Why Should I Consider Bankruptcy

Eliminate the legal obligation to pay most or all of your debts. This is called a discharge of debts. It is designed to give you a fresh financial start.

Stop foreclosure on your house or mobile home and allow you an opportunity to catch up on missed payments.

* Prevent repossession of a car or other property, or force the creditor to return property even after it has been repossessed.

* Stop wage garnishment, debt collection harassment, and similar creditor actions to collect a debt.

* Restore or prevent termination of utility service.

* Allow you to challenge the claims of creditors who have committed fraud or who are otherwise trying to collect more than you really owe.

How Is A Chapter 13 Case Different

By contrast, those filing bankruptcy under bankruptcy Chapter 13 are required to submit completed schedules and a Chapter 13 repayment plan. Like Chapter 7 filers, they are required to be forthcoming when submitting information and documents to the court and the trustee assigned to their case, attend their meeting of creditors, and appear at certain mandatory bankruptcy court appearances. Additionally, they must make their Chapter 13 plan payments on time or risk the dismissal of their case.

Can A Dismissed Bankruptcy Hurt Your Credit

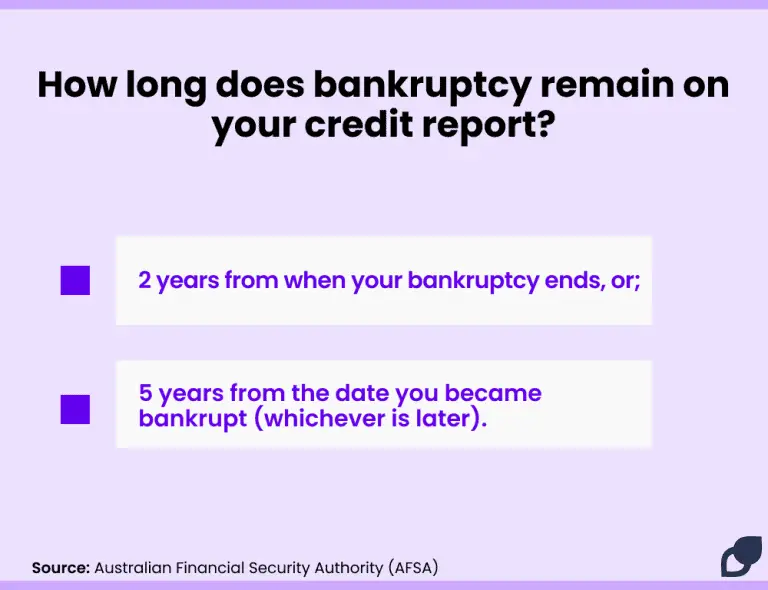

Whether your bankruptcy is dismissed or your debt is discharged, the 3 major credit bureaus treat bankruptcies the same. That means even if your debts aren’t cleared by bankruptcy, your credit score can nose dive up to 200 points! It gets worse. It can stay on for up to 10 years. So what can you do?

Read Also: How Many Bankruptcies Has Donald Trump Filed

My Case Is Dismissed Now What

Since you likely know why the Chapter 13 case was dismissed, the most common question that occurs is, What happens now?

Your financial situation goes right back to where it was before you started the bankruptcy. Literally. When you file a bankruptcy, the second that you have a case number you have an automatic stay or protective bankruptcy stay against you. This means that any pending foreclosure, repossession, lawsuit, or debt collection attempts cease immediately. When you are dismissed from a bankruptcy, your status reverts right back to where it was at the time that you filed the bankruptcy. If your home was in foreclosure at the time that you filed the bankruptcy, the mortgage company has the right to start procedures right back up again. If you were behind in your vehicle, your finance company has the right to resume where they left off and repossess the vehicle.

In 2009 files bankruptcy was dismissed. Filed again in 2011 and the case was managed poorly. The creditors did not get notified in timely manner and were not included in case. At the last few months the trustee is upset that I refused to pay additional money into case so he petition to dismiss the case. I refuse to expend anymore money or time in this case. What can I do at this point

Yes. As long as there is no court order stating she couldnt file then she could file.

