Chapter 11 Bankruptcy 101

Chapter 11 bankruptcy proceedings are normally used by struggling businesses as a way to get their affairs in order and pay off their debts.

In addition, some individuals also file for Chapter 11 bankruptcy when they are not eligible for Chapter 13 bankruptcy or own large amounts of non-exempt property . However, Chapter 11 can be much more expensive and time-consuming when compared to Chapter 13.

What Is Chapter 7 Vs Chapter 13

Chapter 7 and Chapter 13 are sections of the U.S. Bankruptcy Code, the federal law governing bankruptcy in America.

A Chapter 7 bankruptcy is the American solution to personal debt problems that is most similar to a Canadian bankruptcy. A Chapter 13 bankruptcy is the American solution to personal debt problems that is most similar to a Canadian consumer proposal. Both the American types of bankruptcy have these features:

- The debtor is discharged from unsecured debts.

- As soon as the bankruptcy is filed, there is a stay of all collection efforts by creditors.

- A meeting of creditors is held soon after the filing, which the debtor must attend to answer questions about his or her case.

Chapter 7 and Chapter 13 bankruptcies have these differences:

- Chapter 7 is the solution of last resort, in which the individual cannot repay a significant portion of his debts. Chapter 13 is the solution in which the individual intends to repay all or a large part of his unsecured debts, but needs an extended period to do so.

- With Chapter 7, the debtor loses all assets beyond those considered necessary for basic living, which are called bankruptcy exemptions. Under Chapter 13, the debtor keeps all assets.

Chapter 7 Bankruptcy Is A Legal Process That Can Help Individuals Get Relief From Debts By Discharging Or Clearing Some Or All Of Whats Owed

If you qualify, Chapter 7 bankruptcy may allow you to discharge a variety of debts, but typically excludes obligations like child support, student loans or tax debt.

The main benefit of filing for Chapter 7 bankruptcy is that it can give the honest debtor a fresh start, says bankruptcy attorney Richard Symmes, principal attorney at Symmes Law Group.

But it isnt a simple fix-all. The repercussions of filing Chapter 7 bankruptcy can include losing some of your physical assets and having your credit take a major hit.

Chapter 7 bankruptcy may be able to offer the financial reset you need, but you should know about the drawbacks before you consider filing.

Read Also: How Many Times Has Donald Filed Bankruptcy

Bankruptcy Definition: What Exactly Is It

By FindLaw Staff | Reviewed by Maddy Teka, Esq. | Last updated April 19, 2021

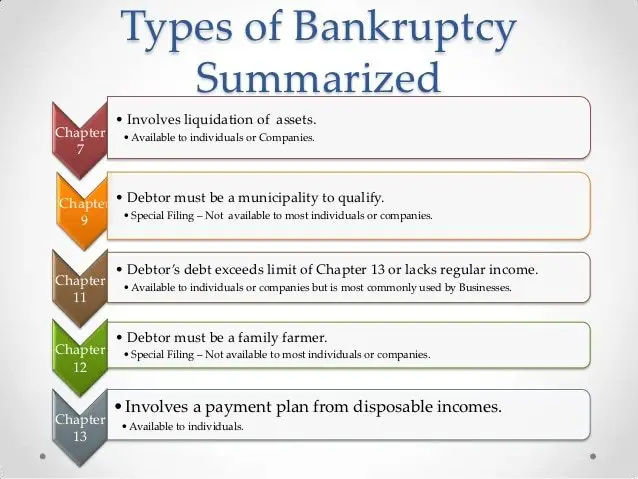

Bankruptcy is a generalized term for a federal court procedure that helps consumers and businesses get rid of their debts and repay their creditors. If you can prove that you are entitled to it, the bankruptcy court will protect you during your bankruptcy proceeding. In general, bankruptcies can be categorized into two types:

Among the different types of bankruptcies, Chapter 7 and Chapter 13 proceedings are the most common for individuals and businesses. Chapter 7 bankruptcies normally fall in the liquidation category, meaning your property could be sold in order to pay back your debts.

Conversely, Chapter 13 bankruptcies generally fall under the reorganization category, meaning that you will probably be able to keep your property, but you must submit and stick to a plan that will allow you to repay some or all of your debts within three to five years.

Filing Chapter 7 Bankruptcy In Florida

Chapter 7 Bankruptcy is the legal procedure where the debtors unsecured debt is discharged after the debtors non-exempt assets have been liquidated. To file a Chapter 7 bankruptcy in Florida, a person must be a permanent Florida resident or own property in the state. Florida has three bankruptcy districts , and each of Floridas counties is assigned to one of the three bankruptcy districts. People must file bankruptcy in the district and local division where they reside.

