If You Dont Find Any Errors Ask The Agency To Validate The Debt

In many circumstances, debts can get shuffled around from one third-party debt collector to another, sometimes several times over. Its not uncommon for inaccuracies to get transmitted to the debt collection agency. Also, documents verifying the original debt can get lost, too.

Once a debt ends up in collections, and you start to get communications about owing the debt, its totally acceptable to ask the debt collector to verify that the debt is valid and actually belongs to you.

Heres the information you should include in your request to validate the debt:

- Information about the original creditor and the original account

- Amount and age of the debt

- Supporting documentation like an original invoice, bill, promissory note or similar document to prove the debts validity

- Why the agency believes you owe the debt

- Whether or not they are licensed to collect debt in your state

Note, once you send the debt collector a written dispute or a written request to validate the debt within 30 days, they have to pause collecting the debt until they respond to your dispute or answer your request.

If the personal information attached to the debt, like your name, aliases, phone number, address, etc., cannot be accurately matched with the debt, it must be removed from your credit report. Also, if they cannot provide any proof the debt is valid, it must also be removed from your credit report.

A Call From A Debt Collection Agency Is A Call Nobody Wants To Receive But If You Become Significantly Delinquent On A Debt You May Need To Deal With A Debt Collection Agency In Order To Pay Back The Money You Owe

Before we go any further, lets agree on one thing: Unpaid debts can be stressful and confusing. You may not even be sure how your debt ended up with a debt collection agency in the first place. But its important to look beyond the potentially intimidating letters and phone calls to understand whats really happening and come up with a solution that works for you.

In this article, well go over how to make a payment to a debt collection agency. Heres a basic outline of the steps, in case youd like to jump ahead.

As An Alternative Hire A Credit Repair Company

If you go this route, make sure that youre dealing with a reputable company that uses effective, nonfraudulent ways to remove items from your credit report. Check sites like the Better Business Bureau, Trustpilot, the Consumer Financial Protection Bureau or Google Reviews to make sure the services dont engage in unethical, shady practices around .

Read Also: What Is A Contingent Claim In Bankruptcy

How To Improve Your Credit Scores After A Collection

The good news about collection accounts on your credit reports? As they age, they count less toward your credit scores. And even while you have a collection or collections on your credit reports, there are many other ways to improve your credit scores.

The best way to start improving your credit score is to prevent new derogatory information from appearing on your credit reports. You can achieve this by making all of your debt payments on time, without exception. If your bills are paid on time, your debts will never go into default and there will never be a need for a debt collector to get involved.

Ensuring that your credit card debt is as low as possible is another great way to improve your credit scores. Credit scoring models consider your , or amount of credit card balances relative to total credit limits, when calculating your scores. Maintaining low balances ensures a low utilization ratio, which can improve credit scores.

Finally, don’t apply for credit unless you need it. Each time you do so, the lender will likely pull one, if not more, of your credit reports. This will result in a hard inquiry on your reports, which can lower your scores temporarily. And while inquiries are the least influential factor in your credit scores, they can still be a red flag to lenders.

Ways To Pay Off A Debt In Collections

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Paying off a debt in collections can get debt collectors off your back and put you on the path to restoring your credit and reclaiming your finances.

Before you make a payment on a debt, first determine whether the debt is past the statute of limitations so you can handle it properly. If it’s not, you have three main options to pay off a debt in collections:

Create a payment plan.

Pay it off in one lump sum.

Settle the debt for less than you owe.

Heres a breakdown of each tactic to pay off a collection agency. No matter which route you take, make sure you get the agreement between you and the debt collector in writing to ensure both parties stick to the plan.

Don’t Miss: How To Find Bankruptcies On Public Records

Collection Accounts And Your Credit Scores

Reading time: 3 minutes

Highlights:

- If you fall behind on payments, your credit account may be sent to a collection agency or sold to a debt buyer

- You are still legally obligated to pay debts that are in collections

- Collections accounts can have a negative impact on credit scores

Past-due accounts that have been sent to a collection agency can be a source of confusion when it comes to your credit reports and credit scores. What does that mean? And if you pay off the accounts, can they be removed from your credit reports? Weve broken down what you need to know.

