Can I Remove A Bankruptcy From My Credit Report On My Own

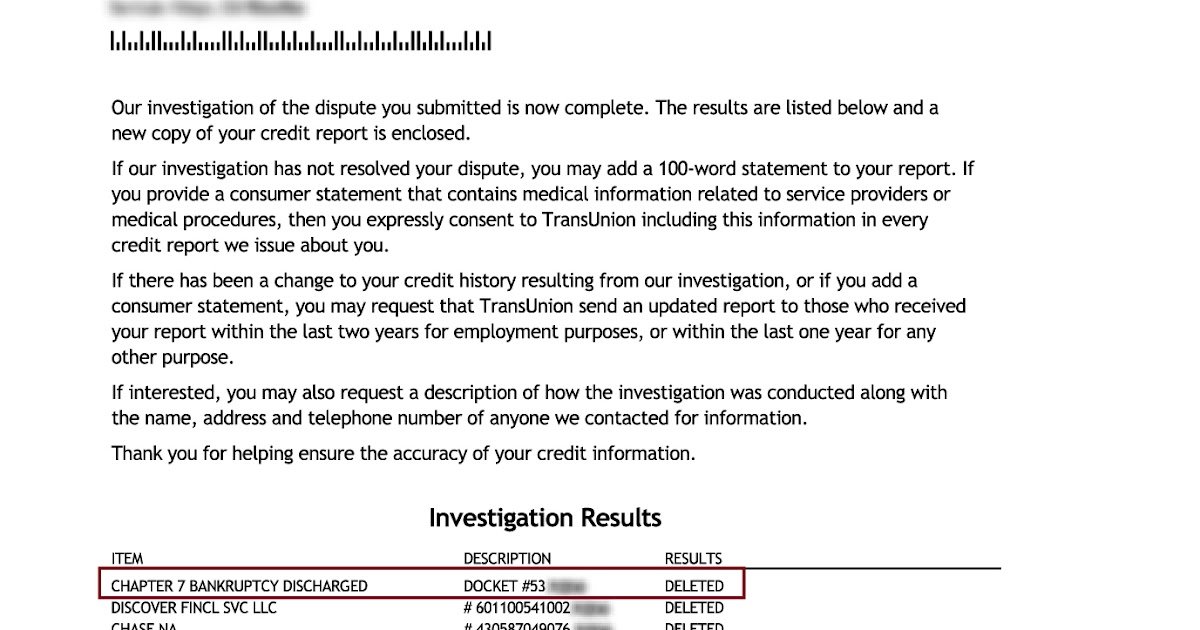

It is possible to pursue removing a bankruptcy from your credit report on your own, and some people have managed to do so. However, it is a time-consuming, labor-intensive process that many people find complicated, confusing, and frustrating.

We encourage you to learn as much as you can about credit report disputes and credit repair processes, then count the real cost of DIY credit repair before committing to handling this important task on your own.

People who have needed to remove a bankruptcy from their credit reports have achieved success by working with a provider like Lexington Law Firm. If other questionable negative items are affecting your credit report and score, we can help you challenge those as well.

Contact us today for a free personalized credit report consultation to find out how we can help you meet your credit goals.

Reviewed by Vincent R. Mayr, Supervising Attorney of Bankruptcies at Lexington Law. by Lexington Law.

Review Your Reports Once The Time Is Up

Once your bankruptcy has been completed and the seven- or 10-year clock has expired, review your reports again to make sure the bankruptcy was removed.

A bankruptcy should fall off your credit reports automatically, but if it doesnt, notify the credit bureaus and ask to have the bankruptcy removed and your reports updated.

Bankruptcy & Your Credit Report

IMPORTANT INFORMATION: The Bankruptcy Court has no jurisdiction over credit reporting agencies and does not report information to any of the credit reporting agencies. The credit reporting agencies collect information regarding bankruptcy cases directly from the courts public records. Bankruptcy petitions, schedules, and other documents are public records. Regardless of the disposition of your case the credit reporting agencies can report your case on your credit report for up to ten years.

The Bankruptcy Court is unable to assist you with removing or correcting information listed on your credit report.

