Dispute Inaccurate Bankruptcy Entries With A Credit Dispute Letter

If you were able to find some inaccurate information within the credit report, then your next step will be to dispute the inaccurate entries with each of the credit bureaus using a .

The best-case scenario is that theyll be unable to verify the bankruptcy and remove it from your credit report. This is unlikely if its a recent bankruptcy. The older the bankruptcy, the better chances you have of getting it removed from your credit report this way. Nonetheless, if it happens, then great, you can skip the other steps.

If the bankruptcy is verified by the credit bureaus, continue to the next step.

Bankruptcys Impact On Your Credit Score

When you file bankruptcy and get relief from your bill problems, you no longer owe any money to your creditors. ;You no longer have to suffer with the continuing delinquencies.

If you take some simple steps to rebuilding your credit after bankruptcy, your credit score will start to rise pretty quickly. ;After as little as 18-24 months, your credit report will be a thing of beauty.

In fact, according to a report released by;the Federal Reserve Bank of New York in May 2015:

The individuals who go bankrupt experience a sharp boost in their credit score after bankruptcy, whereas the recovery in credit score is much lower for individuals who do not go bankrupt.

Clean Up Your Financial Act

There are a number of reasons why you may have been forced to file for bankruptcy. But whats most important when rebuilding your credit is not the culprit, per se, but making sure that history doesnt repeat itself. In other words, you want to establish a solid plan for your finances to make your money work for you. In your list of objectives should be creating a realistic budget that keeps your spending in check, safety net, and plans to eradicate debt that wasnt included in the filing.

You May Like: Will My Spouse’s Bankruptcy Affect Me

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

Review Your Credit Reports

Monitoring your credit report is a good practice because it can help you catch and fix credit reporting errors. After going through bankruptcy, you should review your credit reports from all three credit bureausExperian, Equifax and Transunion. Due to Covid-19, you can view your credit reports for free weekly through April 20, 2022 by visiting AnnualCreditReport.com.

While reviewing your reports, check to see if all accounts that were discharged after completing bankruptcy are listed on your account with a zero balance and indicate that theyve been discharged because of it. Also, make sure that each account listed belongs to you and shows the correct payment status and open and closed dates.

If you spot an error while reviewing your credit reports, dispute it with each credit bureau that includes it by sending a dispute letter by mail, filing an online dispute or contacting the reporting agency by phone.

Read Also: How Do You Get A Bankruptcy Off Your Credit Report

Is It Even Possible To Get A Bankruptcy Removed From Your Credit Report

We want to be upfront and transparent: its very hard to get a bankruptcy removed from your credit report. If all information is accurate and complete, it is not possible to remove a bankruptcy from your credit report. But if the bankruptcy entry contains any inaccurate or incomplete information, it may be possible to have it removed.

But Ive Never Missed A Payment I Just Have No Hope Of Ever Paying Off My Debt

If youâre one of the few that has been able to stay current with all debt payments, but need to reorganize your financial situation through a Chapter 13 bankruptcy, your credit score will go down initially.Â;

But, thatâs not the end of the story. Once your bankruptcy discharge is granted, your debt amount will go down significantly! And guess what helps build and maintain good credit? A low debt-to-income ratio.Â;

Debt-to-income ratio?!

Put differently, the best credit rating is possible only if your total unsecured debt is as low as possible. A bankruptcy discharge eliminates most, if not all of your debt. Itâs the one thing you can do that your current debt management methods canât accomplish.Â;

Doesnât bankruptcy stay on your record for 10 years?Â;

Well, yes, under federal law, the fact that you filed bankruptcy can stay on your credit report for up to 10 years. This is true for all types of bankruptcy. But, Chapter 13 bankruptcy stays on your credit report for only seven years from the filing date.Â;

According to Experian, thatâs because unlike a Chapter 7 bankruptcy, Chapter 13 involves a repayment plan that pays off some amount of debt before a bankruptcy discharge is granted.Â;

Read Also: How Many Bankruptcies Has Donald Trump Filed

Be Sure To Make Timely Payments On Any New Debt Or Credit Products

Since late payments account for 35 percent of your credit score, you cant afford to not make timely payments on credit products when youre trying to rebuild your credit after bankruptcy. Why so? Well, all it takes is one late payment to plummet your score between 90 and 110 points, notes Equifax.

