Many Relied On Credit Cards During The Pandemic

Despite data from the Federal Reserve Bank of St. Louis showing an overall increase in credit card interest rates, the average annual amount of credit card interest paid by households carrying balances dropped slightly this year from $1,155 in 2020 to $1,029 in 2021 because of an overall reduction in household revolving credit card debt. But not every cardholder saw their debt decrease. According to NerdWallets survey, some Americans leaned on their credit cards to get through the pandemic.

One in 5 Americans report increasing their overall credit card debt during the pandemic. Additionally, 18% of Americans say they relied on credit cards to pay for necessities during the pandemic and 17% say the same thing about paying for emergencies.

Under normal circumstances, it goes against most financial advice to carry a credit card balance or rely on credit cards to cover emergencies. But the last two years have been anything but normal. One of the benefits of establishing good credit is being able to lean on it in tough times, and for many, credit cards may have been the thing that kept food on the table and the lights on. And thats completely OK.

If your financial situation has stabilized, a great 2022 goal would be to pay down debt and build up savings. If thats not a possibility for you yet, its OK to spend the year recovering and setting more modest goals.

Sara Rathner, NerdWallet’s Credit Cards Expert

Average Total Debt By Age And State

Several of the states with the highest levels of average total debt are also states with some of the highest costs of living in the country. According to the Missouri Economic Research and Information Centers Composite Cost of Living Index, Hawaii, Washington, D.C., and California rank as the No. 1, No. 2 and No. 4 most expensive places, respectively, in terms of overall cost of living. These three places are also the top three areas in which Gen X members carry the highest average total debt.

Heres a breakdown of the states where each generation has the highest average total debt:

- Gen Z Alaska, $22,756

|

$488 |

78.7 |

Following closely behind the Silent Generation with the least amount of auto loan debt are members of Gen Z, who carry an average of $19,471 in auto loan debt. Members ages 26 to 41 carry the second-highest amount of auto loan debt, followed by members age 58 to 76 .

Average Monthly Debt Payments By Age And Generation

Across all types of debt, Gen X members make the highest average monthly payments: $586. On the other end of the spectrum, Gen Z members make the lowest average monthly debt payments: $190. This makes sense, given that Gen X members have the highest average total debt, while Gen Z members have the lowest.

| Generation |

|---|

|

533.4 |

Recommended Reading: Are Court Judgements Dischargeable In Bankruptcy

In 8 Americans Have Missed A Credit Card Payment In 2022

As inflation drives up costs for goods, many Americans are struggling to keep up with credit card payments. About 1 in 8 credit card users missed a credit card payment in the first eight months of 2022.

Millennials are being hit disproportionately hard: They are 4x more likely than baby boomers to report missing a payment in 2022 .

Looking back further, 1 in 3 Americans have missed a credit card payment in the last five years. Of that group, 80% have missed more than one payment, and 26% have missed more than five since 2017.

At the extreme end of the spending spectrum, 3% of millennials say they have missed more than 20 payments since 2017, and an additional 3% say they “usually” miss their credit card payment.

Actions To Take If You Miss A Payment

It should come as no surprise that the best solution is to get your account current as soon as possible, which means paying the past-due amount. If thats not possible all at once, talk to your creditor and establish a payment plan over a few months.

If you miss a credit card payment, there are additional penalties to consider:

- Late Fees: If you missed a payment, you may see a late fee added to your .

- Penalty APR: Credit card issuers may adjust your account to a higher APR if you miss a payment. If your credit card company does increase your APR when youve missed a payment, it means that interest will accumulate on the revolving balance faster than before. Be sure to check your credit cards terms and conditions and make sure you understand the details.

Disruptive situations like natural disasters, sudden unemployment and unexpected medical bills can have a major impact on personal finances and overall financial wellness. But utilizing some basic best practices may help you manage the situation and get through a tough time.

You are leaving Discover.com

Don’t Miss: What Debts Are Not Covered By Bankruptcy

What Consumers Can Do

The pandemic isnt over, and neither is its financial impact on millions of Americans. If treading water financially right now is all thats possible for you, thats understandable. But if you have more breathing room, there are some steps you can take toward getting your finances back on track.

