The Free And Legal Way To Get Better Credit

Once youve discovered errors on your credit reports, you can send dispute letters out to the credit bureau OR you can get a FREE credit repair lawyer to help you with the entire process.

Dont let errors on your credit reports bring your credit score down. At ,weve been cleaning up credit reports for consumers since 2008 for free. How do we do it? All of our fees come from the defendants in settled cases. This is why our clients pay nothing for the work we do.

Lets start the conversation about what we can do for your credit. Set up your free consultation today by calling Attorney Gary Nitzkin at 591-6680 or sending him a message through our contact page.

Why Georgia Consumers Should Avoid United Debt Services

The letter we received from United Debt Services is typed out on pink paper and looks official. Although, its really a mass-produced and cheaply printed thing. Yet, there are parts of the letter that might induce panic in Georgians who are struggling with debt and worried about being contacted by debt collection agencies.

At the top of this notice from United Debt Services are the words RE: Bank of America, Discover, Capital One, American Express, Wells Fargo. This could easily lead someone to believe that this is a letter that pertains to an account that belongs to them. Next, there is an address labeled Department of Negotiations. Sounds official, doesnt it? It isnt.

The body of this letter starts with This is our second attempt to contact you, which is clearly meant to induce a sense of urgency in the reader. Finally, any Georgian reading the letter will find their eyes drawn to the **Failure to Call** warning located dead center on the page. This could prompt a busy consumer to just call the number provided without reading the rest of the flyer and thats all that this nasty little letter really is. Its a flyer that promotes a service. While theres nothing WRONG with sending out flyers to promote a business, it is shameful to trick Georgia residents into calling the company ANY company.

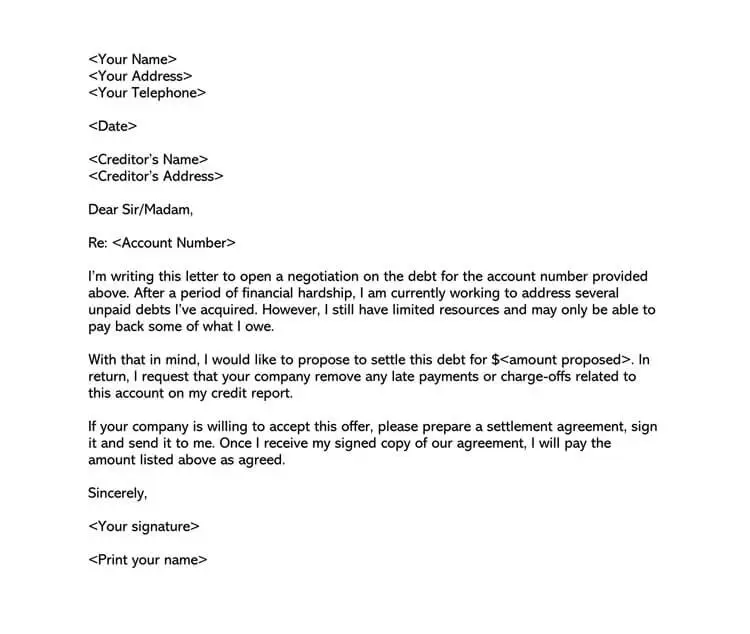

Write A Debt Settlement Letter

Once youâve saved up a reasonable amount, write a debt settlement letter to your creditor. Explain your financial situation and specify how much youâre offering to pay to close the account.

In your settlement offer letter, be sure to provide details of any financial hardship you may be facing, such as unforeseen medical bills or the loss of your job. If a creditor sees that you have a legitimate reason for possibly defaulting, they may be more willing to negotiate for at least something rather than nothing at all.

Donât start by offering your final amount, or the most you can afford to pay. The creditor may reject it, and then you’ll have no negotiating room.

Instead, consider beginning around 30% of the entire balance. Expect them to respond with a higher number. This is a negotiation, after all, so be prepared for a few counteroffers until you can agree.

Don’t Miss: Can You File Bankruptcy And Still Keep Your Home

How To Negotiate Credit Card Debt Settlement Yourself

If your debts are already in collections and youre receiving settlement offers, then you may not need a professional debt settlement company to handle the negotiation for you. Instead, you may be able to save yourself some money and handle the debt negotiation yourself.

