How Do Debt Consolidation Companies Work

Debt consolidation companies are available to coach you on your various debt relief options. During your initial consultation, the agent will ask you questions like:

- How much unsecured debt do you have?

- What is your income?

- Are you current on all of your accounts?

Then, the agent will do a soft pull on your credit to take a look at all your accounts and balances. This soft pull does not hurt your credit score.

Depending on the debt consolidation option that youre eligible for, the agent will give you direction on your next steps to get started. Once you enroll, you may be subject to fees from the company. Fees vary based on the total debt you have and the company youre planning on working with.

Check out our reviews for more information on the top debt consolidation companies.

You Can Repay Your Debt Within Five Years

If you can pay off your debt within five years by cutting expenses or working a side hustle, debt relief isnt necessary for you. You can work with a nonprofit credit counseling agency to develop a budget and get personalized advice to tackle your debt so you can pay off your balances without paying extra fees or damaging your credit.

To find a reputable credit counseling agency, check with your state Attorney General and local consumer protection agency.

Get Breathing Space If You Need More Time To Decide What To Do

If you’re not ready to use a debt solution or you can’t afford to right now, the government-backed Breathing Space scheme could give you extra time.If youre eligible, you could get 60 days of breathing space where your creditors cant:

- take action to make you pay

- add interest and charges to your debt

It covers most debts, including credit and store cards, loans, overdrafts and arrears on household bills. You’ll need to get advice from a debt adviser first – theyll check all your debts to see if theyre covered.

To see if breathing space is right for you, talk to an adviser.

You May Like: How Often Can You File Bankruptcy In Ny

What Are The Three Types Of Debt Relief Services

There are three main types of debt relief services: out-of-court settlements, debt relief programs, and bankruptcy. Each one is different in how it works and whether or not they are right for you, so be sure to consult with a professional to determine which one is best. New Era Debt Solutions offers alternatives to bankruptcy. You are not alone. Please reach out should you need any assistance during this time.

How Does Debt Settlement Work

Debt settlement is a debt relief option that involves working with your creditors to create a debt reduction plan. It is different from a debt management plan in that, with debt management, you are still paying your creditors the full amount of your debt. With debt settlement, on the other hand, your creditors are making an agreement with you to accept less than what you owe to them.

You may wonder why creditors would agree to accept less than what you owe. The simple answer is that, when a person is experiencing financial hardship and having real trouble paying bills, creditors are aware that it is quite possible that they will be unable to recoup any money if the person declares bankruptcy. So, to avoid the possibility of getting none of their investment back, your creditors may be willing to negotiate a settlement to ensure they recoup at least some of their money.

That is not to say that creditors will make this decision lightly. For this reason, most people who choose to try debt settlement do so with the help of a debt settlement company that specializes in negotiating with creditors on behalf of their clients.

