Tracking The Federal Deficit: February 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $312 billion in February 2021, the fifth month of fiscal year 2021. This months deficitthe difference between $246 billion in revenue and $558 billion in spendingwas $77 billion more than last Februarys. The deficit so far in fiscal year 2021 has climbed to just over $1 trillion, an 83% year-over-year increase . Year-over-year, total spending has risen by 25% and revenues have increased by 5%.

Analysis of Notable Trends: Increased spending in February, and fiscal year 2021 as a whole, mostly resulted from pandemic relief legislation. For instance, the Small Business Administrations Paycheck Protection Program accounted for most of the $133 billion spending increase from last February to this one. SBA outlays soared to $91 billion this February compared to only $100 million in the same month last year. The other largest spending changes were greater outlays on unemployment compensation and $17 billion less in refundable tax credit payments because of a delayed start to the tax filing season this year.

Despite a historic recession, revenues were 5% higher in the first five months of fiscal year 2021 than during the same period last year . This healthy growth is surprising, especially when compared to the onset of the last major recession: In the first five months of fiscal year 2009, revenues plunged 11% year-over-year.

Recommended Reading: What Is The National Debt Of The Us

Lower Returns On Your Investments

Bonds issued by the Treasury are typically seen as low-risk investments. When interest rates rise, the yield on these low-risk investments also rises, making them more attractive investments for income-minded investors over other riskier income-generating investments like corporate bonds.

This could leave companies that typically rely on bonds short on the loans they need to finance expansions and operations and translate into lower returns for equity investors when companies fail to meet revenue targets.

Tracking The Federal Deficit: June 2019

The Congressional Budget Office reported that the federal government generated an $8 billiondeficit inJune, theninth monthof Fiscal Year 2019, for a total deficit of$746 billionso far this fiscal year. If not for timing shifts of certain payments, Junes deficit would have been $57 billion, which is $28 billion larger than the adjusted deficit forJune 2018. Total revenues so far inFiscal Year 2019increased by3 percent , while spending increased by7 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Individual and payroll taxes together rose by 3 percent , reflecting an expanding economy and a low unemployment rate. Furthermore, customs duties increased by 77 percent versus last year, primarily due to the imposition of new tariffs. On the spending side, Social Security expenditures increased by 6 percent compared to last year due to increases in the number of beneficiaries and the average benefit payment. Finally, net interest payments on the federal debt continued to rise, increasing by 16 percent versus last year due to higher interest rates and a larger federal debt burden.

You May Like: Forclosed Home For Sale

Less To Spend On Other Government Initiatives

The more money the U.S. has to spend on meeting its debt obligations as interest rates increase, the less financial capacity it could have to fund programs focused on education, veterans benefits and transportation.

This breakdown of the 2019 Federal Budget from the Council on Foreign Relations shows how the budget pie is only so big, so when one area increases , another must decrease.

