Bankruptcy Reporting Requirements Before And During Chapter 11

One of the; central principles of bankruptcy is that a debtor should have the benefit of a fresh start. However, to accord such relief, the Bankruptcy Code, Bankruptcy Rules, and case law require transparency from the debtor and other parties in interest. As such, strict compliance with bankruptcy reporting requirements is a primary responsibility of a debtor in possession .

Courts expect a DIP to keep proper records and file required disclosures and reports in a timely manner. A DIPs failure to do so may result in the:

- Removal of the DIP and the appointment of a case trustee;

- Granting of creditor relief ;

- Conversion of the chapter 11 case to a chapter 7 case; or

- Case dismissal.

Three general points:

- In addition to the statutory reporting requirements outlined below, courts have the power to order additional or modified disclosure;

- Non-bankruptcy reporting requirements are not addressed in this article and may mandate additional reporting during the bankruptcy case; and

- Many jurisdictions have local rules that add to or modify the reporting requirements and dictate the appropriate format of submissions.

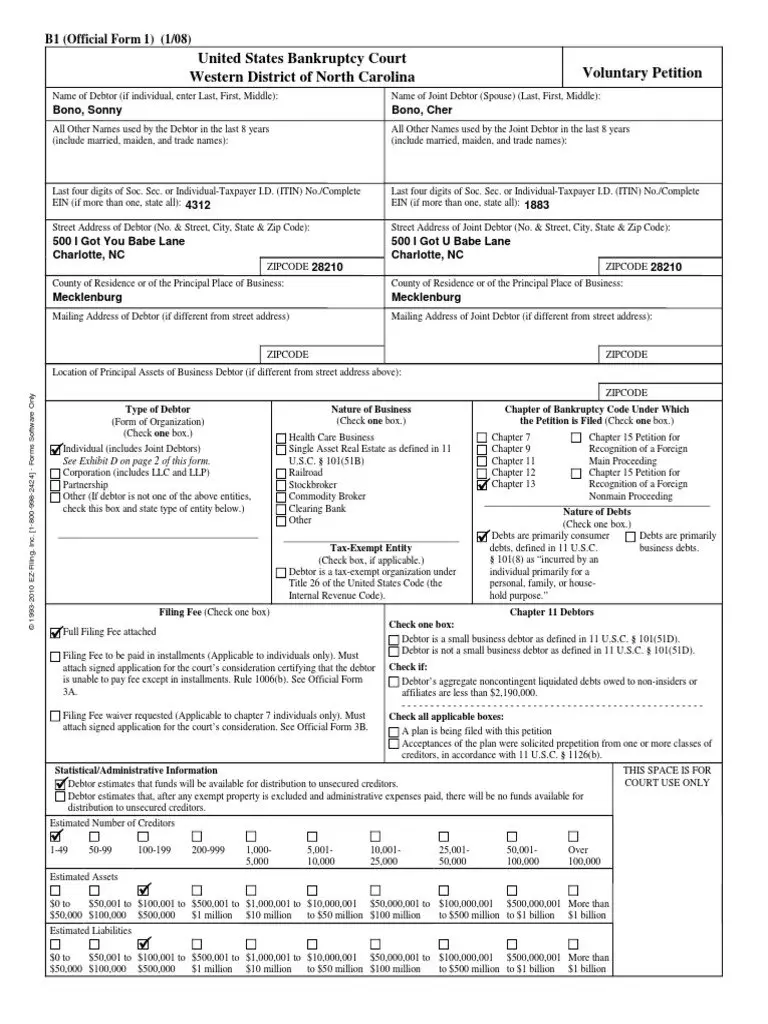

Which Type Of Bankruptcy Should I File For

Not only are the requirements for the two different bankruptcy types very different, but so are the effects. In Chapter 13 bankruptcy, you will work with your creditors to develop a payment plan in which you continue paying off your debt for a period of time; in exchange, you will be allowed to keep the majority of your assets. In Chapter 7 bankruptcy, most of your debts are discharged, but you have to liquidate your assets to pay off your credits. Which type of bankruptcy you should file for, and the regulations for each, can be confusing working with an attorney is advised.

