Can The Government Sustainably Service Its Large Debt

No. The federal government is borrowing huge sums of money and paying interest at less than 1 percent on 10-year debt and about 1.6 percent on 30-year debt. At those low rateslower than the rate of inflationthe U.S. government can sustainably service a much larger federal debt than most of us used to think possible.

What Happens If The National Debt Is Not Paid Off

Lesson Summary. National debt is the total outstanding borrowings of a central government. If left unchecked, national debt can become a drain on the countrys economy and lead to higher taxes and a weaker economy. Most politicians do not want to address their countrys national debt and would rather continue to see an increase in taxes.

Why Does The Us Government Have Debt

The U.S. Government is just like a business. The Government has to provide services for the people of the United States such as military protection, education and health programs, the space program, and social services programs. It also needs money to buy supplies and equipment.

The Government’s main source of money is the taxes it collects from individuals and businesses. There are different kinds of taxes. Here are some examples:

- Sales and excise tax

However, the amount of money the Government spends to pay for the services it provides is often more than the taxes it collects. To make up the difference, the Government borrows money in other words, it goes into “debt.”

Also Check: What Percent Of Chapter 7 Bankruptcies Are Dismissed

The National Debt Is Big And Getting Bigger Does It Matter

WASHINGTON The United States national debt is nestled in a brick-laden underpass just a block away from Times Square. It ticks away, month after month, year after year, never getting smaller, never slowing down.

That national debt clock the brainchild of the real estate tycoon Seymour Durst, who installed it on West 43rdStreet in Manhattan in 1989 isnt actually the national debt. Its a representation of the national debt, a simple tally of how much money the federal government has borrowed from the public and has yet to pay back.

Durst said of the clock when it was installed that it was meant to strike anxiety if not fear into passersby. If it bothers people, he said, then its working.

When Durst died in 1995, the national debt totaled more than $4 trillion. In 2008, less than 20 years later, the debt clock ran out of digits, forcing the Durst Organization to add two more. The clock can now track our collective debt into the quadrillions.

The clock currently reads $28 trillion, give or take, and will grow rapidly in the coming years. The coronavirus pandemic has cost the U.S. economy $16 trillion, give or take, and Congress appropriated more than $3 trillion in aid in 2020.

Lawmakers have echoed Dursts distaste for the national debt for decades, with varying degrees of sincerity. And we are hearing them again, as Congress debates a nearly $2 trillion relief package to respond to the pandemic and its economic fallout.

