Why File For Chapter 7 Bankruptcy In Arizona

A Chapter 7 bankruptcy allows a discharge of most debts. The debtor may also hold on to exempt property such as a house and car. There is no minimum or maximum threshold for the debt. Therefore, a Chapter 7 bankruptcy allows an honest debtor to restart their life financially while holding on to essential property.

Will Your Spouse Be Affected By Your Bankruptcy

If you are making court-ordered payments to your spouse, then he or she will almost certainly be affected by your bankruptcy. Bankruptcy provides debt relief, but only the bankruptcy petitioner is entitled to that relief. When both spouses file bankruptcy, both may be discharged from joint debts.

TIP: When planning to divorce or in a pending divorce, the way to discharge joint and marital debts is for both spouses to file bankruptcy. Spouses may file bankruptcy jointly or separately, but both need to file.

Go To Court To File Your Forms

Since individuals filing bankruptcy in Mesa can’t use the court’s online filing system, you’ll have to submit your forms to the court another way. One option is to mail everything in. However, if you can make the trip to Phoenix to visit the courthouse in person, you should do so. The courthouse is located in downtown Phoenix, at the corner of First Ave and Van Buren. Parking can be a little tricky around that part of town so consider taking the light rail instead. It’ll drop you off right near the courthouse and allow you to avoid the worst of city traffic. Once you pass through security , you’ll find the clerk’s office on your left. That’s where you’ll go to file your Arizona bankruptcy case. If you bring your second copy of the bankruptcy forms, be sure to have them stamp it for you so you have an official copy of what you submitted to the court in your files.

Also Check: Who Bailed Trump Out Of Bankruptcy

Chapter 7 Bankruptcy Arizona

As Chapter 7 is the most common consumer bankruptcy filing, we will cover this bankruptcy first. In order to file Chapter 7 bankruptcy, you have to go through means-testing. The means test was added to the Bankruptcy Code in 2005 to prevent bankruptcy fraud. The income requirement for Arizona helps ensure that a person with a sufficient income to pay back some of the debts may file a Chapter 13 instead of Chapter 7.

Bankruptcy Court Involvement In The Arizona Divorce

In Arizona, the Superior Court is the only place to go for divorce. No municipal court, no city court, no justice of the peace has the authority to grant a divorce or determine child custody.

Likewise, no state court has the power to grant a bankruptcy discharge. U.S. Bankruptcy Court is a federal court with jurisdiction over all bankruptcies. Although the bankruptcy court cannot grant a divorce, it has reason to be involved in marital dissolution proceedings because the property of the bankruptcy estate is divided between the divorcing parties.

Do not be overly concerned about filing for bankruptcy in Arizona while your divorce is pending in another state, such as California. Both cases proceed normally, one in federal court, the other in state court.

If bankruptcy is filed while a divorce is pending or divorce is filed while bankruptcy is pending, then the bankruptcy court will exercise jurisdiction over the property until the bankruptcy case is closed. Then, the remaining distribution of property, if any, will return to the divorce court. Who will be awarded which asset or debt? How will the property be characterized, valued, and divided? When property division is complicated by substantial assets, you can be sure the bankruptcy trustee will be digging into the details so that creditors are not fleeced.

Recommended Reading: How To File Bankruptcy In Mn

Property Exemptions In Arizona For Bankruptcy

Like every other state, Arizona has its own set of property exemptions. Thus, someone filing for bankruptcy in Arizona must be mindful of the property exemptions for the state of Arizona.

In Arizona, you must use the states exemption list although some states allow debtors to choose between the state list and a federal list, Arizona isnt among them.

Arizona provides a generous homestead exemption that protects up to $150,000 in equity in a house or other real property. Arizona law also allows debtors to keep food and fuel for up to six months, and up to $6,000 equity in a vehicle.

