Estimated Home Loan Eligibility

| Your DTI is very good. Having a DTI ratio of 36% or less is considered ideal, and anything under 20% is excellent. | Your DTI is good. Having a DTI ratio of 36% or less is considered ideal. | Your DTI is OK. It’s under the 50% limit, but having a DTI ratio of 36% or less is considered ideal. Paying down debt or increasing your income can help improve your DTI ratio. | Your DTI is over the limit. In most cases, 50% is the highest debt-to-income that lenders will allow. Paying down debt or increasing your income can improve your DTI ratio. |

|---|---|---|---|

| Remaining |

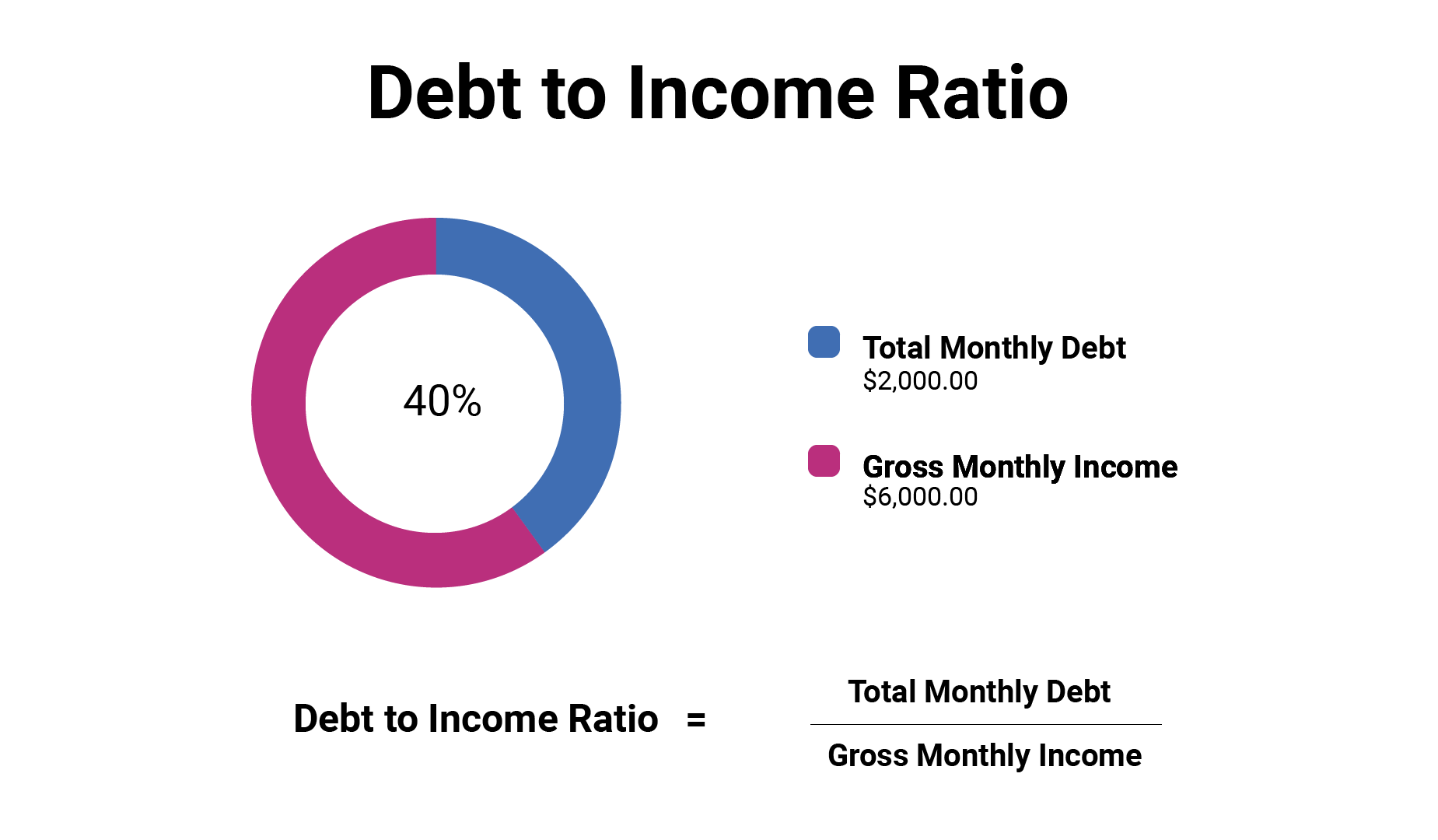

Your debt-to-income ratio measures your monthly debt obligations in comparison to your monthly gross income, or the amount of money you earn before taxes. Its calculated by dividing your minimum monthly debt payments by your monthly gross income, and its expressed as a percentage.