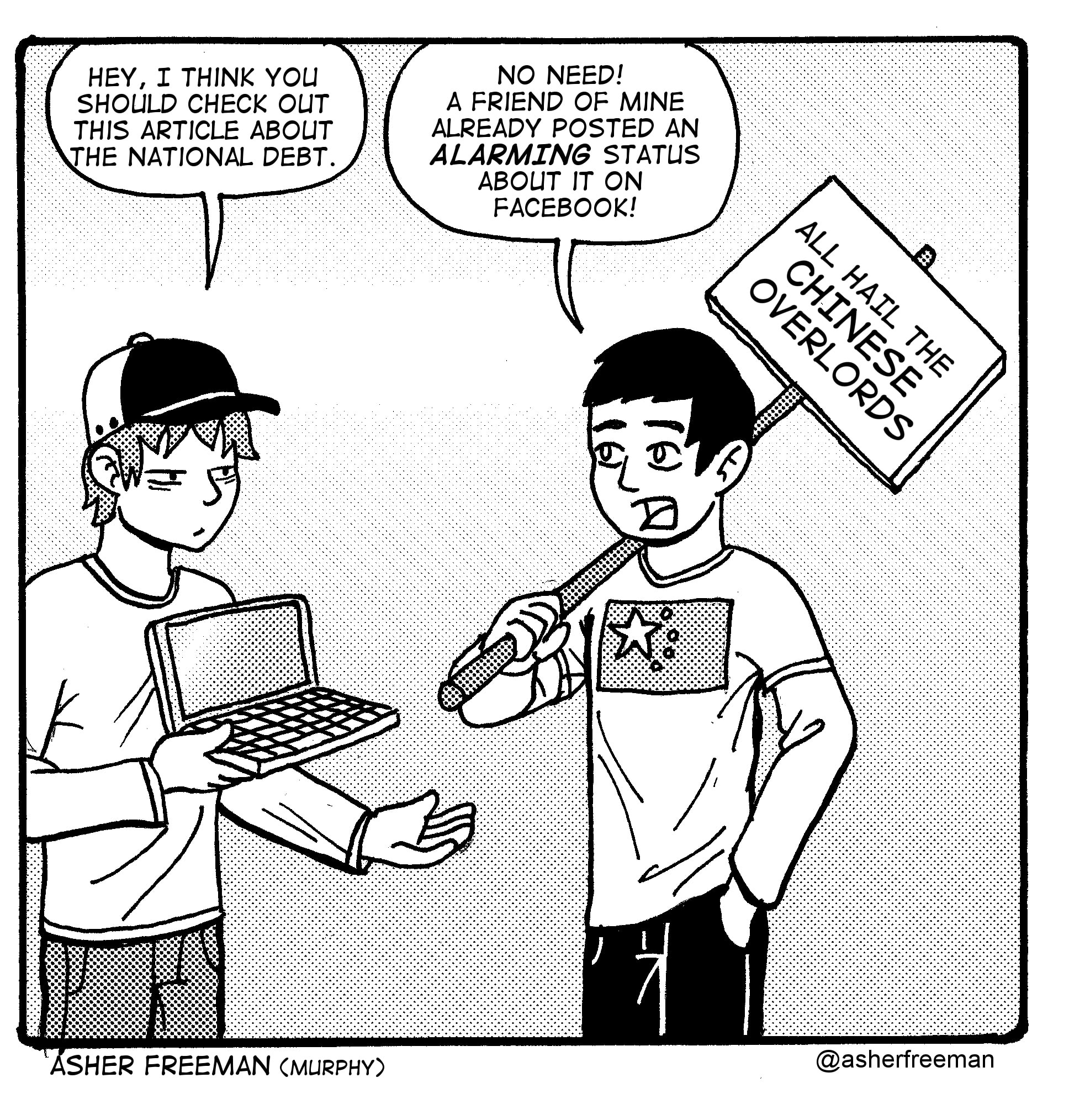

Is Chinas Strategy Working

Chinas low-cost competitive strategy seems to be working. Its economy grew more than 10% for the three decades before the 2008 recession. In 2019, it grew at 6.1%, an even more sustainable rate.

China has become one of the largest economies in the world. And if you measure it by gross domestic product and consider purchasing power parity , China is seen as the worlds largest economy.

China also became the worlds biggest exporter in 2009. China needs this growth to raise its low standard of living. For these reasons, well likely see China remain one of the worlds largest holders of U.S. national debt.

Read Also: What Is Consumer Debt In Bankruptcy

Recommended Reading: Can You File Bankruptcy For Tax Debt

The Real Burden To Worry About

Yet, the $22 trillion on-balance-sheet debt is likely to woefully underestimate the federal governments true liabilities and its potential demand on the economys resources.

The national debt is the governments formal commitment to repay its creditors. But Uncle Sam has many other commitments for future spending that are not on the books, so-called off-balance-sheet liabilities. Such liabilities do not show up in standard debt measures.

While these commitments are different in nature from the promise to pay back previously borrowed funds, they are nonetheless a potentially large burden on taxpayers and surely a governmental imposition on the economy.

These commitments arise from implicit and explicit federal loan guarantees that support housing and education policy, from deposit insurance and Federal Reserve actions that attempt to promote a stable financial system and from commitments to the elderly and poor through Social Security, pension guarantees and Medicare and Medicaid.

Economist Jim Hamilton has recently estimated that such off-balance-sheet liabilities could exceed $70 trillion, more than three times the the current value of outstanding Treasury securities. The biggest share of that, or about a third, is Medicare.

So OK, worry about the debt, but pick the right measure to worry about.

Why Is The Us National Debt Necessarily A Bad Thing

In short, government debt can be a bad indicator of the stance of fiscal policy or its burden on the private sector. The government can be wildly intrusive in the economy and thus a hindrance to growth and welfare even if its debt is low.

What Makes the Debt Bigger?The Overburdened Social Security System. Overall, limited incoming and more outgoing cash flows are making Social Security a big component of the national debt.Healthcare. The U.S. Continued Tax Cuts. Wars in Iraq, Syria, Pakistan, and Afghanistan.

Content

Also Check: Does Chapter 13 Bankruptcy Stop Garnishment

Solutions To Reduce The National Debt

76% of voters believe that the President and Congress should allocate more time and energy towards addressing the national debt. Americans care about the national debt, and some work has been done in order to address this issue. Solutions include raising revenue , cutting spending, and growing the countrys GDP.

