The Older Your Debt Is The Less Reason There Is To Settle

Every state has a statute of limitations on how long a debt collector has to sue you in civil court to force repayment of a debt. The maximum statutes are 10 years. So, regardless of where you live theres no more than a 10-year window where a collector can take you to court to collect on a debt.

You should check with your state Attorney Generals office to find out what the specific statute of limitations is for your state. If your debts are old and close to that statute, theres less reason to pay them anything. After 10 years they can still contact you to attempt to collect, but they have no legal recourse. And if you tell them to stop contacting you, they must honor that request.

If you have any debts that over that statute and the collector is still bothering you, send them a cease and desist letter using the template you can find below. Just be careful to keep the wording close to what it says in the template. If youre not careful and you acknowledge that you owe the debt in any way, you can actually reset the clock on the statute of limitations!

If You Get A Debt Relief Mailer From Negotiations Department Trash It

A reader sent me in a mailer they received from the Negotiations Department of some company.

Do You Have a Question You’d Like Steve to Answer? .

The mailer has two possibilities:

The mailer isnt much different than others that have been sent out over the years. Mailers like these redesigned to draw unsuspecting consumers into calling and getting a debt settlement sales pitch. The mailer makes statements that are nothing more than unverifiable claims.

Here are all the things I could locate in the mailer that could be true.

I cant even tell you if the disclaimer on the bottom is factual since the company soliciting people to call does not identify themselves.

What a load of crap.

This mailer was sent to me through my I Buy Junk Mail program. If you have junk mail youd like to sell, . To see other mailers, .

Why Do Creditors Accept Settlement Offers

With a secured loan, like a mortgage or auto loan, the lender may have a right to claim the collateral and wont be as willing to settle. But theres no collateral with unsecured loans, , personal loans, and medical bills. Creditors can either send your accounts to collections, sue you for nonpayment, or sell the debt to a third-party debt buyer or collector.

Sending an account to collections isnt free, as the company will have to pay operational costs for in-house collections or a fee to third-party collectors. Hiring attorneys to sue you for unpaid debts costs money as well. Even if the creditor can sell the right to collect the debt, it often wont recover the full amount you owe.

According to a Federal Trade Commission report on the debt buying industry from 2013, debt buyers paid an average of 4.0 cents per dollar of uncollected debt. The figure may include debts that have been sold and resold multiple times, which can lower their value. Still, as a borrower, you may see why you have some negotiating power.

If you offer your original creditor more than it could potentially make from a debt buyer, it may accept your offer even if its for less than the full amount owed. Similarly, if you offer a debt collector more than it paid for your debt, it may be making money even if you dont repay the debt in full.

Don’t Miss: How Do You Get A Bankruptcy Off Your Credit Report

If You Don’t Want To Settle

You dont have to take the offer. Maybe the settlement offer is too high or maybe youre just not interested in paying off this debt at this time. In either case, you dont have to respond to an offer youre not interested in taking.

As long as the debt remains unpaid, creditors or their debt collectors may continue collection efforts including listing the debt on your credit report if its within the credit reporting time limit. You can stop communication from a third-party debt collector by sending a written cease-and-desist letter.

If You Need Debt Assistance

Here is some helpful advice if you need help dealing with your debt:

Before working with a credit counselor, check with the Office of the Consumer Credit Commissioner to find a licensed counselor. Ask potential credit counselors exactly what they offer, whether they charge a fee for their services and how long it will take you to become debt free.

Read Also: Return Pallet For Sale

Settlement Fees Are High Compared To Other Debt Relief Options

The way that fee structures tend to work with accredited debt settlement companies is that you pay a percentage of the debt that was settled. This means fees usually range stack up to thousands of dollars, depending on how much you owe. Settlement fees are generally high compared with other solutions. For example, fees on a debt management program are capped at $79 per month and the average DMP client pays about $40.

But as the American Fair Credit Council explains, the cost savings of a settlement usually outweigh the fees. They provide this example:

Essentially, youre going to pay a debt settlement company a pretty penny to get you out of debt. But if the company does their job and gets you the best settlement possible, you should still save money.