The good news is creditors wont report past due accounts until theyre delinquent by over 30 days. So, besides the fee that youll incur, a payment thats a few days late isnt the end of the world.

Submit Dispute Letters To The Credit Bureaus

Before trying anything else, we recommend a writing a dispute letter. Creditors are mandated by federal law, the Fair Credit Reporting Act to report accurate information about each account.

If they cant verify their entries with the proper documentation when a dispute is filed, which is not uncommon, the negative item must be removed from your credit report.

Disputing can be done by phone, online or by mail. But snail mail is the most effective method for several reasons.

The credit bureaus have 30 days to investigate and respond to your dispute. However, you may sometimes receive a letter from the actual creditor requesting that you provide additional documentation so they can properly investigate the claim. This is a common stall tactic and youre not obligated to respond.

Don’t Miss: Will Filing Bankruptcy Stop Irs Debt

Is My Credit Going To Be Bad As Long As A Bankruptcy Shows Up

Myth: You might as well not even try because youll have poor or bad credit as long as the bankruptcy is on your record.

The truth: Yes, bankruptcy tanks your credit score in the short term. But how much a bankruptcy impacts your credit score depends in part on how old the record is. Like many other types of items reported on your credit file, bankruptcies lose some power over time. Thats especially true if you start managing credit and debt in a more positive way while youre waiting for the bankruptcy to fall off your report.

Some ways to help positively impact your score after bankruptcy can include:

- Adding new credit, such as secured credit cards or small installment loans, to offset the negative information on your credit report.

- Making on-time payments for all debt, new and old.

- Keeping your credit card balances under 30% utilization.

How Does Bankruptcy Impact My Credit Report

A bankruptcy will affect your credit report in two ways.

The bankruptcy stays on seven or ten years after filing.

So the agency will typically remove the accounts the bankruptcy includes from your credit report first.

Their delinquency dates will pretty much always precede the bankruptcy filing date.

Bankruptcies will always negatively impact your credit report. However, the severity of the impact will vary case by case.

If you have several accounts included in your bankruptcy, its going to have a more significant impact than if you only have a single car loan or credit card.

Public court records are always accessible via the Public Access to Court Electronic Records system.

If you have a fraudulent bankruptcy on your record, due to identity theft or perhaps a clerical error, it shouldnt be hard to track down.

Read Also: How Long Do Bankruptcy Restrictions Last

How Long Does A Bankruptcy Or Consumer Proposal Stay On My Credit Report

How long bankruptcy stays on your credit report in Canada;will depend on the credit bureau that is reporting.

The largest credit bureau in Canada, Equifax, maintains this record on your credit report for a period from the date of your discharge or last payment:

- A first bankruptcy for six years from the date of your discharge.

- A second bankruptcy for 14 years.

The TransUnion web site states that they keep a bankruptcy on your credit file for six to seven years from the date of discharge or fourteen years from the filing date .

At this point the bankruptcy will leave the credit report and you will need to start to rebuild your credit.

How long a consumer proposal stays on your credit report again depends on the credit bureau that is reporting.

With Equifax, a consumer proposal is reported for three years after your last payment.

