Lesson : Control Your Debts Before They Get Out Of Hand

Having debt is not the problem, but not controlling them is. Bankruptcy only rears its head when you are proven unable to pay off your debt. Hence, if you should take on debt, be sure to track your debt and their interest charges carefully and make sure you are able to keep up with payments.

One important way to control your debt is by reducing their interest charges with the help of a personal loan, balance transfer or a debt consolidation plan.

Another way is to limit how much you borrow each time.

Some People Only Discover They Have Been Made A Bankrupt When They Apply For A Loan From A Financial Institution Now Theres An Easy Way To Find Out Your Bankruptcy Status

- MyDI smartphone app available for download from May 11

- Second phase of app enables bankrupts to apply for discharge

- Insolvency Act to focus on social guarantors

The app does not seem to be working. Instead, check bankruptcy status at;.

Taking the hassle out of visiting the Insolvency Department of Malaysia, the MyDI smartphone app will allow you to search on your bankruptcy status online.

Minister in Prime Ministers Department in charge of Legal Affairs Datuk Seri Azalina Othman Said launched the app today which will be available for download from May 11.

She said the first phase of the app will only allow checking of bankruptcy status. For the second phase, the app would enable bankrupts to apply for release from the Insolvency Department.

The Bankruptcy Bill 2016, which was tabled in Parliament for its first reading in November last year, will be tabled for a second reading in the current sitting. It is expected to receive the consent of the Yang di-Pertuan Agong next month and would be known as the Insolvency Act. The bill will focus, among others, on the social guarantor and those who became guarantors for education grants and purchase of vehicles and property.

There are many people who become victims of circumstances, especially when they sign as guarantors for education loans. It is not fair to them, Azalina said. With the amended act, we hope to provide assistance to help them in getting an early discharge.

- TAGS

Bankruptcy In The United States

Like the economy, bankruptcy filings in the U.S. rise and fall. In fact, they are like dance partners; where one goes, the other usually follows.

Bankruptcy peaked with just more than two million filings in 2005. That is the same year the Bankruptcy Abuse Prevention and Consumer Protection Act was passed. That law was meant to stem the tide of consumers and businesses too eager to simply walk away from their debts.

The number of filings dropped 70% in 2006, but then the Great Recession brought the economy to its knees and bankruptcy filings spiked to 1.6 million in 2010. They retreated again as the economy improved, but the COVID-19 pandemic easily could reverse the trend in 2021. It seems inevitable that many individuals and;small businesses will declare bankruptcy.

You May Like: How To Access Bankruptcy Court Filings

As Bankrupt Can My Past Creditors Still Sue Me

Your creditors cannot sue you for the monies that you owe them before bankruptcy. They ought to have lodged their claim with the Official Assignee. However, should you find yourself in a position where you had become indebted to new creditors after becoming bankrupt through business dealings or a new personal loan, then the new creditors will still be able to commence legal proceedings against you. However, if you are fined for breaching the law, such as for traffic offences, you will have to pay up the stipulated amount.