If you have more questions about filing for bankruptcy or which type of bankruptcy for which to file, do not hesitate to contact an experienced attorney. At the Law Office of Kevin M. Schmidt, P.C, our attorneys in Indiana have more than two decades of experience, and will go to work for you. A consultation with our office is always free!

Who Declares Bankruptcy

Most individuals and business who file for bankruptcy have far more debts than money to cover them and dont see that changing anytime soon. In 2020, bankruptcy filers owed $86 billion and had assets of $56 billion. Most of those assets were real estate holdings, whose value is debatable.

On the other hand, bankruptcy can often be used as a financial planning tool when you do have enough money to repay debts, but need to restructure the terms. This is often in cases when people need to repay mortgage arrears or taxes in a structured repayment plan.

What is surprising is that individuals not businesses are the ones most often filing for bankruptcy. They owe money for a mortgage, credit card debt, auto loan or student loan perhaps all four! and dont have the income to pay for it.

There were 774,940 bankruptcy cases filed in 2019, and 97% of them were filed by individuals. Only 22,780 bankruptcy cases were filed by businesses in 2019.

The other surprise is that most of the people filing bankruptcy were not particularly wealthy. The median income for those who filed Chapter 7, was just $31,284. Chapter 13 filers werent much better with a median income of $41,532.

However, in the end, there is a price to pay and youll pay it for 7-10 years.

Also Check: Can I Be Fired For Filing Bankruptcy

How Chapter 13 Works

Chapter 13 bankruptcy is like Chapter 11, which generally applies to businesses. In both cases, the petitioner submits a reorganization plan that safeguards assets against repossession or foreclosure and typically requests forgiveness of other debts. They both differ from the more extreme Chapter 7 filing, which liquidates all assets except those specifically protected.

No bankruptcy filing eliminates all debts. Child support and alimony payments arent dischargeable, nor are most student loans and some types of taxes. But bankruptcy can clear away many other debts, though it will likely make it harder for the debtor to borrow in the future.

To be eligible to file for Chapter 13 bankruptcy, an individual must have no more than $419,275 in unsecured debt, such as or personal loans. They also can have no more than $1,257,850 in secured debts, which includes mortgages and car loans. These figures adjust periodically to reflect changes in the consumer price index.

One of Chapter 13 allows you to stop an effort to foreclose on your home. Filing a Chapter 13 petition suspends any current foreclosure proceedings and payment of any other debts owed. This buys time while the court considers the plan, but it does not eliminate the debt. Hopefully, the bankruptcy plan will free enough of your income that youll be able to make regular mortgage payments and keep your house.

Benefits Of Chapter 15

A chapter 15 petition may provide immediate benefits. Pursuant to Section 1519 of the Bankruptcy Code, even before the foreign proceeding is formally recognized, upon the filing of the chapter 15 petition, the provisional liquidator will be expected to seek relief from the Bankruptcy Court to, among other things:

- Stay execution against the debtors assets.

- Entrust the administration of all or part of the debtors assets located in the U.S. to the provisional liquidator to protect and preserve the value of the assets.

- Suspend the debtors right to transfer, encumber or otherwise dispose of any of its assets.

- Conduct an examination concerning the debtors assets, affairs, rights, obligations or liabilities.

Upon recognition by the Bankruptcy Court of the foreign proceeding, the foreign representative possesses the right to seek additional relief pursuant to Section 1521 of the Bankruptcy Code.

You May Like: How Many Times Donald Trump Bankruptcy

What Are The Different Types Of Bankruptcies

5 minute read ⢠Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card. Explore our free tool

In a Nutshell

Bankruptcy has helped millions of Americans relieve their debt burden and get a fresh start. There are different types of bankruptcies, so it’s important to know the differences and similarities.

Written by Attorney Andrea Wimmer.

Bankruptcy is a legal tool for debt relief. United States bankruptcy laws offer different types of bankruptcy depending on the type of filer. The most common distinction here is people vs. businesses or personal vs. corporate bankruptcy.