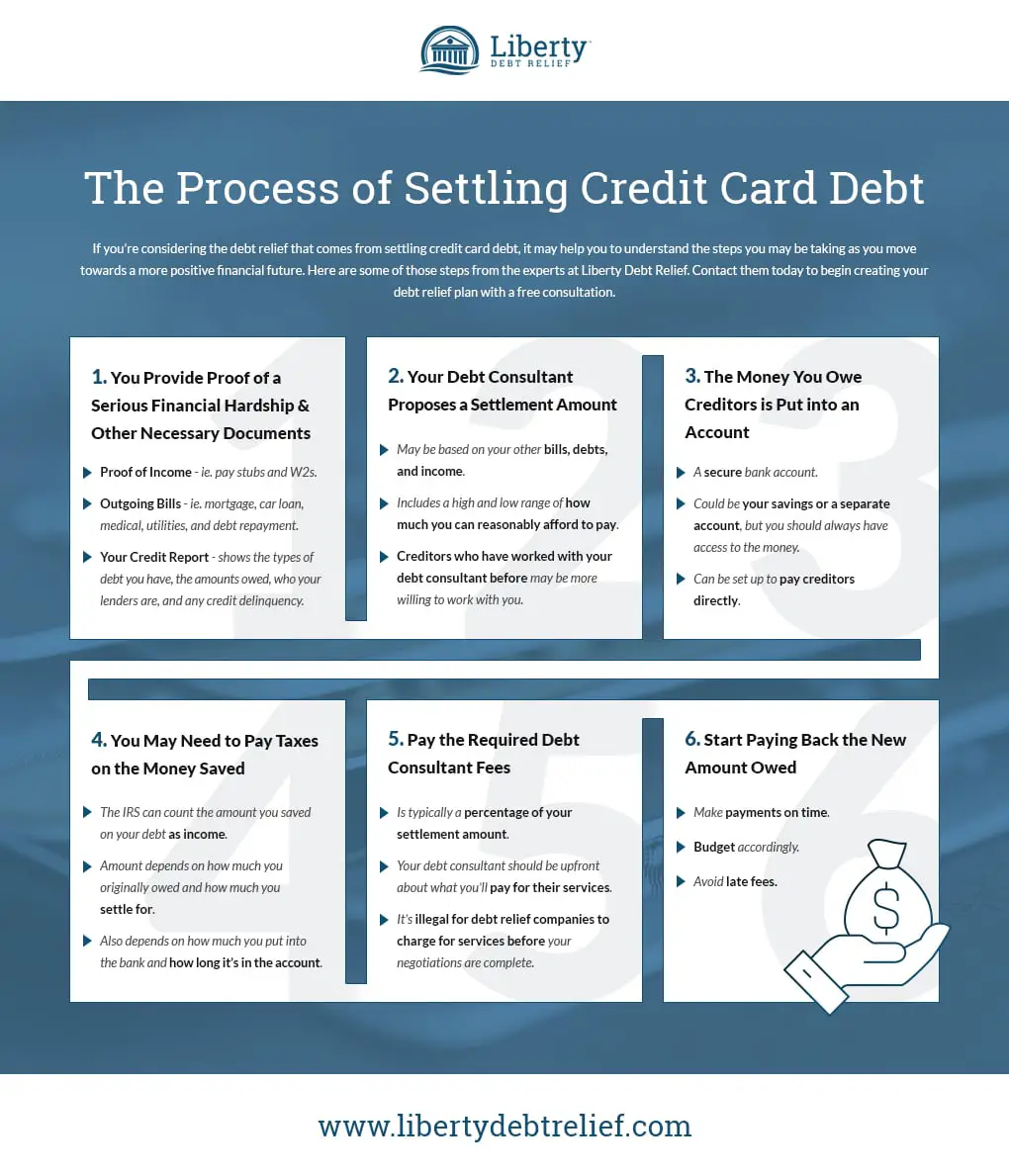

Heres how it works:

Once you decide on which plan fits you best, you will set up an escrow account and begin making payments to the account. Once sufficient funds have accumulated in your escrow account, our skilled negotiators start the process of negotiating with your creditors. And there are no upfront fees to get any of this done.

Don’t Miss: How Do Forclosures Work

Dig Out Of Debt With These Debt Relief Programs

Geber86 / Getty Images

Carrying a large amount of debt can be crippling, especially if its more than you can reasonably afford to pay off. It can overshadow all other financial priorities in your life. The good news is that there are many debt relief programs to help you with overwhelming debt.

As a first step, gain clarity on your financial picture: Understand how much you owe and your current monthly payments for each of your accounts. Then, with a firm grasp on your debt details, you can work toward a strategy to become debt-free. Heres a look at a few ways you can manage your debt with some help.

Types Of Debt Consolidation Programs

There are three forms of debt consolidation programs:

The first two are aimed at consumers who have enough income to handle their debt, but need help organizing a budget and sticking to it.

The third debt settlement is used in desperate situations where the debt has reached unmanageable levels.

If youre not sure which is the best way to consolidate debt, call a nonprofit credit counseling agency like InCharge Debt Solutions. A certified counselor will go through your income and expenses, help you create an affordable monthly budget, then offer free advice on which consolidation program will eliminate your debt.

Credit Counseling will develop an action plan that is tailored to your exact needs, Rebecca Steele, Chief Executive Officer for the National Federation of Credit Counseling, said. When youre in debt, you need to understand your budget, what its going to take to resolve your debts and how you can put fair, affordable payments in place to achieve that goal. That is what credit counselors should do for you.

