How The National Debt Affects You

When the national debt is below the tipping point, government spending continues and contributes to a growing economy, which means more funding for programs that you can take advantage of.

But when the debt exceeds the tipping point, your standard of living could be impacted. Interest rates may increase and that could slow the economy. The stock market could react to a lack of investor confidence, which could mean lower returns on your investments. And a recession may even be possible.

This also puts downward pressure on a countrys currency because its value is tied to the value of the countrys bonds. As the currencys value declines, foreign bond holders’ repayments are worth less. That further decreases demand and drives up interest rates. As the currencys value declines, goods and services may become more expensive and that contributes to inflation.

The Role Of Annuities In The English National Debt

The role of annuities in the evolution of the national debt, to the 171920 South Sea venture, provides interesting contrasts with contemporary continental public debts. As noted, the 1693 Million Pound Loan was actually a life annuity . In 1694, during the formation of the Bank of England, the Exchequer sold a small series of annuities with various durations: for three lives , two lives , and one life . In 1704, the Exchequer sold another series of annuities, paying 6.60% per year: one series for 99 years and the other for one, two, and three lives. Thereafter, from 1705 to 1709, the Exchequer sold another five series of 99-year redeemable or convertible annuities, with rates that fell from 6.60% to 6.25% . In 1710, it began issuing a combination of 32-year annuities and redeemable lottery loans, at 9.00%. By 1719, the long-term annuities had been increased and converted into 5.00% annuities, totaling £13 331 320, and the short-terms annuities had been expanded and converted into a total of £1 703 366, with an average rate of 7.143%.

A.L. Murphy, in, 2013

Official Form To Launch Later This Month

Morgan Russ, Digital News Editor

The U.S. Department of Education launched a beta version of the federal student loan forgiveness application on Friday evening and is now accepting applications.

According to the departments website, applications are now being accepted to help refine processes ahead of the official form launch.

If you submit an application through the beta version of the site it will be processed later this month when the official form is released. Applicants that used the beta application will not need to resubmit.