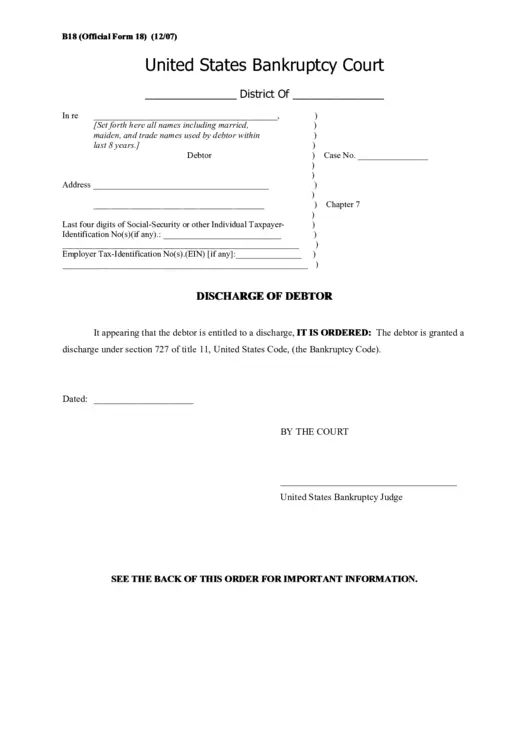

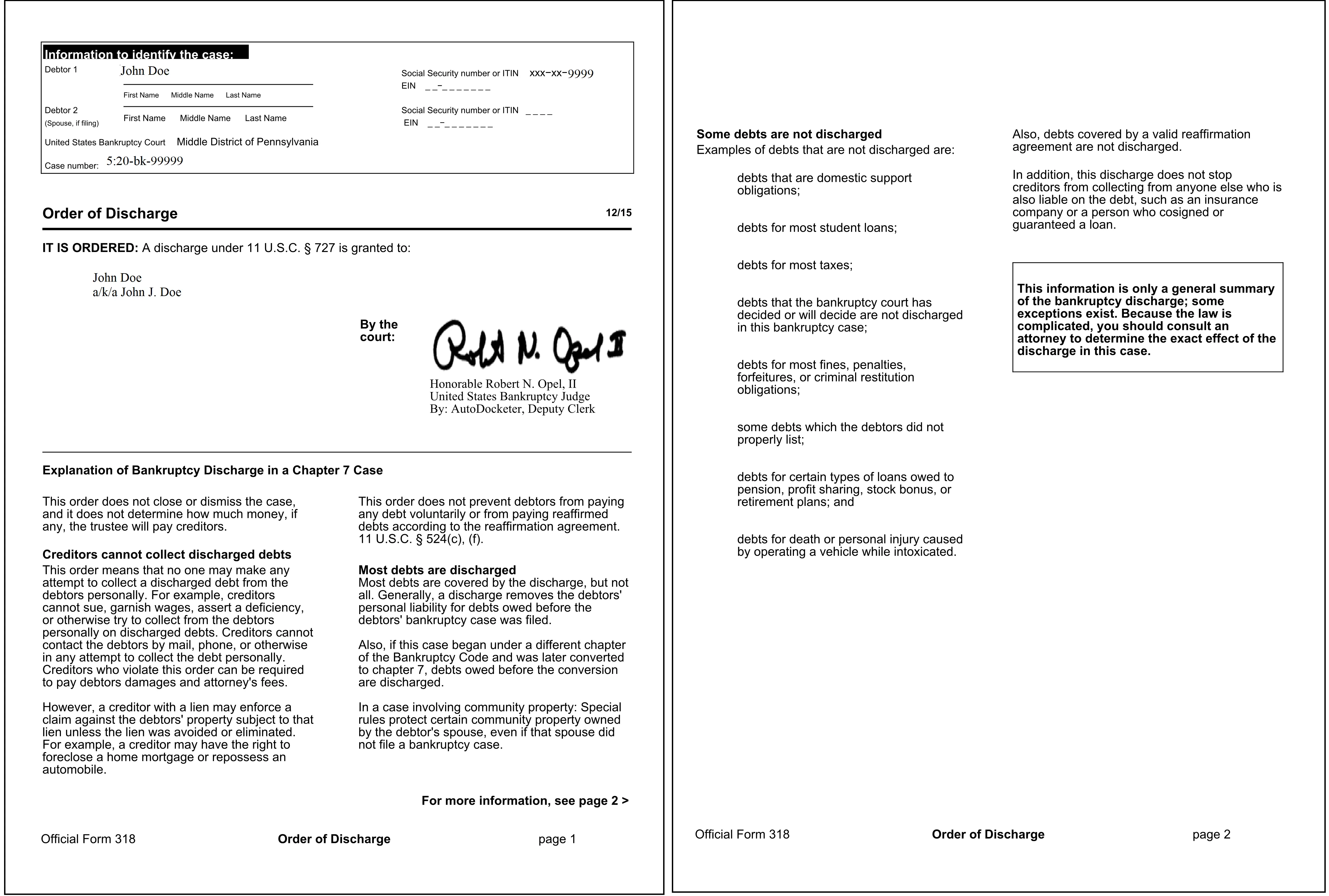

Does The Debtor Have The Right To A Discharge Or Can Creditors Object To The Discharge