Don’t Miss: Bankruptcy Dismissal Vs Discharge

Student Loan Debt Relief

There is a wide range of methods for student loan relief. The best choice usually depends on the type of student debt you have federal or private.

Relief options for federal student loans that dont affect eligibility for other federal relief programs:

Private student loan relief options:

- Student loan refinancing

- Private student loan settlement

Its important to note that you can use private refinancing for federal student loans. However, it converts federal debt to private. You lose all eligibility for federal relief moving forward.

Also, discharging student loans through bankruptcy is not as easy as other types of debt. To discharge, you must prove that not discharging those debts will cause continued financial hardship. Its possible to discharge these debts through bankruptcy. But youll need a good attorney to get the results you want.

Need to find relief from student loan debt? Talk to a specialist now to find the right solution.

How Do Credit Consolidation Companies Work

The term credit consolidation companies” covers a lot of ground in the debt-relief industry. They range from giant national banks to tiny nonprofit counseling agencies, with several stops in between and offer many forms of .

To simplify things, it is easiest to divide credit consolidation companies into two categories:

- Those who consolidate debt with a loan based on your credit score

- Those who consolidate debt without a loan and dont use a credit score at all

Banks, credit unions, online lenders and credit card companies fall into the first group. They offer debt consolidation loans or personal loans you repay in monthly installments over a 3-5 year time frame.

They start by reviewing your income, expenses and credit score to determine how creditworthy you are. Your credit score is the key number in that equation. The higher, the better. Anything above 700 and you should get an affordable interest rate on your loan. Anything below that and you will pay a much higher interest rate or possibly not qualify for a loan at all if your score has dipped below 620.

The second category companies who provide without a loan belongs to nonprofit credit counseling agencies like InCharge Debt Solutions. InCharge credit counselors look at your income and expenses, but do not take the credit score into account, when assessing your options.

Read Also: Tv Pallets For Sale

A Brief Overview Of Debt Relief Types

Debt relief comes in a wide range of forms. Depending on the circumstances, a given person may have many options to choose from to improve his or her financial situation with respect to debt. Here at the Financial Freedom Advocates, we believe that the best type of relief is whichever type places you in the best possible situation. We also believe that debt relief is not a matter of right or wrong, but also helping people move forward and pave a new future. In this post, we will provide a general overview of several of the most common types of debt relief.

Debt Settlement Vs Bankruptcy

When the process works as intended, debt settlement can benefit everyone involved. Consumers get out of debt and save money, debt settlement firms earn money for providing a valuable service, and creditors receive more than they would if the consumer stopped paying altogether or entered chapter 7 bankruptcy. Chapter 7 bankruptcy involves liquidating the debtors non-exempt assets and using the proceeds to repay creditors. Exempt assets vary by state but often include household and personal possessions, a certain amount of home equity, retirement accounts, and a vehicle.

Compared to debt settlement, Detweiler says, if a consumer is eligible for chapter 7 bankruptcy, it may be a faster option. It is a legal process that can stop collection calls and lawsuits. Debt settlement doesn’t offer those guarantees. Still, he adds, there may be a variety of reasons why chapter 7 may not be a good option. A consumer may have to surrender property they may feel they need to keep. Or they may not want their financial troubles to be a matter of public record. Consumers could also find their employment options limited if they declare bankruptcy, as some professions evaluate workers credit histories.

Chapter 7 bankruptcy can be over and done after three to six months, versus years for debt settlement. It can be less stressful and may allow your credit score to recover faster, though bankruptcy will remain on your credit report for 10 years.

You May Like: Las Vegas Bankruptcy Lawyers

The Best Relief Option For Every Type Of Debt

There is a wide range of options available if you need relief from . Most of these options are voluntary and very flexible. So, if do-it-yourself solutions donât work, you can still get professional help through various debt relief programs.

Most credit users usually opt for do-it-yourself solutions first. However, high balances can make it impossible to get out of debt on your own. Most people end up needing professional help. There are two services you can use:

- If most of your accounts are current and you donât want to damage your credit, call a consumer agency

- These agencies run debt management programs, which are consolidation programs designed to eliminate unsecured debt.

- If youâre already behind and most of your debts are in collections, call a settlement company.

Itâs worth noting that solutions for credit card debt also apply to other unsecured debts. You can use the same solution to solve medical debt, unsecured personal loans, and payday loans.

