Are Debt Collectors In Canada Allowed To Keep Calling Me If I Declare Bankruptcy

Once a bankruptcy claim is filed, all creditors and collection agencies are required by law to stop contacting you. Additionally, a creditor cannot garnish your wages.

You can continue to receive calls from secured creditors. This applies to a mortgage, lien on a car, or debt for alimony or maintenance.

Dont Open New Accounts All At Once

After a bankruptcy discharge, it might surprise you that youll get a lot of credit card offers. Many of these offers are for secured credit cards with sky-high interest rates. Companies now consider you a better risk because you dont have a lot of debts anymore. However, opening multiple new accounts at once could make it difficult for you to maintain regular payments and this could harm rather than help your credit score.

Myth #: Paying My Utilities Bills On Time Will Improve My Credit

Unfortunately, this isnt the case. Utilities and most cable/Internet providers do not report payment histories to the credit bureaus unless payments are in default. If payments are up to date, they will not influence your credit score. If payments get behind or go to collections, they can be reported and will have a negative affect on the credit score. One exception to this appears to be Rogers Cable, which some have said are reporting to the bureaus regularly. Cell phone companies also report payment histories to the credit bureaus, so keeping your cell phone payments current can help to improve your credit score.

Recommended Reading: Jack Remondi Net Worth

Canada Credit Reporting Agencies

In all provinces in Canada there are two main credit reporting bureaus Equifax and Trans Union.

Both Equifax and Trans Union have their own rules in regards to reporting bankruptcy or consumer proposal information on your credit report.

For Equifax, they purge a bankruptcy from your credit report after six years from the date of the bankruptcy discharge.

Before the record is purged in 6 years the debts will remain on your credit report and marked as included in bankruptcy.

If a debtor files a second or third bankruptcy Equifax will hold the record of the bankruptcy on your credit report for 14 years from the date of the debtor being discharged from bankruptcy.

Equifax will purge the record of your consumer proposal from your credit score three years following the completion of the consumer proposal

For Trans Union, they state for as long as your information is relevant to an organization making a decision about an application you have supplied

However, provincial credit reporting legislation outlines maximum reporting lengths for information that is negative.

Therefore, TransUnion will not maintain negative information on your credit file longer than what is permitted by provincial credit reporting legislation.

This means a bankruptcy will be kept on your credit report for seven years from the date of your discharge.

