Tracking The Federal Deficit: February 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $312 billion in February 2021, the fifth month of fiscal year 2021. This months deficitthe difference between $246 billion in revenue and $558 billion in spendingwas $77 billion more than last Februarys. The deficit so far in fiscal year 2021 has climbed to just over $1 trillion, an 83% year-over-year increase . Year-over-year, total spending has risen by 25% and revenues have increased by 5%.

Analysis of Notable Trends: Increased spending in February, and fiscal year 2021 as a whole, mostly resulted from pandemic relief legislation. For instance, the Small Business Administrations Paycheck Protection Program accounted for most of the $133 billion spending increase from last February to this one. SBA outlays soared to $91 billion this February compared to only $100 million in the same month last year. The other largest spending changes were greater outlays on unemployment compensation and $17 billion less in refundable tax credit payments because of a delayed start to the tax filing season this year.

Despite a historic recession, revenues were 5% higher in the first five months of fiscal year 2021 than during the same period last year . This healthy growth is surprising, especially when compared to the onset of the last major recession: In the first five months of fiscal year 2009, revenues plunged 11% year-over-year.

Tracking The Federal Deficit: March 2022

The Congressional Budget Office estimates that the federal government ran a deficit of $191 billion in March 2022, the sixth month of fiscal year 2022. This shortfall was the difference between $315 billion in receipts and $506 billion in spending. The March 2022 deficit was $469 billion smaller than the March 2021 deficit, largely a result of the winding down of most pandemic relief spending that was in place during March 2021.

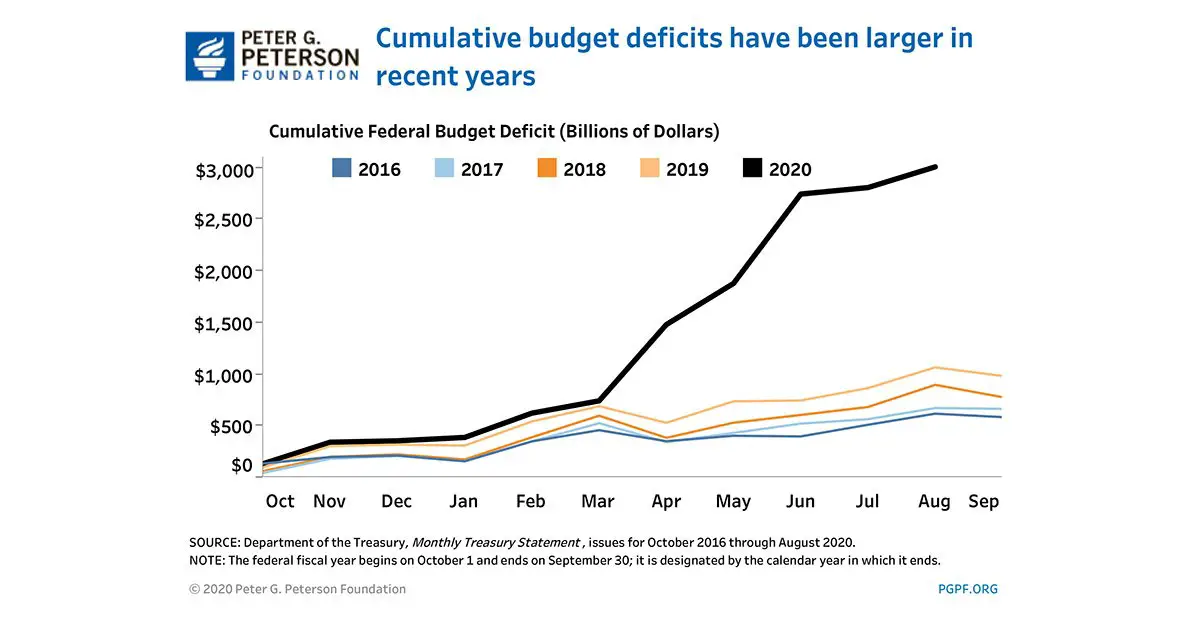

Analysis of notable trends: Halfway through fiscal year 2022, the cumulative deficit has fallen relative to last year and is now comparable to pre-COVID deficits. Through the first six months of FY2022, the federal government ran a deficit of $667 billion, 61% less than at the same point in FY2021 and in the ballpark of the FY2019 and FY2020 deficits, which stood at $691 billion and $743 billion, respectively.