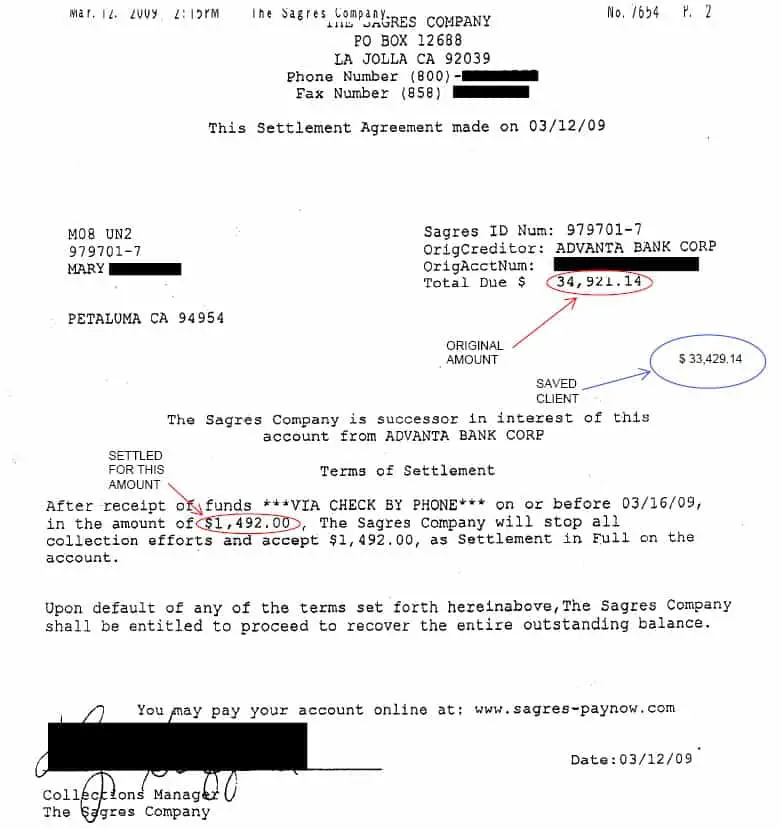

Beware Scam Settlement Offers

It’s important to be on the watch for fake settlement letters, sometimes even for fake debts. Before you pay any money on an unsolicited settlement offer, make sure youre dealing with a legitimate company and that the debt is yours. Then, you can proceed with payment if thats the action you want to take.

Spotting a fake settlement offer can be tough. Some signs the letter is not legit include misspelled words, improper grammar, vague references to “our client” or what happens after you settle, the absence of information about discharged debt being reported to the IRS, or directions to pay via wire transfer or another untraceable payment method. Fake settlement offers are more likely to come from collection agencies than from the original creditor.

You May Like: When Does Foreclosure Start

New Nys Amendment To Reduce Judgment Interest On Consumer Debt Can Be Very Helpful

Please see the attached amendment added to CPLR 5004 with regard to Consumer Debt judgments. All interest accrued on judgments for consumer debt is now at 2%, a significant decrease from the original 9%.

This new interest rate applies to all consumer debt judgments after 9/15/21. If a judgement was entered before that date, the interest a creditor may collect is 9% up to 9/15/21, and any interest collected after 9/15/22 is now only 2%.

New York will lower its interest rate on money judgments in actions involving consumer debt for the first time since 1981 after Gov. Kathy Hochul signed the Fair Consumer Judgment Interest Act on Dec. 31, 2021.

The goal of the law is to remedy hardships on consumers caused by the statutory judgment interest rate, which have increased during the COVID-19 pandemic.

The new law is one of three from New Yorks legislative session that impacts the accounts receivable management industry.