Send The Courts Response To The Credit Bureaus

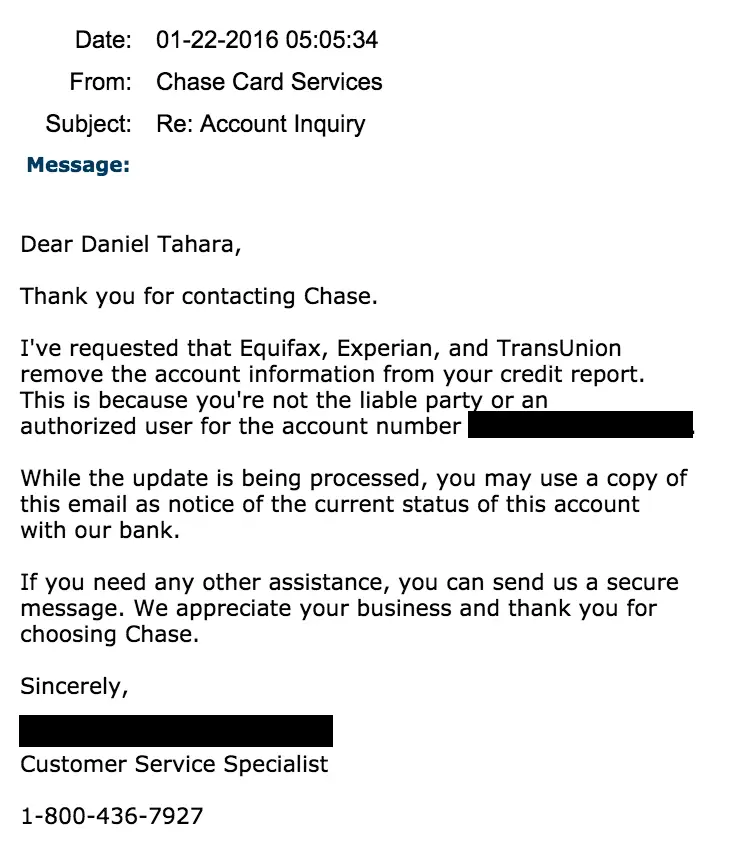

Send the statement from the court to the credit bureaus with a letter asking to have the bankruptcy removed. Mention that the bureau knowingly provided false information and has violated the Fair Credit Reporting Act.

If all goes well, removal of bankruptcy should occur.

- Top 11: Consolidation Loan Companies

You May Like: What Is Better Bankruptcy Or Debt Consolidation

Ask About Becoming An Authorized User

Although it can be difficult to get a cosigner for a loan, it is usually easier to establish credit as an authorized credit user on another persons credit card.;An authorized user is someone with a card thats linked to another borrower rather than their own.;

The card will allow you to make purchases without having to fulfill the accounts requirements. However, you cant change anything about the card.

To improve your credit score, ensure that all authorized user payments are reported directly to the major credit bureaus.;Although it isnt as efficient as other credit-building strategies this may still be useful as part of a larger plan.

What is the average time it takes to rebuild credit after filing for bankruptcy?

Perhaps the most frustrating aspect of bankruptcy filings is the time required to rebuild your credit.;The length of time that a bankruptcy stays on your credit report depends on which type of bankruptcy you have.;Credit repair is also affected by whether the borrower makes conscious efforts to improve his credit score.

How long will it take to rebuild credit after a Chapter 7 bankruptcy?

A Chapter 7 bankruptcy will remain on the borrowers credit report for ten years.;All bankruptcy records must be removed from your credit reports after ten years.

How long will it take to rebuild credit after a Chapter 13 bankruptcy?

How Will Bankruptcy Affect My Credit In 2021

5 minute read ⢠Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card. Explore our free tool

In a Nutshell

Filing bankruptcy does not ruin your credit forever! If you need debt relief but are worried about how a bankruptcy affects your credit rating, this article is for you.

Written by Attorney Andrea Wimmer. Â;

Also Check: How To File Bankruptcy In Iowa For Free

Check Your Credit Report

If you are trying to rebuild your credit after bankruptcy, it is a good idea to start by reviewing your credit report.;AnnualCreditReport.com provides all customers with a free copy of their credit report.;

Normally, reports are provided only once per year. However, in the wake of the Covid-19 outbreak, customers may be able to receive free weekly reports up until April 20, 2022.

Knowing what factors affect your credit score can help you make better decisions and gain insight into why your score has been rising.;It will also help you identify errors that could lower your score such as incorrect account information, public records, or other misinformation.

Your credit report can also be used to help ensure your bankruptcy is removed as quickly as possible. This happens after seven years for Chapter 13 bankruptcy filings and ten years for Chapter 7.

Ask The Credit Bureaus How The Bankruptcy Was Verified

If the bankruptcy is verified by the , you will next need to send them a procedural request letter asking them who they verified the bankruptcy with.

