How Is The Debt Ceiling Raised

Inflation and legislation that expands government activities require the debt ceiling to be raised.

If the debt ceiling is not raised, the Treasury must resort to alternative measures to raise funds. Once those measures are exhausted, the government would go bankrupt. Politics can result in Congress refusing to raise the debt ceiling to gain concessions on other areas of policy.

What Is The Us Debt Ceiling

The United States Congress oversees all American government departments including the Treasury. Until 1917, the Treasury had to seek the approval of Congress for every bond auction. Since then, the debt-raising capability of the Treasury has been limited by a debt ceiling that is set by Congress.

The debt ceiling covers all US government debt, including intragovernmental holdings.

The debt ceiling is stated as an amount rather than a percentage of GDP.

The Beauty Pageant Of Money

While there is a diversity of opinion on how to think about the national debt, there is broad agreement that comparing it to household debt credit cards, mortgages or student loans, for example is the wrong way to think about it.

The important difference is that if you or I run out of dollars, we lack the ability to generate new ones. The government has no such encumbrance, and when it makes new dollars, people all over the world respect their value.

One perspective here is, we call it the national debt, but it’s not really debt, said David Andolfatto, senior vice president in the research division at the Federal Reserve Bank of St. Louis. It’s actually part of the money supply that people find useful, the same way you and I find using money useful.

The government acquires more debt by issuing Treasury securities which come in the form of bills, notes or bonds which have different maturities and have a seemingly infinite market for buyers because they are regarded as the safest of assets. Investments go up or down in value T-bills do too, but theyre never worthless.

Because Treasuries are stable, retain value and are eminently marketable, banks are now required to hold some quantity of them at all times as a provision against the kind of market collapse that the banking system experienced in 2008.

The United States is not experiencing that pressure today far from it. China sold about $180 billion in Treasuries in 2015, and the market largely shrugged it off.

Recommended Reading: Buy Through Auction.com

Why Is National Debt A Problem

If a government increases its national debt to a level that the market thinks is too high, it will have to increase the interest it pay in order to find lenders.

With the backstop of a high return from a safe source, banks do not need to lend to businesses to make a profit. When banks are less interested in offering loans, they raise interest rates for all borrowers.

High interest on loans increases business costs and the return on investment that is funded on debt reduces. In this instance, businesses cease to expand and unemployment rises.

Why Do Governments Lower Interest Rates On Growing Economies

This knowledge in the financial community enables governments to lower the interest rates that it offers on its debt and reduce the cost of financing deficits.

Thanks to economic indicators, you can work out whether a countrys national debt will trigger a virtuous cycle of investment and expansion, or a destructive debt spiral.

Also Check: When Does Bankruptcy Clear From Credit Report

Why Does Larger National Debt Attract Bond Buyer

Having a large national debt doesnt always discourage buyers of bonds. For example, the United States has a debt to GDP ratio of 108% and a lot of people want to buy US Treasury bonds.

You can see this data summary of US Local & State Government Debt for more information.

Some countries, such as the USA are always considered a good place to invest, and the government bonds of those countries are always in high demand.

Which Country Has The Most National Debt

According to the IMF, Japan is the most indebted country in the world in terms of a debt-to-GDP ratio.

To learn more about Japans economy and trade, see our Economic Overview Of Japan. We discuss top imports and exports along with GDP figures.

Debt-to-GDP is expressed as a percentage. GDP is a countys annual income and it is usually expected that the debt of a nation should be less than 100 percent of that GDP figure.

However, in many countries, the national debt is higher than the GDP.

Here are the ten most indebted nations in 2020:

| Rank |

|---|

You May Like: When To Stop Using Credit Cards Before Bankruptcy

Why The Debt Clock Is Important

The U.S. national debt is the sum of all outstanding debt owed by the federal government. It’s an accumulation of each year’s budget deficits. About three-fourths of the national debt is public debt, which is held by individuals, businesses, and foreign governments that bought Treasury bills, notes, and bonds. The government owes the rest to itself, mainly to Social Security and other trust funds, and that’s known as intragovernmental holdings.

The debt clock shows how much the U.S. government owes its citizens, other countries, and itself. Most federal revenue comes from individual taxes. The government counts on you to pay the debt back one day. Corporations pass their tax costs through to you by raising prices. In other words, you, your children, and your grandchildren must pay 100% of the debt through higher taxes. The higher tax burden that the level of U.S. debt causes dampens expectations. It’s a big threat to the quality of life for future generations.

On Dec. 14, 2021, the debt ceiling was raised again. The increase of $2.5 trillion set the new limit around $31.4 trillion. This increase constituted the largest dollar amount increase of the national debt.

President Andrew Jackson Cuts Debt To Zero

The War of 1812 more than doubled the nations debt. It increased from $45.2 million to $119.2 million by September 1815. The Treasury Department issued bonds to pay a portion of the debt, but it was not until Andrew Jackson became president and determined to master the debt that this national curse, as he deemed it, was addressed.