Can Someone Lose Their Home If They File For Chapter 7 Bankruptcy

A person can lose their home if they file for Chapter 7 bankruptcy protection. But dont panic. In Arizona, it is rare to see a person lose his home because he filed for Chapter 7 bankruptcy protection. This is because the homestead exemption most people in Arizona is $150,000. What this means is if your equity in the property is less than $150,000, theres a good chance that youll be able to keep your house. However, if your equity is higher than $150,000, you could lose the house. You must be residing in the house in order to get the homestead protection. If you reside elsewhere or have a second home, you cannot apply the homestead to more than one of the properties.

Another problem arises when a person is behind on payments in a Chapter 7 bankruptcy. If that happens, the creditor will file what is called a motion to lift the automatic stay. The automatic stay is the protection that automatically goes into effect in Chapter 7 cases when the case is filed. It prevents the creditor from suing the debtor, maintaining an already-filed lawsuit, garnishing wages or bank accounts, foreclosing on real estate, etc. The creditor will ask the judge for permission to pursue a foreclosure action even though the Chapter 7 case has been filed. The judge will almost always say yes.

Recommended Reading: Can A Bankruptcy Be Removed Early

How To Keep Secured Property

Debts that are secured by a lien or collateral are secured debts. In bankruptcy, you can typically keep your personal residence and your vehicle if you continue to make the required payments on time. In some instances, you may be required , to file a reaffirmation or redemption for your secured property.

What is a Reaffirmation Agreement?A reaffirmation agreement is a special arrangement on a secured debt through chapter 7 bankruptcy. Essentially, it is a new agreement between you and the lender. You are promising that even though you filed for bankruptcy, you will still be obligated to keep making the payments.

The advantage of a reaffirmation agreement is that it will help rebuild your credit. If you dont file a reaffirmation, any payments you make after bankruptcy will not show up on your credit report. The down side of a reaffirmation is you no longer are protected by your bankruptcy for that particular asset. For example, an individual who does not file a reaffirmation would be able to stop making payments, return his vehicle to the bank, and be protected by his bankruptcy, an option that is lost when filing a reaffirmation. Certain banks require you to file a reaffirmation agreement if you want to keep your asset, so you may not be given the option.

How Do I Know Which Type Of Bankruptcy To File

When filing for bankruptcy, you will take a means test. This test will calculate your income over the previous six months prior to filing and help prepare a budget including your current income and expenses. The result of these calculations will assist in determining which type of bankruptcy is best suited to your financial circumstances.

Fortunately, by working with an experienced bankruptcy attorney, you will not be left on your own to navigate your way through any step of the bankruptcy process. We will help you decide whether to file for Chapter 7 or Chapter 13 of the Bankruptcy Code or seek a different solution.

Recommended Reading: Who Is Eligible To File Bankruptcy

Take Control Of Your Financial Future

Many people think of bankruptcy as a bad word, but in truth, bad things sometimes happen to good people. Even the most fiscally responsible people can find themselves in a tight spot after being laid off from their job, going through a divorce, being injured, or suffering an illness. Through no fault of your own, you can find your savings gone and yourself underwater financially. If you are thinking about declaring BK in Arizona, do not hesitate to call our experienced bankruptcy attorneys in Tempe, Mesa, Chandler, and throughout Arizona.

If you need relief from debt, declaring BK may be the answer to your problems. Whether you feel prey to a credit card with hidden fees and a high interest rate, or misfortune has taken your job, spouse, or health, you may find that the best way to get a clean slate is to file for a personal Chapter 7 or Chapter 13 bankruptcy.

You can start taking back control of your finances and rebuilding your credit score. Though you can legally file yourself, it is not recommended. Let our Arizona debt relief experts do the work for you. With convenient law office locations, we are the debt relief agents you seek.

How To Get Arizona Bankruptcy Records

Generally, Arizona bankruptcy court records are generated and maintained by the United States Bankruptcy Court for the District of Arizona. As a result, the court is responsible for disseminating bankruptcy records to members of the public through various channels. Regardless of the multiple electronic and physical channels, it is always advisable for inquirers to visit the court that addressed the case to obtain complete bankruptcy records.

