- Lenders may use your DTI ratio along with your credit history as an indicator of your financial health.

- Improving your DTI ratio before applying for a loan or credit card could improve your chances of approval.

Breaking Down The Dti Ratio

Lenders often evaluate two different DTI ratios: the front-end ratio and the back-end ratio.

The front-end ratio, sometimes called the housing ratio, shows what percentage of a borrowerâs monthly income is used for housing expenses. This ratio could include monthly mortgage payments, homeowners insurance, property taxes and homeowners association dues.

The back-end ratio is the amount of a borrowerâs income that goes toward housing expenses plus other monthly debts. And it can include revolving debts such as credit card or car payments, student loans and child support.

Lenders typically say the ideal front-end ratio should be no more than 28%, and the back-end ratio, including all expenses, should be 36% or lower. In reality, depending on your credit score, savings, assets and down payment, lenders may accept higher ratios, depending on the type of loan youâre applying for.

Don’t Miss: How To File For Bankruptcy Yourself In Massachusetts

How Do Lenders Use Your Debt

While there are variations between the different types of debt-to-income ratios that lenders will accept when assessing prospective borrowers, banks and financial institutions generally apply the debt-to-income ratio as part of the credit analysis process.

This process determines the amount of credit risk a borrower has which the lender can use to decide whether to accept or decline their loan request and to pinpoint the amount they will allow the customer to borrow. If a customer has a low debt-to-income ratio, this means that a bank will be more likely to accept their request as they have the income and ability to successfully make the repayment.

Some lenders, particularly non-banks, have their own ways to measure whether a customer will be able to make repayments, such as the Net Service Ratio which assesses serviceability. To calculate the Net Service Ratio, lenders take into account a prospective borrowers after-tax income, and then subtract expenses and other liabilities to work out the loan amount the customer may be able to repay.

What Is A Good Debt To Income Ratio

The lower your debt to income ratio, the higher your chances will be of meeting your financial goals and paying your bills on time. A ratio in the mid-30s or lower is usually considered ideal, but this is dependent on the creditor or lender. Any higher, and you may be flagged as higher risk, potentially impacting your chance of obtaining an approval for a loan or credit approval.

You May Like: How To Get A Loan After Bankruptcy Discharge

What Is The Ideal Debt To Income Ratio

This post may contain affiliate links. Please read my disclosure for more info.

There are many different metrics you can use to determine how well youre doing financially. One of the most effective for determining credit worthiness is the debt to income ratio or DTI ratio.

In a perfect world, the ideal debt to income ratio would be 0%.

However, for most of us, thats not realistic as there arelarge expenses that we couldnt fund in a reasonable amount of time without theuse of credit. These include mortgages,small business loans, etc.

Just because we have access to credit and need it for large purchases, you shouldnt abuse it. Checking a few key metrics like your net worth and debt to income ratio can give you a quick snapshot of how youre handling credit.

Does Your Dti Affect Your Credit Score

Your debt-to-income ratio does not affect your credit scores credit-reporting agencies may know your income but do not include it in their calculations.

But your credit-utilization ratio, or the amount of credit youre using compared with your credit limits, does affect your credit scores. Credit reporting agencies know your available credit limits, both on individual cards and in total, and most experts advise keeping the balances on your cards no higher than 30% of your credit limit. Lower is better.

To reduce your debt-to-income ratio, you need to either make more money or reduce the monthly payments you owe.

Recommended Reading: How Long Till Bankruptcy Is Discharged

How Do You Rate

To find out more about your debt-to-income ratio and discover if you qualify as a good candidate for a mortgage, contact Zachery Adam at Prime Mortgage Lending of West Asheville or call 828-242-4780. Zack loves helping people get into new homes. Hell also help you figure out your debt-to-income ratio.

What Is Debt To Income Ratio And Why Is It Important

Shopping around for a or a loan? If so, you’ll want to get familiar with your debt-to-income ratio, or DTI.

Financial institutions use debt-to-income ratio to find out how balanced your budget is and to assess your credit worthiness. Before extending you credit or issuing you a loan, lenders want to be comfortable that you’re generating enough income to service all of your debts.

Keeping your ratio down makes you a better candidate for both revolving credit and non-revolving credit .

Here’s how debt-to-income ratio works, and why monitoring and managing your ratio is a smart strategy for better money management.

Recommended Reading: How Do You Rebuild Your Credit After Bankruptcy

How To Calculate Your Debt

Here’s an example:

You pay $1,900 a month for your rent or mortgage, $400 for your car loan, $100 in student loans and $200 in credit card paymentsbringing your total monthly debt to $2600.

Your gross monthly income is $5,500.

Your debt-to-income ratio is 2,600/5,500, or 47%.

Calculate Your Debt To Income Ratio In 3 Easy Steps

Your debt-to-income ratio is considered when looking at your overall financial health aside from your credit score. Knowing how to calculate it can help you with your decision whether or not to apply for credit or a loan or learn how comfortable you are with your current debt. This ratio is expressed as a percentage.

Lenders view consumers with higher DTI ratios as risky borrowers. They use this percentage to evaluate and determine whether or not to approve you for a loan. They use this to gauge how well you manage monthly debts and if you can actually afford to pay a loan back.

In this article, well teach you how to calculate your debt-to-income ratio, what debt factors make this up, and what you can do right now to improve this ratio to help your financial situation.

Also Check: What Are The Pros And Cons Of Bankruptcy

If Youre Applying For A Mortgage There Are Two Types Of Debt

If youre in the market for a mortgage, you should also consider front and back end debt-to-income ratios. When youre applying for a mortgage, lenders will likely look at debt-to-income ratio in two ways.

- The front-end ratio is used to determine if you can repay your mortgage. A front-end DTI ratio includes your projected monthly mortgage payment, insurance, property taxes, homeowners association fees, but does not include other monthly expenses like student loans or credit card debt. You should only have to worry about your front-end ratio when youre applying for a mortgage.

- The back-end ratio is an overall measure of debt compared to your income. It includes all of your monthly debts, like credit cards and student loan debt, in addition to any household payments. As such, this number tends to be higher than front-end ratios, but it is the more common measure of your DTI.

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

You May Like: How Do You File For Bankruptcy In Ohio

What Is His Debt To Income Ratio

- Gross Monthly Income of Mr. A is 18,00,000 divided by 12 months = Rs.1,50,000/-

- Gross Monthly Debt obligation of Mr. A is = 50,000 + 20,000 = Rs.70,000/-

- His Debt to Income Ratio is *100 which is 46.67%. This may be considered to be a bit high by most lenders.

Once his car loan is paid off Mr. As Debt-income ratio will become *100 = 33.33% which is a very acceptable value.

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

You May Like: Financial Help Debt Relief

Understanding The Ideal Debt

If you’re considering applying for a loan, you may be wondering what constitutes a good debt-to-income ratioand just as importantly, what the ideal debt-to-income ratio is for you.

This ratio calculates your monthly debt obligations relative to your gross monthly incomehow much you earn before taxes and other deductions come out of your paycheck. Once calculated, debt-to-income ratio is expressed as a percentage. While it’s a relatively simple number and concept, it can have a big impact on your financial life.