Additional Fees And Costs When Filing Bankruptcy

Here are a few other expenses youll likely have to pay for when you file Chapter 7.

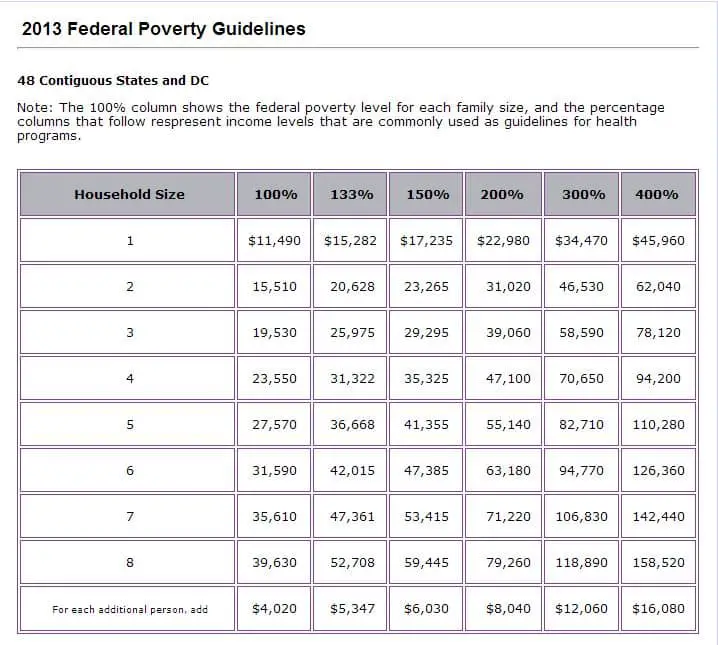

Filing fees.In addition to the fees you pay your attorney, youll have to pay the bankruptcy courts filing fee of $338 unless you qualify for a waiver because you earn no more than 150% of the national poverty guidelines.

Bankruptcy counseling course fees. Everyone filing for Chapter 7 bankruptcy must take two bankruptcy counseling courses: one before filing and another afterward. These courses should cost about $60 or less. Discounted courses are available for low-income people.

Litigation fees and costs. If your bankruptcy case ends up in litigation, you’ll owe your attorney more money. According to our survey, the vast majority of Chapter 7 bankruptcy cases moved through the process without incident. However, not all cases do. In a small percentage of cases, a creditor will object to the bankruptcy court’s discharging a debt on the grounds of fraud .

If a creditor files an adversary proceeding for fraud , youll need to pay your bankruptcy attorney additional fees to oppose the adversary proceeding on your behalf. Your regular bankruptcy fee does not include representing you in this type of litigation.

How Much Does It Cost To File For Bankruptcy In Cincinnati

The three types of costs associate with filling are:

-

Court Filing Fees

- The court filing fee in Ohio for a Chapter 7 case is currently $335.

- The filing fee for a Chapter 13 case costs $310.

- Your bankruptcy trustee may also charge a fee of $15 to $20 when you file.

Attorney’s Fees

Administrative Fees

Bankruptcy Education Courses: $50

One small fee that you mustnt forget covers credit counseling. Completion of two credit counseling courses is required for petitioners in both Chapter 7 and Chapter 13 cases. The first course must be completed before you file for bankruptcy, and the second must take place after you file.

You must consult a nonprofit credit counseling agency approved for your district by the U.S. Department of Justice to arrange to take the courses. The Office of the U.S. Trustee, the federal agency that oversees the counseling requirement, sets reasonable fees for such courses.

If you are unable to pay for the courses, the law requires credit counseling agencies to offer them at a reduced rate or for free.

Recommended Reading: When Does Chapter 7 Bankruptcy Fall Off Your Credit Report

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Factors That Can Affect How Much Your Il Bankruptcy Costs

How much does it cost to file bankruptcy in Illinois? It depends. No one can accurately quote an exact total cost of your Illinois bankruptcy because so many variables can change the costs. However, if you have an understanding of those variables, you can start to get an idea of how much you might end up paying for bankruptcy.

Also Check: Foreclosure Homes For $1 000 Dollars

Why Choose Mcdonald Law Bankruptcy Law Firm

You will be immediately comforted by Attorney McDonalds level of experience and expertise in bankruptcy law. He will help you gain a full understanding of the bankruptcy process and what you can expect in your case, including all costs. Compassionate and dedicated to helping his clients, your experience with McDonald Law will be a great onetaking the fear and stress out of bankruptcy.

Suffering from any of these forms of debt? We can help.

How Much Will It Cost Me To File Chapter 7 Bankruptcy

Lets elucidate the costs attached to filing under Chapter 7 bankruptcy. The majority of applicants hire the service of an attorney, so well factor this into the article. You should note that the attorneys cost will be the most expensive of your cost. To have a better understanding of the cost as it pertains to your case, then its best to use our Chapter 7 bankruptcy cost calculator.

