What Happens To Puerto Rico Pensioners

They might face cuts because Puerto Rico has run out of pension funds.

In the Chapter 9 bankruptcy of Detroit, retirees agreed to accept cuts after a federal judge ruled that their pensions could be cut in municipal bankruptcy. That could pave the way for a similar ruling in Puerto Rico.

The PROMESA law states that the oversight board must identify a fiscal plan that will “provide adequate funding for public pension systems.”

Puerto Rico pensioners also have certain legal protections, but inside of bankruptcy those protections can collapse. That’s exactly what happened in Detroit.

That’s why pension cuts and reductions;to health care insurance could be in the cards.

But pensioners may still fare better than investors, Municipal Market Analytics analyst Matt Fabian suggested Tuesday in a research note. That’s because pensioners are more politically empathetic than Wall Street creditors and bond insurers.

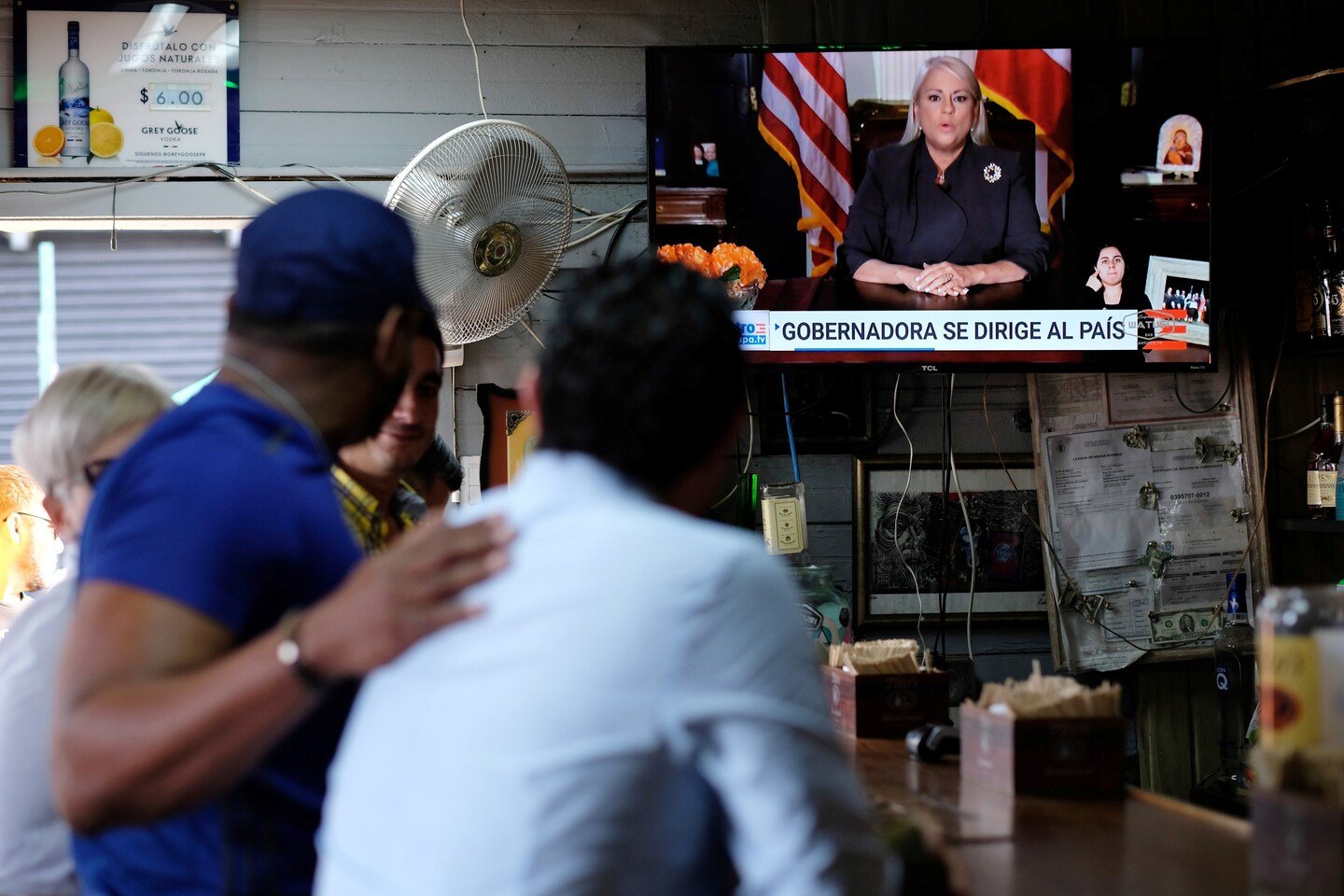

Puerto Rico’s Governor Has A Message For Washington Dc: Change The Law We Want The Right To Declare Bankruptcy

On the brink of default, Governor Alejandro García Padilla demanded that the U.S. government allow Puerto Rico, a commonwealth, access to chapter 9 bankruptcy. That’s what Detroit used when it went belly up. At the moment, only cities, towns and other municipalities are able to declare bankruptcy.

“We cannot allow them to force us to choose between paying for our police, our teachers, our nurses, and paying our debt,” Padilla said in a televised announcement Monday night in Spanish. “We have to act now.”

Puerto Rico is running out of time. The island owes $73 billion that it can’t pay. Its debt is already junk grade and has one of the lowest possible ratings.

“Now is the moment for us to call on Washington for concrete action,” Padilla said, referring to the need to lobby Washington for change on Chapter 9.

The governor compared the island’s financial situation to Detroit’s, but unlike Detroit, Puerto Rico’s only option is to settle its debt with its creditors on its own, which would take years.