Don’t Miss: How To Clear Bankruptcy From Credit Report

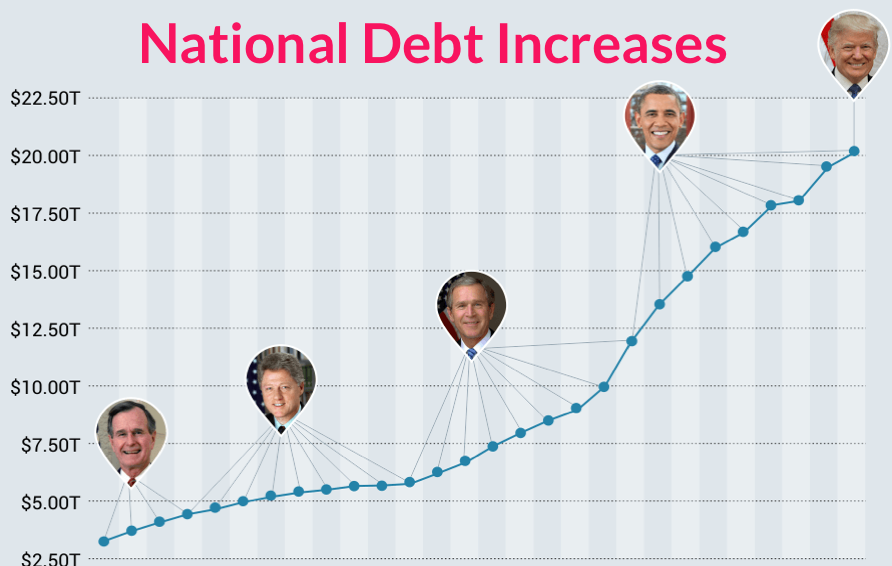

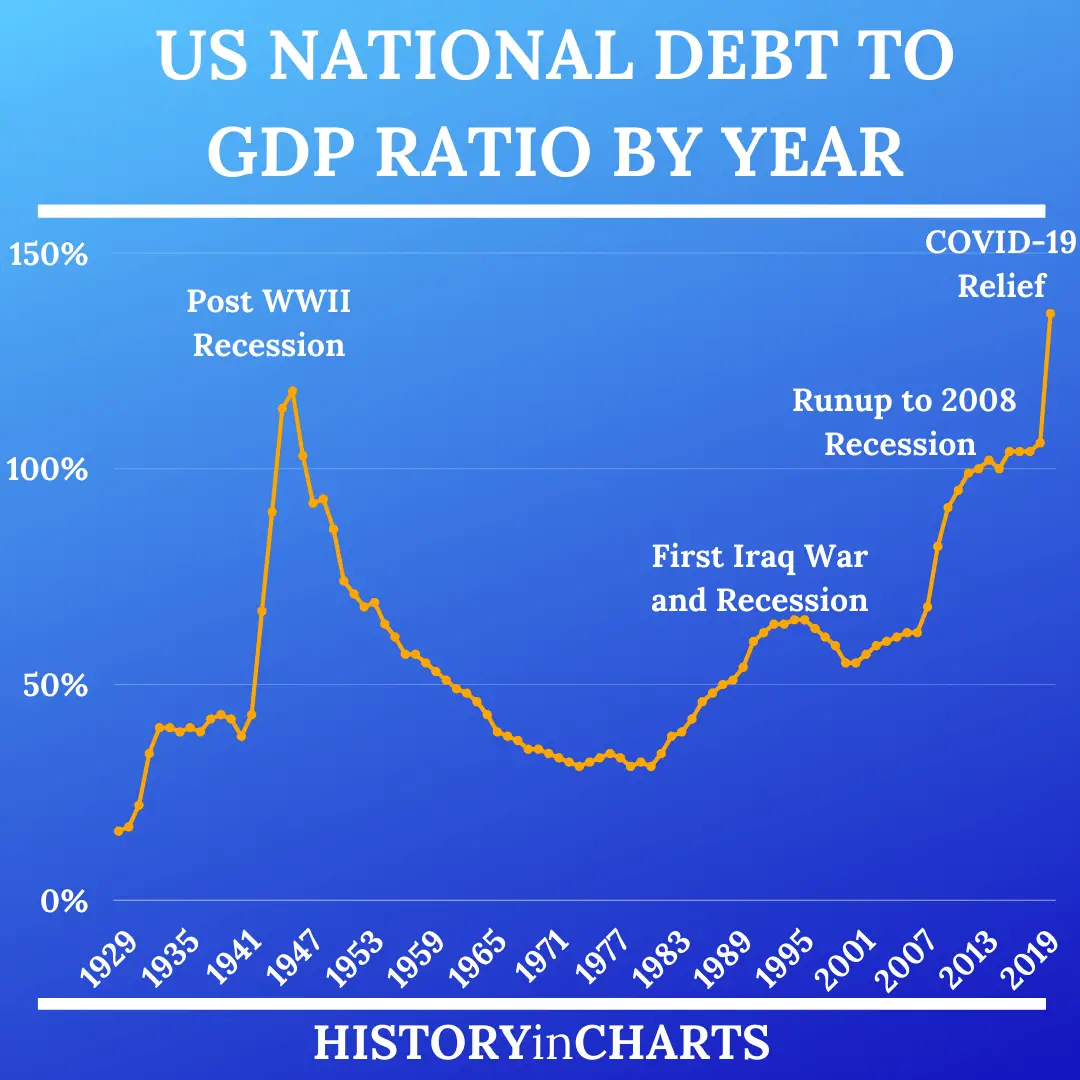

Us National Debt: Great Depression To Great Recession

The national debt again jumped dramatically as the economy tanked and the size, scope and role of government expanded during the Great Depression and the New Deal.

Then came World War II, when the debt-to-GDP ratio would rise above 77 percent for the first time in the nations history, reaching 113 percent by the end of that conflict.

In the post-war years, the national debt shrank in comparison to the booming post-war economy, which saw high GDP growth. The debt-to-GDP ratio went as low as 24 percent in 1974.

Recession and rising interest rates soon caused it to swing upwards again, as did the huge permanent tax cuts during Ronald Reagans first term and increased spending on both defense and social programs, and by the early 1990s, the debt-to-GDP ratio had reached nearly 50 percent.

Economic growth in the late 90s, combined with tax increases under both Presidents George H.W. Bush and Bill Clinton helped bring the debt load back in line, and by 2001 the national debt was less than 33 percent of GDP.

But that would soon change, thanks to increased military spending after the terrorist attacks of 9/11, tax cuts under George W. Bush, and the arrival of the Great Recession, when GDP fell rapidly and business activity and tax revenues shrank.

National Debt Vs Budget Deficit

It’s important to understand the difference between the federal government’s annual budget deficit and the national debt. The federal government generates an annual deficit when its spending over the course of a year exceeds government revenue from sources including taxes on personal income, corporate income and payroll earnings.

When annual congressional appropriations exceed federal revenue, the U.S. Treasury finances the deficit by issuing Treasury bills, notes, and bonds. These Treasury products may be purchased by investors including individuals and pension funds banks, insurers and other financial institutions and the Federal Reserve as well as foreign central banks.

National debt is the sum of such annual budget deficits It is the total amount of money a country owes .

You May Like: How Do You Find Out Who Has Filed For Bankruptcy

Cost Of Servicing The Debt

Distinct from both the national debt and the PSNCR is the interest that the government must pay to service the existing national debt. In 2012, the annual cost of servicing the public debt amounted to around £43bn, or roughly 3% of GDP.