Lets discuss each cost below:

Read Also: What Debts Are Not Covered By Bankruptcy

Chapter 13 Bankruptcy Attorney Fees

The Chapter 13 bankruptcy attorney fee range from $2,500 to around $6,000. Some of the Chapter 13 bankruptcy attorney fee is paid in the monthly payment plan. You can estimate your Chapter 13 monthly payment by using our Chapter 13 calculator, which includes both the bankruptcy attorney fee and the trustee fee.

The Chapter 13 bankruptcy attorney fee may be the same across the bankruptcy district regardless of who you choose to hire. The reason for the similarities in bankruptcy fees is called the no-look fee. The no-look fee is the reasonable fee that the attorney may charge to represent a debtor. You may see this as a sort of consumer protection.

However, the amount that the attorney charges might be different depending on the state where one files bankruptcy.

You can use the Chapter 13 bankruptcy cost estimator below to estimate the bankruptcy attorney cost in your zip code.

Understand Fixed And Variable Costs Of Filing Bankruptcy

In bankruptcy, there are fixed costs and variable costs. The fixed costs are the filing and administrative fees and the variable costs are the attorney fees. We will provide you with the fixed costs below and recommend you take the bankruptcy cost estimator to estimate the cost in your city.

Fixed Costs: Provided by the US Courts , the filing cost for a Chapter 7 bankruptcy is $338 and the filing cost for a Chapter 13 bankruptcy is $313

Variable Costs: The variable cost is based on the attorney fee. We estimate the fee is based on 1) Type of Bankruptcy 2) Complexity of case 3) Your location 4) Level of attorney involvement 5) Bankruptcy experience and expertise.

Recommended Reading: Will Capital One Approve Me After Bankruptcy

The Cost Of Filing Bankruptcy In Kansas For An Individual

The cost of filing bankruptcy in Kansas for an individual is $306. This fee is paid to the bankruptcy court when you file your petition. In addition to the filing fee, you will also need to pay for credit counseling and a debtor education course, which will cost around $50-$100. If you cannot afford to pay the fees upfront, you may be able to file for a fee waiver or installment plan.

The Complexity Of Your Case

If you have a simple Chapter 7 case with few complications or a Chapter 13 case that requires little more than a repayment plan and some meetings, the cost of your bankruptcy will likely be on the lower end of the average Illinois bankruptcy cost.

But if you have an extremely complex financial situation or need to make all kinds of court motions, both the courts and your attorney are likely to charge you more. To get an idea of the complexity of your case, you can speak with a bankruptcy lawyer who can advise you on costs to expect.

Also Check: Who Bailed Trump Out Of Bankruptcy

Bankruptcy Costs And Surplus Income

Your monthly after-tax income is the major factor that impacts both the amount of money you pay towards your bankruptcy, as well as how long it will take before you are released from bankruptcy.

- While most people filing personal bankruptcy will fall under the scenario of paying only the basic bankruptcy costs over the nine months of their bankruptcy, if your household income is above the government-set superintendents standards, you may be required to pay what is called surplus income.

- Its important to understand that if you have surplus income, you will not pay the $2,300 bankruptcy fee AND your surplus income you will instead pay either $200 per month for 21 months or your surplus income amount for 21 months .

- The income standard used to calculate surplus income varies depending on the number of people in your household and is generally adjusted each year to account for increases in cost of living.

- Money paid as surplus income is done for the general benefit of your creditors, since this will usually mean they will receive some return on the debts that are being forgiven.

Example:

Do I Have Enough Debt To Justify The Cost To File Bankruptcy

A common question is whether you may have enough debt to file bankruptcy. Unlike what most people would think, there is no minimum debt threshold that one has to achieve to qualify for a bankruptcy filing. You should consider your financial condition so that you can determine whether you should file for bankruptcy.

There is no minimum debt amount that warrants a bankruptcy filing. Although, it is important to keep in mind the amount of debt you hold is a critical determinant in the decision to file for bankruptcy. The decision to file or not to file for bankruptcy should depend on factors such as

- The creditors desire to continue doing business with you.

- Your ability to clear your debt during bankruptcy.

- The ability to repay debt outside bankruptcy.

- Your financial situation and other underlying facts may influence the decision.

There is a Chapter 13 debt limit that anyone should consider, especially when planning to file for Bankruptcy under Chapter 13. As of April 1, 2022, an individual is not allowed to have unsecured debt of more than $465,275 for liquidated, non-contingent unsecured debts. Also, secured debts must not exceed $1,395,875 for liquidated, non-contingent secured debts when filing Chapter 13 bankruptcy.

You May Like: What Types Of Bankruptcies Are There

Get Your Moneys Worth With A Bankruptcy Law Firm Llc

It is completely understandable to wonder how much it costs to file bankruptcy in Illinois. Unfortunately, the answer cant be definitive until youve met with an attorney to get an estimate of what you will have to pay.

Here is something that wont add to your Illinois bankruptcy costs: a free bankruptcy consultation with A Bankruptcy Law Firm, LLC. Our trusted and experienced bankruptcy lawyers offer free consultations with no obligation to move forward and no hidden fees. During your consultation, an attorney can help you get a better understanding of what your unique case might cost when all is said and done.