To do this, you will want to send formal letters to each of the collectors or creditors that hold your debts. Here is the step-by-step process for do-it-yourself credit card debt settlement:

The Older Your Debt Is The Less Reason There Is To Settle

Every state has a statute of limitations on how long a debt collector has to sue you in civil court to force repayment of a debt. The maximum statutes are 10 years. So, regardless of where you live theres no more than a 10-year window where a collector can take you to court to collect on a debt.

You should check with your state Attorney Generals office to find out what the specific statute of limitations is for your state. If your debts are old and close to that statute, theres less reason to pay them anything. After 10 years they can still contact you to attempt to collect, but they have no legal recourse. And if you tell them to stop contacting you, they must honor that request.

If you have any debts that over that statute and the collector is still bothering you, send them a cease and desist letter using the template you can find below. Just be careful to keep the wording close to what it says in the template. If youre not careful and you acknowledge that you owe the debt in any way, you can actually reset the clock on the statute of limitations!

Also Check: How Long To Get Credit After Bankruptcy

Debt Settlement Negotiation Letter Sample 1 Offer To Pay Debt In One Lump Sum

Dear

I have been informed that an outstanding debt of mine that was previously held with has been passed to your company for collection. I have also been informed that the outstanding balance on the debt is but I understand that there may have been additional charges added to this balance since it has been passed to your company.

I have taken advice with regards to my debts and have been advised to write to all of my creditors with the intention of negotiating a final debt settlement figure. My financial advisor has placed all of my debts in order of priority and I am at the moment negotiating final settlement discounts on these debts. If there is a way we can negotiate a discounted debt settlement figure then I will be able to make an outright payment on this account.

At present the creditors I have contacted are willing to settle at a 50% discount on the outstanding debts. If you would like to contact me with regards to negotiating an amount then this debt can be settled as soon as an agreement has been reached.

I look forward to hearing from you, and your understanding in this matter is appreciated.

Yours sincerely

How To Negotiate With Debt Collectors

In some cases, a creditor may have turned your debt over to a debt collector. Debt collectors make money by collecting past-due debts that originated with a creditor, such as a credit card company.

When dealing with debt collectors, be patient. It may take several attempts to get the type of settlement youre comfortable with. Resist pressure to agree to a settlement thats not in your best interest. Also, ask about whether the debt collector is willing to settle the debt through a payment plan rather than all at once, with one lump-sum payment.

Read Also: What Happens If You File Bankruptcy On Student Loans

Debt Consolidation Vs Debt Settlement

Debt consolidation and debt settlement offer very distinct options for managing debt.

With debt consolidation you pay off debt from several different creditors with a single loan. Debt consolidation is often considered a smart tactic for taking control of debt so that you can improve your credit health.

Debt settlement involves negotiating an agreement on your debt with one or more creditors. This is a tactic often used by people struggling to make payments due to unexpected financial adversity and seeking to avoid bankruptcy.

If youre looking to control your debt, rather than have your debt control you, its good to understand how debt consolidation and debt settlement differ, which option might save you time or money, and what the benefits and challenges are for each. Weve laid out the basics, and our friendly loan specialists are here to help with any additional questions you might have.

Scam Alert United Debt Services A Debt Consolidation Company To Avoid

Attorney and CEO of Credit Repair Lawyers of America

Recently, we received a letter from a debt consolidation company that raised a number of red flags. Clearly, the letter was written to readers into calling them. This smacks of bad business ethics right off the bat. Then, after looking for United Debt Services online, it was clear that Georgia consumers should avoid this company like the plague if they want to protect their credit scores.

Recommended Reading: National Credit Card Debt Relief

You May Like: Bankruptcy Attorney Rockford Il

Next Steps If You Want To Go Ahead With Debt Settlement

Do your research. The Federal Trade Commission helps protect consumers by trying to prevent unfair business practices in the marketplace. The FTC has useful information on debt settlement thats worth reading as you consider debt settlement options.