The time of prosperity was short-lived, as state banks began printing money and offering easy credit, and land value dropped.

Also Check: Can You Look Up Bankruptcies Online

Medicare Part C Update From 2022 Medicare Trustees Report

| Budgeted Outlays in |

United States National Debt: What Affect Does Hiding $5 Trillion From The Books Have On The Us Debt Clock

The United States is one of the world’s most eager consumers of national debt. Due to the high volume of new US national debt being added on an irregular basis, this clock is regularly updated.

US Treasury & USA.gov website. US national debt statistics include Intragovernmental Holdings.

September 10, 2022

Disclosure:

In this guide to the United States National Debt, we discuss the amount of the countrys debt, whats included in it, who manages the debt, the countrys debt ceiling, how it raises loans, and who holds the US debt.

Also Check: How Do You File For Bankruptcy In South Carolina

How The Debt Compares To Gdp Plus Major Events That Impacted It

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

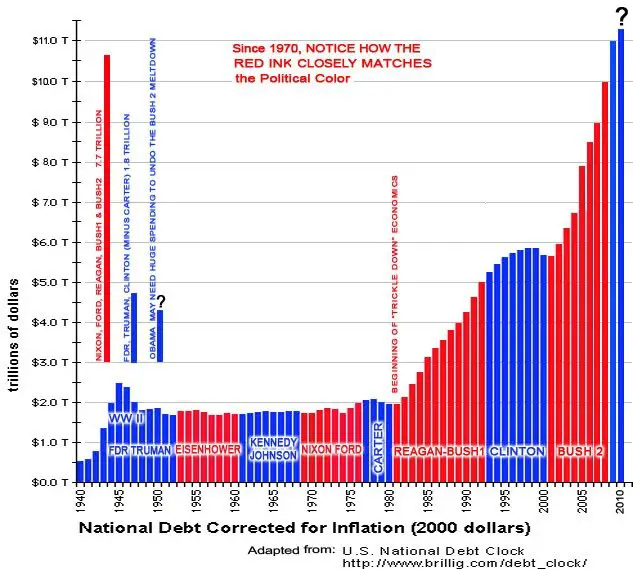

The U.S. national debt moved above $30 trillion on Jan. 31, 2022. It has grown over time due to recessions, defense spending, and other programs that added to the debt. The U.S. national debt is so high that it’s greater than the annual economic output of the entire country, which is measured as the gross domestic product .

Throughout the years, recessions have increased the debt because they have lowered tax revenue and Congress has had to spend more to stimulate the economy. Military spending has also been a big contributor, as has spending on benefits such as Medicare. In 2020 and 2021, spending to offset the effects of the COVID-19 pandemic also added to the debt.

When the debt gets so big that it hits the debt ceilingthe limit put in place by Congressinvestors may worry that the U.S. will default on the debt. In that case, the government will need to raise the debt ceiling or reduce the debt through higher taxes, spending cuts, and more.

How Is National Debt Rated

Rating agencies score governments on a range of metrics. Countries with higher ratings can offer lower interest rates on their bonds because they are considered to be safe investments.

When investigating a countrys economy, the national debt is one metric that rating agencies note.

They also look at the debt-to-GDP ratio, the national debt per head of population, the interest rates on government debt, and the average bank lending rate.

Also Check: What Questions To Ask A Bankruptcy Lawyer

What Other Factors Impact National Debt Rating

A countrys rating is also influenced by the:

- Rate of population growth

- Distribution of income in the country

- Levels of private debt

- Value of the housing stock

- Rate of homeownership

- Annual inward investment in a country

The above factors show whether the economy is likely to grow. A growing economy can bear the burden of tax that is needed to comfortably repay national debt.

Who Owns Most Of Us Debt

The largest percentage of US debt is held by foreign investors. International investors hold 29.5% of all US debt. However, these investors hold 40% of all debt held by the public, which amounts to about $6.7 billion. In terms of countries, the US Treasury department lists Japan and China as the largest foreign investors, holding 18% and 15%, respectively, of all foreign securities.

Recommended Reading: How Long It Takes To File Bankruptcy

How Are Debt Clocks Calculated

Well use the United Kingdom as an example:

1 We obtain the latest data regarding the countrys national debt and the 10-year average interest rate they pay on it, like:

National Debt: $1,717,879,000,000 10-Year Interest Rate: 2.50

2 Using these two figures we can then calculate how much the debt increases per year and subsequently per second.

Increase per Year: $42,946,975,000 Increase per Second: $1,362

3 We then work out the time difference between when the data was obtained and when the debt clock is being viewed by a visitor.