There are five bankruptcy court locations in Arizona. While the Flagstaff and Bullhead City court locations are mainly hearing locations, the Phoenix, Tucson, and Yuma court locations provide hearing, filing, and record collection services. Therefore, depending on the inquirers preference and location, they can visit the court clerks office during regular business hours to inspect or copy bankruptcy records.

If the inquirer prefers 24-hour online access to bankruptcy records, the individual may use the government-provided electronic public access service called Public Access to Court Electronic Records . The federal judiciary provides and funds this centralized service to keep its commitment to providing public access to court information. The service allows registered users to obtain public case and docket information from federal appellate, district, and bankruptcy courts. Similarly, each federal bankruptcy court in Arizona maintains its case information locally through the District of Arizona CM/ECF Document Filing System.

You May Like: Can You Get A Loan After Bankruptcy

Chapter 7 Bankruptcy Arizona Income Limits

The Arizona median income figures for the Means Test are adjusted periodically, based on IRS and Census Bureau data. Arizona median income for bankruptcy cases filed on or after April 1, 2022, is:

| # of People | |

|---|---|

| 9 | $139,241 |

For Arizona households with more than 9 members, add $9,000 for each additional family member. You should always double-check the US Trustees website for the most current figures when calculating the Means Test.

Get The Best Debt Relief Representation In Arizona

A great BK attorney needs to be trusted, knowledgeable of the Arizona Bankruptcy Code, and capable of providing the expert legal services to suit your needs. My Arizona Lawyers will analyze your financial situation, communicate your options, give honest advice, prepare your BK petition, review the process, attend court hearings, take any legal actions necessary to the success of your case, and follow up with you regarding your case. Additionally, our Arizona law firm even offers assistance with clients who have completed the bankruptcy process, received a discharge, and need help rebuilding credit in the post-bankruptcy stage of the process.

Don’t Miss: When Did Hertz File For Bankruptcy

Are Bankruptcy Records Public Information

Unless sealed by federal law, all documents filed in a bankruptcy claim are open to members of the public for viewing and copying. These records are obtainable from the bankruptcy courts in the state. However, federal laws require that some specific information be deleted or redacted from bankruptcy court documents before making them available for public inspection. These include personal information such as home addresses, minor childrens names, social security numbers, and financial information such as bank accounts.

