Are All Of The Debtor’s Debts Discharged Or Only Some

Not all debts are discharged. The debts discharged vary under each chapter of the Bankruptcy Code. Section 523 of the Code specifically excepts various categories of debts from the discharge granted to individual debtors. Therefore, the debtor must still repay those debts after bankruptcy. Congress has determined that these types of debts are not dischargeable for public policy reasons .

There are 19 categories of debt excepted from discharge under chapters 7, 11, and 12. A more limited list of exceptions applies to cases under chapter 13.

Generally speaking, the exceptions to discharge apply automatically if the language prescribed by section 523 applies. The most common types of nondischargeable debts are certain types of tax claims, debts not set forth by the debtor on the lists and schedules the debtor must file with the court, debts for spousal or child support or alimony, debts for willful and malicious injuries to person or property, debts to governmental units for fines and penalties, debts for most government funded or guaranteed educational loans or benefit overpayments, debts for personal injury caused by the debtor’s operation of a motor vehicle while intoxicated, debts owed to certain tax-advantaged retirement plans, and debts for certain condominium or cooperative housing fees.

How Do My Creditors Learn Of My Bankruptcy

The Licensed Insolvency Trustee in an individuals consumer bankruptcy mails a notice of bankruptcy to each of the individuals creditors. Creditors of a bankrupt individual record the bankruptcy when they receive this notice.

If you are applying for new credit while your bankruptcy remains on your credit bureau records, the companies considering granting credit to you may record the bankruptcy when they check your record at a credit bureau.

What Is Chapter 15 Bankruptcy

The Bankruptcy Code offers Chapter 15 bankruptcy to debtors with assets and business spread across multiple countries, including the US. Introduced by the Bankruptcy Abuse Prevention and Consumer Protection Act in 2005, Chapter 15 promotes cooperation between US courts and foreign courts for the fair treatment of debtors and creditors. This type of bankruptcy also protects the value of the debtor’s assets and properties and creates a better legal framework for solving cross-border insolvency. Chapter 15 also helps insolvent businesses to preserve employment and protect their investments.

In many cases, Chapter 15 bankruptcy serves as a secondary proceeding while the primary process is ongoing in the foreigner’s country. Upon receiving a Chapter 15 filing, the bankruptcy court will specify the foreign proceeding as a “foreign non-main proceeding” or a “foreign main proceeding.” The latter is used when most of the debtor’s main interests are in the U.S. Federal law also requires the relevant bankruptcy court to cooperate with the foreign court to the maximum extent possible.

Bankruptcy Glossary

Abandonment: This is a process by which the court releases properties of little or no value to the debtors estate.

Adversary Proceeding: Related to a bankruptcy case, an adversary proceeding often commences by filing a complaint with a bankruptcy court.

Assisted Person: Persons or entities with non-exempt assets less than $150,000 and debts consisting primarily of consumer debts.

You May Like: When Does Bankruptcy Fall Off Credit Report

Does The Debtor Have The Right To A Discharge Or Can Creditors Object To The Discharge

In chapter 7 cases, the debtor does not have an absolute right to a discharge. An objection to the debtor’s discharge may be filed by a creditor, by the trustee in the case, or by the U.S. trustee. Creditors receive a notice shortly after the case is filed that sets forth much important information, including the deadline for objecting to the discharge. To object to the debtor’s discharge, a creditor must file a complaint in the bankruptcy court before the deadline set out in the notice. Filing a complaint starts a lawsuit referred to in bankruptcy as an “adversary proceeding.”

The court may deny a chapter 7 discharge for any of the reasons described in section 727 of the Bankruptcy Code, including failure to provide requested tax documents failure to complete a course on personal financial management transfer or concealment of property with intent to hinder, delay, or defraud creditors destruction or concealment of books or records perjury and other fraudulent acts failure to account for the loss of assets violation of a court order or an earlier discharge in an earlier case commenced within certain time frames before the date the petition was filed. If the issue of the debtor’s right to a discharge goes to trial, the objecting party has the burden of proving all the facts essential to the objection.

Insolvent Debtor Records C1792

Insolvent debtors could be kept indefinitely in a debtors prison if their creditors so wished. Imprisonment for debt only ended in 1869.