When you go through the mortgage application process, lenders review your DTI ratio to assess whether you can handle monthly mortgage payments in addition to your current monthly obligations. If you dont meet a lenders minimum DTI ratio requirements, you might not be approved for a mortgage loan. A debt-income ratio calculator can help you crunch the numbers.

Debt To Income Ratio Explained

If the ratio obtained is higher than expected, the banks and financial institutionsFinancial InstitutionsFinancial institutions refer to those organizations which provide business services and products related to financial or monetary transactions to their clients. Some of these are banks, NBFCs, investment companies, brokerage firms, insurance companies and trust corporations. read more do not agree to offer finances in such a scenario. A higher DTI ratio indicates the debts and liabilities are considerably higher, and another loan would be difficult to manage for a borrower. On the other hand, when the debt to income ratio for mortgage is low, lenders know they will receive payments on time.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Debt to Income Ratio

The DTI ratios are of two kinds front-end ratios and back-end ratios. The front-end ratios include the portion of the gross monthly income used for repaying mortgage installments, rent, property taxes, insurance, etc. On the contrary, the back-end ratios mark all recurring payments that borrowers are liable to pay, including those under the front-end ratios category.

Lower Your Debt Payments

For most people, attacking debt is the easier of the two solutions. Start off by making a list of everything you owe. The list should include credit card debts, car loans, mortgage and home-equity loans, homeowners association fees, property taxes and expenses like internet, cable and gym memberships. Add it all up.

Then look at your monthly payments. Are any of them larger than they need to be? How much interest are you paying on the credit cards, for instance? While you may be turned down for a debt consolidation loan because of a high debt-to-income ratio, you can still consolidate debt with a high DTI ratio with nonprofit debt management. With nonprofit debt management, you can consolidate your debt payments with a high debt-to-income ratio because you are not taking out a new loan. You still qualify for lower interest rates, which can lower your monthly debt payments, thus lowering your ratio.

Remember that improving your DTI ratio is based on debt payments, and not debt balances. You can lower your debt payments by finding a debt solution with lower interest rates or a longer payment schedule.Other alternatives worth considering to lower your expenses and pay off debt:

Most important, make a realistic budget designed to lower your debt and stick with it. Once a month, recalculate your debt-to-income ratio and see how fast it falls under 43%.

Also Check: When Does A Company File For Bankruptcy

Whats Included In Your Dti Ratio

Our tool calculates your back-end DTI ratio using potential mortgage payments and the following recurring debts:

-

Auto loans

-

Child support and alimony

-

Personal loan or other monthly debts

Of course, these probably arent your only monthly expenses. Your back-end DTI ratio can also include what you spend on food, utilities, gas, insurance or entertainment, in addition to proposed mortgage payments. Although lenders may not inspect your back-end ratio to this detail, its important to look carefully at these costs so your true monthly financial obligations are represented.

Ideally, your total DTI ratio should be under 36%. Keep this in mind when deciding what affordable means for you.

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

Also Check: Interest On National Debt 2021

Front End And Back End Ratios

Lenders often divide the information that comprises a debt-to-income ratio into separate categories called front-end ratio and back-end ratio, before making a final decision on whether to extend a mortgage loan.

The front-end ratio only considers debt directly related to a mortgage payment. It is calculated by adding the mortgage payment, homeowners insurance, real estate taxes and homeowners association fees and dividing that by the monthly income.

For example: If monthly mortgage payment, insurance, taxes and fees equals $2,000 and monthly income equals $6,000, the front-end ratio would be 30% .

Lenders would like to see the front-end ratio of 28% or less for conventional loans and 31% or less for Federal Housing Association loans. The higher the percentage, the more risk the lender is taking, and the more likely a higher-interest rate would be applied, if the loan were granted.