In chapter 7 cases, the debtor does not have an absolute right to a discharge. An objection to the debtor’s discharge may be filed by a creditor, by the trustee in the case, or by the U.S. trustee. Creditors receive a notice shortly after the case is filed that sets forth much important information, including the deadline for objecting to the discharge. To object to the debtor’s discharge, a creditor must file a complaint in the bankruptcy court before the deadline set out in the notice. Filing a complaint starts a lawsuit referred to in bankruptcy as an “adversary proceeding.”

The court may deny a chapter 7 discharge for any of the reasons described in section 727 of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; destruction or concealment of books or records; perjury and other fraudulent acts; failure to account for the loss of assets; violation of a court order or an earlier discharge in an earlier case commenced within certain time frames before the date the petition was filed. If the issue of the debtor’s right to a discharge goes to trial, the objecting party has the burden of proving all the facts essential to the objection.

You May Like: How To File For Bankruptcy In Wi

Can You Add Creditors After Filing Chapter 7

If you file a Chapter 7 case and find out about it before the case is closed, you can have your attorney file an amendment to add the creditor and all will be well. For Chapter 7 cases where no money is distributed to creditors, if you learn of a debt that was missed after the case was closed, do not panic.

How To Find The Date A Bankruptcy Was Discharged

Finding your bankruptcy discharge order is the simplest way to find the date your bankruptcy was discharged. When a person files for bankruptcy, they eventually receive a bankruptcy discharge that signifies the end of the process and releases the debtor from personal liability for their debts. All debts involved in the bankruptcy case are no longer legally enforceable. The discharge is a permanent order prohibiting any creditors listed in your bankruptcy petition from making any contact with you or taking any action to collect the discharged debts.

If you plan on applying for credit after completing bankruptcy, new lenders may require you to provide proof that your discharge has taken place. If you are uncertain of the date of your bankruptcy discharge, there are a few different ways to find it.

Recommended Reading: Getting Apartment After Bankruptcy

The Difference Between The Two

Bankruptcy searches are done by individuals. When a bankruptcy search is carried out in Singapore, it is usually done by any individual who wants to determine if they are otherwise bankrupt or not. The Singapore High Court considers any individual unable to repay more than $15,000 in debt bankrupt.

Companies keen to determine their liquidation status in Singapore would perform the corporate insolvency search. This search is carried out by companies who have been forced to wind up by the court. In this context, any organisation unable to fulfil their financial obligations to creditors are categorised under insolvency.

Both searches can be performed by anyone. This means that creditors, employers, investors and even employees can conduct this search if they wanted. Individuals can perform searches on themselves on companies and vice versa.

Debtors Have Debts Frozen Are Protected From Legal Proceedings

Once a person is declared a bankrupt, their debt stops accumulating.

This means that the creditor cannot continue charging interest on the principal sum owed.

The creditor also cannot commence legal proceedings against the bankrupt to recover the debt owed before the debtor was declared a bankrupt, unless they obtain special permission from the courts to do so.

The Official Assignee, or the appointed PTIBs will manage the bankruptcy estate and work towards helping the bankrupt obtain a discharge from bankruptcy.

Recommended Reading: How To File Bankruptcy In Wisconsin

Guide To Bankruptcy Insolvency Searches In Singapore

Bankruptcy is an unavoidable experience for some of us. Unfortunately, it will hinder you when making important career, business, or financial decisions, especially if someone conducts a bankruptcy search and discovers your financial mishap.

