Is Buying A Pre

It’s obvious why pre-foreclosure homes are attractive to those looking to make a quick acquisition. Sellers are generally in a tough spot financially and don’t have a pulse for how much their house is worth on the open market. This makes itpossible for buyers to make a purchase at sub-market prices by dealing directly with the seller.

That said, it is important to exercise caution when looking to buy a pre-foreclosure home. Although you might save money on the price of the house, you will have to bear the cost for any maintenance and inspections that might need to be undertaken. Those costs have a way of adding up quickly.

Another thing to keep in mind is that a lot of pre-foreclosure homes come bearing various financial burdens. The owners of these properties often owe large sums of money in the form of loan repayments and taxes.When you acquire such a home, you’re also taking the responsibility to deal with these added expenditures.

For those reasons, it is best for first-time buyers to steer clear of pre-foreclosure properties. However, if you’re a seasoned buyer and looking to acquire an investment property, such a house can be a steal.

Who Preforeclosure Properties Are Right For

Preforeclosure homeowners frequently face financial difficulties, and some would prefer to sell the home rather than have a foreclosure appear on their credit report. Preforeclosure homes are commonly available at a reduced rate to market value for investors.

Preforeclosure property investments are right for the following investors:

- Fix-and-flippers: They use a hard money loan to buy preforeclosures that need extensive repairs, then flip the property for a profit to pay off the loan.

- Long-term investors: They purchase homes that are about to go into foreclosure, make the necessary repairs, stabilize the property, and then finish the renovations to make the property eligible for a long-term loan.

The Pros And Cons Of Buying Properties In Pre

Buying houses in pre-foreclosure might seem like a no-brainer for a real estate investor. Foreclosure is imminent and the homeowner is desperate to sell before they lose their home. Its true there are definitely some advantages to buying pre-foreclosed properties and a savvy investor knows how to take advantage of the situation. However, you should understand all the pros and cons before jumping into such an investment of your time and money.

So, what are the pros and cons of buying properties in pre-foreclosure?

Read Also: What Is The Purpose Of Bankruptcy Laws

Who Should Buy A Foreclosed Home

People who are willing to do significant research before making an offer, and who are willing to deal with lengthy delays and onerous paperwork, could find this a good strategy.

It very much helps to be able to pay significant cash on short notice for repairs, overdue taxes, and liens.

Eligibility for one of the federal financing programs such as a 203 loan, HomePath ReadyBuyer, or a HomeSteps mortgage, is a plus. These programs were created to help you buy a home.

Failing that, an all-cash offer, if possible, can give you a leg up.

How To Buy A Foreclosed Home

To find a foreclosed home, you can peruse listings of foreclosures on realtor.com®, which may also be marked as bank owned or REO. If you spot a home you like, contact the real estate agent on the listing as usual.

The biggest caveat when buying a foreclosed home is that it is typically sold as is, which means the bank is not going to fix any problems. And there may be plenty of them, considering that many foreclosures have been slowly crumbling into disrepair due to the previous owners financial strain. And unlike a traditional home sale, in which disclosure requirements force owners to reveal a homes every flaw, theres no such legal stipulation in a foreclosure. What you see is truly what you get.

Thats why foreclosed homes risk costing buyers a ton of money to renovate that could negate their supposed savings. This is why Eric Workman of the Chicago-based residential rehab lender Renovo Financial suggests that buyers take extra precautions such as the following before making an offer:

If you find out the home has problems, you will want to carefully weigh whether its worth all the extra work. In some cases it will be in others, it may be more prudent to walk.

You May Like: When Does Bankruptcy Come Off Credit

What Is A Short Sale

If a pre-foreclosure home is listed for sale, it will be considered a short sale, not a pre-foreclosure. Most pre-foreclosure homes are not for sale.

However, not every short sale is a pre-foreclosure. Some sellers can be current on their mortgage payments and still do a short sale. Sellers who are current on their payments would not fall into the pre-foreclosure category.

Save Time By Screening Preforeclosures Efficiently

With experience, youll learn the most efficient techniques for how to buy preforeclosure homes in California.

Until then, itll behoove you to get the right tools of the trade for vetting prospects. That means finding a solution for home valuation, getting a good set of on preforeclosure homes, and making sure that your access to financing is both quick and seamless.

Many new real estate investors find that becoming an independently owned and operated HomeVestors® franchisee is an elegant solution to address these issues. With HomeVestors, franchisees benefit from using powerful valuation software, not to mention the HomeVestors national marketing campaign for generating quality leads.