1. How long does a bankruptcy remain on my credit report?

The Fair Credit Reporting Act, Section 605, regulates credit reporting agencies. The law states that credit reporting agencies may not report a bankruptcy case on a persons credit report after ten years from the date the bankruptcy case is filed.

Debtors must directly contact credit reporting agencies to discuss information on a credit report. Under the Fair Credit Reporting Act the credit reporting agency are required to correct inaccurate or incomplete information on a credit report. The credit bureau will verify the item in question with the creditor at no cost to the consumer.

There are a number of educational publications that the Federal Trade Commission has on its website to help consumers.

2. How do I get a free copy of my credit report?

You May Like: How Soon After Bankruptcy Can I Buy A New Car

How Bankruptcy Impacts Credit Records

A bankruptcy filing temporarily decreases your credit score. However, the amount of the decrease in your credit rating depends on several factors. For example, late payments, debt collections, and lawsuits impact your credit score.

Many people file bankruptcy after they have struggled to pay debts for months or even years. Therefore, most debtors credit scores may already be damaged from late payments or financial hardship.

For these individuals, filing a bankruptcy case might not lower the credit rating very much. However, if someone with relatively good credit files a bankruptcy case, that person may see a larger drop in his or her credit rating. Either way, this decrease is temporary.

Reporting Debts As Discharged In Bankruptcy

While it might be daunting to think about a bankruptcy filing showing up on your credit report for ten years, it might not be as bad as you think. A bankruptcy discharge can help you clean up debt much faster than youd be able to do yourself. For instance, instead of a delinquent or unpaid debt lingering on your report for years, it will show as being discharged as part of your bankruptcy. In fact, creditors wont be able to report your debt in a variety of ways that could cause your credit to suffer, such as allowing the obligation to show as: currently owed or active late or delinquent or outstanding charged off having a balance due, or converted to a new type of debt . Such reporting labels are often the reason creditors deny applicants credit. In some cases, applicants must pay off such debt as a condition of loan approval. Instead, when you pull your report, each qualifying debt should be reported as:

having a zero balance, and discharged, included in bankruptcy, or similar language. Unfortunately, some creditors dont update information to the credit reporting agencies. This tactic could be a way to get you to pay up, even though you no longer legally owe the debt. If your credit report shows an improperly labeled discharged debt, youll want to take steps to correct the problem.

Don’t Miss: Bankruptcy Petition Preparer

What Else Do The Cras Do With Personal Data

All of the CRAs have different business functions running through them.

As well as credit referencing, CRAs also operate other activities such as direct marketing and lead generating functions. The data they sell in this area of their business may include information which the CRAs have bought from local authorities about individuals who had not previously opted-out of the full or open electoral register and information from other sources, such as lifestyle questionnaires and competition entries.

How Do I Remove Inaccurate Information From My Credit Report Even If I Have Never Filed Bankruptcy

The Bankruptcy Court does not report to the credit reporting agencies. The Bankruptcy Court has no control over credit reporting agencies.

The bankruptcy petition, schedules and other documents are public record and are available at the Clerk’s Office and online through PACER with an account . Credit reporting agencies regularly collect information from the petitions filed, and report the information on their credit reporting services.

You can request your credit report at no charge from each of the three reporting bureaus by visiting www.annualcreditreport.com .

The three credit reporting agencies are:

Equifax Information Services LLC

If your credit report indicates that you have filed bankruptcy, but you have never filed bankruptcy in Oregon, you can request a document that states you have never filed a bankruptcy case in Oregon. This document is called a Certificate of Negative Filing. To request a Certificate of Negative Filing, please mail a letter, with your full name and social security number, along with the certification fee of $11.00 and a self-addressed stamped envelope, to the Bankruptcy Court. If no record of a bankruptcy is found for you, the court will mail the Certificate of Negative Filing back to you.

There are a number of educational publications that the Federal Trade Commission has on its website to help consumers address credit and financial issues.