Pick a reputable debt settlement service provider. Before you enroll in any debt settlement program, the Consumer Financial Protection Bureau recommends contacting your state attorney general and local consumer protection agency to check whether there are any complaints on file. The state attorney generals office can also check if the company is required to be licensed and whether it meets your states requirements.

The Better Business Bureau has consumer reviews of businesses that could help you as you research a debt settlement service provider.

About the author:

Resources

What To Do When A Creditor Or Collector Reaches Out

Getting a settlement offer on a debt you couldnt afford to pay in full may be the perfect opportunity to take care of an old account. You can avoid the anxiety of initiating the conversation with the creditor. Plus, you don’t have to convince the creditor to settle because theyve already made that decision.

Dont get too excited about the prospect of finally being rid of this debt, though. Before you pay or even speak to anyone about the settlement , you need to be sure the settlement offer is legitimate.

Also Check: Is Bankruptcy State Or Federal Law

Debt Settlement Negotiation Letter Sample 1 Offer To Pay Debt In Regular Payments

Dear

I have been informed that an outstanding debt of mine that was previously held with has been passed to your company for collection. I have also been informed that the outstanding balance on the debt is but I understand that there may have been additional charges added to this balance since it has been passed to your company.

I have taken advice with regards to my debts and have been advised to write to all of my creditors with the intention of negotiating a payment plan to repay the debt. My financial advisor has placed all of my debts in order of priority and I am at the moment negotiating payment plans on these debts. The amount I can afford to pay on a basis towards this debt is .

If you would like to contact me with regards to negotiating a payment plan, then this can be set up as soon as an agreement has been reached.

I look forward to hearing from you, and your understanding in this matter is appreciated.

Yours sincerely

Know Your Negotiation Options

Before negotiating with a credit card company on your own, you should get familiar with the types of settlement options that are typically available to consumers. If the credit card company is willing to entertain the idea of a debt settlement, then the odds are high that it will want to make one of the following arrangements.

Recommended Reading: Whats Our National Debt

Alternatives To Credit Card Debt Settlement

Debt settlement is the right choice for some people, but keep in mind that it will lower your credit score and make it harder to borrow money in the future. Even if you do qualify for future credit, your interest rates will be much higher than they would be if you had an excellent credit score. If youd like to avoid debt settlement, you do have other options.

Debt Negotiation Fees And Scams

Many disreputable debt negotiation firms charge high fees for their services, including:

a fee to open your file monthly fees for services, and a percentage of the money youve supposedly saved.

This money could be going to pay your debts, but instead its being pocketed by the firm. Essentially, you end up adding one more payment to your monthly debt load.

Some firms require that consumers make monthly payments to them, rather than to creditors. Then, according to the FTC and consumer protection agencies, these firms keep some of that money without telling the consumer or worse, never pay the creditors at all. The consumer is left with the original debt, plus late fees and interest, all the while having paid large sums of money into the debt negotiation firms coffers.

You May Like: What Does Declaring Bankruptcy Do For You

How To Negotiate Credit Card Debt

JGI / Tom Grill / Getty Images

If you’re facing financial challenges that are making it seem impossible to pay off your credit card debt, then negotiating with your creditor to reach a settlement agreement may be an option to consider. You don’t necessarily need to hire a debt settlement company to do ityou can negotiate a deal on your own if you approach it with some knowledge and determination.

Scam Alert United Debt Services A Debt Consolidation Company To Avoid

Attorney and CEO of Credit Repair Lawyers of America

Recently, we received a letter from a debt consolidation company that raised a number of red flags. Clearly, the letter was written to readers into calling them. This smacks of bad business ethics right off the bat. Then, after looking for United Debt Services online, it was clear that Georgia consumers should avoid this company like the plague if they want to protect their credit scores.