Chapter 13 Bankruptcy Attorney In Phoenix

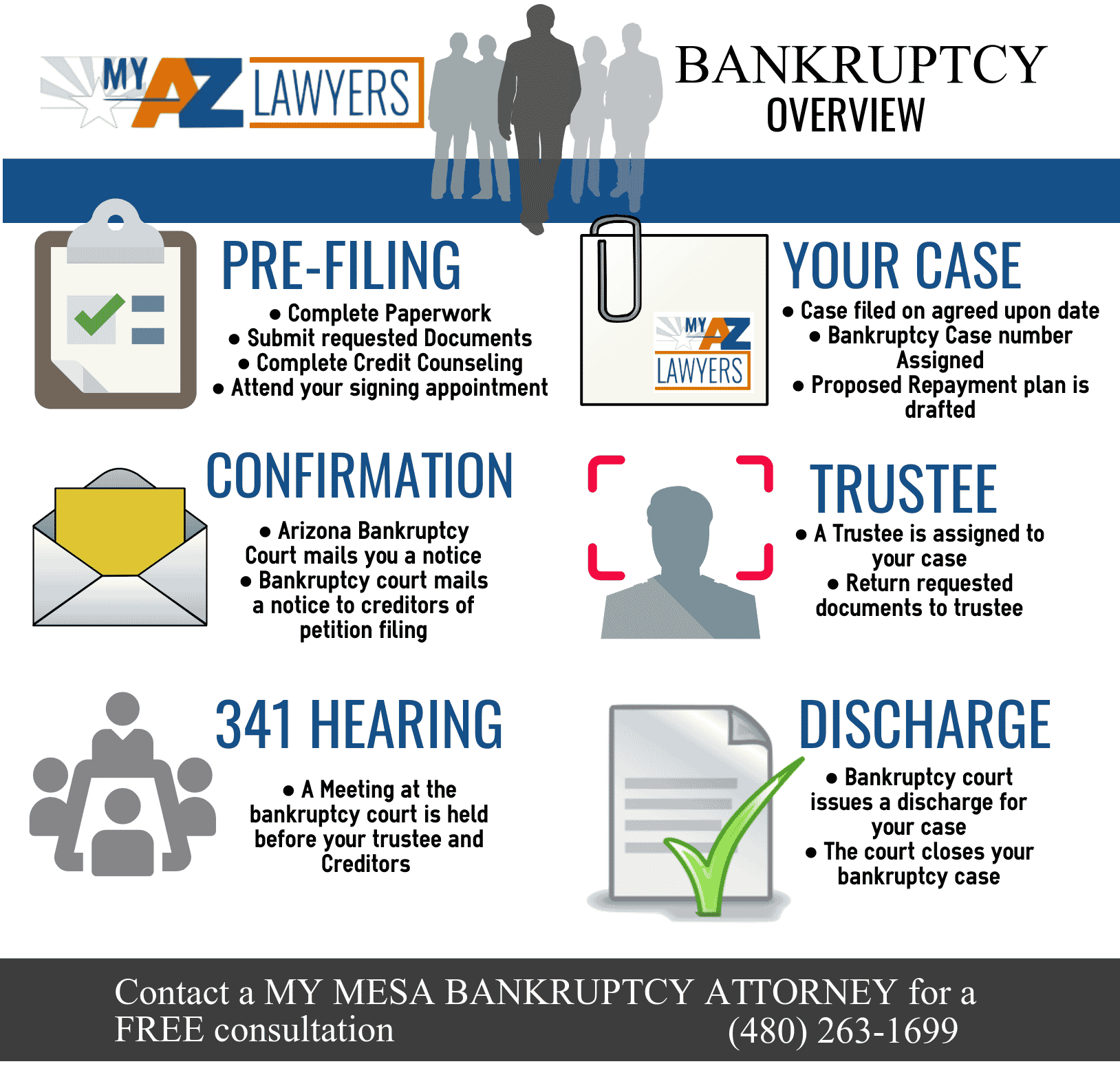

Chapter 13 is an option for BK designed to permit a debtor to keep assets of value. It allows for a plan to repay creditors over a period of time. If a debtor does not meet the requirements to file Chapter 7, then Chapter 13 filing is an option. Once the payment plan is approved, a trustee is used to oversee the plan and make payments to creditors. During the course of the payment plan, the debtor is protected from garnishments, creditor lawsuits or other actions.

Recommended Reading: Will Bankruptcy Get Rid Of Tax Debt

Public And Private Pensions Retirement Accounts And Financial Benefits

IRAs, 401s, and other similar accounts are exempt in Arizona. This exemption also applies to items like 529 college savings accounts. This exemption is very important. If creditors are just able to seize one asset, they usually go for the cash in a retirement account.

Government pensions, like teacher retirement benefits, are also exempt, as are Social Security, VA disability, unemployment, and most other government benefits.

This exemption has some pitfalls. Some people move money into retirement accounts shortly before they file to take advantage of the exemption. This movement might be illegal. Other people keep government benefits, which are exempt, in the same account with wage income, which is usually nonexempt. Such commingling makes it difficult to apply this exemption.

Where Do I File For Bankruptcy In Arizona

The United States Bankruptcy Court has one District of Arizona. However, depending upon where you live, you will file Chapter 7 bankruptcy in different places. If you live in the counties of Apache, Maricopa, Gila, Yavapei, Coconino or Navajo, you must file in the Phoenix Division. If you live in the counties of Pima, Graham, Cochise, Pinal, Greenlee or Santa Cruz, you must file in the Tucson Division. If you live in Yuma, Mohave or La Paz counties, you must file in the Yuma Division.