Interested? To claim your free Illinois bankruptcy consultation, all you have to do is reach out to us. Contact us online or call .

How The Type Of Bankruptcy Attorney Affects The Fee

Some people want to work in close collaboration with their bankruptcy lawyer, while others prefer as little contact as possible. The level of attention you require can be a factor in determining your fees.

For example, firms practicing bankruptcy law exclusively often save money by hiring paralegals to prepare your paperwork. An attorney will review your petition for accuracy but might not participate in the entire process. The benefit of using this type of firm is that you might pay attorneys’ fees of $1,000 to $1,200 for a straightforward Chapter 7 case.

Other lawyers with smaller practices might take a hands-on approach and be there to consult with you throughout the entire process. You can expect to pay more for that service: $1,500 to $2,000 for a standard consumer bankruptcy case.

To help you meet your particular needs, here are some questions you can ask during your consultation:

- Who will complete my paperwork?

- Who will answer my questions if I call the office?

- Will you or a junior attorney go with me to the 341 meeting of creditors?

Read Also: What Do You Need To File Bankruptcy

Heres A Breakdown Of The Cost:

You can request that your Chapter 7 bankruptcy filing fee should be waived. However, what determines whether your request will be granted or not is your income. To get a fee waiver, then the income for your household should be below %150 of the government stipulated poverty line as at the time youre filing for a discharge.

However, if your income does not fall below the requirement for a fee waiver, then you should request an instalment payment. Before youre allowed to make an instalment payment, then you must fill the form that allows you to pay your filing fee in instalments. In an instance where the bankruptcy court approves your instalment request, then you must make all payments in four instalmentsat most. Also, you wont be issued your bankruptcy discharge certificate if you havent paid your filing fee in full.

What Happens When You Go Bankrupt

If the adjudicator makes you bankrupt:

- youll receive a copy of the bankruptcy order and may be interviewed about your situation

- your assets can be used to pay your debts

- youll have to follow the bankruptcy restrictions

- your name and details will be published in the Individual Insolvency Register

You can apply to have your address removed from the Individual Insolvency Register if publishing it will put you at risk of violence. This will not affect your bankruptcy.

After 12 months youre usually released from your bankruptcy restrictions and debts. Assets that were part of your estate during the bankruptcy period can still be used to pay your debts.

You might be able to cancel your bankruptcy before youre discharged.

Bankruptcy only applies to individuals. Find out what your options are if your limited company cannot pay its creditors.

Also Check: Store Returns For Sale

How Much Bankruptcy Costs And How To Pay For It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Its a classic catch-22: Youre in rough financial shape and need to file for bankruptcy. But between filing fees and the cost of hiring the right bankruptcy attorney, you could end up paying hundreds or even thousands of dollars to do so.

Heres what bankruptcy costs and how to pay for it.

Bankruptcy Filing Fee Waivers

Your bankruptcy filing fee will be one of the larger costs you have to pay for bankruptcy in Illinois unless you get it waived. To do that, you have to fill out an application and meet strict income qualifications.

Put simply, you have to make less than 150 percent of what the federal government considers poverty-level monthly wages. The poverty level varies for different household sizes. Here is the monthly income breakdown:

- One-person household: $1,610.00

- Additional monthly income for each family member over eight: $567.50

You May Like: How Long Before Bankruptcy Is Removed From Credit Report

Bankruptcy How Much Does It Cost To File

If youre filing bankruptcy, chances are youre looking to save money, not spend it. However, filing bankruptcy costs money-filing fees, court fees, and if you hire an attorney in Ft. Myers to assist you with your case, attorney fees. So how much does it cost to file for bankruptcy? Well, that depends

How To Pay For A Bankruptcy

Filing Chapter 13 means you have the financial footing to structure a repayment plan for your debts including attorney fees after youve filed.

But if youre in enough financial distress that you need to file Chapter 7, youll likely need to pay your attorney before he or she files your case. If you cant afford these costs, you can:

-

Raise the money

-

Work out a payment plan before filing

-

Go pro bono, which means finding an attorney who will take your case free of charge

The first option takes creativity and hard work. The others require you to prove financial need, so gather proof of your income and expenses, as well as your tax statements, before meeting with any legal counsel.

Also Check: How To Look Up Bankruptcies In Florida

Bankruptcy Court Filing Fee

Every individual that aims at filing under a Chapter 7 bankruptcy discharge is mandated to pay the sum of $335 as the filing fee. Beyond this, theres an additional charge ranging between $15 to $20 thats to be paid to the Bankruptcy Trustee.

The filing fee charged by the bankruptcy court is uniform to all bankruptcy cases, irrespective of the case complexity, the amount involved, and whether its a business, joint, or individual case. The total sum of a Chapter 7 bankruptcy fee is $335, out of which $15 is the Trustee fee, while the administrative fee is $75.