Correcting Inaccurate Information On Your Credit Report

A common problem, before and after bankruptcy, is inaccurate information on your credit report. With so many companies and collection agencies reporting to the credit bureaus on so many individuals, errors occur, probably more frequently than you realize.

The Fair Credit Reporting Act is a set of laws that provide protection for consumers from this inaccurate reporting of credit information. Under the FCRA, you have the right to dispute any item on your credit report, and the credit bureau and the company or organization that reported the information to the credit bureau are responsible for correcting the inaccurate information.

If you have inaccurate information on your credit report, here are the steps to follow to get that information corrected:

Clean Up Your Financial Act

There are a number of reasons why you may have been forced to file for bankruptcy. But whats most important when rebuilding your credit is not the culprit, per se, but making sure that history doesnt repeat itself. In other words, you want to establish a solid plan for your finances to make your money work for you. In your list of objectives should be creating a realistic budget that keeps your spending in check, safety net, and plans to eradicate debt that wasnt included in the filing.

The Difference Between Discharged Vs Dismissed Bankruptcies On Credit Reports

agencies are required by law to report the following two types of bankruptcy filings to the credit bureaus:

- Discharged bankruptcy

- Dismissed bankruptcy

If the bankruptcy was dismissed or if it wasn ‘t completed , then only the fact that you filed for bankruptcy will be shown on your credit report. There is no period in which this data can be removed, unlike when a discharged bankruptcy is expunged. However, in most cases where a debt has been listed as “discharged in bankruptcy,” it will be removed from your credit report after the period of time that is required by law.

| How Long Do Discharged Bankruptcies Remain on a Credit Report? | Bankruptcies are one of the worst things that can happen to your credit score. Fortunately, they will not stay on your credit report forever. Bankruptcy stays on your credit report for up to 10 years. However, you might be able to remove it sooner than that if you complete a bankruptcy plan or file Chapter 13 instead of Chapter 7 bankruptcy. |

| How Long Do Dismissed Bankruptcies Remain on a Credit Report? | Dismissed bankruptcies will stay on your credit report for up to 10 years unless you fail to pay a debt listed in the bankruptcy. In this case, the creditor may request that the Court reinstate your bankruptcy and force you to pay back all of the debts listed in it. |

You May Like: Can You Get A Car Loan With A Bankruptcy

How Is A Chapter 13 Case Different

By contrast, those filing bankruptcy under bankruptcy Chapter 13 are required to submit completed schedules and a Chapter 13 repayment plan. Like Chapter 7 filers, they are required to be forthcoming when submitting information and documents to the court and the trustee assigned to their case, attend their meeting of creditors, and appear at certain mandatory bankruptcy court appearances. Additionally, they must make their Chapter 13 plan payments on time or risk the dismissal of their case.

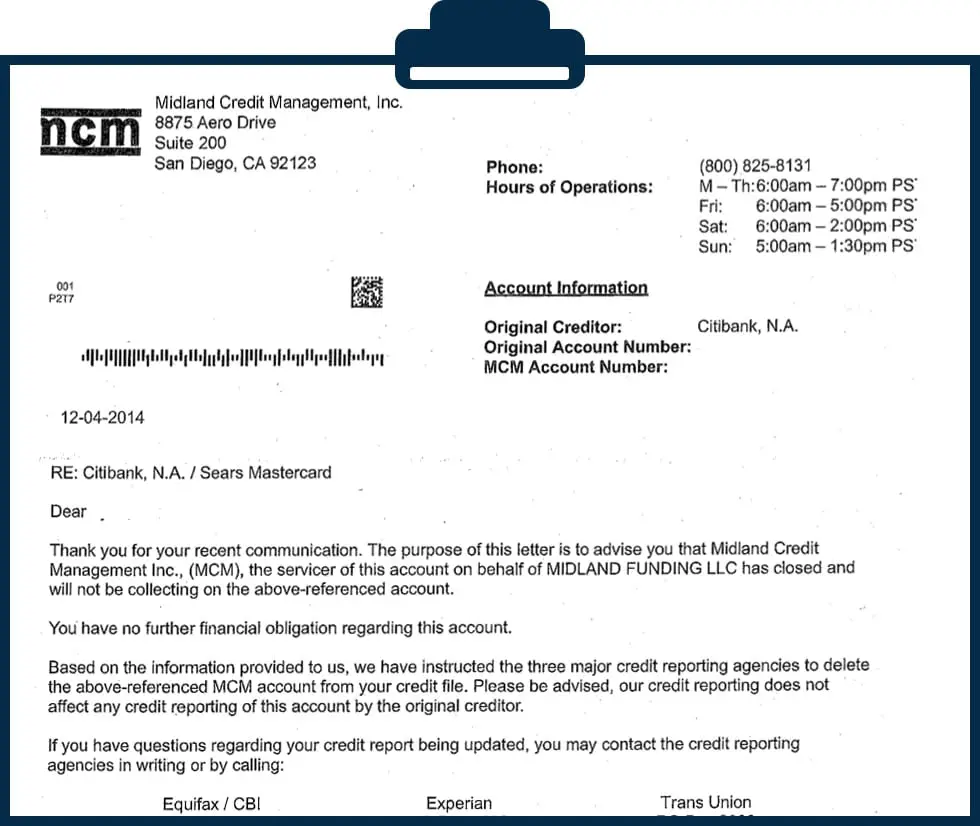

Q: I Am Having Trouble Renting An Apartment Because Of A Dismissed Chapter 13 Bankruptcy Can It Be Removed From Credit Reports Since I Did Not Continue With It And The Debt Has Since Been Paid In Full