The first domino could fall on Wednesday when Puerto Rico’s government-run energy company, PREPA, has a debt payment due. PREPA almost certainly can’t make the payment and is likely to default. That could trigger other Puerto Rican bonds to default later this year.

Many experts believe the island’s creditors will have to take a big discount, or “hair cut,” to reach a settlement.

The Disparity In Federal Social Funding

More than 60% of Puerto Rico’s population receives Medicare or Medicaid services, with about 40% enrolled in Mi Salud, the Puerto Rican Medicaid program. There is a significant disparity in federal funding for these programs compared to the 50 states, a situation that Congress started in 1968, when it placed a cap on Medicaid funding for US territories. That has led to a situation in which Puerto Rico might typically receive $373;million in federal funding a year, but Mississippi, a state with a population similar to that of Puerto Rico, receives $3.6;billion. The situation leads to an exodus of underpaid health care workers to the mainland, and the disparity has also had a major impact on Puerto Rico’s finances.

Also Check: Dave Ramsey Engagement Ring Cost

Puerto Rico Debt Crisis: A Timeline

2017

May 23;- Reverend Heriberto Martínez writes about;Puerto Rico’s crises;and bankruptcy process.;

May 17;- Puerto Rico’s title III;bankruptcy process;begins.;Follow @Eric_LeCompte and check out his live tweets from the proceeding. Read more on;CBC. San Juan’s Catholic Archbishop and Evangelical Bible Society head;write letter;to the presiding Judge.

May 12;- Eric LeCompte speaks at the Puerto Rico;Diaspora Summit. Read about it in;El Nuevo Dia;and the;CBC.;

May 7;-;Eric LeCompte releases an update after winning a process to deal with 100% of;Puerto Rico’s Debt.

May 3;- Puerto Rico’s oversight board initiated the;Title III bankruptcy process.

May 2;- Eric LeCompte speaks to Congress on Puerto Rico’s humanitarian crisis. You can watch the;forum, read Eric’s;remarks;or see;event details.

May 1;-;Puerto Rico secures $295 million in;Medicaid funding.;;from taking away Puerto Rico’s bankruptcy process.;

Apr 27;- Jubilee USA calls on Congress to;protect Title III;for Puerto Rico. Puerto Rico oversight board meets as;bankruptcy deadline;approaches.

Apr 25;- Puerto Rico religious leaders;;ahead of “vulture fund” deadline.