Policy options such as the Simpson-Bowles plan and the Domenici-Rivlin Task Force have made efforts to create plans to reduce the national debt. Centers and institutes such as the American Enterprise Institute, Bipartisan Policy Center, Center for American Progress, and Economic Policy Institute all proposed things ranging from slow growth to reduction in benefits for high-income individuals.

Young people across America are getting educated about fiscal policy and making changes at their colleges and universities with Up to Us. Sign the pledge to let local representatives know that you are concerned about the nations fiscal future, or get involved by learning about how you can make a difference in your own community.

Us National Debt Tops $30 Trillion For First Time In History

The Treasury Department this week reported that the total national debt of the United States surpassed $30 trillion for the first time in history, an amount equal to nearly 130% of America’s yearly economic output, known as gross domestic product. The eye-popping figure makes the U.S. one of the most heavily indebted nations in the world. The federal debt has been high and rising for decades, but the federal government’s response to the coronavirus pandemic, which involved massive infusions of cash into the U.S. economy, greatly accelerated its growth. At the end of 2019, prior to the pandemic, the national debt stood at $22.7 trillion. One year later, it had risen by an additional $5 trillion, to $27.7 trillion. Since then, the nation has added more than $2 trillion in further debt. A grim reminder

While the $30 trillion figure, by itself, has no significant meaning, it may serve to focus attention on what some see as a major concern for the future health of the country. “Hitting the $30 trillion mark is a reminder of just how high our debt is and just how much we’ve been borrowing,” said Marc Goldwein, senior vice president and senior policy director for the Committee for a Responsible Federal Budget.

Read Also: What Are Requirements For Filing Bankruptcy Brainly

The Beauty Pageant Of Money

While there is a diversity of opinion on how to think about the national debt, there is broad agreement that comparing it to household debt credit cards, mortgages or student loans, for example is the wrong way to think about it.

The important difference is that if you or I run out of dollars, we lack the ability to generate new ones. The government has no such encumbrance, and when it makes new dollars, people all over the world respect their value.

One perspective here is, we call it the national debt, but it’s not really debt, said David Andolfatto, senior vice president in the research division at the Federal Reserve Bank of St. Louis. It’s actually part of the money supply that people find useful, the same way you and I find using money useful.

The government acquires more debt by issuing Treasury securities which come in the form of bills, notes or bonds which have different maturities and have a seemingly infinite market for buyers because they are regarded as the safest of assets. Investments go up or down in value T-bills do too, but theyre never worthless.

Because Treasuries are stable, retain value and are eminently marketable, banks are now required to hold some quantity of them at all times as a provision against the kind of market collapse that the banking system experienced in 2008.

The United States is not experiencing that pressure today far from it. China sold about $180 billion in Treasuries in 2015, and the market largely shrugged it off.

What Is The Difference Between Public And Private Debt

Public Debt is the money owed by the Union government, while private debt comprises of all the loans raised by private companies, corporate sector and individuals such as home loans, auto loans, personal loans. The Union governments liabilities account for a little over 46% of the countrys GDP.

The Union government describes those of its liabilities as public debt, which are contracted against the Consolidated Fund of India. This is as per Article 292 of the Constitution. As per Reserve Bank of India Act of 1934, the Reserve Bank is both the banker and public debt manager for the Union government.

Is high public debt harmful for economic growth? Countries with high public debt tend to grow slowly a correlation often used to justify austerity. This column presents new evidence challenging this view. The authors point out that correlation does not imply causality it may be that slow growth causes high debt.

Also Check: What Does Debt To Income Ratio Mean

Who Owns The Us National Debt

Who Owns The Us National Debt? The public holds over $22 trillion of the national debt. 1 Foreign governments hold a large portion of the public debt, while the rest is owned by U.S. banks and investors, the Federal Reserve, state and local governments, mutual funds, pensions funds, insurance companies, and savings bonds. Oct 8, 2021. Who does the US owe money to 2020?

What Is National Debt

National debt denotes the outstanding obligations of a country. Such obligations may also be called government debt, federal debt, or public debt.

The national debt of the United States is what the federal government owes creditorsincluding debt held by the public and federal government trust funds. U.S. national debt totaled $30.5 trillion as of July 15, 2022.

Read Also: How To File Bankruptcy With No Money

Who Holds The Debt

The bulk of U.S. debt is held by investors, who buy Treasury securities at varying maturities and interest rates. This includes domestic and foreign investors, as well as both governmental and private funds.