But if youre on the other side of the table and will be the one hiring, lending, investing, or even job hunting, bankruptcy searches will help you decide more wisely.;

In Singapore, a bankruptcy search will tell you an individuals bankruptcy status, while a corporate insolvency search will inform you of an organisations liquidation status. Both can help you make a smarter financial decision.;

Usual Ways The Following Parties Use Bankruptcy Or Corporate Insolvency Search Data

An individual and corporate insolvency search is sensitive information, and Singapore keeps records on who sees it. While bad actors can use it against borrowers deep in debt , reputable parties will use it for decision-making and risk-mitigation procedures. Here are the usual ways these individuals use this data to guide their next steps.

Don’t Miss: Epiq Corporate Restructuring Llc

What Happens After The Search

After the search has been done, the following groups may carry out these next steps:

- Employers May reconsider hiring a candidate. If it involves an existing employee, the employer may want to review the scope of duties.

- May decline loan applications, or choose to offer the loan under more onerous terms.

- Investors May want to reconsider investing in the company.

Bankruptcy Will Also Protect Some Assets

Earlier on, we stated that bankruptcy will result in having your assets seized and sold.;

But there are some assets which are protected by law which you will be allowed to keep, such as:

- Property held by you as a trustee for someone else

- Your HDB flat

- Money in your CPF account

- Life insurance policies held in express trust for your spouse or children

- Any items/equipment required for the personal use in your employment, business or vocation

- Equipment/furniture required for your familys needs

- The remainder of your monthly income after deduction of the monthly contribution;

- Any annual bonus or annual wage supplement paid as part of your income

These items listed above will be excluded from the bankruptcy estate, and thus protected from distribution to your creditors.;

Recommended Reading: Can You Be Fired For Filing Bankruptcy

What Are The After

When concluded, a bankruptcy filing remains on the debtor’s credit report for 10 years. However, the damage to the debtor’s credit rating may be mitigated by other factors.

For example, most debtors are unaware that FHA, the federal agency that insures millions of mortgages, has one of the most liberal polices concerning bankruptcy and me mortgages. Generally, the FHA only precludes debtors from obtaining a new FHA mortgage for two years from the discharge date of a Chapter 7 bankruptcy, provided the debtor has an otherwise acceptable credit standing during the two-year period. Because a home is typically the largest purchase individuals make, debtors should realize that financing for a new home may still be available shortly after the bankruptcy action is completed.

It is important to list all debts in a bankruptcy filing, as debts not listed cannot be discharged. However, some debtors retain a credit card with a very low balance, but a large credit line, by purposely omitting the debt from the filing, to ensure they will have future credit available. On the other hand, many banks periodically check customer’s credit reports. If this is done, the card will likely be canceled anyway. Such an action could also jeopardize the bankruptcy discharge, for it smacks of fraud.

What Can The Debtor Do If A Creditor Attempts To Collect A Discharged Debt After The Case Is Concluded

If a creditor attempts collection efforts on a discharged debt, the debtor can file a motion with the court, reporting the action and asking that the case be reopened to address the matter. The bankruptcy court will often do so to ensure that the discharge is not violated. The discharge constitutes a permanent statutory injunction prohibiting creditors from taking any action, including the filing of a lawsuit, designed to collect a discharged debt. A creditor can be sanctioned by the court for violating the discharge injunction. The normal sanction for violating the discharge injunction is civil contempt, which is often punishable by a fine.

You May Like: Getting A Personal Loan After Bankruptcy

Bankruptcy Is Designed To Protect The Debtor

The popular image of a bankrupt is someone who has been stripped bare of every single possession but their clothes, doomed to slog away for the rest of their lives shackled to a never-ending mountain of debt.;

But the truth is a lot less dramatic. And in bankruptcys case, sensible.;

You see, the purpose of bankruptcy is to help settle debts. Since a candidate for bankruptcy is someone who is unable to pay back their debts under the original lending terms, the way out would be to alter the terms to make them more favourable.