Each type of bankruptcy is named after a chapter of the Bankruptcy Code. The U.S. Bankruptcy Code is the federal law governing bankruptcy cases. Because itâs federal, itâs the same in the entire United States and the bankruptcy court is a federal court.

Eligibility To File Chapter 12

An individual family farmer is eligible to file a Chapter 12 bankruptcy if:

- Total debts do not exceed $4,153,150;

- At least 50% of;the fixed;debts, exclusive of home loans,;relate to the farm operation; and

- More than 50% of the gross income;is;from farming.

A;family farm that is owned by a corporation or partnership is eligible to file a Chapter 12 bankruptcy if:

- More than;50%;of the corporation or partnership is;owned by one family or an extended family;

- The family or the extended family;operates;the farm;

- More than 80% of the value of the corporate or partnership assets relate to the farm;

- The total indebtedness of the farm corporation or partnership does;not exceed $4,153,150;

- At least 50% of the corporations or partnerships;fixed;debts,;exclusive of one home loan for a home occupied by an;owner,;relate to the farming operation; and

- The;stock in the farm corporation is not publicly traded.

You May Like: Renting After Chapter 7

Bankruptcy In The United States

Like the economy, bankruptcy filings in the U.S. rise and fall. In fact, they are like dance partners; where one goes, the other usually follows.

Bankruptcy peaked with just more than two million filings in 2005. That is the same year the Bankruptcy Abuse Prevention and Consumer Protection Act was passed. That law was meant to stem the tide of consumers and businesses too eager to simply walk away from their debts.

The number of filings dropped 70% in 2006, but then the Great Recession brought the economy to its knees and bankruptcy filings spiked to 1.6 million in 2010. They retreated again as the economy improved, but the COVID-19 pandemic easily could reverse the trend in 2021. It seems inevitable that many individuals and;small businesses will declare bankruptcy.

What Is The Means Test For Chapter 7 Bankruptcy

You must pass a means test if your monthly income is more than the median income in the state. This means test considers:

- Your monthly income over the course of the past five years; and

- Whether or not you have enough disposable income to pay off a portion of your unsecured debts.

If you do not have a enough disposable income to pay off a portion of your debts, then you will likely be eligible to file for Chapter 7 bankruptcy. If you do have enough income, then you will likely need to file for Chapter 13 bankruptcy.

You May Like: How Many Bankruptcies Has Donald Trump Filed

The Chapter 12 Plan And Confirmation Hearing

Unless the court grants an extension, the debtor must file a plan of repayment with the petition or within 90 days after filing the petition. 11 U.S.C. §;1221. The plan, which must be submitted to the court for approval, provides for payments of fixed amounts to the trustee on a regular basis. The trustee then distributes the funds to creditors according to the terms of the plan, which typically offers creditors less than full payment on their claims.

There are three types of claims: priority, secured, and unsecured. Priority claims are those granted special status by the bankruptcy law, such as most taxes and the costs of bankruptcy proceeding. Secured claims are those for which the creditor has the right to liquidate certain property if the debtor does not pay the underlying debt. In contrast to secured claims, unsecured claims are generally those for which the creditor has no special rights to collect against particular property owned by the debtor.

A chapter 12 plan usually lasts three to five years. It must provide for full payment of all priority claims, unless a priority creditor agrees to different treatment of the claim or, in the case of a domestic support obligation, unless the debtor contributes all “disposable income” – discussed below – to a five-year plan. 11 U.S.C. §;1222, .

Determining The Median Income For Your Household Size

The income limit for your state and household size is based on data from the Census Bureau and it changes multiple times per year.

To find the most up-to-date information, go to the website for the United States Trustee on means-testing and choose the current option in the drop-down menu titled âData Required for Completing the 122A Forms and the 122C Forms.â

This will bring you to a new page on the Justice Departmentâs website that provides a link to the Median Family Income Based on State/Territory and Family Size provided by the Census Bureau. From there, youâll be able to pull up a table showing median incomes, by household size, for each state.

