Work With Your Creditor

At this point, you may be dealing with a debt collection agency or a law firm instead of the original lender. These agencies or firms typically buy debt for pennies on the dollar, so they may have some wiggle room to work with you.

If a lawsuit is on the table, reach out to the creditor to see if you can come up with a solution that doesn’t involve garnishment. For example, you may be able to get set up on a modified payment plan based on your ability to pay.

Alternatively, you can try to settle the debt for less than what you owe. To do this, though, you’ll typically need to pay the settlement amount in a lump sum. You can even enlist the help of a debt settlement company or law firm with the negotiations. However, these companies can be risky to your already damaged credit scoreand scams are commonso opting for a credit counselor to guide you may be a better option. The National Foundation for Credit Counselors can get you started.

Note, however, that it’s best to pursue these options before a garnishment is in place, as they may not be as appealing to creditors as guaranteed court-ordered payments.

What Is Wage Garnishment

Wage garnishment happens when a court issues an order requiring your employer to withhold a portion of your paycheck and to send it directly to a creditor that you owe. In general, your paycheck continues to be garnished until the debt is paid off in full or otherwise resolved.

A wage garnishment lasts until the debt is completely paid off. While this helps creditors obtain debts from borrowers, a lot of times it wreaks havoc on a borrowerâs financial situation. Even though most of your wages are protected from garnishment, it can still have a serious impact on your income. For example, so long as there is only one debt being garnished from your wages, your employer cannot retaliate against you because of wage garnishment. However, if multiple creditors are garnishing your wages, then your employer can renegotiate the terms of your employment. Consequences like these lead to many people being trapped by their debts, creating a cycle of financial instability.

Do Not Ignore Debt Or Payment Plans

Unfortunately, debt seems to be on the rise in the United States. Americans now hold higher overall debt than previous spikes seen before the 2008 financial crisis. The Federal Reserve Bank of New York issued its Quarterly Report on Household Debt and Credit, which shows that total household debt increased by $32 billion to $13.54 trillion in the last quarter of 2018.

If your debts are left unacknowledged, or have progressed beyond the stages of negotiating an installment plan, a Los Angeles wage garnishment attorney may be needed. A wage garnishment attorney can contact your creditor and open a new channel of communication. An exemption can be filed so that your attorney can prove to a judge that the amount being seized exceeds a reasonable or even legal amount. And if no other options remain, a Chapter 7 bankruptcy filing will stop any wage garnishment and may even discharge the original debt.

Don’t Miss: Will A Bankruptcy Affect A Top Secret Clearance

Get The Judgment Overturned

You may be able to get the wage garnishment order overturned or vacated if one of the following scenarios applies to you:

- You missed a court date

- You didnt receive any papers about the complaint that ended up with garnishment

- You have a legally sound reason for why the creditor should not have won the case that resulted in wage garnishment

After completing your states Motion to Vacate form within the allotted time frame, you can expect to attend a hearing to present your case.

Filing A Consumer Proposal

A consumer proposal is legally required to be administered by a Licensed Insolvency Trustee. Your trustee will work with you to determine an affordable monthly repayment, and will then negotiate with your creditors to agree a reduced debt amount. Typically, filing a consumer proposal reduces your overall debt by up to 80%. Most importantly, a stay of proceedings is put in place, meaning wage garnishments must stop, and creditors are unable to contact you.

Book your free phone consultation with our caring team to discuss your options and start your journey towards financial freedom.

Don’t Miss: Do You Lose Your Home When You File For Bankruptcy

What Types Of Garnishments Are Not Stopped By Bankruptcy

Bankruptcy isnt a silver bullet where wage garnishment is concerned. Bankruptcy may not be able to stop wage garnishment under the following circumstances :

- Family support payments are not subject to an automatic stay.

- Non-dischargeable debts .

- Multiple recent bankruptcies

If you file a Chapter 13 bankruptcy , keep up with your monthly payments. Failing to pay the bankruptcy trustee as promised could result in a dismissal of the bankruptcy and a reinstatement of wage garnishment in the future.

Chapter 7 Bankruptcy And The Automatic Stay

When you file for Chapter 7 bankruptcy, the law immediately begins protecting you from creditors by imposing an automatic stay. The stay prohibits creditors from taking any collection activity against you during your bankruptcy case.

Because wage garnishment is a collection action, wage garnishments must stop once you file for bankruptcy. There are a few exceptions to this prohibitionmost notably, child support collections will not be stopped by the automatic stay.

