How Does A Bankruptcy Filer Get A Fresh Start

A bankruptcy discharge ends your legal obligation to pay certain debt. The bankruptcy discharge means that you no longer owe the debt â whether it is paid or not. Qualified judgments, garnishments, and collection actions related to the bankruptcy case permanently stop as soon as the case is filed and can never resume once a discharge has been entered. The discharge also protects the filer from employment discrimination.

Should I Declare Bankruptcy

There is a reason bankruptcy is called the nuclear option for debt relief. It should only be considered if you already have tried and failed to make a dent in your debt obligations using other debt-relief options.

If thats the case, consider the pros and cons before deciding to push the button.

The Chapter 7 Process

A Chapter 7 bankruptcy starts with and ends with a discharge of debt. The Chapter 7 bankruptcy process officially starts when you file your bankruptcy petition and thatâs when the automatic stay goes into place.Youâll have to get your documents together and fill out bankruptcy forms to share your financial information with the bankruptcy trustee, creditors, and the judge, but it will be worth your time. The creditors will get paid what you can afford to pay, and unsecured debt will be resolved. The whole process can be done in 3-4 months, depending on your personal finances.

You May Like: Cost To File Bankruptcy In Wisconsin

How Your Creditors Are Paid

The official receiver will take control of your assets unless an insolvency practitioner is appointed. An insolvency practitioner is usually an accountant or solicitor.

The person who takes control of your assets is known as the trustee. The law says you must cooperate fully with them.

The trustee will sell your assets and tell the creditors how the money will be shared. Creditors must then make a formal claim. You cannot make payments directly.

If you have assets, money from the sale of these will be used to pay the costs of the bankruptcy process before creditors are paid. If your case is administered by the official receiver the following fees will all be deducted from the money realised:

- an administration fee of £1,990 if you applied for your own bankruptcy or £2,775 if someone else applied

- a general fee of £6,000

- 15% of the total value of assets realised

- a fee charged at an hourly rate where money is paid to creditors

If there are insufficient assets in your case the official receiver will still process your bankruptcy.

Next, money will be used for:

- certain debts in relation to employees, if you had any

- your other creditors

- interest on all debts

Any money left over will be returned to you. If everyone is paid in full you can apply to have your bankruptcy cancelled .

Bankruptcy: How It Works Types & Consequences

Bankruptcy is a legal process overseen by federal bankruptcy courts. It’s designed to help individuals and businesses eliminate all or part of their debt or to help them repay a portion of what they owe.

Bankruptcy may help you get relief from your debt, but it’s important to understand that declaring bankruptcy has a serious, long-term effect on your credit. Bankruptcy will remain on your credit report for 7-10 years, affecting your ability to open credit card accounts and get approved for loans with favorable rates.

Read Also: How To File For Bankruptcy In Indiana

The Single Asset Real Estate Debtor

Single asset real estate debtors are subject to special provisions of the Bankruptcy Code. The term single asset real estate is defined as a single property or project, other than residential real property with fewer than four residential units, which generates substantially all of the gross income of a debtor who is not a family farmer and on which no substantial business is being conducted by a debtor other than the business of operating the real property and activities incidental. 11 U.S.C. § 101. The Bankruptcy Code provides circumstances under which creditors of a single asset real estate debtor may obtain relief from the automatic stay which are not available to creditors in ordinary bankruptcy cases. 11 U.S.C. § 362. On request of a creditor with a claim secured by the single asset real estate and after notice and a hearing, the court will grant relief from the automatic stay to the creditor unless the debtor files a feasible plan of reorganization or begins making interest payments to the creditor within 90 days from the date of the filing of the case, or within 30 days of the courts determination that the case is a single asset real estate case. The interest payments must be equal to the non-default contract interest rate on the value of the creditors interest in the real estate. 11 U.S.C. § 362.

Single asset real estate cases are ineligible for the small business or subchapter V election. 11 U.S.C. § 101, 1182.

Chapter 7 Bankruptcy Is A Legal Process That Can Help Individuals Get Relief From Debts By Discharging Or Clearing Some Or All Of Whats Owed

If you qualify, Chapter 7 bankruptcy may allow you to discharge a variety of debts, but typically excludes obligations like child support, student loans or tax debt.