Yes. They still likely have a lien agains the vehicle and hold the title to it. If so, they can come pick it up.

Q: I Am Having Trouble Renting An Apartment Because Of A Dismissed Chapter 13 Bankruptcy Can It Be Removed From Credit Reports Since I Did Not Continue With It And The Debt Has Since Been Paid In Full

A: A discharged bankruptcy means you have satisfied the debts included in the Chapter 13 BK and that creditors will not further pursue you for payment. In addition, discharged debts listed on your credit report must be listed as discharged. This will either lower or eliminate your overall debt making you are better credit risk.

When a Chapter 13 has been dismissed, creditors can immediately pursue you for payment again in addition to initiate or continue with court litigation for payment which causes potential new creditors to deny you.

Even if you pay the debt, potential creditors are still going to look at a dismissed bankruptcy more negatively than a discharged bankruptcy. Unfortunately, when you attempt to get new credit with a dismissed bankruptcy its going to be more difficult.

Most creditors, lenders and rental companies want to see a discharged bankruptcy. Its great that you paid the debt but ironically theres no benefit to your credit profile for doing so.

Once a bankruptcy is filed it is almost impossible to un-ring the bell. But because a discharged Chapter 13 stays on your credit report for 7 years and dismissed Chapter 13 stays on your credit report for 10 years I suggest several strategies:

To Credit Bureaus:

Any case, civil or otherwise, which is dismissed no longer exists in the eye of the law and a case filed may never have actually been adjudicated. Therefore, you have no right to maintain information which the government has deemed nonexistent.

Recommended Reading: Has Mark Cuban Ever Filed For Bankruptcy

Can I Remove A Bankruptcy From My Credit Report On My Own

It is possible to pursue removing a bankruptcy from your credit report on your own, and some people have managed to do so. However, it is a time-consuming, labor-intensive process that many people find complicated, confusing, and frustrating.

We encourage you to learn as much as you can about credit report disputes and credit repair processes, then count the real cost of DIY credit repair before committing to handling this important task on your own.

People who have needed to remove a bankruptcy from their credit reports have achieved success by working with a provider like Lexington Law Firm. If other questionable negative items are affecting your credit report and score, we can help you challenge those as well.

Contact us today for a free personalized credit report consultation to find out how we can help you meet your credit goals.

Reviewed by Vincent R. Mayr, Supervising Attorney of Bankruptcies at Lexington Law. by Lexington Law.

My Bankruptcy Was Dismissed What Happens Now

4 minute read ⢠Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card. Explore our free tool

In a Nutshell

A bankruptcy case is much like any other legal proceeding in that it may be affected by delays, impacted by other legal action, and subject to dismissal. This guide provides bankruptcy filers with a sense of their obligations as a debtor, how to prevent dismissal of a bankruptcy case, how to better ensure that a case is dismissed when bankruptcy dismissal is the goal, and options filers may want to consider if their case has already been dismissed.

Written by Attorney Kassandra Kuehl.

Filing for bankruptcy is not always a straightforward process. A bankruptcy case is much like any other legal proceeding in that it may be affected by delays, impacted by other legal action, and subject to dismissal. You may be in a position where youâre trying to avoid dismissal of your Chapter 7 bankruptcy case or your Chapter 13 bankruptcy case. If so, there are steps you can take to better ensure that your case is ultimately successful. However, you may also be in a position wherein youâre hoping to get your bankruptcy case dismissed. If so, you may be able to accomplish this goal by taking a certain approach.

Also Check: How Many Times Has Trump Declared Bankruptcy

Why Do You Store Social Security Numbers On Credit Reports

Your personal information, such as name, address, date of birth, and Social Security Number, is reported to TransUnion by your creditors. TransUnion maintains a separate credit file for each individual. Without your Social Security Number, the quality and accuracy of your credit history could be compromised. The federal Fair Credit Reporting Act permits TransUnion to maintain personal and credit information in our records.