Back-end ratios are the same thing as debt-to-income ratio, meaning they include all debt related to mortgage payment, plus ongoing monthly debts such as credit cards, auto loans, student loans, child support payments, etc.

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

Recommended Reading: File Emergency Bankruptcy Online

Divide That Total By Your Gross Monthly Income

Once you have an idea of what your monthly debt total is, divide it by your gross monthly income to determine your DTI ratio. Your gross monthly income is the amount of money you make each month before taxes. You can usually find your gross income on your paystubs or you can calculate it.

If you are a salaried employee, you can divide your yearly salary by 12 to find your gross monthly income. If you are paid hourly, multiply your hourly rate by the number of hours you work in a week and then multiply that number by 52 to get your yearly income, which you can divide by 12 to get your monthly gross income.

Once you know your monthly gross income, you should be able to use it to find your DTI. If you make $4,000 a month as your gross income and your total debts amount to $1,200, the formula to calculate your DTI would look like this:

= 0.3, or 30%

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

You May Like: What Can They Take In Bankruptcy

How Does The Dti Affect Your Finances

That could also apply to companies. However, companies usually have the whole process automated. It is interesting to focus on what it means for individuals as it can easily extrapolate to companies.

It usually goes to 28% as the ideal percentage for the initial relationship. Remember that this was the one that referred to housing costs.

On the other hand, a maximum of 36% will be considered an acceptable amount for the final ratio.

You should not think, in any case, that this will mean that you will not be granted a loan if you exceed these percentages. Other factors such as your credit score, property, savings, etc., will play a role here.

How Is The Debt

The debt-to-income ratio can be calculated using these two formulas:

Gross debt service ratio

This corresponds to the percentage of your gross income that goes towards housing fees for the home youre looking to buy. Generally speaking, you need a GDS between 32% and 39% to get a loan, but your bank may require a lower ratio.

To calculate it:

1. Add up your monthly occupancy expenses: Mortgage payments + municipal taxes + school taxes + heating and electricity + 50% of the condo fees . 2. Multiply the total by 100. 3. Divide the new total by your gross monthly income.

Total debt service ratio

This is the percentage of your gross monthly income that goes towards housing fees for the home youre looking to buy, in addition to your other debts. Your TDS shouldnt exceed 44%, but a lender may require a lower ratio. Usually, a TDS under 40% is good enough to get a loan.

To calculate TDS:

1. Add up your monthly occupancy expenses: Mortgage payments + municipal taxes + school taxes + heating and electricity + 50% of the condo fees . 2. Add your other monthly financial commitments to this total: Loans, typically 3% of the limit on each of your credit cards and lines of credit , child support and alimony, as well as any other debt payments. 3. Multiply the total by 100. 4. Divide the new total by your gross monthly income.

To calculate these ratios, you can use the Canada Mortgage and Housing Corporations debt service calculator.

Recommended Reading: What Is The National Debt In The United States

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

Breaking Down The Dti Ratio

Lenders often evaluate two different DTI ratios: the front-end ratio and the back-end ratio.

The front-end ratio, sometimes called the housing ratio, shows what percentage of a borrowerâs monthly income is used for housing expenses. This ratio could include monthly mortgage payments, homeowners insurance, property taxes and homeowners association dues.

The back-end ratio is the amount of a borrowerâs income that goes toward housing expenses plus other monthly debts. And it can include revolving debts such as credit card or car payments, student loans and child support.

Lenders typically say the ideal front-end ratio should be no more than 28%, and the back-end ratio, including all expenses, should be 36% or lower. In reality, depending on your credit score, savings, assets and down payment, lenders may accept higher ratios, depending on the type of loan youâre applying for.

Recommended Reading: What Can You File Bankruptcy On

If Your Dti Is Less Than 36%

Youre in great shape. Approval for most loans, including car loans and consolidation loans should be easy. Even mortgage approval should go smoother with a DTI in the optimal range. However, a great DTI ratio does not guarantee the best loan terms . As such, in addition to ensuring that your debt-to-income percentage stays low, make sure your credit score is healthy by maintaining a low credit utilization rate, making on-time payments, and keeping credit inquiries to a minimum.

How Do You Manage The Relationship Between Income And Debts

There are many formulas for both personal and business finances to improve the relationship between income and financial debts.