Plus, HomeVestors franchisees get preferential access to hard money financing, as well as mentorship from more experienced investors. Especially for preforeclosure investors in California, HomeVestors franchisees have what it takes to rise above the competition and maintain a sustainable business.

Still, wondering how to buy preforeclosure homes in California before the competition does? To learn more about our franchise program for investors, check out our franchise consideration page.

Also Check: What Debts Can Be Discharged In Bankruptcy

Should You Buy A Foreclosed Home

Postedby Gary Ashton RE/MAXon Wednesday, April 3rd, 2019 at 4:04pm.

Foreclosure filings spiked in the height of the housing crisis, and for many years, foreclosed homes were readily available. Today foreclosures are less common in many parts of the country, but they are still available for patient home buyers. If you’re thinking about purchasing a home in foreclosure, the following tips will help you understand the process and get the best value for your money.

For informational purposes only. Always consult with a licensed mortgage professional before proceeding.

The Bottom Line: Preforeclosure Can Be Stopped

Homeowners in preforeclosure have several options to get out of home debt, and often without a huge hit to their credit score.

If youre a homeowner in preforeclosure, you should speak with your mortgage servicer today. If youve already gone beyond preforeclosure, learn more about how to stop foreclosure in our Learning Center.

Recommended Reading: What Information Do You Need To File For Bankruptcies

Notice Of Trustees Sale

Following notice of default, lenders generally provide borrowers an additional 90 days to pay their loan balance. If they fail to do so, the lender files a notice of trustees sale . This notice must be published somewhere , and it lets potential buyers know that the property has been foreclosed upon and will be available at auction.

Trustees Sale: This is the technical name for a foreclosure auction. Banks conduct an analysis of the propertys pricing. They account for the outstanding loan balance, any liens, unpaid taxes, and the costs of the sale. Using this information, theyll determine an opening bid for the auction. Potential buyers then bid on the property. Once sold, the buyer owns the property and is allowed to immediately take possession.

Seek The Services Of A Real Estate Agent

While there are many real estate agents you can tap to assist you, you would want to work with someone knowledgeable on pre-foreclosed homes and the property repossession process to avoid costly mistakes.

However, if you are a seasoned investor with sufficient knowledge of this real investment strategy, the level of experience of the real estate agent you work alongside may not be relevant. They will still help, though, because they have better access to information beyond what you can find in the public records. For instance, the Multiple Listing Service , a local database of properties for sale, is only available to real estate professionals. Aside from access to real estate information, real estate agents can filter the MLS search so that they will only provide you with pre foreclosure listings.

When you choose this method, the real estate agent you picked will not only help you find the right property. They will also take care of setting appointments, negotiating offers, and other relevant work on your behalf.

However, this option presents two drawbacks. First, you are dependent on the real estate agentâs availability, and if you want quicker action, this dependence on the agent will be a hiccup in your endeavor. Second, the propertys price may significantly increase when the real estate agentâs commission is added to it.

Also Check: Are Tax Debts Discharged In Bankruptcy

Get An Inspection And Appraisal

Because the property may not have been well taken care of, its strongly recommended that you get a home inspection. A professional inspector will flag any problems with the homes structure or major appliance systems. If there are large issues thatd be expensive to fix, youll have to weigh the cost of repairs with the savings youre getting from purchasing a foreclosed home. A home appraisal will provide you and your future lender with a professional estimate of the homes value.

Californias Competitive Landscape For Preforeclosures

The availability of preforeclosure homes on the market is ample in California, but it varies widely by county, and some properties in especially hot regions may be intensely overvalued.

Los Angeles County and Orange County are over-represented in the state regarding preforeclosure listings, so either place might be a good place to start looking, assuming that youre ready to pay a premium for properties. In contrast, rural areas like Glenn County and Inyo County probably wont have much of a selection for you to work with, so its better to steer clear.

In terms of the intensity of competition, you should expect it to increase significantly in hot real estate markets, which tend to be in the major metro areas along the coast, and Silicon Valley. So, as tempting as the Los Angeles County market may be, it might be hard to get established there as an investor thats just learning, as competition is intense despite a large number of eligible properties on offer. Likewise, areas like San Bernardino County that have a mix of urbanized and rural regions, are less saturated than the coast. However, youll still face plenty of other investors.