Revenues remained strong, rising $418 billion from the same period in FY2021 to a total of $2.1 trillion during this fiscal year to date. Increases in individual income and payroll tax receipts rose by $357 billion and drove much of the overall surge in receipts. Higher total wages and salaries, especially among upper-income workers who are subject to higher tax rates, contributed to the increase in those tax revenues, as did the receipt of some payroll taxes that pandemic relief legislation authorized companies to defer from 2020 into 2021. Corporate income tax revenues rose by $22 billion year-over-year.

Tracking The Federal Deficit: February 2019

The Congressional Budget Office reported that the federal government generated a $227 billion deficit in February, the fifth month of Fiscal Year 2019, for a total deficit of $537 billion so far this fiscal year. Februarys deficit is 5 percent higher than the deficit recorded a year earlier in February 2018. Total revenues so far in Fiscal Year 2019 decreased by 0.3 percent , while spending increased by 8.5 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Income tax refunds were down by 10 percent from October-February 2019 compared to the same period in Fiscal Year 2018, and corporate income tax receipts were down by 19 percent from October-February 2019 relative to the same period in Fiscal Year 2018. The dip in corporate revenues is primarily attributable to the Tax Cuts and Jobs Act of 2017. On the spending side, Department of Homeland Security outlays decreased by 31 percent due to a relative decrease in disaster spending versus last year. Conversely, net interest payments on the national debt were up 15 percent from October-February 2019 compared to the same period in Fiscal Year 2018.

Also Check: Are Medical Bills Dischargeable In Bankruptcy

National Debt Of The United States

| This article needs to be . Please help update this article to reflect recent events or newly available information. |

| This article is part of a series on the |

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms “national deficit” and “national surplus” usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

During the COVID-19 pandemic, the federal government spent trillions in virus aid and economic relief. The CBO estimated that the budget deficit for fiscal year 2020 would increase to $3.3 trillion or 16% GDP, more than triple that of 2019 and the largest as % GDP since 1945.

What Is The Debt

The debt is the total the U.S. government owesthe sums it borrowed to cover last years deficit and all the deficits in years past. Each day that the government spends more than it takes in, it adds to the federal debt. When the fiscal year ended on September 30, 2019, the federal government owed $16.8 trillion to domestic and foreign investors. By the middle of June 2020, this measure of the debt was up to $20.3 trillion. To see the very latest tally, check the Treasurys The Debt to the Penny website.

