Boost Your Savings To Cover Costs

The more cash reserves you have, the easier it is to tackle unavoidable medical bills. To this end, it pays to have a robust emergency fund — one with enough money to cover three to six months worth of living expenses.

If you have a medical condition that not only results in high bills but also could impede your ability to work, you may want to aim even higher and have up to a years worth of living costs in the bank. That way you wont have to charge your medical bills on a credit card or take out loans to cover them.

Contact Attorney Joseph P Doyle For A Free Review

It is important to contact an attorney to begin fighting your debt. We know that your personal finances are important to you and we can provide you with compassionate legal assistance. Our firm knows that handling debt and filing for bankruptcy sometimes means that you cannot stop until you obtain a successful result. We know to help you achieve the best outcome available.

Bankruptcy Filings By State

Considering how much their populations vary, it doesn’t make sense to evaluate states by their number of bankruptcy filings.

In the table below, states are ranked by their number of bankruptcy filings per 1,000 residents to provide a more accurate picture of where debtors file bankruptcy the most. It also includes the numbers for Washington, D.C., and the United States as a whole.

Bankruptcy is a much bigger problem in the South — the four states with the highest bankruptcy rates are all Southern states. This could be in part because these states often have more seasonal work and fluctuating wages. Median incomes in several of these states are below the national average, too.

Interestingly, Chapter 13 filings are far more common in the South than they are in the rest of the country. Of the 25 federal judicial districts with the most Chapter 13 filings from 2006 to 2017, 23 were in the South. Chapter 13 bankruptcy originated in this region, which could partially explain this, but fee structures for bankruptcy attorneys in this part of the country are a more likely explanation.

In several Southern states, bankruptcy attorneys don’t charge anything upfront for Chapter 13 cases. Instead, they let debtors pay through their bankruptcy payment plan. With Chapter 7 cases, attorney fees are usually due immediately or shortly. This leads lower-income debtors in these states to predominantly choose Chapter 13 bankruptcy, even if they’d be better off filing through Chapter 7.

You May Like: Can You File Bankruptcy And Keep Car

Medical Debt In The United States

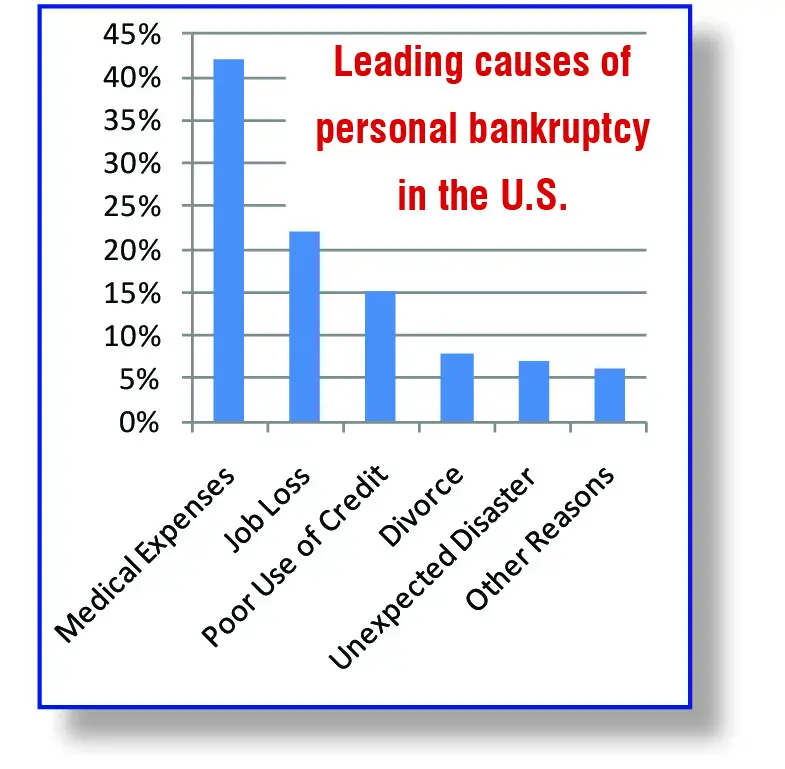

Medical debt has been the leading cause of American bankruptcy for years. In 2013, a CNBC report revealed that unpaid medical bills would affect the finances of two million people in one year. Even of those who do not file for bankruptcy, an estimated 56 million adults will suffer in some way because of medical expenses, which accounts for more than 20% of the American population between the ages of 19 and 64.