A creditor can ask the bankruptcy court to lift the automatic stay. However, the court is unlikely to lift the stay unless:

- the creditor has a debt secured by collateral, such as a house or car, and

- the creditor will lose money if forced to wait until the case ends.

Learn more about when the court might lift the automatic stay.

Also Check: Can You File Bankruptcy On A Judgement Against You

Chapter 7 Chapter 13 And Wage Garnishment

Chapter 7 BankruptcyA stop will be put on your wage garnishment when you file for Chapter 7 Bankruptcy . If you successful complete the Chapter 7 and a discharge is entered against that debt, the creditor will not be able to garnish your wages anymore.

Note Child support, certain taxes, and student loan debts arent dischargeable through Chapter 7 Bankruptcy. You are also required to continue to pay your child support and alimony while in bankruptcy.

Chapter 13 BankruptcyWhen filing for Chapter 13 Bankruptcy, youll pay your creditors, including the ones garnishing your wages, through payment plans. At the end of the Chapter 13 case, the debt should be discharged and the creditor will not be able to have your employer withholding income to satisfy the debt.

Note As long as youre complying with your Chapter 13 three-to-five-year repayment plan, your garnishments will stop. After that, however, the court can decree that the repayment plan be fulfilled by garnishing wages.

What Happens If Your Wages Are Garnished And You Quit Your Job

Quitting your current job will not erase the debt it will only leave you without the money to pay it. Once you find another job, the creditor can file to have your wages garnished there. Youre best off staying employed where you are.

How long does it take for garnishment to stop?

Some employers have stopped wage garnishments upon the filing of the bankruptcy case, however, most will want something from the sheriffs department to stop it. Once all the factors are taken into account, it takes about 7 days to 4 weeks to release a wage garnishment after it is filed.

You May Like: What Cannot Be Discharged In Chapter 7 Bankruptcy

Bankruptcy Stops Wage Garnishment

The minute a bankruptcy cases filed, an injunction called the automatic stay is issued, which prohibits creditors from trying to collect on debts that were included in the bankruptcy.

The Ninth Circuit Court of Appeals has called the automatic stay one of the most important protections in bankruptcy law.

The automatic stay is self-executing, effective upon the filing of the bankruptcy case and requires that all collection calls, lawsuits and garnishments must stop immediately.

Section 362 of the Bankruptcy Code provides:

An individual injured by any willful violation of a stay provided by this section shall recover actual damages, including costs and attorneys fees, and, in appropriate circumstances, may recover punitive damages.

The Automatic Stay In Bankruptcy

Filing for Chapter 7 bankruptcy prompts a court injunction called the automatic stay. This freezes nearly all creditor collection activities against you including wage garnishments for the duration of the case.

The automatic stay is quite powerful, but as with any law, exceptions apply. The injunction wont stop garnishments for domestic support obligations, such as past-due alimony or child support. And, creditors have the legal right to ask the bankruptcy court to lift the stay at any point, though this is typically only granted for debts secured by collateral.

You May Like: Can A Married Couple File Bankruptcy Separately

How Will My Employer Know To Stop Garnishing My Wages

Once you have filed for bankruptcy, you will need to give the court a list of all your creditors and their addresses. The court will then notify all of your creditors about your bankruptcy filing. Once the creditors have received notice, they are required to take the steps to suspend the garnishment.

If you are under any time constraints, you may want to have your bankruptcy attorney forward the filing directly to the creditor. This is a faster and more direct way to communicate this information if the wage garnishment is scheduled to begin soon.