Also Check: Trump How Many Bankruptcies

How Do I Decide Between Chapter 7 Vs Chapter 11

Chapter 11 bankruptcy is an extremely expensive process that makes sense for high net-worth individuals who need a way to restructure their obligations. Notable individuals who filed for Chapter 11 bankruptcy include Hall of Fame Quarterback Johnny Unitas, Real Housewife of New York Sonja Morgan and Oscar winner Kim Basinger.

If you’re not among the and famous and can’t afford to pay your credit cards, car loan, or medical bills because your regular income isnât enough to cover it all, you probably need to file a Chapter 7 case. A Chapter 7 case gets rid of most, if not all, of your unsecured debts.

Who Can File Chapter 7 Bankruptcy

Not everyone qualifies for a Chapter 7 discharge. You’ll qualify if your gross income is lower than your state’s median income. If it’s higher, you’ll still qualify if, after paying allowed monthly debts, you don’t have enough left over to feasibly complete a Chapter 13 repayment plan.

Other requirements exist, too. For instance, you won’t be able to use Chapter 7 bankruptcy if you already received a bankruptcy discharge in the last six to eight years . And where you can file will depend on how long you’ve lived in the state.

Learn more about the Chapter 7 eligibility requirements.

Recommended Reading: Toygaroo Company

Adversary Claims And Objections

If a creditor believes its debt should not be discharged, it may file an adversary case during the bankruptcy proceeding. The most common ground for a creditor filing an adversary case is fraud.

Fraud in this context is not criminal. In this context, fraud means that the debtor abused his relationship with the creditor and bankruptcy process. Fraud supporting a creditors discharge objection could, for example, refer to a bankruptcy debtor who used a credit card to buy property or take cash advances prior to filing bankruptcy when the debtor was financially insolvent.

If a debtor incurred a debt when the debtor planned to file bankruptcy the creditor could have a basis to set aside a discharge of that debt for fraud during an adversary case.

Chapter 7 Filing Fees And Administrative Fees

When you file for Chapter 7 bankruptcy, the courts will charge you:

- One case filing fee of $220

- One miscellaneous administrative fee of $39

- One trustee surcharge of $15

Typically, the total fee of $274 is paid to the clerk of the court when you file your paperwork. If you cannot pay this amount right away, you must:

- Ask the court’s permission to delay paying

- Pay in four installments of $68.50

- Complete all payments within 120 days after filing for bankruptcy

- Ask the court for extra time which will extend your time to 180 days after filing for bankruptcy.

If you and your spouse chose to file together, you only owe one set of these fees. If you don’t pay these fees your case can be dismissed.

The court may waive the requirement that the fees be paid if:

- Your combined income is less than 150% of the poverty level

- You can’t afford the fees even with an extension or four payments

Read Also: How Many Times Has Trump Declared Bankruptcy

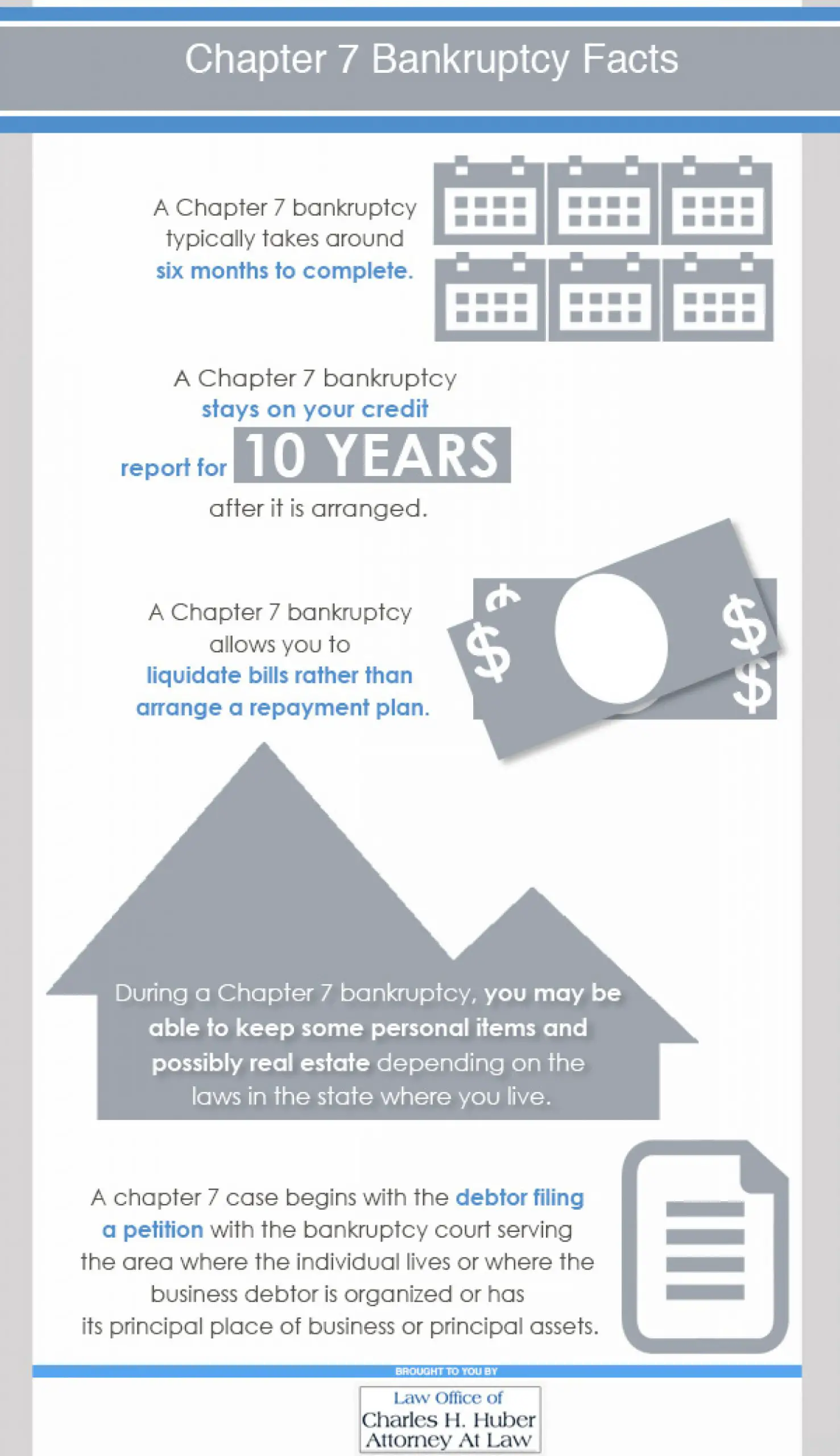

How Can Chapter 7 Bankruptcy Affect My Credit

One of the major repercussions of filing for bankruptcy is the likely hit to your credit. According to VantageScore Solutions, a company that provides scoring models that calculate some of your , filing for bankruptcy can have a more severe negative impact on your credit than many other financial events.

How many points can you lose? It will vary depending on your current scores and other factors relating to your financial situation. While the impact to your credit can decrease over time, your scores will probably take the biggest hit upfront.

Chapter 7 bankruptcy stays on your for up to 10 years. Bankruptcy wont necessarily prevent you from qualifying for new credit or even from being approved for a mortgage, but it can mean facing higher interest rates and fees.

Remember that no matter what the impact, your credit can be improved with time and effort. By practicing healthy financial habits paying bills on time, keeping credit card balances low, and trying not to apply for multiple new loans or credit in a short period you can eventually rebuild your credit.

Ask A Lawyer A Question

You’ll hear back in one business day.

Other than consumer perceptions that bankruptcy is somehow unethical or wrong, the primary issue with filing bankruptcy is that it remains on the debtors credit for up to seven or ten years from filing and may interfere with efforts to obtain credit, purchase or refinance a home or even obtain employment. However, it should be noted that most who seek this relief already have impaired credit and, more importantly, in reality new credit is generally extended to debtors who keep their payments current for a year or two following discharge. So, in effect bankruptcy can work to repair credit.

The United States Bankruptcy Code offers two primary paths for consumers: Chapter 7 and Chapter 13. Chapter 11, on the other hand, is primarily for businesses. Here’s some more information on each type:

Also Check: What Is Epiq Bankruptcy Solutions Llc

Which Should I Usechapter 7 Or Chapter 13 Bankruptcy

Most people who file for bankruptcy choose to use Chapter 7 if they meet the eligibility requirements. Chapter 7 is a popular choice because, unlike Chapter 13, it doesn’t require filers to pay back a portion of their debts. Learn when Chapter 7 bankruptcy is a better choice than Chapter 13.

Chapter 13 will make more sense if you’re behind on your mortgage and want to keep your house. You can repay the missed payments over time using the Chapter 13 repayment plan. You can also force a creditor to allow you to repay nondischargeable debts, like back taxes or support arrearages, over three to five years. Find out more about when you’d use Chapter 13 bankruptcy instead of Chapter 7.