Even if you have health insurance, you are not safe from the dangers of medical debt. Many insurance plans include high deductibles. Even for people with stable finances, the deductibles can be steep enough that a few medical issues could plunge them into serious debt, an occurrence that can eventually lead to bankruptcy. An unexpected medical bill for $500 is too much for many Americans to pay. In 2017, 45% of Americans said they would have a hard time paying an unexpected $500 medical expense. Such an expense would require them to take out a loan, pay it slowly over time, or not pay it at all. Many serious health problems have deductibles that are significantly higher than $500. More than half of Americans who have insurance end up using most or all of their savings to pay medical bills. Avoiding medical debt often requires serious financial sacrifices.

Medical Costs Is The Number One Cause Of Bankruptcy

Two out of every three bankruptcies in America are a result of medical costs. Because medical costs are expensive, unpredictable, untimely, and people generally do not plan ahead for them, they are the biggest cause of bankruptcy in America, bigger than credit card debt and bad mortgages combined. Among seniors and retirees, medical costs will come from long-term care.

Don’t Miss: When Does Chapter 7 Bankruptcy Fall Off Credit Report

Medical Bankruptcy Is Real Even If The Washington Post Refuses To Believe It

The Washington Post has broken new ground, calling a presidential candidate a liar for citing a statistic from research published in the world’s leading public health journal. The Post’s Fact Checker column labeled Bernie Sanders a “three pinocchio” level liar for saying that 500,000 Americans are bankrupted by medical bills each year. Sanders’ statement relied on research that we and three colleagues published in the American Journal of Public Health . Dozens of politicians and publications have cited that study as a reliable source.

Our AJPH study was part of an ongoing research effort by the Consumer Bankruptcy Project . For decades, the CBP has been surveying debtors about the causes and consequences of their bankruptcy. In our 2019 research, 37.0% of bankrupts “very much” agreed that medical bills were an important factor, while another 21.5% “somewhat agreed”. Many others cited lost wages due to illness, and overall, two-thirds cited illness-related bills, income loss or both. As we wrote in the AJPH, that’s “. . . equivalent to about 530 000 medical bankruptcies annually.” That figure is in line with estimates based on our earlier CBP studies , which were published in leading medical and policy journals.

Yet despite these flaws, the economists behind the study insisted that their math was a more reliable indicator of what caused financial ruin than the testimony from the thousands of debtors surveyed and interviewed by the CBP.

Sign Up

Global Medical Bills Bankruptcy Statistics

1. Medical bankruptcies in Canada are the most common among senior citizens.

While about 4.6% of Americans filed for personal bankruptcy in 2007, in Canada the percentage was higher at 5.3%. A share of those insolvencies was caused by outstanding medical bills or other medical reasons. Fraser Institute concluded that senior Canadians of at least 55 years struggle with medical indebtedness the most. Namely, 15% named medical reasons as the primary cause of insolvency.

2. Medical bankruptcy exists in the United Kingdom, even with the single-payer system.

Even though the United States leads in medical bankruptcies around the world, other countries have them too. Medical bills bankruptcy statistics from 2005 show that 8.2% of those that went bankrupt in the UK listed illness or a disability as the reason. An article by the National Center for Public Policy Research further shows that medical-related bankruptcy doesnt always happen due to medical bills serious medical conditions often affect peoples ability to work and generate income.

3. In 2008, there were no medical-related insolvencies in France.

4. Less than 10% of personal insolvencies in Australia are due to medical reasons.

5. In Germany, medical reasons arent included in the top five reasons for personal bankruptcies.

Read Also: How Much Debt To File Bankruptcy

Myth And Measurement The Case Of Medical Bankruptcies

The New England Journal of Medicine, March 22, 2018

During the push to pass the Affordable Care Act, President Barack Obama often described the crushing cost of health care that was causing millions of Americans to live every day just one accident or illness away from bankruptcy and repeatedly stated that the high cost of health care causes a bankruptcy in America every 30 seconds. Stories of illnesses and injuries with financial consequences so severe that they caused households to file for bankruptcy were used as a major argument in support of the 2010 Affordable Care Act. And in 2014, Senators Elizabeth Warren and Sheldon Whitehouse cited medical bills as the leading cause of personal bankruptcy when introducing the Medical Bankruptcy Fairness Act, which would have made the bankruptcy process more forgiving for medically distressed debtors. But it turns out that the existing evidence for medical bankruptcies suffers from a basic statistical fallacy; when we eliminated this problem, we found compelling evidence of the existence of medical bankruptcies but discovered that medical expenses cause many fewer bankruptcies than has been claimed.