From 1861 insolvent debtors could apply for bankruptcy even if they were not traders.

The series B 6 contains registers to documents filed in insolvency proceedings. They often give brief details of bankrupts, creditors, insolvent debtors, the sums involved and the nature of associated deeds. Sometimes the outcome of an action or result of a petition is indicated. They may also provide a link to court cases and debtors prison records.

Indexes to the registers and other documents are in B 8.

Don’t Miss: Is Bankruptcy A Good Option For Me

How Do I Find Out If My Bankruptcy Case Is Closed

If the filer does not have an attorney, filers will receive a notice from the court on the bankruptcy case closing order via mail. Otherwise, the court will send the mail to the attorney, and interested parties may obtain the information from the attorney, court clerk, or online. Record seekers should note that getting a discharge does not mean that the case is closed. Bankruptcy cases may take some time to close after discharge, depending on the debtors property situation, trustees ongoing actions, and other complications that may hinder the court from closing the case. Usually, no-asset Chapter 7 cases close quickly. However, bankruptcy may take longer if

- The trustee is still selling assets or distributing assets

- Debtor fails to comply with court procedures

- Revoked discharge due to fraud, failure to disclose all assets, misstatements, or failure to comply with a court order

- There is outstanding litigation.

Note: A court may reopen a bankruptcy case if the court discovers an unlisted asset, creditor violates a discharge, or the debtor forgot to list a debt.

The Difference Between Bankrupts And Insolvent Debtors

Insolvent debtors and bankrupts are different. To qualify for bankruptcy you were supposed to be a trader, making your living by buying and selling. By the late 18th century this was extended to include most skilled craftsmen. People sometimes gave false or misleadingly general descriptions of their occupations so they could qualify as a trader. The term dealer or chapman was often used. Farmers were specifically excluded but still sometimes appear in records. Partnerships of individuals could declare themselves bankrupt, but companies were not covered until after 1844.

Bankruptcy was later extended to include most skilled craftsmen.

Insolvent debtors were individuals unable to pay their debts. Only after 1861 could insolvent debtors apply for bankruptcy.

Recommended Reading: Can You File Bankruptcy On A Wage Garnishment

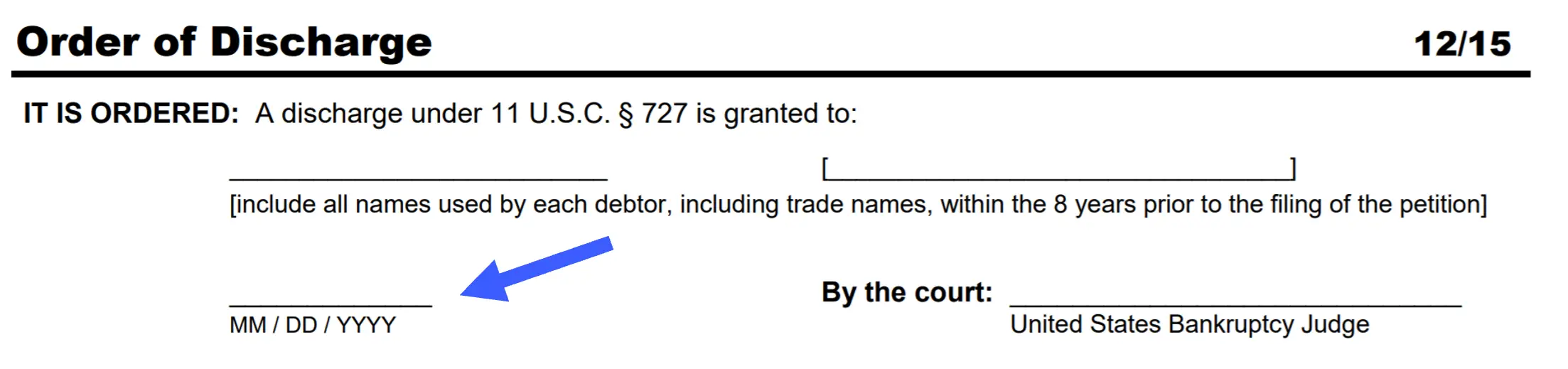

How Can The Debtor Obtain Another Copy Of The Discharge Order

If the debtor loses or misplaces the discharge order, another copy can be obtained by contacting the clerk of the bankruptcy court that entered the order. The clerk will charge a fee for searching the court records and there will be additional fees for making and certifying copies. If the case has been closed and archived there will also be a retrieval fee, and obtaining the copy will take longer.

