Creation Of The Debt Ceiling

Congress used to exercise its borrowing authority by passing legislation to allow borrowing for specific purposes, often directing details of debt issues such as interest rates, maturities, and type of financial instruments. As the debt grew, Congress began providing the Treasury Secretary with greater leeway. Legislation enacted in 1917 to help finance the costs of World War I gave Treasury greater flexibility and first placed a limit or debt ceiling on combined debt issues. However, that legislation retained separate borrowing limits for some previous issues. Subsequent amendments to the 1917 law increased Treasurys flexibility and, by 1941, the modern debt ceiling was in place. Congress has regularly increased the limit since then.

The debt ceiling does not affect federal spending or the amount we need to borrow. Those levels are determined by previous spending and tax decisions by Congress. Instead of limiting future debt, failure to increase the debt ceiling would make Treasury unable to honor existing commitments and execute the laws already passed by Congress, forcing a default.

National Debt For Selected Years

| Fiscal year | |

|---|---|

| 130.6% | 21,850 |

On July 27, 2018, the BEA revised its GDP figures in a comprehensive update and figures back to FY2013 were revised accordingly.

On June 25, 2014, the BEA announced: “n addition to the regular revision of estimates for the most recent 3 years and for the first quarter of 2014, GDP and select components will be revised back to the first quarter of 1999.

Fiscal years 19402009 GDP figures were derived from February 2011 Office of Management and Budget figures which contained revisions of prior year figures due to significant changes from prior GDP measurements. Fiscal years 19502010 GDP measurements were derived from December 2010 Bureau of Economic Analysis figures which also tend to be subject to revision, especially more recent years. Afterwards the OMB figures were revised back to 2004 and the BEA figures were revised back to 1947.

Fiscal years 19401970 begin July 1 of the previous year fiscal years 19802010 begin October 1 of the previous year. Intragovernmental debts before the Social Security Act are presumed to equal zero.

19091930 calendar year GDP estimates are from MeasuringWorth.com Fiscal Year estimates are derived from simple linear interpolation.

Audited figure was “about $5,659 billion.”

Audited figure was “about $5,792 billion.”

Audited figure was “about $6,213 billion.”

Audited figure was said to be “about” the stated figure.

Audited figure was “about $7,918 billion.”

Audited figure was “about $8,493 billion.”

Tracking The Federal Deficit: July 2019

The Congressional Budget Office reported that the federal government generated a $120 billion deficit in July, the tenth month of Fiscal Year 2019. This makes for a total deficit of $867 billion so far this fiscal year, 27 percent higher than over the same period last year . Total revenues so far in Fiscal Year 2019 increased by 3 percent , while spending increased by 8 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Increased revenues were driven mostly by a 7 percent increase in payroll taxes due to the strong labor market that has resulted in continued job growth and rising wages. On the spending side, outlays for Social Security, Medicare, and Medicaid increased by a combined 6 percent . Department of Education outlays rose by 79 percent , mostly due to an upward revision to the net subsidy costs of previously issued student loans. Finally, net interest payments on the federal debt continued to rise, increasing by 14 percent versus last year due to higher interest rates and a larger federal debt burden.

You May Like: Pallets Of Clothes For Sale

Deficit Doves Vs Hawks

Does a balance sheet that looks more and more like Italys really pose a threat? Not according to economists such as Larry Summers, the former Treasury secretary, and Jason Furman, a top adviser under President Obama, who argue that America needs a lot more stimulus spending and can easily afford it because interest rates will stay extremely low for many years to come, owing in part to a global savings glut that will keep foreigners buying our Treasuries at bargain yields far into the future. But as Riedl points out, shouldering over $23 trillion in debt by late next year poses big risks. The CBO is forecasting that the yield on 10-year Treasuries goes from todays just over 1% to 4.4% over the next 30 years, he says. At that point, interest would be absorbing half of all revenues. We could get there a lot faster because accumulating so much debt could prompt borrowers to demand higher yields as compensation for the growing danger of holding U.S. debt. It takes a lot of hubris to risk your solvency on the assumption rates stay unusually low forever.