Adjust your budget. While the pandemic continues, the relief programs have mostly ended, with the automatic forbearance on federal student loans ending in a few months. If you havent yet revisited your budget to account for such changes, do it now. Figure out whether your income can reasonably cover your expenses going forward. If not, aim to make cuts to your expenses or seek out programs to help you balance your budget. This may mean switching your federal student loan payments to an income-based repayment plan or seeking COVID-related mortgage forbearance.

If youre getting out of the house more now than before, its tempting to spend on all the things you denied yourself over the past 18 months, Rathner says. Its OK to treat yourself, but create a spending plan first. Make space in your budget not just for savings, debt repayment and necessary expenses, but also for fun. That can help you stay on track without feeling like you have to deprive yourself.

American Credit Card Usage Statistics

How many credit cards are in American wallets?

US cardholders are using a small portion of their available credit

You May Like: Best Place To Buy Return Pallets

Averagecredit Carddebt In 2021

The average credit card debt is continuing to weigh Americans down

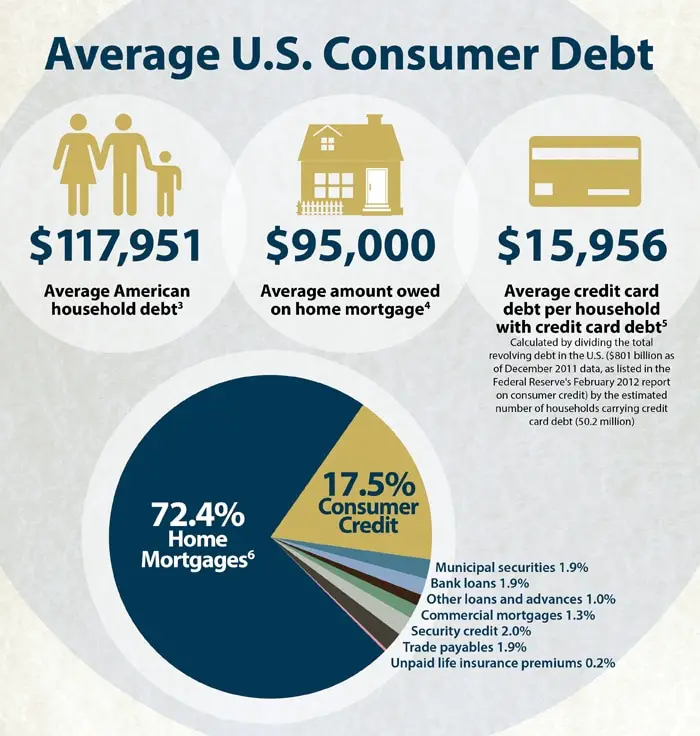

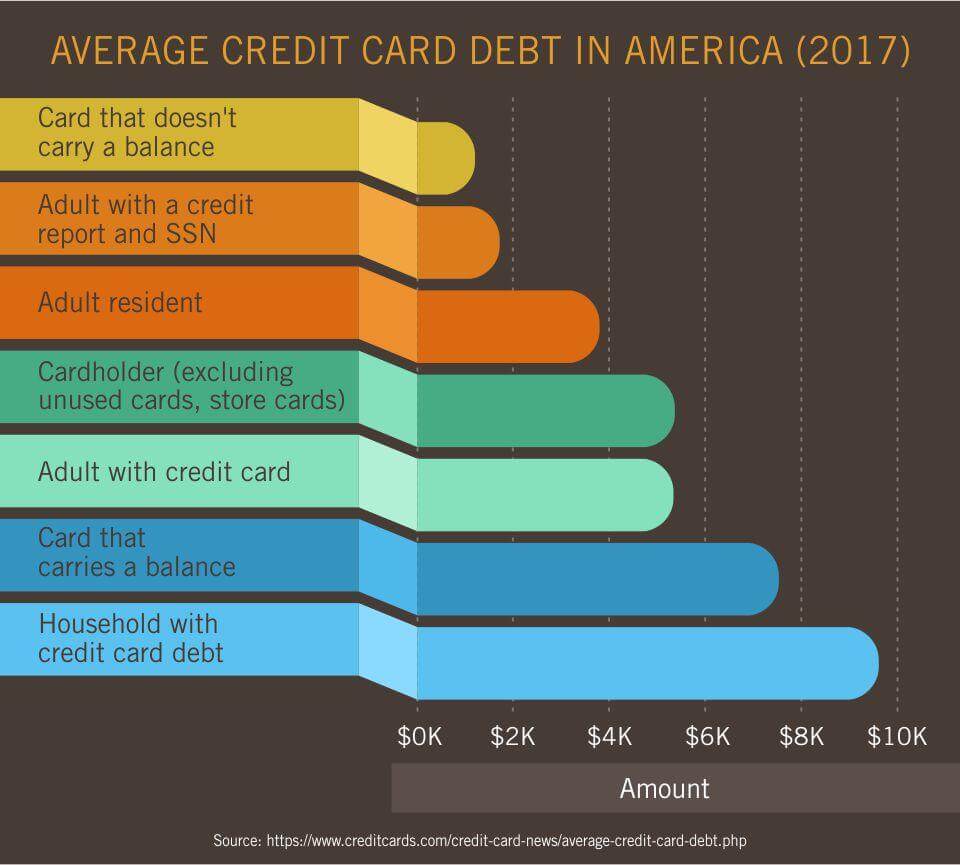

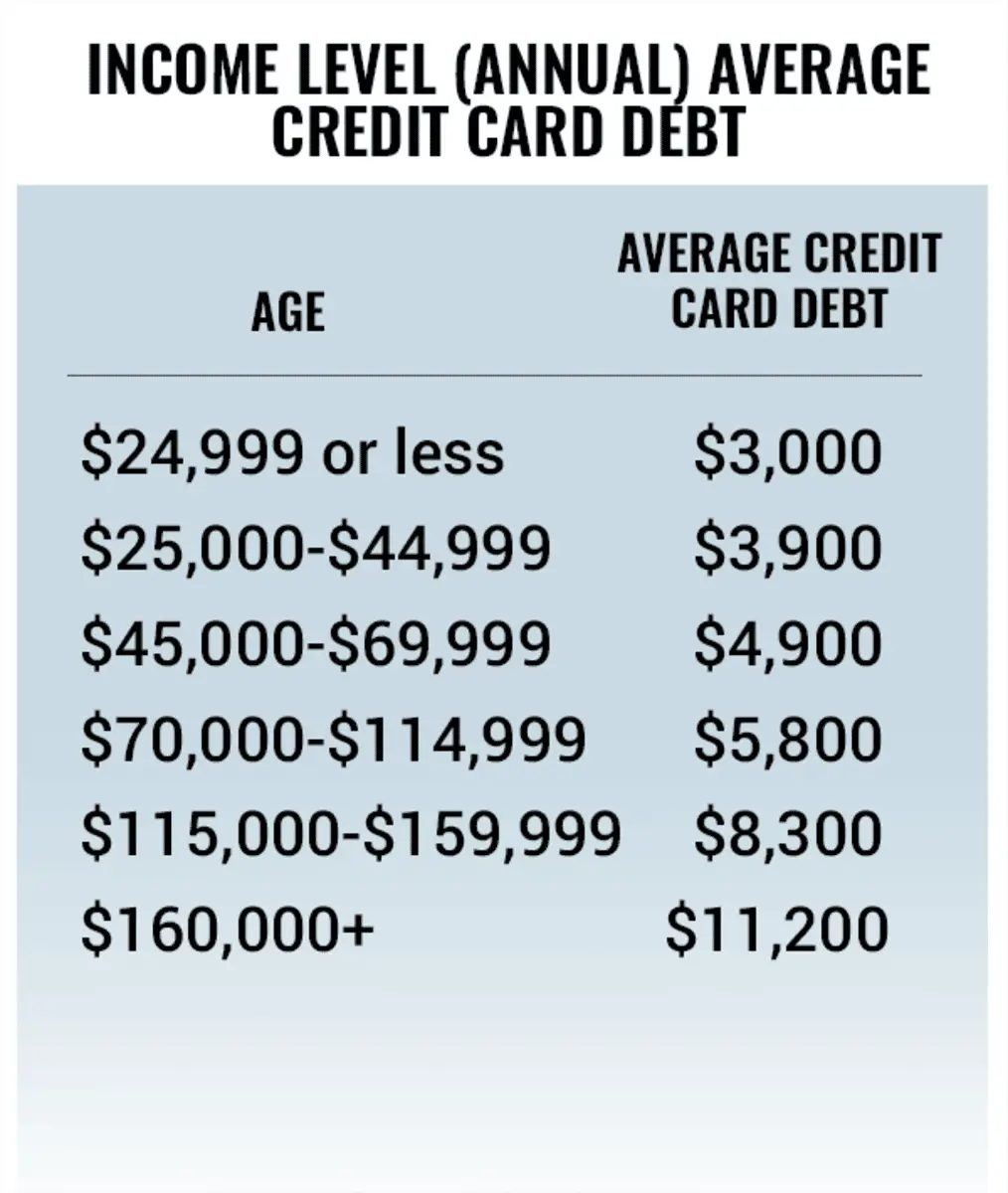

While greater spending may indicate that Americans are feeling more optimistic about their future and the economy, it is also a reason for concern because most employees aren’t experiencing the sort of pay growth that would sustain that increased spending. The surge has left the average credit card debt at $5,525 down from $5,315 in 2020 and $6,194 in 2019.

