Ask For Payments To Be Reported To The Consumer Credit Bureaus

If youre making on-time rent payments every month, why not let them boost your credit?

Ask your landlord to report your monthly payments to the three major consumer credit bureaus Equifax, Experian and TransUnion or let companies like RentTrack help take care of it for you.

But theres a caveat: Even if the information makes it onto your credit reports, not every credit scoring model actually uses that information. Certain credit-scoring models, like FICO® 9 and VantageScore® scores based on your Experian credit report, use available rental-payment information when calculating scores, and FICO® Score XD even uses reported cellphone and utility payments.

Unfortunately, you cant control which scoring model a lender uses to check your credit but you could ask about this before you apply for a new line of credit.

Learn To Get Debt After Case Of Bankruptcy

- Whilst mending the credit ratings score after case of bankruptcy is actually difficult, its not extremely hard.

- You ought to accompany these regards to their case of bankruptcy order though it may be in effect and accomplish everything possible to steadfastly keep up with settlements on any obligations it can dont protect.

- A financial budget planner will help manage their month-to-month earnings and outgoings

- If you were to think its likely you have dilemma encounter a compensation, confer with your expert right away to sort out an answer.

- As soon as six months have actually died as your personal bankruptcy has been discharged, and assuming you havent had any trouble making their settlements, you could apply for loan once more

- How to get loans after personal bankruptcy is always to submit an application for financial products which has been created for people who have poor credit or from financial institutions that specialize in a low credit score financial products and credit card bills.

- You should pays in return all you need. This is on the list of quickest ways to rebuild your credit ratings score, because it shows that one could need and repay within limits.

How Long Does Bankruptcy Remain On Your Credit Report

Your credit report will have a record of your bankruptcy for a minimum of six years after you are discharged a consumer proposal remains on your credit report for a maximum of three years after you have completed all of your payments.

This means that if you apply for a loan or credit card during these time periods, the lender will know that you went bankrupt or filed a proposal, which may make it more difficult to borrow for a period of time.

However this does not mean you have to wait out this period to begin to rebuild credit.

Recommended Reading: How Long Does Chapter 7 Take In Texas

Monitoring Your Credit Report

Also, it’s essential to examine your credit report for mistakes after your discharge. If you notice an error, correct it promptly so that it doesn’t derail your efforts to rebuild your credit. You can check your credit report for free using annualcreditreport.com . You’re entitled to one free copy per year from each of the three reporting agencies. Requesting a report from one of the three agencies every four months is an excellent way to keep track of changes. Also, all of the three reporting agencies allow you to file a dispute online.

How Long Does It Take To Rebuild Credit After Chapter 13

Chern also says that most Chapter 13 petitioners will see a reduction in debt-to-income ratio, but this wont occur as quickly.

After three to five years of living on a strict budget, Chapter 13 debtors should be much more equipped to manage their money efficiently, he says. In many cases, after 18 months of regular Chapter 13 payments, a debtor can refinance out of a Chapter 13, especially if the debtor has any equity in a home.

Recommended Reading: Can You Rent An Apartment After Filing For Bankruptcy

What Are Va Loans

The VA loan program, administered by the U.S. Department of Veterans Affairs, offers low-cost loans to veterans and active military personnel. Qualified borrowers arent required to make down payments, some of the closing costs are forgiven and borrowers dont have to pay mortgage insurance.

There are several requirements for those who have gone through a bankruptcy if they want to get a VA loan.

Dont Depend On Overdrafts

Too often, people think its a good idea to spend up to the limit of whats in their bank account. This is a dangerous practice, because you might have forgotten about a charge for your account thats been lingering for a little bit. Or it might be that you have a subscription to Netflix or another service which will automatically be charged to your bank account.

Also, emergencies do happen. If you dont have much money in your account, the temptation is to use the overdraft protection as a way to manage these types of situations. Some Canadians become almost addicted to this practice, as if theyre somehow getting more money by doing it.

The reality is youre paying dearly to borrow money for the short term. Each overdraft charges a fee. Thats also true with a non-sufficient funds charge. Its better to just manage your money properly through strict budgeting and limit spending.

Recommended Reading: Can You Rent An Apartment While In Chapter 13

Are There Any Employment Restrictions

The Bankruptcy Act 1966 does not impose any restrictions on employment, either during or after bankruptcy. However some trades or professions may impose restrictions.

We recommend you contact the relevant agency or association to see if your bankruptcy will impact your employment. Common professions that bankruptcy may affect are listed under employment restrictions.

How Will Bankruptcy Affect My Credit In 2021

5 minute read ⢠Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card. Explore our free tool

In a Nutshell

Filing bankruptcy does not ruin your credit forever! If you need debt relief but are worried about how a bankruptcy affects your credit rating, this article is for you.

Written by Attorney Andrea Wimmer.