Required Information To Submit When Filing Chapter 7

Filing for Chapter 7 requires information about income, debts, and property. You should be ready to submit:

- A list of all credit cards and the amount you owe

- Any child support or spousal support you pay and/or owe

- Most recent federal tax return

- Last year’s tax return

- Paycheck stubs for the past 60 days

- A list of your assets, property, and any liabilities

- Current monthly total income and expenses

- Your general financial affairs

- Any current contracts or unexpired leases

- Proof of your credit counseling class

- Your debt repayment plan

- A record of qualified federal or state education tuition accounts or interest gained

Even If you decide to file together you both still need to submit all the documents above as if you were filing alone, such as both spouses submitting their income records.

Don’t Miss: Is Taco Bell Filing For Bankruptcy

Debts That Can And Cant Be Discharged In Chapter 7 Bankruptcy

Chapter 7 should dismiss most of the debts you owe, but there are some hard-and-fast debts that cant be discharged in Chapter 7.

The list of non-dischargeable debts includes:

- Child support

- Student loans must prove undue hardship

- HOA fees if you surrender your home or condo

- Any other form of unsecured debt.

Will Bankruptcy Cause Me To Lose My Safe Deposit Box

Maybe. You are required to declare all of your assets when filing bankruptcy, including the contents of any safe deposit boxes that you own. If you are filing Chapter 7 bankruptcy, for example, all of your assets beyond certain exempt amounts may be liquidated in this situation, you could lose your safe deposit box. Additionally, if you fail to disclose the safe deposit box and/or its contents in your bankruptcy filings, your bankruptcy could be subject to dismissal for attempting to hide assets.

Recommended Reading: How Many Times Trump Filed Bankruptcy

How Do I Pay Creditors Back In A Chapter 7 Vs Chapter 11 Case

Debts are handled differently in Chapter 7 vs. Chapter 11 cases. Debtors in Chapter 7 cases do not pay creditors back. If the bankruptcy trustee sells property as part of the administration of the case, unsecured creditors receive a share of the money. Debtors in Chapter 11 cases pay back different classes of creditors in different ways through a bankruptcy plan. The Debtor routinely makes regular payments to creditors after filing a Chapter 11 bankruptcy proceeding.

Why Would Someone Choose Chapter 13 Over Chapter 7

First, under Chapter 13, the list of debts eligible for discharge is more expansive than under Chapter 7. This includes debts arising from willful and malicious injury to property and debts from divorce property settlements.

Retired bankruptcy court attorney adviser Shaun K. Stuart has some other possible explanations. Stuart assisted with the St. Louis Feds Page One Economics essay, Bankruptcy: When All Else Fails, published in April 2018.

Stuart noted that:

- Chapter 13 allows you to reschedule certain debts to be spread out over a longer period of time, which could lead to smaller, more manageable payments.

- If you are behind on your mortgage, you can keep your home and prevent foreclosure, as long as you keep making payments.

- Furthermore, you have more time to pay back debts that cant be discharged under Chapter 7 .

- Chapter 13 can also protect third parties who are liable with the debtor on consumer debts. For example, if a payment plan is completed, co-signers are protected from creditor action.

- You can assign debts with co-debtors to different payment percentages and creditor classes than debts incurred by yourself.

Lastly, Stuart said, you can pay attorney fees through the Chapter 13 plan, and file a Chapter 13 more than once if needed.

Also Check: How Many Times Has Donald Filed For Bankruptcy

What Is The Difference Between Chapter 7 And Chapter 13 Bankruptcy

If you do ultimately decide to file, one of the first big decisions you’ll make is whether to file Chapter 7 or Chapter 13 bankruptcy. These chapter names refer to sections of the U.S. Bankruptcy Code where it’s outlined how, exactly, your debt is taken care of in each process. The choice to file one or the other determines whether you’ll be put on a debt repayment plan or if your debts will be settled with the property you own. If you find yourself at a crossroads, start here to get a grasp on what’s ahead.

Chapter 7 Vs Chapter 11 Bankruptcy In 2021

Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card. Explore our free tool

In a Nutshell

Chapter 11 bankruptcy can be quite similar to Chapter 7 bankruptcy. But it’s also really different. Learn how each type of bankruptcy can provide you with debt relief.

Written by Attorney Jonathan Petts.

For many people, filing for bankruptcy relief is a difficult decision. Once the decision is made, however, itâs time to decide what type of bankruptcy to file. If you’re not eligible to file for Chapter 13 bankruptcy, it helps to understand the difference between Chapter 7 vs. Chapter 11 bankruptcy before making a decision.