What is a collection account? If you fall behind on payments, the lender or creditor may transfer your account to a collection agency or sell it to a debt buyer. This generally occurs a few months after you become delinquent, or the date you begin missing payments or not paying the full minimum payment.

Typically, lenders and creditors will send you letters or call you regarding the debt before it is sent to a collection agency. You may not be notified if your account is being sold to a debt buyer, however. The collection agency or debt buyer will then attempt to collect the debt from you.

If your debt is sold to a debt buyer or placed for collection with a collection agency, you are still legally obligated to pay it. You may end up making payments directly to the collection agency or debt buyer instead of the original lender.

What Is A Statute Of Limitations On A Debt

If youre contacted by a debt collector before a statute of limitations on a debt runs out, you could be sued over your unwillingness to pay what you owe.Generally, a statute of limitations lasts from three to six years. According to the Consumer Financial Protection Bureau, it depends on the state, what type of debt you have and whether the state law attached to your situation is named within your credit agreement.

Also Check: Will Filing For Bankruptcy Stop A Judgement

What Are Your Rights

Debt collection calls are the cause of more complaints to the Federal Trade Commission than any other industry. Collectors in bad-faith have been known to harass consumers with phone calls and demand larger payments than what is legal, among other deceptive practices. Under a federal law known as the Fair Debt Collection Practices Act , this behavior is illegal.

The FDCPA gives consumers rights and protections when it comes to how an agency can conduct debt collection. The act protects consumers from abusive, deceptive and unfair debt collection practices such as limiting debt collection calls before evening hours, not allowing incessant calling or communication via postcard and prohibiting the use of violence or intimidating language from the debt collector.

Changes to the law are coming. In May 2019, CFPB Director Kathy Kraninger announced a proposal to change certain restrictions under the FDCPA, ranging from how collectors can contact consumers, when and how many times. In the future, collectors may be able to communicate via email and text messages, and would be limited to seven attempts of calls per week .

The proposal is described as an overhaul by industry experts with many different changes. Its expected to pass by the end of the year, so consumers should pay attention to the final changes.

How To Pay A Debt In Collections

At a glance

To pay off a debt in collections, youll need to confirm the validity of the debt , choose a payment strategy, and contact your debt collector.

Speak with our credit specialists today and start your path towards a better credit score.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. That’s our first priority, and we take it seriously. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

If you have a debt in collections, then the quickest way to minimize the damage to your credit is to pay it off as quickly as possible. However, figuring out where to start can be daunting.

Whether youve just noticed a collection account on your credit report or youve been trying to find a way to get debt collectors off your back, youll need to understand what exactly collections are, what payment options you have, and what your rights are.

Also Check: How Many Times Can I File Bankruptcy

What A Collection Agency Can Do

Collection agencies collect unpaid debts or locate debtors for others.

A collection agency or collector must:

- be licensed in Alberta

- use the name that is shown on their licence in all contacts and correspondence related to their collection activities

- provide you with information about the original creditor and current creditor of the debt and any details of the debt

- disclose in writing the fee the agency will charge for a non-sufficient funds cheque before the submission of the cheque

- provide a receipt for all cash transactions and payments made in person or at your request

- give you an account of the debt if you ask for it

- the accounting must include details of the debt

- agencies only have to give you this information once every 6 months

- if the agency cannot provide the accounting within 30 days from the request, they must cease collection activity until they can

A collector can:

- contact you at home between 7 am and 10 pm Alberta time

- contact your spouse, adult interdependent partner, relative, neighbour, friend or acquaintance to request your residential address, personal or employment telephone number

- contact you at work to discuss your debt unless you ask them not to

- if you dont want to be contacted at work, you must make other arrangements to discuss the debt and you must keep those arrangements

Theres More Than One Way To Clear Your Debt

The Balance / Caitlin Rogers

A debt collection is a severely past-due credit account. In fact, it’s one of the worst types of entries you can have on your credit report. Having a collection on your credit report, especially a recent one, can affect your credit score and make it harder to get approved for credit cards and loans. If you’re cleaning up your credit report, reducing the impact of collection accounts is important.