Read Also: How To File Bankruptcy In Wisconsin

Bankruptcy May Help Relieve Your Debt Obligations But It Will Impact Your Credit For Years

Bankruptcy is a special legal proceeding you can use to reorganize or get rid of your debt, depending on your financial situation. Bankruptcy can be helpful if youre overwhelmed with financial commitments, but it could also negatively affect your credit. A bankruptcy will generally stay on your reports for up to 10 years from the date you file.

I refer to bankruptcy as kind of Armageddon on someones , says Freddie Huynh, vice president of data optimization for Freedom Debt Relief.

The good news is your credit can gradually heal if you take the right steps. Heres what can happen to your credit reports when you file for bankruptcy.

Can You Get Credit Right After A Bankruptcy

Back in the day, you couldnt get credit right after filing for bankruptcy but thats no longer the case. In fact, some credit card companies actually cater to people who have recently filed for bankruptcy.

What they do is offer such people secured credit lines or unsecured lines for relatively small amounts, such as $500 or $1,000, and with very high interest rates and fees.

Why would a credit company do business with someone as soon as they file? There are plenty of reasons.

First, they realize they have a captive audience with few options so they often charge extremely high fees and get it.

Next, they realize that borrowers who recently declared bankruptcy dont have other debts because their slate is wiped clean. As a result, these borrowers might indeed be a good risk.

If you are in this situation, these companies offer you a quick way to start rebuilding your financial life. But just make sure not to take on more than you can handle Pilgrim.

Also Check: Can You Rent An Apartment After Filing For Bankruptcy

Not Been Bankrupt Yet

If you have not yet filed for bankruptcy as a solution to your difficulties, reading this page was wise. We advise everyone with money problems to research personal bankruptcy and bankruptcy alternatives, so as to make the best possible decision. This site is intended to answer all your bankruptcy questions. If you still have a personal question, or wish to have a free, confidential consultation, please contact a Licensed Insolvency Trustee near you.

Talk to a trustee today in places anywhere from British Columbia to Ontario and more. Get a free consultation today.

Will Applying For A Credit Card Hurt My Credit Score

When you apply for a credit card, issuers will check your credit report to see if you qualify. This check will be indicated on your report and may temporarily lower your score. This may feel like a catch-22 for people recovering from bankruptcy: you need a credit card to help repair your score, but applying for cards may actually hurt it. For this reason, we recommend you only apply to a secured card meant for people in your situation. That way, you’ll only need to apply once and you won’t have multiple credit checks listed on your report.

Read Also: Can You Rent An Apartment If You File Bankruptcy

Is Your Credit Rating Really Worth Stressing About

Are you current on all your debt payments? Yes? No? Maybe?

If youâre behind on any debt payments, your credit score could probably be better. So, rather than worrying about possibly making your already bad credit worse, think about how a bankruptcy discharge could help you build credit.

So, what happens to my credit score if I file bankruptcy?

Like all negative information reported to the credit credit bureaus, filing any type of bankruptcy will have a negative impact on your credit score. Since a bankruptcy filing is public record, they will find out, even if theyâre not directly notified by the bankruptcy court.

But, unlike other things that have a negative effect on your FICO score, a bankruptcy filing is often the first step to building a good credit score.

Will My Bankruptcy Affect My Spouse And Others

If youâre financially connected to someone, declaring bankruptcy could negatively impact how a lender views them. Examples of a financial connection include joint bank accounts or a shared mortgage. If youâre not connected to someone financially, their credit information shouldnât be affected â even if you live with them. Find out more about financial association here.

If your partner or spouse jointly owns property or possessions with you, this could be sold to help repay your debts. They’ll usually be given the chance to buy out your share or agree a value for the item. If the item is sold, the money will be split between your partner and creditors.

You May Like: How To File Bankruptcy Yourself In Ohio

Rebuilding Credit After Bankruptcy

- Until youre discharged from your bankruptcy, you will be unable legally to borrow more than £500 from any lender

- Once youre discharged, theres no legal limit on the amount you can borrow, but you may still be seen as a credit risk by lenders.

- You might find it difficult to get accepted for loans, credit cards and overdrafts for the six years that the bankruptcy is visible on your credit file.

- Some lenders will refuse to lend to you altogether

- Before you apply for any form of credit after bankruptcy, you should make sure your discharge has been included on your credit report

- You should also check your credit report for any mistakes and get these corrected by telling the relevant credit referencing agency to get them corrected.

Become An Authorized Account User

To become an authorized account user, have a close friend or relative add you to their credit card account. Youre not responsible for repaying any of the money charged to the account. If the account is maintained responsibly, you will get positive marks on your credit report.

On the flip side, if he or she racks up unpaid bills, your score will reflect that. So, choose someone you would trust to make good financial decisions.

Recommended Reading: Can You File Bankruptcy On Student Loans In Missouri

Strategy To Utilize If You Shouldve Experienced Bankruptcy

Determine all of our steps below to determine just how to make an application for a Vanquis cc after case of bankruptcy.

