How Long Do Bankruptcies Impact Your Credit Scores

Since your credit score is based on the information listed on your credit reports, the bankruptcy will impact your score until it is removed. This means a Chapter 7 bankruptcy will impact your score for up to 10 years while a Chapter 13 bankruptcy will impact your score for up to seven years. However, the impact of both types of bankruptcies on your credit score will lessen over time. Plus, If you practice good credit habits, you could see your score recover faster.

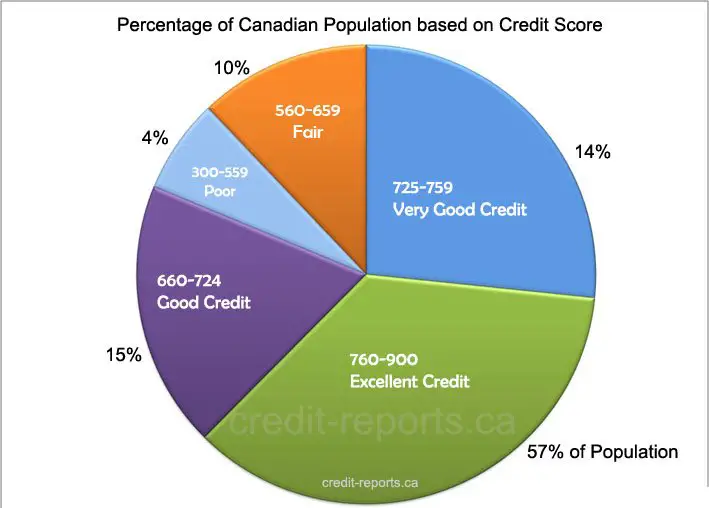

Also, how much your credit score decreases depends on how high your score was before filing for bankruptcy. If you had a good to excellent score before filing, this likely means your credit score will drop more than someone who already had a bad credit score.

How Long Do Closed Accounts Stay On My Credit Report

When you close an account, it may not be removed from your credit report immediately. This is true whether the closed account is a credit card or an installment loan. Closed accounts stay on your report for different amounts of time depending on whether they had positive or negative history. An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

Avoid The Following Strategies

While the following methods can be tempting options when trying to repair your credit, they can often cause more harm than good. Stay away from the following:

Closing a line of credit that is already behind on payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Filing for bankruptcy

There are two types of bankruptcies available for individuals: Chapter 7 and Chapter 13. A third type, Chapter 11, is meant for businesses.

You May Like: Bankruptcy Records Wisconsin

Signing A Bankruptcy Petition

To file for bankruptcy protection, you sign various bankruptcy forms, including an Assignment and a Statement of Affairs. In your bankruptcy assignment, you state that you are handing over your property to the Licensed Insolvency Trustee for the benefit of your creditors. The statement of affairs is a list of all your assets and liabilities.

You will also be required to answer several questions about your situation including details about your family, work, and disposition of assets before bankruptcy. It is an offence under the Bankruptcy & Insolvency Act to sell or hide assets from your creditors when you know you intend to go bankrupt.

With the advent of COVID-19 and the required social distancing, it is now possible to file bankruptcy online by video-conference and electronic signature. However, you must still file with a trustee in the province where you live or where most of your assets are if you live outside of Canada.

Why Is A Bankruptcy Part Of The Public Record

Bankruptcy cases are court proceedings. Court proceedings are always matters of public record unless a judge orders the sealing of the records. Itâs unlikely that a bankruptcy judge will order your records sealed, but itâs possible when access to these records could present a threat to your personal safety. You would have a very high burden to prove to the satisfaction of the court that your safety is at risk due to your full court record being public.

There are parts of your bankruptcy that are not part of the public record. Bankruptcy Form B-21 is the form that contains your full social security number. This is the only information kept on this form. Even your attorney canât view a record of it through the courtâs PACER site, where they have access to all other documents filed in your case. Understand that some of your bankruptcy information is always redacted to protect sensitive information about you. Such redacted information on bankruptcy forms is all but the last four digits of your social security number and financial account numbers. Minor childrenâs names can only appear as initials. For your birthday, the forms can only show your birth year.

