What Are Conventional Loans

Conventional loans are those originated by banks, credit unions and online lending sources.

They are not guaranteed by the government, but they typically have the best interest rates and terms, which means lower monthly payments. The most common type of conventional mortgage is 30-year fixed-rate, which accounted for 79% of mortgages between 2019 and 2021, according to ICE Mortgage Technology.

Conventional loans require a credit score of 620 or higher. The higher the score, the better the terms. One of the biggest advantages is that a down payment of 20% means you dont have to pay private mortgage insurance, which can add thousands to a mortgage.

Even if you dont put down 20% at the closing, once the equity in the house reaches 20%, the PMI is dropped. With an FHA loan, it never drops, and you have to pay a one-time up-front premium of 1.75% of the base amount of the loan.

The waiting period for a conventional loan after bankruptcy is:

- Chapter 7 Four years after discharge date

- Chapter 13 Two years. If the case is dismissed, which happens when the person filing for bankruptcy doesnt follow the plan, its four years.

Meet Other Lending Requirements

- requesting pay stubs, W-2 forms and income tax returns

- pulling your credit reports to check debt balances

- contacting your employer

- going through your recent bank statements

While lenders wonât require that you earn a certain dollar amount, they want to be reasonably sure you can make mortgage payments every month. Have your documents ready to make yourself an attractive borrower and aim to put down as much as youâre comfortable with. If you seem like a good candidate, your lender will approve you for a mortgage loan.

Is A Conventional Loan Right For You

A conventional loan can come from three organizations called:

- Ginnie Mae: Government-owned loans such as FHA loans, VA loans, and USDA loans

- Fannie Mae or Freddie Mac: Private loans or government-insured loans

You cannot get a lender to approve Fannie Mae or Freddie Mac loans if:

- You filed Chapter 7 bankruptcy in the last four years

- You filed Chapter 13 bankruptcy and got a discharge within the last two years

- Your Chapter 13 bankruptcy was dismissed less than four years ago

Sometimes, the waiting period can be shortened for major life changes, called extenuating circumstances. Things like a divorce, losing your job, or illness or accidents that result in large medical debt are beyond your control. They can reduce your waiting period after these circumstances.

Some banks or private loan officers can choose to underwrite a loan with less strict rules and waiting times, or more strict rules. That always depends on the bank’s practices.

You May Like: What Is Epiq Bankruptcy Solutions Llc

Do You Qualify For A Mortgage

Having a Chapter 13 bankruptcy in your credit history shouldntstop you from getting a mortgage.

You might even be able to buy a home duringChapter 13 if youre in good standing with your repayment plan and you qualifyfor the mortgage.

If youve been working hard to pay down debts andimprove your financial situation during Chapter 13, you might be able to get ahome loan a lot sooner than you think.

Popular Articles

Step by Step Guide

Can I Purchase A House While In A Chapter 13 Bankruptcy

While in a Chapter 13 bankruptcy, you must get permission from the bankruptcy Trustee to incur any new debt. This includes a mortgage if you want to purchase a new house. When you are serious about buying a new home within a Chapter 13 bankruptcy, you should let your bankruptcy lawyer know. They will get in contact with the Trustee for you and let him or her know that you would like permission to incur debt. They will file a motion with the court for this. Once the trustee makes a decision, the attorney will let you know.

Obtaining a new mortgage while in the middle of a Chapter 13 bankruptcy may be difficult, depending upon your situation. The longer that you are in a Chapter 13 bankruptcy and making your monthly payments on time, the more likely a lender will be willing to give you a better interest rate in a mortgage. Be prepared to shop around a bit. There may be some lenders who will not give a new loan to someone who has recently filed a Chapter 13 bankruptcy. Be patient, we find a lot of our clients will get pretty decent mortgage rates about a year and a half to two years after filing bankruptcy.

If you are interested in getting a new house while in a Chapter 13 bankruptcy you need to contact your bankruptcy lawyer. They will help guide you through the process and will be able to let you know whether they think the bankruptcy judge will approve your Motion to Incur Debt so you can get the financing necessary to purchase the home.