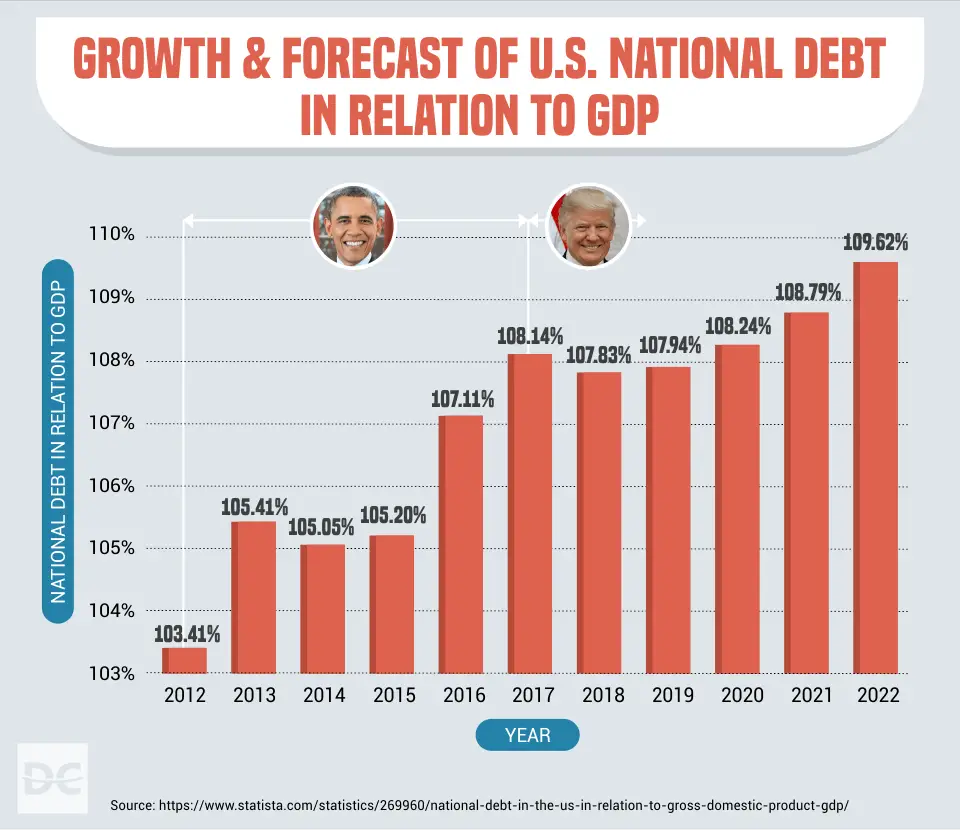

Measured against the size of the economy, the debt was around 35% of GDP before the Great Recession of 200709 and had risen to nearly 80% of GDP right before the pandemic. Its headed to around 100% of GDP by the end of Fiscal Year 2020 on September 30, andbarring a major change in tax or spending policyit will keep rising after that to levels never before seen in U.S. history.

Recommended Reading: How Long Does It Take To File Bankruptcy

Why Is There A Huge Federal Deficit In The First Place

When coronavirus, the virus causing coronavirus disease 2019 began spreading through the United States, the economy came to a screeching halt. Many local businessesâwhich are major drivers of the economyâwere forced to close their doors temporarily, and even permanently, as social distancing measures were put into place.

This sudden halting of businesses thrust the country into a deep recession, officially declared by the National Bureau of Economic Research in June. The bureau determined the U.S. economyâs contraction began in February of this year as employment and economic production levels dropped sharply into March.

The federal government swiftly moved to action by passing the CARES Act in late March. The stimulus relief package provided economic aid to both businesses and individuals through one-time stimulus payments and small-business lending programs, like the Paycheck Protection Program.

The package, which many have described as imperative to keeping the country afloat during the crisis, cost a flabbergasting $2 trillion, solidifying it as the biggest stimulus package in U.S. history.

Editorâs note: This post has been updated to reflect that the unemployment rate for August 2020, which was 8.4%, not 10.2%.

The Great Federal Debt Debate

Some people worry about the countrys ability to repay its debts, or about passing on debts to the next generation. But generally, most economists agree that there is some level of debt that can be OK, and even beneficial.

Another way to see debt is as a useful tool that allows the government to respond to unforeseen crises , provide necessary services that private industry cant or wont provide, or make long-term investments for the good of the country, like in infrastructure or education. It may even save money in the long run, if we spend to prevent problems from getting more expensive. In this view, leaving some debt for future generations may well be worth it if it also means leaving a safer, stronger country and world. In the case of climate change, more spending on renewable energies now could prevent the worst-case scenarios, making the future safer and also saving money in the long run.