The main benefit of filing for Chapter 7 bankruptcy is that it can give the honest debtor a fresh start, says bankruptcy attorney Richard Symmes, principal attorney at Symmes Law Group.

But it isnt a simple fix-all. The repercussions of filing Chapter 7 bankruptcy can include losing some of your physical assets and having your credit take a major hit.

Chapter 7 bankruptcy may be able to offer the financial reset you need, but you should know about the drawbacks before you consider filing.

Also Check: Chapter 7 Bankruptcy Wisconsin

A Quick History Of Bankruptcy

The term bankruptcy probably came from the Italian phrase banca rottawhich literally means broken benchbecause in medieval days, if a merchant couldnt pay their creditors, they could come break the merchants market stall .1

What about bankruptcy in America, specifically? Well, several different bankruptcy acts popped up during times of economic crisis before the Bankruptcy Act of 1898. This one said bankruptcy didnt require the creditors approval and stuck around until the Bankruptcy Reform Act of 1978which set the laws we follow today.

Now when you file for bankruptcy, no ones coming to smash your bench , but its still a painful experience.

What Happens If I Declare Bankruptcy

Home » Frequently Asked Questions » What Happens If I Declare Bankruptcy?

When you declare bankruptcy, you will file a petition in federal court. Once your petition for bankruptcy is filed, your creditors will be informed and must stop pursuing any debt you owe. The court will then request certain information from you, including:

- The total amount of debt you owe

- A complete list of all your creditors

- An accounting of your total income

- An accounting of your outgoing expenses

You are permitted to represent yourself in bankruptcy court. You are also allowed to hire a lawyer who can serve as your advocate and help you navigate the complicated process of what happens if you declare bankruptcy. Having your debt discharged or reorganized in bankruptcy court can take a lengthy period of time. Should you get a lawyer, your lawyer can help you understand the relevant timeline in your bankruptcy case.

You May Like: Trump Personal Bankruptcies

Disadvantages Of Filing For Bankruptcy:

The Bankruptcy and Insolvency Act is the legislation by which Licensed Insolvency Trustees administer bankruptcy files. The laws and regulations of the Act are meant to balance the scales between the need of an honest but unfortunate debtor for a fresh financial start, and the rights of the creditors. For this reason, filing for bankruptcy in Canada has some disadvantages:

- Filing for bankruptcy will lower your credit score for a minimum of six years from the time your bankruptcy is completed

- Some of your assets may need to be surrendered, and/or a portion of your income above a certain level may need to be paid into your bankruptcy

- In bankruptcy, you must provide the Trustee with detailed income and expense information

- Your income tax refund, if you get one, is part of the bankruptcy and is forfeited to the Trustee for the year of bankruptcy

If you have reached the point where you are over-extended and can no longer afford your debt, the advantages of filing for bankruptcy or consumer proposal likely far outweigh the disadvantages.

Why Do People File For Bankruptcy

As mentioned before, people file for bankruptcy when they cant pay their debts. The idea behind bankruptcy protection is that not paying your debts SHOULD NOT be a criminal offense, but also that a party should not be able to escape liability on a debt yet still keep lots of property. Bankruptcy cases are a push and pull between enforcing a creditors right a right that was bargained for when the debtor took on the debt and an honest but unfortunate debtors ability to get a fresh start in life.

More practically, people often file for bankruptcy when they cant afford to maintain a minimal standard of living as a result of their debts. Often, people that are thinking about filing for bankruptcy have suffered some event that has caused a decrease in assets or income. It could be a medical issue, separation or divorce, having a new child, loss of employment. When one or more of these things happen, people have to choose between keeping a roof over their head and food on their table versus paying their debts.