Foreign investors, mostly governments, hold more than 40 percent of the total. By far the two largest holders of Treasurys are China and Japan, which each have more than $1 trillion. For most of the last decade, China has been the largest creditor of the United States. Apart from China, Japan, and the UK, no other country holds more than $500 billion.

In response to the pandemic, the Federal Reserve dramatically increased its purchases of U.S. debt, buying in days what it used to buy in a month, and the central bank committed to essentially unlimited bond buying. Since March 2020, the Feds balance sheet has almost doubled to $8 trillion, renewing concerns among economists about the Feds independence.

Social Security System Strains

For decades, payroll tax receipts earmarked for Social Security have exceeded benefit payments, producing system surpluses that have masked the structural U.S. budget deficit.

But those surpluses shrank before turning into a shortfall in 2021, and in the near future the deficits are expected to increase as Baby Boomer retirements swell the ranks of Social Security recipients.

The Old-Age and Survivors Insurance Trust Fund funding the Social Security payments for retirees saw annual gains that peaked at about $180 billion in 2006-2008. Those surpluses are projected by the trust fund’s board of trustees to give way to growing deficits topping $200 billion annually by 2028 and $300 billion from 2031. In combination with payroll taxes, the $2.75 trillion trust fund is expected to finance full benefit payments until it is exhausted in 2034.

Growing life expectancy and reduced fertility rates are expected to reduce the share of working-age population from 58.3% in 2021 to 54.6% by 2050. Over the same span, the ratio of working-age Americans to those of retirement age is projected to drop from 3.4-to-1 to 2.6-to-1.

You May Like: Does Bankruptcy Affect Your Tax Refund

How Much Debt Does The United States Have

Facts and Figures about American Debt. Total U.S. consumer debt is at $13.86 trillion. That includes mortgages, auto loans, credit cards and student loans. The first step to getting help with credit cards is learning about this type of debt. Your goal should be to pay off your credit card debt as soon as possible.

How Much Does The National Debt Affect The Economy

Its important for everyone to understand the significant implications the national debt has on our economy. As the national debt grows so do our individual shares, which according to one statistic at the end of the 2019 fiscal year, amounts to $315,315 dollar for every person living in the United States.

Don’t Miss: What To Wear To Bankruptcy Court

Theres Never Enough Money

Think back to when you were first starting your career and what your financial situation was like then. If youre like most of us, you rented the nicest apartment you could manage to pay for and never felt like you had any money.

Now think about your present life and what your financial situation is like. You probably live in the nicest house you can afford to pay for. And even though you make far more than you did when you were younger, you likely still feel like you never have any money.

The truth is that most of us live on the outside edge of our means if we can afford a nicer house, car, or dinner, we get one. This means that no matter how much money we make, it will never feel like theres enough money, and that leads us into debt.

Read Also: Will Capital One Approve Me After Bankruptcy

Top 10 Reasons Why The National Debt Matters

At $30 trillion and rising, the national debt threatens Americas economic future. Here are the top ten reasons why the national debt matters.

Recommended Reading: Pallet Lots For Sale

Why Does The Us Have So Much Debt

There are a few main reasons why: U.S. economic growth has historically outpaced its debt: For example, the U.S. debt was $258.68 billion in August 1945 but the economy outgrew that in less than a few years. By 1960, GDP more than doubled. Congress believes that todays debt will be dwarfed by tomorrows economic growth. 4

When the fiscal year ended on September 30, 2019, the federal government owed $16.8 trillion to domestic and foreign investors.

Content

The Politics Of National Debt

Disagreements about national debt have repeatedly preoccupied U.S. Congress. Whenever the national debt approaches the limit periodically reset by Congress, lawmakers are faced with a choice of raising the ceiling once again or letting the U.S. government default on its obligations, risking dire economic consequences. The U.S. government briefly shut down before Congress raised the limit in 2013. A similar standoff two years earlier led Standard & Poor’s to downgrade its U.S. credit rating.

In 2021, Congress narrowly averted a scheduled Oct. 1 government shutdown by passing a short-term funding bill, then raised the U.S. debt ceiling by $2.5 trillion to $31.4 trillion in December. That limit was expected to be reached in early 2023.

Americans profess to be concerned about the national debt in poll after poll, while also overwhelmingly supporting defense spending and outlays for Social Security and Medicare, and opposing tax increases.

As a result, elected officials too have been eager to be seen to be addressing the national debt, usually without linking it to the spending the debt enables or to the tax increases that a balanced budget would require.

You May Like: How To Find Out If Company Filed Bankruptcy