Estimates climb when looking at typical household credit card debt when there is the possibility of two or more incomes and numerous persons spending. According to latest statistics, the average household credit card debt in 2021 is $8,701.

Nearly Half Of Americans Depend On Credit Cards

Here are some other questions to ponder:

- What percentage of Americans are debt free? Only 23 percent of Americans were completely free of debt as of 2020. This isnt purely a credit card debt statistic, though, as it reports people who are free of all forms of debt.

- How much debt is too much? The amount of debt that is considered too much depends on your income. A rule of thumb used by mortgage companies is that debts shouldnt exceed 36 percent of your income.

Read Also: What Is The National Debt Of Usa

How Much Is Too Much Credit Card Debt

If you have less total credit card debt than the national average, thatâs great, but youâll be more financially resilient when you have no credit card debt. And if you have more credit card debt than the average, you may not be in as bad shape as you think.

Earlier, we touched on how families often have more financial commitments than individuals. Whether you have a family or not, you have to consider your whole financial situation to see if you have too much debt. Your debt-to-income ratio is an excellent indicator it is calculated by taking all your monthly payments on your credit report and dividing them by your gross monthly income.

But how do you know if your DTI is too high?

According to certified financial planner Marguerita Cheng, âHaving a DTI ratio of 50% and above is considered an unhealthy and unsustainable level of debt⦠You want to have some money left over at the end of the month, so you can continue to build your cash reserves and pay down debt.â

Other clear signs that you have too much credit card debt are:

- You can only afford the minimum payment.

- Your credit card debt is more than 30% of your credit card limit.

A less clear sign that you have too much total credit card debt is that you canât see a path out of debt. If that sounds like your situation, it may be time to develop a plan to reduce your debt.

How Much Credit Card Debt Does The Average American Have In 2022

In the first quarter of 2022, American consumer credit card debt hit a total of $840 billion. While the number has decreased marginally from 2021s peak at $860 billion, it still represents a historically high amount of consumer debt.

In September 2020, the Federal Reserve reported that the average credit card debt per household between 2016 and 2019 was about $6,300.

Below, well take a closer look at how credit card debt varies based on factors like age, income, and education.

Recommended Reading: How Long Until Bankruptcy Is Off Credit Report

Ways To Tell That You Have Too Much Credit Card Debt

There are three simple ratios you can use to assess if you have too much credit card debt:

How The National Average Credit Card Debt Has Changed Over Time

At the end of Q4 2021, the national average credit card balance had decreased 10.7% since the fourth quarter of 2017, and 14% since the most recent peak in Q4 2019.

The steepest drop occurred in the first half of 2020. At the onset of the COVID-19 pandemic, the Federal Reserve Bank lowered interest rates to nearly zero to stimulate the economy amid the global health crisis.

In Q4 2021, the annual rate of inflation began to inch up, and Americans were suddenly feeling the financial pressure. Whether shopping for new and used vehicles or home prices and even rental cars, U.S. consumers had to pay more for many products and services.