With the governors signature on the FCJIA, Section 5004 of the civil practice law and rules is amended to read as follows:

Scam Alert United Debt Services A Debt Consolidation Company To Avoid

Attorney and CEO of Credit Repair Lawyers of America

Recently, we received a letter from a debt consolidation company that raised a number of red flags. Clearly, the letter was written to readers into calling them. This smacks of bad business ethics right off the bat. Then, after looking for United Debt Services online, it was clear that Georgia consumers should avoid this company like the plague if they want to protect their credit scores.

Recommended Reading: National Credit Card Debt Relief

Make Payments Over Time

If you say you can pay the debt in monthly installments, the agency has little incentive to compromise for less than the full amount. It still has to chase you for payment, and it knows from experience that many people stop paying after a month or two.

Before a collection agency will consider accepting monthly installments, it might have you fill out asset, income, and expense statements. Two points to keep in mind:

- You could be giving the collection agency more information about you than it previously had, like where you currently work and bank, and that might not be to your advantage.

- Don’t lie. You might be signing these forms under penalty of perjury. It’s unlikely that you would ever be prosecuted for lying on the forms, but if the creditor later sues over the debt, lies can only hurt your case.

If you reach an agreement with the collector, get a written confirmation. For help in crafting a payment plan offer, get Nolo’s eForm Offer to Pay Debt in Installments.

What Are Debt Settlement/debt Relief Services And Should I Use Them

Debt settlement companies are companies that say they can renegotiate, settle, or in some way change the terms of a person’s debt to a creditor or debt collector. Dealing with debt settlement companies can be risky.

Debt settlement companies, also sometimes called “debt relief” or “debt adjusting” companies, often claim they can negotiate with your creditors to reduce the amount you owe. Consider all of your options, including working with a nonprofit credit counselor, and negotiating directly with the creditor or debt collector yourself. Before agreeing to work with a debt settlement company, there are risks that you should consider:

Warning: Debt settlement may well leave you deeper in debt than you were when you started. Most debt settlement companies will ask you to stop paying your debts in order to get creditors to negotiate and to collect the funds required for a settlement. This can have a negative effect on your credit score and may result in the creditor or debt collector filing a lawsuit while you are collecting settlement funds. And if you stop making payments on a credit card, late fees and interest will be added to the debt each month. If you exceed your , additional fees and charges may apply. This can cause your original debt to increase.

Avoid doing business with any company that promises to settle your debt if the company:

Recommended Reading: Can You Lose Your 401k In Bankruptcy

Proof That United Debt Services Isnt The Company It Claims To Be

So, what about this company? Is United Debt Services a legitimate company that just uses unsavory means to get customers in the door? No. By most accounts, this is an unscrupulous organization that has been exploiting indebted consumers nationwide, for over six years. After pouring over dozens of complaints and reviews, three major details stood out.

- UDS sends letters to consumers in states where they are NOT licensed to operate.

- The company has urged past clients to stop paying their credit card bills so that they would default. UDS then negotiated with debt collectors in order to reduce the amount owed by the consumers, but at the price of their credit scores.

- Several consumers have complained that UDS collected money from them, but paid nothing to their creditors.

Honestly, if you need debt consolidation services, there are plenty of good companies out there. We can even recommend a few.

If, on the other hand, you want to improve your credit score, request copies of your credit reports from the three major credit bureaus TransUnion, Experian, and Equifax. Look over your credit reports and circle any errors that you find. Unfortunately, lot of Georgia consumers dont realize that about 80% of consumer credit reports contain inaccuracies of some type. Also, these mistakes can hurt your credit score.

If Your Monthly Credit Card Payment Rivals Your Mortgage Or Rent Or If High Interest Rates Are Making It Impossible For You To Get Rid Of The Debt It Might Be Time To Negotiate With Your Credit Card Company

On average, people hold around $3,100 in credit card debt, according to a 2019 Credit Karma analysis. And with a median household income of $61,937, according to 2018 Census Bureau data, most Americans likely use a substantial portion of their earnings to pay down consumer debt.

But when this debt becomes an unbearable financial burden, what can you do? One option may be to try to negotiate with your credit card company.