The discharge order may be available electronically. The PACER system provides the public with electronic access to selected case information through a personal computer located in many clerk’s offices. The debtor can also access PACER. Users must set up an account to acquire access to PACER, and must pay a per-page fee to download and copy documents filed electronically.

What Is Bankruptcy Protection In California

Bankruptcy protection is a court action that protects debtors by placing an “automatic stay” on the collection of all debt. It provides an individual or company in California with more time to reorganize or restructure debt payments. The court order freezes the actions of most creditors and collectors, including evictions, vehicle repossessions, collector calls, letters, wage garnishments, legal proceedings, and some tax actions. The bankruptcy court mails the order to all creditors or any party seeking payment, informing them of the decision. Depending on the case, bankruptcy protection may last anywhere from 90 days to 63 months. Creditors who violate the courts automatic stay order risk facing severe penalties such as:

- Paying court costs and attorney fees

- Sanctions and fines from the court

- Paying punitive damages

You May Like: Does Bankruptcy Clear Tax Debt In Canada

How Discharge Affects Your Belongings

Discharge from bankruptcy doesn’t mean you’ll get back any belongings, even if they haven’t been sold yet. It might take some time for the official receiver to deal with them.

If you come by any new assets after you’ve been discharged, these will usually remain yours and can’t be claimed by the trustee. An important exception to this rule is any payments you receive by claiming for payment protection insurance which was mis-sold before you become bankrupt.

Declarations Of Insolvency And Inability To Pay

Consult B 6/74-8, B 6/176-177 and B 6/220-222 for registers of declarations of insolvency and inability to pay. From 1825-1854 these registers cover London and county cases. After 1854 they cover London only. They usually show:

- the date the declaration was filed

- name, address and occupation of the debtor

- debtors solicitors name

You May Like: How Long Does Personal Bankruptcy Last

Records / Case Information

Case Information by PhoneCase information is available through the Court’s automated Voice Case Information System at 222-8029 . This system is available 24 hours a day, 7 days a week. A case number, complete name, or a Social Security Number / ITIN is required to obtain case information.

The information available from the automated system is:

- Case number

- Name of debtor, or principal party

- Date the case was filed, whether a voluntary or involuntary petition was filed, and the chapter under which the petition was filed

- Name and phone number of the debtors attorney

- Trustee’s name

- Name of the assigned judge

- Discharge and closing dates

- Whether there are assets in the case

- Case status

- Case disposition

Case Information OnlinePublic Access to Court Electronic Records is a Web-based system that allows users with an Internet connection and a PACER account to view or print case documents online. A fee is charged for each viewed page. To sign up for a PACER account, register at .

Case Information in PersonMost bankruptcy records can be viewed at no charge using the public access terminals at the U.S. Bankruptcy Court – Southern District of California Clerk’s Office.

Paper Copies of Bankruptcy DocumentsPaper copies of bankruptcy documents can be obtained in person, by mail, or by using Public Access to Court Electronic Records . To sign up for a PACER account, register at .

What Can The Debtor Do If A Creditor Attempts To Collect A Discharged Debt After The Case Is Concluded

If a creditor attempts collection efforts on a discharged debt, the debtor can file a motion with the court, reporting the action and asking that the case be reopened to address the matter. The bankruptcy court will often do so to ensure that the discharge is not violated. The discharge constitutes a permanent statutory injunction prohibiting creditors from taking any action, including the filing of a lawsuit, designed to collect a discharged debt. A creditor can be sanctioned by the court for violating the discharge injunction. The normal sanction for violating the discharge injunction is civil contempt, which is often punishable by a fine.

Recommended Reading: How To File Bankruptcy In Michigan

How Discharge Affects Your Home

The official receiver has 3 years to take action in relation to your home, this means it wont be affected by your discharge. Your share in your home will become yours again if they haven’t done any of the following within 3 years from the date your bankruptcy order was made:

- sold your share to someone – like your partner, friend or family member

- applied to the court for an order that you and anyone else living in your home have to leave

- applied to the court for a charging order

- come to an agreement youll pay them the value of your share

Find out more information about how bankruptcy will affect your home.