Don’t Miss: Has Mark Cuban Ever Filed For Bankruptcy

Can I Buy A House While In Chapter 13 Bankruptcy In Athens Ga

Bankruptcy, Chapter 13 | January 18, 2021 | Lee Paulk Morgan

Right now, this question is more pressing than ever. As of December 30, 2020, mortgage rates were at all-time lows. These low rates will probably not last. If the coronavirus pandemic fades in 2021 and more people buy houses, rates will go up. If the coronavirus pandemic extends into 2021 and Congress passes more stimulus measures, the resulting pressure on Treasury notes will drive up mortgage rates. This all complicates the question, Can I buy a house while in Chapter 13 bankruptcy?

This question is really two questions. First, there is the legal possibility of buying a house in Chapter 13 bankruptcy. Second, there are obvious practical considerations. A Georgia bankruptcy lawyer address both these sub-questions. An attorney advocates for you in what is usually a tough fight with creditors. Furthermore, a Georgia bankruptcy lawyer typically has professional associations with bankers.

How Long After Bankruptcy Can You Buy A House

The waiting period to buy a house depends on whether you filed Chapter 7 or Chapter 13 bankruptcy, and the type of loan you seek. Waiting periods after Chapter 7 is discharged vary from two to four years. After Chapter 13 is discharged, some federal loans are available immediately, though a conventional loan requires a two-year waiting period.

The first step in qualifying for a home loan after bankruptcy is to have the bankruptcy judge discharge your case. Then comes the patience test, and the timeframe is determined by the type of bankruptcy you have and the type of loan you desire.

You May Like: What Is A Bankruptcy Petition Preparer

Chapter 7 Waiting Periods

A Chapter 7 declaration must have been discharged or dismissed for 2 years prior to application, if a borrower has either reestablished good credit or not incurred new debt. Its possible an FHA loan will be approved after only 1 year since discharge. That occurs if the borrower shows the bankruptcy was caused by extenuating circumstances, is unlikely to reoccur and they have exhibited an ability to manage their finances since the bankruptcy occurred.

You May Need A Credit Score Of 500 Or Higher To Buy A House

The waiting period and loan approval are essential factors, but some loan officers will not consider you until you rebuild your credit score. Credit scores typically range from 300 to 850.

For each type of loan, you need a credit score of the following:

- FHA loan: 500+

- VA loan: no minimum credit score

- USDA loan: 640+

- Fannie Mae or Freddie Mac: 620-640 is the lowest they will accept

If your bankruptcy was years ago, but no one will loan to you, you may have options. There could be misinformation on your record or an outdated credit score.

Talk to a bankruptcy attorney about the issues you face in the home buying process to learn about your options. A new home is attainable within one to two years after bankruptcy if you take the right steps and seek legal guidance during the bankruptcy journey.

Thank you for subscribing!

You May Like: How Many Trump Bankruptcies

How Soon Can I Buy A House After Bankruptcy

Depending on the type of mortgage you qualify for, your lender, the type of bankruptcy you declared and the cause of your bankruptcy, you may have to wait one to four years after filing bankruptcy. You will also have to wait until your credit score has recovered enough for you to qualify for a mortgage.

First, lets talk about the two most common types of consumer bankruptcy: chapter 7 and chapter 13. Well also show you how long you have to wait before you might qualify for certain common mortgage types.

What Types Of Mortgage Loans Can You Get After Bankruptcy

Technically, you can qualify for any kind of mortgage. As we have shown, some have waiting periods, and some of those waiting periods are longer than others. If you meet that waiting period and believe you qualify, you can apply for any loan.

That being said, FHA Loans may be the most advantageous option. The waiting period is shorter after Chapter 7. After Chapter 13. there is no waiting period after the court discharges or dismisses you.

FHA loans also have lower credit requirements than conventional loans. That matters because Chapter 7 bankruptcy will show on your credit report for 10 years, Chapter 13 for seven. FHA loans can be approved with a credit score as low as 580. A down payment of at least 10% may mean you can qualify with a credit score as low as 500.