In some instances, they will claim it has been verified with the courts, even if it is not. In most cases, the courts do not verify bankruptcies for the credit bureaus.

If the credit bureau claims it was verified with the courts, then proceed to step 4.

Also Check: What Happens If You Declare Bankruptcy Uk

Will A High Credit Score Help You During A Bankruptcy

Myth: A clean credit historyone with no late payments or other issuesand a high credit score means youll be less impacted by a bankruptcy.

The truth: Bankruptcy will have a huge negative impact on your credit, and a previously positive payment history doesnt change that. In fact, if you have a higher score, you could stand to lose more;than if you already have a low score.

A bankruptcy also temporarily wipes out all the goodwill you might have developed with your timely payments. Some lenders may have rules about offering credit when a recent bankruptcy shows up on your credit historyno matter how good your score used to be.

Make Sure You Pay All Your Bills Early Or On Time

Your payment history is the most important factor that makes up your FICO score, accounting for 35 percent. With that in mind, youll want to make sure you pay every bill you have early or on time. Set a reminder on your phone if you have to, or take the time to set up each of your bills on auto-pay. Whatever you do, dont wind up with a late payment that will only damage your credit score further and prolong your pain.

You May Like: Can You File Bankruptcy On Your Own

How Long Do Bankruptcies Impact Your Credit Scores

Since your credit score is based on the information listed on your credit reports, the bankruptcy will impact your score until it is removed. This means a Chapter 7 bankruptcy will impact your score for up to 10 years while a Chapter 13 bankruptcy will impact your score for up to seven years. However, the impact of both types of bankruptcies on your credit score will lessen over time. Plus, If you practice good credit habits, you could see your score recover faster.

Also, how much your credit score decreases depends on how high your score was before filing for bankruptcy. If you had a good to excellent score before filing, this likely means your credit score will drop more than someone who already had a bad credit score.

How Long Does Bankruptcy Stay On A Credit Report

The most common type of bankruptcy about 70% of those filed each year is;Chapter 7 bankruptcy;and it remains on your credit report for 10 years. The other type,;Chapter 13 bankruptcy, clears from your credit report after seven years.

Chapter 7 lasts longer on your record because, after you liquidate assets and pay what you can, the rest of the debt is written off. Chapter 13 bankruptcy involves a plan to continue paying off at least part of your debt in three to five years, so it leaves your credit report sooner.

Getting the bankruptcy removed from the credit report early wont happen simply because you dont want it there. It requires proving that it didnt belong there in the first place, meaning that it is the result of;identity theft;or a clerical mistake that you can prove to be the case.

If you find a fraudulent bankruptcy on your record, you need to challenge it with all three credit bureaus Equifax, TransUnion and Experian by filing a;. The Fair Credit Reporting Act requires that the agencies investigate and resolve your dispute within 30 days. To maintain evidence supporting the start of that 30-day deadline, informing the agencies by certified mail is recommended. The credit bureaus will notify you of their findings.

Also Check: What Is The Number One Cause Of Bankruptcies In America

Bankruptcys Impact On Getting A New Job

Employers are allowed to;use credit reports to make hiring decisions, as well as;when they evaluate employees for promotion, reassignment, and retention. In fact, many;employers ask for credit reports, driving records, and criminal histories.

The prospective employer;has to let you know theyre going to pull your credit report and;get your;written authorization to do so.

The bankruptcy law says the government cant deny you a job just because you filed for bankruptcy. Private employers cant fire you because you filed for bankruptcy.

As to new employers, the rule is unclear because that part of the law is written poorly.;Courts in;New York have ruled that a private employer;cant refuse to hire you because you filed for bankruptcy. Judges;in Mississippi, Pennsylvania and Florida, however, have;said the opposite.

My experience as a bankruptcy lawyer over the past 20 years shows its better to be out of debt when you apply for a new job than to have past due debts showing up on your credit report.

If you owe money, your employer may think youve got a motivation to steal. Once youre debt free, that motivation disappears and your potential employer is likely to be more comfortable hiring you. Lots of people;have come to me after Human Resource Managers and headhunters have told them to get their debts wiped out to for;a better chance at a good job.