Read Also: How To File Bankruptcy In Illinois

Should I File For Bankruptcy

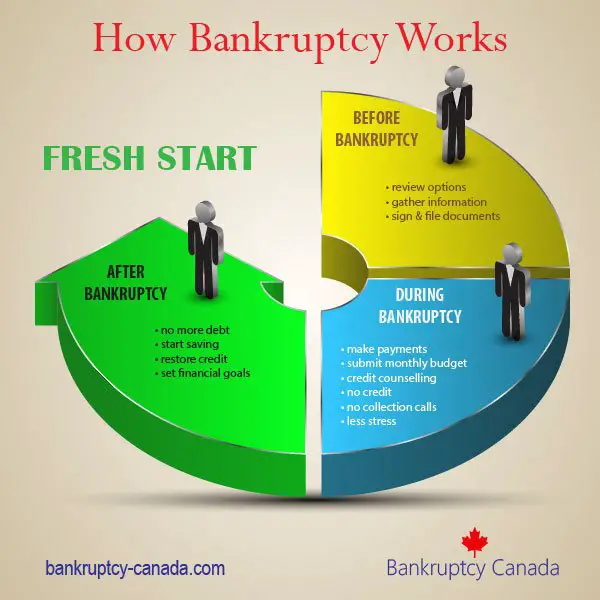

The first step in declaring bankruptcy in Canada is recognizing and assessing your financial situation.

Filing for personal bankruptcy starts with understanding that you have a debt problem. The sooner you recognize your financial situation, the sooner you can begin your bankruptcy filing. If you have been wondering whether or not to file for bankruptcy, here are a few signs that you might need to consider taking this step:

- Your credit cards are always at their limit

- You are paying bills with your credit cards or cash advances

- You continually fail to make one or more payments each month

- You have received letters threatening legal action unless you pay money owed

- Loss of income in the household means there is no money to pay the debts

- You are making the payments, but the debt is persisting/increasing

- You are credit reliant the cost of the debt is so high there is no money left for everyday expenses so you need to use your credit cards to buy gas and groceries

- You are overwhelmed and stressed about your finances, and it is affecting your sleep and wellness

- You have reached your borrowing limit and your bank will not provide any further financial assistance

Every bankruptcy file is different, but there are consistent indicators that you need to seek help with your finances. If any of the above points sound familiar, declaring personal bankruptcy may be the right choice.

How Do I Declare Bankruptcy

You can go bankrupt in one of two main ways. The more common route is to voluntarily file for bankruptcy. The second way is for creditors to ask the court to order a person bankrupt.

There are several ways to file bankruptcy, each with pros and cons. You may want to consult a lawyer before proceeding so you can figure out the best fit for your circumstances.

Recommended Reading: What Type Of Bankruptcy Did Trump File

Bankruptcy Can Stop Collection Activities Eliminate Most Types Of Debt And Allow You To Reorganize Your Debts And Catch Up On Missed Mortgage Or Car Loan Payments

Updated By Cara O’Neill, Attorney

Filing for bankruptcy relief can help you get out of debt. Depending on the chapter you file, you’ll be able to:

- stop foreclosure, repossession, lawsuits, and other collection activities

- eliminate your personal liability for most types of debt, and

- reorganize your debts and catch up on missed payments.

Learn what Chapter 7 and Chapter 13 can offer.

Downsides To Chapter 11 Bankruptcy For Small Businesses

If you own a small business, you will want to seriously consider whether Chapter 11 is right for you.

Chapter 11 gives small businesses extra time to create a plan, file it, and renegotiate repayment terms with their creditors . But it also has its drawbacks.

It can cost tens of thousands of dollars in legal fees, which may be unsustainable for a struggling small business.

If the emergence from bankruptcy protection proves successful, these costs are offset by the ultimate reward of becoming profitable. In any case, its best to discuss your options with a seasoned business bankruptcy attorney before deciding.

You May Like: Wi Bankruptcy Filings

The Individual Insolvency Register On Annulment

Once notice of the annulment is received your bankruptcy will be removed from the Individual Insolvency Register after:

- 28 days if the bankruptcy order should not have been made

- 3 months if the debts were paid in full or an IVA has been agreed

If an IVA has been agreed, details of this will appear on the register.

How To Assess Your Financial Situation

Here are a few questions to help you assess your financial danger zone:

- Do you only make minimum payments on your credit cards?

- Are bill collectors calling you?

- Does the thought of sorting out your finances make you feel scared or out of control?

- Do you use credit cards to pay for necessities?

- Are you considering debt consolidation?

- Are you unsure how much you actually owe?

If you answered yes to two or more of the questions above, you at least want to give your financial situation a little more thought. Simply put, bankruptcy is when you owe more than you can afford to pay.