To qualify for a conventional loan, your credit must be re-established, which means making timely payments on your court-ordered plan in Chapter 13, and paying bills on time after Chapter 7. Typically a conventional loan will require a minimum credit score of 620.

VA loans are provided to veterans and typically are more lenient when it comes to credit history. A USDA loan is for homes in qualifying rural areas. To qualify, the borrowers income cannot exceed 115% of the median income in the area where the home is being purchased. Generally, USDA loans require a credit score of 640, so boosting that score is important.

Also Check: Trump Declared Bankruptcy

Home Equity In Chapter 13 Bankruptcy

Chapter 13 bankruptcy works differently. You won’t be forced to give up any property. Instead, you’ll pay for the nonexempt portion of the equity in your plan. Of course, if you have significant nonexempt equity, this could get expensive. You’ll have to demonstrate that you have enough income to pay all amounts required in your plan.

Example. You have $50,000 in equity in your house, but the maximum amount you can exempt is $30,000. You’ll have to structure your Chapter 13 payment plan so that your unsecured creditors will receive at least $20,000 over the life of the plan. That amount is in addition to any other debts your plan payment must cover, like mortgage arrearages and car payments.

Find out more about what happens to your home and mortgage in Chapter 13 bankruptcy.

But being able to protect or pay for your home equity isn’t enough. You’ll have other requirements you must meet, as well.

When Can I Buy A House After Bankruptcy

A bankruptcy can affect many aspects of your life, not just in the present, but for many years into the future as well. Unfortunately, that includes how soon you can qualify for a home loan. For those whove filed for bankruptcy, and anyone considering such a move, this guide lays out the facts that apply in various scenarios. Depending on the type of bankruptcy, you may find buying a house after bankruptcy is only two to four years away.

You May Like: How To File Bankruptcy In Wisconsin

Getting A Mortgage After Bankruptcy

Bankruptcy doesnt have to put an end to your dream of owning a home it could happen as early as a year after bankruptcy discharge.

The key is to take positive steps with your credit and get back your financial footing. There are a lot of balls to juggle when getting a mortgage after bankruptcy. Besides the variety of mortgages available, all with their own rules, there are also different types of bankruptcy. Both factor in to how long you have to wait before you can apply for a mortgage after bankruptcy is discharged.

Another factor is you what led to your bankruptcy, how you have handled your finances since and how you plan to handle them going forward.

Whatever the length of the waiting period, use that time to do the work that will help you qualify.

A mortgage after bankruptcy can mean higher interest rates and a more expensive mortgage. Improving your credit score after bankruptcy will help counter that.

When You Want To Sell

Should you want to dispose of a house, you need to file a Motion to Sell Real Property with the bankruptcy court. All particulars, including the selling price and the names of creditors with liens on the property, must appear in the formal motion. You’ll also need to give the court detailed information about what you want to do with the proceeds of the sale.

You May Like: Toygaroo Worst Deal

Do You Have A Question For Our Staff

Everybody I have encountered and meet with at Lee Law Firm has been positive and encouraging. And that is exactly what I needed because nobody looks forward to going through bankruptcy. The staff was honest about my situation and put my mind at ease about the process, and for the first time in months I was able to relax and focus

on getting out of my financial situation with hope of starting over. I would recommend Lee Law firm of friends and family because I feel like they have my best interest at heart.

Kimberly and I had our 341 meeting today and it literally lasted perhaps 1.5 to 2 minutes and we were asked only 5 or so questions. We didnt even have time to sign in before the Trustee said, meeting completed and had to sign in over at the side of the room so he could continue with others. I am personally taking this to mean all our ducks were in a

row and you are all part of that. I know its just your job but there are those who do just their job and those who do their job very well and you all are included in the later. So a big thank you to the entire Christopher Lee law firm and especially to Jon, Heena, Erin and Rachel. I know we arent completely finished yet but this milestone seemed to us as one of the biggest after making our initial decision.