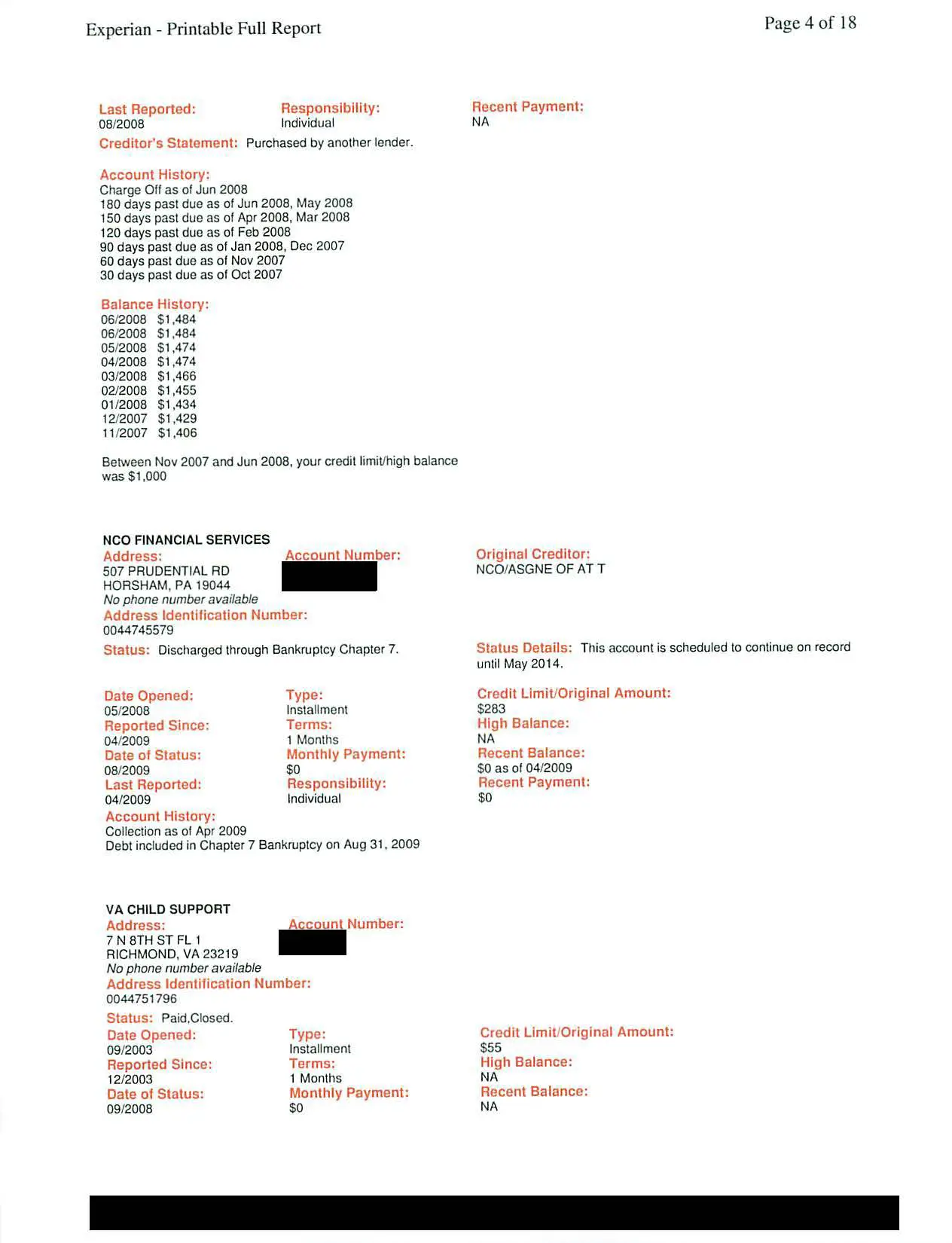

Make Sure The Right Accounts Were Reported

After your debts are discharged, review your credit reports to make sure that only the accounts that were part of your bankruptcy are reported by the as discharged or included in bankruptcy on your reports. If you find mistakes, notify the credit bureaus and dispute the errors on your credit reports .

Read Also: Has Donald Trump Filed Bankruptcy

How Long Does Debt Stay On Your Credit Report

How long a collection stays on your credit report depends on the type of loan you have. Derogatory items may stay on your credit reports for seven to 10 years or more, according to the Fair Credit Reporting Act. But heres the good news: As those items age, negative items have less of an impact on your credit scores.

Heres how long you can expect derogatory marks to stay on your credit reports:

| Hard inquiries |

| 10 years |

How Long Do Collections Stay On Your Credit Report

If a creditors information regarding an accounts delinquency is valid, the collections record will exist for seven years starting on the date it is filed.

Heres how it typically works: When a creditor considers an account neglected, the account may be handed over to an internal collection department. Sometimes, however, the accounts debt is sold to an outside debt collection agency. This often happens when you are about six months behind on payments.

Around 180 days after the original due date of the payment, the creditor might sell the debt to a collections agency, says Sean Fox, president of Freedom Debt Relief. This step indicates that the creditor has decided to give up on getting payment on its own. Selling to the collections agency is a way to minimize the creditors loss.

At that point, you will start to hear from a debt collector, who now has the right to collect the payment. Depending on the type of debt you have, a variety of countermeasures exist on behalf of creditors to prevent major financial losses.

Unsecured debts, like credit card debt and personal loans, are generally sent to a collections agency, or can even be handled internally. If you fail to pay a secured debt, like an auto loan or a mortgage, foreclosure and repossession are the most common approaches for creditors to begin regaining losses.

Recommended Reading: Cost To File Bankruptcy In Wisconsin

How Long Does A Bankruptcy Or Consumer Proposal Stay On My Credit Report

How long bankruptcy stays on your credit report in Canada will depend on the credit bureau that is reporting.

The largest credit bureau in Canada, Equifax, maintains this record on your credit report for a period from the date of your discharge or last payment:

- A first bankruptcy for six years from the date of your discharge.

- A second bankruptcy for 14 years.

The TransUnion web site states that they keep a bankruptcy on your credit file for six to seven years from the date of discharge or fourteen years from the filing date .

At this point the bankruptcy will leave the credit report and you will need to start to rebuild your credit.

How long a consumer proposal stays on your credit report again depends on the credit bureau that is reporting.

With Equifax, a consumer proposal is reported for three years after your last payment.

Review Your Reports Once The Time Is Up

Once your bankruptcy has been completed and the seven- or 10-year clock has expired, review your reports again to make sure the bankruptcy was removed.