How Long Does A Chapter 13 Bankruptcy Stay On Your Credit Report

For a Chapter 13 bankruptcy, it will remain on the report for up to seven years. The bankruptcy event should automatically be removed from the report by the reporting bureaus at the end of this period of time, and the individual should not have to take any additional steps for the event to be removed.

Also Check: Which Of The Following Phrases Best Summarizes Chapter 7 Bankruptcy

Why Did You Deny My Credit Card Request

TransUnion does not make the decision to grant or deny credit. We supply credit history to entities that evaluate the information when making a decision.

A denial, cancellation or decrease in credit limit may be due to several factors based on creditors’ different lending policies. Only the creditor can inform you of the reason for denial, cancellation or decrease in credit limit. You may wish to contact your creditor for an explanation of the decision.

Mail A Copy Of Your Documents Along With Your Request To Confirm/update Your Address To:

TransUnion LLC

P.O. Box 1000

Chester, PA 19016

When providing proof of your current mailing address, please ensure that any bank statements, utility bills, cancelled checks, and letters from a homeless shelter are not older than two months. All state issued license and identification cards must be current and unexpired. P.O. Box receipts may not exceed more than one year in age. Please note that any electronic statements printed from a website cannot be accepted as proof of address.

You May Like: Will Bankruptcy Clear A Judgement

How To Get A Dismissed Bankruptcy Case Off Credit Report

If a dismissed case is erroneously reported on your credit report, then you may be able to have it removed. Wait 10 years. Bankruptcies automatically drop off credit reports after 10 years, so if you do not want to fight to have your case removed from your credit report, you can wait until it happens automatically.

Re: Dismissed Bankruptcy Removed

Be careful of disputing when LN is frozen. Bureaus are coming up with ways to combat this.

Be careful of disputing when LN is frozen. Bureaus are coming up with ways to combat this.

I was just about to post this! Thank you

For starters, for you guys who are disputing valid PR’s, whats your basis for the dispute, and Id be curious to know what you’re actually saying when you ask for deletion. Not yours? Never had a BK? If so, then you’re lying. Just do the time like the rest of us….

CRA’s are getting smarter, and are on too us, so they are switching up the game and going with different 3rd parties now. I dont even think you can ask for a report from this LCI, or freeze.

Also Check: How Many Times Has Trump Filed Bankruptcy

Failing To File Paperwork

Failure to file the proper paperwork leads to many early dismissals. There are many pages of schedules and statements that lay out the debtors financial picture, including income, expenses, debts, assets, and previous financial transactions.

In addition, the debtor must also have filed tax returns for the last four years and file returns each year they are in a bankruptcy case , and provide pay stubs.

How Often Can I File For Bankruptcy

The answer to this question can be a bit complicated. For Chapter 7 you cannot file a bankruptcy until 8 years have passed since the date of filing of your prior Chapter 7 bankruptcy. For Chapter 13, you must generally wait 6 years after the filing of the prior Chapter 13 case .

Please note that these deadlines only apply if you received a bankruptcy dischargeSo, if your case was dismissed, you can re-file immediately. Also, there are certain circumstances where you may wish to file both Chapter 7 and then Chapter 13. In that case, even if you received a Chapter 7 discharge, you can immediately thereafter file a Chapter 13 case .

Recommended Reading: What Is Epiq Bankruptcy Solutions Llc

What Is Dismissal In Bankruptcy

A dismissal in bankruptcy means that the bankruptcy court has stopped all proceedings in the main bankruptcy case and in all adversary proceedings related to the bankruptcy case and that the bankruptcy court has not entered a discharge order in the case.

A bankruptcy court may choose to order dismissal of a case on its own, such as when the debtor commits misconduct in connection with the bankruptcy proceeding , or if the judge deems the filing abusive.

The bankruptcy trustee, the US Bankruptcy Administrator, or a creditor may file a motion for dismissal of a bankruptcy case. Occasionally a Motion to Dismiss may seek a bar to refiling for a period of time.