How much confidence theyll still have in the worlds reserve currency is anybodys guess.

Us National Debt Tops $30 Trillion For First Time In History

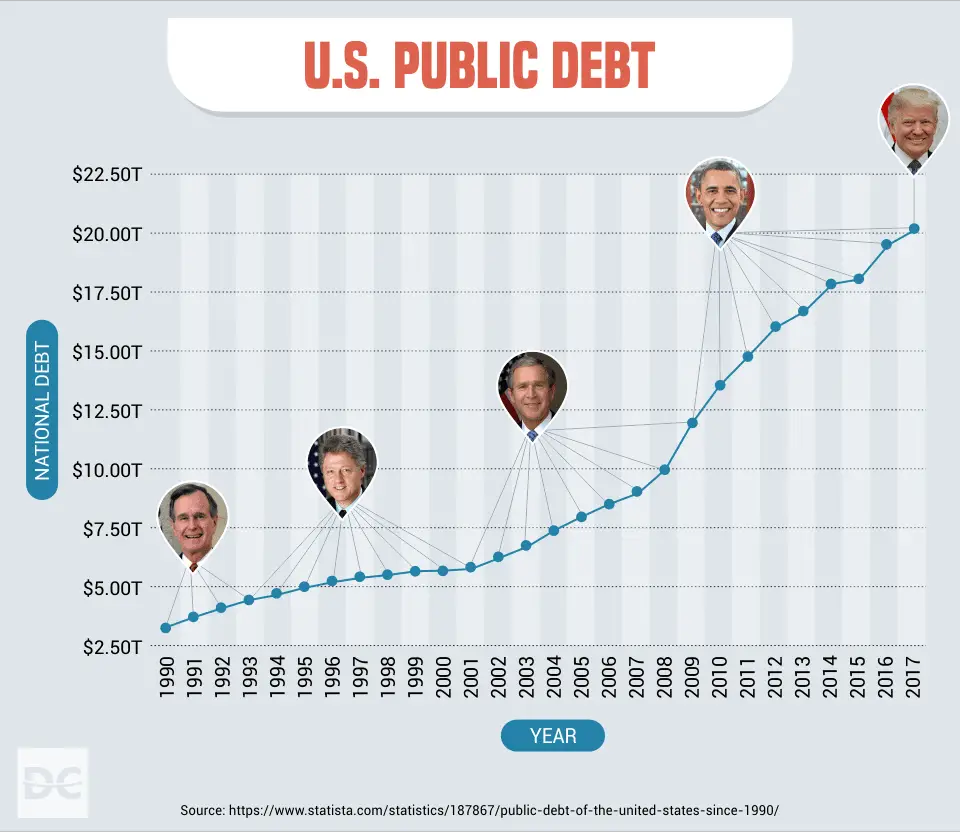

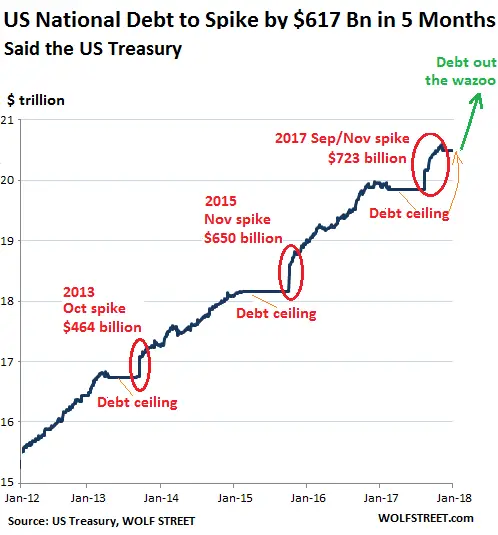

The Treasury Department this week reported that the total national debt of the United States surpassed $30 trillion for the first time in history, an amount equal to nearly 130% of America’s yearly economic output, known as gross domestic product. The eye-popping figure makes the U.S. one of the most heavily indebted nations in the world. The federal debt has been high and rising for decades, but the federal government’s response to the coronavirus pandemic, which involved massive infusions of cash into the U.S. economy, greatly accelerated its growth. At the end of 2019, prior to the pandemic, the national debt stood at $22.7 trillion. One year later, it had risen by an additional $5 trillion, to $27.7 trillion. Since then, the nation has added more than $2 trillion in further debt. A grim reminder

While the $30 trillion figure, by itself, has no significant meaning, it may serve to focus attention on what some see as a major concern for the future health of the country. “Hitting the $30 trillion mark is a reminder of just how high our debt is and just how much we’ve been borrowing,” said Marc Goldwein, senior vice president and senior policy director for the Committee for a Responsible Federal Budget.

Don’t Miss: The United States Debt

Relevance Of Debt Ceiling

There is a debate about whether the debt ceiling is useful or needed. Some argue that the debt ceiling is outdated, given the central role that Treasury debt now plays in the global financial system and that we now have a formal congressional budget process that gives Congress a regular opportunity to review and modify overall fiscal policy. Eliminating the debt ceiling would prevent Members of Congress from threatening the full faith and credit of the United States and holding our economy hostage in order to force action on other legislation, and it would allow fiscal debates to take place without the threat of a looming financial crisis. Others argue that Congress should retain control over the debt ceiling as a matter of Congressional prerogative.

The Senate never had a version of the Gephardt Rule. It responded in different ways to House resolutions passed under this rule, sometimes passing them, sometimes ignoring them, and sometimes amending them, requiring another House vote on a revised resolution.

Tracking The Federal Deficit: December 2018