Thank you very much.

My appointment today was very good and informative. I really do appreciate the time and effort put to helping me get back onto a new financial path.

Tips To Improve Your Chances Of Getting A Mortgage After Bankruptcy

Several common-sense tips apply, starting with addressing your finances to improve your credit score before you file for bankruptcy. Getting the financial house in as much order as possible before filing means you will start a challenging process with the highest credit score possible.

Other steps follow discharge and involve rebuilding credit after bankruptcy they fall under the umbrella heading: Get and keep your financial house in order:

Read Also: How Many Times Have Donald Trump Filed Bankruptcy

Overview Of Home Loans For Bankruptcy Filers

United States Department of Agriculture loans, Federal Housing Administration loans, and Veterans Administration loans do not have a long waiting period after you file for bankruptcy. The clock starts on the day you get the bankruptcy discharge for either Chapter. Generally, you must wait:

- Two years after filing for Chapter 7 bankruptcy for FHA loans and VA loans

- Three years after filing for Chapter 7 bankruptcy for USDA loans

- One year after Chapter 13 for FHA loans, VA loans, and USDA loans

The Department of Veterans Affairs guarantees every VA loan, so a VA mortgage can work well for veterans after bankruptcy.

A USDA loan comes from the United States Department of Agriculture. Their rural development program guarantees these loans for lower-income residents of rural areas.

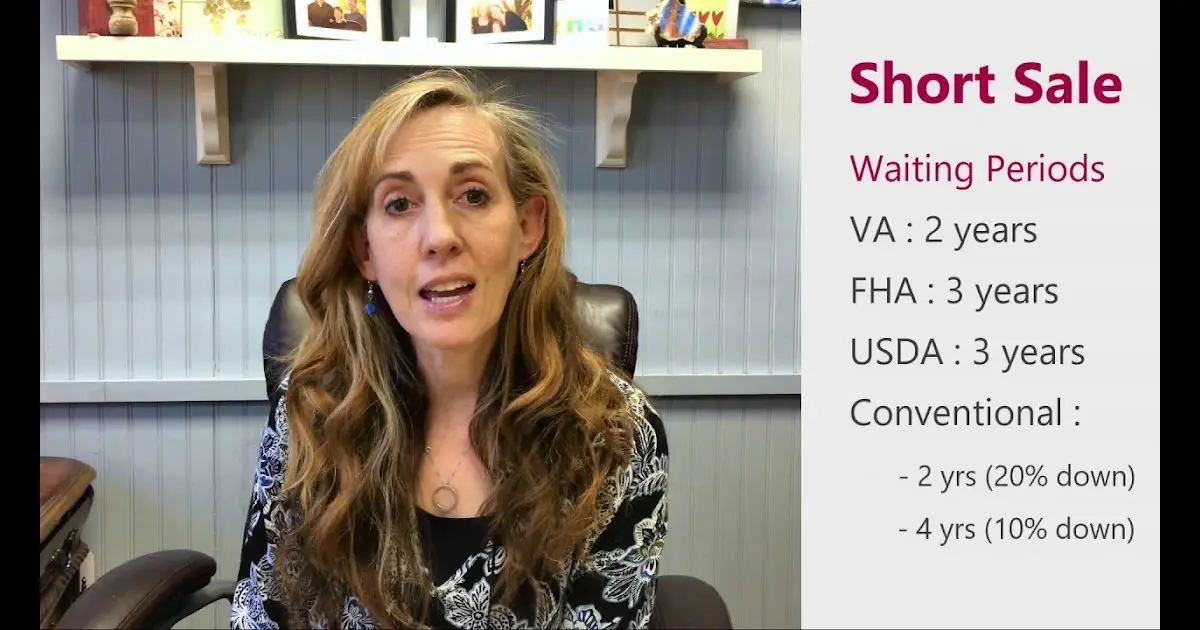

Conventional loans require a longer waiting period between filing for bankruptcy and requesting a home loan. These types of loans are not guaranteed by a department or federal organization.