![How to Get Bankruptcy Off Credit Report Early [See Proof] How to Get Bankruptcy Off Credit Report Early [See Proof]](https://www.bankruptcytalk.net/wp-content/uploads/how-to-get-bankruptcy-off-credit-report-early-see-proof.jpeg)

A: A discharged bankruptcy means you have satisfied the debts included in the Chapter 13 BK and that creditors will not further pursue you for payment. In addition, discharged debts listed on your credit report must be listed as discharged. This will either lower or eliminate your overall debt making you are better credit risk.

When a Chapter 13 has been dismissed, creditors can immediately pursue you for payment again in addition to initiate or continue with court litigation for payment which causes potential new creditors to deny you.

Even if you pay the debt, potential creditors are still going to look at a dismissed bankruptcy more negatively than a discharged bankruptcy. Unfortunately, when you attempt to get new credit with a dismissed bankruptcy its going to be more difficult.

Most creditors, lenders and rental companies want to see a discharged bankruptcy. Its great that you paid the debt but ironically theres no benefit to your credit profile for doing so.

Once a bankruptcy is filed it is almost impossible to un-ring the bell. But because a discharged Chapter 13 stays on your credit report for 7 years and dismissed Chapter 13 stays on your credit report for 10 years I suggest several strategies:

To Credit Bureaus:

Any case, civil or otherwise, which is dismissed no longer exists in the eye of the law and a case filed may never have actually been adjudicated. Therefore, you have no right to maintain information which the government has deemed nonexistent.

Recommended Reading: How To Get A Car While In Bankruptcy

How To Remove Dismissed Bankruptcies From Your Credit Report Yourself

Removing dismissed bankruptcies from your is possible, but it is not easy. There are two ways you can go about removing bankruptcy information from your credit report:

To dispute a dismissed bankruptcy, you will need to gather as much of the following information as possible:

- Your name and address associated with the bankruptcy case

- The individual or business that filed for bankruptcy

- Court-related documents showing that the case was dismissed

- Date of dismissal

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Lenders are required to investigate and respond to all disputes.

Remember to include as much documentation as possible to support your claim. Including a copy of your report marking the error is also helpful.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

Also Check: Repo Houses For Sale

Get Your Bankruptcy Removed Today

If youre looking for a reputable credit repair company to help you dispute your bankruptcy and repair your credit, consider working with Lexington Law.

Give them a call at for a free credit consultation. They have helped many people in your situation and have paralegals standing by waiting to take your call.

Why Use Donotpay To Remove A Dismissed Bankruptcy From Your Credit Report

DoNotPay is the best way to clean up your credit report. The team behind it understands that filing for bankruptcy can be difficult and stressful, which is why they want to take care of this process for you.

Using their simple interface, you will be able to dispute all three major credit reporting companies in just five minutes or less.

It’s quick, easy, and accurate.

Also Check: Can Medical Debt Be Discharged In Bankruptcy

Common Mistakes To Avoid With Credit Dispute Letters

So over the years, Ive seen clients of mine make errors that end up hurting their chances for deletion.Here are ways to avoid these mistakes:

C) Do not dispute any inquiries linked to accounts youve legitimately opened, your inquiry dispute will be forwarded to the creditor, who may close the account fearing fraud.

D) Make sure to include entire account numbers if the same creditor is reporting multiple accounts. You do not want the wrong account disputed and deleted.

Check Your Credit Report After Bankruptcy Discharge

Theres no way around itfiling for bankruptcy will tank your credit score, and for good reason. While it may have been the best solution for your debt situation, it will take time to rebuild your credit again. One of the first steps you should take after declaring bankruptcy is to check your credit reports and make sure the debts you discharged through bankruptcy are showing a zero balance. If they arent, you will need to take action to fix it.

You May Like: What Debts Will Bankruptcy Not Erase

Remove Dismissed Bankruptcies From Your Credit Report Now With Help From Credit Glory

Disputing negative items on your credit report is hard work! It takes a lot of time, effort, organization, and follow up. The good news? Our team of credit repair professionals are here to simplify everything! Let your dedicated credit repair expert relieve you of the stress, hassle, and time needed to fight your inaccuracies and boost your credit score

Call us at or set up a consultation to get started, today!

What Items To Enclose With The Credit Bureau Dispute Letter

The credit bureaus require you to verify your identity in order for them to investigate and send you dispute results back

Photo ID: This could be any state or government-issued identification

Proof of Residency: This could be a recent utility bill, or bank statement, mortgage statement, or a copy of your home rental agreement. It should show your name and current mailing address.

Proof of SSN#: This could be any state or government document showing your SSN#. Or a page from your tax return, W-2, paystub, or 1099, etc.