A bankruptcy should fall off your credit reports automatically, but if it doesnt, notify the credit bureaus and ask to have the bankruptcy removed and your reports updated.

Recommended Reading: Chapter 7 Bankruptcy Virginia Cost

Can You Still Get A Loan Even With A Bankruptcy On Your Credit Report

Many people think that just because they filed for bankruptcy, then this means that they will not be able to get a loan or a new line of credit. The truth is, there are many different companies and lenders that specialize in lending to people who just filed for bankruptcy or with bad credit.

Of course, you will find that the interest rates and the fees are high compared to when you still had a stellar credit score. Thats why its important to be cautious and to not be blinded by the unbelievable offers immediately after your bankruptcy discharge. Make sure that you read the fine print and clarify all the details before going for a loan or a credit card. You dont want to end up in a more dreadful situation than you were in pre-bankruptcy.

So, what types of loans or credit are you still eligible for even after filing for bankruptcy? We listed down the credit options for you

Ways To Remove Negative Items From Your Credit Report

Your credit report almost always has a huge influence on the financial aspect of your life and if your credit report is full of negative items like closed credit accounts, overdue bills, repossessions, and foreclosures, you may have some serious issues in your financial life. If you have a bad credit score, your eligibility for car loans, apartment rentals, and even job opportunities can be seriously damaged.

But the good news is, theres hope! Even if you have bad credit, there are some basic steps that you can take to remove negative items from your credit report, and start your journey towards better financial health.

In this article, Ride Time will take a look at the 5 most common ways that you can get negative items removed from your credit report, so that you can start rebuilding your credit today!

Also Check: Donald Trump Bankruptcy History

How Long Does Bankruptcy Last In Canada

If you complete the duties assigned to you during your bankruptcy and your trustee, your creditors, or the Superintendent of Bankruptcy do not make any objections to your discharge, you may get out of bankruptcy in as little as 9 months. Your duties during bankruptcy also include attending two counselling sessions to help you understand why you went bankrupt and to assist you in managing your financial affairs in the future.

See below for a summary of the time periods to obtain your discharge under various situations. The number of months indicated below start counting from the day you are officially bankrupt:

For 1st time bankruptcy:

- 9 months if you do not have earnings in excess of the income guidelines set out by the government based on the size of your household

- 21 months if you have surplus income and pay it to the trustee for your creditors

For 2nd time bankruptcy:

- 24 months if no surplus income

- 36 months if you have surplus income

In the above situations, your discharge happens automatically provided you fulfill all of the duties imposed on you.

There are situations where the court has to decide when you are discharged from bankruptcy, such as the following:

- If you owe personal income tax debt of $200,000 or higher and it represents at least 75% of your total unsecured proven debt

- If a creditor, the Superintendent of Bankruptcy, or your trustee oppose your discharge

In both of the scenarios, a court hearing will determine when you will be discharged from bankruptcy.

What Is The Credit Reporting Process For A Bankruptcy

In Canada, credit reports are maintained by two main credit bureaus: Equifax Canada Inc. and TransUnion of Canada. Their objective is to collect information that lenders would consider important in making a decision about whether or not they should grant you a loan.

What each does is collect and compile factual information about your bill and debt payment history. This information comes from two sources:

- Transactions reported to them by banks, credit card companies, finance companies and other financial institutions.

- Public records. This includes items such as judgements, bankruptcies, consumer proposals and any registered liens or debt actions.

As a result, you can see that if you file for bankruptcy, or file a consumer proposal, it will appear on your credit report. What the credit bureau is reporting however is a statement of the facts. What will be included will be:

- The fact that you filed bankruptcy, a consumer proposal, or that your debts have been subject to a repayment program including an or Debt Management Plan through a credit counselling program.

- The date of filing.

- The date of discharge or completion.

You May Like: Epiq Bankruptcy Solutions Llc Scam

Why You Should Not Be Embarrassed By Bankruptcy

According to the Office of the Superintendent of Bankruptcy, approximately 100,000 Canadians every year turn to bankruptcy or consumer proposal as a way to deal with their debt problems.

It is important to recognize that there should be no shame associated with declaring personal bankruptcy. People find themselves in this stressful position for a wide variety of reasons, from a sudden loss of employment to large, unexpected bills.When your bankruptcy is completed , the debts included in your bankruptcy will be extinguished and you can begin to improve your right away.