When you use, you need to use a qualifications examiner, which will undoubtedly ensure that you get an illustration of whether the job will be acknowledged.

This willnt hurt your credit score.

Well show your hop over to the website provide challenging critical information should assist you in deciding.

How Long Does It Take To Rebuild Your Credit After Bankruptcy

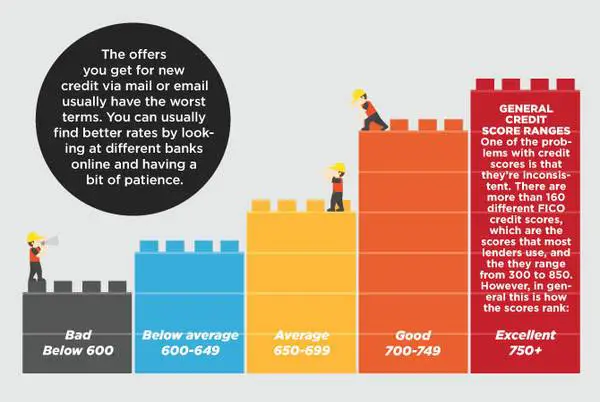

Depending on your credit score, bankruptcy filing, and post-bankruptcy habits, it can take anywhere from 12-18 months to substantially improve your credit score. While that seems like a long time, less than two years to recover your financial standing isnt that long in the grand scheme of life. And with each positive mark on your report, your credit score will nudge you further in the right direction.

Consult a Jackson bankruptcy attorney today!

You May Like: How To File For Bankruptcy In Indiana Without A Lawyer

How Soon After Bankruptcy Should I Apply For A Credit Card

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

So you’ve filed for bankruptcy. You know that the filing will stay on your credit report for at least seven years, and that your credit score’s taken a hit. But when can you apply for a credit card once you’ve gone through the bankruptcy process? The answer has more to do with you than your bank.

The Effect That Bankruptcy Has On Getting A Job Or A Home

Some credit card lenders may be willing to take a chance on extending you a small line of credit, but it will be virtually impossible to get a home mortgage at least immediately.

Current regulations make it almost impossible to get a home loan unless at least two years have passed since the filing of a chapter 13 bankruptcy, or four years after the discharge of chapter 7.

The good news is that you dont have to wait the full 7 to 10 years.

But there are a few more bankruptcy speed bumps to deal with.

For one, it may be really difficult to rent a place to live. Landlords are a skittish lot.

If you have a bankruptcy on your record, youre going to have to do some out-of-the-box thinking in order to convince a property owner to do business with you.

When it comes to employment, the situation is a little better, but not much.

There are laws that are supposed to stop employers from discriminating against people who have a bankruptcy on their record but these regulations may be hard to enforce.

Its on your record and the company you are interviewing for sees it. They may not hire you because of the black mark without admitting it and tell you they are hiring someone else for another reason.

And if the position you are applying for involves financially sensitive information, your would-be boss can show you the door without thinking twice.

Read Also: How To File Bankruptcy Chapter 7 In Texas

If You’re Worried You Might Dig Yourself Into A Hole

While building credit is important, you won’t be able to raise your credit score if you’re still struggling to pay off your balance. A big part of your credit score is your “credit utilization ratio,” or how much debt you have compared to your overall credit limit. Normally, you’d want to keep debts under 30% of your limit. After a bankruptcy, you may want to set your ceiling around 15%. For example, if you get a credit card with a $500 limit, you should keep the balance under $75. This can be tough when you have a low limit. If you’re worried that access to a credit card will just end with you back in bankruptcy court, it’s okay to take a pass for now.

What You Can Do

There are many things you can do to start building good credit after a bankruptcy. Just how much each one will affect your credit score really depends on several factors, since credit scores are fairly complex.

The best thing to do is concentrate on doing one thing at a time. Figure out what item you can do first. If youre freshly out of bankruptcy, some of the following items might not be an option yet. Dont let that discourage you. Instead, figure you what you can be doing now, even if its getting ready to take a step.

Don’t Miss: Online Bankruptcy Preparation Services

If You’re Sure You Won’t Get Into Debt Again

If you trust yourself not to rack up credit card debt you can’t repay, you can start rebuilding your credit score as soon as you’re done filing for bankruptcy. Your FICO score can affect your ability to acquire loans, get approved for an apartment rental and even find a job. The sooner you can reconstruct your credit, the better.

Getting a credit card after bankruptcy might seem counterintuitive, but it is the quickest and easiest way to improve your credit. Lenders want to see you can spend responsibly and make timely repayments. A credit card is a great tool for demonstrating your trustworthiness.

When you get your credit card, proceed with caution. You should use it regularly, but you need to be very careful to spend only what you can afford. Pay off purchases quickly and avoid carrying a balance month to month. When building credit, a good strategy is to use the card only for items you need to buy anyway. Groceries and gas are good examples. Pay for them with your credit card and pay them off before the grace period ends.