In 2012, the British population numbered around 64 million, and the debt therefore amounted to a little over £15,000 for each individual Briton, or around £33,000 per person in employment. Each household in Britain pays an average of around £2,000 per year in taxes to finance the interest.

Like other sovereign debt, the British national debt is rated by various ratings agencies. On 23 February 2013, it was reported that Moody’s had downgraded UK debt from Aaa to Aa1, the first time since 1978 that the country has not had an AAA credit rating.

This was described as a “humiliating blow” by Shadow Chancellor Ed Balls. George Osborne, the Chancellor, said that it was “a stark reminder of the debt problems facing our country”, adding that “we will go on delivering the plan that has cut the deficit by a quarter”. France and the United States of America had each lost their AAA credit status in 2012.

The agency Fitch also downgraded its credit rating for British government debt from AAA to AA+ in April 2013.

What Will Happen To Our National Debt

U.S. spending is currently at an all-time high to combat the effects of COVID-19. The current level of debt-to-GDP is comparable to the period immediately after World War II. Despite the effort to reduce the national debt, it is apparent and crucial for the government to take on the debt during times of crisis. Being able to adequately and successfully respond to emergencies is one of the many reasons why the national debt should be reduced governments should respond to events in an appropriate and timely manner with its citizens in thought.

Don’t Miss: How Many Times Did Trump File Bankruptcy

Definition Of Public Debt

Economists also debate the definition of public debt. Krugman argued in May 2010 that the debt held by the public is the right measure to use, while Reinhart has testified to the President’s Fiscal Reform Commission that gross debt is the appropriate measure. The Center on Budget and Policy Priorities cited research by several economists supporting the use of the lower debt held by the public figure as a more accurate measure of the debt burden, disagreeing with these Commission members.

There is debate regarding the economic nature of the intragovernmental debt, which was approximately $4.6 trillion in February 2011. For example, the CBPP argues: that “large increases in can also push up interest rates and increase the amount of future interest payments the federal government must make to lenders outside of the United States, which reduces Americans’ income. By contrast, intragovernmental debt has no such effects because it is simply money the federal government owes to itself.” However, if the U.S. government continues to run “on budget” deficits as projected by the CBO and OMB for the foreseeable future, it will have to issue marketable Treasury bills and bonds to pay for the projected shortfall in the Social Security program. This will result in “debt held by the public” replacing “intragovernmental debt”.

What Happens If You Refuse To Pay A Collection Agency

If you refuse to pay a debt collection agency, you could be hit with a lawsuit aimed at recovering the money you owe. But the harm to you and your credit goes well beyond that:

- Communication from a debt collection agency generally wont stop unless you request in writing that the agency quits contacting you.

- Interest charges may continue to pile up on unpaid debt.

- Late fees might be tacked onto unpaid debt.

- Unpaid debt typically stays on your credit report for up to seven years.

- The presence of unpaid debt on your credit report could damage your credit score for years to come.

Recommended Reading: Declaring Bankruptcy Chapter 13

What Is The National Debt

The national debt is the amount of money that a national government has borrowed through various means, including foreign governments, investors and federal agencies.

When the U.S. federal government runs a deficit, or spends more than it receives in tax revenue, the U.S. Treasury Department borrows money to make up the difference.

A major way it does this is by issuing bills, notes and bonds, which are bought by investors, including the public, the Federal Reserve and foreign governments.

In addition to this public debt, the national debt also includes intra-governmental debt, also known as intragovernmental holdings, which is money borrowed from trust funds used to pay for government programs like Social Security and Medicare.

If the federal government spends more than it receives as tax revenue in a given fiscal year, it adds to the national debt. If revenues are greater than spending, the government can use the surplus to pay down some of the existing national debt. The two ways to reduce debt are to increase taxes or reduce spending, both of which can slow economic growth.

Mandatory And Discretionary Spending History

Mandatory spending has taken up a larger and larger chunk of the federal budget over time. The first expansion came with the Social Security Act of 1935, followed by the Medicare Act of 1965 that enacted Medicare and Medicaid. In 1962, before the healthcare programs, less than 30% of all federal spending was mandatory. In 2020, mandatory spending amounted to $4.6 trillion, about 70% of total government spending and 21.8% of GDP.

Meanwhile, discretionary outlays have shrunk, as evidenced in the Congressional Budget Office chart below. Discretionary spending averaged about 7% of GDP between 2000 and 2019, and jumped slightly to 7.8% of GDP in 2020.

Khan Academy further breaks down how these two spending sources have essentially switched in terms of total government spending in the last 50 years.

Recommended Reading: Can You Include Irs In Bankruptcy

Current Foreign Ownership Of Us Debt

Japan owned $1.23 trillion in U.S. Treasurys in June 2022, making it the largest foreign holder of the national debt. The second-largest holder is China, which owns $967.8 billion of U.S. debt. Both Japan and China want to keep the value of the dollar higher than the value of their own currencies. This helps to keep their exports to the U.S. affordable, which helps their economies grow.