You May Like: How To File Bankruptcy In Tennessee

How Accounts Appear On Your Credit Reports

Before filing for bankruptcy, you probably had bills you struggled to keep up with credit cards, medical debt and more. When you include those accounts in a bankruptcy filing, theyll still be reported on your credit reports. Accounts discharged in bankruptcy can be reported as discharged or included in bankruptcy with a zero balance. Even though you owe $0 for them, theyll still appear on your reports. If you apply for credit, lenders may see this note when they check your reports, and they may deny your application. But heres that good news we promised: Accounts included in a bankruptcy filing wont be reported as unpaid or past due anymore, and you may feel relief without those financial burdens. Your credit scores will eventually start rebounding with those positive effects. Thats assuming, of course, you use credit responsibly from here on out.

How Long Does A Bankruptcy Stay On Your Credit Report

How long a bankruptcy stays on your credit report depends on which bankruptcy filing you opted for in the first place.

- Chapter 7 bankruptcy can remain on your credit report for 10 years

- Chapter 13 bankruptcy stays on your credit report for 7 years

Chapter 13 bankruptcy leaves your credit report sooner because it involves a plan where you pay your debt to a trustee over a set time period. Chapter 7, on the other hand, means that you liquidate your assets, pay what you can, and get rid of whats called dischargeable debts..

Dischargeable debts include such things as medical bills, collection accounts, credit cards, personal loans, utility bills, some judgments, and some older tax bills and penalties.

Non-dischargeable debts include things like alimony, child support, federal student loans, and debts that belong to someone else.

Read Also: Can You Get A Personal Loan After Bankruptcy

How Long Will A Bankruptcy Stay On My Credit Report

In general, a bankruptcy will stay on your for ten years. This report is the simple method for determining your , and it can even have an impact on whether or not you can be hired for certain jobs when you file a straightforward Chapter 7 bankruptcy. If you file for Chapter 13, agreeing to pay certain amounts of debt over a period of time, the bankruptcy usually stays on your credit report for seven years.

It has become increasingly more popular to screen potential employees by looking at their financial records. This is particularly the case when the employee might be handling large sums of money, but it may also hold true for other types of jobs. Though it may not be fair, bankruptcy can follow you for a long time.

This does not mean that you cannot get a job, purchase a home, rent an apartment, or even get a within a few years of bankruptcy, but financial experts warn those who are newly bankrupt to be very cautious about obtaining or using any new credit cards. In fact, it’s often best to pay in cash as much as possible for a few years.

Late Payments And Defaults

Late payments can be notified to a credit agency when they are more than thirty days in default. Most late payments notified to the credit agencies are from either the credit card companies or the utility providers.

Not all utility companies report payments to credit reference agencies but the number that do is increasing. More and more lenders are starting to pass their data onto these agencies and you may soon see all your personal and household bill payments recorded on your credit file.

Open accounts stay on your report indefinitely and settled or closed accounts can remain on your credit file and available for future lenders to see for six years.

Recommended Reading: Can You Rent An Apartment After Filing For Bankruptcy

When Is A Good Time To File For Chapter 13

Today, the most common reason that people file for any kind of bankruptcy is medical expenses. This sad fact has not gone unnoticed by politicians and activists who claim that our health care system is broken. Once a creditor obtains a judgment against you in court, they can make your life a living hell. Not only can they garnish your wages, they can also place a levy on your bank account which allows them to freeze your funds. At that point, they can petition the court to transfer those funds over to them.

Additionally, they can place liens on your real estate. If you own properties other than your legal residence, they can force the sale of the properties to repay the debt that theyre owed. In other words, right about the same time they threaten to sue you and you know that theyre going to win that judgment, its a good time to start considering filing for bankruptcy.

Once in bankruptcy, your creditors hands are tied insofar as using aggressive tactics are concerned. Essentially, you have regained control of the situation and you can work out a repayment plan that works within your finances and prevents your creditors from seizing your money or property.

I Owed Money To My Credit Card Company And Stopped Making Repayments Because I Lost My Job Because I Was Able To Demonstrate Financial Hardship And The Stress This Was Causing Me The Credit Card Company Agreed That They Would Stop Pursuing Me For This Debt However They Have Refused To Remove The Default From My Credit File Can They Do This

Data protection law requires that the information on your credit file is an accurate reflection of your credit history. While we appreciate you may want this debt removed, the fact that this debt was accrued and defaulted on is accurate. The fact that this default remains on your credit file is likely to comply with data protection requirements.