The Congressional Budget Office reported that the federal government generated an $11 billion deficit in December, the third month of Fiscal Year 2019, for a total deficit of $317 billion so far this fiscal year. If not for timing shifts of certain payments, the deficit in December would have been roughly $32 billion, according to CBO. Decembers deficit is 52 percent lower than the deficit recorded a year earlier in December 2017. Total revenues so far in Fiscal Year 2019 increased by 0.1 percent , while spending increased by 9.4 percent , compared to the same period last year.

Analysis of Notable Trends in December 2018: Revenue from customs duties spiked by 83 percent from October-December 2018, relative to the same period in 2017, due to the administrations imposition of new tariffs. Conversely, corporate income tax revenue declined by 15 percent from October-December 2018 relative to the same period in 2017. This dip mainly reflects the reduction of corporate tax rates enacted in the Tax Cuts and Jobs Act of 2017. On the spending side, interest payments on the federal debt in December 2018 rose by 47 percent relative to December 2017.

Read Also: Repo Houses For Sale

Tracking The Federal Deficit: January 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $165 billion in January, the fourth month of fiscal year 2021. This months deficitthe difference between $552 billion of spending and $387 billion of revenuewas $132 billion greater than last Januarys. But federal finances deteriorated more than the raw numbers suggest. Adjusting for shifts in the timing of some payments, the deficit this January would have been $211 billion greater than last Januarys. The federal deficit has now reached $738 billion so far this fiscal year, an increase of 120% over the same point last year . Compared to the same point last fiscal year, cumulative revenues have ticked up 1%, but cumulative spending has surged 27%mostly due to the COVID-19 pandemic and the federal response to it.

Increased spending so far this fiscal year has likewise mostly resulted from pandemic relief. About 60% of the increase in cumulative year-to-date spending has come from refundable tax credits and unemployment insurance benefits . Outlays from the Public Health and Social Services Emergency Fund are also up $26 billion compared to the first four months of fiscal year 2020, and Medicaid spending is $29 billion greater.

Revenues rose 4% from last January, thanks to greater revenue from individual income, payroll, and corporate income tax revenue.