You need not have a bankruptcy attorney in order to file Chapter 7 bankruptcy in Arizona. However, having a bankruptcy attorney can make the process go much more smoothly for you. An Arizona bankruptcy attorney knows the ins and outs of the states bankruptcy law, including requirements and exemptions, and can help you to achieve the best outcome in your bankruptcy case.

Recommended Reading: How Long Does It Take To Recover From A Bankruptcy

Must Spouses File Bankruptcy Together In Az

No. Each person decides whether to file for voluntary bankruptcy. Spouses may file bankruptcy jointly, or individually, or one may choose not to file at all. One spouse may file a Chapter 7, for instance, while the other files a Chapter 13. At any time during the marriage , you may file bankruptcy, your spouse may file bankruptcy, or both of you may jointly file bankruptcy. Joint petitions are reserved for married spouses.

After the divorce, either individual may file for bankruptcy. You cannot prevent your former spouse from seeking bankruptcy relief and vice versa. But as a creditor entitled to regular support payments, you have rights, too.

You Need To Consider How Complicated Your Debts And Assets Are

If you only have a few serious debts, you may be able to handle your bankruptcy on your own. However, people who only have a few debts dont need to file bankruptcy in the first place. Bankruptcy lawyers in Arizona meet with people every day who wonder if theyre qualified to file bankruptcy. The laws can be confusing. Your list of debts and assets can be long and confusing too. Let an experienced lawyer make sense out of it for you.

Don’t Miss: What Is Involved In Filing Personal Bankruptcy

Seeking Debt Relief Our Arizona Bankruptcy Law Firm Can Help

today to talk with an experienced bankruptcy lawyer about whether bankruptcy might be right for you. We represent clients seeking protection through Chapter 7 bankruptcy or Chapter 13 bankruptcy. Our goal is to help you get the maximum debt relief possible as quickly as possible. We serve clients throughout the Phoenix area. Call us today to make an appointment with a Mesa bankruptcy attorney to learn more about your options.

Before You File For Chapter 7

The first step you should take before actually filing for Chapter 7 bankruptcy is to get a birds eye view of your situation. Ask yourself or a financial adviser if filing is indeed your best course of action for eliminating your debt. You also need to determine what assets or possessions youre willing to part with or keep and what lifestyle changes you can make to improve your situation. Its also recommended that you attempt to negotiate with your creditors for a new repayment plan, lower interest rate or lower minimum payment.

Don’t Miss: Why Is Us In Debt

What Happens Immediately After Filing For Bankruptcy

After youve completed the bankruptcy filing, an automatic stay goes into effect right away. What this means is creditors wont be able to directly contact you. Nor can they stake claims on your property.

In other words, this will prevent foreclosure proceedings. This can be used strategically, so its important to consult with an attorney as soon as possible.

Filing Without An Attorney

Welcome! While the information presented is accurate as of the date of posting, it should not be cited or relied upon as legal authority. It should not be used as a substitute for reference to the United States Bankruptcy Code and the Federal Rules of Bankruptcy Procedure, both of which may be reviewed at local law libraries, or to local rules of practice adopted by each bankruptcy court. Finally, this information should not substitute for the advice of competent legal counsel.

In addition to the information presented here, the Court also provides walk-in Self Help Centers for visitors who are seeking more information about how the bankruptcy process works in Arizona. In Phoenix, the Self Help Center is located on the 6th floor of the U.S. Bankruptcy Courthouse located at 230 N. 1st Avenue. In Tucson, the Self Help Center is located in Room 100 of the James A. Walsh Courthouse at 38 S. Scott Ave, and in Room 247 for free attorney consultations by appointment .

Self Help Center Customer Satisfaction Survey: If you have used any of our Self-Help Centers in the District of Arizona, we want to know what you think. Please take a few moments to fill out this short survey to help us improve our services.

Toll-Free Self-Help

Don’t Miss: How To File For Bankruptcy In Ny