Time Difference = Time and Date of Visit Time and Date of Official Figure

4 The current debt is then calculated by adding the increase over this time to the official figure.

Current National Debt = Official Figure +

5 The debt clock then updates every two seconds, increasing according to the figures calculated in step 2.

Current National Debt = ) x Exchange Rate

Contents

How Much Would Each American Owe To Pay Off Its National Debt

The US Census Bureau estimates the American population is 324,356,000 at the end of 2019. The US national debt as of 2019 was approximately $22.7 trillion. Thus, every American, regardless of age, would have to pay nearly $70,000 to resolve the US national debt. If only adults are taken into account, then the per capita debt would be about $90,500.

You May Like: Financial Help Debt Relief

Social Security Trust Fund

Every president borrows from the Social Security Trust Fund. Over the years, the Fund has taken in more revenue than it needed through payroll taxes leveraged on the baby boomer generation.

Ideally, this money should have been invested to be available when members of that generation retire. Instead, the Fund was “loaned” to the government to finance increased spending. This interest-free loan helps keep Treasury bond interest rates low, allowing more debt financing. But, it must be repaid by increased taxes as more individuals retire.

The National Debt Is Big And Getting Bigger Does It Matter

WASHINGTON The United States national debt is nestled in a brick-laden underpass just a block away from Times Square. It ticks away, month after month, year after year, never getting smaller, never slowing down.

That national debt clock the brainchild of the real estate tycoon Seymour Durst, who installed it on West 43rdStreet in Manhattan in 1989 isnt actually the national debt. Its a representation of the national debt, a simple tally of how much money the federal government has borrowed from the public and has yet to pay back.

Durst said of the clock when it was installed that it was meant to strike anxiety if not fear into passersby. If it bothers people, he said, then its working.

When Durst died in 1995, the national debt totaled more than $4 trillion. In 2008, less than 20 years later, the debt clock ran out of digits, forcing the Durst Organization to add two more. The clock can now track our collective debt into the quadrillions.

The clock currently reads $28 trillion, give or take, and will grow rapidly in the coming years. The coronavirus pandemic has cost the U.S. economy $16 trillion, give or take, and Congress appropriated more than $3 trillion in aid in 2020.

Lawmakers have echoed Dursts distaste for the national debt for decades, with varying degrees of sincerity. And we are hearing them again, as Congress debates a nearly $2 trillion relief package to respond to the pandemic and its economic fallout.

Also Check: How To Stop A Garnishment Without Bankruptcy

Recovery From The Civil War

The Civil War alone is estimated to have cost $5.2 billion when it ended and government debt skyrocketed from $65 million to $2.6 billion. Post-Civil War inflation along with economic disturbance from Europes financial struggles contributed to the vulnerable economic climate of the late 19th century.

The collapse of Jay Cooke & Co., a major bank invested in railroading, caused the Panic of 1873. Nearly a quarter of the countrys railroads went bankrupt, more than 18,000 businesses closed, unemployment hit 14 percent and the New York Stock Exchange began sinking.

This period of deflation and low growth continued for 65 months making it the longest depression, according to the National Bureau of Economic Research. During this time the government collected less money in taxes and the national debt grew.

Why Is The National Debt So High

When the federal government spends more than it takes in, we have to borrow money to cover that annual deficit. And each years deficit adds to our growing national debt.

Historically, our largest deficits were caused by increased spending around national emergencies like major wars or the Great Depression.

Don’t Miss: Is It Bad To File Bankruptcy Twice

Revolutionary War Kicks Off Us Debt

Wars were always a major debt factor for our nation. Congress could not finance the Revolutionary war with large tax raises, as the memory of unjust taxation from the British stood fresh in the minds of the American public. Instead, the Continental Congress borrowed money from other nations.

The founders led negotiations with Benjamin Franklin securing loans of over $2 million from the French Government and President John Adams securing a loan from Dutch bankers. We also borrowed from domestic creditors. While the war was still going on, in 1781, Congress established the U.S. Department of Finance.

Two years later, as the war ended in 1783, the Department of Finance reported U.S. debt to the American Public for the first time. Congress took initiative to raise taxes then, as the total debt reached $43 million.

How Has The Covid

According to the Congressional Budget Office, debt held by the American public will rise to 98% of GDP due to the economic impact of the coronavirus pandemic and legislative actions taken as a result. The CBO says that the main driver of the increased debt is a federal budget shortfall of $3.3 trillion, the largest since 1945.

Read Also: What Are The Alternatives To Filing Bankruptcy

Can The United States Pay Off Its National Debt

The current US debt, at around $30 trillion, is unlikely to be paid off with any speed. In fact, as the worlds principal reserve currency, there are some ways in which the American national debt is good for other countries: Foreign investors can purchase US Treasury bonds to help fund their own countries.

The most likely way that the United States can pay off its debt is through budget surpluses, which boost a countrys GDP. However, the last time the US had a budget surplus was 2001.