However, there are at least three aspects of improvement that you should take into account. All these areas of improvement always consider an initial factor: the need to create budgets to manage your finances.

The first aspect would be to have a clear plan for debt repayment. Numerous formats allow you to deal with debts in a more or less simple way, from the more aggressive methods such as the avalanche method to the slower ones such as the snowball method.

The second aspect would be to improve the conditions of your financial debt. We have contracted financial products that have become obsolete in the market on many occasions. If they are expensive or have high-interest rates, we should try to negotiate these debts. Sometimes it may even be more interesting to consolidate the debt through debt consolidation.

Finally, a crucial aspect is not to take on more debt. Please do not take on more credit, increasing the DTI index and worsening the credit score.

Don’t Miss: How Many Times Has Sears Filed Bankruptcy

How Does Our Income

To calculate your DTI ratio using our income-debt ratio calculator, enter the following information:

Annual gross income: Enter your annual gross income the total amount you earn per year before taxes and deductions are taken out. If you dont know what your annual income is, estimate it based on your average monthly income.

Minimum monthly credit card payment: This is the amount on your credit card bills you must pay, at a minimum, each month.

Auto loan payment: Include your auto payment for a leased or purchased vehicle, along with any monthly payments toward a spouse or another family members vehicle.

Other loan obligations: Also include any other loan obligations you may have, such as student loans, personal loans, home equity loans, and other debts that appear on your credit report.

After inputting these numbers, our calculator will show you how much money you have left over each month after paying your total monthly debts and your estimated maximum mortgage payment.

The more money you have remaining after paying your existing monthly debts, the more you can afford in a monthly mortgage payment. However, its important not to overextend your housing budget. Consider the other costs of homeownership homeowners association dues, maintenance, repairs, and future improvements when figuring out a comfortable monthly housing payment.

Why Do I Need To Know My Debt

Lenders view your debt-to-income ratio as a good predictor of your ability to manage your recurring monthly bills along with the potential monthly payment on the loan they might give you. If you plan on borrowing money, its wise to know your DTI and how to reduce your ratio of debt compared to income.

For instance, when applying for a credit card, lenders look at more than just your credit score and credit history to determine if youre capable of adding another credit card payment to your debt-to-income load. If your DTI is high, they might deny another card.

Do You Know? Are Trade Deficits Good or Bad for the US?

When applying for a mortgage loan, lenders will look at your debt-to-income ratio to consider your ability to repay. If your DTI is high, they might require extra safeguards as part of the loan agreement, such as a bigger down payment or proof of adequate savings or cash reserves.

Bonus Offer: Bank of America $100 Bonus Offer for new Online Checking Accounts. See page for details.

You can lower your DTI ratio by increasing your income you might decide its time to seek a higher-paying job or ask for a raise. You can also lower DTI by reducing your debt load. If you get a windfall or large tax refund, consider paying off a high payment or high-interest loan or credit card. Or you can use a combination of both to reduce your debt.

Read More: National Debt and Deficit What Is It and How Does It Affect Me?

Don’t Miss: Can You Rent An Apartment With A Bankruptcy

How To Understand Your Dti Ratio

Your DTI can help you determine how to handle your debt and whether you have too much debt.

Heres a general rule-of-thumb breakdown:

-

DTI is less than 36%: Your debt is likely manageable, relative to your income. You shouldnt have trouble accessing new lines of credit.

-

DTI is 36% to 42%: This level of debt could cause lenders concern, and you may have trouble borrowing money. Consider paying down what you owe. You can probably take a do-it-yourself approach two common methods are debt avalanche and debt snowball.

-

DTI is 43% to 50%: Paying off this level of debt may be difficult, and some creditors may decline any applications for more credit. If you have primarily credit card debt, consider a . You may also want to look into a debt management plan from a nonprofit credit counseling agency. Such agencies typically offer free consultations and will help you understand all of your debt relief options.

-

DTI is over 50%: Paying down this level of debt will be difficult, and your borrowing options will be limited. Weigh different debt relief options, including bankruptcy, which may be the fastest and least damaging option.

Debt-to-income ratio, or DTI, divides your total monthly debt payments by your gross monthly income. The resulting percentage is used by lenders to assess your ability to repay a loan.

To calculate debt-to-income ratio, divide your total monthly debt obligations by your gross monthly income.