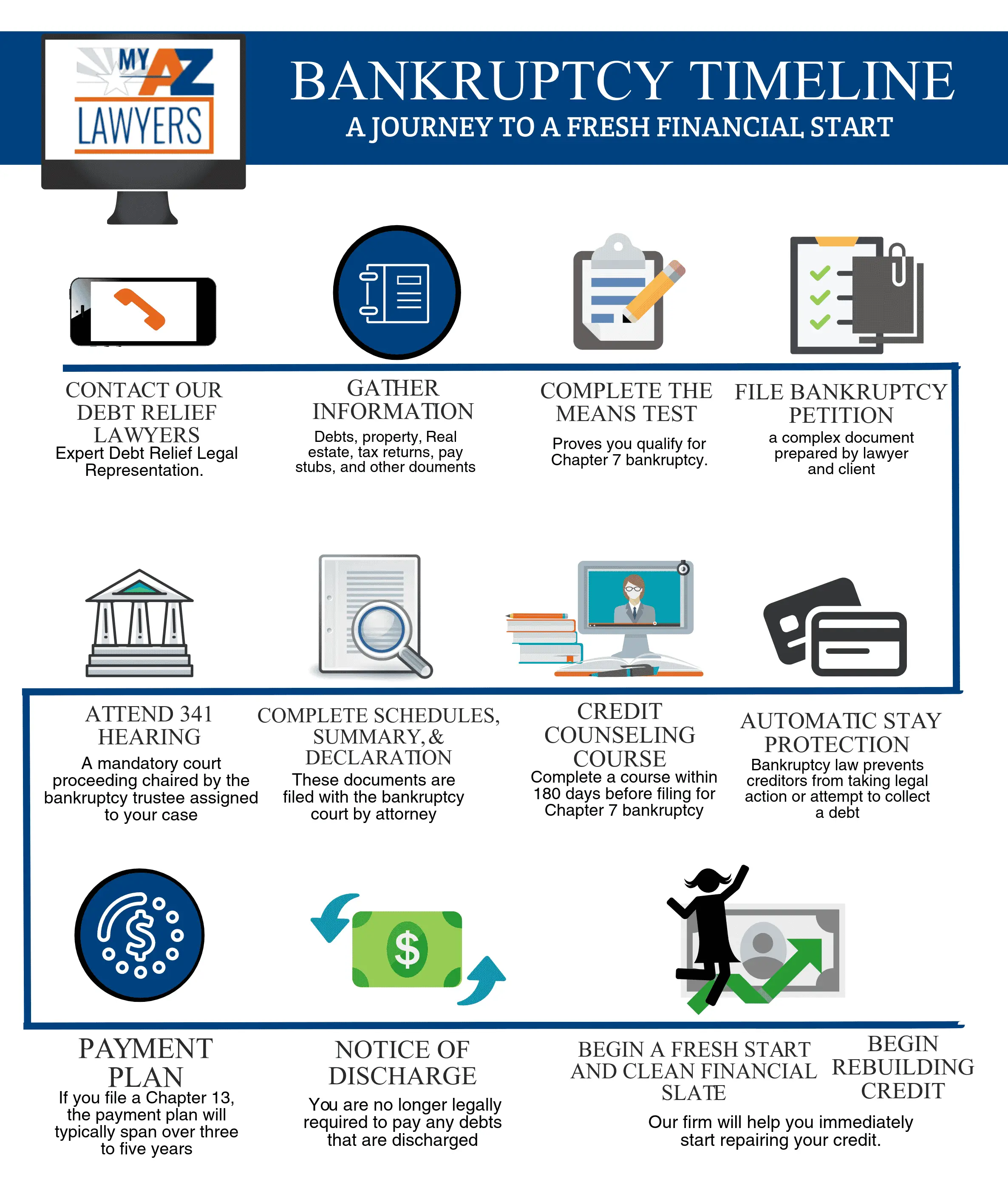

S To File Bankruptcy To Stop Garnishments

You can hire a bankruptcy attorney to represent you in legal proceedings that pertain to your debts, and there are certainly benefits to doing so. Yet some people opt to file a bankruptcy petition on their own. This process is known as filing bankruptcy pro sea Latin phrase that means for yourself.

If you decide to move forward with the do-it-yourself bankruptcy approach to try to stop garnishments, below are some of the steps you may need to complete:

Read Also: What It Means To Declare Bankruptcy

Can The Irs Garnish Wages From Two Jobs

If you have two jobs and one covers your living expenses, the IRS may garnish 100 percent of your paycheck from the other job. In addition, if your boss grants you a bonus, you may be liable for it as well. This tax levy will remain in effect until you have paid your taxes or arrange other arrangements with the agency.

A creditors has the right to garnish wages for a variety of reasons. A large proportion of this debt is owed to consumer debt, child support, and alimony. If the IRS has been unable to collect the full amount owed, the IRS may resort to wage garnishedries as a last resort. An IRS representative will notify you by mail of the amount of money you owe. If you do not pay your taxes by the due date specified in the first letter, you will receive a Final Notice of Intent to Levy. To avoid wage garnishment, you must pay the IRS the full amount you owe. You cannot discharge your tax debt by filing for bankruptcy under Chapter 7.

If you have been ordered to repay wages, you should act quickly. If you work for a company that does not cover your living expenses, the IRS may seize your wages up to the amount you owe in back taxes. When the IRS sends a levy notice to your employer, it will also notify you that the IRS intends to garnish your funds. You have the right to object to the garnishment, and you can also request a hearing to determine the amount due. If you are unable to pay back taxes, you may need to file for bankruptcy.