Bankruptcy achieves this in three ways:

Determining The Date A Bankruptcy Discharge Took Effect

In the world of bankruptcy, there are many different dates to keep track of. For many debtors, one of the most important is the date the bankruptcy was actually filed. Thefiling date creates a number of powerful protections, including the bankruptcy stay which prevents creditors from attempting to collect on a debt they are owed.

Other dates include the 341 creditor meeting date, the date by which motions must be filed, and of course the discharge date. The bankruptcy discharge date is the date on whichall of your qualifying debts are officially wiped away. After that, creditors cannot attempt to collect on those debts that were the subject of the bankruptcy discharge.

If you recently went through a bankruptcy, and you need to know the date of your bankruptcy discharge, there are a few different things you can do.

You May Like: How To Claim Bankruptcy In Massachusetts

Are The Bankruptcy Or Corporate Insolvency Records Deleted

Bankruptcy orders that have been annulled or discharged for 5 years or more will be deleted. Undischarged bankrupts will continue to remain in the public search database.

An individual who is discharged from bankruptcy despite not paying their target contribution in full after 7 years or after 9 years will have their name on the bankruptcy record permanently.

Corporate insolvency records are not removed and will continue to remain accessible in a public search.

How Can I Get Out Of Bankruptcy

Under Singaporean law, there are various ways to get out of bankruptcy. Under Section 125 of the Bankruptcy Act, your Official Assignee can issue a certificate discharging you out of bankruptcy, after youve paid a target contribution. The target contribution is determined by the Official Assignee, and it is this very target that needs to be reached in order to receive a discharge from bankruptcy. It is also worth noting that if your monthly contributions add up to your target contribution at certain points of review, you will also be eligible for discharge.

Recommended Reading: Paying Off Chapter 13 Early

What Is The Npii

The National Personal Insolvency Index is a publicly available and permanent electronic record of all personal insolvency proceedings in Australia.

See National Personal Insolvency Index ;for more information.;

Note: The NPII does not include any information on sole trader, company liquidations or administrations.;If you need this information, please speak to the Australian Securities & Investments Commission .

How The Bankruptcy Or Corporate Insolvency Search Is Done In Singapore

Should you need to, this search may be performed online through the e-services offered by the Ministry of Law Insolvency Office. If you belong to an organisation with granted partner access, you can do the search through the Partners option. You will need a SingPass to log in.

To execute the bankruptcy or corporate insolvency search, you need to provide the following information:

- Bankruptcy Searches Identification or bankruptcy number of the individual.

- Corporate Insolvency Search The Unique Entity Number or winding up reference number of the organisation.

;Online bankruptcy searches will incur a fee of $6 per search result that you wish to access. The fee applies whether your results are positive or not. The fee is applicable to both individuals and corporations.

Payment options for the bankruptcy or corporate insolvency search in Singapore can be done through the following channels:

- Visa

Read Also: Does Declaring Bankruptcy Affect Your Spouse

What Other Ways Can Bankruptcy Affect You

Although bankruptcy can protect you from further escalation by your creditors and offer you a basic, if restricted, lifestyle, there are far-reaching consequences to consider.;

- Bankruptcy will be made public

Once declared bankrupt, your name will be entered into Singapores bankruptcy register, which can be freely searched by anyone, including potential employers, clients and the public. This can affect your career path.;

- A declared bankrupt can continue to work, but not in high positions

Contrary to what some might believe, persons under bankruptcy can continue to take up a job. However, part of their wages will be deducted and paid to their bankruptcy estate.

Also, they are not allowed to be involved in the management of a business or act as a director of a company, unless prior permission has been granted by the court or the OA.;

Bankruptcy will cause your credit score to take a hit, and credit bureaus continue to report default in payment for three years from the date of settlement, and bankruptcy data for five years from the date of discharge. This will severely affect your ability to apply for loans, credit cards and mortgages even in the future.;