Us National Debt Growth Statistics

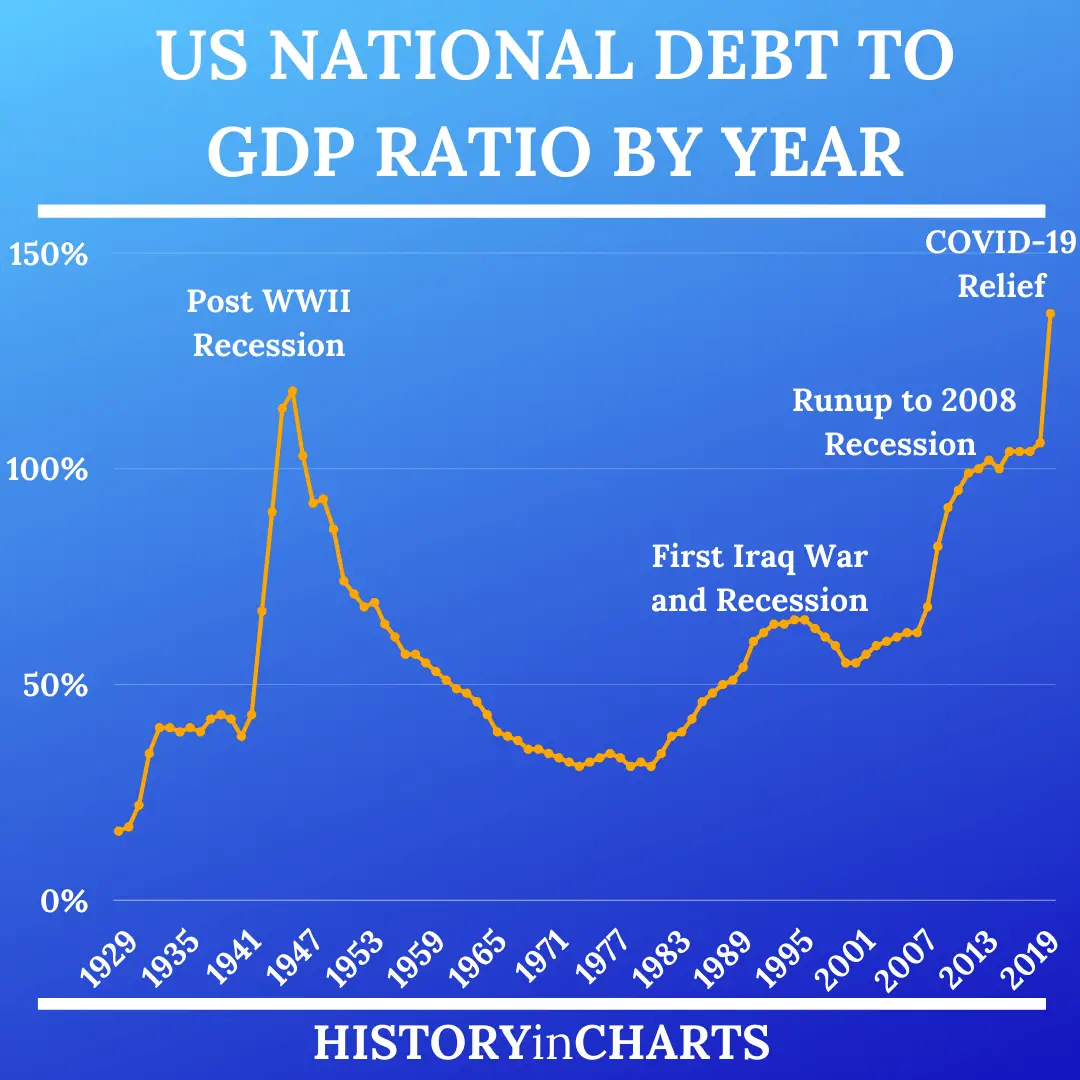

24. The ratio of US national debt held by the public to the US GDP is expected to reach nearly 100% by 2028.

According to the US debt graph based on CBOs baseline projections, which assume that the current laws on taxation and spending will not change, the federal budget deficit is expected to increase substantially over the next few years. It will stabilize between 2023 and 2028 at high historical levels, with a corresponding negative effect on the national debt.

The debt held by the public has nearly doubled in relation to the GDP since 2008, and current legislation, which has significantly reduced revenues and increased outlays, will take it close to 100%, a level not seen since World War II.

25. Data on the US national debt by year show that gross federal debt will grow to $45.3 trillion by 2032.

For the 2022 fiscal year, the gross federal debt, which includes both public and intragovernmental debt, is expected to rise to $32.6 trillion, with the current levels showing that the actual figures might overshoot this estimate. The current estimate of $45.3 trillion for 2032, therefore, might prove conservative unless future administrations take measures to curb the budget deficit.

26. The gross domestic product is expected to reach $36.6 billion by 2032, as per the latest national debt by year chart.

You May Like: Can Student Loans Be Discharged By Bankruptcy

Tracking The Federal Deficit: June 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $173 billion in June, the ninth month of fiscal year 2021. Junes deficit was the difference between $450 billion in revenue and $623 billion in spending.

So far this fiscal year, the federal government has run a cumulative deficit of $2.2 trillion, the difference between $3.1 trillion in revenue and $5.3 trillion in spending. This deficit is nearly triple the shortfall over the same period in FY2019 , but is 19% lower than at the same point in FY2020. This is the first time in FY2021 that the cumulative deficit has decreased year-over-year.

Analysis of Notable Trends: Thus far in FY2021, year-over-year comparisons of deficit levels have largely reflected the trajectory of the COVID-19 pandemic and subsequent federal response. BPC expects this trend to continue through the rest of the fiscal year.

Cumulative year-to-date outlays are up 6% compared to the first nine months of FY2020 and are 58% greater than at this point in FY2019. These changes are indicative of continued spending towards COVID-19 relief programsin particular, refundable tax credits and supplemental unemployment compensationas every month to date in the current fiscal year has contained pandemic-related expenditures, whereas only March-June did for the relevant period last year.

The Early 20th Century: 1900

In first 50 years or so following the Civil War, the national debt generally fluctuated between $1.5 billion and $2.5 billion. But that changed quickly as Europe began to tear itself apart in 1914 in World War I.

Although America didn’t join the war until April 1917, our impending involvement began to drive borrowing in the years before that. Between 1915 and 1917, the country’s borrowing climbed to over $5.7 billion as the country prepared for and ultimately entered war. And over the course of 1918 and 1919, borrowing soared to $27 billion and would never again end the year below $16 billion.