Dealing with debt collection can be tricky. Paying a collection doesn’t always have the intended impact on your credit score, and working with collection agencies is sometimes difficult. Fortunately, there are some proven strategies for handling a debt in collection.

Recommended Reading: How To File A Bankruptcy Creditor Claim

Create A Payment Plan

Creating a payment plan lets you set a payment schedule and amount that works for your budget.

Comb through your finances to see how much you can afford to pay each week or month, whether it’s $20 or $100. Then contact the debt collector by phone or mail to propose the plan. If the collection agency agrees, it should send you a document outlining the deal. Make sure the terms of this agreement are correct before making a single payment.

This option can help you pay off the debt in a manageable way. It also can lead to the debt being marked paid in full on your credit reports, which can offset some of the damage done by delinquent debt.

Be sure you set an amount and schedule that won’t strain your budget to the breaking point. If you miss a payment, the debt collector may abandon the agreement and try to sue you for payment, which can lead to wage garnishment.

> > More: 7 Debt Tips from People Who’ve Been There

Settle The Debt For Less Than You Owe

Negotiating a settlement for a single payment of less than you originally owed can make the debt easier to pay off. You can do this yourself, even though many debt settlement companies will try to get you to pay them for this service.

There are risks. Ramon Khan, a former debt collector in Texas who now works in online marketing, says its routine for debt collectors to tell a consumer that they will take a partial payment as a settlement, only to sell the remainder of the balance to another debt collecting company.

It can put you in a vicious cycle where you still have to pay the rest of the debt, but now theres another company thats calling to collect the rest of it, Khan says.

Note, too, that if you have more than $600 forgiven, the IRS can consider that taxable income. You may receive a 1099-C form that you must then report on your taxes. There are exemptions to this, so you may want to consult a tax expert.

Negotiating a settlement takes persuasion and caution. Explain to the creditor why you can’t make full payment. The greater the debt and the longer its been in collections the more likely the creditor is to accept a settlement. As with any negotiation, start lower than your target. If you want to settle for 50% of what you owe, for example, try starting at 30%.

About the author:Sean Pyles is a debt writer at NerdWallet whose work has appeared in The New York Times, USA Today and elsewhere. Read more

Read Also: Buying Returned Items Pallets

What Are Collections Agencies

Collection agencies are companies that collect debts for companies that are owed money. How the collection agency gets paid can differ by the company and state laws. In some cases, if an agency collects money from a debtor, it will take 25% to 50% of the amount collected as a commission. Some debt collection companies purchase delinquent accounts from the original creditors for pennies on the dollar of the amount owed and keep 100% of whatever they collect.

How To Pay Your Debt Collector

You can pay a debt collector directly. Commonly accepted payment methods include:

- Bank account withdrawals

- Debit card or credit card payments

- Prepaid card payments

In some cases, a collection agency might ask you to allow it to make automatic withdrawals from your bank account. However, this might create a problem if you were to run into financial difficulties or overdraw on the account. Its usually better to pay a collector with a certified check or money order that secures your personal information and leaves proof of payment.

You May Like: How Far Back Does A Solicitors Bankruptcy Search Go

What Is A Collection Account

A collection is a past-due debt that your creditor has charged off because they no longer think youll pay it. This usually happens after around 36 months of missed payments. 1

Creditors will then either transfer the debt to a debt collection agency or sell it to a third-party debt buyer, usually for only a fraction of the amount owed. 2 At this point, an item called a collection account will appear on your credit report and severely damage your credit score.