If you try all these solutions and still canât get out of debt, itâs time for bankruptcy. Unsecured debts are fairly easy to discharge through bankruptcy. So, if you have a lot of unsecured debts on your plate and need a clean break, bankruptcy may be the way to go.

Student loan debt relief

There is a wide range of methods for student loan relief. The best choice usually depends on the type of student debt you have â federal or private.

Private student loan relief options:

Tax debt relief

Which Type Of Debt Relief Is Right For Me

There are many types of debt relief available and its not always easy to know which option is right for you. If you have any questions about the above options, call a coach with our team. Theyll help you understand your financial situation and the options you have available. Here are a few guidelines to help you on your own:

- If you have over $7,500 in debt, professional debt consolidation could be the right option.

- If you have under $7,500 in debt, a Debt Management Plan could be right for you.

- If you have multiple high-interest debts and your goal is to reduce your interest rates and number of accounts, a personal loan is a quick and easy way to consolidate your debt.

Debtreliefreviews.com is an independent review service and may be compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Debtreliefreviews.com does not include all companies or all available products.

Links

Also Check: How Does Bankruptcy Affect Car Insurance

What Is Unsecured Debt

Unlike secured debt, unsecured debt is not backed by an asset such as a home or car. Instead, a lender lets you borrow money based on your . Common types of unsecured debt include:

- Most credit cards

- Most personal loans

Since unsecured debt is not backed by an asset, a creditor cant seize your property if you fail to make payments. But if you fail to make payments for too long, the creditor likely will report the missed payments to the major credit bureaus. In addition, the creditor may turn your debt over to a debt collector or seek a court judgment requiring you to pay the debt.

If You Get A Lump Sum Of Money

If you receive a windfall during your IVA, for example an inheritance, this will usually be taken and paid to your creditors. If you find out that you’re due some money because of something that happened before the IVA, your creditors might have the right to claim it too – even if your IVA has finished.

Talk to an adviser if you get a lump sum after your IVA finishes.

Also Check: Which Chapter Of Bankruptcy Is For Consumers

How Best To Handle Secured Debt

Here are four tips to avoid trouble with secured debt or to get out of trouble:

What If My Debts Are Near The 30000 Limit

Creditors can add interest and charges to your debts up until the date the official receiver approves your DRO. Therefore, if your debts are near the £30,000 limit when you start the application process, your debts could rise to above £30,000 by the time the official receiver considers your application. If this happens, the official receiver will not approve your DRO. You will not get the money you have paid in fees back if this happens.

You need to think about the following ideas and get further advice.

Recommended Reading: What Are The Negatives Of Filing For Bankruptcy

Debt Settlement Vs Minimum Monthly Payments

Making minimum monthly payments on high-interest debt is not a good option for consumers who want to save money. It can take yearsdecades, evendepending on how much debt you have and what the interest rate is. Interest compounds every day on your entire balance, and with minimum payments, you make little progress paying your balance down each month.

Consistently making minimum monthly payments and forking over tons of interest might make you highly profitable to your creditors, and, yes, solid payment history is good for your credit score. However, we dont recommend spending more than you have to on interest to boost your credit score. A good credit score wont pay for your retirement money in the bank will.

Further, if the amount of available credit youve used is high relative to your credit line, that will hurt your credit score and potentially negate the effect of your consistent, timely payments. The AFCC report cites that “the average client reduced their total debt at the time of settlement of approximately $30,000 to $35,000 by roughly $9,500 after deducting fees.

Consumer who consistently make just the minimum monthly payment on high interest credit card debt can end in paying more in interest than the principal.

How To Deal With Joint Debts

You might have some joint debts which are owed by you and another person, such as a partner.

An IVA can only cover one person, so the other person will still be responsible for the whole of the debt. It might not be a good idea to include joint debts in the IVA.

You can’t take out a joint IVA, but you and the other person might be able to take out individual IVAs that are connected – these are called interlocking IVAs. Your insolvency practitioner will be able to advise you about this.

If you have a lot of joint debts and the other person doesn’t want an IVA, you might need to take a different option.

Read Also: How To File Bankruptcy Chapter 7 Yourself In Colorado