This borrowing also created the debt ceiling. As President Woodrow Wilson’s administration needed to borrow more and more money to pay for World War I, Congress’ previous approach of approving each bond sale individually became unworkable. Instead, Congress issued an overall cap, telling the U.S. Treasury how much it could borrow overall and allowing the administration to manage the sale of individual rounds of debt. This law has remained in place ever since.

Borrowing ticked up again during President Franklin Roosevelt’s administration during Great Depression. Once the New York Democrat took over from President Herbert Hoover, he began his program of vast, active spending called the New Deal. Roosevelt pushed borrowing to over $40 billion fighting the Depression — nearly doubling the national debt when he took office.

Recommended Reading: How Many Bankruptcies Has Donald Trump

Debt Held By Foreign Creditors

15. 26.16% of the US government debt was owned by foreign and international institutions in December 2021.

As of December 2021, the largest component of the US government debt 40.94% was owned by the federal reserve and government accounts. However, it is the foreign-held debt that could be a matter of concern. According to the national debt chart, 11.09% is held by mutual funds, 5.87% by depository institutions, 4.9% by state and local government, etc.

16. Japan is the largest holder of US treasury securities, valued at $1.3 trillion in May 2022.

Other countries with significant holdings are China , the United Kingdom , Ireland , and Luxembourg . The large foreign holdings of the national debt of the United States leave the country vulnerable in the event of a shock, such as a collapse in housing prices or an extreme national security breach. There are other concerns, as well, when foreign countries, including potentially antagonistic ones, hold a large portion of the countrys securities.

18. China has held more than $1 trillion in US national debt since 2010.

What Causes The National Debt To Increase

Sometimes the government needs to increase spending to stabilize the economy, and protect Americans and businesses from unexpected economic conditions.

During The Great Recession , for example, Congress passed legislation injecting $1.8 trillion into the economy. But that pales in comparison to the $4.5 trillion the Trump and Biden administrations have pumped into the economy since the Covid pandemic began in March 2020.

However, there are other reasons the national debt increases, even during years where spending is moderate and the economy is in good shape.

You May Like: How In Debt Is The United States

What Makes The Debt Bigger

The leading federal spending categories currentlySocial Security, Medicare/Medicaid and defenseare the same as in the 1990’s, when national debt was much lower relative to GDP. The U.S. remains the world’s largest economy and one of the richest countries. How, then, did the debt situation deteriorate? Numerous factors are in play.

The National Debt In Perspective

Consider what it means when the graph says 100%. It means the national debt equals one year of Gross Domestic Product . So if we used the full value of what the US produces for one year just to pay off that debt, that would just do it. And 50% means the debt would be paid off in six months of using the full output.

That sounds outlandishly huge, but consider a family making $100,000 a year that buys a $250,000 house with 20% down and takes a $200,000 mortgage. No one considers this unusual or risky. But that family would be off the top of the graph at 200%. It would take all they made for two years to pay off their debt. And the US has a slight advantage over most families. It can print money. So there is zero chance of default.

And only about 1/4 of the national debt is owed to foreigners. Another 40% is owed to Americans, for example, pension plans own quite a bit of it. And the rest is owed by the US governments General Fund to other Government Trust Funds, like the Social Security Trust Fund and the militarys pension fund.

Click for an explanation of the Green Line, balanced budgets, tax cuts and a bit of Keynesian stimulation.

You May Like: Pallets Of Merchandise For Sale In Los Angeles

Read Also: Us Gov Mortgage Relief

Stats On The Us National Debt By Year

- In June 2022, the total US public debt hit $30.46 billion.

- The US interest on the national debt is projected to be $305 billion in 2022.

- The US per capita national debt in 2021 stood at $85,552.

- Interest payments are the US governments 6th largest budgetary expense as of 2022.

- Japan holds the most of the US national debt .

- In terms of Dollar value, Barack Obama was the US President who grew the debt burden the most.

- The wars in Afghanistan and Pakistan have cost the US more than $2.3 trillion.

Tracking The Federal Deficit: July 2021

![US National Debt (And Related Information) [OC] US National Debt (And Related Information) [OC]](https://www.bankruptcytalk.net/wp-content/uploads/us-national-debt-and-related-information-oc-national-debt.png)

The Congressional Budget Office estimates that the federal government ran a deficit of $301 billion in July, the tenth month of fiscal year 2021. Because August 1 fell on a weekend in both 2020 and 2021, certain federal programs that typically pay out large sums on the first of the month did so twice in July. If not for these timing shifts, the deficit would have been $60 billion less last month. Julys deficit was the difference between $261 billion in revenue and $562 billion in spending. Monthly receipts dropped 54% compared to last July due to 2021s return to the regular April and June tax filing deadlines for individual and corporate tax payments.