Why Counting Votes On Election Night Will Take Some Time

Analysis from CNN’s David Chalian

CNN political director David Chalian explained why counting votes on election night will take some time, including in states like Pennsylvania where a high-stakes Senate race could determine which party controls the chamber.

“In Pennsylvania, the election officials are not even allowed to open and process the absentee ballots until polls open on election day. So it takes awhile then for them to process them, sort them, get them counted and report them out,” he said.

Chalian noted that Republicans tend to show up in larger numbers on election day to vote in person. Meanwhile, Democrats tend to show up in larger numbers in the pre-election period or vote absentee by mail.

On election night, Pennsylvania “will start filling in probably very red and then as those absentee ballots, which tend to be more Democratic in nature, get counted, get processed and counted and reported then the blue will start filling in and we’ll get a more realistic picture of what’s going on there,” Chalian said, as CNN’s Brianna Keilar noted that what unfolds early on during election night could change drastically as time progresses.

Watch the full analysis:

Recommended Reading: How Long Does Bankruptcy Show On Credit Report

Tracking The Federal Deficit: June 2019

The Congressional Budget Office reported that the federal government generated an $8 billiondeficit inJune, theninth monthof Fiscal Year 2019, for a total deficit of$746 billionso far this fiscal year. If not for timing shifts of certain payments, Junes deficit would have been $57 billion, which is $28 billion larger than the adjusted deficit forJune 2018. Total revenues so far inFiscal Year 2019increased by3 percent , while spending increased by7 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Individual and payroll taxes together rose by 3 percent , reflecting an expanding economy and a low unemployment rate. Furthermore, customs duties increased by 77 percent versus last year, primarily due to the imposition of new tariffs. On the spending side, Social Security expenditures increased by 6 percent compared to last year due to increases in the number of beneficiaries and the average benefit payment. Finally, net interest payments on the federal debt continued to rise, increasing by 16 percent versus last year due to higher interest rates and a larger federal debt burden.

Tracking The Federal Deficit: May 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $132 billion in May, the eighth month of fiscal year 2021. Mays deficit was the difference between $463 billion of revenue and $596 billion of spending. To note, May spending was impacted by May 1 falling on a weekend, shifting certain payments into April that are normally paid at the beginning of May. If not for these timing shifts, the May deficit would have been $192 billion.

So far this fiscal year, the federal government has run a cumulative deficit of $2.1 trillion, the difference between $2.6 trillion of revenue and $4.7 trillion of spending. This deficit is 10% greater than at the same point in FY2020when only three months of pandemic-related spending had occurredand 179% greater than at this point in FY2019.

Analysis of notable trends: The pandemic response continues to disrupt normal spending and revenue patterns. Individual income taxes are usually paid in April however, in both 2020 and 2021, the federal government pushed back Tax Day due to COVID-19. This year, individual income taxes were due on May 17, compared to July 15 in 2020. Additionally, this year, estimated quarterly tax payments were due in April, whereas they were due in July in 2020. These shifting dates must be taken into account when considering year-over-year deficit comparisons.

You May Like: Did Boy Scouts File For Bankruptcy

Tracking The Federal Deficit: September 2020

Each September, the government receives substantial revenue from individual and corporate income taxes, which generally produces a monthly surplus. For example, the federal government recorded an $83 billion surplus last September . This year, however, greater spending in response to the pandemic and recession dominated the usual revenue increase, and the government ran a monthly deficit of $124 billion. This deficit was the difference between revenues of $372 billion and spending of $496 billion.

Revenue this September fell 1% from last September, the result of lost economic activity and policy changes allowing some taxes to be deferred or reduced. For instance, individual income and payroll taxes were 5% below last years level, while corporate income taxes fell 16%. Individual income tax refunds also increased by 68%, further lowering net revenue.