To determine where you are financially, inventory all of your liquid assets. Don’t forget to include retirement funds, stocks, bonds, real estate, vehicles, college savings accounts, and other non-bank account funds. Add up a rough estimate for each item.

Then, collect and add up your bills and credit statements. If the value of your assets is less than the amount of debt you owe, declaring bankruptcy may be one way out of a sticky financial situation. However, bankruptcy shouldn’t be approached casually. After all, it’s not a simple, easy cure-all for out-of-control debt.

Also Check: New Car After Chapter 7

Benefits Of Chapter 11 Bankruptcy

Chapter 11 bankruptcy restructuring has some key benefits. It:

- Avoids total liquidation of the business

- Provides more time to develop and file a plan

- Allows reorganizing of things that are not working

- Allows you to retain control of your business

On the other hand, Chapter 11 is also more time-consuming and costly than other forms of bankruptcy.

Alternatives To Chapter 7

Debtors should be aware that there are several alternatives to chapter 7 relief. For example, debtors who are engaged in business, including corporations, partnerships, and sole proprietorships, may prefer to remain in business and avoid liquidation. Such debtors should consider filing a petition under chapter 11 of the Bankruptcy Code. Under chapter 11, the debtor may seek an adjustment of debts, either by reducing the debt or by extending the time for repayment, or may seek a more comprehensive reorganization. Sole proprietorships may also be eligible for relief under chapter 13 of the Bankruptcy Code.

In addition, individual debtors who have regular income may seek an adjustment of debts under chapter 13 of the Bankruptcy Code. A particular advantage of chapter 13 is that it provides individual debtors with an opportunity to save their homes from foreclosure by allowing them to “catch up” past due payments through a payment plan. Moreover, the court may dismiss a chapter 7 case filed by an individual whose debts are primarily consumer rather than business debts if the court finds that the granting of relief would be an abuse of chapter 7. 11 U.S.C. § 707.

Debtors should also be aware that out-of-court agreements with creditors or debt counseling services may provide an alternative to a bankruptcy filing.

Also Check: Filing Bankruptcy In Maryland Yourself

Understand The Advantages Of Filing For Bankruptcy

You may have wondered, what is the downside of filing for bankruptcy? There are some advantages to filing for bankruptcy, too, however. When you need a fresh start to get out from under a heavy debt load, filing for bankruptcy could be just the answer you need. In addition to a new start, federal bankruptcy offers consumers, business owners, and corporations many benefits, including the following:

- Complete relief of all dischargeable debts with no further obligation to repay them.

- The ability to hold on to some personal property and assets like your home and vehicle.

- Relief from the constant pressure and invasive contact from debt collectors.

- Over time, your credit score can improve when discharged debts are removed from your .

Your wages cannot be garnished by your creditors and your car cannot be repossessed while you are going through the bankruptcy process. Your lawyer can explain other advantages to filing bankruptcy that apply to your specific situation. Bankruptcy can give you the opportunity to create a new financial picture for yourself, your family, or your business.

Your Interview With The Official Receiver

If your bankruptcy is approved, youll have an interview with the official receiver. If youve presented your own bankruptcy petition, this might happen directly after the bankruptcy order is made. Alternatively, your letter from the official receiver may invite you to an interview either in person or by telephone. If offered a telephone interview you can ask to be interviewed in person, if you prefer.

If youve been made bankrupt by one of your creditors the official receiver may also contact you by telephone to find out if there is anything that needs to be sorted out urgently.

You must attend the interview and cooperate with the official receiver. If you do not, your bankruptcy could be extended beyond the normal 12 months and you could face an examination in court. The more organised you are, the more straightforward the process will be.

Before the interview, telephone the official receiver to confirm or rearrange the appointment let them know if:

- you require special facilities

- there is anything that needs to be sorted out urgently

- you need more time to gather the paperwork for the meeting

If you have been sent a questionnaire, fill it in, and note down anything you do not understand. If youre having a telephone interview, return it by the date given.

Collect together all the paperwork youve been asked to take to the interview or have with you during the telephone call.

Face-to-face interviews may take 2 to 3 hours.

After you arrive:

The examiner will:

You May Like: How Many Bankruptcies Has Trump Had