Also Check: How To File Bankruptcy Without An Attorney

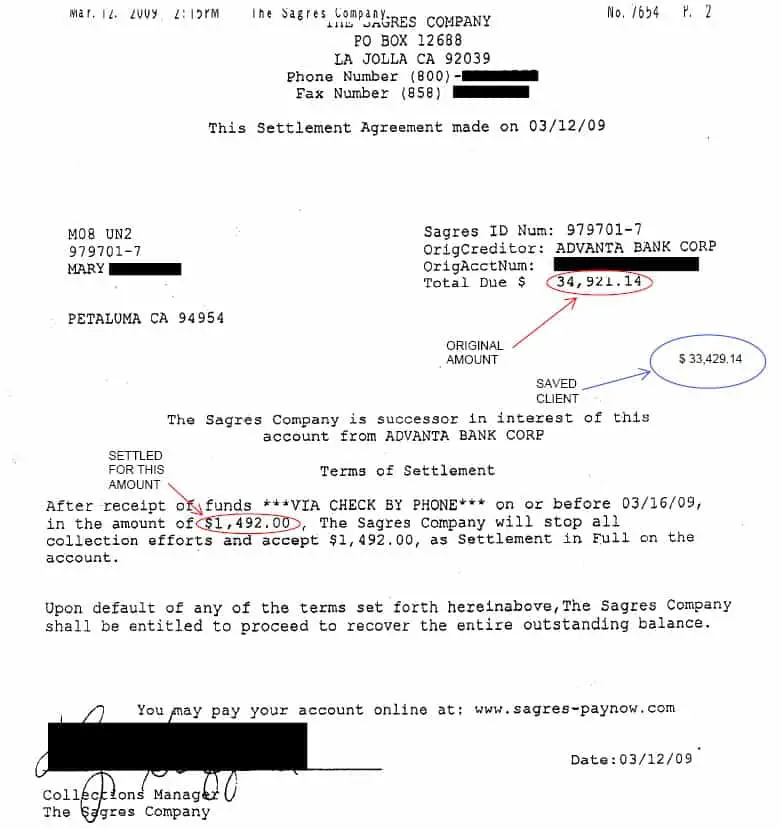

Pennies On The Dollar Can Be More Money Than You Might Think

Debt settlement companies tend to use the catchphrase pennies on the dollar. That almost makes it sound like you can get out of debt with the loose change stuck in your couch cushions. But thats not really the case.

According to the American Fair Credit Council, the average settlement amount is 48% of the balance owed. So yes, if you owed a dollar, youd get out of debt for fifty cents. But the average amount of debt enrolled is $4,210 and the median amount is $25,250. That means you should still expect to pay a hefty sum to get out of debt. The more you owe, the more money youll need to settle your debts.

Save Up The Money For The Proposed Settlement

Before making a settlement offer, be sure you have enough money saved up to meet the settlement terms if the creditor agrees to your terms.

Create a budget and a proposed payment plan, and choose a settlement amount you can afford. Then, consider opening a separate bank account into which you can deposit money each month to save up.

Meanwhile, if youâre settling a , itâs a good idea to stop charging anything on that card for three to six months before proposing a settlement. If youâre claiming hardship but still using the card to buy expensive clothes or eat at fancy restaurants, it wonât look like there’s any hardship at all. Youâll lose credibility, and the company will be less likely to consider your proposal.

You may propose monthly payments of a specific amount in a repayment plan. Or your creditor or collection agency may be open to accepting a lump sum payment thatâs less than the total you owe to settle your account.

A credit counseling agency can help you set up a debt management plan, which entails negotiating a repayment plan with your creditors. Under such plans, you make a monthly payment to the credit counselor, which in turn pays the creditors.

An arrangement with a reputable nonprofit debt management counselor likely will require your participation in educational programs and counseling before youâre accepted for a debt management plan.

You May Like: Auction For Foreclosed Homes

What Is A Debt Settlement Letter

If youâre unable or unsure about negotiating a debt settlement over the telephone, negotiating by letter is a reasonable option. Itâs not much different negotiating with your creditor by telephone, but it might take longer. There are several ways to prepare a settlement letter, including hiring an attorney to write it for you or going online to download a template to use as a starting point. There are also several sample letters you can look at to get an idea of what your completed letter should look like.

If youâre writing and sending the debt settlement letter yourself, be sure to follow up on it. Thereâs a chance it could get lost or the creditor or debt collection company wonât properly process it. If your letter ends up in the wrong department, it could be delayed or never read and processed.