What Will Happen To Our National Debt

U.S. spending is currently at an all-time high to combat the effects of COVID-19. The current level of debt-to-GDP is comparable to the period immediately after World War II. Despite the effort to reduce the national debt, it is apparent and crucial for the government to take on the debt during times of crisis. Being able to adequately and successfully respond to emergencies is one of the many reasons why the national debt should be reduced governments should respond to events in an appropriate and timely manner with its citizens in thought.

You May Like: What Are Requirements For Filing Bankruptcy Chapter 12 And 15

Tracking The Federal Deficit: December 2020

The Congressional Budget Office estimates that the federal government ran a deficit of $143 billion in December, the third month of fiscal year 2021. This deficitthe difference between $346 billion of revenue and $489 billion of spendingwas made greater because January 3 fell on a Sunday, causing some payments normally made on that day to instead be made in December. If it were not for this timing shift, Decembers deficit would have been $96 billion, still $55 billion greater than that of December 2019. The deficit so far in fiscal year 2021 has climbed to $572 billion, which is $215 billion more than at this point last year. While revenues in these months were nearly unchanged from last year, outlays have grown by 16% .

Analysis of notable trends: December extended the pattern of fiscal year 2021, with little year-over-year change in revenue but a 17% rise in spending. Of all outlays, unemployment insurance benefitswhich totaled $3 billion last December but $28 billion this Decembercontributed the most to the spending increase. This has been a trend: Unemployment insurance benefits have caused almost 40% of greater cumulative spending from this point last year, soaring from $7 billion in the first three months of fiscal year 2020 to $80 billion so far this fiscal year. Decembers spending on Medicaid and Social Security benefits further added to the deficit.

Revenues rose 3% from last December, thanks to greater individual income and payroll tax receipts.

What Are The Primary Drivers Of Future Debt

The main drivers are still mandatory spending programs, namely Social Securitythe largest U.S. government programMedicare, and Medicaid. Their costs, which currently account for nearly half of all federal spending, are expected to surge as a percentage of GDP because of the aging U.S. population and resultant rising health expenses. Yet, corresponding tax revenues are projected to remain stagnant.

Meanwhile, interest payments on the debt, which now account for nearly 10 percent of the budget, are expected to rise, while discretionary spending, including programs such as defense and transportation, is expected to shrink as a proportion of the budget.

President Trump signed off on several pieces of legislation with implications for the debt. The most significant of these is the Tax Cuts and Jobs Act. Signed into law in December 2017, it is the most comprehensive tax reform legislation in three decades. Trump and some Republican lawmakers said the bills tax cuts would boost economic growth enough to increase government revenues and balance the budget, but many economists were skeptical of this claim.

The CBO says the law will boost annual GDP by close to 1 percent over the next ten years, but also increase annual budget shortfalls and add another roughly $1.8 trillion to the debt over the same period. In addition, many of the provisions are set to expire by 2025, but if they are renewed, the debt would increase further.

Read Also: How To Pay Collections

The Debt Ceiling: An Explainer

The Constitution grants Congress the sole authority to borrow on behalf of the United States. It has delegated that authority to the Executive Branch but placed a ceiling, or limit, on the total amount of debt that can be outstanding at one time.

Currently, the debt ceiling is slightly below $31.4 trillion. That limit is expected to cover federal borrowing needs until the early part of 2023, with the precise date depending on actual federal spending and revenue levels over the coming year. Treasury will be able to use extraordinary measures to continue normal operations for some period after that.

The debt ceiling does not constrain federal spending or the amount we need to borrow it simply restricts the Treasury Departments ability to honor financial commitments previously made by Congress and the President. Failure to set the debt ceiling at the level necessary to meet borrowing needs could jeopardize the full faith and credit of the United States by preventing the Treasury from paying the governments bills. This could take the form of failing to pay interest on, or redeem, Treasury Bonds when due, or failing to make scheduled payments for vital programs such as Medicare, Medicaid, Social Security, or veterans benefits.