Apr 14;- Puerto Rico oversight board mediates last-ditch debt negotiations; Archbishop;.

Apr 6;- Puerto Ricos electric company and bondholders agree on a;debt deal.;

Mar 31;- Eric LeCompte meets with Puerto Rico’s Governor, Congresswoman and religious leaders. The Puerto Rico Oversight Board discusses;economic growth;proposals for the island.

2016

2015

2014

What Is The Islands Economic Outlook

Puerto Rico has been ravaged by a sustained recession over the past fourteen years.;

Annual economic growth fell by roughly 7.5 percent overall between 2004 and 2019, while Puerto Ricos population shrunk by more than 16 percent. It has also entered bankruptcy proceedings after defaulting on its massive debt, a downward spiral that has been compounded by natural disasters, government mismanagement and corruption, the coronavirus pandemic, and population decline.

Puerto Ricos debt has skyrocketed in recent years, hitting $123 billion or 118 percent of gross domestic productin 2017. On a per-person basis, this far outpaces any U.S. state. Unable to borrow on global markets, Puerto Rico is in economic limbo after turning over its budget to an independent control board appointed by Washington as part of a plan to restructure its debts. Making matters worse, in 2019, U.S. authorities arrested former high-level officials in a corruption scandal, leading to the resignation of Governor Ricardo Rossello.

Recommended Reading: How Do You File Bankruptcy In Oregon

Puerto Rico: A Us Territory In Crisis

- Puerto Rico, which became a U.S. territory following the 1898 Spanish-American War, has some measure of self-rule but limited representation in Washington.;

- Its economy has languished following the loss of federal tax provisions; the accumulation of massive debt; and the ill effects of natural disasters, the coronavirus pandemic, government mismanagement, and population decline.

- Some have pushed for Washington to change the territorys political status, repeal policies such as the Jones Act, and provide more economic relief.

Puerto Rico is a political paradox: part of the United States but distinct from it, enjoying citizenship but lacking full political representation, and infused with its own brand of nationalism despite not being a sovereign state. More than a century after being acquired by the United States from Spain, the island continues to grapple with its status as a U.S. territory and the legacy of colonialism in the Caribbean.

That debate remains as relevant as ever, with Puerto Rico struggling with the combined effects of economic depression, debt crisis and bankruptcy, natural disasters, the coronavirus pandemic, and government mismanagement. Absent a solution, migration to the U.S. mainland could continue to surge. At the same time, a resolution of Puerto Ricos debt woes could serve as a template for debt-saddled U.S. states.;;;;

Puerto Rico Could See Debt Cut By 60 Percent Through Federal Control Board Bankruptcy Plan

A federal control board that oversees Puerto Rico’s finances filed in court Friday a long-awaited plan that it says would reduce the U.S. territory’s debt by more than 60 percent and pull the island out of bankruptcy in what government officials called a historic moment.

The plan comes three years after U.S. Congress created the board and would reduce $35 billion in liabilities to $12 billion, a move that some believe would help ease Puerto Rico’s financial crisis amid a 13-year recession, pave the way to the board’s departure and allow Puerto Rico to regain fiscal autonomy.

“Today we have taken a big step to put bankruptcy behind us,” said board chairman José Carrión. “Three years after Congress passed PROMESA and two years after the most severe hurricane in more than 100 years hit Puerto Rico, after more than a decade of economic decline and fiscal disarray, after tens of thousands of Puerto Ricans left their island to find prosperity elsewhere, we have now reached a turning point.”

Puerto Rico was dragging more than $70 billion in public debt after decades of mismanagement, corruption and excessive borrowing to balance budgets. In June 2015, the government declared the debt unpayable, and in May 2017, Puerto Rico filed for the biggest U.S. municipal bankruptcy in history.

You May Like: How Many Bankruptcies Has Donald Trump Filed

Is There Any Way The Puerto Rico Debt Crisis Can Affect Me

Maybe. If you invested in Puerto Rico municipal bonds directly, you already know you’re in for steep losses.