Also Check: How Many Times Has Trump Filed Bankruptcy

Q How Do I Receive A Free Copy Of My Transunion Personal Credit Report

A. You can obtain a free copy of your Consumer Disclosure online through our self-service website. to visit our self-service website.You can also request a copy of your Consumer Disclosure by phone or mail, and it will be mailed to you. To review the options for receiving a copy of your Consumer Disclosure, please refer to the Consumer Disclosure section of our website

Ways To Remove Negative Items From Your Credit Report

Your credit report almost always has a huge influence on the financial aspect of your life and if your credit report is full of negative items like closed credit accounts, overdue bills, repossessions, and foreclosures, you may have some serious issues in your financial life. If you have a bad credit score, your eligibility for car loans, apartment rentals, and even job opportunities can be seriously damaged.

But the good news is, theres hope! Even if you have bad credit, there are some basic steps that you can take to remove negative items from your credit report, and start your journey towards better financial health.

In this article, Ride Time will take a look at the 5 most common ways that you can get negative items removed from your credit report, so that you can start rebuilding your credit today!

Also Check: Can I Get A Personal Loan After Bankruptcy

Filing Consumer Proposals With David Sklar & Associates

The hardest part of the consumer proposal process is asking for help. The team of compassionate Licensed Insolvency Trustees at David Sklar & Associates will guide you throughout the process, help you weigh your options, and make suggestions based on your unique situation.

There is no one size fits all debt relief solution, and our compassionate trustees work with you to identify the solution that will be best suited to you so that you achieve financial independence as soon as possible.

We provide the credit counselling required to file a proposal and establish debt management and financial plans for your future. Contact David Sklar & Associates to book your initial consultation.

What About My Credit Report

Your credit report is not part of the public record. The credit report is private and is only viewable by those you authorize to view it. Your bankruptcy will remain on your credit report for up to ten years from the date of filing. In most cases, when you apply for a loan, you authorize the lender to view your credit report.

You May Like: How Many Times Did Donald Trump File Bankruptcy

File A Dispute With The Credit Agency

If you take the time to look at your free yearly Canadian credit report, theres a fair chance youll find some reporting errors. Perhaps a past credit card is listed as delinquent despite the fact that you paid off the entire account, and then closed it.

If you do notice inaccuracies in your credit report, you can challenge it via Transunion or Equifax creditors will have 30 days to respond. Be prepared to furnish proof of your claims if youre right, the incorrect items could be removed from your report entirely.

Why Does Information Show Up On Your Credit Report For Years

Both good and bad credit information stays on your record for several years because it helps lenders determine your risk level when they consider approving you a loan.

Positive credit information, such as making your payments on time and in full, usually stays on your credit report for up to 10 years with Equifax and 20 years with TransUnion Canada.

Negative credit information, such as missed or late payments, accounts sent to collections, bad cheques, and so on, will show up on your credit for several years as well.

Equifax Canada starts counting the time from the date our debt was assigned to a collection agency and keeps the negative information on record for 7 years. TransUnion Canada starts counting from the date of your accounts first delinquency and keeps the negative information on record for 6 years.

However, different types of information stay on your credit report for different lengths of time. Heres a breakdown of how long different items show up on your credit report.

Recommended Reading: How Do I File Bankruptcy In Ohio

Can I Remove A Bankruptcy From My Credit Report On My Own

It is possible to pursue removing a bankruptcy from your credit report on your own, and some people have managed to do so. However, it is a time-consuming, labor-intensive process that many people find complicated, confusing, and frustrating.

We encourage you to learn as much as you can about credit report disputes and credit repair processes, then count the real cost of DIY credit repair before committing to handling this important task on your own.

People who have needed to remove a bankruptcy from their credit reports have achieved success by working with a provider like Lexington Law Firm. If other questionable negative items are affecting your credit report and score, we can help you challenge those as well.

Contact us today for a free personalized credit report consultation to find out how we can help you meet your credit goals.

Reviewed by Vincent R. Mayr, Supervising Attorney of Bankruptcies at Lexington Law. by Lexington Law.