What Is A Trustee And What Is The Trustees Role

A Licensed Insolvency Trustee is the only professional who can administer a bankruptcy or consumer proposal in Canada. This means that you need to engage a Trustee in order to file your bankruptcy.

Licensed Insolvency Trustees are highly qualified professionals and are federally licensed by the Office of The Superintendent of Bankruptcy. Trustee fees are regulated under the Bankruptcy and Insolvency Act.

The federal government requires the Trustee to perform an assessment of your financial situation to determine if bankruptcy is the best option for you.

With your help, the Trustee will examine your financial situation including your assets, income, expenses, and debt level. You may have additional options, which the Trustee will explain and describe. The Trustee will also fully explain the bankruptcy process so you can decide if you should declare bankruptcy.

If you choose to file for bankruptcy or to file a consumer proposal the Trustee will prepare the necessary paperwork, review it with you, and file it with the Office of the Superintendent of Bankruptcy.

You May Like: Bankruptcy Document Preparer

Rebuilding Your Credit Score

You can start to rebuild your credit rating after a bankruptcy so that you will be looked upon favourably by lenders again.

To start rebuilding your credit, you need to be able to show that you can borrow responsibly and that you can make payments on time.

You can look for lenders that specialize in lending to people after bankruptcy to make it easier to borrow and show that you can make payments on time.

Using a secured credit card for small monthly purchases is one method that can help to improve your score.

Bankruptcy Canada can help you with issues concerning bankruptcy and debt relief.

If you are interested in our services, you can contact us online or over the phone to find out more about how we can help you.

Bankruptcy Affects High Credit Scores More Than Low Credit Scores

The higher your FICO score is before a bankruptcy filing, the more it will affect your credit rating:

| Score | |

| Note: Scores do not go lower than 300 | 130-150 points |

You will likely drop to a poor credit score no matter what score you started with. Your credit history already shows you filed for bankruptcy, but credit bureaus want to ensure you take steps to improve your bad credit before you take on more debt and new credit.

The sliding scale system will generally knock your credit points however much it takes to show you have poor credit. Your score may barely change if you already have bad credit . It is not common to see credit scores lower than 500 even after a bankruptcy filing.

Don’t Miss: How Many Times Has Donald Trump Filed For Bankruptcy

What Is A Credit Report

Your is created the first time you apply for credit or borrow money. It will contain information such as details about your credit cards and loans, including when you opened your accounts, how much you owe, when you make or miss payments, and if you go over your credit limit. A credit report also contains personal information such as if you have ever filed for bankruptcy.

Your Creditors May Hold A Meeting

Sometimes, a meeting of creditors is required or requested. The purpose of this meeting is to

- allow creditors to obtain information about the bankruptcy

- confirm the appointment of the LIT

- appoint up to five inspectors to supervise the administration of your estate and

- allow creditors to give direction to the LIT.

If a meeting is called, you will be required to attend.

Recommended Reading: How To Declare Bankruptcy In Canada

How Does Bankruptcy Affect My Credit Rating

Your credit report is maintained by one of two major credit rating agencies in Canada: Equifax and Trans Union. When you apply for a loan, whether a credit card or a mortgage, your lender will review your credit report. This report contains information about whether or not you have unpaid bills, how much credit you have outstanding and even how many times you have applied for credit.

If you file for bankruptcy a note will appear on your credit report indicating that you have done so. This information is provided to the credit bureau by the federal Superintendent of Bankruptcy. Each month they provide a list to the credit reporting agencies of everyone who has filed or a . It is important to understand that it is not your trustee advising the credit bureau of your bankruptcy, or your discharge. Rather it is part of the process completed by the Office of the Superintendent of Bankruptcy. They also provide a list of people who have been discharged.

How Bankruptcies Work In Canada

Your bankruptcy begins when you file for bankruptcy with a Licensed Insolvency Trustee , as they are the only professionals in Canada that are licensed and regulated to administer bankruptcies. Your trustee settles all of your debts by paying the proceeds of your non-exempt assets to your creditors. A non-exempt asset is an asset that exceeds the equity limit set by your province. For example, if the value of your motor vehicle exceeds the limit set by your province, then your trustee can sell your car to repay creditors.

Alternately, if you would like to keep an asset that exceeds the exemption limit, you can make an arrangement with your creditors to buy back the asset by paying off the amount that exceeds the exemption limit.

Each province provides a list of exempt assets that you can keep regardless of the fact that you declared bankruptcy. While you are bankrupt, you will likely be required to make monthly payments to your trustee.

You May Like: How Many Times Has Trump Filed Bankrupsy