Deficits and debt are actually less controversial than you would think from listening to the rhetoric. Both major political parties in the U.S. tend to run deficits when they are in power. For this reason, its worth reading between the lines and asking some questions when anyone argues against a program or law on the grounds of the debt. Often, its not a question of whether or not to add to the debt. Its more a question of when politicians believe it is worth adding to the debt: from tax cuts to wars to COVID relief, all debt is not created equal.

Recommended Reading: Does Bankruptcy Get Rid Of Tax Debt

Tracking The Federal Deficit: April 2022

The Congressional Budget Office estimates that the federal government ran a surplus of $308 billion in April 2022, the seventh month of fiscal year 2022. This surplus was the difference between $864 billion in receipts and $556 billion in spending. Aprils surplus compares to a $226 billion deficit in April 2021, with the dramatic change primarily due to the winding down of most pandemic relief spending and income tax receipts arriving in April 2022 that were delayed during the last fiscal year. In both 2021 and 2022, May 1 fell on a weekend, shifting some outlays into April that would normally have occurred in May. If not for those shifts, the April 2022 surplus would have been $373 billion and the April 2021 deficit would have been $166 billion. The following discussion excludes the effects of those timing shifts.

Analysis of notable trends: The federal government typically runs a surplus in April, the month when most taxpayers pay individual income taxes. However, due to high levels of pandemic relief spending and the IRSs decision to delay Tax Day in 2020 and 2021, April 2022 marked the first April surplus since 2019.

Tracking The Federal Deficit: November 2020

The Congressional Budget Office estimates that the federal government ran a deficit of $146 billion in November, the second month of fiscal year 2021. This deficit was the difference between $365 billion of spending and $219 billion of revenue. Spending in November, however, was artificially lowered by the fact that November 1 fell on a weekend, causing $63 billion worth of payments that would normally be made in November to be made in October instead. If those payments had been made in November as usual, this months spending and deficit would each have been $63 billion greater, or $428 billion and $209 billion . In the first two months of this fiscal year, the federal government has run a deficit of $430 billion, $87 billion more than at this point last fiscal year. Compared to this point last fiscal year, spending has run 9% higher while revenues have fallen by 3%.

Revenues also fell by 3% from last November, mostly reflecting a drop in withheld individual income and payroll taxes due to lower levels of employment.

Recommended Reading: How To Claim Bankruptcy In Ontario Canada

Tracking The Federal Deficit: December 2018

The Congressional Budget Office reported that the federal government generated an $11 billion deficit in December, the third month of Fiscal Year 2019, for a total deficit of $317 billion so far this fiscal year. If not for timing shifts of certain payments, the deficit in December would have been roughly $32 billion, according to CBO. Decembers deficit is 52 percent lower than the deficit recorded a year earlier in December 2017. Total revenues so far in Fiscal Year 2019 increased by 0.1 percent , while spending increased by 9.4 percent , compared to the same period last year.

Analysis of Notable Trends in December 2018: Revenue from customs duties spiked by 83 percent from October-December 2018, relative to the same period in 2017, due to the administrations imposition of new tariffs. Conversely, corporate income tax revenue declined by 15 percent from October-December 2018 relative to the same period in 2017. This dip mainly reflects the reduction of corporate tax rates enacted in the Tax Cuts and Jobs Act of 2017. On the spending side, interest payments on the federal debt in December 2018 rose by 47 percent relative to December 2017.

Corporate And Individual Tax Revenue Are Expected To Remain Elevated Over The Next 10 Years

In 2021, the federal government collected about $4 trillion in revenue, totaling about 18.1 percent of GDP. In 2022, CBO projects revenue will rise to about $4.8 trillion, or 19.6 percent of GDPthe largest annual revenue has been as a share of the economy since 2000.

Over the past 50 years, federal revenue has averaged about 17.3 percent of GDP. Revenue is expected to remain above its long-term average through the next 10 years, averaging about 18.1 percent of GDP from 2022 through 2032 . In particular, individual income tax receipts are expected to increase from 9.1 percent of GDP in 2021 to 10.6 percent in 2022, averaging 9.6 percent over the next 10 years. Corporate tax revenue will remain within its historical average, averaging about 1.5 percent from 2023 to 2032 after a record year of nominal revenue in 2021.