In situations like this, whether the entry should be recorded in some way to indicate that a debt has been settled relies heavily upon the specific agreement between you and the lender and can vary on a case-by-case basis.

If the lender agrees to accept a lower payment from you in settlement of an account we would expect them to mark the entry in a way which indicates that you are no longer being pursued for a debt. However, if a debt has not been paid off in full we do understand that the lender may be reluctant to mark a credit file as satisfied. However, where an organisation has decided to stop pursuing a debtor for payment, it would appear unfair to show that money is still owed under the account. In these circumstances, we would generally expect an organisation to indicate the situation on an individuals credit file, in some way. Organisations will usually mark an account as partially settled or partially satisfied. This shows any lenders searching your file that you are no longer being pursued for the debt but also that the debt was not fully repaid.

You May Like: Can You Buy A Car After Filing Bankruptcy

Will A High Credit Score Help You During A Bankruptcy

Myth: A clean credit historyone with no late payments or other issuesand a high credit score means youll be less impacted by a bankruptcy.

The truth: Bankruptcy will have a huge negative impact on your credit, and a previously positive payment history doesnt change that. In fact, if you have a higher score, you could stand to lose more than if you already have a low score.

A bankruptcy also temporarily wipes out all the goodwill you might have developed with your timely payments. Some lenders may have rules about offering credit when a recent bankruptcy shows up on your credit historyno matter how good your score used to be.

How Long Will My Credit Score Be Hurt

Your credit score will likely be impacted by the bankruptcy for the first two or three years immediately following your bankruptcy filing. After that time, it is important for you to work on rebuilding your credit, even though the bankruptcy is still showing on your credit report. By working on rebuilding your credit while the bankruptcy is still showing, you are taking important steps to ensure your credit is not ruined for ten years. If you are in Chapter 13 bankruptcy, however, be sure to talk to your attorney before you incur any new credit or debt.

After two or three years following your bankruptcy filing, if you have been working on rebuilding your credit, you will begin to see your credit score increase again. It is important to remember that the bankruptcy is similar to a wound it will not heal overnight, and it takes diligence, time, and care to completely heal. Eventually, that wound will turn into a scar and can still be seen but is not painful. Just like after two or three years the bankruptcy will still be visible on your report but will not have a big impact on your actual FICO score. By caring for your credit and taking the necessary steps to rebuild it during the seven to ten years it is reflected on your credit report, you will ensure that the bankruptcy gives you a true clean slate and that it does not ruin your credit for ten years.

How can I rebuild my credit after bankruptcy?

Read Also: What Is Epiq Bankruptcy Solutions Llc

How To Remove A Bankruptcy From Your Credit Report

Home»»How to Remove A Bankruptcy From Your Credit Report

If you are one of the half million people a year who file for bankruptcy, youre probably trying to figure out when and how you can get that bankruptcy removed from your credit report. While bankruptcy filings bucked the trend and actually by 29.7% last year , a half a million filings indicate that there are a lot of people still struggling.

If youre trying to better understand how long bankruptcy will stay on your credit report and how to remove bankruptcy from your credit report, weve got you covered. Well walk you through the specifics..

Understanding Chapter 13 Credit Reporting

During a Chapter 13 bankruptcy the creditors are not required to report anything to the credit reporting agencies. Even though a debtor is making payments in their plan, those payments may not be reported to the credit reporting agencies.

On the other hand, some creditors will zero out the debtors balance after the bankruptcy filing. This, however, is not guaranteed. But whether or not a creditor zeros out a debtors balance will not impact the fact that they cannot attempt to collect on the debt while the debtor is in bankruptcy.

Lastly, your credit report is not entirely important at the moment. Generally speaking a debtor is not able to obtain new credit while in Chapter 13 bankruptcy without the permission of the bankruptcy trustee. Because of this their credit rating during bankruptcy is not as important as their credit rating after their bankruptcy discharge.

Read Also: How Long To Keep Bankruptcy Papers