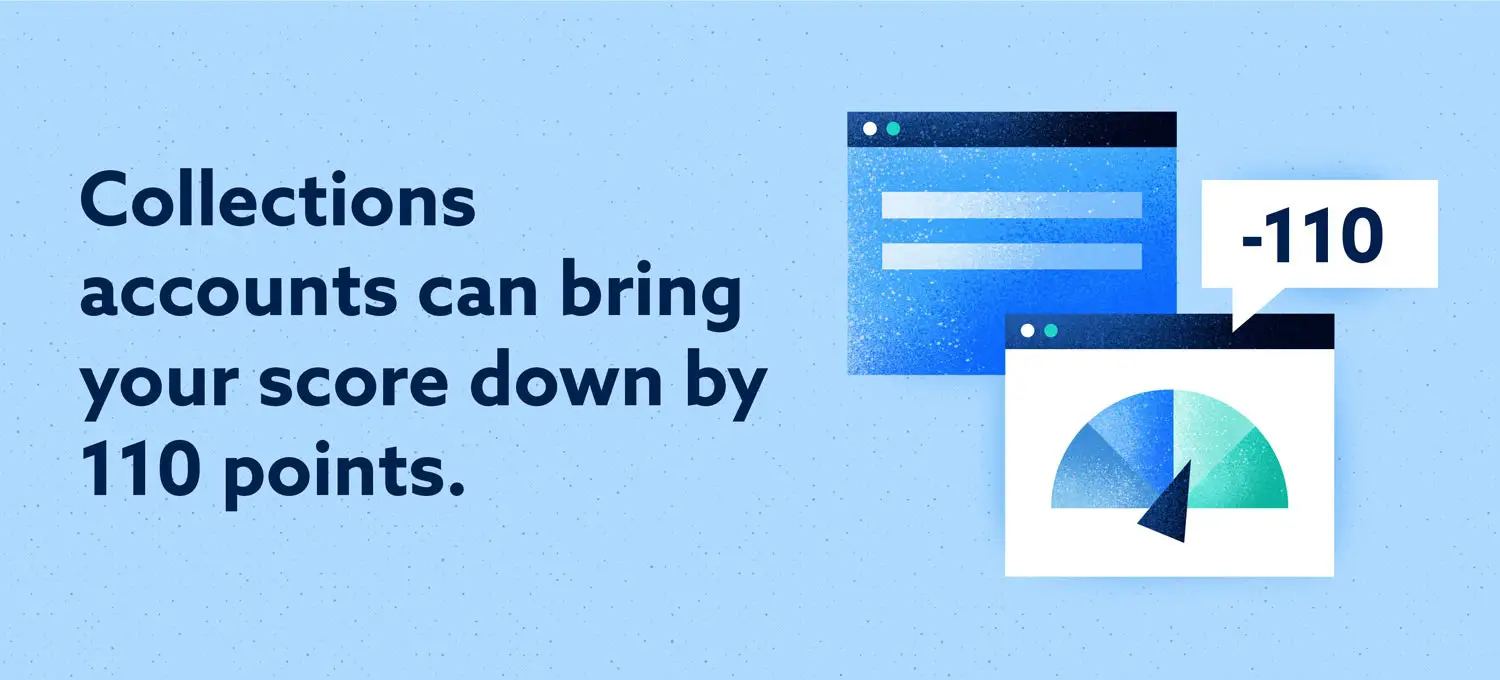

How Much Do Collections Affect Your Score

Although there’s no formula to calculate how much a collections account affects your credit score, it’s important to know there is little difference between a paid collection account and those that remain unpaid regarding your credit score.

In fact, paying old collections accounts can activate them again and further impact your score. If you want to remove a collections account for the purposes of borrowing, check with your lender to find out the best approach for your loan approval.

The type of debt does play a part in how it affects your score. Medical collections, for instance, are given less weight in the latest FICO scoring models.

Don’t Miss: How To File Bankruptcy In Maryland Without A Lawyer

Errors Happen Dont Let Them Happen To You

To offer some eye-popping context: Since 2015, through the , more than $10.2 billion in erroneous debt has been removed from TransUnion® credit reports.

See an error? Make sure you reach out to both the lender that issued the inaccurate information and the credit bureau thats reporting it. Its also good practice to notify all three major consumer credit bureaus to make sure the mistake isnt repeated.

If you have questions about whether youre liable for a debt, it can be helpful crucial, even to consult with a and a lawyer.

You may also want to review the rights afforded to you by the Fair Debt Collection Practices Act, which aims to end abusive debt collection practices by debt collectors.