Don’t Miss: Can I File Bankruptcy Without My Spouse Knowing

Attend Your 341 Meeting

Your 341 meeting, or “meeting of creditors” will most likely be the only formal proceeding you have to attend as part of your Indiana bankruptcy. It’s helpful to prepare for your 341 meeting, so you know what to expect. Creditors can attend this meeting to ask you questions about the information in your petition, schedules and statements, but it is rare for them to do so. Filing Chapter 7 in Indiana includes a process for creditors to seek payment on their claims from your bankruptcy estate that is automatic, so it rarely makes sense for them to ask you questions at your 341 meeting. Since the trustee has to verify your identity at your 341 meeting, you have to bring a valid picture ID and acceptable proof of your social security number. Without it, the trustee will likely be unable to conduct the meeting, which means you have to come back for another meeting at a later time. This is not only unnecessary and inconvenient, it may also delay the entry of your discharge.

United States Bankruptcy Court

Petitions and schedules can be found on the U.S. Court’s website.

| INDIVIDUAL Required Documents Due WITH the petition : |

|---|

|

| INDIVIDUAL Documents due with the petition or within 14 days: |

|

Also Check: Dave Ramsey How Much To Spend On Engagement Ring

Before Filing A Bankruptcy Petition

Though bankruptcy filings are sometimes the best way to resolve debts, they are not the only alternative. Before deciding if you should file for bankruptcy, consider steps to resolve your debt. Then speak with an attorney to determine if bankruptcy is right for you. Each of these alternatives has its own set of pros and cons and only an attorney can advise you as to the best course of action in your particular case.

Advertiser Disclosure

Debt.org wants to help those in debt understand their finances and equip themselves with the tools to manage debt. Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up. These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. Here is a list of our service providers.;

Chapter 1: Bankruptcy Relief For Family Farmers

Chapter 12 of title 11 was enacted in 1986 to provide specially-tailoredbankruptcy relief for “family farmers.” Chapter 12 was originally scheduled toexpire in 1993, but the expiration was extended to October 1, 1998. A total of18,212 Chapter 12 cases have been filed since it was enacted in 1986. Theprincipal Chapter 12 issue facing the Commission, and Congress, is whether Chapter12 provides necessary relief to family farmers and should become a permanent partof the Bankruptcy Code. The Commission concluded that Chapter 12 should becomea permanent form of relief under the Bankruptcy Code. Senator Charles Grassley recently introduced legislation, The Working Family Farmer ProtectionAct of 1997 , to make Chapter 12 permanent.

Don’t Miss: Mark Cuban Bankruptcy

Bankruptcy Procedures For Farmers

If a business finds its current debt payment obligations exceed its current cash flow the business may consider filing for bankruptcy to lessen their debt obligations. Depending on the business structure, its total debt levels, and whether or not the business intends to continue its operation, a business has four chapters of bankruptcy to choose from: 7, 11, 12, and 13 . Chapter 7 is a liquidation of the business which necessarily requires cessation of operation . There are no debt limits associated with a chapter 7, however all nonexempt assets will be sold off and the resulting funds distributed to creditors in the order of priority of their claims. Chapter 7 results in cessation of operation and is only used for a business if there is no viable business model that can result in a positive cash flow in the foreseeable future. Chapter 7 is by far the most common filing and has represented approximately 65% of all business bankruptcies since 2001 with an average of around 23,000 filed annually. All other chapters represent a form of reorganization for a business which allows for continued operation which has been a stated goal for chapter 12 to protect the family farm. Recent legislative changes to chapter 12 have attempted to address concerns related to the ability for farmers to file for bankruptcy.

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Recommended Reading: How To Get Out Of Bankruptcy Chapter 13 Early

Questions That Are Frequently Asked

Will declaring bankruptcy harm my credit?

Your credit report will show dents from late payments or accounts that were closed when you file for bankruptcy.;After receiving a bankruptcy discharge, your credit rating will improve in six months.

Can I file for bankruptcy by myself?

When you file for bankruptcy, it is a good idea to hire an attorney.;Because there are so many moving parts to a bankruptcy case, even a slight error in clerical writing can result in it being rejected.

How long does it take to file for bankruptcy?

Filing for bankruptcy involves many steps.;The process will take no more than six months if you have a competent bankruptcy attorney.