Our study was based on a random stratified sample of adults 25 to 64 years of age who, between 2003 and 2007, were admitted to the hospital for the first time in at least 3 years. We linked more than half a million such people to their detailed credit-report records for each year from the period 20022011.

Percent Of Bankruptcy Filers Cite Illness And Medical Bills As Contributors To Financial Ruin

Researchers found no evidence that the ACA reduced the proportion of bankruptcies driven by medical problems; insurance offered little protection to middle-class Americans

Physicians for a National Health Program

Medical problems contributed to 66.5% of all bankruptcies, a figure that is virtually unchanged since before the passage of the Affordable Care Act , according to a study published yesterday as an editorial in the American Journal of Public Health. The findings indicate that 530,000 families suffer bankruptcies each year that are linked to illness or medical bills.

The study, carried out by a team of two doctors, two lawyers, and a sociologist from the Consumer Bankruptcy Project , surveyed a random sample of 910 Americans who filed for personal bankruptcy between 2013 and 2016, and abstracted the court records of their bankruptcy filings. The study, which is one component of the CBP’s ongoing bankruptcy research, provides the only national data on medical contributors to bankruptcy since the 2010 passage of the ACA. Bankruptcy debtors reported that medical bills contributed to 58.5% of bankruptcies, while illness-related income loss contributed to 44.3%; many debtors cited both of these medical issues.

Relative to other bankruptcy filers, people who identified a medical contributor were in worse health and were two to three times more likely to skip needed medical care and medications.

Journal

You May Like: What Happens When You Declare Bankruptcy In Texas

Medical Costs Will Continue To Grow

High medical costs are caused by systemic issues in the healthcare industry. Until these issues are addressed, medical costs will continue to increase.

- Health spending is projected to reach $6 trillion by 2027.

- Health spending is expected to grow at an average rate of 5.5% per year.

- Health spending is projected to reach 19.4% of GDP by 2027.

- Health spending for people on Medicare was $12,347 in 2017 and is expected to reach $19,546 by 2027.

- Health spending for people on Medicaid was $8,013 in 2017 and is expected to reach $12,029 by 2027.

- Health spending for people on employee-sponsored health care plans was $5,942 in 2017 and is expected to reach $9,137 by 2027.

- Health spending for people on medical plans is expected to rise approximately 50% in the next 10 years.

We encourage journalists, researchers, students, and others to share these statistics. Medical debt, and the high costs that cause it, can destroy finances. According to experts, costs will continue to rise, exposing more and more Americans to the risk of debt. We all have a part to play in demonstrating the seriousness of this issue.

Personal Bankruptcy: The New American Pastime

Personal bankruptcies hit a record 1.35 million in 1997, with many analysts expecting the high mark to topple again in 1998. Unlike other milestones, howeversay, the most home runs in a single seasonthe bankruptcy boom is not exactly a feat Americans can be proud of. It’s also puzzling. After all, the U.S. economy is in its eighth consecutive year of expansion, an expansion that features both low unemployment and inflation. Moreover, the stock marketuntil very recentlyhas been booming. So why are so many Americans striking out with their personal finances?

You May Like: Which Statement Regarding Bankruptcy Is Not True

Poor Or Excess Use Of Credit

Some people simply can’t control their spending. bills, installment debt, car, and other loan payments can eventually spiral out of control until finally, the borrower is unable to make even the minimum payment on each type of debt.

Having an emergency fund, medical insurance, and keeping your debt-to-credit ratio low are all ways to protect yourself from a future declaration of bankruptcy.

If the borrower cannot access funds from friends or family or otherwise obtain a debt-consolidation loan, then bankruptcy is usually the inevitable alternative.

Statistics indicate that most debt-consolidation plans fail for various reasons, and usually only delay filing of bankruptcy for most participants. Although home-equity loans can be a good remedy for unsecured debt in some cases, once it is exhausted, irresponsible borrowers can face foreclosure on their homes if they are unable to make this payment as well.

Top 5 Reasons Why People Go Bankrupt

Contact Roger A Kraft Attorney At Law Pc

To set up a free consultation, please call me in Midvale, Utah, at or , or complete my contact form. I represent clients throughout the Salt Lake area, including Utah County, Salt Lake County, Tooele County and Summit County.

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.