A debtor may file a motion to voluntarily dismiss their bankruptcy case, which the bankruptcy court may grant if it finds the debtor meets the requirements for voluntary dismissal. However, voluntarily dismissing your own bankruptcy case can negatively impact your options for filing for bankruptcy in the future or the right to an automatic stay in a future bankruptcy case.

Dismissals In Chapter 13 Vs Chapter 7

The difference between Chapter 7 and Chapter 13 is that a Chapter 13 bankruptcy typically costs more than a Chapter 7 bankruptcy and takes much longer to complete. Because of this, a Chapter 13 bankruptcy case is much more likely to be dismissed at some point in time before a discharge is granted. The most common cause of the dismissal being failure to make the required repayment plan payment when due.

Don’t Miss: Petition Preparer

Bankruptcy Dismissed Vs Discharged

If you have never filed for bankruptcy, you might have heard bankruptcy-related terms like dismissal and discharge, but you may not know what they mean. When you find yourself in debt or serious financial trouble and are considering filing for bankruptcy, you will need to know the differences between bankruptcy dismissal and bankruptcy discharge and what effect both can have on your bankruptcy case.

When you have questions about the bankruptcy process and what a dismissal or a discharge means to for your finances, let the experienced North Carolina bankruptcy lawyers from Sasser Law Firm help you understand the bankruptcy process and explain more about your rights and options in bankruptcy. We have three board-certified bankruptcy attorneys who have the specialized legal knowledge and experience you need to help you no matter what may come up in your bankruptcy case.

Weve helped over 8,500 individuals and businesses throughout North Carolina file for bankruptcy, including bankruptcy petitions under Chapter 7, Chapter 11, and Chapter 13. We regularly work with clients facing serious financial emergencies, including auto repossession or foreclosure on their home.

Contact the dedicated bankruptcy attorneys of Sasser Law Firm today to schedule a free and confidential initial consultation to go over your legal rights and options and to learn more about what a dismissal or a discharge may mean in your bankruptcy case.

Alternative Car Buying Options

Since a bankruptcy dismissal with prejudice isnt likely to fly with most lenders, checking out a BHPH dealer that uses in-house financing could be your best bet.

In-house financing simply means that all car shopping and lending is done at the dealership, by the dealer. The dealerships only sell used vehicles, but its usually a quick process because the dealer is the lender.

The biggest advantage of finding a BHPH dealership is that they dont normally care whats on your credit reports because they arent likely to review them. They do, however, verify your income, your identity, and require a down payment for you to be considered for an auto loan approval.

The income requirements vary greatly depending on the dealer you’re working with and the selling price of the car youre looking to purchase. However, the down payment requirement could be around 20% of the vehicles selling price.

Additionally, a BHPH auto loan may not be reported to the credit bureaus, which means your on-time payments wouldnt help improve your credit score. Missed or late payments are typically reported, however.

Read Also: What Is Epiq Bankruptcy Solutions Llc

Discharge Vs Dismissal: What’s The Difference

4 minute read â¢Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

Many individuals filing bankruptcy for the first time are unsure of the terminology used by lawyers and the courts. Two words that frequently confuse first-time filers are âdismissedâ and âdischarged.â The purpose of this article is to explain the difference between the two and when lawyers and the court are most likely to use them when referring to your case.

Written bythe Upsolve Team. Reviewed byAttorney Andrea Wimmer

Many individuals filing bankruptcy for the first time are unsure of the terminology used by lawyers and the courts. Two words that frequently confuse first-time filers are âdismissedâ and âdischarged.â The purpose of this article is to explain the difference between the two and when lawyers and the court are most likely to use them when referring to your case.

How Discharged Debts Appear On Your Credit Report

If your debts are legally gone, how do they remain on your credit report? Your former creditor just doesnt bother to update the report.

Some of them, and I kid you not, some of them will be so out of it that they will keep automatically pulling your credit report every month just like you still had an open account with them!

Everyone thinks it wont happen to them, but it does. It happens to thousands and thousands of people every year many of whom become my clients.

You May Like: How Many Bankruptcies Has Donald Trump Filed