China replaced the U.K. as the second-largest foreign holder in 2006 when it increased its holdings to $699 billion.

The U.K. is the third-largest holder with $615.4 billion. Its holdings have increased in rank as Brexit continues to weaken its economy. Luxembourg is next, holding $306.8 billion. The Cayman Islands, Switzerland, Ireland, Belgium, France, and Taiwan round out the top 10.

Can You Get Collections Removed From Your Credit Report

You may be able to get collections activity removed from your credit report.

Three major credit bureaus Equifax, Experian and TransUnion produce credit reports for consumers. Not all debt thats gone to collections is reported to all three credit bureaus, though.

To see whether debt in collections appears on any of your credit reports, order a copy of your report from each of the three bureaus. Once youve figured out which credit reports show the collection activity, you can take one of these three steps to try to get it removed your credit reports:

Don’t Miss: Can Bankruptcy Get Rid Of Tax Debt

Our Fiscal Forecast The Structural Deficit

At 79 percent of GDP, our federal debt is at its highest point since just after World War II. Unfortunately, the even more depressing fiscal fact is that our debt is projected to nearly triple over the next 30 years to more than twice the size of the U.S. economy. These levels have no precedent in American history.

This growth in our debt isnt based on partisan factors or politics its the simple math of spending more than we take in. Some think we spend too much, while others say taxes are too low but theres no doubt that the federal budget has a structural mismatch between spending and revenues, and the gulf between them is growing.

The growth in our deficit is caused primarily by three key drivers of spending demographics, healthcare costs, and interest on the debt as well as by revenues that are insufficient to cover the promises that have been made.

This growth in our debt isnt based on partisan factors or politics its the simple math of spending more than we take in. Some think we spend too much, while others say taxes are too low but theres no doubt that the federal budget has a structural mismatch.

National Debt For Selected Years

| Fiscal year | |

|---|---|

| 130.6% | 21,850 |

On July 27, 2018, the BEA revised its GDP figures in a comprehensive update and figures back to FY2013 were revised accordingly.

On June 25, 2014, the BEA announced: “n addition to the regular revision of estimates for the most recent 3 years and for the first quarter of 2014, GDP and select components will be revised back to the first quarter of 1999.

Fiscal years 19402009 GDP figures were derived from February 2011 Office of Management and Budget figures which contained revisions of prior year figures due to significant changes from prior GDP measurements. Fiscal years 19502010 GDP measurements were derived from December 2010 Bureau of Economic Analysis figures which also tend to be subject to revision, especially more recent years. Afterwards the OMB figures were revised back to 2004 and the BEA figures were revised back to 1947.

Fiscal years 19401970 begin July 1 of the previous year fiscal years 19802010 begin October 1 of the previous year. Intragovernmental debts before the Social Security Act are presumed to equal zero.

19091930 calendar year GDP estimates are from MeasuringWorth.com Fiscal Year estimates are derived from simple linear interpolation.

Audited figure was “about $5,659 billion.”

Audited figure was “about $5,792 billion.”

Audited figure was “about $6,213 billion.”

Audited figure was said to be “about” the stated figure.

Audited figure was “about $7,918 billion.”

Audited figure was “about $8,493 billion.”

You May Like: Does Bankruptcy Stay On Your Record Forever

What Is The Debt Ceiling

The debt ceiling is the legal limit set by Congress on how much the Treasury Department can borrow, including to pay debts the United States already owes. Since it was established during World War I, the debt ceiling has been raised dozens of times. In recent years, this once routine act has become a game of political brinkmanship that has brought the United States near default on several occasions, CFRs Roger W. Ferguson Jr. writes. Ferguson and other experts argue that the debt ceiling should be scrapped entirely. The only other advanced economy to have one is Denmark, and it has never come close to reaching its ceiling.

The National Debt Is Now More Than $31 Trillion What Does That Mean

The gross federal debt of the United States has surpassed $31,000,000,000,000. Although the debt affects each of us, it may be difficult to put such a large number into perspective and fully understand its implications. The infographic below offers different ways of looking at the debt and its relationship to the economy, the budget, and American families.

The $31 trillion gross federal debt includes debt held by the public as well as debt held by federal trust funds and other government accounts. In very basic terms, this can be thought of as debt that the government owes to others plus debt that it owes to itself.

Americas high and rising debt matters because it threatens our economic future. The coronavirus pandemic rapidly accelerated our fiscal challenges, but we were already on an unsustainable path, with structural drivers that existed long before the pandemic. Putting our nation on a better fiscal path will help ensure a stronger and more resilient economy for the future.

You May Like: How Long To Wait To File Bankruptcy Again