At the moment, minor inland metro regions like Fresno County and Kern County are probably the best place for new investors to look for preforeclosures. These markets arent as crazy as the coastal markets, but theyre still packed with plenty of opportunities for buyers, and often at lower prices than elsewhere.

Also Check: What Happens To Your Assets When You File Bankruptcy

Know The Difference Between Preforeclosure And Short Sale

At first glance, there may seem to be parallels between a home in preforeclosure and a short sale property, but the two are very different.

The nature of a short sale is that the homeowner owes more than what the home is worth. We might also say that theyre underwater, explains Fuller.

If they were to sell the property, they would have no proceeds and would in fact owe the lender or the lienholder money at the time of closing.

To avoid this deficit, short sale homes involve negotiating with the mortgage company to sell the property for less than what is owed. The seller can then typically walk away from the closing table without owing anything further.

Meanwhile, homes in preforeclosure generally have enough value to cover the outstanding mortgage.

A preforeclosure doesnt mean that the seller doesnt have any equity it simply means they are heading toward a foreclosure, notes Fuller.

Close On The Investment Property

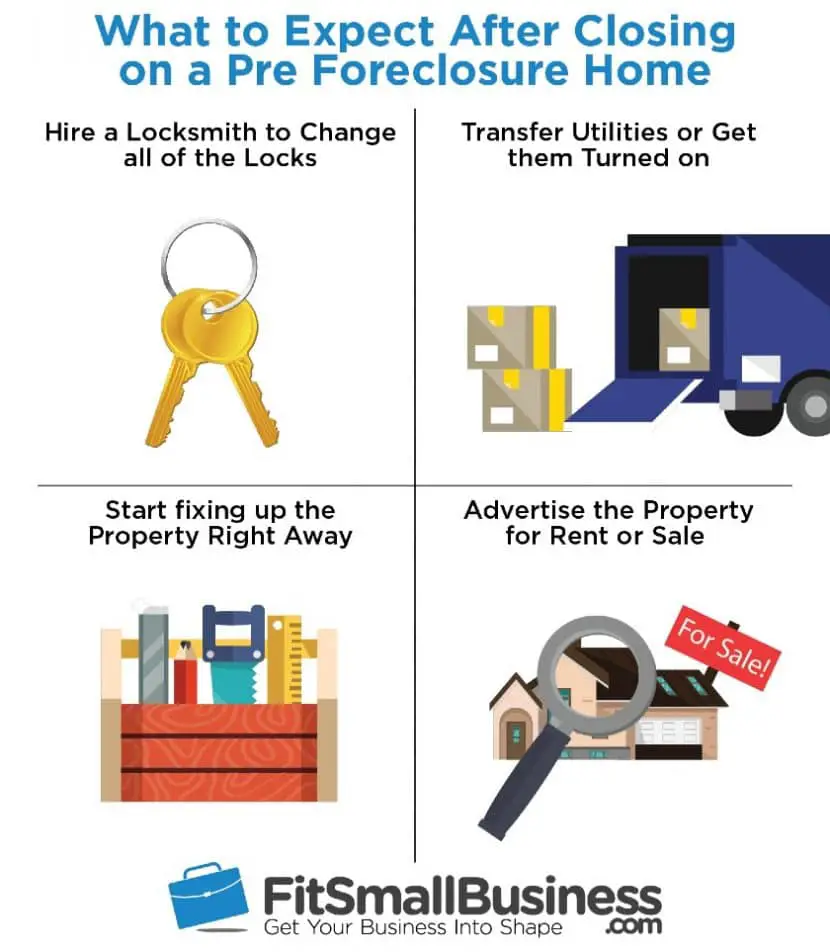

Closing is the last step in the process of how to buy a pre foreclosure. It is where the deed of ownership is transferred to the new ownerâs name. The transfer usually occurs at a title company and takes 1-2 hours. You will then be required to pay the closing costs, which include lender fees, title insurance, transfer taxes, and property taxes. The costs could add up to about 2%-5% of the purchase price. Once the closing step in buying a pre foreclosure is done, the income property is yours.

You May Like: When Should You Consider Filing Bankruptcy

How To Buy A House In Pre

In order to buy a pre-foreclosed home, you would be working with the buyer to resolve their existing debt.

To get the ball rolling, you’ll need to get in touch with the homeowner. Although door knocking is likely the most direct route, keep in mind that they may not have any desire to sell – and they may find your presence intrusive as well. Prepare to be empathetic to their situation.