You May Like: What Does Pre Foreclosure Nod Mean

Like Consumers 53 Percent Of Businesses Also Use Credit Cards

We partnered with Bankcard in 2017 and they’ve been there for us every time. Everything is super fast and I love how well they communicate with our staff. They really know their stuff, and we work in a very complex industry! My account executive knows our business inside and out.

Alexandria, CMO

Average Credit Card Debt By State And Region

How much credit card debt the average American has is impacted by where they live.

In Q3 2020, an Experian analysis found that people living in Alaska had the highest average credit card balance at $6,617 per person. The states where people had the next highest debts were Connecticut , Virginia , New Jersey , Maryland , Texas , Georgia , District of Columbia , Florida and Hawaii .

The state with the lowest average credit card debt is Iowa with $4,289. The states with the next-lowest average credit card debts were Wisconsin , Kentucky , Idaho , Mississippi , South Dakota , Indiana , Vermont , Maine and Oregon .

Average Credit Card Debt by State

Scroll for more

Recommended Reading: How Long Can A Bankruptcy Stay On Your Credit Report

Average Auto Lease Debt By Age And Generation

Though you dont own the car once your auto lease ends, a car lease is still a form of debt obligation. Members age 77 to 94 carry the least amount of auto lease debt $8,065 on average. On the other end of the spectrum, members who carry the most are those ages 42 to 57, with an average auto lease debt of $11,852.

| Generation |

|---|

|

$146 |

1,076.70 |

Both baby boomer members and Silent Generation members carry more credit card debt on average than millennials. The average of next credit card payments largely align with the average levels of debt carried. But members age 26 to 41 make higher average credit card payments than members ages 77 to 94, despite having lower average credit card debt.

Talk To Your Credit Card Company

If youre struggling to pay off credit card debt, get in touch with your credit card issuer. Your card issuer may be willing to work out a manageable repayment plan with you if you think you cant make your payments. Some credit card companies also offer hardship programs that could reduce or delay your monthly payments for a period of time.

Recommended Reading: Are Student Loans Included In Bankruptcy

How Much Money Can A Balance Transfer Save

If the average American with a $6,194 balance on their credit card pays $200 each month toward their debt, it will take them 42 months more than three years to pay off that debt. And they will spend $2,012 in additional interest, assuming an average 16.97% APR.

If you complete a balance transfer with promotional 0% APR period, you could save hundreds on interest. Keep in mind that most balance transfer credit cards have a one-time 3% fee.

Here is additional information on some popular balance transfer cards:

Those Who Started Using Credit Cards Earlier Have Less Debt

Our survey data suggests using credit cards at a younger age may actually help card holders avoid debt later in life.

Americans who started using their cards at age 25 or younger are 13% more likely to not carry credit card debt compared to those who took out their first credit cards at a later age.

About 68% of Americans say they started using their own credit card at age 25 or younger. Americans started using their cards at age:

Don’t Miss: What Happens If You File Bankruptcy On Student Loans

How Credit Card Debt Accruesand Gets Paid Down

A credit card is considered revolving credit, and cardholders owe interest on any debt they incur on the card. Unlike installment loans, however, credit card issuers calculate interest based on the account’s average daily balance, not the original debt amount. This means your balance can grow over time as interest accrues on your balance and compounds.

Each credit card comes with an interest rate, also called an annual percentage rate , which varies based on several factors, including the applicant’s credit score and central bank interest rates. In 2021, credit cards had an average interest rate of 16.45%, according to Federal Reserve data. But with the Fed raising interest rates this year, credit card interest rates have risen as well.

Paying off your credit card balance at the end of every billing period is a good habit to get into. While interest compounds daily, the cardholder doesn’t pay any of that interest if the card’s full balance is paid off by the monthly due date.

Average Monthly Credit Card Payment

The average next credit card payment for Credit Karma members is $173. But the average payment is naturally higher for those with higher total credit card debt. For example, Gen X members average $7,923 in credit card debt and have an average next payment of $222. On the flip side, Gen Z members have an average of $2,589 in total card debt and an average next payment of only $78.

Recommended Reading: Why Did The Boy Scouts File For Bankruptcy