Path To Credit Recovery

If you are avoiding talking to a bankruptcy trustee because you are concerned about how your credit will be affected, its important to consider two factors:

If debt is holding you back from rebuilding your credit, talk with a Licensed Insolvency Trustee about how to eliminate your debt. We provide free, no-obligations consultations during which we will conduct a full debt assessment and provide you with options to get out of debt so you can build a stronger financial future.

Recommended Reading: Why Did Fizzics Fail

How Long Do Accounts Remain On My Credit Report

The time limits listed below apply to federal law. State laws may vary.

Accounts:

In most cases, accounts that contain adverse information may remain on your credit report for up to seven years from the date of first delinquency on the account. If accounts do not contain adverse information, TransUnion normally reports the information for up to 10 years from the last activity on the account. Adverse information is defined as anything that a potential creditor may consider to be negative when making a credit-granting decision.

Bankruptcies:

Generally, bankruptcy and dismissed bankruptcy actions remain on file for up to 10 years from the date filed. A completed or dismissed Chapter 13 remains on file for up to seven years from the date filed. A voluntarily dismissed bankruptcy remains on your file for up to seven years from the date it was filed. The actual accounts included in bankruptcy remain on file for up to seven years from the date of closing/last activity regardless of the chapter pursuant to which you filed.

Inquiries:

Under law, we are required to keep a record of inquiries for a minimum of two years if related to employment and for one year if not employment related. It is TransUnion’s policy to keep a record of all inquiries for a period of two years.

Foreclosure public record:

Generally, foreclosures, both paid and unpaid, remain on file up to seven years from the date filed.

Forcible detainer:

Garnishment and attachment:

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

Table 1: What letters mean in a rating on a credit report| Letter |

|---|

You May Like: How Many Times Has Trump Filed For Bankruptcy

How Long Does A Chapter 13 Bankruptcy Stay On Your Credit Report

A Chapter 13 bankruptcy stays on your credit reports for up to seven years. Unlike Chapter 7 Bankruptcy, filing for Chapter 13 bankruptcy involves creating a three- to five-year repayment plan for some or all of your debts. After you complete the repayment plan, debts included in the plan are discharged.

If some of your discharged debts were delinquent before filing for this type of bankruptcy, it would fall off your credit report seven years from the date of delinquency. All other discharged debts will fall off of your report at the same time your Chapter 13 bankruptcy falls off.

Are Debt Collectors In Canada Allowed To Keep Calling Me If I Declare Bankruptcy

Once a bankruptcy claim is filed, all creditors and collection agencies are required by law to stop contacting you. Additionally, a creditor cannot garnish your wages.

You can continue to receive calls from secured creditors. This applies to a mortgage, lien on a car, or debt for alimony or maintenance.

Recommended Reading: How To Declare Bankruptcy In Va

Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

Can You Still Get A Loan Even With A Bankruptcy On Your Credit Report

Many people think that just because they filed for bankruptcy, then this means that they will not be able to get a loan or a new line of credit. The truth is, there are many different companies and lenders that specialize in lending to people who just filed for bankruptcy or with bad credit.

Of course, you will find that the interest rates and the fees are high compared to when you still had a stellar credit score. Thats why its important to be cautious and to not be blinded by the unbelievable offers immediately after your bankruptcy discharge. Make sure that you read the fine print and clarify all the details before going for a loan or a credit card. You dont want to end up in a more dreadful situation than you were in pre-bankruptcy.

So, what types of loans or credit are you still eligible for even after filing for bankruptcy? We listed down the credit options for you

Also Check: Fizzics Net Worth

How Long Do Delinquent Credit Accounts Stay On My Report

When it comes to delinquent credit accounts or other negative credit information, its best for your overall credit health if that information is removed from your credit report as soon as possible. Its this type of information that will lower your credit score and hinder your ability to get approved for the credit and loan products you need.

Unfortunately, negative credit information does stay on your credit report as its used by creditors and lenders to assess your risk level. The good news is that negative credit information doesnt stay on your credit report for as long as positive credit information.

Because there are so many different types of negative credit information that can appear on your credit report, here is a detailed list of how long each will stay on your report.