How To Find Bankruptcy Records

Filing for bankruptcy is not an easy decision for anyone. Anyone that has ever filed for bankruptcy or knows someone who has experienced bankruptcy, understands how stressful the process can be. However, the bankruptcy process is also a method of relief and financial freedom for many hardworking people who have experiencing financial hardship.In many cases, the same factors that cause debt burdens significant enough to need bankruptcy relief in the first place, are the same factors that typically require detailed financial records years later. For example, tax, business or legal matters may require the information included in your bankruptcy petition and/or discharge. For this reason, a record of bankruptcy filing is an important source of information. To make matters worse, finding these old records or level of financial details again can be nearly impossible. Until now.If you are looking for bankruptcy records, BKDATA can provide them. Use this guide to learn more about finding bankruptcy records as quickly as possible.Searching For Bankruptcy Records

Also Check: How Long After Bankruptcy Can You Apply For Credit

Why Should I Find Out If Someone Filed Bankruptcy

Discharging debts in bankruptcy means that a debtor is no longer required to pay those debts. Debs are either discharged and assets sold to pay the creditors, or the court creates a repayment plan for the debtor to repay debts in a way that is more manageable based on their current income and finances.

The court enters an order that prohibits creditors to attempt to collect the discharged debts via legal action, telephone calls, letters, or other forms of contact.

There are a variety of reasons why someone might file for bankruptcy. Some of the more common reasons include:

- Unemployment

- Overextended personal lines of consumer credit

Filing for bankruptcy is generally not a decision people take lightly, but the fact that someone has taken that route to get out of debt might be of interest to other individuals who have an interest in their financial history and current financial health.

Bankruptcy cases are exclusively the jurisdiction of federal bankruptcy courts. Bankruptcy records are public information and can be helpful for making financial decisions. There are several reasons why you might want to find out if someone filed for bankruptcy. Some of the more common reasons are:

- Researching the financial history of a potential business partner

- You need to determine whether it is a smart decision to loan money to someone or

- You are interested in the financial history of a business.

How Does The Debtor Get A Discharge

Unless there is litigation involving objections to the discharge, the debtor will usually automatically receive a discharge. The Federal Rules of Bankruptcy Procedure provide for the clerk of the bankruptcy court to mail a copy of the order of discharge to all creditors, the U.S. trustee, the trustee in the case, and the trustee’s attorney, if any. The debtor and the debtor’s attorney also receive copies of the discharge order. The notice, which is simply a copy of the final order of discharge, is not specific as to those debts determined by the court to be non-dischargeable, i.e., not covered by the discharge. The notice informs creditors generally that the debts owed to them have been discharged and that they should not attempt any further collection. They are cautioned in the notice that continuing collection efforts could subject them to punishment for contempt. Any inadvertent failure on the part of the clerk to send the debtor or any creditor a copy of the discharge order promptly within the time required by the rules does not affect the validity of the order granting the discharge.

Also Check: Is It Hard To Rent An Apartment After Bankruptcy

What Information Do I Need To Find Out If Someone Filed For Bankruptcy

Very little information is required to start researching whether someone has filed for bankruptcy. Bankruptcy petitions are filed in bankruptcy courts, which are federal courts. Therefore, you need to locate the federal district court where the person you are interested in resides. Then you can call the court and obtain the case number using the personâs full name, social security number, or, if you are looking into a business, the tax ID number.

With the case number you can use the PACER system to access additional information online. You can also go to the courthouse in person and access the bankruptcy record there.

What If You Live Overseas

If you are living overseas you can still become bankrupt. Creditors that are not based in NZ will be sent a report if they are listed in your bankruptcy, but they can continue to chase you for any money you owe them.

Your assets in New Zealand become the property of the Official Assignee. If you have assets outside of NZ, the Official Assignee may have your NZ bankruptcy recognised in the overseas country and may deal with those assets also.

You can return to NZ during your bankruptcy, but if you want to leave again you will need to apply for permission.

The public register can be searched from overseas. Several credit reporting companies operate in more than one country so your credit rating outside of NZ may be affected.

Recommended Reading: When Does Chapter 13 Bankruptcy Get Discharged