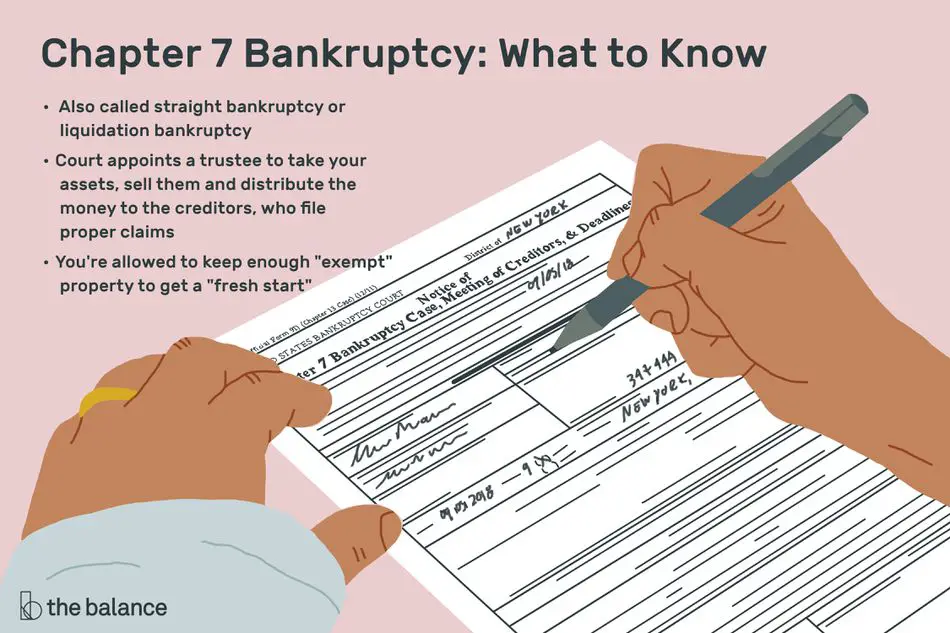

The United States bankruptcy laws have the goal of giving the unfortunate but honest debtor a fresh start. One way that can be accomplished is by having a bankruptcy trustee liquidate the debtor’s assets for the benefit of creditors as part of a Chapter 7 bankruptcy proceeding.

You May Like: How To File Bankruptcy In Texas Without An Attorney

Federal Tax Refunds During Bankruptcy

You can receive tax refunds while in bankruptcy. However, refunds may be subject to delay, to turnover requests by the Chapter 7 Trustee, or used to pay down your tax debts. If you believe your refund has been delayed, turned over, or offset against your tax debts you can check on its status by going to our Wheres My Refund tool or by contacting the IRS Centralized Insolvency Operations Unit at 1-800-973-0424. The unit is available Monday through Friday from 7:00 a.m. to 10:00 p.m. eastern time.

What Is Chapter 7 How Does It Work

In a Chapter 7 bankruptcy, youâll fill out forms about what you earn, spend, own, and owe and submit these forms to the bankruptcy court. Youâll also submit recent tax returns and pay stubs, if youâre employed.

A trustee, who is an official assigned to your case, will review your forms and documents. Youâll have a brief meeting with them, where theyâll ask you basic questions about whatâs in your forms.

A couple of months later, youâll get a notice in the mail from the court making your bankruptcy discharge official. The vast majority of people who are honest, fully fill out their bankruptcy forms, and complete the required steps get their bankruptcy accepted by the court.

Don’t Miss: How Many Times Did Donald Trump File For Bankruptcy

The Players In Bankruptcy

There are five important groups of people you need to be aware of in your Chapter 7 bankruptcy case.

1. The Chapter 7 Trustee: The person tasked with taking inventory of your assets and liquidating any non-exempt property for the benefit of creditors. The Trustee is not a court or government employee, but an individual appointed by the U.S. Trustee to administer your case. The Trustee gets paid a flat-fee of $60 and makes money by liquidating your assets. Most cases are what we call no-asset cases, meaning that there are no assets that can be taken from you to sell for the benefit of your creditors.

2. The Debtor: This is you.

3. Your Attorney: The lawyer you choose to represent you in your bankruptcy case.

4. The Judge: The man or woman in the shiny black robe. The Judge is there to decide any disputes that cannot be agreed to between the Trustee, any creditors, and the Debtor. You will most likely never meet a bankruptcy judge.

5. Your Creditors: You owe these people money , and they will be represented by their own attorneys.