So far this fiscal year, the federal government has run a cumulative deficit of $2.5 trillion, the difference between $3.3 trillion in revenue and $5.9 trillion in spending. This deficit is 10% lower than over the same period in FY2020, but nearly triple the FY2019 deficit .

Analysis of Notable Trends: Fiscal patterns over the past month continue to reflect the federal governments response to the COVID-19 pandemic, as well as the developing economic recovery.

Growth in federal revenues remains robust, increasing 17% compared to the same 10-month period in FY2020. This increase is indicative of a strengthening economy, with a steady inflow of individual income and payroll taxes from higher total wages and salaries, and corporate taxes from larger corporate profits, the latter of which increased 76% year-over-year.

Read Also: Us To China Debt

Tracking The Federal Deficit: December 2018

The Congressional Budget Office reported that the federal government generated an $11 billion deficit in December, the third month of Fiscal Year 2019, for a total deficit of $317 billion so far this fiscal year. If not for timing shifts of certain payments, the deficit in December would have been roughly $32 billion, according to CBO. Decembers deficit is 52 percent lower than the deficit recorded a year earlier in December 2017. Total revenues so far in Fiscal Year 2019 increased by 0.1 percent , while spending increased by 9.4 percent , compared to the same period last year.

Analysis of Notable Trends in December 2018: Revenue from customs duties spiked by 83 percent from October-December 2018, relative to the same period in 2017, due to the administrations imposition of new tariffs. Conversely, corporate income tax revenue declined by 15 percent from October-December 2018 relative to the same period in 2017. This dip mainly reflects the reduction of corporate tax rates enacted in the Tax Cuts and Jobs Act of 2017. On the spending side, interest payments on the federal debt in December 2018 rose by 47 percent relative to December 2017.

Breakup Of Northern Securities

In 1902, President Theodore Roosevelt ordered the Justice Department to break up the Northern Securities Company. This holding company controlled the main railroad lines from Chicago to the Pacific Northwest.

Roosevelt took the position that the company was an illegal monopoly. The company appealed the move, and the case went all the way to the Supreme Court, which ruled in favor of the federal government.

National debt: $2.3 billion

Also Check: Small Business Liquidation Services

Tracking The Federal Deficit: April 2019

The Congressional Budget Office reported that the federal government generated a $161 billion surplus in April, the seventh month of Fiscal Year 2019, for a total deficit of $531 billion so far this fiscal year. Aprils surplus is 33 percent less than the surplus recorded a year earlier in April 2018. If not for timing shifts of certain payments, the surplus would have been 5 percent smaller than the surplus in April 2018. Total revenues so far in Fiscal Year 2019 increased by 2 percent , while spending increased by 6 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Income tax refunds were down by 5 percent compared to last tax season, contrary to many analysts expectations. Further, outlays from the refundable earned income and child tax credits increased by 12 percent versus last year, reflecting expansions enacted in the Tax Cuts and Jobs Act of 2017. Net interest payments on the public debt continued to rise, up 13 percent compared to last year, largely as a result of higher interest rates and the nations steadily growing debt burden.

Interest Expense On The Debt Outstanding

As of June 6, 2022, this data moved permanently to FiscalData.treasury.gov, where it is available for download in multiple machine-readable formats with complete metadata!

The Interest Expense on the Debt Outstanding includes the monthly interest for:

- State and Local Government series and other special purpose securities.

Amortized discount or premium on bills, notes and bonds is also included in the monthly interest expense.

The fiscal year represents the total interest expense on the Debt Outstanding for a given fiscal year. This includes the months of October through September.

Recommended Reading: What Can You Include In Bankruptcy

Recommended Reading: Will Filing Bankruptcy Stop Irs Debt

Tracking The Federal Deficit: June 2020

The Congressional Budget Office reported that the federal government ran a deficit of $864 billion in June, the ninth month of fiscal year 2020. This monthly deficit is more than 100 times larger than last Junes deficit of $8 billion. This difference came from a sizable drop in revenues, which were down 28% from last June , and especially from a massive increase in outlays, up 223% from last June . The budget deficit so far this fiscal year has surged to $2.7 trillion, $2 trillion more than at the same point last year. As exemplified by June, the cumulative difference stems from a drop in revenues13% lower than at the same point last yearand a much bigger leap in outlays49% higher than at this time last year.

The drop in revenue between last June and this one was due almost entirely to the administration delaying the deadline for quarterly tax payments from June 15 to July 15. Monthly revenue was down $93 billion compared to a year ago, of which $43 billion came from delaying corporate tax payments while $42 billion came from delaying individual and payroll tax payments. CBO expects most of this delayed revenue to eventually be collected, although some will be lost as businesses fail before the new payment deadlines.