Contact A Daytona Bankruptcy Attorney For More Information

Our Florida bankruptcy lawyers can help you stop wage garnishments and get out of debt through a bankruptcy filing. In most cases, a bankruptcy filing is more affordable than wage garnishment, and you can eliminate most, if not all, your debts instead of just one debt. For a free bankruptcy consultation with a bankruptcy attorney in Volusia County, call or use the contact form on our website to contact our office.

Recommended Reading: How Long Does Bankruptcy Stay On U4

Using Wage Garnishments To Collect Debts In Florida

Wage garnishments are a collection tool used by creditors in Florida to collect bad debts. Section 77.0305 of Chapter 77 of the Florida Statues governs wage garnishments.

The first step in the wage garnishment process in Florida is for the creditor to file for a judgment against you. A creditor files a debt collection lawsuit with the court and serves you with a copy of the papers. If you do not respond to the lawsuit before the deadline, the creditor can obtain a default judgment from the court for the money you owe to the creditor.

After the court grants the judgment, a creditor must file a Motion for a Continuing Wage Garnishment order. Because this motion is filed ex-parte with the court, you will not receive notice that the creditor has applied for a wage garnishment. Once the judge grants the creditors motion, the Continuing Writ of Garnishment is served on your employer. Therefore, your first notice that your wages are being garnished may be when you see the deduction on your paystub. Wage garnishment orders can require your employer to freeze up to 25 percent of your pay to be forwarded to the creditor.

Understanding The Automatic Stay

Not only does the automatic stay gives you a break from a difficult financial situation, but it also puts your creditors on an equal footing. Once you file, the bankruptcy court takes control of your financial affairs. If money is available to disperse to your creditors, the bankruptcy trusteethe official tasked with overseeing your casewill do so according to the payment priority system outlined in bankruptcy law. This process ensures that each creditor gets the amount of funds its entitled to receive.

Recommended Reading: How Long Do Chapter 7 Bankruptcies Stay On Credit Report

How Much Can Be Garnished From Your Wages

The most a creditor can garnish from your wages under the Ontario Wages Act is 20% of your gross wage to pay towards debts, or up to 50% for child support. It is a good to idea to try and negotiate with your creditor before your employer receives a wage garnishment order to prevent this deduction from your paycheque.

How Much Of Your Wages Can Be Garnished

When we hear wage garnishment, many think that it means youll be left with nothing in your paycheck. However, thats not actually the case at all.

Under federal and Ohio state law, there are limits on wage garnishment amounts. In Ohio, a creditor with a money judgment can take the following amount from your income earnings:

- 25% of disposable earnings

- Disposable earnings less 30 times the current federal minimum wage of $7.25 per hour or $217.50 per week

Disposable earnings are the remaining balance after taking out taxes, and other mandatory deductions. Deductions like health and life insurance dont reduce disposable earnings.

Other wage garnishment limitations include:

- Child support: Under federal law, up to 50% of your disposable earnings can be garnished for child support if youre currently supporting a spouse or a child who is not part of the bankruptcy order.

- Defaulted student loans: Up to 15% of your disposable income can be garnished for defaulted student loans.

- Unpaid taxes: Depending on the local and state tax law ramifications, this will determine the percentage of disposable earnings that can be deducted for back taxes. An Ohio bankruptcy attorney can guide you through that specific process.

Read Also: How Many Times Did Donald Trump File Bankruptcy

Recommended Reading: What Is Cram Down In Bankruptcy

Filing For Chapter 7 Bankruptcy Will Stop Most Wage Garnishments But There Are A Few Exceptions

If your wages are being garnished, or you fear they soon will be, filing for Chapter 7 bankruptcy will stop the garnishment in most cases. This happens because bankruptcy’s automatic stay prohibits most creditors from continuing with collection actions during your bankruptcy case.

Read on to learn about wage garnishment and how the Chapter 7 automatic stay will put a temporary stop to wage garnishment.

File Your Bankruptcy Petition

Wage garnishments have to stop immediately once your case is filed but you should allow time for the creditor to provide your employer with the necessary paperwork to actually cause the stop. If your case is filed the day before your next payday, chances are you’re paycheck will still be garnished, as the payroll has already been processed. However, you’ll get that money back.

Recommended Reading: When Will Sears File For Bankruptcy