While revenue will remain above-average over the next 10 years, some trends may push in the other direction. For example, the CBO expects capital gains realizations may decline from 5.8 percent of GDP in 2021 to 5.1 percent of GDP over the next 10 years because realizations have been well-above the historical average over the past two years.

CBO Report Shows Total Federal Revenues Will Remain Above Average Over Next Decade| 9.6% |

Also Check: Can Medical Debt Be Discharged In Bankruptcy

Tracking The Federal Deficit: July 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $301 billion in July, the tenth month of fiscal year 2021. Because August 1 fell on a weekend in both 2020 and 2021, certain federal programs that typically pay out large sums on the first of the month did so twice in July. If not for these timing shifts, the deficit would have been $60 billion less last month. Julys deficit was the difference between $261 billion in revenue and $562 billion in spending. Monthly receipts dropped 54% compared to last July due to 2021s return to the regular April and June tax filing deadlines for individual and corporate tax payments.

So far this fiscal year, the federal government has run a cumulative deficit of $2.5 trillion, the difference between $3.3 trillion in revenue and $5.9 trillion in spending. This deficit is 10% lower than over the same period in FY2020, but nearly triple the FY2019 deficit .

Analysis of Notable Trends: Fiscal patterns over the past month continue to reflect the federal governments response to the COVID-19 pandemic, as well as the developing economic recovery.

Growth in federal revenues remains robust, increasing 17% compared to the same 10-month period in FY2020. This increase is indicative of a strengthening economy, with a steady inflow of individual income and payroll taxes from higher total wages and salaries, and corporate taxes from larger corporate profits, the latter of which increased 76% year-over-year.

Wars In Iraq And Afghanistan

Overseas wars and military operations launched after the Sept. 11, 2001, attacks in the U.S., in combination with increased domestic security spending, interest costs, and long-term veterans funding obligations, has added about $8 trillion to the national debt since 2001, by one estimate.

Meanwhile, annual U.S. military spending exceeds that of the next nine highest spenders combined.

Also Check: Does Filing Bankruptcy Cover Back Taxes

What Makes The Debt Bigger

The leading federal spending categories currentlySocial Security, Medicare/Medicaid and defenseare the same as in the 1990’s, when national debt was much lower relative to GDP. The U.S. remains the world’s largest economy and one of the richest countries. How, then, did the debt situation deteriorate? Numerous factors are in play.

Interest And Debt Service Costs

Despite rising debt levels, interest costs have remained at approximately 2008 levels because of lower than long-term interest rates paid on government debt in recent years. The federal debt at the end of the 2018/19 fiscal year was $22.7 trillion. The portion that is held by the public was $16.8 trillion. Neither figure includes approximately $2.5 trillion owed to the government. Interest on the debt was $404 billion.

The cost of servicing the U.S. national debt can be measured in various ways. The CBO analyzes net interest as a percentage of GDP, with a higher percentage indicating a higher interest payment burden. During 2015, this was 1.3% GDP, close to the record low 1.2% of the 19661968 era. The average from 1966 to 2015 was 2.0% of GDP. However, the CBO estimated in 2016 that the interest amounts and % GDP will increase significantly over the following decade as both interest rates and debt levels rise: “Interest payments on that debt represent a large and rapidly growing expense of the federal government. CBO’s baseline shows net interest payments more than tripling under current law, climbing from $231 billion in 2014, or 1.3% of GDP, to $799 billion in 2024, or 3.0% of GDPthe highest ratio since 1996.”

According to a study by the Committee for a Responsible Federal Budget , the U.S. government will spend more on servicing their debts than they do for their national defense budget by 2024.

Recommended Reading: How Many Times Can You File Bankruptcy In Ga