Any Supporting Documentation: This could include anything that could support your dispute claim, like a letter of deletion from the creditor.

Wait for 30 Days for the Dispute Completion:

Within 30 days after receipt of the letters by the bureaus, you should receive the investigation results from them.

Recommended Reading: Legal Aid For Bankruptcy Chapter 7

Review Your Reports Once The Time Is Up

Once your bankruptcy has been completed and the seven- or 10-year clock has expired, review your reports again to make sure the bankruptcy was removed.

A bankruptcy should fall off your credit reports automatically, but if it doesnt, notify the credit bureaus and ask to have the bankruptcy removed and your reports updated.

Dont Miss: How Many Bankruptcies For Donald Trump

How A Bankruptcy Damages Credit

It is important to note that there are two types of bankruptcy, and these are a Chapter 7 and a Chapter 13 bankruptcy. With a Chapter 7 bankruptcy, all of the debts that are included in the bankruptcy are forgiven, and repayment of the debts is not required.

With a Chapter 13 bankruptcy, a debt repayment plan is created, although the full amount of debt may not be repaid to creditors. With both types of bankruptcy, all debt collection efforts will cease, and the individual will no longer feel the pressure associated with owing creditors money.

However, the events leading up to the filing of bankruptcy generally will include numerous late payments on various types of accounts as well as collections accounts.

These factors alone can damage a credit rating, and many people who file for bankruptcy will already have a lower credit rating before filing. In addition, bankruptcy is also viewed as a derogatory credit item, and it can result in credit scores dropping even lower.

Recommended Reading: How Long Is A Bankruptcy On Your Credit Report

What Else Can Donotpay Do

DoNotPay can do a lot more than just removing bankruptcies from your credit report. Check out the other tasks you can complete with the help of DoNotPay:

- Stop wasting time and money on parking tickets! Appeals are possible for any violation in any city.

- Get rid of your unwanted services and subscriptions. We’ll cancel your gym membership, phone contracts, and more in minutes. Easy and hassle-free!

- When online shopping turns into a nightmare, you need chargebacks and refunds to get your money back. With our 100% customer satisfaction guarantee, you can get your money back for items bought on the internet.

- Free trials make it easy to try new products without the risk of paying for something you may not like.

Don’t delay – sign up for DoNotPay today!

Checking Credit Report Accuracy After Bankruptcy

Youre entitled to get a free credit report from the three major credit reporting agencies each year. You can claim your reports by visiting www.annualcreditreport.com.

Instead of getting them all at once, a prudent approach is to claim one report three months after receiving your bankruptcy discharge. That should allow enough time for creditors to report the bankruptcy information.

Thoroughly review each listed debt for accuracy. Also watch out for unfamiliar creditor names or debts, as they might be discharged debts that were bought and sold to a third party, but are not accurately reflected as having been discharged. To make changes, follow the instructions under the Correcting Misreported Discharged Debt heading.

Youll want to claim each of the remaining two credit reports at three-month intervals. Each time, check to see if the credit report reflects the previously requested changes, and, take steps to correct any remaining inaccurate information. This approach should allow you to clean up your credit report at no cost to you.

Recommended Reading: Will Credit Score Increase After Bankruptcy Falls Off

Hire A Credit Repair Specialist To Deal With The Bankruptcy

This is obviously a lot of work, and it may seem a bit overwhelming. You may feel like its too much to handle with everything else going on in your life.

In that case, you may want to procure the services of a quality credit repair company. You could also hire a good bankruptcy attorney.

Granted, its never a good feeling when you pay out of pocket to fix something that wasnt your fault.

Taking it on by yourself can be a big challenge, though. It will cost you in terms of time and money.

Someday, fraud and cybercrime might be a thing of the past. But, for now, its a part of life that many of us have to deal with at one time or another.

Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders you’re unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

Repossessions

Judgments

Collections

Also Check: What Are The Negatives Of Filing For Bankruptcy

How Long Can A Debt Collector Pursue An Old Debt

Each state has a statute of limitations about how long a debt collector can pursue old debt. For most states, this ranges between four and six years. These statutes govern the amount of time that a debt collector can sue you, but there is no limit to how long a collector has to try and collect on a debt. If you are being contacted about a debt that you believe is not yours or is outside the statute of limitations, do not claim the debt instead, ask the company to validate that the debt is yours.

Discount For Family Members Couples And Active Military

Lexington Law is now offering $50 off the initial set-up fee when you and your spouse or family members sign up together. The one-time $50.00 discount will be automatically applied to both you and your spouses first payment.

Active military members also qualify for a one-time $50 discount off the initial fee.

Recommended Reading: Where Can I Buy Liquidation Pallets

Causes Of Bankruptcy Dismissal

Here are some specific reasons your bankruptcy case might be dismissed:

- Failure to comply with court rules

- Procedural violations

- Fraud against creditors, lenders, or courts

- Failure to make court appearances or attend creditors meetings

- Failure to pay filing fees or installment payments

- Prior cases, prior dismissals, and prior discharges

- Failure to make timely plan payments in a Chapter 13 case