Credit card companies are about collecting the money. Theyre going to size this up and if they say, This is a person who sounds like a good risk and is likely to eventually repay this bill, then theyre likely to make concessions, says Mike Sullivan, a personal finance consultant with Take Charge America, a national nonprofit credit counseling agency.

If youre drowning in credit card debt, it may take a phone call to your credit card company to devise a workable solution. Dont know where to start? Heres a guide for how to negotiate with your credit card company.

Recommended Reading: How Do You Know When Bankruptcy Is Discharged

Make A Debt Settlement Offer To The Creditor

Once you think you have enough money saved up to settle an account, you can call your creditor and make an offer. In some cases, the creditor may have already sent you a settlement offer. You could accept the offer, or respond with a lower counteroffer.

Whether youve lost your job or are dealing with medical bills, share why you can only afford the settlement amount youre offering. To avoid confusion, make sure the offer is for a specific dollar amount rather than a percentage of your balance.

If the creditor doesn’t agree to settle, you may want to wait until it sells the debt and try again with the debt buyer or collection agency.

Debt Settlement Proposal Letter Template

For many of us, writing a letter can feel very strange in this digital age especially when its such an important one. To help, we have created an example of a debt settlement proposal letter below that you can use as a guide.

Simply copy and paste this into a Word document and fill out the blank sections or tailor it to suit your needs:

|

Account Number: Dear Sir/Madam, I am writing to you regarding the money you are claiming payment for, on the above account. I am unable to repay this amount in full due to I can instead offer the total amount of £ as a full and final settlement. If this is accepted, you agree that you or any associate company can take no further action against myself to enforce or collect this debt and that I will be released from all liability. Please also confirm that you will also mark my credit reference agency file to show that you have accepted the above amount as the full and final settlement and that the account is closed and paid. I am able to pay the amount I have offered within once you have accepted my offer and I have received written agreement of this. Please confirm where to make payment to. Yours faithfully, |

This letter clearly states your intentions and what you need the creditor to do. We recommend you follow the same structure or use this as a template if you wish to offer a debt settlement.

GET FREE DEBT HELP

Fill in our simple, 3-step form to get immediate debt help and advice.

HOW WE CAN HELP:

GET FREE HELP ONLINE

Read Also: What Do You Lose In Bankruptcy

Us Bank Settlement Letter

Each year the negotiations team reaches many settlements with creditors. The settlements are negotiated based on the funds that the clients have available to reach either a lump sum or in some cases installments on the settlement amounts.

Please click on the year below to expand and view a few of the many settlement letters that are reached each year. If you have a different creditor and would like to see a sample settlement letter from that creditor, please feel free to request a prior settlement letter with that creditor from your CuraDebt counselor.

Please keep in mind that future results are not guaranteed, but experience of over 12 years gives the CuraDebt team more experience than most any other company in the industry, with the goal of saving you the most money as quickly as possible based on your funds available.

Find out how much you could save in just minutes. No commitment.

Why Georgia Consumers Should Avoid United Debt Services

The letter we received from United Debt Services is typed out on pink paper and looks official. Although, its really a mass-produced and cheaply printed thing. Yet, there are parts of the letter that might induce panic in Georgians who are struggling with debt and worried about being contacted by debt collection agencies.

At the top of this notice from United Debt Services are the words RE: Bank of America, Discover, Capital One, American Express, Wells Fargo. This could easily lead someone to believe that this is a letter that pertains to an account that belongs to them. Next, there is an address labeled Department of Negotiations. Sounds official, doesnt it? It isnt.

The body of this letter starts with This is our second attempt to contact you, which is clearly meant to induce a sense of urgency in the reader. Finally, any Georgian reading the letter will find their eyes drawn to the **Failure to Call** warning located dead center on the page. This could prompt a busy consumer to just call the number provided without reading the rest of the flyer and thats all that this nasty little letter really is. Its a flyer that promotes a service. While theres nothing WRONG with sending out flyers to promote a business, it is shameful to trick Georgia residents into calling the company ANY company.

Don’t Miss: What Happens When A Business Files For Bankruptcy