Read Also: Can You Buy A House After Bankruptcy Canada

Medical Debt Is A ‘uniquely American Problem’ Caused By A ‘very Broken’ System Expert Explains

The cost of health care in the U.S. has grown worse in recent years as Americans continue taking on unprecedented levels of medical debt.

The issue has gotten so bad that one New York-based 501 charity, RIP Medical Health, uses donations to buy up peoples medical debt. The organization recently announced a purchase of $278 million in medical debt owed by roughly 82,000 patients in the Tennessee and Virginia regions.

Medical debt is the no. 1 cause of bankruptcy in the United States, which is something thats obviously a uniquely American problem, Allison Sesso, executive director of RIP Medical Debt, said on Yahoo Finance Live . So were out there trying to give people relief from this economic burden. Weve got donors that are excited across the country to do more of this debt relief. That number 278 million were very proud of that, but we have a lot more debt relief ahead of us.

RIP Medical Debts recent purchase involved buying peoples medical bills directly from the Ballad Health hospital system, which has previously been criticized for using lawsuits to collect on medical debt. Sesso noted that most of the patients affected by RIP Medical Debts latest move are considered low-income.

Roughly 21 million Americans holding $46 billion of medical debt as of April 2021 face collections meaning that a third-party debt collector is trying to obtain the money owed according to Credit Karma data previously provided to Yahoo Finance.

Reasons Why People Go Bankrupt

Termination of a Marriage

Not only is a divorce personally traumatic, but it can also lead to financial problems. When a household is split, the expenses dramatically increase,and the income is divided. If either party or both individuals are unable to pay their debts, it can be very difficult to control the expenses that arise. Splitting apart the incomes of two is rarely an easy situation and our Chicago bankruptcy attorney can determine if filing is theright solution for you.

Medical Problems

Illness and injury are not usually an expected situation. When it comes about, however, it must be handled diligently. Even with substantial health insurance, unexpected medical expenses can quickly get out of control. These situations can be very frustrating for all involved. When taking into consideration the time that must be taken off of work and the loss of income, it is easy to see why a trip to the hospital can result in serious debt trouble.

Mismanagement of Finances

The mismanagement of finances is a cause of bankruptcy that affects many. It is often associated with individuals who have graduated from college and are now using credit without having a clear grasp of the consequences. College loans can cause a problem for young individuals and couples after the grace period has come to a close. Also, decisions to purchase a home or vehicle that cannot be reasonably afforded can damage their financial situation.

Unexpected Job Loss

Don’t Miss: What Can They Take In Bankruptcy

What Happens When People File Medical Bankruptcies

Filing for bankruptcy is a controversial decision. On the one hand, its subject to moral judgment and can even be seen as a failing. On the other hand, however, there are also benefits of declaring bankruptcy, like a chance to get a fresh start, move forward, and get out of uncontrollable debt due to an accident or severe illness.

Bankruptcy can be good for the economy because the affected people become contributing members of society again. The US Constitution established the uniform laws on the subject of bankruptcy throughout the United States as a mechanism to help people in such situations.

As for what happens tomedical debt after death, the medical bills dont go away. Instead, medical debt, as well as all the other debt you have, is paid by your estate. And by estate, we mean all the assets you owned at death. Moreover, even thoughlife insurance programsguarantee payments after the insured persons death, health insurance pays for their medical expenses.

Opinion: The Truth About Medical Bankruptcies

Pop quiz: What percentage of bankruptcies in the United States are caused by medical bills?

If you lived through the debate over passing Obamacare, you probably answered something like half. That was the figure in common currency among advocates of health-care reform; then-Sens. Chris Dodd and Hillary Clinton; were just two of the prominent advocates who used it. Other variants were also popular; Barack Obama, for example, was fond of saying that the cost of health care now causes a bankruptcy in America every 30 seconds.

Its a memorable number. But its almost certainly many times the true count.

The figure was based on a series of papers released by a team including Sen. Elizabeth Warren and co-authors David Himmelstein and Stephanie Woolhandler of Physicians for a National Health Program. Theirs was hardly the only paper to attempt an estimate of medical bankruptcies, but no one else got eye-popping numbers like that or nearly so much attention from the media.

Critics at the time, including me, pointed out that there were all sorts of problems with the data, but none of the critiques had the viral charms of the original study. But behind the scenes, the debate has continued. And;last week, the New England Journal of Medicine published a new estimate;done by a team of health and labor economists.

Don’t Miss: Can You File Bankruptcy On Just Credit Cards