But many Americans don’t realize that their retirement funds may be invested in Puerto Rico debt. And some high-yield municipal bond funds also loaded up on Puerto Rico debt. Here’s an in-depth look at the municipal bond funds with the most exposure to Puerto Rico.

How Will Investors Be Treated

They’re in trouble.

To be sure, it depends on the status of their debt. If they hold secured bonds, they might get paid in full. But unsecured bondholders could suffer significant cuts, depending on which types of debt the judge determines to be vulnerable.

Financial creditors, including major investors that had bet on Puerto Rico bonds that were exempt from federal, state and local taxes, argue that their investments were made when the island was not eligible for bankruptcy.

But Congress passed the Puerto Rico Oversight, Management and Economic Stability Act specifically to create a process that allows the island’s numerous debt-saddled governmental entities to achieve debt relief.

Complicating matters is the various governmental entities included in the bankruptcy filing, each of which has its own investors and creditors wanting to be paid.

“It really isnt clear how creditors stack up against each other,” Jacoby said.

Moody’s Investor Service Vice President Ted Hampton concluded Wednesday that the bankruptcy filing is actually “a positive step for bondholders overall” because it will bring about “orderly process that should be better for creditors in the aggregate than a chaotic and uncertain period involving proliferating lawsuits.”

Recommended Reading: Bankruptcy Renting Apartment

Cessation Of Federal Subsidies

For much of the 20th century, Puerto Rico was subject to favorable tax laws from the US federal government, which essentially acted to subsidize the island’s economy. In 1996, US President Bill Clinton signed legislation phasing out important parts of the favorable federal tax code over ten years ending in 2006. The end of the subsidies led to companies fleeing the island which itself subsequently led to tax shortfalls. At first, the Puerto Rican government tried to make up for the shortfall by issuing bonds. The government was able to issue an unusually large number of bonds, due to dubious underwriting from financial institutions such as Santander Bank, UBS, Barclays, Morgan Stanley, and Citigroup. Eventually, the debt burden became so great that the island was unable to pay interest on the bonds it had issued.

Puerto Rico’s Economy Has Been Struggling Since 2006 When The Federal Government Stopped Offering Business Incentives

In the middle of the 20th century, the federal government wanted to encourage manufacturers that were tempted to move or expand to developing countries to move to Puerto Rico instead. But since Puerto Rico has the same labor standards as the US, that wasn’t exactly appealing to businesses especially when Congress decided in 1974 to bring Puerto Rico’s minimum wage up to the rest of the US’s, as well.

So instead, the government granted big tax breaks to businesses that had operations in Puerto Rico; starting in 1976, basically any profit a company could trace to Puerto Rico wouldn’t be taxed. The tax breaks gave Puerto Rico a pharmaceutical industry.

This cost the US a lot of money in lost tax revenues, and in 1996 Congress decided to phase out the tax break. It officially ended in 2006, throwing Puerto Rico into a recession.

That was swiftly followed by the Great Recession of the late 2000s, which basically kicked Puerto Rico while it was down. It’s been struggling ever since. In 2013, 45.4 percent of Puerto Ricans were living in poverty.

Not great.

You May Like: Who Is Epiq Corporate Restructuring Llc

But If Nothing Changes Puerto Rico Is Looking At A Slow Rolling Fiscal Disaster

Now that Puerto Rico has started defaulting on its payments, however, it’s in dangerous territory. Creditors might start suing Puerto Rico to get their money back and asking a judge to make the territory start paying any revenue it gets to its creditors, rather than paying its public employees or paying any benefits to its residents.

This seems like an unlikely scenario but something similar actually happened last year, when a federal court ordered Argentina’s government to pay out a massive amount of money to an American hedge fund. The difference is that this time, the court can actually force Puerto Rico to follow through. The other difference: The creditors are Americans but so are the people living under debt.

How Did Puerto Rico Get Into Such A Desperate Fix Anyway

The road to the Puerto Rico debt crisis was paved with good intentions. Decades ago, generous welfare programs were launched to lift citizens out of poverty. But as the costs of these programs mounted, the island government took on more debt.