What Is Pre Fore Closure

Still wondering, What does pre foreclosure mean? Pre foreclosure is the first step in the foreclosure process. Its designed to give homeowners options to stay in their pre foreclosure homes before a foreclosure. Pre foreclosure homes come when a homeowner fails to make mortgage payments, causing the lender to issue a notice of default. This is a legal notice that means the lender has begun the foreclosure process.

Pre foreclosure is an important phase because the lender may be open to negotiation on the borrowers delinquent debt. The borrower often has a last chance to possibly reverse the default status by either making up late payments, negotiating a modification, or opting to sell the property before it reaches a final foreclosure eviction.

Read Also: How Bad Does Bankruptcy Ruin Your Credit

How To Buy Foreclosed Homes In Florida

Florida is a popular state for investors because the taxes are low, and there is a consistent flow of residents and vacationers eager to rent properties. Buying a house in Florida is relatively straightforward, but what if you’re considering purchasing a foreclosed home? Buying a foreclosed home in Florida is a bit trickier and requires more knowledge, but it can be a great way to make a handsome profit. Here is everything you need to know about buying a foreclosed home in Florida to add to your investment portfolio.

Is Now A Good Time To Buy A Foreclosed Home

The moratorium on foreclosures due to the COVID-19 pandemic ended on July 31, 2021. Investors predicted a wave of foreclosures when the moratorium ended but so far there is no evidence that has occurred.

People looking to buy foreclosures in today’s market should expect to find a limited supply and competition on most deals.

Don’t Miss: How Long After Bankruptcy To Buy A House

Can You Finance A Pre

Yes, you can get a loan for a pre-foreclosure but if there is competition for the house it will likely go to the the cash buyer first.

Bloomquiest recommends getting prequalified for a loan before ever making an offer. Youll then know how much you can afford for the house and for any repairs.

Banks are always happy to give loans on properties even if they arent listed for sale, he explains.

Lee Nelson

MyMortgageInsider.com Contributor

Explore Real Estate Websites

When you type âpre foreclosure homes near meâ on the search bar, your search will lead you to several websites offering access to pre foreclosure listings.

But which of these websites should you pick and rely on? The most comprehensive among these websites is Mashvisor which offers several real estate investment tools. One of these tools is the Mashvisor Property Marketplace, which contains listings of various properties ranging from pre- foreclosure homes to tenant-occupied rentals. You will find in the next section how Mashvisorâs tools can help you with your investment project.

This approach is best for real estate investors hunting for pre- foreclosure listings. The listings will allow you to narrow down your choices, so you save on time, effort, and money scouting around for the best pre-foreclosed property.

Although most of the methods listed above cater more to experienced real estate investors, it doesnât mean first-time investors should not try them out. In fact, you can use one or a combination of these methods.

Related: 7 Real Estate Investor Websites to Use

You May Like: What Are The Requirements To File Chapter 7 Bankruptcy

Get A Preapproval Letter

Unless you can afford to pay cash, youll want a mortgage preapproval letter in hand when you make an offer on a foreclosure. It separates the lookers from the buyers, Soffee says.

Preapproval letters detail how much money you can borrow based on the lenders thorough assessment of your finances, including credit score and income. Its always good to be prepared, Sklar says. Having your proof of funds will make it an easier transaction.

Youll also want to consider what kind of loan to get preapproved for. Foreclosed properties often require repairs or upgrades, and an FHA 203 loan can help. These loans allow buyers to finance up to $35,000 for repairs.

Foreclosures often get scooped up by real estate investors who pay cash. But dont let that discourage you many lenders will help you find the right financing to buy a foreclosed home. Find a mortgage lender who understands your goals.

Look At Comps To Determine What To Offer

Finding the right price to offer is as much an art as it is a science. Your agent can run a comparative market analysis , which helps you understand recent sale prices of comparable properties, or comps.

Soffee says he runs a CMA from the last 180 days and evaluates several factors, including the pace of home sales, tax assessment history and a deeper analysis of similar properties nearby that have recently sold.

If youre up against cash offers, knowing this information can help ensure your offer is a competitive one. Your lender will require an appraisal to assess the homes value, so keep that in mind when making your offer, as well. If theres a shortfall between your offer and the homes appraised value, you might have to make up the difference in price if the bank doesnt budge.

Read Also: Chapter 7 Bankruptcy Examples