That debt was manageable until about 10 years ago, with the phasing out of tax breaks that had attracted pharmaceutical, textile, and electronics companies. That caused many of these companies to pull out of Puerto Rico, destroying 80,000 jobs and decimating the tax base.

Since 2006, the Puerto Rico economy has contracted every year, forcing the government to borrow more and more money to balance budgets and “keep the lights on.”

Don’t Miss: Can You Rent An Apartment After Filing For Bankruptcy

Opinion: Finally Puerto Rico Has A Way Out Of Its Debt Crisis

David Skeel is the S. Samuel Arsht professor of corporate law at the University of Pennsylvania. He is a member of the Financial Oversight and Management Board for Puerto Rico.

Its hard to imagine a worse strategy for negotiating the largest public bankruptcy in American history than insisting that more than $6 billion of the debt should be declared null and void. Yet when Puerto Ricos oversight board did precisely this in January, it broke a two-year logjam, opening a path to a new restructuring proposal filed on that could help solve Puerto Ricos debt crisis.

The process began in 2016, when Congress created the Financial Oversight and Management Board for Puerto Rico, authorizing me and other members of the board to certify five-year fiscal plans and, if necessary, to put Puerto Rico into Title III a territory-specific form of bankruptcy. Even then, a year before Hurricane Maria, Puerto Ricos roughly $70 billion of debt was unpayable, as its former governor had put it in 2015. We filed for Title III on May 3, 2017, shortly after a temporary freeze on creditor collection imposed by the 2016 legislation came to an end.

The initial reaction wasnt surprising. A bond market expert denounced the objection as highly unusual and kabuki theater. Creditors attacked the board as more willing to disrespect the rule of law and litigate than engage in meaningful negotiations.

Read more:

Hundreds Of Thousands Of Puerto Ricans Moved To The Mainland Worsening The Economic Crunch

Because Puerto Ricans are US citizens, it’s easy for them to move to the mainland. So even when times were good in the 1980s and 1990s, more people were leaving Puerto Rico than arriving. And after the recession of the late 2000s, out-migration accelerated:

Immigrants in the US from Mexico, China, and India send a lot of money back to families back home . Puerto Rican emigrants in the US don’t partly because an American dollar doesn’t go as far on an island that also uses the American dollar as it does in a developing country, partly because it’s just as easy for emigrants’ relatives to move to America as for emigrants to move back to Puerto Rico.

Also Check: How To Access Bankruptcy Court Filings

Puerto Rico Files For Biggest Ever Us Local Government Bankruptcy

By Nick Brown

5 Min Read

– Puerto Rico announced a historic restructuring of its public debt on Wednesday, touching off what may be the biggest bankruptcy ever in the $3.8 trillion U.S. municipal bond market.

While it was not immediately clear just how much of Puerto Ricos $70 billion of debt would be included in the bankruptcy filing, the case is sure to dwarf Detroits insolvency in 2013.

The move comes a day after several major creditors sued Puerto Rico over defaults its bonds.

Bankruptcy may not immediately change the day-to-day lives of Puerto Ricos people, 45 percent of whom live in poverty, but it may lead to future cuts in pensions and worker benefits, and possibly a reduction in health and education services.

The islands economy has been in recession for nearly 10 years, with an unemployment rate of about 11.0 percent, and the population has fallen by about 10 percent in the past decade.

The bankruptcy process will also give Puerto Rico the legal ability to impose drastic discounts on creditor recoveries, but could also spook investors and prolong the islands lack of access to debt markets.

Congress ‘complicit’ In Crisis Say Some

The health care situation is just one factor that has forced residents off the island: 10 per cent of Puerto Rico’s population has moved away in the last decade.;

Garcia says Americans stateside need to pay attention to what’s going on in the territory.

“We are American citizens living in Puerto Rico, and what happens in Puerto Rico affects the United States,” she said.

Melendez says many in Congress think passing PROMESA was enough, but they need to do more.;

“They were complicit in all the things that led to the crisis,” Melendez said. “They looked the other way for many years, and they have not invested resources to really pull Puerto Rico out of the crisis.”

Recommended Reading: How To File Bankruptcy In Wisconsin